Lending Protocol and Governance Dependencies

TechFlow Selected TechFlow Selected

Lending Protocol and Governance Dependencies

For protocols that do not rely on governance, everything is determined by the market, which places higher demands on lending participants.

Overview

Lending protocols are the most critical component within DeFi systems. However, different lending protocols have adopted various architectures based on their governance mechanisms. This article primarily discusses the architecture of lending protocols from the perspective of governance systems. Focusing on this objective, the content mainly covers the relationship construction between Collaterals and Liabilities and the parameter configuration of lending protocols.

Collaterals and Liabilities

Monolithic

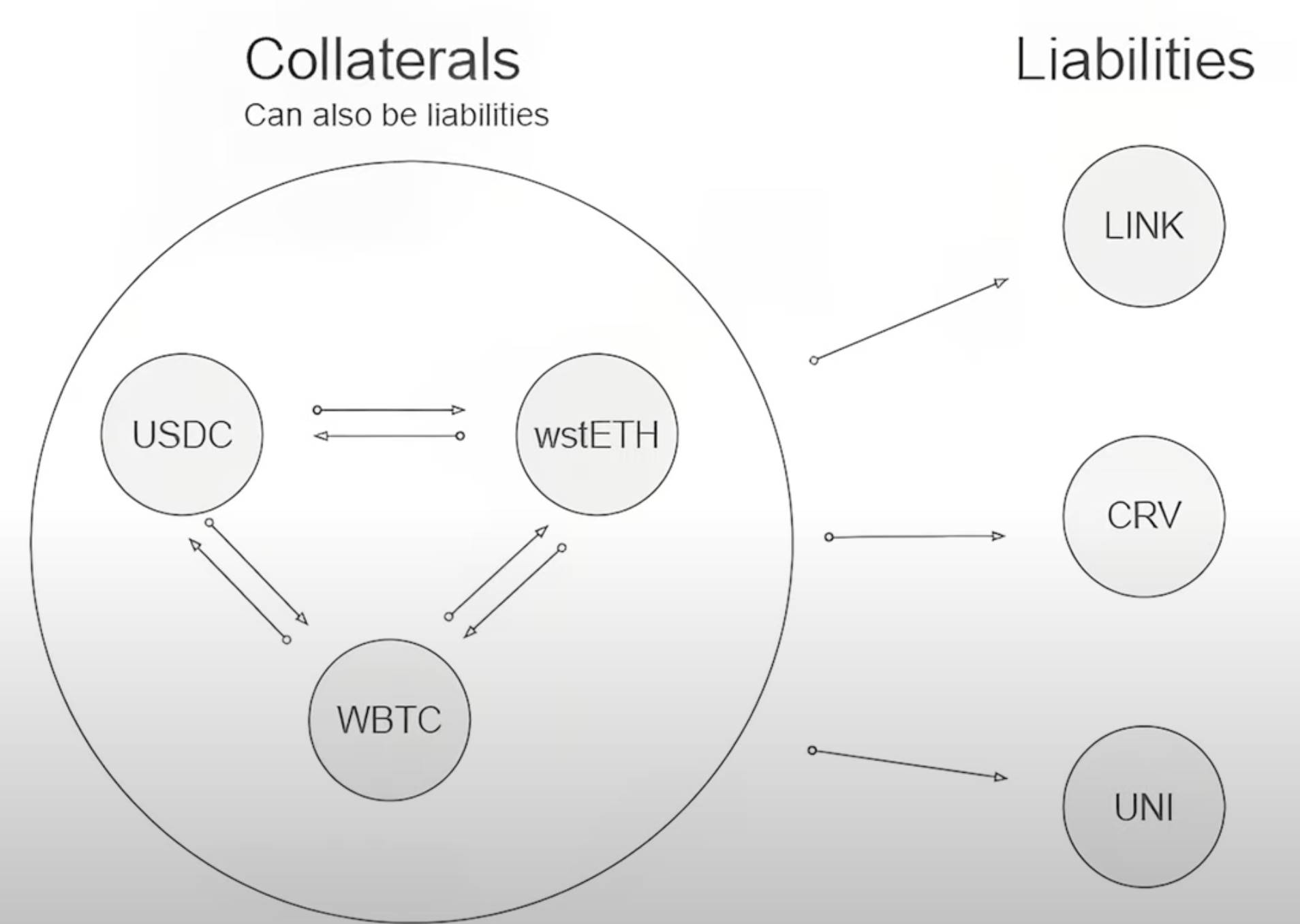

Monolithic is currently still the most mainstream architecture for lending protocols. Under this architecture, users can use multiple assets as Collaterals to borrow other assets, and the Collaterals deposited by users can also be borrowed again by other users. Therefore, users' Collaterals can earn interest.

