Why Can Cosmos L1 Build the Next Killer Application?

TechFlow Selected TechFlow Selected

Why Can Cosmos L1 Build the Next Killer Application?

The theory behind the rise of application-specific chains.

Author: RainandCoffee

Translation: TechFlow intern

Over the past few weeks, there has been a resurgence in the Cosmos ecosystem as applications and founders either decided to build their own application-specific chains (L1s on Cosmos) or expressed interest in doing so. This follows the collapse of the Terra ecosystem, which also impacted the broader IBC ecosystem.

However, it's important to note that technically, the entire system has held up very well—despite highly volatile transaction volumes, it continues to handle both internal and external message and asset transfers across chains via IBC, and internally through the Cosmos SDK with Tendermint, ABCI, and a chosen VM (such as the EVM).

In this article, we aim to explain the theory behind the rise of application-specific chains and why the sovereignty, composability, and interoperability they offer are crucial for building the next "killer app" and ecosystem in the upcoming cycle.

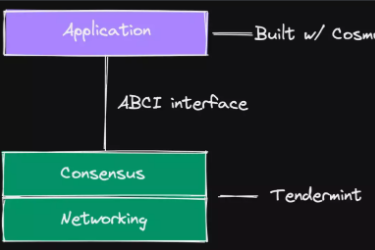

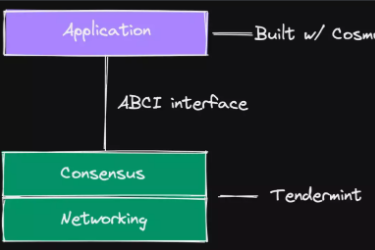

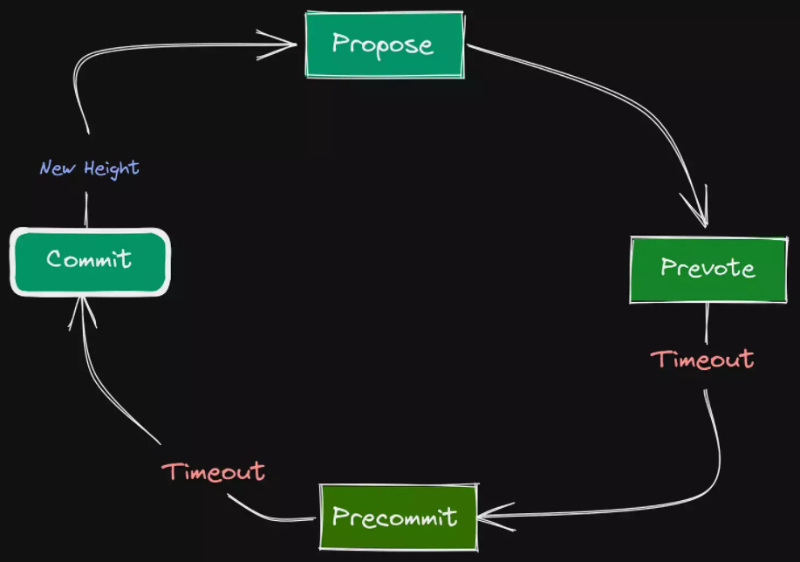

Before diving into the thesis itself, we’ll briefly introduce some unique technical components of the Cosmos ecosystem in an easy-to-digest way. The overall architecture looks like this:

Cosmos SDK

The Cosmos SDK is a modular framework that allows blockchain developers to build application-layer logic independent of any virtual machine. Designed to connect with Tendermint via ABCI, the Cosmos SDK not only provides a foundation for creating application-specific blockchains but also supports various customizations such as protocol-agnostic governance, transaction, and staking mechanisms. The SDK handles most tasks required at the application logic layer, meaning developers don’t need to build everything from scratch. It uses a router to process transactions received from the Tendermint consensus engine, forwarding messages along with state changes to the appropriate handler modules.

