Timeswap: A New Option for Earning Risk-Free Profits with Stablecoins

TechFlow Selected TechFlow Selected

Timeswap: A New Option for Earning Risk-Free Profits with Stablecoins

Timeswap, an oracle-free protocol, provides users with opportunities to earn returns under low-risk conditions.

Author: CryptoDoctor

Compiled by: TechFlow

When the market is in a bear phase, figuring out how to earn yield with stablecoins becomes an important consideration. Timeswap, an oracle-free protocol, offers users an opportunity to generate returns under low-risk conditions. This article will introduce the three tokens of Timeswap, its mechanisms, and how to participate, helping readers better understand and utilize this protocol.

To find yield opportunities with minimal risk, you need to know how; to explore possible strategies in DeFi, you need to know where to start. Take a look at Timeswap, which delivers attractive yields on your assets and stablecoins across Arbitrum, Polygon, and Ethereum.

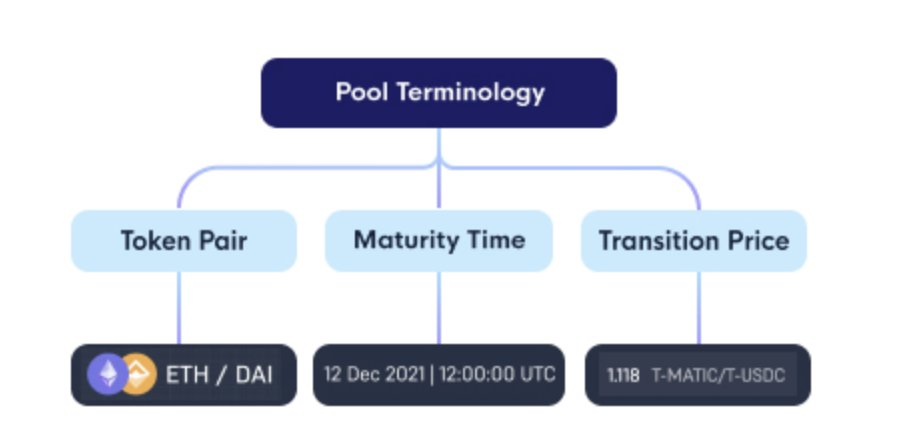

TimeSwap is an oracle-free protocol that allows permissionless creation of pools for any ERC-20 token pair.

