Looking back at the previous cycle, what was the best DeFi token economic model?

TechFlow Selected TechFlow Selected

Looking back at the previous cycle, what was the best DeFi token economic model?

Fundamentals matter, narrative matters.

Author: Lucas Campbell, Bankless

Translation: TechFlow

Tokenomics is an emerging field. The industry is collectively exploring optimal designs, distributions, utilities, governance frameworks, and everything else—like painting on a blank canvas. As token teams have experimented over the years, several distinct token models have emerged as standards. During the DeFi summer, we saw the rise of valueless governance tokens like UNI and COMP. There are also cash-flowing tokens such as MKR and SNX, which have been workhorses for years. More recently, we've seen the vote-escrow model (veTokens) gain increasing attention across the sector.

So, what's the best model?

That’s exactly what we’re going to dive into. First, we’ll outline the different token models and their designs. Then, we'll evaluate their price performance to see which ones fared better. Let’s get started.

Different Types of Token Models

As mentioned earlier, we’ve mainly observed three distinct token models:

- Governance;

- Staking/Cash Flow;

- Vote Escrow (veTokens);

Governance Tokens

Examples: UNI, COMP, ENS

For a time, governance tokens were the norm in DeFi. Popularized by Compound and Uniswap in 2020, governance tokens do exactly what they say on the tin—they grant holders voting rights over the protocol.

But these meme tokens themselves hold no intrinsic value; they confer no economic rights. One token equals one vote—and that’s it.

Governance tokens are often heavily criticized by the community: No cash flows! Why would they have value?

Well-known governance tokens like UNI and COMP don’t receive any dividends from the protocol’s business activities (i.e., Uniswap trades or Compound lending), although this is largely due to legal reasons. In most cases, the lack of cash flows helps minimize regulatory risk.

But as Joel Monegro outlined on our podcast, having influence over a protocol clearly has some value—even if it's hard to quantify.

A common belief is that these tokens will eventually vote on future economic rights to the protocol—which is currently happening with Uniswap. The protocol is actively discussing turning on the fee switch to capture profits from liquidity providers.

While the profits from the fee switch won't flow directly into the UNI token (they'll go to the DAO treasury), this is an early signal that this narrative may play out over the long term—it just takes one proposal.

While critics might argue governance tokens have no place in an investment portfolio, Uniswap’s $9 billion valuation says otherwise.

Whether it's the best-performing token model is another question (which we’ll answer below).

Staking / Cash Flow

Examples: MKR, SNX, SUSHI

While some protocols chose the path of valueless governance tokens, others like MKR, SNX, and SUSHI decided to assign economic rights to their token holders.

In all cases, these tokens earn revenue from the protocol’s business operations. MakerDAO was one of the earliest pioneers of this experiment. Protocol revenue from Dai loans (accrued interest) is used to buy back and burn MKR—a mechanism that has been in place for years. Through reduced supply over time, holding MKR indirectly provides exposure to cash flows.

While MKR offers passive ownership, SNX and SUSHI require users to stake their tokens to gain claim to dividends. Both protocols generate fees from trading activity and redistribute them to stakers on the protocol. For SNX, users earn sUSD (Synthetix’s native stablecoin) weekly in addition to their staked SNX. On the other hand, SUSHI stakers earn additional SUSHI through automatic market purchases funded by protocol revenue.

Note that for staking/cash-flow tokens, we should not consider native inflation as part of income. A key example here is Aave. It acts like a pseudo-productive token. While the protocol offers staking for AAVE (stkAAVE), staking does not yield any exogenous cash flow from protocol activity—it simply comes from the DAO treasury distributing AAVE.

Vote Escrow (veToken Model)

Examples: CRV, BAL, YFI

Vote-escrowed tokens are currently the hottest trend in token economic design, popularized by Curve Finance. Under this model, holders can choose to lock up their tokens for a predetermined period (typically ranging from 1 week to 4 years).

By locking their tokens, users receive a veToken based on the duration of the lock (e.g., veCRV for CRV). For instance, staking 1,000 CRV for 1 year yields 250 veCRV, while staking the same amount for 4 years yields 1,000 veCRV (250 x 4).

The key point is that veTokens typically come with special rights within the protocol. For Curve, veCRV holders have the power to vote on which liquidity pools receive CRV emissions and gain enhanced rewards when providing liquidity. Additionally, veCRV holders earn dividends from trading fees and any bribes flowing through the protocol.

Overall, the veToken model incorporates elements from both previous models and adds extra utility, creating a highly compelling use case.

But let’s now dive deeper into how these tokens have performed.

Historical Performance

To assess this, let’s take a very simple approach.

We will create an equally weighted average of three tokens from each category and measure their year-to-date price performance—close to the relative peak of the crypto market.

This way, we can gauge which token model exhibited the most price resilience during an extended bear market. Clearly, there are many nuances involved—fundamentals, catalysts, narratives within the space, etc.

Nevertheless, this will give us a straightforward evaluation of today’s different token models.

Performance Across Models

Index:

- Governance: UNI, COMP, ENS;

- Productive: MKR, SNX, SUSHI;

- Vote-Escrow: CRV, BAL, FXS;

Let’s acknowledge upfront: 2022 wasn’t kind to cryptocurrency. BTC and ETH both fell around -50% from the beginning of the year.