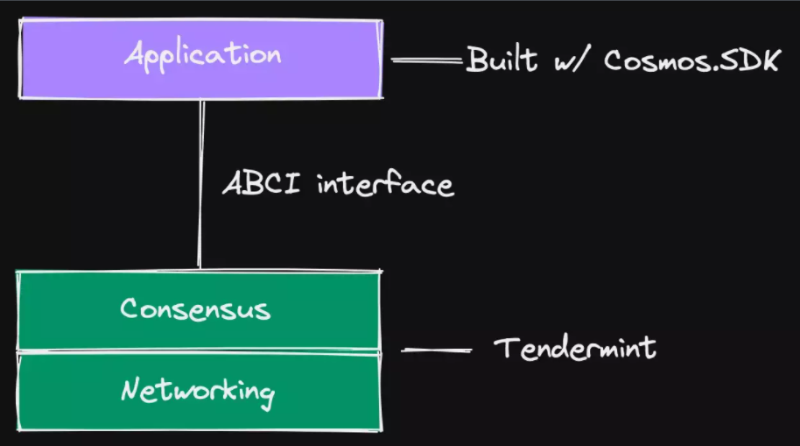

ABCI

ABCI (Application Blockchain Interface) connects the application portion of a blockchain with Tendermint’s state replication engine, which provides consensus and networking. ABCI enables a clean separation within the blockchain stack, making the application layer VM-agnostic—thus allowing any virtual machine or execution environment to be used. Examples include JunoWasm, CosmWasm, Agoric’s Hardened JavaScript, and even Secret Network’s TEE-enabled version of CosmWasm. Tendermint establishes three ABCI connections to the application: one for validating transactions during mempool broadcasting, another for linking the application with the consensus engine, and a third for proposing blocks and querying application state.

Tendermint

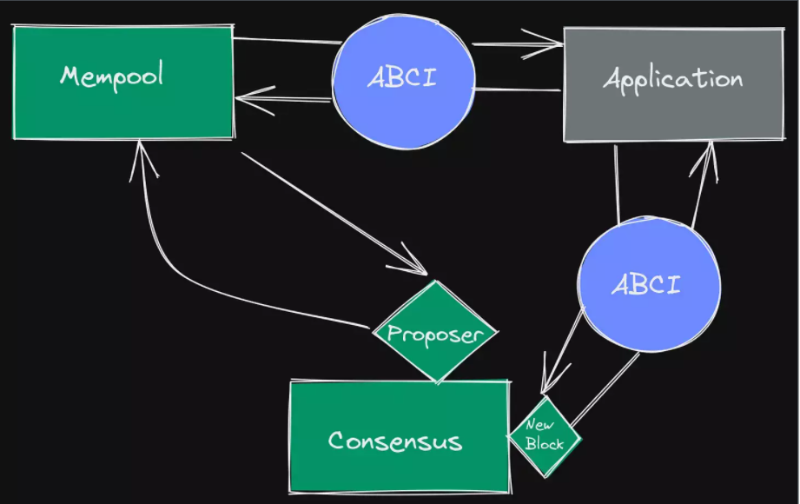

Tendermint Core is responsible for the consensus and networking layers of chains within the Cosmos ecosystem. The consensus layer ensures transaction validity and ordering through a consensus algorithm among network participants, while the networking layer facilitates peer-to-peer communication between nodes and enables third-party apps and nodes to interact with the consensus layer.

Tendermint employs a Byzantine Fault Tolerant (BFT) consensus model and achieves instant finality. The BFT process goes through three stages before finalizing a proposed block:

-

Propose phase: A block is proposed at a specific height;

-

Pre-vote phase: 2/3 of validators pre-vote for the proposed block;

-

Pre-commit phase: 2/3 of validators pre-commit to the proposed block.

