Folius Ventures: Making P2E Games More Sustainable – Ten Game Economic Model Design Approaches

TechFlow Selected TechFlow Selected

Folius Ventures: Making P2E Games More Sustainable – Ten Game Economic Model Design Approaches

In this report, Folius Ventures proposes 10 key design principles for P2E game economic models, aiming to achieve more stable exchange rates, more sustainable economies, and long-term game development. We hope this report serves as a source of design inspiration for any project interested in this field.

Author: Folius Ventures

Below is an excerpt from this report

Reprinted with permission by TechFlow

Preface

After two months of relentless inquiry and refinement, MapleLeafCap and I have finalized ten recommendations on P2E games.

This process coincided with the emergence of new phenomena and hints of paradigm shifts. We debated repeatedly, writing these insights as carefully as possible, hoping to offer some inspiration to developers, exploring together the possibilities of blockchain game economies, and venturing into uncharted territory.

Compared to traditional games, virtual currency game economies lack foreign exchange controls and exhibit stronger asset rent-seeking characteristics. However, through deep design elements such as multi-factor ROI models, foreign exchange reserves and exchange rate regulation, infrastructure, and governance tokens, we can avoid excessive dependence on external resources and build a stable, independent game ecosystem.

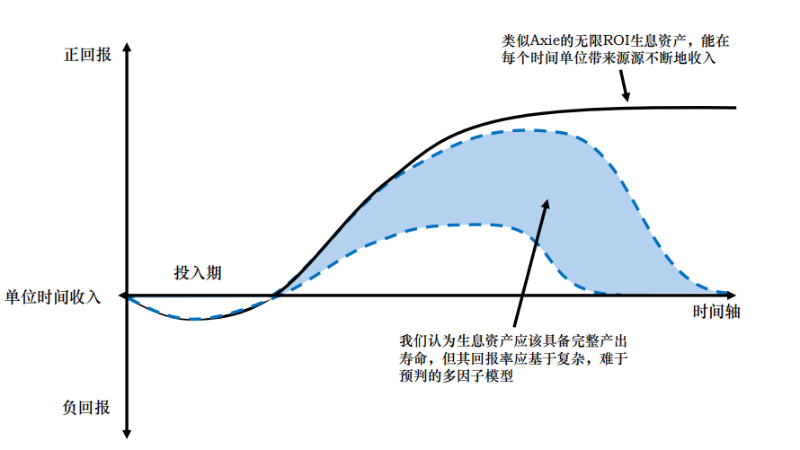

1. Set potential return caps or permanent reinvestment cycles for assets:

Whether it’s Axie’s one-time infinite yield or Thetan’s hero usage limits, neither approach is sustainable nor aligned with the essence of gaming.

Instead, multiple fundamental expenditures such as upgrades, forging, and repairs should be introduced under moderate negative feedback, along with utility decay curves and income-generating asset models based on unpredictable return formulas.

Natural systems experience entropy increase—we believe virtual economies require deliberate mechanisms for return decay or lifecycle management:

1. Asset depreciation in NFT games should be inherently valid, affecting net income invisibly rather than explicitly;

2. Repairing, scrapping, recycling, and upgrading income-generating assets should drive in-game consumption of native currency;

3. Returns from income-generating assets denominated in native currency should be capped and based on complex, hard-to-predict multi-factor cost-output models, making crude rent-seeking difficult;

4. Income-generating assets must have return decay or a defined lifecycle. Unlimited yields will destabilize the economy over time.

