Unveiling the Economic Model of Blockchain Games

TechFlow Selected TechFlow Selected

Unveiling the Economic Model of Blockchain Games

Fun gameplay isn't enough for blockchain games? Now we have to scrutinize their economic models too!

About 15,000 words; reading time approximately 20 minutes. Original by: Kluxury and Guatian from WLabs

(I) Introduction: Why Are We Writing This Kind of Theoretical Article?

Play-to-earn games (P2E), as the name suggests, are games running on blockchains. As players or investors, we don't need to understand deeply how the game operates technically—we just want to enjoy playing and earn profits. However, starting in the second half of 2021, a wave of "rug pulls" in P2E projects caused many GameFi players to suffer significant losses.

As an emerging industry, blockchain gaming requires careful study to determine which projects are worth investing in, how much to invest, and what their lifecycle might be. Among these considerations, a game’s economic model is both the most challenging topic and the crown jewel of any project.

Guatian Guild's content team includes a group of passionate and quirky members who can spend one to two hours daily discussing various game economic models without getting tired. We love sharing insights and summarizing findings. Over the coming weeks, we will gradually turn our discussions into written articles, hoping more GameFi players can benefit—reducing losses while finding the best-suited P2E games for themselves.

Alright, let’s begin! First, here’s a key point: A blockchain game’s economic model refers to the theoretical structure describing interdependencies among all variables related to economic phenomena within the game. Sounds complicated and awkward, right? Don’t worry—this may be the only sentence in this entire series that sounds overly academic. From now on, everything will be explained in plain language.

In simple terms, a blockchain game’s economic model describes changes in prices and quantities of NFTs and tokens inside the game. Understanding it allows you to see how the system circulates, where selling pressure comes from, under what conditions positive spirals occur, and when risks emerge.

This article follows an engineer’s logic, analyzing blockchain game economies in three layers:

1. Core models (single-token, dual-token, or multi-token);

2. Model variations (embedding DeFi features,叠加 NFT attributes, etc.);

3. Auxiliary mechanisms (time taxes, lock-up periods, token burns, etc.).

OK, let’s get started!

(II) Four Patterns of Single-Token Models

Let’s start with the relatively simple single-token model: A single-token project uses only one unified token to sustain its internal economy. Typical examples include CryptoZoon, Playvalkyr, Hashland, Radio Caca—all adopt such tokenomics (ZOON later introduced a secondary token).

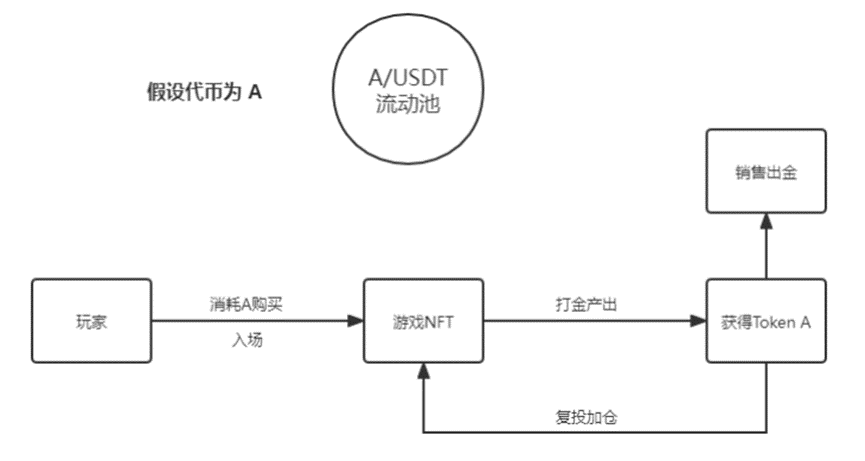

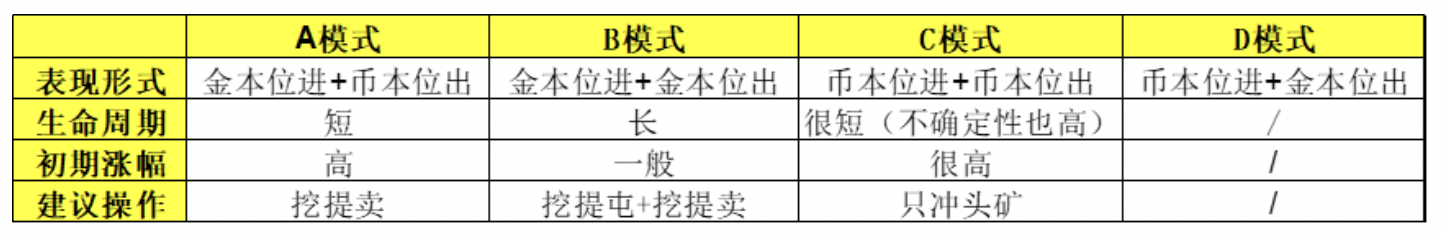

From the above diagram, it’s clear that both output and consumption in single-token models revolve around Token A. To profit via P2E, there must be a continuous influx of new players or reinvestment by existing ones—essentially relying 100% on external circulation. We classify single-token models into four types based on whether input and output use the game’s own token (Token A, “token-based”) or widely recognized value assets like USDT, BTC, ETH, BNB (“gold standard”—even if converted through intermediate steps, as long as the fiat amount remains fixed, it counts as gold-standard).

