Compared to other lending protocols, conduct an in-depth analysis of Silo Finance's advantages and moats.

TechFlow Selected TechFlow Selected

Compared to other lending protocols, conduct an in-depth analysis of Silo Finance's advantages and moats.

Silo Finance is a money market protocol that leverages a novel design pattern to isolate risks while maintaining capital efficiency.

Author: Gustavo Lobo

Translation: TechFlow

Introduction

Lending protocols in DeFi aim to create decentralized, permissionless loans that provide users with efficient capital strategies. Users can lend out their funds to earn interest income. Borrowers can take loans if they are willing to pay interest.

Like all forms of leverage, the most immediate risk comes from liquidations.

Once funds are deposited into a lending protocol’s smart contract and a position is opened, borrowers are assigned a Health Factor (HF). The HF represents the principal value of borrowed assets relative to the solvency of deposited collateral. Initial HFs vary because each protocol uses different risk parameters to define liquidation thresholds for different assets. A simplified view is that the closer a borrower’s HF is to "1", the closer they are to default.

In the event of a default, the lending protocol seizes and liquidates the locked collateral to repay the associated debt. Additionally, a penalty fee will be charged on the debt before any remaining collateral is returned to the borrower.

Competitor Analysis

AAVE

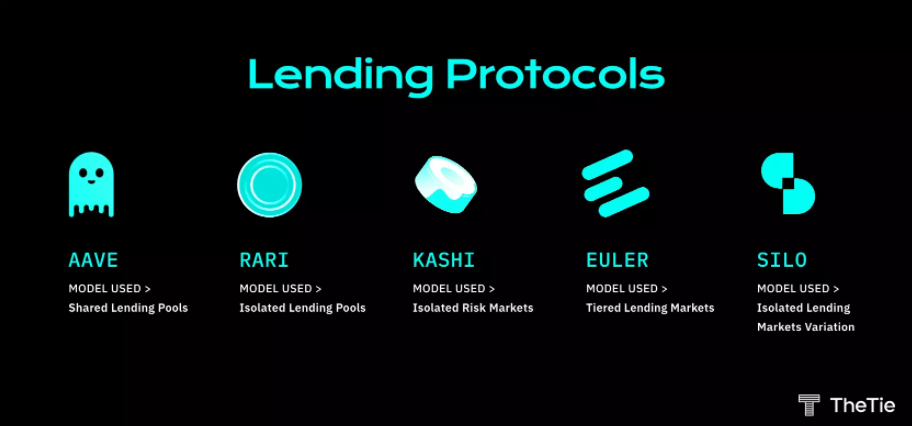

Model: Shared Lending Pools — First-generation lending protocols (like Aave) use a liquidity model known as "shared pools." Deposited assets are pooled into a single "shared" pool containing all the collateral held by the protocol.

Risks & Considerations

While this model is technically more capital-efficient than more isolated alternatives, it also introduces significant risks. Since numerous tokens share one lending pool, if one token is exploited, the entire lending pool is considered at risk. As such, these markets are better suited for short-tail assets to avoid potential vulnerabilities. We’ve already seen such cases with C.R.E.A.M., where a vulnerability allowed hackers to steal $137 million worth of crypto assets.

Rari

Model: Isolated Lending Pools — Users can create their own isolated money markets called Fuse Pools. These pools consist of multiple tokens, as creators can use any asset, oracle, or interest rate model. This multi-token structure creates an effective money market model.

Risks & Considerations

Isolated lending pools offer improved security over shared pools. However, each pool still depends on the individual security of all its assets. If one asset in a pool is compromised, the entire pool is at risk. It’s also worth noting the issue of centralization—each pool creator can adjust parameters as needed, adding further pressure on pool security. Note: Due to recent regulatory pressures and a major vulnerability, Rari and Fei have decided to shut down the protocol.

Kashi

Model: Isolated Risk Markets — Users can provide liquidity and create a money market for any trading pair they desire.

Risks & Considerations

This model achieves a high level of security, as each trading pair is fully isolated from others. If one pair is compromised, only that specific pair is affected. However, this level of isolation has drawbacks—liquidity becomes fragmented across many pools. For example, USDC has over 30 different pools. This fragmentation presents a challenge, forcing borrowers to carefully select the appropriate pool based on their funding size.

