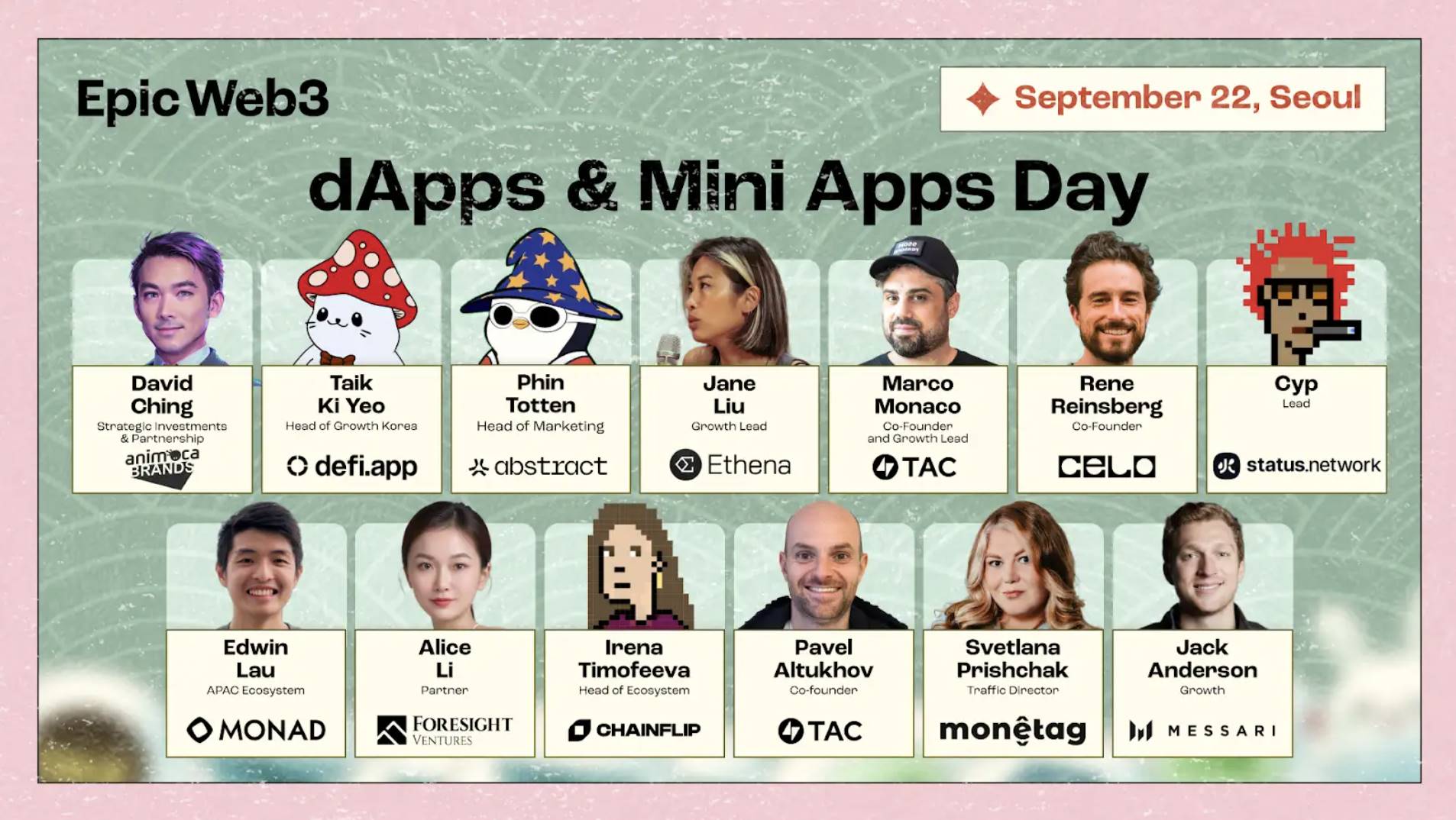

Blockchain gaming in South Korea: Players are not resistant to blockchain integration, but remain wary of publishers' greed

TechFlow Selected TechFlow Selected

Blockchain gaming in South Korea: Players are not resistant to blockchain integration, but remain wary of publishers' greed

This article will reveal the "resistance" and "challenges" in the Korean market.

