How to Find GEMS by Reading Crypto Whitepapers?

TechFlow Selected TechFlow Selected

How to Find GEMS by Reading Crypto Whitepapers?

How to Read a Whitepaper?

This article is compiled from the YouTube video "Reading Crypto White Papers: How To Find GEMS" by Coin Bureau, a crypto-focused content creator with over a million subscribers. Unfortunately, an increasing number of projects today don't even have white papers. However, this also creates space for those projects that take the time to write thorough white papers to stand out and reveal their unique value.

To date, one of the most important steps in understanding a project is reading its white paper.

When researching cryptocurrencies, one of the most critical sources of information is the project's white paper. The only problem is that white papers can be difficult to understand—especially if you don't know what you're looking for. That’s why today I’ll explain what a white paper is, what to look for, and how this information can help you maximize your crypto returns.

White Paper Explained

First, what is a white paper? In short, a white paper is a summary of a cryptocurrency project. It includes the project’s purpose, design, underlying team, funding sources, and roadmap.

White papers are typically among the first things a crypto project produces, right after its website and social media accounts. For this reason, many believe the primary purpose of a white paper is marketing, as they are often designed to attract investors. This ultimately depends on the specific crypto project being analyzed, but it's definitely something to keep in mind when evaluating a white paper.

White papers come in all shapes and sizes—some contain many images, while others have none. Similarly, some are extremely long, which usually reflects the complexity of the project. Clearly, more complex projects require longer white papers. White papers can also vary in color.

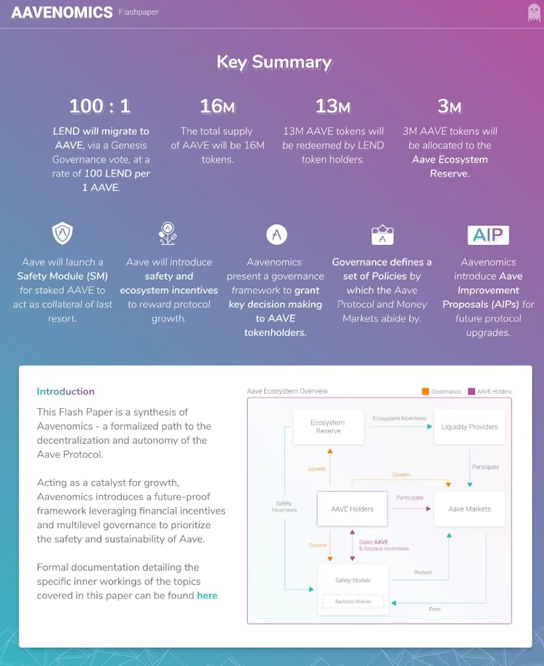

Yellow papers provide technical details behind crypto projects. The most famous example is likely the Ethereum Yellow Paper written by Ethereum co-founder and Polkadot creator Dr. Gavin Wood. There are also beige papers, which are essentially simplified versions of yellow papers designed to be accessible to non-technical readers. Another function of these is to allow quick reading—they serve as concise summaries of crypto projects, ranging from one page to several pages.

Before I proceed, there's one thing you should note: a white paper should not be your only method of analyzing a project.

Who Wrote It, and When?

The first thing to check in a white paper is who wrote it and when it was published. Cryptocurrency projects often evolve over time, and some have released multiple white papers since inception. Therefore, it's crucial to ensure you’re reading the latest version.

Typically, white papers are hosted on the project’s official website or documentation. If you can’t find the white paper on the project’s site, try visiting whitepaper.io.

This site has a useful feature: you can browse all versions of a project’s white papers. If you want to understand how a project has changed over time, this feature is invaluable.

Personally, I look back at previous white papers to see whether a crypto project has used the same narrative over the years or continuously adapted to keep up with competitors. I also pay attention to differences between past and current authors, as a change in team could signal shifts in the project’s future—or even underlying issues, which is bad news for any venture regardless of type. Core team members should almost always be among the white paper authors; if not, that’s a major red flag.