IBC

The Inter-Blockchain Communication (IBC) protocol is fundamentally a cross-chain messaging standard designed for homogeneous blockchains. It connects chains that share similar properties—in this case, chains using Tendermint’s BFT consensus with instant finality and light client capabilities. IBC works by having two chains interested in connecting to each other submit governance proposals on the destination chain, typically routed initially through Cosmos Hub or Osmosis (currently Osmosis connects 45 chains, Cosmos Hub connects 40). This means connectivity happens at the protocol level, eliminating the need for third-party bridges.

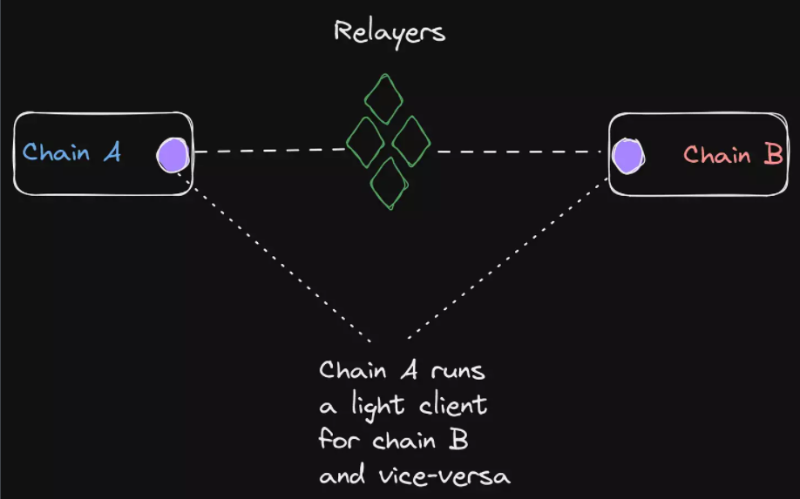

The two chains must run light clients of each other to cryptographically verify consensus states, and require relayers to pass information between these light clients. Relayers are essential for validity—they enable information exchange between nodes and ensure successful consensus. Let’s examine how this works in practice:

This design places trust assumptions only on the validators of the two connected blockchains, resulting in significantly fewer trust assumptions compared to other cross-chain bridges or messaging protocols. For example, Polkadot’s XCMP relies solely on trust in the relay chain (Polkadot).

To illustrate IBC’s compatibility and reach within the Cosmos ecosystem—and the number of chains it connects—let’s look at the current real-time scale of connections:

ICS

ICS stands for Interchain Standard, setting parameters for transactions between chains using IBC. ICS essentially defines module specifications for IBC transactions—two IBC-connected chains must support the same ICS to communicate.

One particularly interesting and unique ICS is ICS-27, also known as Interchain Accounts.

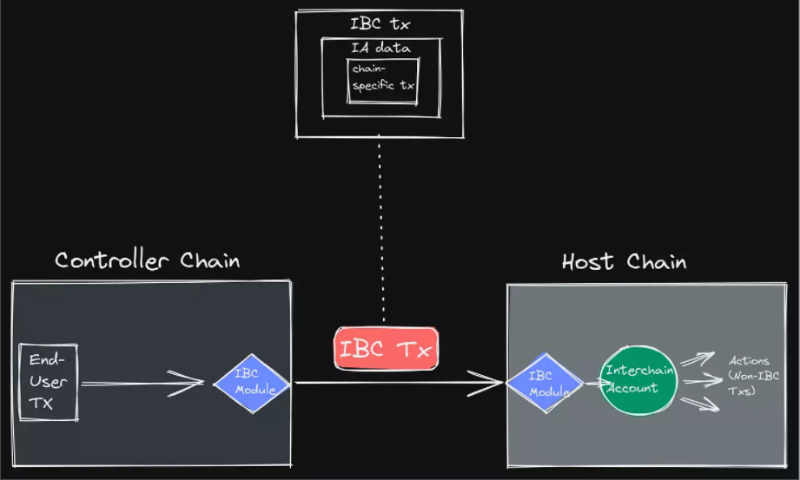

ICS-27

Interchain Accounts enable true composability and interoperability. They allow users not only to exchange data but also to write state from a smart contract on one chain to another. As long as endpoints are specified, users can operate through a single interface on the source chain instead of switching across multiple interfaces during asset or message transfers. Chains supporting ICS-27 can create accounts on other ICS-27-compatible chains and control them via IBC transactions. These interchain accounts retain all functionalities of regular accounts but are operated by a separate chain or end user over IBC, ensuring full ownership and control by the source chain over any cross-chain account registered on the destination chain.