Given that most other tokens carry higher risk and amid a broader risk-off environment in financial markets, it’s unsurprising that most other tokens declined similarly or worse.

Nonetheless, it’s fascinating to observe how these assets performed when grouped by their token model.

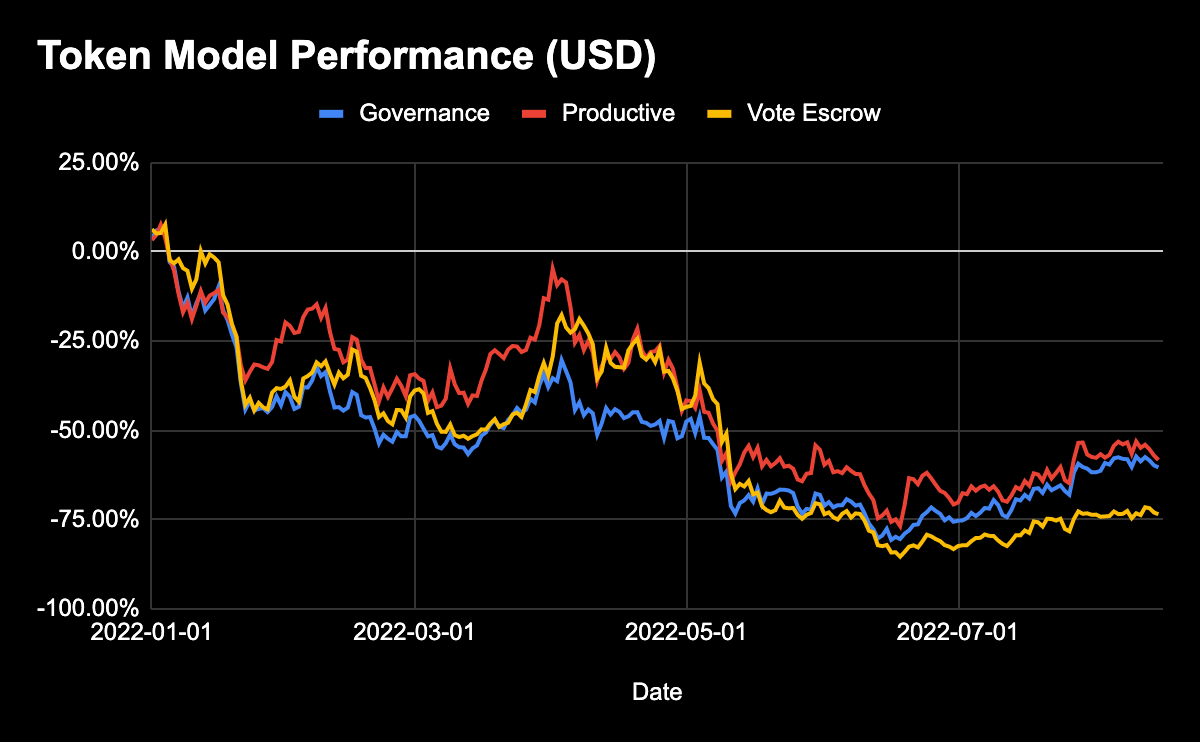

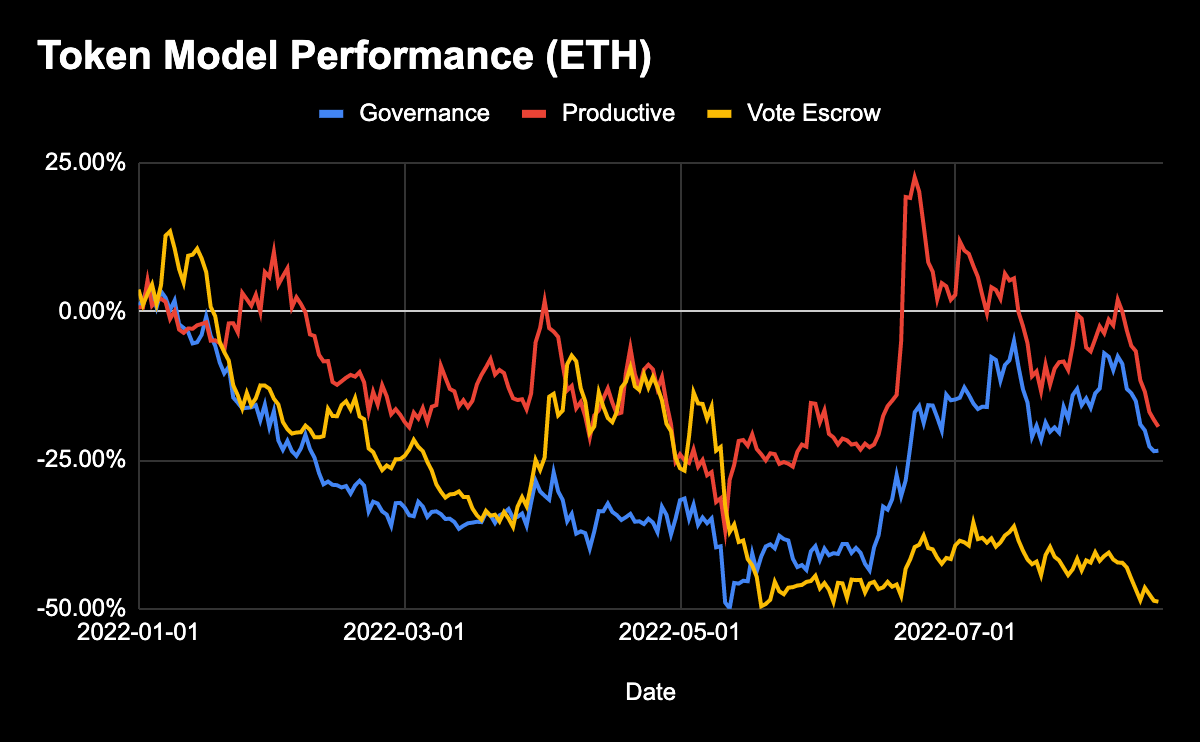

When averaging the three tokens in each category into an index, here’s what we see in terms of year-to-date price performance.

While many might assume governance tokens would perform worst—given their widespread perception as valueless—the vote-escrow tokens actually averaged the poorest performance among the three models.

Regardless, this remains quite surprising given the positive sentiment among crypto investors toward the vote-escrow model. It's currently the darling of token economic design, offering compelling lock-up incentives, cash flow generation, and strong governance powers (such as directing liquidity incentives).

Yet all three tokens performed poorly against both USD and ETH. Curve, the pioneer of this model, dropped -71%. Meanwhile, Frax’s FXS fell -84%, and even BAL, despite implementing the vote-escrow model in March, declined -61%.

Why Is That?

One angle is that vote-escrow tokens often come with massive token emissions. For example, Curve currently distributes over 1 million CRV per day to liquidity providers on its protocol. Based on CoinGecko’s reported circulating supply, this equates to over 100% inflation annually. Similarly, Balancer currently distributes 145,000 tokens weekly, implying an annualized inflation rate exceeding 21%.