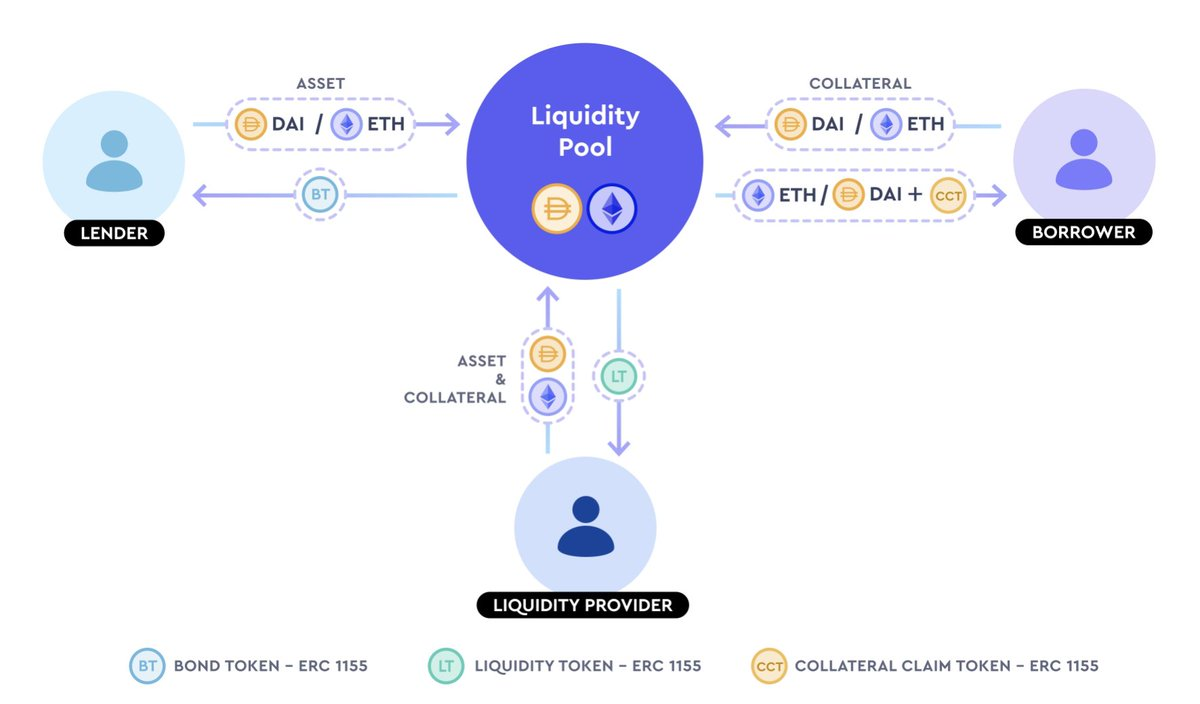

TimeSwap combines a zero-liquidation money market with an options market, using its own unique AMM model and design for lending and borrowing. Users can deposit tokens into pools to earn fixed yields, borrow tokens, or leverage positions—all without liquidation risk. It features three distinct tokens for different participants: Liquidity Tokens (LT) → minted by LPs; Bond Tokens (BT) → minted by lenders; and Claim Tokens (CCT) → minted by borrowers.

Mechanism

The three tokens serve different roles: Liquidity Tokens (LT) → minted by liquidity providers; Bond Tokens (BT) → minted by lenders; and Claim Tokens (CCT) → minted by borrowers.

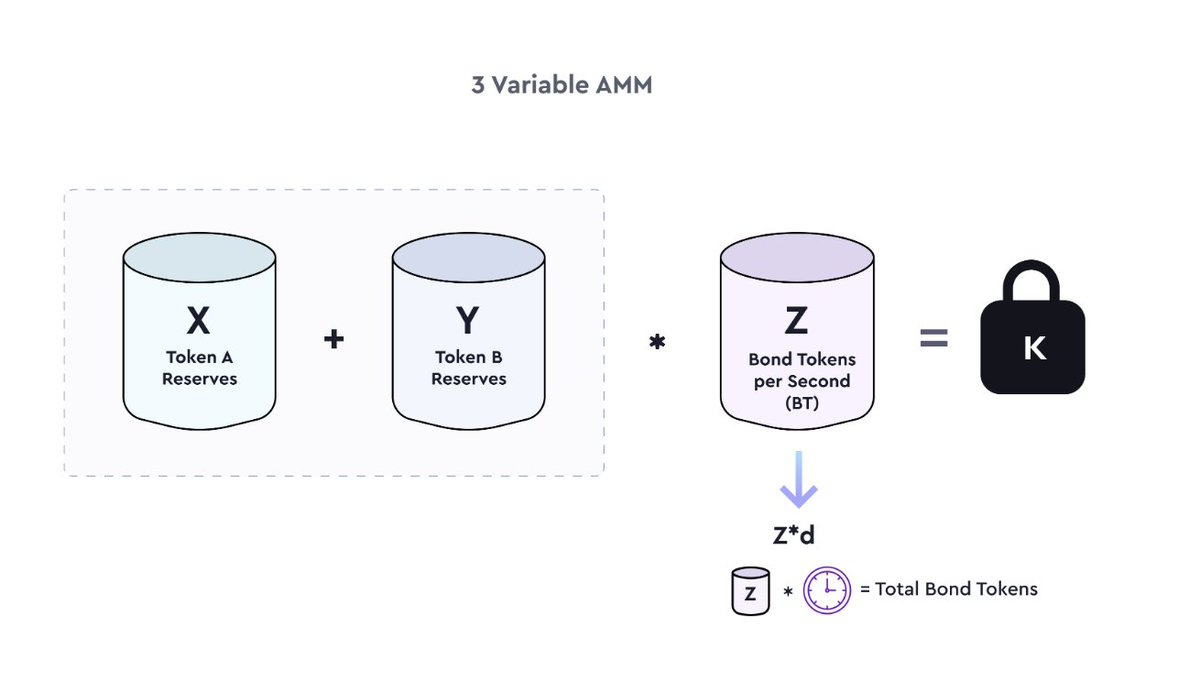

V2 employs a three-variable AMM model within pools, enabling interest rate (APR) and CDP (collateral factor) discovery while ensuring the pool remains over-collateralized. It is permissionless and uses the ERC-1155 standard to represent user positions as NFTs.