Author: 1mpal

Translation: TechFlow

It's hard to believe that South Korean gamers have a certain resistance toward games with blockchain elements.

STEPN has a user community of about 30,000 people in South Korea, most of whom knew almost nothing about cryptocurrency. SuperWalk has been downloaded over 100,000 times. Blockchain games like *Idle Ninja Online* and *Mudol* once topped the revenue charts on app stores.

However, after the LUNA crash in May 2022, the P2E (Play-to-Earn) narrative suddenly stalled. In South Korea, games must go through classification by the Game Rating and Administration Committee (GRAC) before launch, and public sentiment shifted as courts repeatedly rejected classification applications for P2E games.

In other words, I don't think Koreans dislike "blockchain games" per se, but rather resent the negative associations they bring. This article will unpack the "resistance" and "challenges" present in the South Korean market.

1. The Issue of Tokens

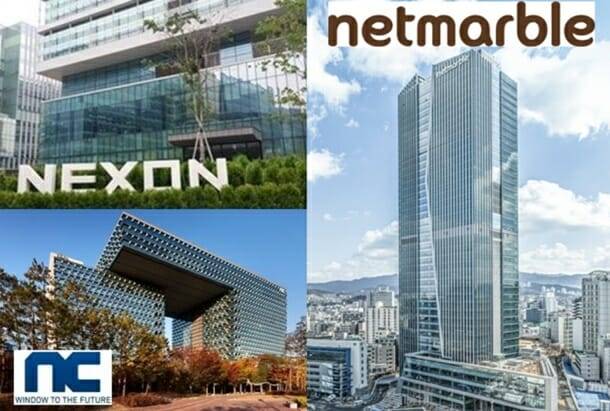

South Korean players have long held a negative view of game publishers. In the 2010s, the three major gaming companies—NCSoft, Netmarble, and Nexon—were collectively known as the "3N," a term rarely used positively. They are frequently accused of stifling innovation and progress in Korea’s gaming industry.

Given this reputation, token issuance is quickly perceived as exploitative. WeMade led the P2E charge in Korea, selling large amounts of WEMIX tokens to acquire another company. This move was widely seen as greedy—not only profiting from the game itself but also cashing in on token sales.

Therefore, if you want to introduce South Korean players to blockchain games without backlash, you need to clarify that your token “won’t directly benefit the publisher or venture capitalists.” This is difficult to sell—the safest statement might simply be: “We’re not issuing a token.”

