Blockchain Gaming Report for January 2025: Market Indicators Decline, Platform Competition Intensifies

TechFlow Selected TechFlow Selected

Blockchain Gaming Report for January 2025: Market Indicators Decline, Platform Competition Intensifies

This month's market highlights were centered on social platforms, with TON receiving exclusive authorization for Telegram's blockchain infrastructure, while LINE launched its Mini Dapps ecosystem through Kaia.

Author: Stella L (stella@footprint.network)

Data source: Footprint Analytics Blockchain Game Research Page

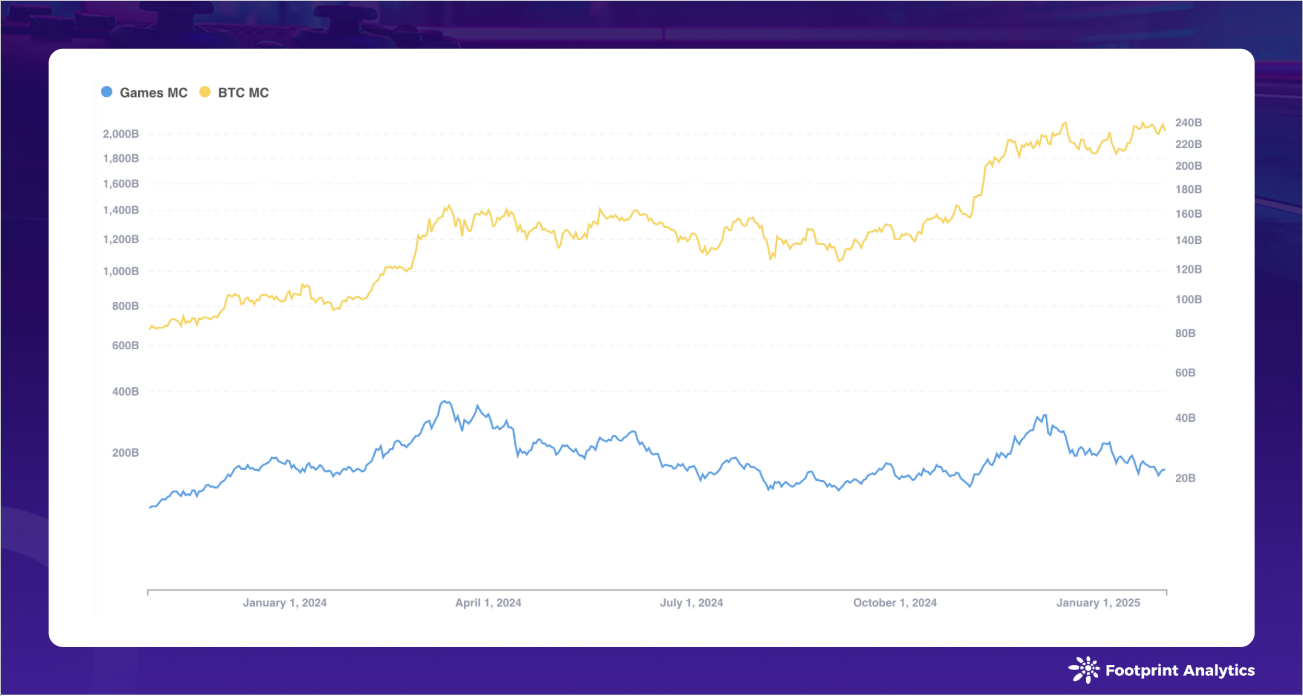

Despite the overall crypto market maintaining strength, the gaming sector's market cap dropped 19.3% to $22.3 billion.

This month’s market focus centered on social platforms, with TON securing exclusive authorization for Telegram's blockchain infrastructure, while LINE launched its Mini Dapps ecosystem via Kaia.

Macro Market Review

Bitcoin rose from $94,577 to $102,180, an 8.0% increase. Ethereum underperformed, declining from $3,353 to $3,292, a drop of 1.8%, and the ETH/BTC ratio hit its lowest level since September 2024.