In the TimeSwap V2 version, multiple choices and assets are offered to Arbitrum users to earn yield with zero liquidation risk. These pools include:

-

gDAI - DAI;

-

wstETH - USDC;

-

plsARB - USDC.

How to Participate in TimeSwap and Develop Strategies?

Before we begin, I want to emphasize that borrowers do not face liquidation risks—they only need to repay their debt before maturity. If a borrower defaults, lenders will reclaim the corresponding collateral.

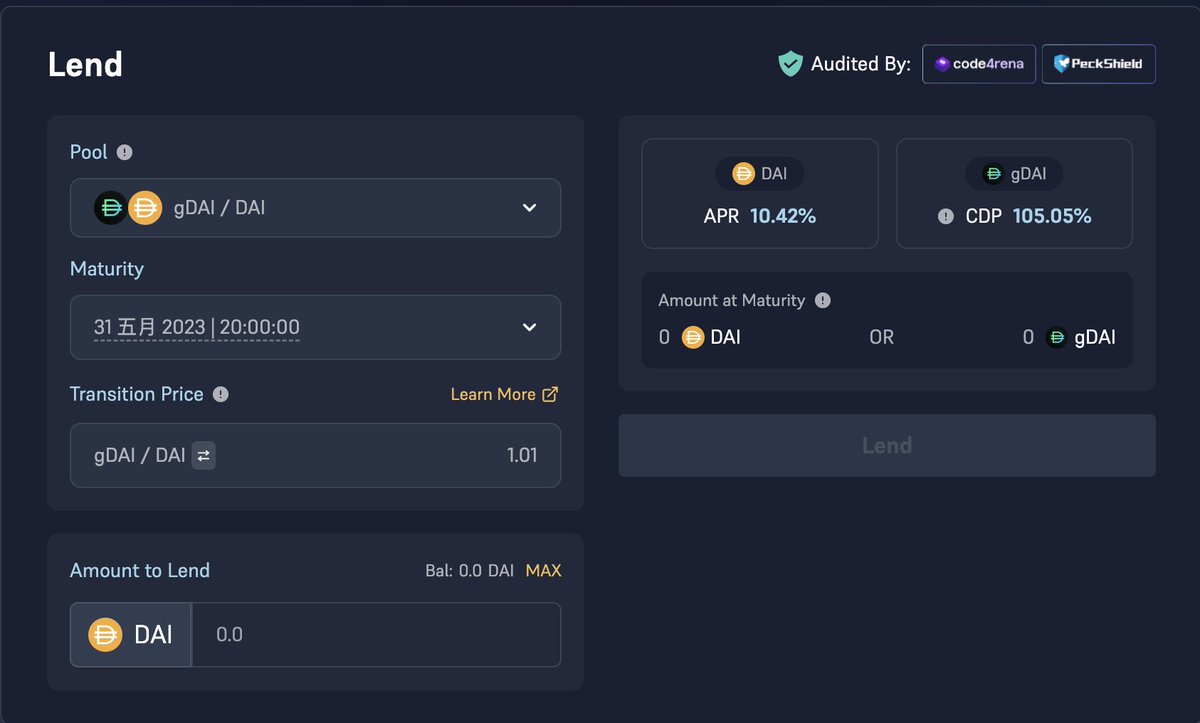

$gDAI - $DAI

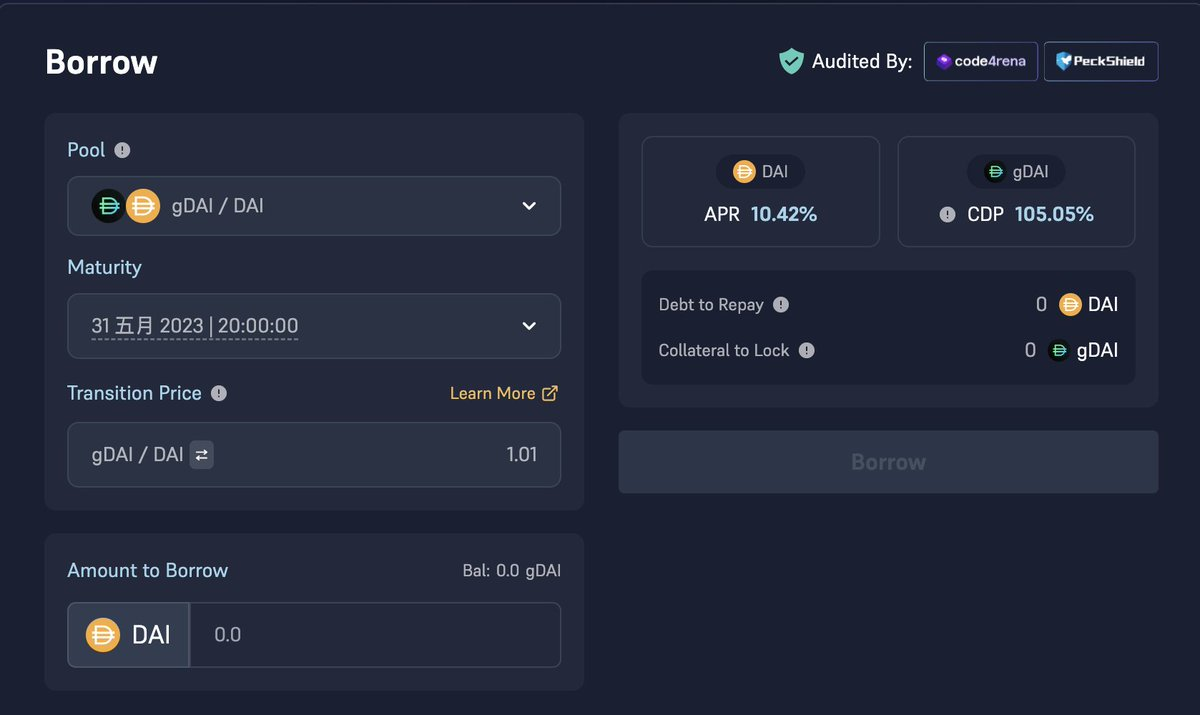

For borrowers, you can use $gDAI as collateral with a CDP of approximately 105% to borrow $DAI, which can then be used in other DeFi protocols or recycled back into $gDAI.

Borrowers can take out $DAI loans against $gDAI at a CDP close to 105%, use the received $DAI in other DeFi protocols, or further recycle it into $gDAI. During the initial phase of the lending pool, recycling 10 times could yield a 72% return on $gDAI, equivalent to nearly 6.2% fixed interest.

For lenders, they can lend $DAI at a fixed interest rate and receive $gDAI when the ratio drops below 1.01. TimeSwap currently offers over 10% fixed interest on $DAI, making it highly attractive for stablecoin holders.

$wstETH - $USDC

$wstETH is an alternative version of $stETH. If you're a lender, you can simply deposit your $USDC into the pool (lending $USDC at a fixed rate). For borrowers, they can pledge interest-bearing ETH derivatives like $wstETH as collateral to borrow $USDC at a fixed rate.

$plsARB - $USDC

PlutusDAO is a yield-aggregating protocol operating on Arbitrum that converts received governance tokens into pls assets. The integration between PlutusDAO and TimeSwap aims to unlock secondary liquidity for $plsARB.

If you're a borrower, you can deposit your plsARB and borrow $USDC at a fixed interest rate, then use the received $USDC in other DeFi protocols. Lenders will always receive principal plus interest, though the specific asset they receive depends on whether the borrower defaults.

Summary

When market sentiment turns bearish, finding a solid place to park your assets—especially stablecoins—requires significant upfront research. We hope this article saves you time and sparks your interest in TimeSwap.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News