While team credentials often receive significant attention, the collaborative history among core members is arguably more important than any degree or work experience. Gala Games is a great example—the founders had previously worked together successfully in other ventures. Ironically, Gala Games does not have a white paper.

Project Location and Partnerships

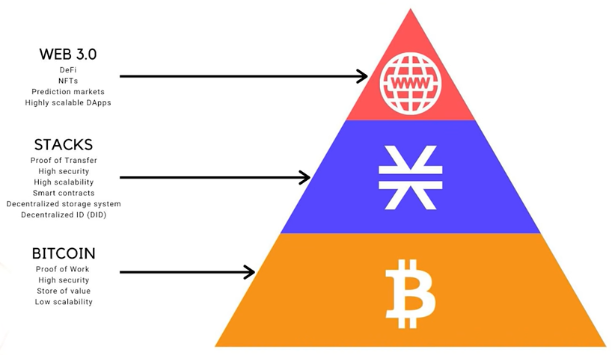

The second key aspect to examine in a white paper is the project’s jurisdiction and its partners or supporters. There are several important reasons for this. Currently, crypto projects based in countries like the United States often face greater challenges getting off the ground compared to those in more crypto-friendly jurisdictions. As we’ve seen with projects like Stacks, being located in an unfriendly jurisdiction can jeopardize token launches and exchange listings—even if the team follows everything outlined in the white paper.

Fortunately for Stacks, it has strong institutional backing, meaning the project has sufficient funds to meet any legal requirements—enabling STX to list on Coinbase.

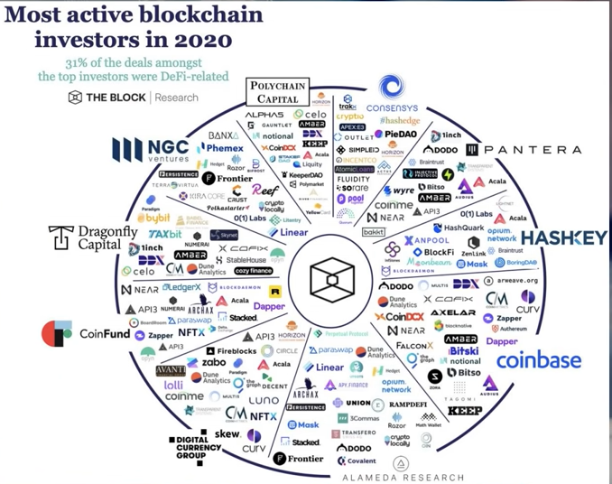

In this regard, STX’s listing on a U.S. exchange serves investor interests and highlights another crucial factor—particularly relevant to venture capital firms (VCs).

Contrary to popular belief, VC involvement can actually be a positive sign. Many VCs are in it for the long haul, especially those who invest heavily post-launch. Moreover, some of the largest crypto VCs are subsidiaries of cryptocurrency exchanges—for instance, Coinbase Ventures. If you see such VCs mentioned in a white paper, you can reasonably assume the token may eventually be listed on the associated exchange.

For similar reasons, partnerships matter. You might see references to partner projects in the white paper. Of course, the quality of these partnerships depends on the reputation and performance of the other crypto projects involved, which may take time to assess.

If you have time, dive into the white papers of their partnered projects. Alternatively, check whether the partner project’s token remains active and is listed on reputable exchanges such as Binance, Coinbase, FTX, or KuCoin.

Although traditional institutional partnerships are rarely mentioned in crypto white papers—since they’re often published early—you can sometimes predict future partnerships by examining the backgrounds of team members and their affiliations.

Theta is a prime example. Steve Chen, co-founder of YouTube, was one of Theta’s earliest advisors. Theta later partnered with Google, YouTube’s parent company, and Theta Labs was recently appointed to Google Cloud’s digital assets team. Therefore, it’s no surprise that the Theta token surged 200x between 2020 and 2021.

What Makes the Project Unique?