2. Regulatory Issues Around Fungibility

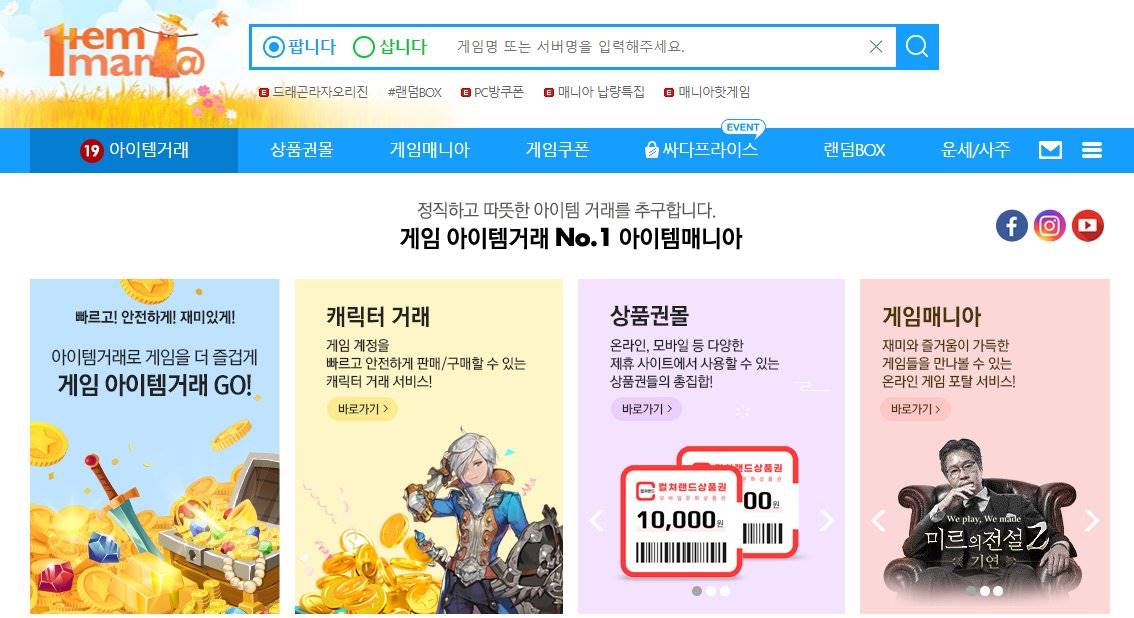

South Korean gamers are highly active in P2P transactions and RMT (Real Money Trading). The largest P2P platform in Korea sees annual transaction volumes exceeding $750 million. Yet these activities are officially prohibited by game publishers. Some games, like *MapleStory*, are relatively tolerant of RMT and have even developed their own RMT communities. In Korean, this is called “ssalmek.” (TechFlow note: “Ssalmek” is a Korean term commonly used to describe informal in-game trading behaviors, especially involving real-money transactions using in-game resources.)

Beyond debates over whether blockchain suits RMT services, South Korea’s legal framework for games offers two classifications:

-

If transactions involve only paid currency, the game receives an R18 rating.

-

If transactions also include in-game earned currency, it falls under gambling regulations. Legal complications arise with blockchain markets because while traded items may not be labeled R18, converting them into fiat currency creates issues. Similar to tokens, NFTs are also regulated in South Korea—if they hold significant value on external markets, they are considered “fungible.”

The recent buzz around “revenue sharing” in some Web3 games is nothing new in South Korea. As early as 2009, *RF Online* paid monthly salaries to top guilds, sparking controversy—but it didn’t break any laws. It was allowed because payments weren’t tied to in-game items. However, direct monetization of in-game items is banned in South Korea.

3. Player Demographics

The number of young investors in South Korea is substantial. They are quick, intelligent, and well-informed. Aware that P2E models often collapse, they avoid getting caught in death spirals. Assuming that targeting younger audiences is key to winning over Korean gamers would be a mistake. When examining user demographics of successful blockchain games (or apps) in Korea, the results are striking. The core user base of MIR4, MUDOL, STEPN, and SuperWalk consists primarily of men in their 30s and 40s. They tend to be indifferent to online noise and, interestingly, express fewer strong objections to blockchain games.

I once wrote a blog guide for a portal site in Korea about the successor to MUDOL. Perhaps younger investors had already moved on, dismissing MUDOL as a failure, but to this day, more than 350 people—all in their 40s—used my referral code to register at their first overseas centralized exchange (CEX).

Many game projects still see South Korea as an attractive market—and for good reason. Competition is fierce, MMORPGs have high ARPPU (Average Revenue Per Paying User), game quality is excellent, and it remains the world’s fourth-largest gaming market. However, some claims about its potential are overstated. Through conversations with many players, I’ve found that while they may be skeptical of blockchain games themselves, they rarely dislike the keyword “blockchain.” What worries them is publisher greed and the risk to ordinary players when token prices crash.

Players don’t seem opposed to officially sanctioned RMT (real money trading)—currently a legal gray area—or even pure revenue-sharing models. But this may require relinquishing control over “tokens,” or waiting for the South Korean government to clarify regulations around in-game monetization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News