In contrast, Frax only emits about 7% of its token supply as rewards to LPs. While this number isn’t outrageous, Frax’s poor performance may largely stem from the collapse of algorithmic stablecoins following Terra’s downfall and the subsequent failure of the 4pool launch.

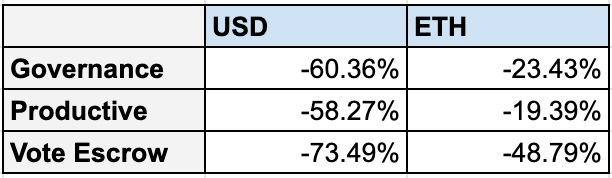

Zooming out, productive tokens performed best on average. This was primarily driven by SNX, which experienced only a 35% decline since the start of the year. This could be attributed to the recent successful integration of atomic swaps with various aggregators (e.g., 1inch), causing the token to surge 135% from its June lows.

Beyond SNX, MKR performed in line with the basket, down -57%, while the largest drop came from SUSHI, falling -87% amid governance and operational turmoil.

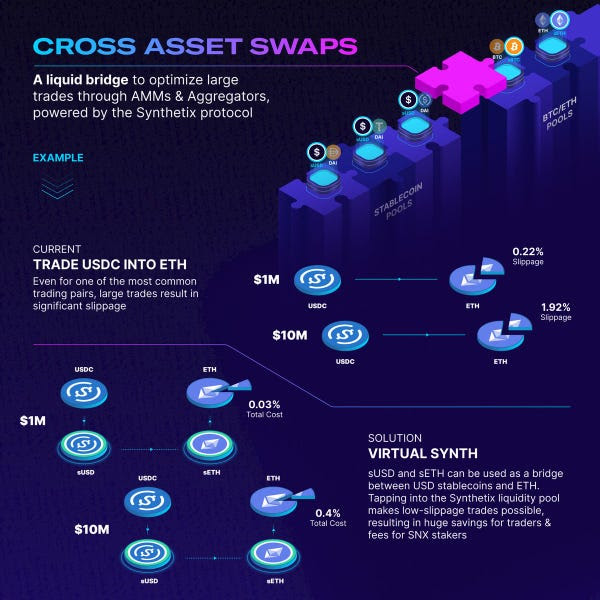

While performance appears mediocre in dollar terms under turbulent macro conditions, viewing these assets in ETH terms—since our goal is often to outperform ETH—is less grim.

At one point near the recent market bottom, productive tokens measured in ETH were actually rising.

Fundamentals > Cash Flows

Each protocol has its own independent drivers. Ultimately, macro price movements are primarily driven by these catalysts—not the underlying token model. While building floating or dividend mechanisms favorable to token holders helps, it’s no magic bullet.

Undeniably, cash flows offer positive upside potential for token holders and increase the appeal of holding the asset—especially when the protocol earns substantial fees.

But in the end?

Fundamentals matter. Narratives matter.

The underlying token model—unless fundamentally broken—should merely be a meme-level artifact beneath larger trends.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News