Euler Finance

Model: Tiered Lending Markets — Euler uses Uniswap v3 price oracles to create risk-based asset tiers to protect the protocol and its users. The three asset tiers are: Collateralized Tier, Cross Tier, and Isolated Tier.

Risks & Considerations

The main issue is oracle risk. Euler relies on Uniswap v3 price oracles, which have been exploited multiple times in the past.

Silo Finance

Model: Alternative Form of Isolated Lending Markets — Users can create a money market for any token asset they want by leveraging a predefined bridging asset (ETH).

Risks & Considerations

Silo utilizes Uniswap v3 and Balancer v2 price oracles, meaning market creation is limited to tokens that have liquidity pools on these platforms. By isolating different money markets, risks are also isolated, achieving a high level of security. Each money market is paired with what Silo calls a bridging asset; currently, $ETH is the only bridging asset used. All transactions go through this asset, making it the only one requiring trust. If a token is compromised or exploited, only the bridging asset suppliers (i.e., $ETH lenders) in that isolated pool are affected.

Silo Protocol Overview

Silo Finance is a decentralized, permissionless lending protocol that provides secure and efficient money markets through the use of isolation mechanisms. Silo is designed to address key pain points of existing lending protocols—the security flaws of shared pools are mitigated by isolating each lending pool, similar to Kashi’s approach. However, Kashi faces challenges due to excessive liquidity fragmentation across too many pools. While this model ultimately achieves high security compared to shared pools, it does so at the cost of efficiency.

Silo improves upon the isolated lending market model by:

- Whitelisting any token asset without relying on governance. Liquidity limits are set by the market, not governance.

- Achieving deeper liquidity by creating isolated pools for each asset

- Allowing listing of any crypto asset as long as counterparties exist, enhancing scalability.

Architecture

Lending Model

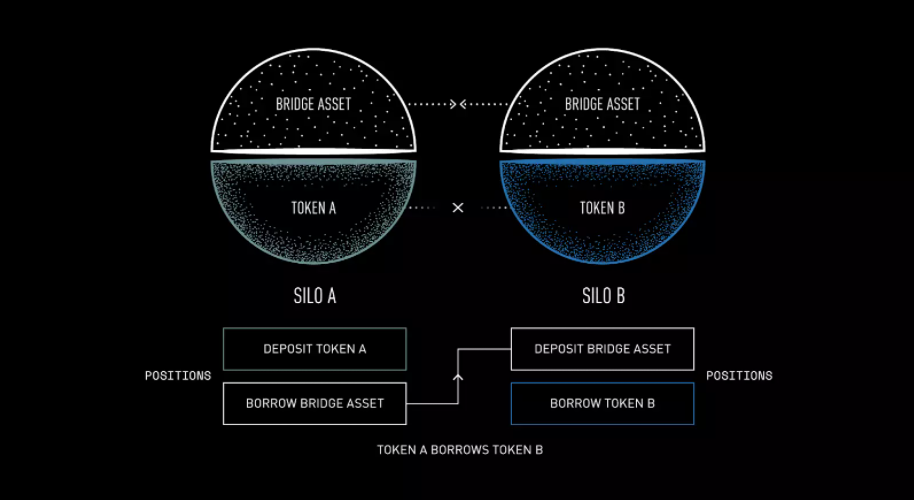

The design itself is simple. When suppliers borrow using their collateral, the basic process requires creating two positions.

The first step in opening a position is depositing the token you wish to borrow against. Since each token is paired with a trusted bridging asset (ETH), this is the token users receive when borrowing against their collateral. The second step is depositing the borrowed bridging asset into the pool holding the asset the user wishes to borrow. One consideration to keep in mind is that due to the nature of this model, it requires four transactions, meaning four gas fees.

