How to evaluate and analyze a token's economic model?

TechFlow Selected TechFlow Selected

How to evaluate and analyze a token's economic model?

Good tokenomics can make a bad project perform well (for a while), while bad tokenomics can kill the best project.

Written by: Shivsak

Translated by: TechFlow intern

It's easy to make money during a bull market, but it's hard to find altcoins that outperform BTC in a bear market. Your best bet is to stick with buying BTC, ETH, and some major cryptocurrencies.

However, if you do want to pick altcoins, you must understand tokenomics. Good tokenomics can make a weak project perform well (for a while), while poor tokenomics can kill even the strongest project.

When evaluating tokenomics, here’s what I like to look at:

1. Utility

2. Supply (distribution, unlock schedule, etc.)

3. Demand drivers (growth drivers, holder incentives, adoption)

4. Other token dynamics (staking, burning, locking, taxes)

Let’s try to understand this with some examples.

1. Token Utility

• What is the token used for (besides speculation)?

• Does utility grow over time or with adoption?

• Are the use cases for buying/holding the token compelling enough?

Utility Examples:

• $CRV used for governance directing emissions

• $LUNA used to mint $UST

• $PTP used for APR boosting

2. Supply

• How many tokens exist?

• How many are in circulation?

• How were tokens distributed?

• What is the unlock schedule for remaining supply?

• How much inflation/deflation occurs annually?

Supply is a very important piece of the tokenomics puzzle. Allocating large amounts of tokens to internal teams makes the token vulnerable to attacks by a small number of participants holding minimal tokens. Accelerated unlock schedules increase selling pressure from whales on the market.

Tokens like ETH have both inflationary (issuance) and deflationary (burning) mechanisms, which together determine the net daily growth in ETH supply.

Example:

Currently, around 13,000 ETH are newly minted each day, while approximately 3,000 ETH are burned.

This results in a net issuance of about 10,000 ETH per day.

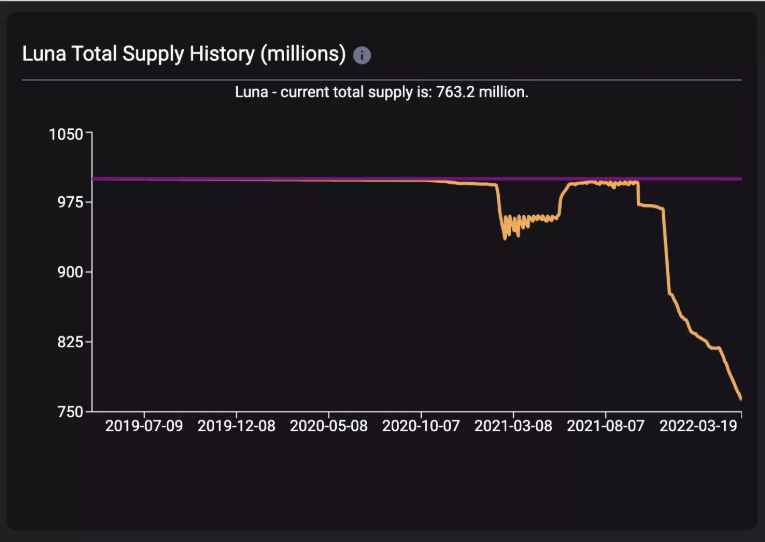

Deflationary tokens with usage-based burn mechanisms (like LUNA, ETH) offer a significant advantage. For example, over the past 6 months, LUNA's total supply decreased from 996 million to 763 million.

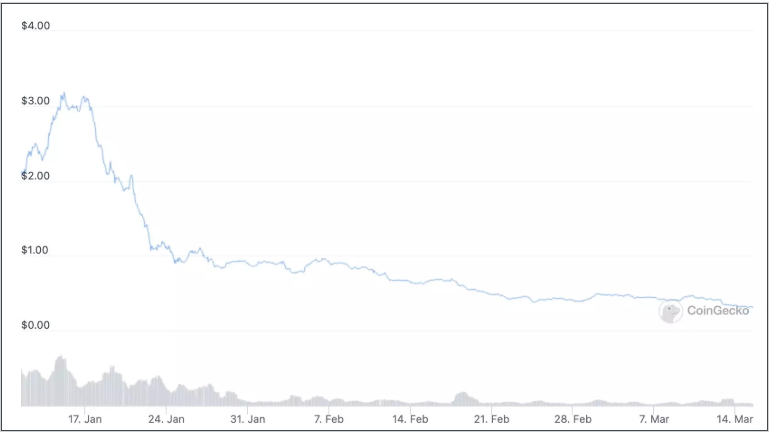

For inflationary tokens—you’ll find they struggle to sustain price surges. Mining/staking coins are perfect examples. Their charts aren’t pretty.

3. Demand Drivers

-

What will drive demand for the token (excluding speculation)?

-

Do people have incentives to buy/hold/stake/lock the token?

-

Does the platform have competitive advantages enabling rapid adoption?

Demand Driver Examples:

• Highly publicized project launches can act as temporary demand drivers for launchpad tokens, potentially rewarding long-term holders.

• CRV holders compete for governance rights over a critical part of DeFi infrastructure.

• Locking HND to boost APR rewards

While I prefer fundamental-based demand drivers, marketing/hype/narrative-driven demand factors should not be ignored.

For example:

• NEAR / FTM / AVAX have attracted developers into their ecosystems through incentive funds, driving ecosystem projects, TVL, and price growth.

• DOGE / SHIB

Governance can sometimes be a demand driver, but usually isn't. Is there any real voting motivation within the community?

In the case of CRV, the incentive is vote-buying (bribes). But in most cases, governance incentives are not actual demand drivers.

4. Token Dynamics (Locking, Staking, Taxes, Burns, etc.)

• SOLID and CRV are staked for voting power/bribes.

• FaaS coins tax buys and/or sells to fund the treasury.

• $LUNA is burned to mint $UST.

Platypus Finance is an interesting case study in tokenomics.

Consider this:

• Staked PTP earns vePTP every hour.

• vePTP is used to boost reward APRs.

• Unstaking any amount of PTP means forfeiting accumulated vePTP.

This means PTP holders have a strong incentive to keep all their PTP staked. Therefore, if the vePTP boost incentive is high, it serves as a powerful mechanism to reduce selling pressure on PTP.

Conclusion

Crypto is a live economic experiment. A key factor behind a project’s success (or failure) boils down to tokenomics and game theory. But it’s important to remember that successful projects and rising prices require more than just solid tokenomics.

For example, SOLID had relatively strong tokenomics, but when developers abruptly exited due to poor communication, it damaged overall sentiment and trust—and subsequently, the price.

Another example is the OHM (3,3) model—its underlying game theory suggests rational participants would stake rather than sell their OHM. Yet, a token’s price behavior often deviates significantly from theoretical models or expected outcomes.

Bear markets operate under different game theory. Market participants become less rational and require stronger, clearer incentives to avoid panic selling during broad market declines. Models relying on participants’ understanding of game theory tend to fail. While human behavior in markets cannot be perfectly predicted, studying tokenomics helps you avoid bad projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News