Post-IBC transaction procedures follow ICS specifications that each chain must implement. This transforms transactions from being application-specific to application-agnostic—in other words, enabling genuine composability across diverse networks.

Interchain Security

Interchain Security allows one chain (or hub) to produce blocks for other chains. Validators run two (or more) nodes—one per chain—but only stake their native tokens on the primary chain. This is enabled by Cross-Chain Validation, an IBC-level protocol. Consumer chains use IBC to communicate with the provider chain to track which validators are participating in Interchain Security. In this way, security derived from value locked on the main chain is shared with consumer chains. Thus, consumer/sub-chains inherit strong security without needing to bootstrap their own validator set. This allows capital-light applications to launch their own chains while benefiting from the robust security of existing validators.

The main chain is responsible for generating blocks for a group of consumer chains, and validators earn staking rewards from all chains they validate. Slashing mechanisms help prevent malicious behavior by validators.

Summary

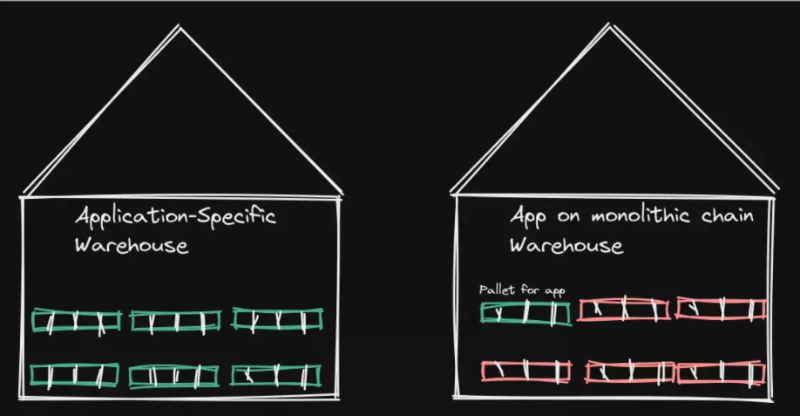

Application-specific blockchains enable what we call “warehousing” of blockspace. If you view the blockchain stack as a supply chain, then blockspace across different layers is effectively “purchased” by the applications residing on that chain. On monolithic chains, thousands of applications compete for the same blockspace, driving up gas fees due to congestion and competition.

These fee spikes on overcrowded monolithic chains are ultimately passed down to users, who bear the burden of high costs. On an application-specific chain, the application itself gains better control over fees paid by end users, enabling it to maintain stable and predictable pricing—a prime example being Osmosis.

Because such applications do not rely on Chain X or Y as infrastructure providers, they avoid the risk of bearing higher average costs—similar to inventory risk in traditional retail. This means the application and its community can actively manage and hedge against resource availability risks, leading to more efficient resource pricing and, in turn, better economic models for the application.

Since the application owns the chain it operates on, it can self-manage fee structures—no longer subject to the rules of a shared chain. It determines the cost of every resource on its own chain.

Additionally, the flexibility afforded by the underlying tech stack enables optimization at the application layer, while native cross-chain messaging preserves composability across the broader ecosystem—all without reliance on third-party trust.

Prior to Cosmos, there was a clear divide between applications and infrastructure (chains). Application-specific chains with IBC break down this barrier, allowing applications to become interconnected, composable infrastructure themselves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News