Pattern A: Gold Standard In + Token-Based Out

This was the common model at the beginning of the 2021 GameFi boom—players buy NFTs using USDT or BNB, then earn rewards in the form of the game’s native token (Token A). Notice anything familiar? Most DeFi mining protocols follow this exact pattern. Key characteristics: fixed entry cost, variable returns depending on token price fluctuations.

If the token price is rising, payback periods shorten accordingly. Under this model, a positive feedback loop can create strong FOMO, but also amplifies supply and demand imbalances, making death spirals more likely—and irreversible. Once prices start falling, scam projects prepare to rug pull, while legitimate teams must continuously support the market with real capital, release good news, attract new users, stabilize charts, and delay decline.

It's evident that most scam projects prefer Pattern A: They receive real money like USDT, while distributing self-minted tokens to players.

Our assessment of Pattern A games: High initial gains, short lifespans. If you play, focus on “mine, sell, repeat.” Once a downward trend appears, sell aggressively.

Pattern B: Gold Standard In + Gold Standard Out

Due to widespread abuse of Pattern A, some teams developed Pattern B—“gold standard out”: “You’re worried your earned tokens will drop too fast? Let’s give you a fixed dollar value instead!” For example, suppose daily earnings are fixed at $100. If yesterday’s token price was $1, you got 100 Token A; today, if the price drops to $0.50, you get 200 Token A instead.

Pattern B is indeed an innovative improvement! Not only is entry cost fixed, but daily income is stable. During bull runs, fewer tokens are distributed due to higher prices, keeping payback cycles steady. During bear markets, players’ daily dollar-denominated earnings remain unchanged—at least temporarily.

But is it really that perfect? Not quite. Withdrawals in Pattern B usually come with vesting periods. For instance, those 200 Token A might require a 7-day lockup. By then, the token price could have changed significantly.

Take PlayValkyrio (Valkyrie), a moderately known BSC project. It followed classic Pattern B: gold-in, gold-out. Despite unremarkable mechanics, art, or storytelling, Valkyrie briefly enjoyed a positive spiral during the early days because few other gold-out games existed and the overall P2E environment was booming. But within two weeks, it entered a downward death spiral.

Some readers might mention BNBH (Binance Hero) as another famous “gold-out” case. Its situation is more complex—we’ll analyze it in detail later. This reinforces our point: economic models help identify profit points and risk zones, but full project evaluation requires additional dimensions, such as team credibility and smart contract robustness. Take Hashland, a game some Guatian members actively play—it follows Pattern A. While imperfect, we believe its shareholders are strong and the team unlikely to run away. Though the token has steadily declined over three months since public testing began, updates continue regularly, and there were even three distinct opportunities for players to become rich.

Our assessment of Pattern B games: Stable income, less volatility, longer lifespan. Suggested strategy: Mine and hold part of early earnings; sell high later. When new user growth slows noticeably, switch to mine-and-sell mode.

Pattern C: Token-Based In + Token-Based Out

In Pattern C, both entry cost and reward fluctuate with token price. During uptrends, this model dramatically accelerates returns for early players—it’s like a turbocharged version! Example: On Day 1, Token A trades at $1. Entry costs 100 Token A ($100 equivalent), and players earn 10 Token A per day. On Day 2, if the price rises to $2, old players still earn 10 Token A—but now worth $20. Meanwhile, new players face doubled entry costs: $200!

Sounds familiar? Yes—RACA exemplifies this model. The team invited Elon Musk’s mother and CZ for an AMA, driving massive interest. New players kept buying MetaBeast NFTs at ever-higher prices, becoming veterans who recruited others, pushing entry fees higher. Hence, some MetaBeasts appreciated hundreds of times.

Pattern C easily triggers FOMO and creates countless “get-rich-quick” stories. With sufficient player base, a positive spiral forms quickly. Fundamentally, veteran players not only benefit from price appreciation but also extract value from new players’ inflated entry fees. Pattern C most transparently reflects the essence of external circulation (veterans profiting from newcomers’ principal)—and is thus favored by many “Ponzi-style” schemes aiming for overnight wealth creation.

Our assessment of Pattern C games: Prone to extreme volatility, short lifespan unless backed by large user bases. Strategy: Only join early mining phases; carefully assess whether the team can keep attracting new users—if not, exit immediately.