Data source: Bitcoin and Ethereum Price Trends

Several major policy developments significantly influenced the crypto market. The Trump administration's executive order on cryptocurrency regulation provided unprecedented clarity for the industry, particularly emphasizing protection of self-custody rights and support for stablecoin development. However, Trump's late-month comments on international trade tariffs sparked concerns about global economic growth, cooling market sentiment.

The $TRUMP and $MELANIA tokens launched by the Trump family on Solana triggered significant volatility in the Memecoin sector. This speculative surge notably diverted market attention and capital away from other crypto sectors, including blockchain gaming.

DeepSeek's breakthrough advances in artificial intelligence also impacted market dynamics. These developments accelerated interest in decentralized AI infrastructure within the crypto ecosystem, leading to gains in AI-related tokens this month.

Blockchain Gaming Market Overview

In January, despite the broader crypto market remaining strong, the Web3 gaming sector faced headwinds. The market cap of blockchain gaming tokens declined from $27.6 billion to $22.3 billion, a drop of 19.3%.

Data source: Blockchain Gaming Token Market Cap and Bitcoin Market Cap

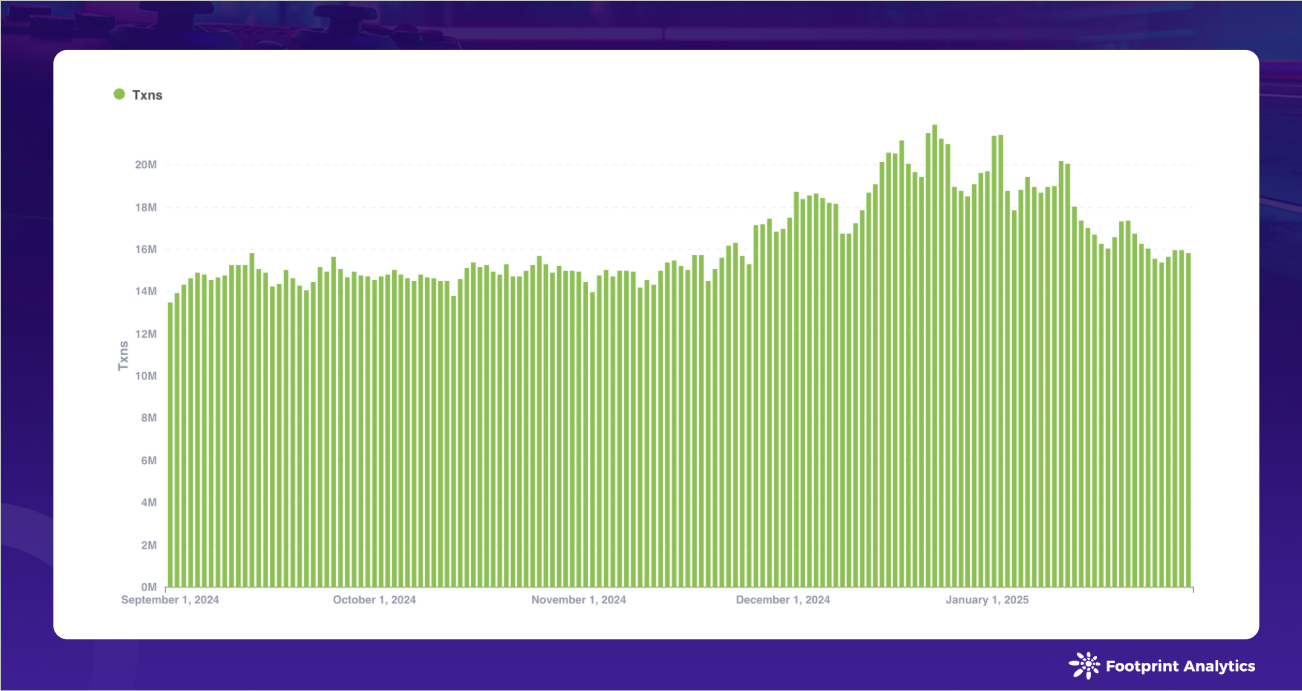

On-chain activity metrics also showed weakness, with monthly transaction counts falling 7.2% to 550 million and transaction volume dropping 12.4% to $230 million.