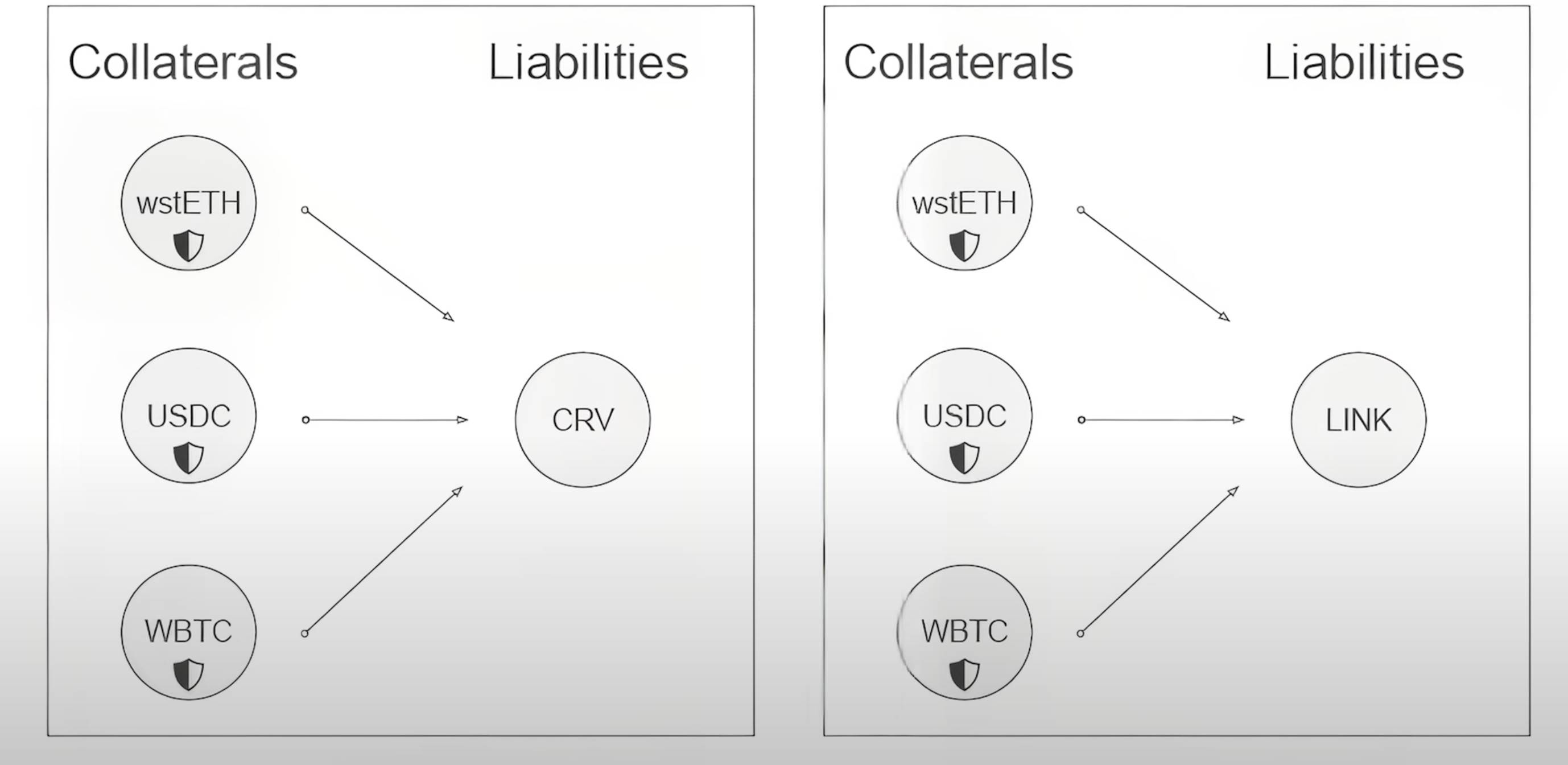

In the Monolithic architecture, to avoid risks, certain tokens are only allowed to be borrowed but cannot serve as Collaterals. For example, in the figure below, users can deposit wstETH and USDC as Collaterals to borrow LINK tokens, but they cannot use LINK tokens as Collaterals to borrow WBTC.

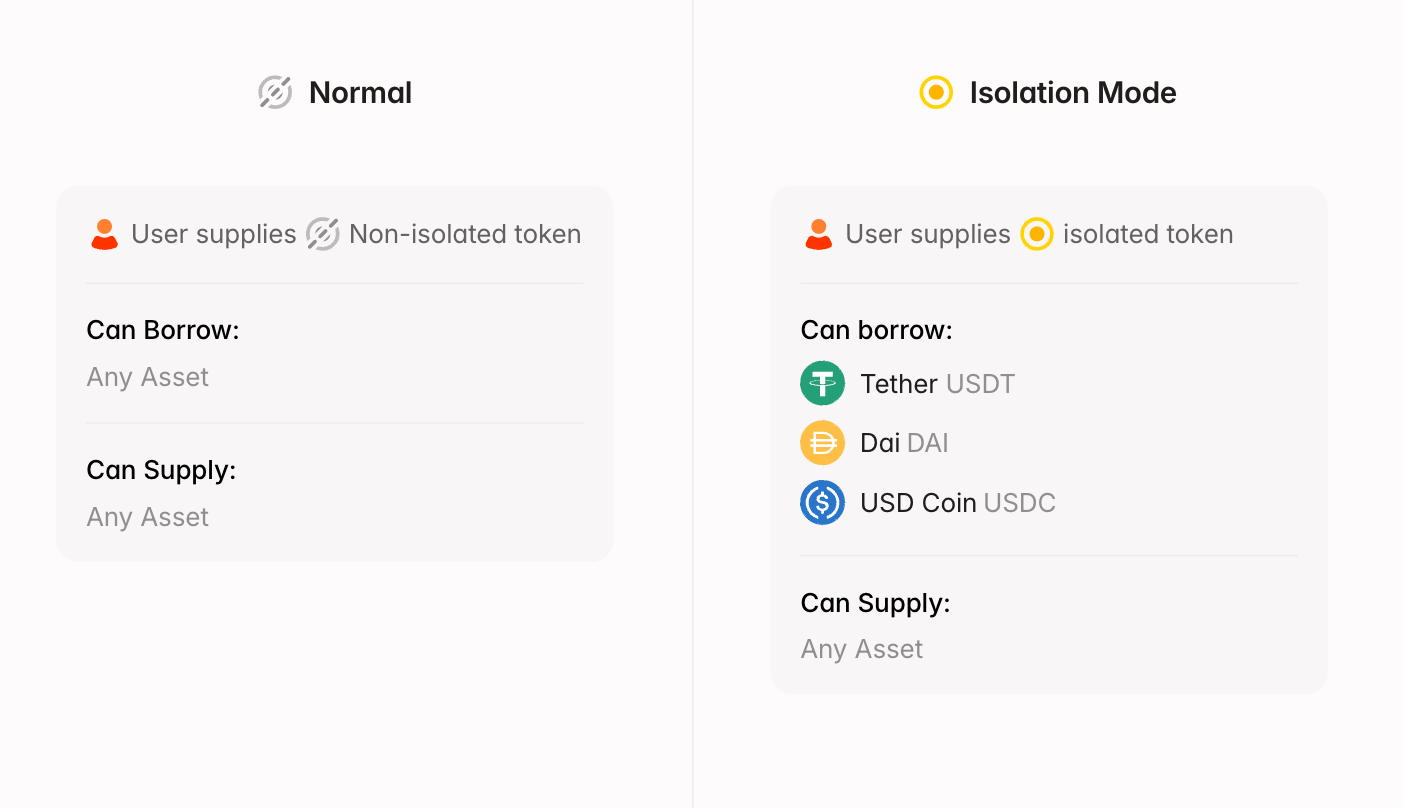

The lending protocol that best fits the Monolithic architecture is AAVE V3, currently the largest lending protocol on Ethereum. In AAVE V3, most assets can function both as Collaterals and Liabilities (i.e., the Normal case shown in the figure below). AAVE V3 also features an Isolation Mode, where certain assets can only be used as Collaterals to borrow stablecoins but not other tokens.

