zkLend: A StarkNet money market protocol pioneering KYC-based uncollateralized lending

TechFlow Selected TechFlow Selected

zkLend: A StarkNet money market protocol pioneering KYC-based uncollateralized lending

The project team will focus on developing features we believe the next-generation money market should have, including backend contracts and frontend UI/UX, to build the best native money market protocol.

Author: Kadeem Clarke

Translation: TechFlow

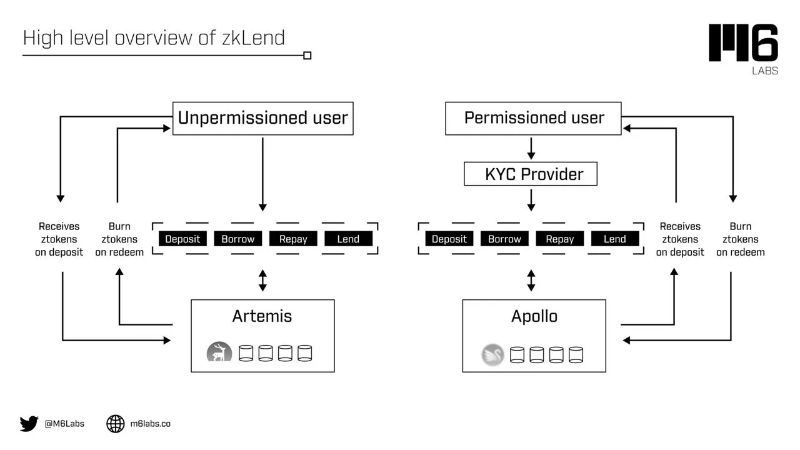

The protocol offers a dual solution without compromising decentralization: permissioned and compliance-focused solutions for institutional clients, and permissionless services for DeFi users.

The growing adoption of cryptocurrency has led to sharp price increases and a surge in the number of dApps. On networks like Ethereum, higher transaction volumes have also highlighted several issues. Whether you've experienced it firsthand or only heard about it, scalability remains a key challenge for blockchain networks, directly affecting their functionality.

As a result, on today’s most well-known, secure, and decentralized smart contract networks, transactions are more expensive and take longer to execute. Before we proceed, you should know there are two main types of Rollup solutions: Optimistic Rollups, and Zero-Knowledge (or validity) Rollups—which is what we're discussing today—commonly referred to as ZK-Rollups. zkLend is a Layer 2 money market protocol—more precisely, a native money market protocol built on StarkNet—that combines Ethereum's security with the scalability, incredible transaction speed, and cost savings of ZK-rollups.

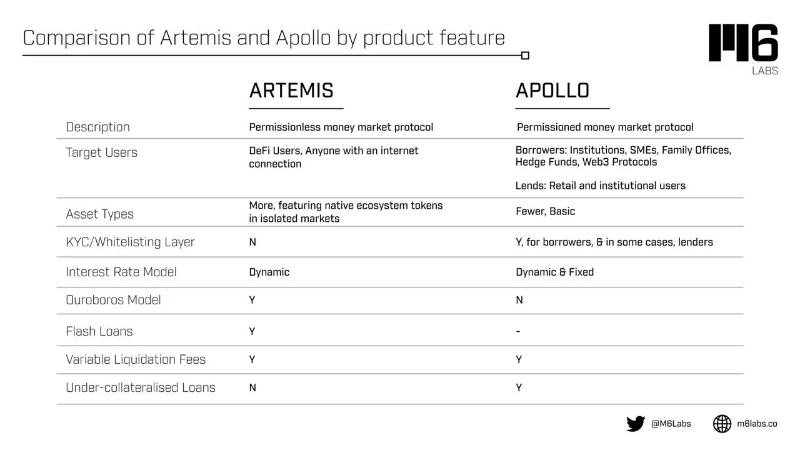

The protocol provides a dual solution without sacrificing decentralization: a permissioned, compliance-oriented solution ("Apollo") for institutional clients and a permissionless service ("Artemis") for DeFi users.

Notably, StarkNet gas fees are over 100 times lower than those on the main chain, making it ideal for transaction-intensive dApps.

With Artemis and Apollo, zkLend is building next-generation finance inspired by both tradition and innovation. Users can deposit assets into Artemis to earn yield while using some of their holdings as collateral for loans. Using Artemis, you can save, borrow, and lend in a decentralized and cost-effective way on StarkNet, all while benefiting from the security of Ethereum Layer 1.

Regarding Artemis, it enables lending/borrowing, tokenizes debt, offers flash loans to customers, and categorizes assets into different tiers.

-

Lending/Borrowing: Users can borrow assets deposited in the money market using their zTokens as collateral. Borrowers' funding rates depend on market demand and the utilization rate of the liquidity pool. A user’s borrowing capacity, calculated based on the value of their collateral and the loan-to-value ratio of the target asset, determines their maximum borrowable amount. If a user’s total debt exceeds their borrowing capacity, their position may be liquidated to protect the protocol from systemic risk.