Data source: Daily Blockchain Game Transaction Count

The TON Foundation's announcement on January 21 of its exclusive authorization for Telegram's blockchain infrastructure marked a pivotal moment for the ecosystem. This exclusive partnership requires all Telegram-based applications to migrate to TON within 30 days, putting pressure on projects built on other chains. While the TON Foundation is offering incentives for early adopters who complete migration by February 21, it still presents real technical and community challenges for affected gaming projects.

The day after this announcement, LINE unveiled Mini Dapps and a Dapp Portal through LINE NEXT, highlighting emerging competition in the social platform gaming space. The Kaia Wave initiative plans to launch 32 Mini Dapps initially, demonstrating a more controlled, ecosystem-driven approach compared to Telegram’s relatively open development environment.

These platform-level shifts, combined with weakening market indicators, suggest the Web3 gaming sector is entering a consolidation phase, where platform integration and user experience may take precedence over token economics. The strategies of Telegram and LINE could significantly influence how blockchain gaming projects approach user acquisition and retention throughout 2025.

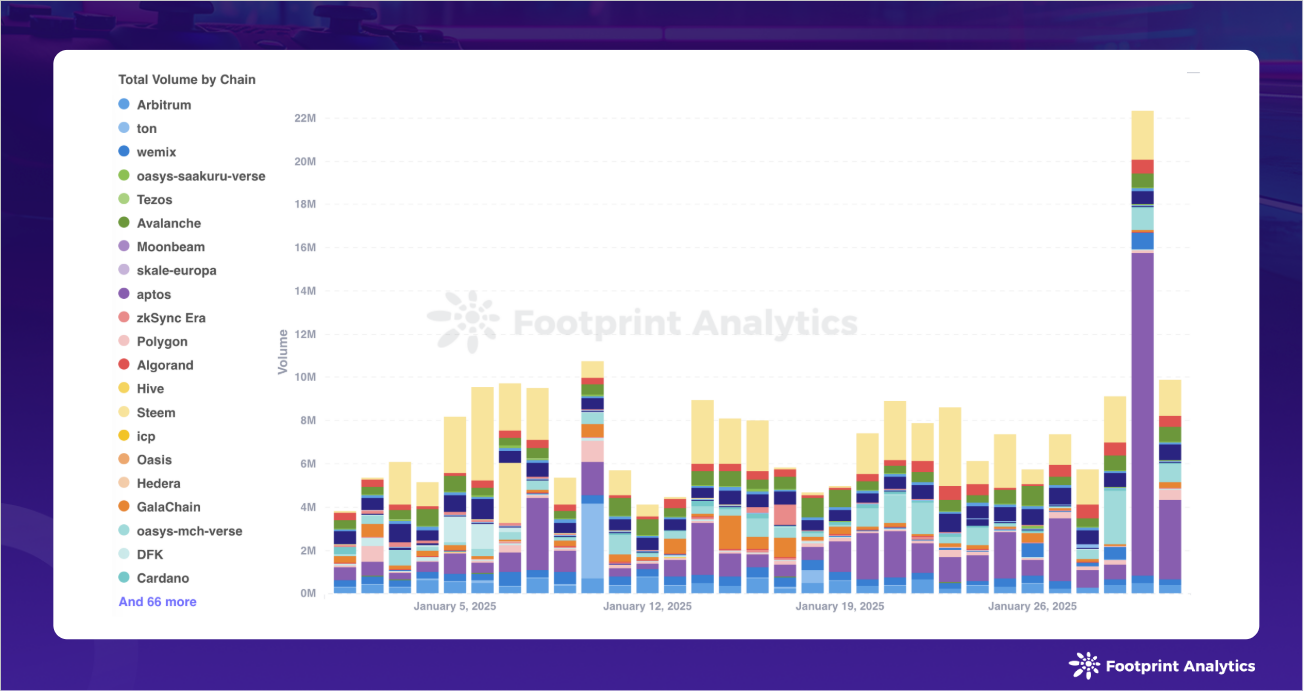

Blockchain Gaming Public Chain Overview

In January 2025, there were 1,697 active blockchain games, a modest 1.4% increase from December. Traditional market leaders maintained their positions in game distribution: BNB Chain (24.2%), Polygon (15.6%), and Ethereum (13.1%). However, this stability in game distribution contrasts sharply with significant changes in on-chain activity.