Pattern D: Token-Based In + Gold Standard Out

Currently, no known projects use this model—it's unfavorable for both developers and players. For teams, receiving their own tokens while paying out real money seems unnecessary. For players, converting stablecoins into native tokens adds uncertainty before purchasing NFTs. Thus, almost no games adopt this approach.

Our assessment of Pattern D games: Likely designed by inexperienced teams—unless they plan powerful future modifications requiring initial D-mode setup.

Below is a summary table of the four single-token patterns. All evaluations assume identical teams, market conditions, and player inflows across models.

The judgments about lifespan and initial surge reflect inherent logic of each pattern. Real-world performance also depends on variations and auxiliary mechanisms—topics we’ll cover in the next article. Also remember: even D-mode projects can thrive if they consistently attract new players.

(III) Fundamentals of Dual-Token Models

After publishing our previous piece, reader engagement exceeded that of our gossip series “Evolution of Blockchain Games,” mainly because players found value in reverse-engineering project designers’ intentions to predict game development trajectories. Many community members discussed why they lost money playing certain single-token games, applying our four-pattern framework—and suddenly exclaimed “Ah-ha!” in realization.

Encouraged, we now dive into the currently dominant dual-token model.

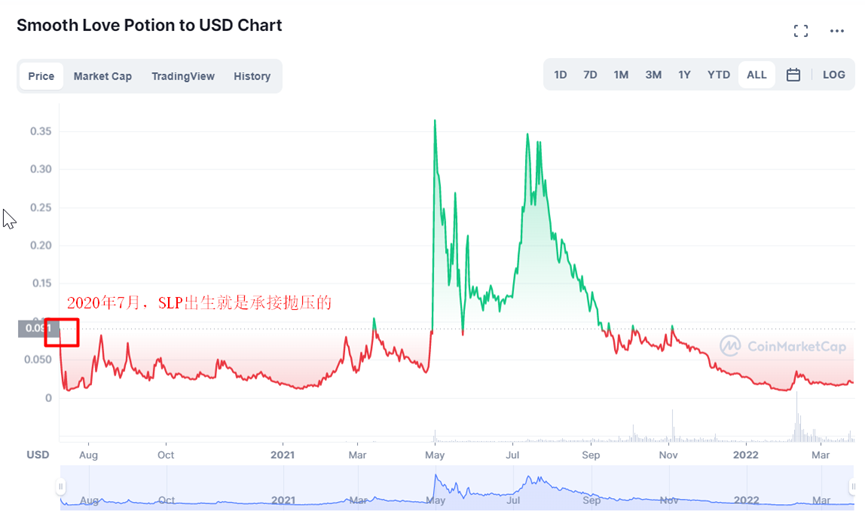

Dual-token models originated in mid-2020 when Axie Infinity—the elder statesman of blockchain gaming—introduced SLP (Smooth Love Potion, always evoking cheeky associations, possibly coined by MASA). This new token absorbed selling pressure previously borne solely by AXS, marking the birth of the dual-token framework.

For those familiar with Axie, its pre-SLP model was single-token A-mode: gold-in, token-out. Yet Axie wasn’t a scam project. With constant new users, backing from major PE firms, and solid fundamentals, it sustained this model for over a year. Still, the team surely realized that once new player inflow halted, death spiral would inevitably follow.

Axie’s dual-token model sacrificed SLP to protect AXS—like abandoning a pawn to save the king. Observe the following two charts: AXS price soared steadily from July 2020 onward, freed from dump pressure. Meanwhile, SLP started weak, rose during the bull market due to heavy new-user inflow, then collapsed into a death spiral, surviving only via centralized interventions. Recently, PVE rewards stopped issuing SLP, causing another temporary price bump.