The capital efficiency of the Monolithic architecture is relatively high. For ordinary users, they can directly deposit multiple tokens as Collaterals to borrow needed assets while earning interest on those Collaterals. However, the biggest issue with this architecture is its inability to include most tokens as Collaterals because introducing volatile-value tokens as Collaterals could lead to significant losses for the lending protocol.

Token listing on AAVE V3 is extremely strict, so currently AAVE V3 supports only about 30 tokens as collateral, many of which are under Isolation Mode and cannot serve as general-purpose collateral.

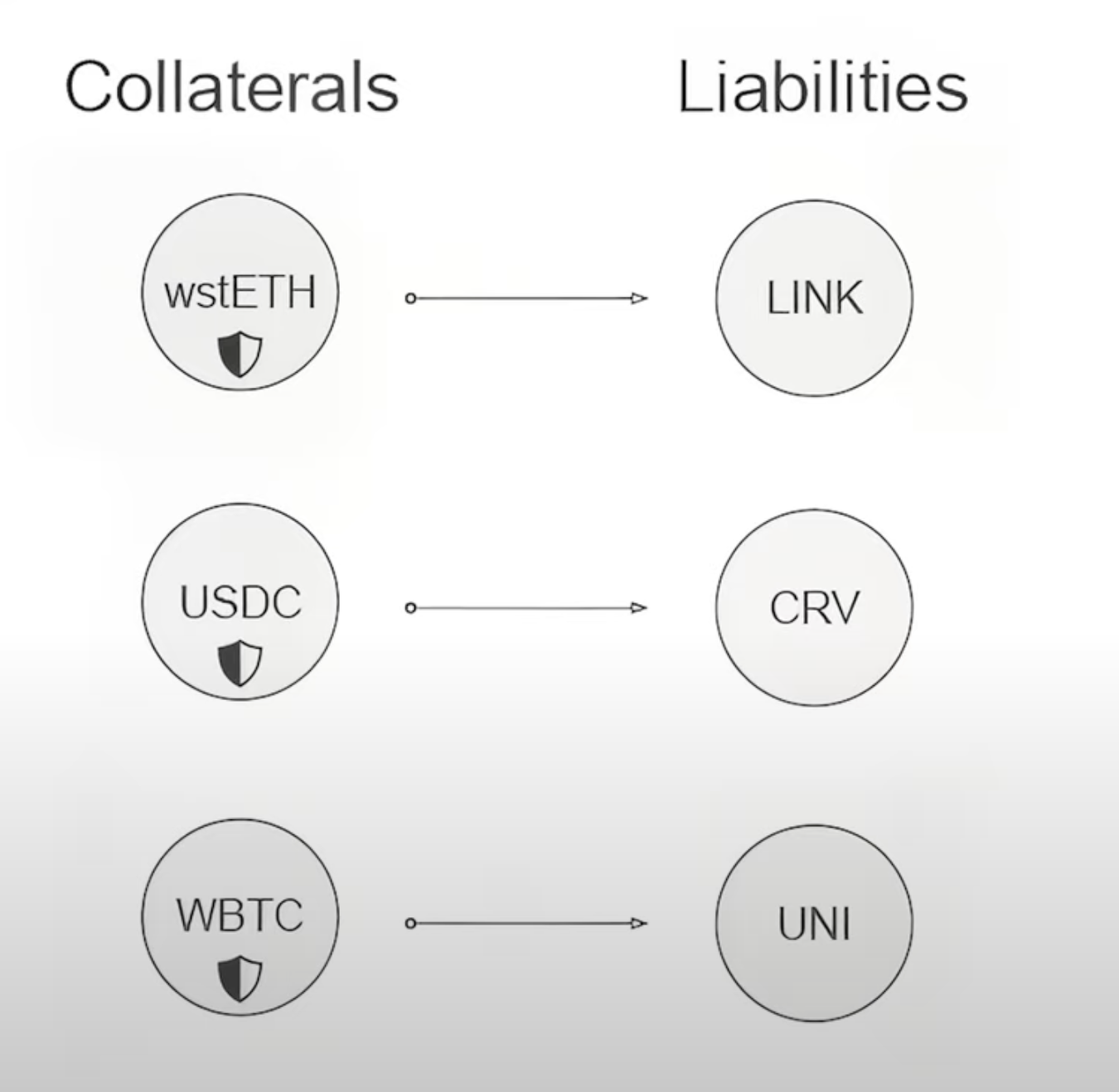

Isolated Pairs

Isolated Pairs is another commonly used structure for lending protocols. In this institutional setup, Collaterals deposited by users can only be used to borrow a specific token. Additionally, the deposited Collaterals will not be lent out again, so Collaterals do not earn interest.

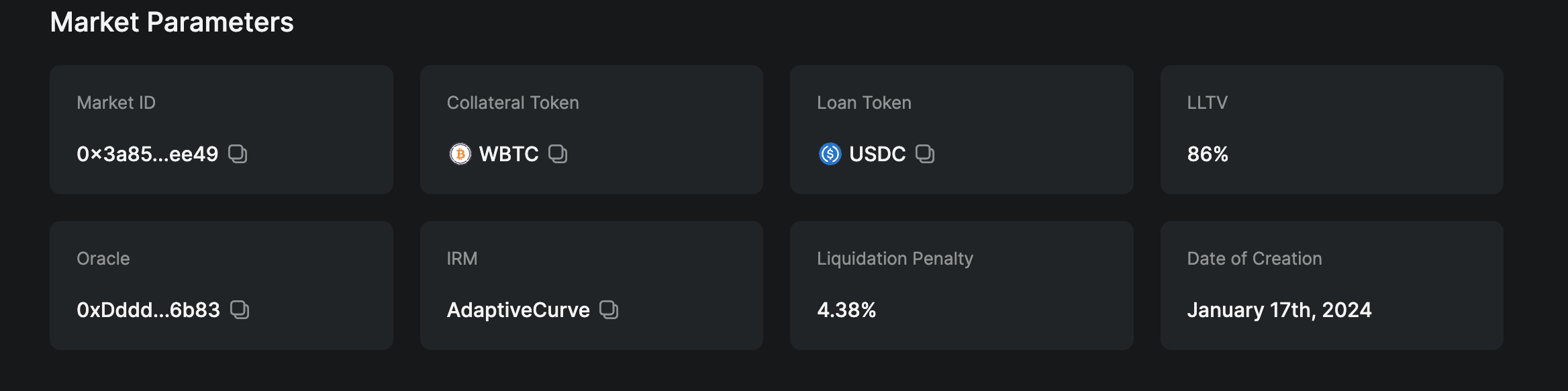

Currently, Morpho Blue, the third-largest lending protocol on Ethereum, uses this model. The protocol contains a series of discrete markets where users can choose to deposit Collaterals into a specific market to borrow corresponding Liabilities tokens. However, since Collaterals are not re-lent, users cannot earn interest income on their Collaterals. The figure below shows the WBTC/USDC market, where users’ deposited WBTC can only be used to borrow USDC tokens, and the deposited WBTC does not earn interest.