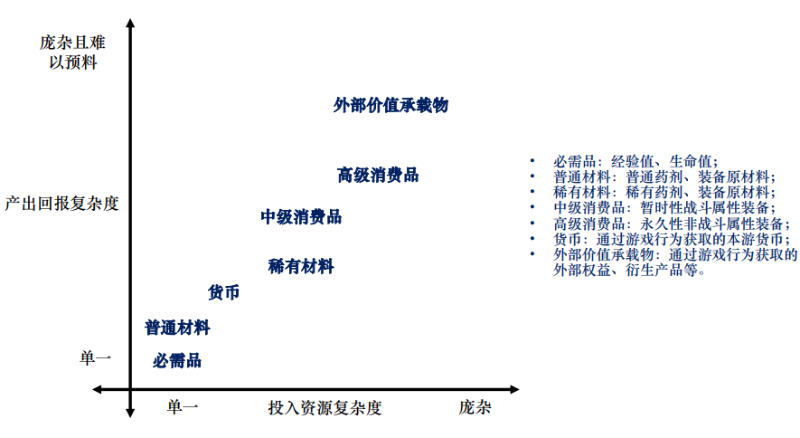

2. Diversify investment inputs and returns for income-generating assets

Designing yield-bearing assets solely around simple, quantifiable APY metrics will inevitably turn games into short-lived gold rush mines.

Input requirements and reward outputs for game assets should be designed with greater complexity and variety, abandoning tiered reward models in favor of a pyramid structure—where higher-quality assets yield stronger utility, making brute-force rent extraction difficult.

3. Keep value within the game ecosystem as much as possible

In Web3 games with free capital flow, we believe games should retain economic resources internally through at least three methods—to buy time for future external cash injections, internal rent generation, organic growth, and building emotional user connections.

1. Raise capital outflow barriers appropriately

2. Offer value-preserving stores of value

3. Enable internal循环 (closed-loop) yields

Whether through exit taxes, value-preserving asset designs, or promoting internal resource exchanges, these measures help keep value circulating within the ecosystem longer, allowing sustained value creation over extended lifecycles.

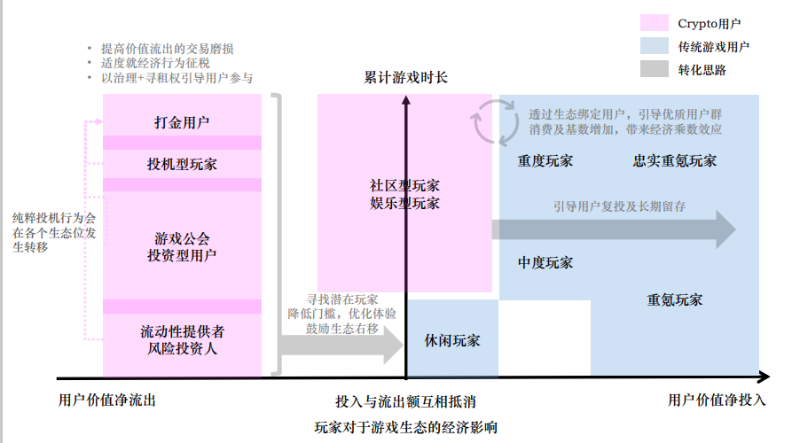

4. Recognize profit-driven user profiles and attempt education and conversion

Traditional player segmentation should be rethought. P2E games are filled with ROI-driven players. Teams must acknowledge this reality and the associated risk of capital outflows due to user inertia, guiding them toward becoming contributors via community, identity, and gameplay satisfaction.

5. Own infrastructure rights and stabilize the economy through its revenue

Taxing trading and lending activities involving FTs and NFTs is simpler, more sustainable, and potentially more lucrative than selling game assets directly.

Teams should own autonomy over core ecosystem infrastructure and financial components, collecting fees to stabilize the economy.

We consider the following core open financial components essential:

Fungible Token Exchange (AMM DEX, e.g., Uniswap)

Typical transaction fee: 1–30 bps; additional 5–100 bps rent capture via user access control, directed to treasury.

Due to routing challenges with broader on-chain ecosystems and difficulty securing liquidity for stablecoins like USDC, frontend integration may be preferable.

Fungible Token Lending (e.g., Compound)

Typical net interest margin: 100–500 bps; teams controlling user entry can operate in-house or claim 10–80% of spreads, directed to treasury.

Given difficulty acquiring USDC liquidity, dedicated fundraising or investor support may be necessary.

NFT Marketplace (e.g., OpenSea)

Typical transaction fee: 200–600 bps; teams with user access control can operate their own platform, directing revenue to treasury.

NFT metadata offers far richer dimensions than mere JPEGs, and given the relatively closed ecosystem, reliance on external exchanges is unnecessary.