Data source: CoinMarketCap

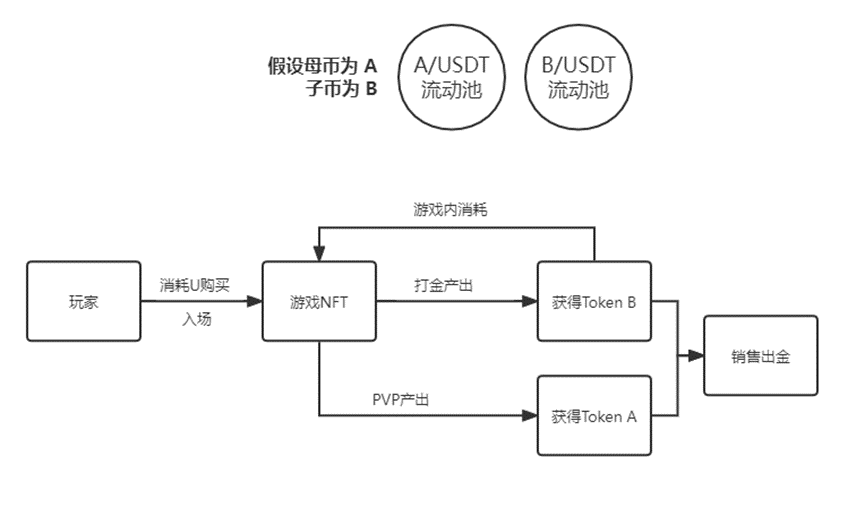

To summarize: Dual-token systems split tokens into parent (governance) and child (in-game utility). Most in-game outputs are in child tokens, with minor parent token emissions. Besides Axie, popular 2021 titles like BinaryX and StarSharks adopted dual-token models with further innovations. Below is a structural diagram:

(IV) Practical Classification of Dual-Token Models

Our content team debated classification methods for dual-token models. Reapplying the ABCD “X-in, Y-out” method would generate 4×4=16 combinations—too many and unrealistic given actual market diversity. More importantly, we observed a trend: most modern dual-token models use token-in, token-out setups—e.g., BinaryX (parent-in, child-out), StarSharks (child-in, child-out).

Why? Our hypothesis: Dual-token models offer greater flexibility, reducing need for centralized adjustments seen in gold-standard designs. Gold standards require oracle mechanisms to fix token equivalents—complexity increases unnecessarily in dual-token contexts. (This is our view—open to discussion.)

So how should we categorize them? K suggested focusing on a key designer intention: After genesis NFT sales, how does the project increase NFT supply to meet demand from new players?

Initially, nearly all blockchain games sell genesis NFTs on official platforms or partners like Binance NFT/OpenSea to build core communities—a universal starting point. For subsequent NFT issuance, we observe two primary approaches:

Type 1: Breeding & Consumption Model

Under this model, second-generation and later NFTs result from breeding genesis NFTs—official blind box sales cease.

Parent NFTs produce offspring NFTs with varying traits, enabling new player entry. Breeding consumes tokens—the main mechanism for token burn. Compared to single-token models, dual-token versions merely allocate consumption/output differently between parent and child tokens, determining which token bears selling pressure.

Take Axie again: gameplay generates abundant SLP and minimal AXS, while breeding consumes specific amounts of both. As NFT count grows, SLP selling pressure intensifies, leading to gradual price erosion.

Breeding inherently introduces gambling elements—players hope to breed high-stat offspring. Constant breeding options reduce central control, enhance combat strategy depth, and test design skill.

Summary: Identify which token bears dumping pressure—aggressively consume it early or mine-and-sell late. For low-pressure tokens, accumulate moderately based on new player volume and trading activity, then sell high.

Type 2: Blind Box Sales Model

Contrasting breeding models, blind box sales are straightforward: NFT supply is centrally controlled. Sell more when demand surges, increase supply when consumption rises—clear signs of centralization. Based on pricing, three subtypes exist: USD-box, parent-token-box, child-token-box. These reveal developer priorities:

USD-box: Pay USDT/ETH for NFTs. Massive inflows enable teams to fund price supports, marketing campaigns, PvP events—or abscond entirely. USD-box grants financial freedom, enabling breakout hits—but raises risks for players. This is the preferred model for most scam projects.

Suggested strategy: High risk, high reward—bet small for big wins.

Parent-token-box: Players convert USDT to parent token to purchase NFTs, heavily consuming parent tokens—whether burned or sent to team wallets. This drives upward momentum in parent token price. Teams gain easier market control: if price gets too high, hindering new entrants, they can sell reserves to cool it down. Regarding child tokens, either confidence exists in sufficient sinks, or the team simply accepts infinite dilution.

Suggested strategy: Short-term speculation on parent tokens may outperform in-game farming.

Case validation: BinaryX uses parent-token boxes. Compare BNX (parent) vs GOLD (child): BNX surged ~50x from lows (~$4 to ~$200), whereas GOLD farmed from gameplay rose only ~4x. Clearly, trading often beats grinding. But once parent token collapses, game declines rapidly.

Data source: DexGuru

Child-token-box: Players convert USDT to child tokens to buy NFTs, creating strong sinks for child tokens. Similar to breeding models, teams aim to internally balance child token prices, extend game longevity, and foster true internal cycles via evolving gameplay.

Suggested strategy: Farm steadily, enjoy consistent returns until new user inflow clearly slows.

Case validation: StarSharks uses child-token boxes, hence its longevity—maintaining ~40–50-day payback for months, eventually listing on Binance. Observe SSS (parent) and SEA (child): SSS stabilized between $7–$10; SEA fluctuated slightly wider, $0.6–$2.