Therefore, in Morpho Blue, there exists another group of users who provide USDC to the lending market to earn interest. For instance, users might inject USDC into the market above, which uses WBTC as Collateral, to earn interest. Thus, in the Isolated Pairs system, users are divided into two categories:

- Depositors, who supply Liabilities tokens to the market for others to borrow and earn lending interest

- Borrowers, who provide collateral to borrow tokens but forgo interest income on the collateral

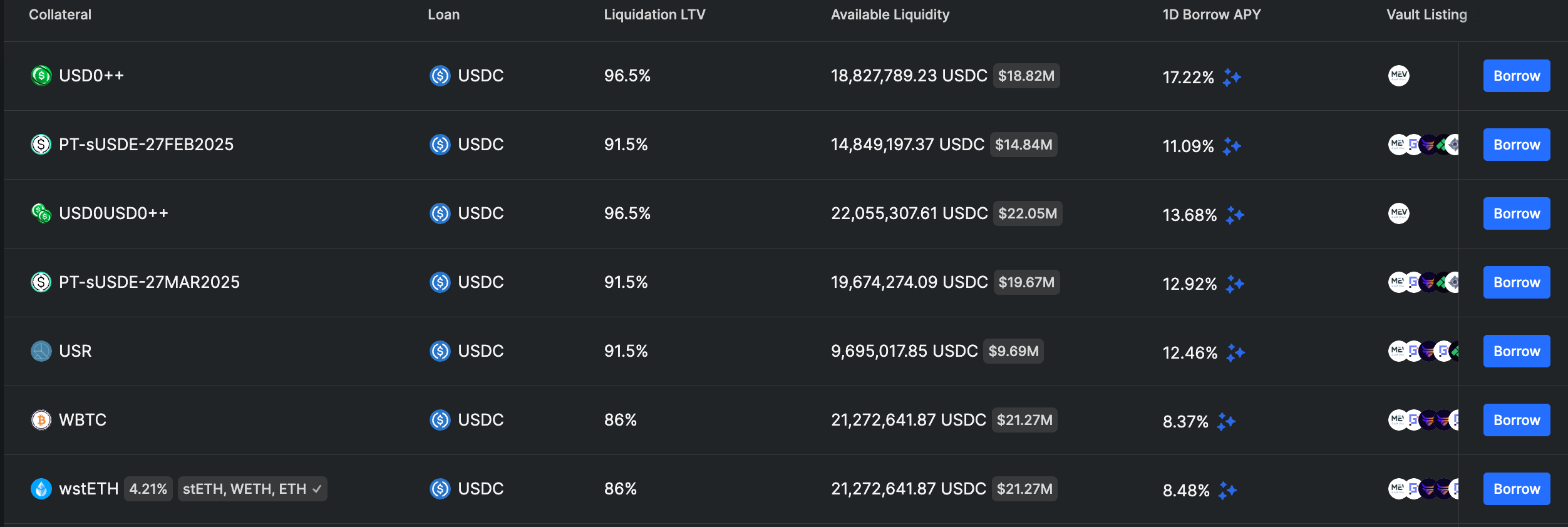

For depositors, in the Morpho Blue protocol, the same token may be available for borrowing in multiple markets. For example, there are markets using WBTC as Collaterals to borrow USDC and markets using wstETH to borrow USDC, with different interest rates paid to USDC providers across these markets. The figure below displays interest rates for some markets where USDC can be borrowed using different Collaterals:

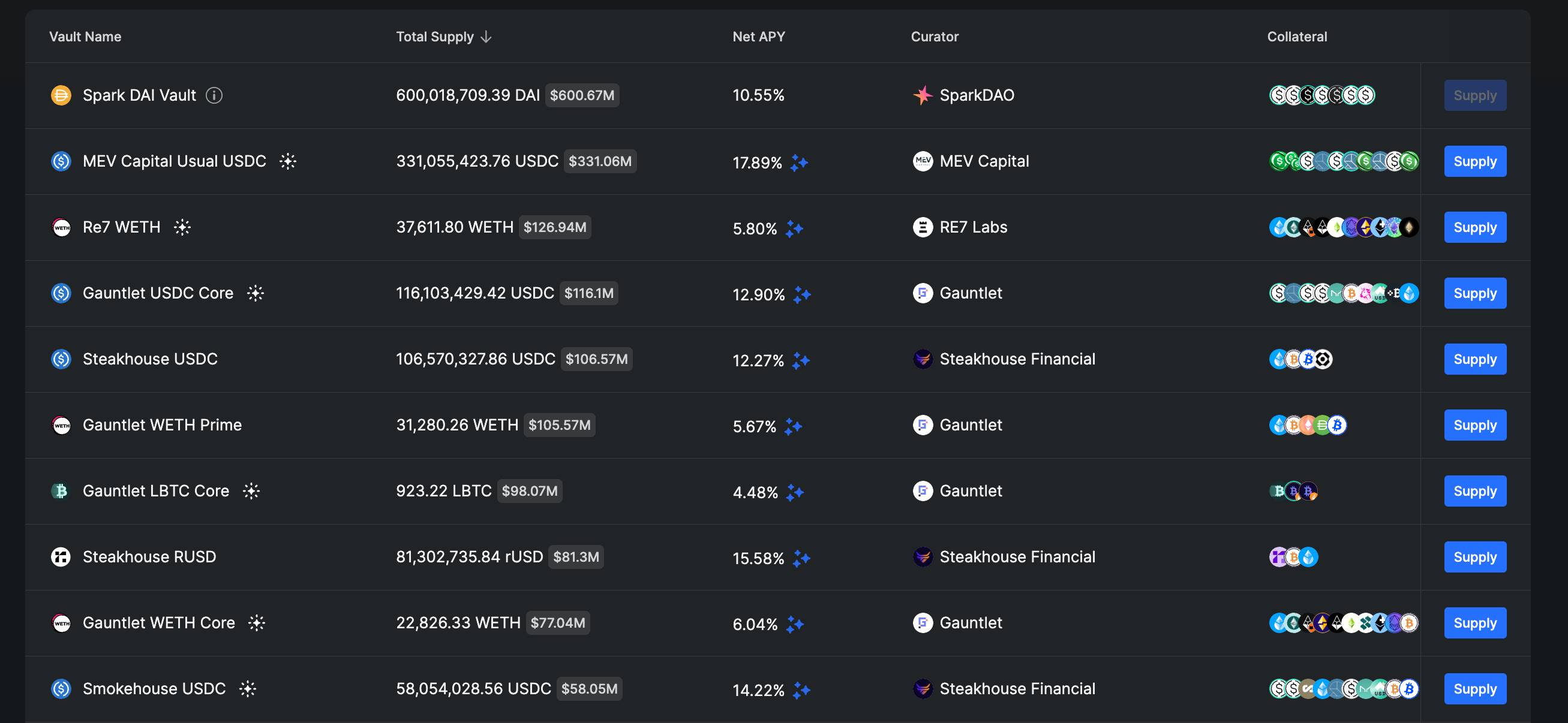

Therefore, if users deposit USDC and wish to earn higher yields, they need to allocate their USDC across different markets—a non-trivial task because some markets may involve highly volatile Collateral tokens. Providing USDC to such markets could result in liquidation losses due to extreme price volatility. Hence, in Isolated Pairs markets, a third type of market participant often emerges—the Curator. Curators are typically professional financial institutions that analyze each market's risk and return profile and design their own capital allocation strategies. Users can then delegate their USDC management to Curators based on these strategies and performance records.

Another advantage of Isolated Pairs is that it completely avoids the governance issues present in Monolithic architectures. Any user can create a lending market without requiring governance approval. For example, USD0++, a new type of yield-bearing token, would find it difficult to enter lending protocols like AAVE, but it can directly establish a market within Morpho Blue.

From a developer’s perspective, the Isolated Pairs architecture has another major advantage: because it does not involve secondary lending of Collaterals, there is no need for code to track interest accrual on Collaterals, making the overall implementation simpler. Morpho is currently one of the most popular lending protocols among developers.

Isolated Groups

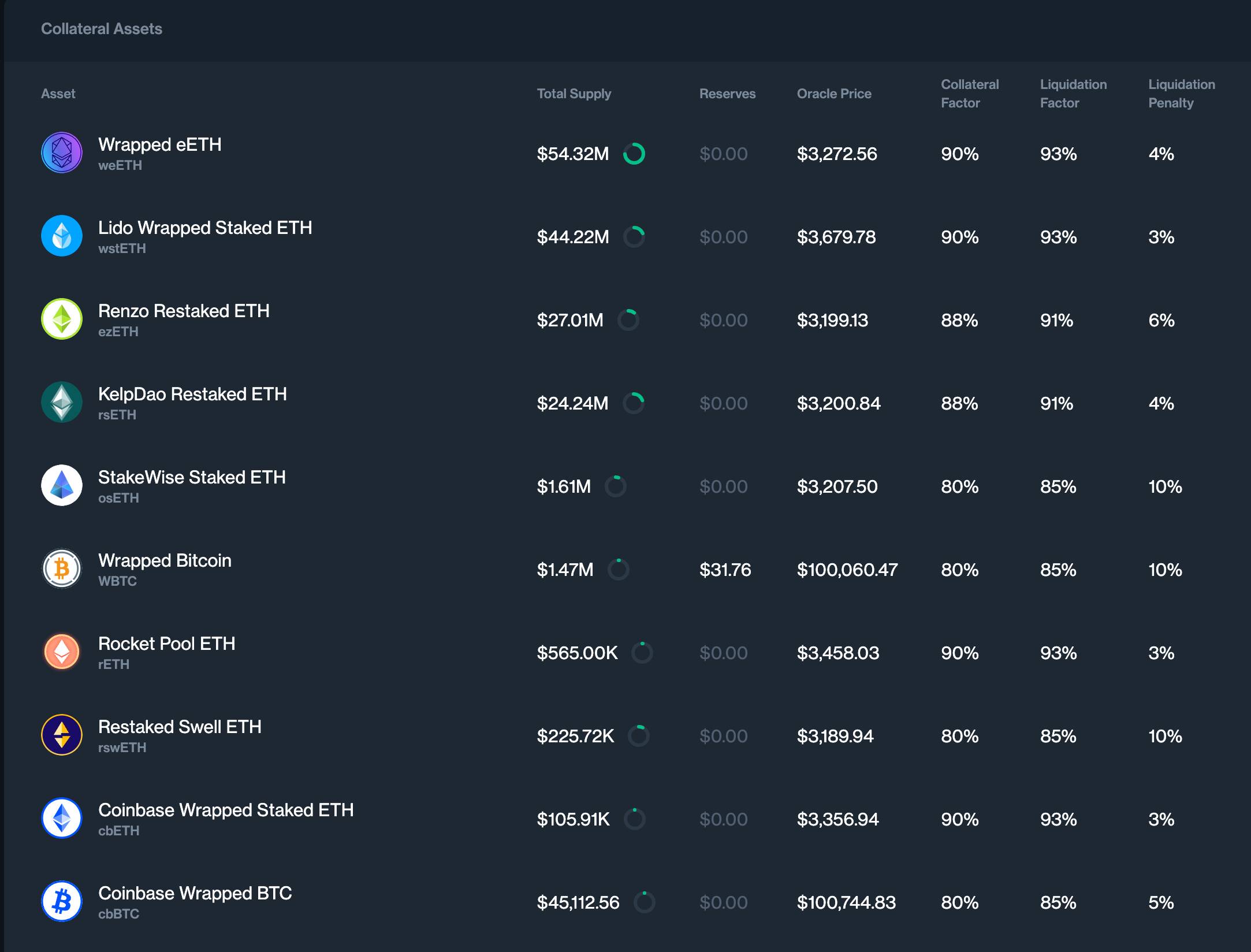

Currently, only Compound V3 uses this architecture among lending protocols. Under this architecture, different Liabilities have distinct sets of Collaterals.