NFT Lending (not yet mature)

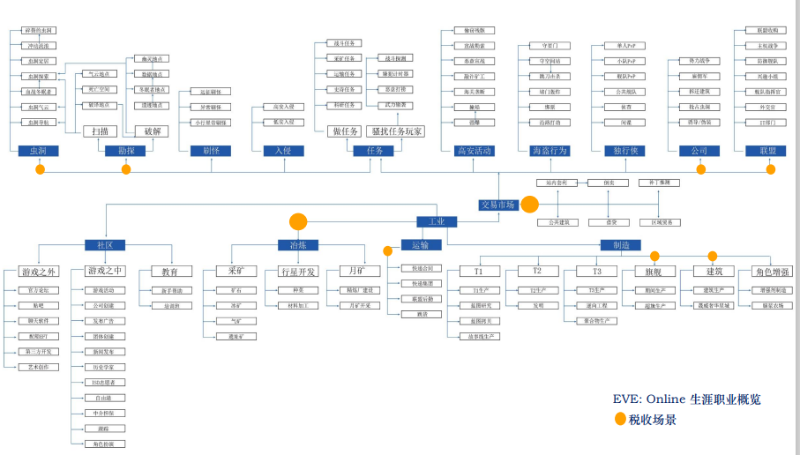

Both NFT leasing and collateralized borrowing (for native tokens or USDC) should be considered in future game designs. Referencing EVE Online’s rental system, using collateral and time limits can prevent unchecked gold farming, while tax revenue from rent-seeking can be captured by both treasury and users.

6. Build a more robust and complex in-game commercial system and tax it to stabilize the economy

For open-world/MMORPG games, diverse resource systems offer many opportunities to create player profit margins. Designers should foster a healthier commercial environment, encourage peer-to-peer trading, and implement appropriate taxation to stabilize the overall economy.

7. Foster emotionally driven spending once user base stabilizes

When illusion becomes real, narrative-driven immersion makes virtual asset utility self-evident.

Whether rare weapons, limited-edition skins, guild affiliations, or home achievements, guiding non-profit-oriented investments through value alignment and emotional attachment—and precisely rewarding loyal players—is the fairest form of value exchange, closest to the true spirit of gaming.

8. Explore introducing external cash flows

Achieving economic balance purely through internal sinks is extremely difficult. Introducing external cash flows not only reduces the need for heavy internal consumption mechanics but also mitigates ROI-driven speculation, serving as an effective economic regulator. In this process, teams can earn stablecoin revenues or redirect external resources to absorb internal inflation. Consider the following:

Direct advertising revenue: User attention is scarcer than ever in web3; community-based marketing allows precise targeting.

Product/resource partnerships: Once the community grows, collaborate with like-minded teams, exchanging products as scarce rewards to boost engagement and burn native currency.

Esports broadcasting & betting: Applicable only to high-intensity, highly competitive, and spectator-friendly PvP scenarios, generating revenue from broadcast rights and betting.

Merchandise release: Partner with fashion brands or independently launch apparel, sneakers, and other trendy items.

IP licensing: Promote IP衍生 (derivative) products or even film/TV adaptations, with royalties flowing directly into the treasury.

9. Properly distribute and manage governance tokens, integrating them organically into ecosystem contributions

Pure token rent collection or speculation benefits the game economy not at all. Teams should scientifically distribute tokens, define their utility within the game economy, carefully assess holder qualifications, and structure participation methods and power scopes to incentivize continuous contribution to the ecosystem.

10. Learn to govern a nation

Although this may sound unrelated to game design, it's precisely what we hope game teams come to understand—

Today’s games resemble nations with freely floating exchange rates and unrestricted capital flows. Preventing financial crises, minimizing financial risks, and delivering great gameplay experiences are equally important. Beyond expectation management, policy-making, and prepared intervention tools, there is no alternative.

Finally, heartfelt thanks to MapleLeafCap for wisdom and patience—meticulously refining my fragmented and awkward ideas into actionable methodology.

We also thank all developers committed to the Web3 entertainment space. If you have different opinions, better ideas, or wish to join us in designing P2E/PnE game economies, please don’t hesitate to reach out.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News