Data source: DexGuru

Nowadays, ambitious projects may announce that most blind box proceeds—regardless of currency—are burned or deposited into treasury funds! “Earned from players, returned to players.” Why did StarSharks gain popularity? Because it announced burning 90% of child tokens earned from box sales. When encountering such transparent teams, take note—their future looks promising.

Through our classification, you should now grasp which dual-token games favor token speculation over farming, and if farming, whether to target parent or child tokens.

(V) Summary of Primary Single & Dual-Token Models

Primary models represent foundational architecture. Thus, evaluating any blockchain game solely based on its core model—single or dual—is insufficient. At heart, all rely on new capital funding veterans’ earnings. When token prices and entry barriers rise positively, if new player inflow fails to match veteran output, inflection points appear—possibly triggering death spirals. Hence, monitor three metrics constantly: number of new players, active players, and output vs. consumption ratio.

As the GameFi sector evolves, projects seek unique keys. Some aim to cycle through bubble formation, deflation, bottom stabilization, and restart via capital injection and mechanism design. Others employ burn, lock-up, and market control to delay collapse, seeking longer life and eventual shift from external to internal circulation. Many new games showcase innovative mechanisms.

Therefore, beyond core models, innovation and variation combined with engaging gameplay define a blockchain game’s brilliance. Like a tree, the economic model is the trunk—basic yet supportive; mutations are blossoms on branches—beautiful and vibrant. Next, we’ll categorize mutation patterns.

(VI) Mutation #1: GameFi + DeFi

Most 2021 GameFi projects simply re-skinned basic DeFi 1.0 code—an outdated approach not considered true “GameFi + DeFi” here.

Our definition of “GameFi + DeFi” involves building a core GameFi economy first, then layering DeFi mechanisms onto it—enhancing select tokens with utility. GameFi leads, DeFi supports. Goal: Create nesting layers (matryoshka effect) to retain capital internally, reducing token sell pressure.

DeFi Mechanism 1: Staking Mining

Core of DeFi is staking mining—using single-token or LP (token + stablecoin) stakes to linearly distribute rewards. Common in dual-token models: Since parent tokens often lack in-game utility, pairing them with USDT in LP stakes reduces circulating supply, stabilizing price.

Based on staking rewards, further divisions:

First, reward = child token:

Simplest and widely used last cycle. Child tokens become dumping grounds—not only payout vehicles, but also absorbing breeding inflation and staking-induced sell pressure. During FOMO, child tokens drag parent tokens up. But once in-game burns lag behind supply, farming and staking yields drop simultaneously—capital flees rapidly, accelerating death spiral.

Second, reward = parent token:

Commonly uses parent-stablecoin LP stakes, offering extremely high APY initially to attract liquidity. Like DeFi’s “second pool,” unsustainable long-term. Mechanisms must transition to in-game utility-driven staking within controllable timeframe.

DNAxCAT example: Initially attracted massive stakes on Yooshi platform with stable 400–500% APY. Combined with moderate hype, parent token DXCT rallied 3–4x despite bearish macro. But game issues (e.g., breeding bugs) triggered downturn. Unable to maintain high yields, LP returns dropped to ~100%, prompting mass exodus and hastening project decay.

Third, special staking rewards:

Instead of direct token payouts, issue special points, rights, badges—“soft tokens” embedded in gameplay. These must tightly integrate with game mechanics and be valued by players. This is currently Guatian’s preferred method—avoids immediate sell pressure, naturally blending into game operations.

Examples: Familiar BNX and StarSharks. BNX locks portion of dungeon raid rewards—only unlocked linearly by staking parent token. StarSharks already had locking; latest AMA revealed: stake certain BNX + shark NFT → directly claim max SEA farming rewards. Watch this space.

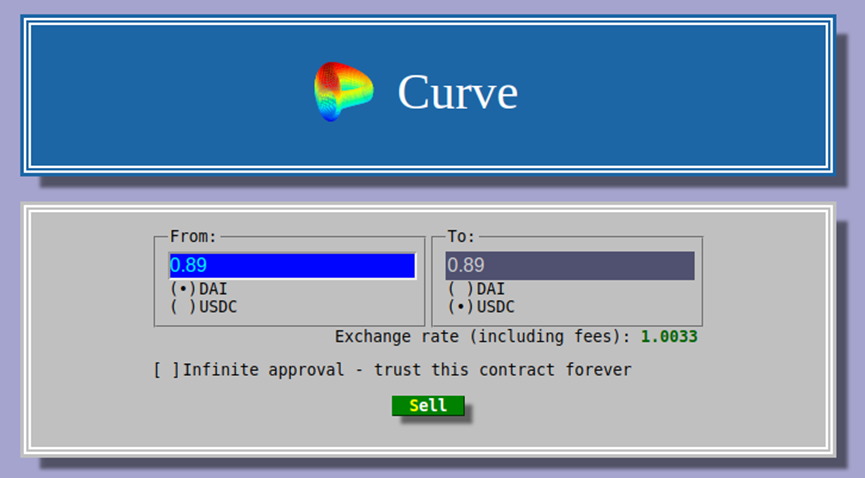

DeFi Mechanism 2: Clever Use of ve-Token Model

ve-Token originated in Curve’s yield aggregators. Simply put: CRV holders restake tokens to mint veCRV (imagine asset-backed securities). Same amount of CRV earns different veCRV based on lock duration. Basic function: voting power—rewarding loyalists disproportionately. A fanatic locking 10 tokens for 4 years may wield more influence than casual user locking 1000 tokens for 1 month.