The third thing to look for in a white paper is the specific purpose of the crypto project and how it differentiates itself from competitors. This information is typically presented at the beginning of the white paper. If the document starts with a lengthy story about Bitcoin’s creation in 2009, that’s a red flag.

Evidence suggests such white papers are aimed at attracting inexperienced crypto investors and may indicate a low-quality project.

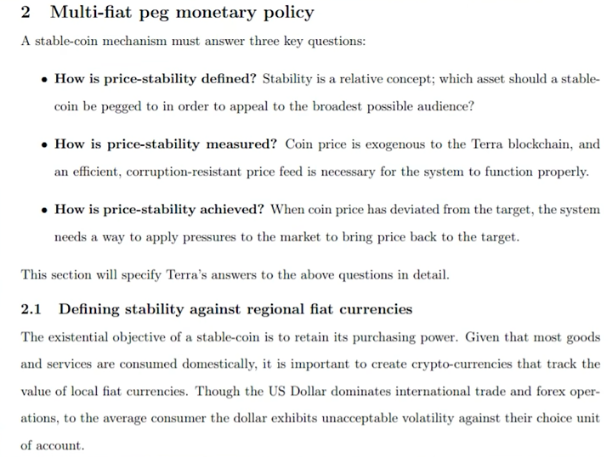

Ideally, the white paper should get straight to the point—something like: “We’re building a smart contract platform like Ethereum, but faster. Here’s how.” A good example is the Terra white paper, which briefly outlines the problem it aims to solve, details the three components needed to solve it, and explains how the project implements them.

It’s even better if the author can define their project’s purpose without referencing competitors. Spending too much time discussing other crypto projects in the same space is a negative sign.

Conversely, if you encounter a project that sounds completely unfamiliar, you’ve either found the next big thing or the next scam coin. One simple rule of thumb I use is checking whether the cryptocurrency is built from scratch or is a fork of an existing project.

Logically, a cryptocurrency built from scratch likely has more potential than a fork of an older project.

How Does It Work?

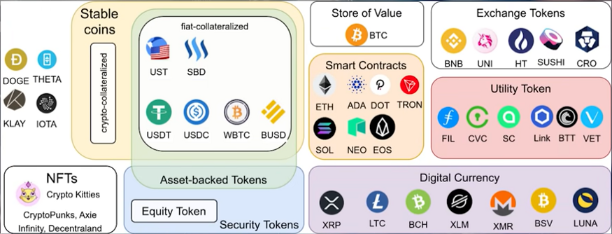

The fourth element to investigate in a white paper relates closely to the third: the cryptocurrency’s architecture. The standard structure of a cryptocurrency’s architecture depends on whether it’s a coin or a token. Coins are native cryptocurrencies of a blockchain. Simple examples include BTC on Bitcoin and ETH on Ethereum. In contrast, tokens are built on top of blockchains and can exist across multiple chains. Examples include stablecoins like USDT and USDC.

The architecture of a cryptocurrency coin consists of three parts:

1- A consensus mechanism that secures transactions.

2- Validators or miners participating in the consensus mechanism.

3- Any additional technologies, such as a virtual machine for smart contracts.

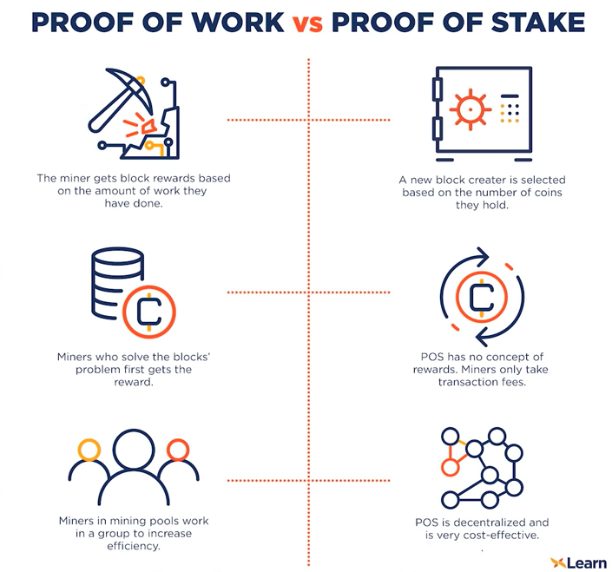

Starting with the consensus mechanism, the two most common types are Proof-of-Work (PoW) and Proof-of-Stake (PoS), with the latter gaining popularity recently. Once you determine which consensus mechanism the blockchain uses, try to find out whether there's a limit on the number of validators participating in the network.