Interest Rate Model

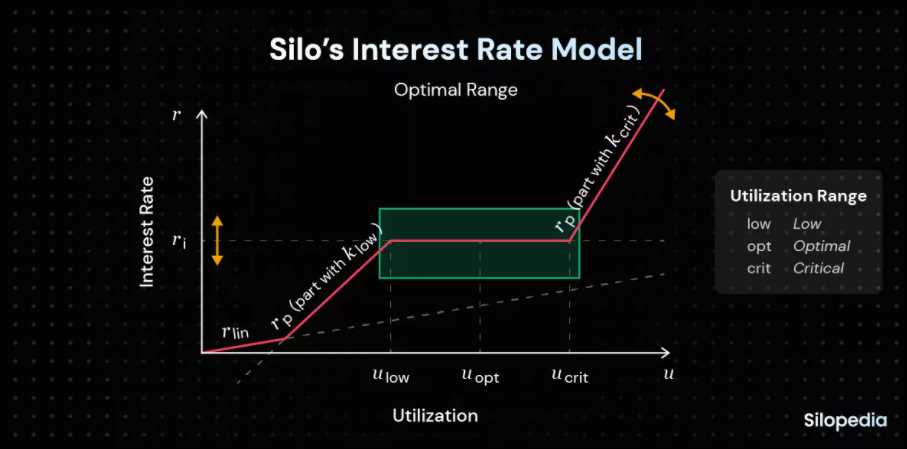

Silo employs a novel dynamic interest rate model, different from those used by other lending protocols. The conventional model is straightforward—borrowers typically pay interest to depositors, so borrowing rates fund lending rates; as demand for borrowing increases, borrowing rates rise accordingly.

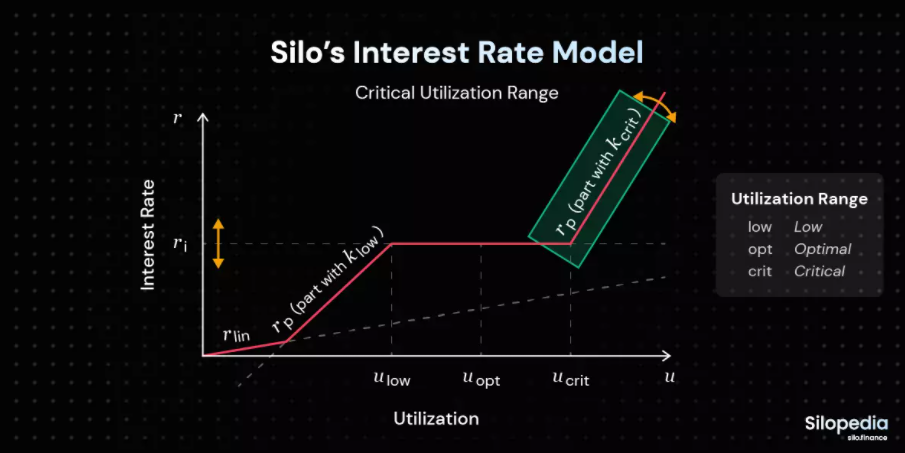

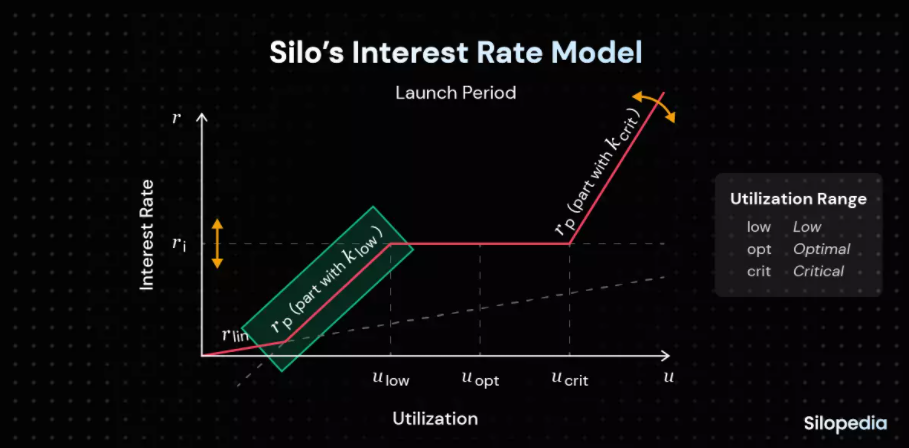

Silo’s interest model aims to maintain borrowing demand for any specific asset within an optimal range (the green rectangle in the chart above). The optimal range is the average/midpoint between ulow (Utilization Low) and ucrit (Utilization Critical). When utilization reaches critical levels, the model adjusts the interest rate (r) to influence user behavior and bring utilization back into the optimal range.