Recently, some GameFi projects adopted ve-Token for in-game module voting. Example: Hoppers on Avalanche lets users stake FLY to mint veFLY, which votes on four dungeons—system allocates extra FLY rewards accordingly.

Could veTokens vote on which dungeon offers higher token rewards? Players might favor familiar maps or optimal NFT builds. Could they vote on treasury allocation? Exactly—veToken naturally integrates trendy DAO concepts into GameFi. Upcoming “auxiliary” section on “DAO Treasury” pairs perfectly with veToken.

Even cooler: Last month, a dev team Guatian met plans to integrate OHM’s (3,3) ve-model into GameFi: “If none of us sell, everyone earns more.” But wait—does this drift too far from actual gaming? Haha.

DeFi Mechanism 3: Gamifying DeFi

A niche category presenting DeFi components (DEX, AMM) as game elements, blending core gameplay. Attempts to lure capital via DeFi appeal, then retain it with gameplay and yield. Resembles educational apps teaching English through gamified levels—learning disguised as fun.

Current cases: Defiland, Defi Kingdoms (first subnet on AVAX). Reality check: Hard to enrich gameplay sufficiently—resulting in huge DeFi inflows but insufficient gamers, failing to achieve internal loops. We’ll keep monitoring.

(VII) Mutation #2: GameFi + NFT

Looking around, NFTs seem mandatory for every blockchain game today. Why? For teams, NFTs provide alternative fundraising beyond tokens. If players willingly pay, why not? For players, post-Q3 2021 NFT mania made whitelist access highly profitable. Given this consensus, NFTs became indispensable in GameFi.

Let’s break down GameFi NFT functions into three categories:

1. Ticket-Type NFTs

Simply put, these NFTs serve only as entry tickets—basically ERC-721 or ERC-1155 codes. Value depends entirely on game quality: great game → valuable NFT; poor game → worthless NFT. Examples: Land NFTs in Mavia—visually mundane, but required to play, so whitelists are fiercely contested. At peak, prices reached 5x mint cost thanks to game popularity.

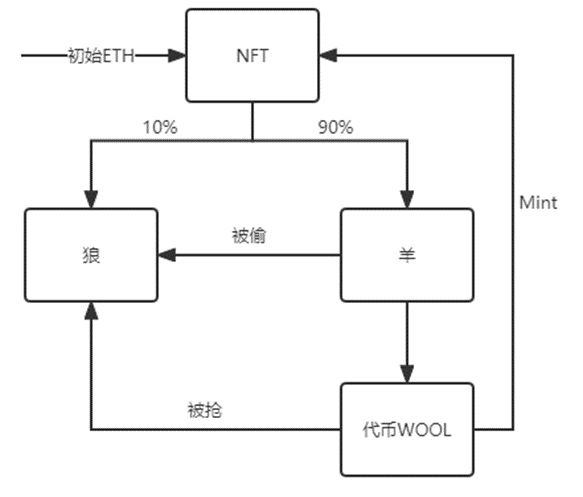

Another iconic ticket-NFT case: “Wolf & Sheep Game.” Initial rules simple: 10K genesis NFTs mintable—90% chance sheep, 10% wolf. Sheep mine 10,000 tokens/day in barn, but surrender 20% rewards to staked wolves upon withdrawal. Retrieving sheep requires leaving 2 days’ earnings and succeeds only 50% of the time. Later entrants mint NFTs using tokens. Wolves earn passive income and occasionally steal newly minted NFTs.

Wolf & Sheep pioneered faction rivalry, NFT theft, ERC-20/ERC-721 hybrid mechanics. Peak returns: wolves break even in one day, sheep in three. High yields drove NFT prices up during that period. Numerous clones emerged with improved mechanics, enhancing balance and longevity—e.g., Wizards And Dragons, Pizza Game—enjoying temporary success.

Our judgment: Ticket-type NFT value tracks game热度—popular games → valuable NFTs.

2. Self-Valuing NFTs

Classic example: Yuga Labs’ Bored Apes—top-tier NFTs regardless of ApeCoin launch or partnered games. Community and consensus—not utility—drive value for such NFTs.