A concrete example is within the mainnet version of Compound V3. Suppose we want to borrow ETH; then we can offer the following collaterals:

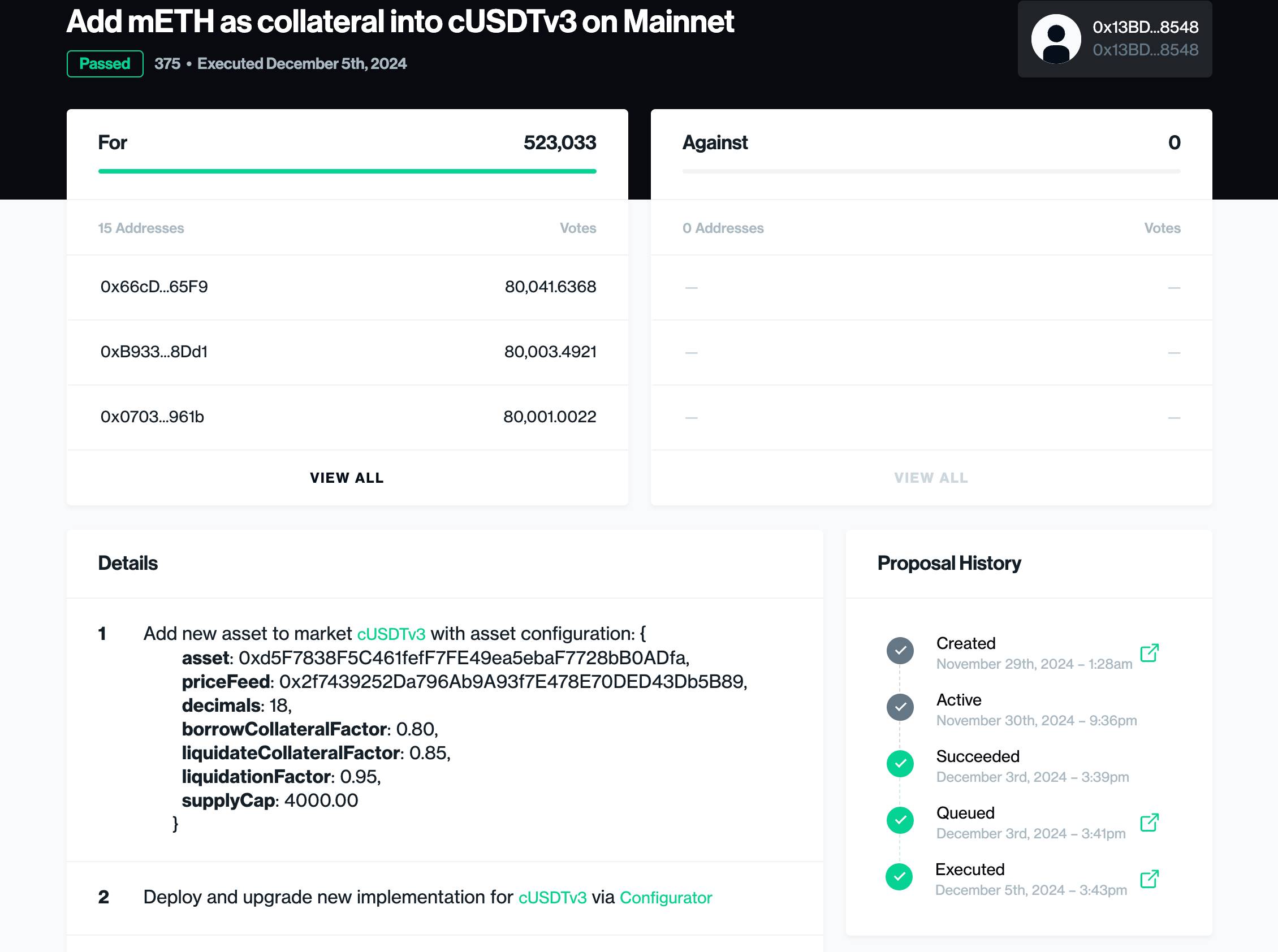

Compared to the Isolated Pairs system, Isolated Groups allow users to provide multiple types of collateral for a single asset. This model theoretically enables developers to freely deploy lending markets and configure relationships between Collaterals and Liabilities. However, Compound V3, the only current implementation of this model, still employs a governance mechanism based on COMP tokens, where all market creations and collateral modifications require voting by COMP token holders:

Somewhat awkwardly, Compound has experienced two instances of code vulnerabilities. These incidents are detailed in Rekt’s articles Compound Errors and Overcompensated. However, neither incident affected assets within the lending protocol, so Compound remains the fifth-largest lending system on the Ethereum mainnet.