A validator cap often indicates the blockchain is likely centralized—especially if validators must submit KYC documents to the company that created the cryptocurrency.

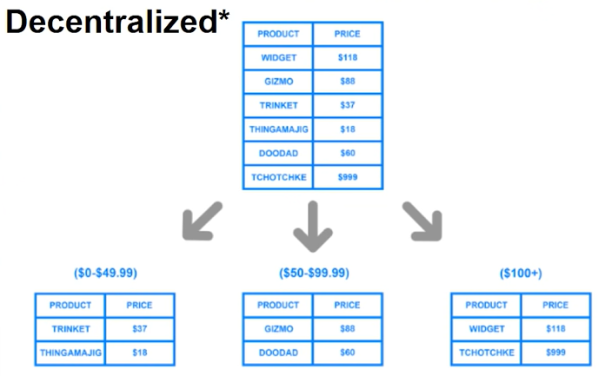

Centralized blockchains may be faster unless decentralized projects adopt superior technology. This ties into additional technical components, which can get highly technical.

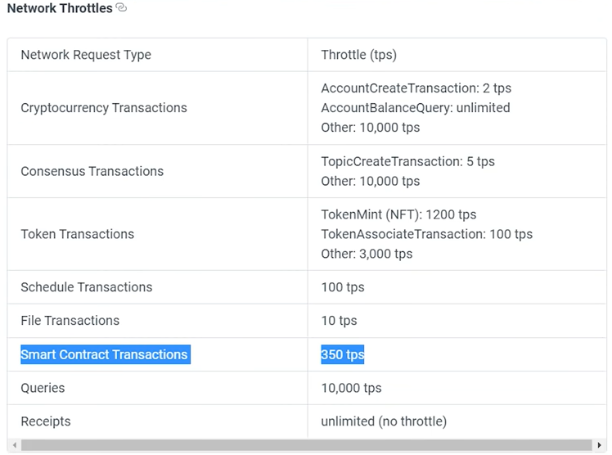

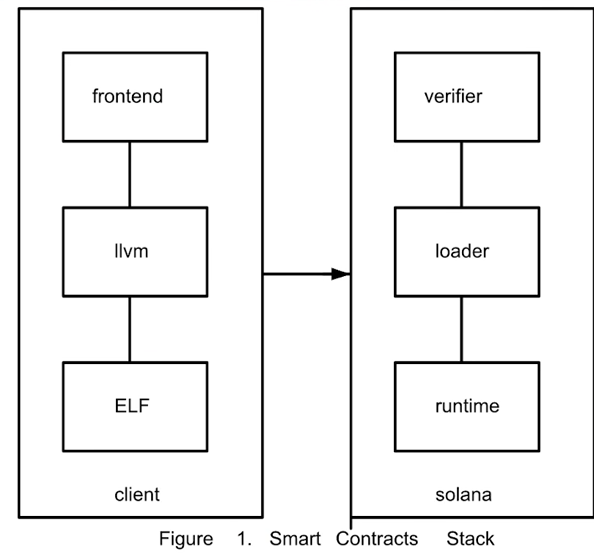

Regarding technology, I primarily look at whether the blockchain uses an existing virtual machine—like Ethereum’s EVM—for smart contracts, or if it uses a completely new one. This involves trade-offs: if the blockchain simply adopts the EVM, it risks copying another project and may face transaction throughput limitations in its smart contracts.