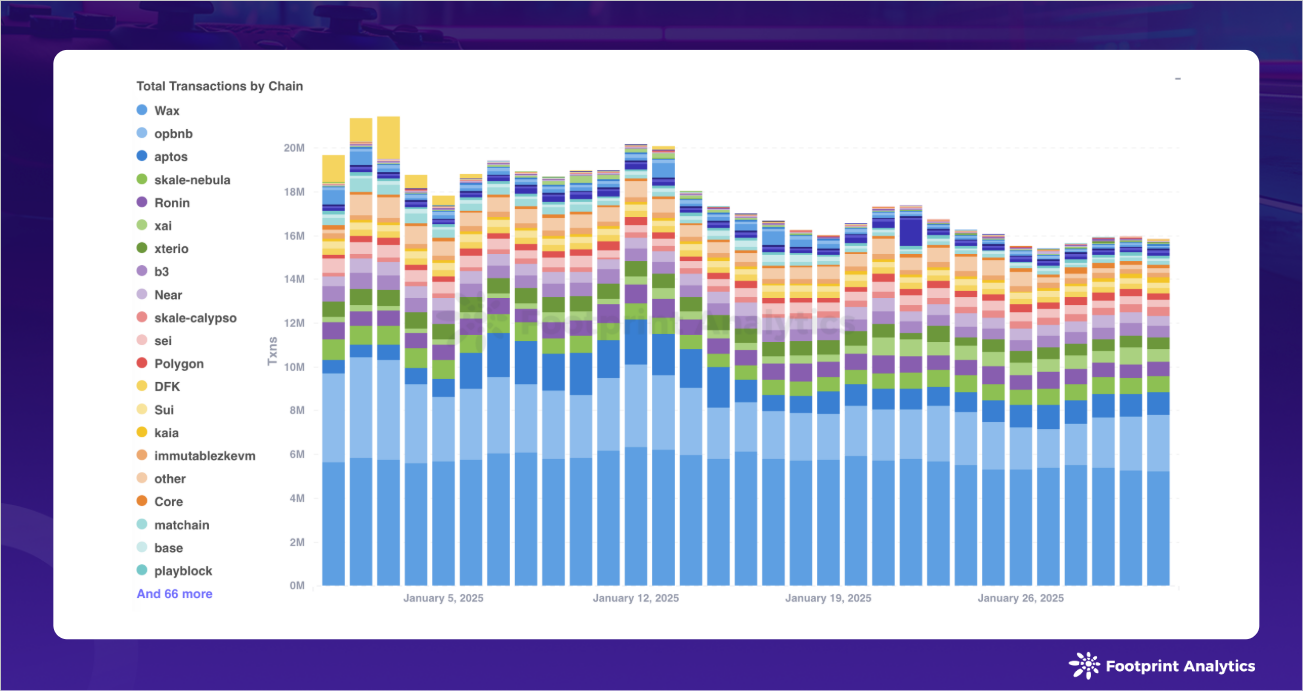

Transaction activity showed a clear concentration trend, with three chains dominating. WAX led with 180 million transactions, accounting for 32.4% of all gaming activity. opBNB ranked second with 87.2 million transactions (15.9% share), followed by Aptos with 37.5 million transactions (6.8% share). Together, these three chains accounted for over 55% of all gaming transactions in January.

Data source: Daily Transaction Count by Chain

In terms of transaction volume, Aptos topped the list with $51.9 million in trading volume (22.1% share), followed closely by Ronin at $49.5 million (21.1% share). Immutable X ranked third with $19 million in volume (8.1% share).

Data source: Daily Transaction Value by Chain

Competition among chains for developers intensified, with aggressive incentive programs being rolled out. Multi-million dollar funds from Sonic SVM and Galaxy Interactive targeting the intersection of Web3 gaming and AI reflect growing market interest in AI-enhanced gaming experiences. Meanwhile, Ronin Network expanded its $10 million grant program beyond gaming into consumer apps and DeFi protocols to build a more comprehensive ecosystem.