Isolated Groups with Mutual Collateral

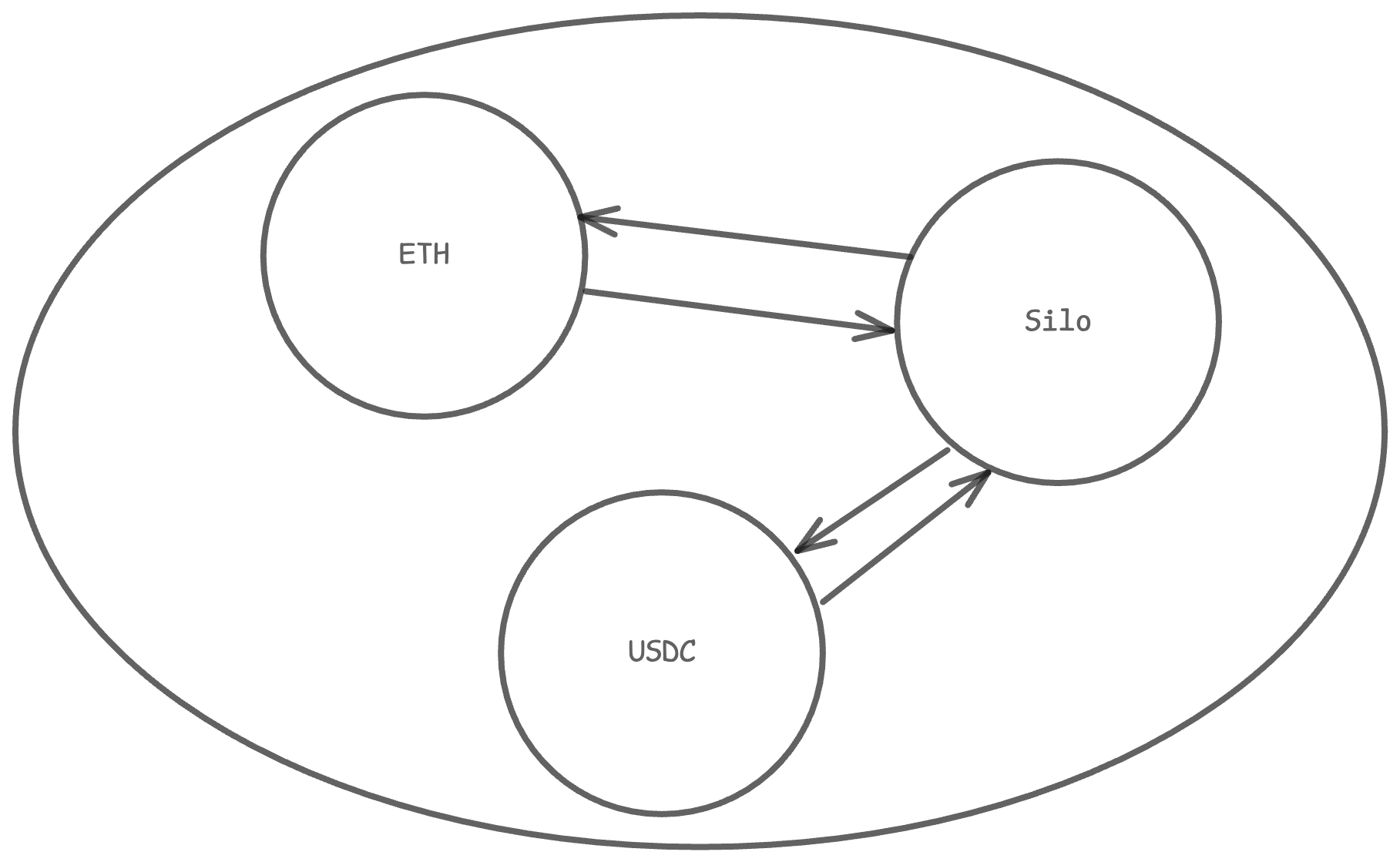

This lending protocol architecture is rarely used. Currently, Silo Finance, ranked 18th on DefiLlama’s Lending Protocol TVL leaderboard, implements this architecture.

The figure above illustrates the lending relationships in the Silo Arbitrum version for the Silo token-specific lending market. Under the Isolated Groups with Mutual Collateral architecture, tokens are mutually linked and serve as each other's Collateral. In the Silo Arbitrum version, every lending market includes two common tokens—ETH and USDC—alongside a third token designated by the market creator, which is the Silo token in the figure above.

In Silo’s documentation, ETH and USDC are referred to as bridge assets, while the third token specified by the market creator is called the base asset. The term bridge assets is appropriate because users can construct chained borrowing paths using ETH and USDC to meet their needs—for example, using the Silo token as collateral to borrow ETH, then using ETH as collateral to borrow ARB. Through this path, we effectively achieve the goal of borrowing ARB using the Silo token as collateral.

The benefit of Isolated Groups with Mutual Collateral is that it achieves both risk isolation offered by Isolated Groups—allowing users to select lending markets according to personal risk preferences—and partially mitigates liquidity fragmentation by enabling users to design chained borrowing paths leveraging bridge assets to indirectly fulfill certain borrowing needs. Finally, due to the mutual collateral relationship, deposited Collateral can actually earn interest.

However, Silo also allows users to configure Collateral Status. This option lets users prevent their Collateral from being borrowed—thus ensuring Collateral safety—at the cost of forfeiting interest earnings on the Collateral

Parameters

In the second part of this article, we will discuss parameter settings within lending protocols, focusing primarily on Collateral Factor—the parameter most closely related to capital efficiency. This parameter measures the discount rate applied to Collateral within the lending protocol. The higher the Collateral Factor, the lower the discount applied to the asset within the protocol. Generally, stable assets like ETH have higher Collateral Factors, while low-market-cap assets tend to have lower ones.

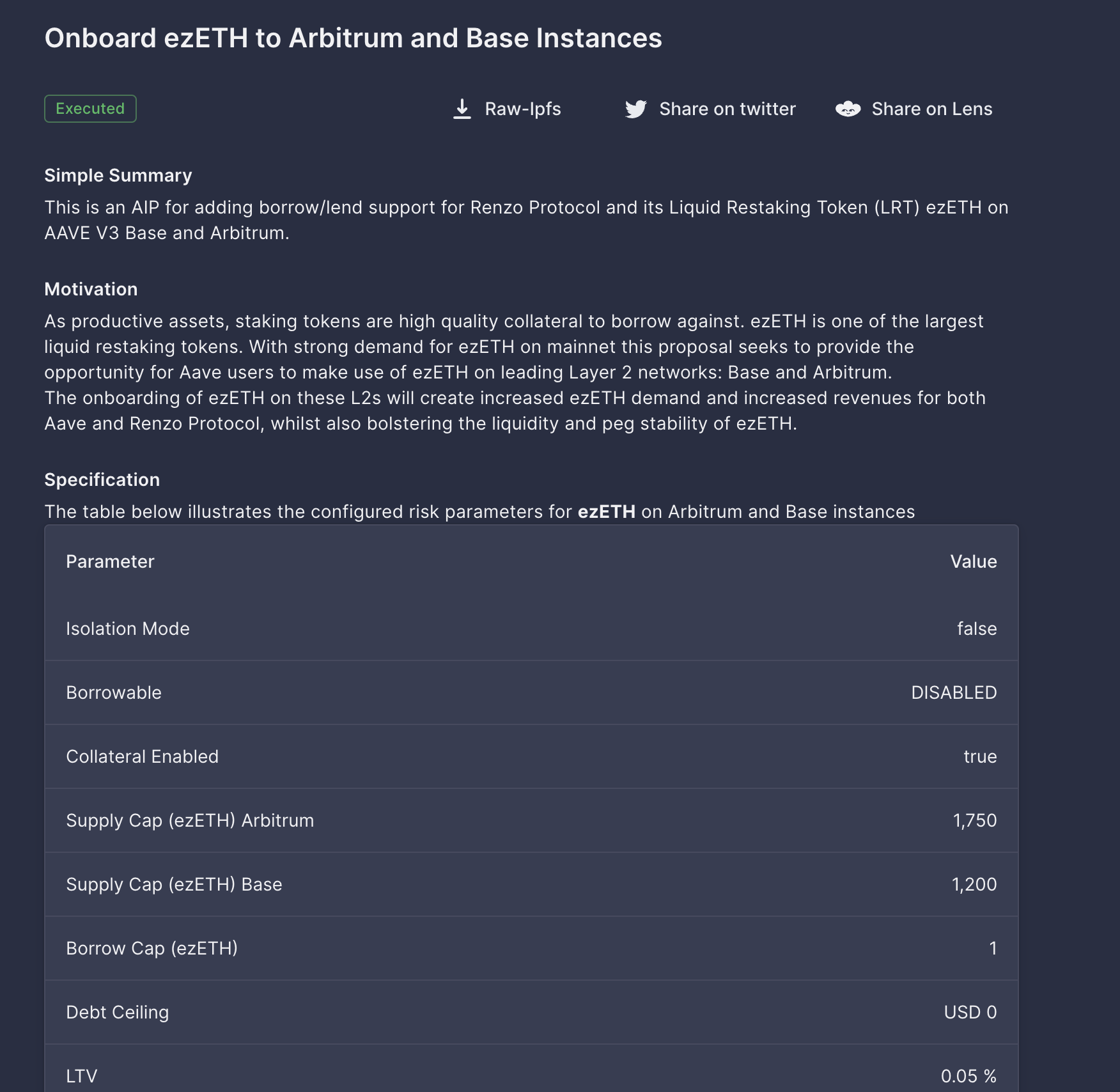

Global Paternalism

Global Paternalism is currently the most common mode for configuring Collateral Factor parameters within lending protocols. Simply put, the protocol team directly sets and modifies the Collateral Factor. For example, within AAVE, the AAVE DAO organization proposes changes to parameters for certain Collaterals. The figure below shows the parameters set by AAVE governance for ezETH when used as Collateral.