On the other hand, if the blockchain uses a new virtual machine, its smart contract functionality might not be as mature or robust as competitors’, which poses a significant risk in such a competitive industry.

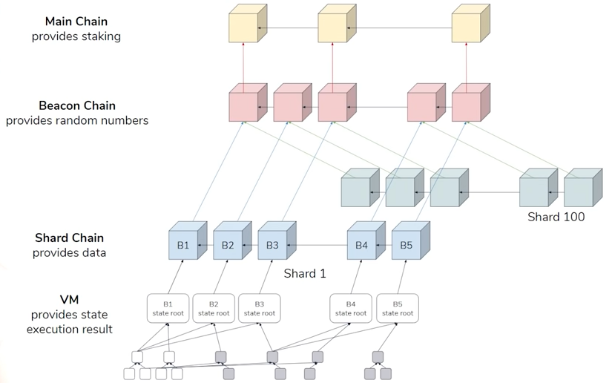

Other advanced technologies include sharding, which involves splitting the blockchain into smaller segments called shards to improve speed. This is done by assigning certain transactions to specific validator groups. Sharding has become increasingly popular recently—be sure to watch out for it.

As for crypto tokens, their architectures are far less standardized.

Over time, you'll notice recurring components across crypto projects within the same category—whether coins or tokens—which helps minimize technical complexity.

Tokenomics

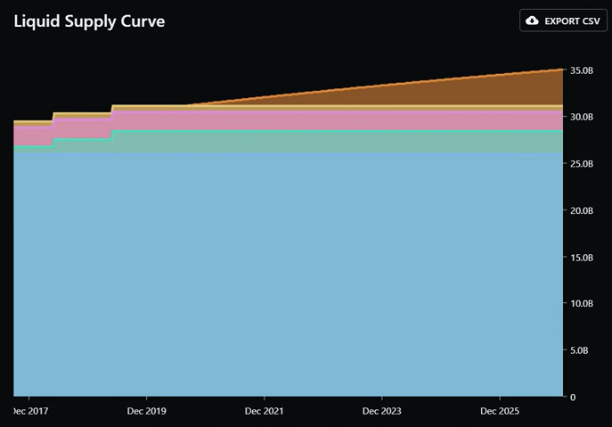

The fifth key element to examine in a crypto white paper is tokenomics—specifically, sources of supply and demand drivers. Supply sources include:

1- Annual inflation of the coin or token.

2- Its initial distribution.

3- Its vesting schedule.

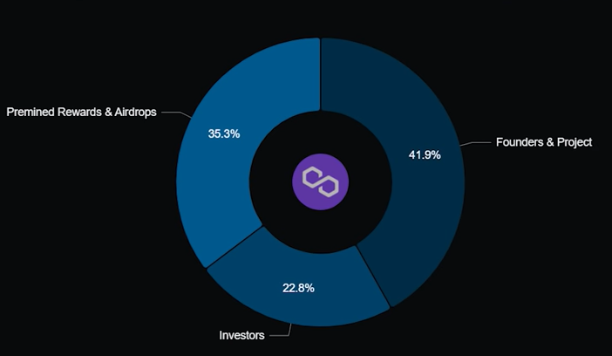

Inflation is self-explanatory. Excessive inflation makes it difficult for a cryptocurrency to maintain value—just like fiat currencies such as the U.S. dollar. Interestingly, the dollar’s own distribution isn’t balanced either. This could be problematic for crypto—if most of a token’s initial supply goes to the founding team and affiliates, selling pressure from these parties could suppress price, especially if they've already made substantial profits.

The impact depends on how aggressive the distribution plan is. If the vesting schedule is long and gradual, sell-off pressure shouldn’t significantly affect price. Conversely, a short vesting period often leads to ugly price action.

With an aggressive distribution schedule, the hope is that you gain insight into when a price drop might occur—allowing you to buy the dip if you believe in the project.