When utilization exceeds ucrit, interest rates increase sharply. Higher rates incentivize lenders to deposit more funds to benefit from increased lending yields. Additionally, higher borrowing costs may encourage borrowers to repay loans earlier.

If utilization drops below ulow (low utilization), interest rates drop rapidly. Lower rates attract borrowers seeking cheaper financing, thereby increasing utilization.

Tokenomics

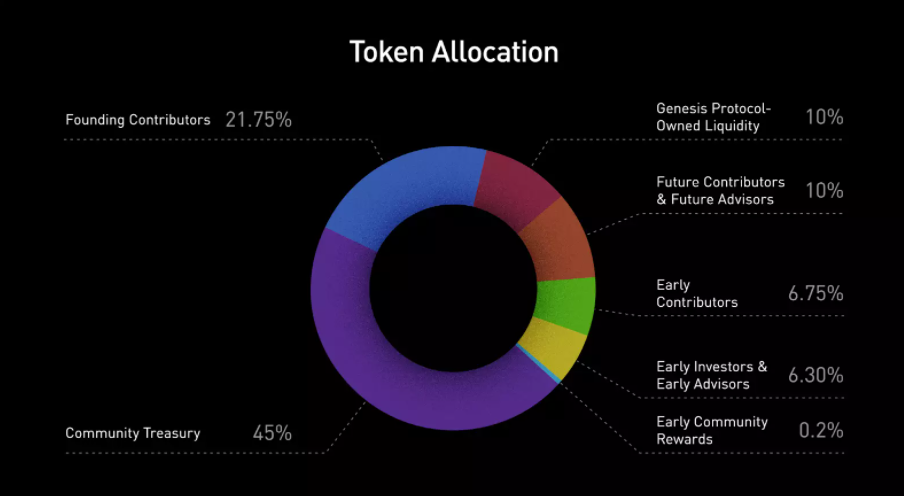

Starting December 1, 2021, one billion $SILO tokens will be minted over the next four years, with future inflation potentially determined by governance votes. At the time of writing, Silo has committed to zero emissions.

Liquidity Incentives

On March 6, 2022, Silo proposed creating a $SILO pool on Curve V2 and incentivizing liquidity via CRV emissions. Silo’s plan was as follows:

- Launch SILO on Curve v2 using the FRAX pool to drive liquidity.

- Purchase $CVX tokens on the open market to gain voting power within the Curve DAO.

- Use the newly acquired voting power to vote for CRV emissions for the SILO:FRAX pool.

The team acted on this proposal by beginning CVX acquisition. Between March 4 and March 6, the team had already purchased $250,000 worth of CVX, spending $4.41 million in USDC, with an average position size of $17. Fast forward several months—despite high yields (peaking around 130%), Silo only attracted relatively small liquidity on Curve. This resulted in high slippage, creating a bottleneck for investor accessibility.

Since then, the community collectively created and passed a proposal to migrate Silo’s liquidity from Curve to Balancer. By enabling metrics for the SILO:ETH Balancer pool, SiloDAO will be able to establish a primary liquidity source for its token through incentives (supported by bribes). Balancer is far more integrated with price and DEX aggregators than Curve, making it a more favorable option from a liquidity standpoint. Moreover, pairing with ETH instead of stablecoins exposes LPs to lower impermanent loss.

Now, the Balancer incentive proposal has recently passed, and Silo will begin injecting ETH liquidity into Balancer. While no exact date has been confirmed, incentives are expected to start in mid-September.

Silo’s Stablecoin

Although not yet officially named, Silo is launching its own stablecoin. This stablecoin will be used alongside ETH as a bridging asset.

The plan is to develop a mechanism to mint a decentralized stablecoin backed by collateral, rather than wrapping or basketing existing stablecoins. This is particularly important given recent developments involving USDC and decentralized stablecoins that use USDC as backing assets.

Conclusion

Silo Finance is a money market protocol that leverages a novel design to isolate risk while maintaining capital efficiency. It achieves this through flagship features such as “Silos” (isolating risk for each market on the platform) and dynamic interest rates (optimizing utilization). Nevertheless, it’s important to note that Silo is still in its early stages, and significant token price volatility should be expected as post-launch liquidity sources begin to form.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News