For both the protocol and users, Global Paternalism is the simplest approach.

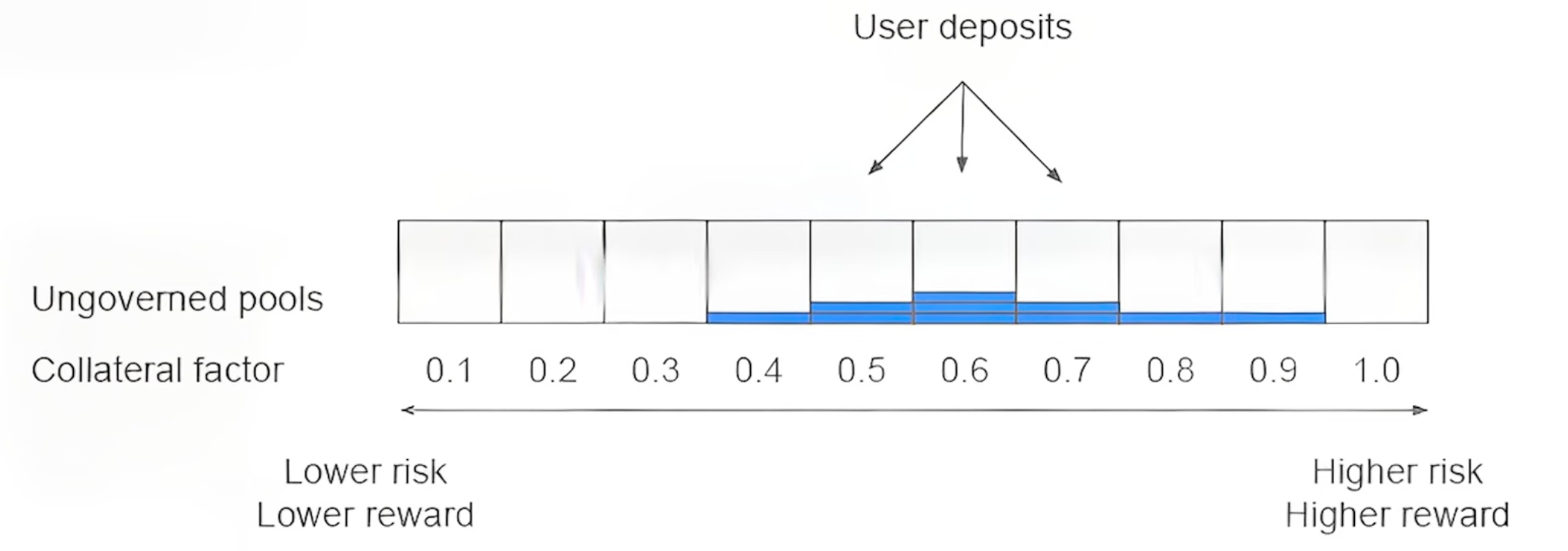

The Invisible Hand

Currently, lending protocols represented by Morpho insist on not introducing governance systems, so Global Paternalism cannot be implemented within Morpho. Therefore, Morpho adopts an alternative solution. Under this scheme, any user can create a market with arbitrary Collateral Factor parameters, and depositors allocate their funds to markets they deem most reliable.

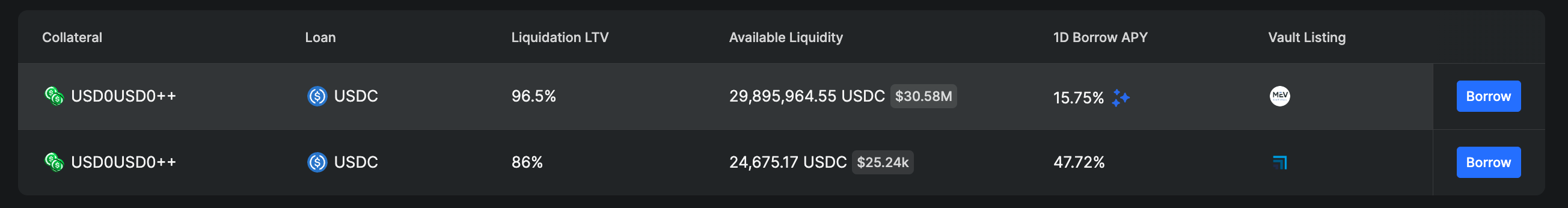

For example, in Morpho, we observe two markets with different parameters for the USD0++ / USDC pair, and users allocate their USDC funds into different markets based on their individual risk preferences.

Conclusion

This article introduces common architectures found in current DeFi lending protocols. In short, different lending protocols have emerged due to varying degrees of reliance on governance. We can broadly categorize lending protocols into two types:

- Highly governance-dependent: Parameters and collateral selection within the lending protocol require strict governance processes

- Governance-independent: Lending protocols allow free market creation and arbitrary parameter setting, with users "voting with their feet"

For highly governance-dependent protocols, the governance mechanism is paramount. Compound and its forked projects have repeatedly encountered governance issues leading to protocol problems. Currently, AAVE stands out as having the most robust governance mechanism among all protocols. A significant advantage of governance-dependent protocols is that, assuming trust in the governance mechanism, depositors need not perform any actions beyond depositing assets. This is extremely attractive for institutional entities such as the Ethereum Foundation.

For governance-independent protocols, everything is determined by the market. This places higher demands on lending participants, as both depositors and borrowers must monitor market dynamics and constantly reallocate funds across different lending markets to achieve optimal returns. This is highly unfriendly to foundation-type users, who cannot frequently adjust their capital positions due to structural constraints. Of course, users may choose to delegate funds to third parties, but currently, third-party managers within Morpho are not more trustworthy than those in AAVE.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News