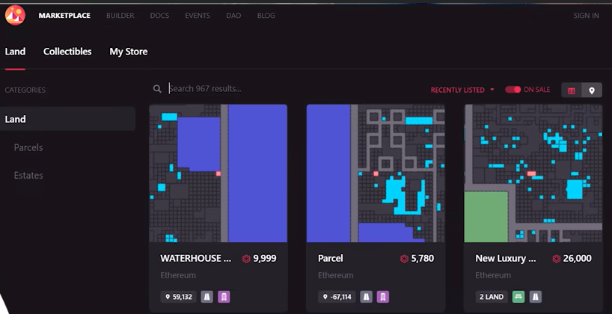

On the demand side of the equation, we have demand drivers such as fee payments and staking rewards—revenue-generating mechanisms—as well as other benefits that give ordinary users reasons to buy and hold the cryptocurrency beyond mere price speculation. In my view, the strongest demand driver for cryptocurrencies is when they’re required to pay all fees on their respective blockchains. This is why I’m bullish on Layer 1 blockchains. If a project’s team drives adoption by building new decentralized applications (dApps) and experiences, their native tokens are likely to rise as users need to interact with these dApps and smart contracts. That said, token-based demand drivers aren’t insignificant. For example, MANA from Decentraland is used as a payment method in metaverse marketplaces and saw surging usage over the past year. Over the long term, between lows and highs, MANA has grown nearly 500x since 2020.

Some crypto tokens (like MANA) also benefit from additional institutional demand drivers, even if these aren’t explicitly mentioned in their white papers. Regardless, as basic economics teaches us, if demand consistently exceeds supply, prices will rise—though this may not always be obvious in the short term, it clearly holds true over the long run.

Roadmap

The sixth thing to look for in a crypto white paper is the roadmap. The roadmap should span at least several years and include achievable goals within realistic timelines.

Examples of concrete goals include testnet or mainnet launches, wallet releases, exchange listings, scalability or privacy upgrades, and specific partnerships within a three-year timeframe.

Be sure to note any specific dates, as tokens or coins often surge as milestones approach. Conversely, vague goals like “attracting 1 billion users within a year” are unrealistic.

However, not all white papers include roadmaps. This could be because the project doesn’t have one, or because the roadmap exists as a separate document or page on the website—or possibly because the project cannot legally publish a roadmap due to regulatory concerns. This is particularly relevant for projects from unfriendly jurisdictions, which you can often identify by the extensive disclaimers included in their documents.

In such cases, publishing a roadmap could signal to regulators that the team is creating profit expectations for investors—drawing unwanted regulatory scrutiny.

References, Sources, Footnotes

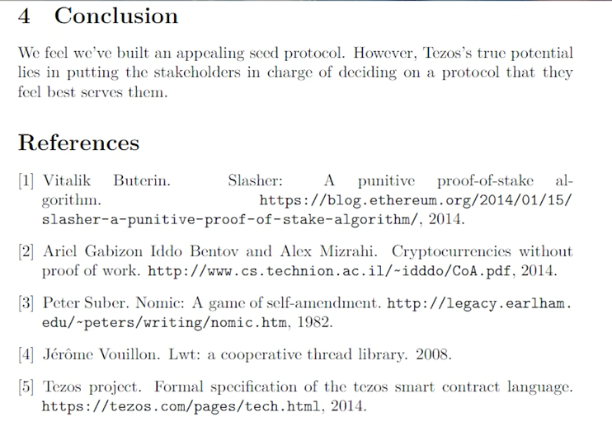

The final—and often overlooked—element to examine in a white paper is references, sources, or footnotes. After all, details matter.

References often reveal whether the white paper’s author is genuinely talented. Citing common websites like Wikipedia or other crypto white papers is a red flag. Having no citations at all is equally concerning.

High-quality sources include publicly accessible scientific papers or niche cryptographic writings by early cypherpunks like David Chaum and Adam Back.

Beyond providing interesting reading material, high-quality references can lead you to other crypto projects—or even inspire you to build your own. Footnotes can also contain crucial information about the project you’re researching. That’s why you should read every crypto white paper from start to finish—even if you don’t fully understand the technical aspects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News