-

Tokenized Debt: ERC20-compliant zTokens are used to tokenize debt on the protocol. Depositors receive an equivalent amount of zTokens upon deposit, pegged 1:1 to the underlying asset. Over time, a depositor’s zToken balance increases, reflecting accrued interest. zTokens represent claims on the deposit pool and serve as collateral for determining borrowing power. In future developments, zTokens could be used to build derivatives such as vault strategies, debt obligations, and other credit derivatives.

-

Flash Loans: Borrowers can use liquidity from reserve pools without posting collateral, provided the loan is repaid within the same block—enabling them to seize market arbitrage opportunities. Borrowers pay a fee for their flash loan, which is then distributed evenly among all liquidity providers in the respective pool.

The second component of zkLend is Apollo, which works similarly but is only accessible to approved users who have completed the protocol’s KYC/KYB procedures. Therefore, these two protocols will operate independently, each with its own liquidity pools and governance details.

Before understanding Apollo, we must first grasp the concepts of whitelisted layers and whitelisting.

The whitelisted layer ensures that only authorized participants can create their own pools and borrow undercollateralized funds. On the other side, lenders may include other institutions or retail users.

Compliance checks such as KYC, KYB, AML, and CFT, along with pre-onboarding due diligence (understanding terms and conditions, fiat-to-crypto conversion, background checks), and technical steps (granting permissions to selected Ethereum wallet addresses) are typically part of the borrower whitelisting process. External parties will conduct compliance reviews, while the governance body will define standards and eligibility criteria for borrowers participating in Apollo. Robust KYB checks and governance-approved procedures are in place to ensure maximum transparency and protection for lenders.

As Apollo develops, the team will reveal further details regarding whitelisting, responsibilities, and obligations within the zkLend protocol to ensure additional risk controls, adequate compliance standards, and oversight are implemented. Notably, zkLend will work closely with financial and legal advisors.

-

Institutional Verification: The institutional verification process consists of off-chain and on-chain components. Off-chain includes background, credit, and reference checks conducted in collaboration with industry-recognized service providers. On-chain involves working with blockchain-based service providers for whitelisting, custody, and wallet tracking analysis. Apollo will adopt a "high-touch," client-centric approach. Prior to verification, a dedicated institutional and compliance team will engage with institutions to understand their product needs and compliance requirements, provide guidance through the verification process, and coordinate with KYC/KYB providers, custodians, and whitelisting services to streamline onboarding.

-

Deposits/Lending: The key difference between unpermissioned and permissioned pools on Apollo is that the former allows retail users to deposit, while the latter is restricted to vetted lenders. In both cases, borrowers must pass KYB checks and be approved by governance. Pool depositors (participants) will receive corresponding zTokens representing their share in the pool and accumulated interest, with balances increasing according to earned yields.

-

Borrowing: Only KYB-verified institutions and/or participants can become borrowers. Each borrower can either create their own pool or join an open one. Each pool will have distinct borrowing terms—including maturity, optionality, and collateral ratios—that influence interest rates across different pools.

Now that we’ve covered the core features of both zkLend tools, let’s examine the key differences between Artemis and Apollo, as shown in the diagram below:

What Should We Know About zkLend’s Token?

ZEND is the native utility and governance token, providing economic incentives to encourage users to contribute to and participate in zkLend’s ecosystem, thereby creating a mutually beneficial system where every participant's efforts are fairly rewarded. ZEND is an integral and essential component of zkLend; without ZEND, there would be no incentive for users to spend resources participating in activities or providing services that ultimately benefit the entire ecosystem on zkLend.

Before diving into zkLend, you should be aware of several distinctions between zkLend and other money market protocols—this is also why we chose this particular ZK-rollup project to highlight today:

-

Offers a dual solution for permissioned and permissionless services without sacrificing decentralization.

-

The two protocols can leverage each other to maximize capital efficiency at scale.

-

User experience: MM protocols are more intuitive to use.

-

Built with institutions in mind, guiding institutional users through practical approaches.

What Else Makes zkLend Worth Watching?

ZK-rollups are among the most highly regarded solutions for Ethereum’s scalability challenges. Compared to others, ZK technology delivers higher efficiency. Although ZK-rollup solutions are still in early stages, they significantly improve Ethereum’s scalability by reducing gas fees and minimizing data per transaction.

Stay tuned for key dates on zkLend’s roadmap. There are four phases, each bringing major updates to the project:

Phase One: Artemis MVP (Q3 2022)—Core functionality established; testnet already launched and deployed.

Phase Two: Artemis Mainnet (Q4 2022 / Q1 2023)—Finalize Artemis mainnet product.

Phase Three: Apollo MVP (Q2 2023)—Launch Apollo testnet, onboard first institutional clients.

Phase Four: Apollo 1.0 (Q3 2023)—Launch Apollo mainnet and prepare transition to DAO governance.

As you can see, zkLend’s roadmap is comprehensive, focusing on refining processes and functionalities for both Artemis and Apollo. The team is committed to developing features expected of the next-generation money market, including backend contracts and frontend UI/UX, aiming to establish the best native money market protocol.

Keep in mind that while scalability holds significant value in modern blockchain networks, you must dive deeper into various scaling solutions to determine the best fit for your needs. ZK-rollups and other applications leveraging ZK proofs are still in their infancy, and we expect substantial technological advancements in this space—so buckle up, the best is yet to come.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News