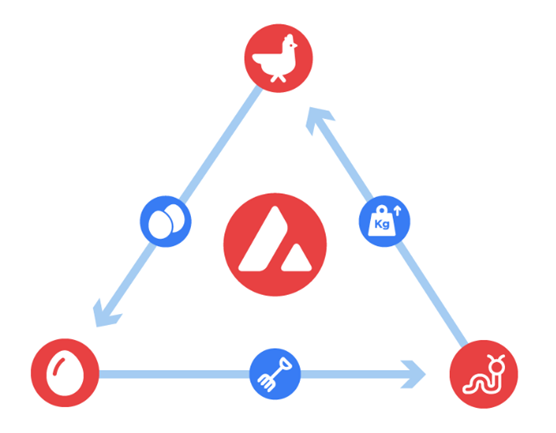

Bored Apes crossed from NFT world to GameFi. Any reverse cases—GameFi-born NFTs achieving standalone value? Not yet, but early signs exist. Example: Chikn on Avalanche. Simple model: Own Chikn NFT → stake → produce eggs → earn EGG token → stake EGG LP → get feed → feed NFT → gain weight → produce more eggs → repeat.

Compared to standard dual-token models, Chikn adds just one nesting layer. Yet meme appeal and recursive mechanics foster community attachment and emerging consensus—so NFT price didn’t crash alongside token. Chikn survives on Avalanche despite initial simplicity. Clones added richer gameplay—e.g., Avalant, Hoppers…

Our judgment: Unlike ticket-NFTs, self-valuing NFTs represent blockchain gaming’s future. Entire ecosystems should revolve around NFTs—unique appearances, attributes, dedicated gameplay. Metaverse-focused games should pursue this direction from day one.

3. Operational NFTs

Certain “soft tokens” in games can be represented as NFTs—if players perceive them as valuable or socially prestigious (social attributes).

Recently, Guatian debated token design with a game CEO. Discussion sparked insight on a long-standing puzzle: How to integrate guild battle systems with current dual-token models? Previous ideas—reward in parent, child, or third token—all flawed. Suddenly realized: Use special NFTs as rewards. Winning guild members wear them as badges; these NFTs also boost farming speed or multiplier in-game.

Our judgment: Operational NFTs smooth integration between game modules, enhance social interaction—which is crucial for long-term sustainability.

(VIII) Summary of Economic Model Mutations

The two mutation types discussed are merely frequent/hot trends in current blockchain gaming—not exhaustive. Combinations exist: e.g., Hoppers combines meme-NFTs, Trade Joe’s FLY LP pools, and veToken locking.

GameFi grows richer in content, diverse in玩法, complex in mechanisms. Who’ll spark the next breakthrough? Unknown. But players encountering fresh ideas early can reflect, debate, and innovate themselves.

Industry is nascent—no experts. Hope more thoughtful “guas” join deep-thinking teams, learn together, grow together—and make money while standing upright.

(IX) Supporting Mechanisms in Economic Models

Compared to core models and mutations, supporting mechanisms are like adding mango and strawberry slices to an already delicious mousse cake—not changing flavor, but enhancing color and texture.

In blockchain games, these are subtle techniques. More tools → more complexity. Core purpose: Delay game lifecycle. No universally effective tool—choice depends on project phase, market shifts, player sentiment, on-chain trends.

Many tools exist. Here are commonly used ones:

1. Time Tax & Lock Thresholds

Time tax: Project sets withdrawal fee decreasing over time. E.g., withdraw today → 20% tax; tomorrow → 15%; fifth day → 0%.

Lock threshold: Rewards locked until fixed condition met—lock duration or token amount.

Purpose: Reduce concentrated dumps. Most basic/common technique in GameFi. Time tax spreads sell pressure evenly over time; lock thresholds push it forward.

Most projects implement these at launch. Players estimate future token supply based on parameters, identifying arbitrage opportunities. Some projects add them reactively—if sell pressure threatens operations. Recent example: StarSharks updated to 14-day lock for withdrawals. Players must act fast to adapt strategies and capture alpha.

2. Limited Centralized Market Control

Seeing “centralization,” many crypto veterans scoff—believing it contradicts blockchain principles. Personally, Guatian believes neither “centralized” nor “decentralized” is inherently right/wrong. Given the industry hasn’t solved the “impossible trinity,” blockchain games should pragmatically blend both modes for stability.

We insist: Provided teams act in good faith, limited centralization early on benefits long-term health. Early-stage games resemble newborn foals—wobbly and fragile. Gameplay, marketing, etc., may trigger rapid capital inflows, spiking NFT/token values, forming bubbles. Once hot money leaves, crashes follow swiftly—shortening lifespan. Hence, limited early intervention helps “support and escort” projects through infancy.

How do teams exercise limited control? One way: Adjust in-game parameters to slow inflation—e.g., tweak BNX dungeon reward rates, Daofarmer’s PAAS NFT release quantity/pricing.