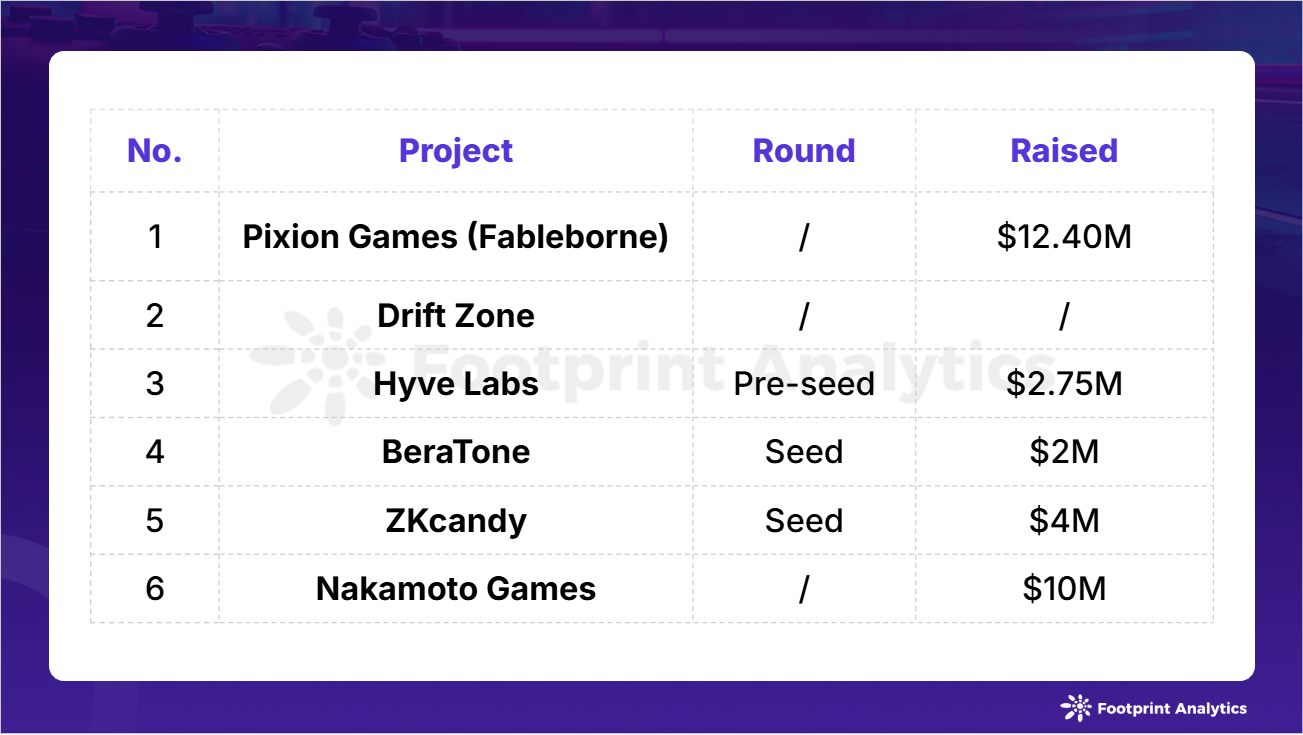

Blockchain Gaming Investment and Funding

In January 2025, Web3 gaming investment activity continued its downward trend, with six funding events raising a total of $31.2 million. The decline in fundraising reflects broader market dynamics. The surge in speculative activity has significantly diverted market attention and capital from other crypto sectors, including blockchain gaming.

Web3 gaming funding events in January 2025 (source: crypto-fundraising.info)

Pixion Games led this month’s fundraising, raising $4 million in a strategic round led by Delphi Ventures, with participation from Spartan Capital, Sky Mavis, and Animoca Brands. The studio’s flagship game, Fableborne, combines ARPG mechanics with strategic base-building elements. Its success on Ronin has been particularly notable. Other notable gaming funding events included Drift Zone, BeraTone, and Nakamoto Games.

Infrastructure development remained a key investor focus, with two significant raises: ZKcandy secured $4 million for its ZKsync-based gaming-dedicated Layer 2 chain following a successful open testnet phase. Additionally, Hyve Labs raised $2.75 million to develop core infrastructure, including launching a testnet chain, its first game, and other on-chain assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News