Another: Early token management—market-making via LP to stabilize prices, maintaining consistent payback periods. PokeMoney recently excelled in peer-to-peer promotion. Our analysis shows team tightly controls child token, fixing player payback at 30–40 days, sustaining visibility during aggressive sale phase.

Good-faith centralized projects typically offer smaller arbitrage margins but longer lives. Players should evaluate team capability, background, and genuine intent before joining.

3. Treasury Establishment

Treasury: Project deposits partial blind box revenue, marketplace fees, or slippage into designated address for future development. Message to players: We’re transparent—what we earn, we reinvest.

Recently, treasuries evolved from team-controlled funds to DAO-managed ones—via contracts or LP shares—where players govern usage per agreed rules.

Regardless of type, treasuries signal goodwill, lowering apparent rug-pull risk and strengthening consensus. E.g., DNAxCAT’s $2M treasury or DAOfarmer’s $8M fund helped retain loyalists during downturns.

Recall earlier gap on BNBH (Binance Hero)? BNBH’s treasury is part of P2E: Players spend tokens to buy boxes → project converts proceeds to BNB → adds to prize pool → all in-game earnings drawn directly from treasury. But on Dec 6–7, 2021, whales drained massive BNB from treasury, triggering panic sell-off of BNBH tokens—price crashed, ending 2021 GameFi boom. In short: As long as treasury holds enough BNB, farming continues safely. Initially, BNBH farmers could monitor treasury address and exit promptly when drained.

Final takeaway: Support mechanisms allow projects to correct course during critical phases. Most aim to delay death spiral. Whether and when to deploy them depends on team judgment. But we recommend preparing reserve tools—consider them during initial model design.

(X) Conclusion: Unveiling Blockchain Game Economic Models

Engineers plan well—final chapter happens to be Chapter Ten. Feeling smug. Reflections: This series marks first collaborative writing effort by Guatian Guild’s content team. Framework and draft by Kluxury (@LuxuryWzj), ~1,500 words per piece. Guatian expanded with additions and edits, adding 1,500–2,000 words—final length ~3,000–3,500 words.

Before writing, we spent long discussing structure and tone within the team. Special thanks to Lao Wu for contributing cases and insights. Only after reaching consensus did we begin drafting.

Our goal: Help players understand how teams design models, then decide their own gameplay strategy. We committed to plain-language explanations accessible even to beginners with minimal blockchain knowledge—cutting jargon, relying on everyday speech and examples. To address suggestions like “Can articles be more professional?”—we aim to welcome newcomers without overwhelming them, helping grow the ecosystem together.

Next, sharing K’s original closing remarks verbatim—feel his practical mindset:

So far, I’ve dissected current blockchain game economies from my perspective, referencing many past mainstream projects. While we often joke that current P2E games are Ponzi schemes, fundamentally GameFi is still a game—gameplay and economics are equally vital. Present overemphasis on tokenomics stems from environmental, technological, and demographic factors.

Finally, my personal P2E strategy: 1. Gauge热度—primary indicator for entry. Twitter, Discord, Telegram, story virality, group mentions, DappRadar rankings, on-chain user counts—develop your own metric set. 2. Analyze docs to judge model/risk—decide play style: trade or farm, compound or mine-sell. 3. Monitor data for inflection points—time your exit.

Now Guatian’s personal wrap-up:

The entire “Decoding Blockchain Game Economic Models” series resembles a bikini-clad woman on a beach. Sections (I)–(V): her figure—core attraction. Sections (VI)–(VIII): bikini design/color—complementing her shape, creating elegance. Final section: embellishments—perhaps a butterfly or flower—small touches making her stand out.

Yet after completing analysis, I feel melancholy—because I confirmed a suspicion I’d sensed but avoided admitting: Currently dominant token-economic models will inevitably fall into death spirals—the whole series merely discusses delaying the inevitable.

I keep wondering: Does Axie’s Play-to-Earn model fully represent blockchain gaming? Probably not. Not blaming Axie—its 2020 dual-token innovation was groundbreaking. But by 2022, better models are needed to redefine the space.

So how can future blockchain games escape death spirals and achieve normal game lifecycles? Guatian throws out three ideas:

- Make games genuinely fun—so enjoyable that Web3 players willingly spend money to play;

- Shift model dominance from tokenomics to NFT-centric economics—emphasizing asset depth over liquidity;

- Expand scope—e.g., metaverse settings—where games are just one component supported by interconnected virtual environments.

Let’s look forward to co-creating smoother, more sustainable blockchain game economies.

Special thanks to Footprint Analytics for on-chain data support—we enjoy daily chats with data geeks. Also grateful to Nathan from CryptoPlus+ for strong endorsement! Looking forward to deeper discussions with more friends!

End of article.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News