Building a Bitcoin-based banking platform: Side Protocol releases whitepaper

TechFlow Selected TechFlow Selected

Building a Bitcoin-based banking platform: Side Protocol releases whitepaper

Side Protocol, an expansion protocol for the Bitcoin ecosystem, has released its Whitepaper v1, introducing Bitcoin's first on-chain bank. Centered around native lending, it will launch a full range of decentralized financial services.

Author: RunesCC

Side Protocol, an expansion protocol for the Bitcoin ecosystem, has released its whitepaper v1, introducing Bitcoin's first on-chain bank with native lending at its core and expanding into comprehensive decentralized financial services.

What is Side?

According to the whitepaper, Side Protocol is the first decentralized banking system built specifically for Bitcoin, centered around native lending and offering diversified financial services. Side leverages native Bitcoin technology to enable a non-custodial liquidity lending protocol for Bitcoin and promotes the development of more financial products through sidechain infrastructure.

What is Side’s vision?

As Dave Hrycyszyn, co-founder of Side Protocol, previously stated in an interview: "If Bitcoin aims to replace fiat and gold, then Side Protocol's vision is to play the role of traditional banks within the Bitcoin world."

In traditional finance, the most important institutions are banks, and what is their core business? Lending—other financial services revolve around this function. Even in Web3, the largest DeFi protocols (such as Aave) are primarily focused on lending.

As Dave said, if Bitcoin represents digital cash or gold, then a massive lending market around Bitcoin must inevitably exist.

The current industry problem is that no protocol offers bank-like native lending services for Bitcoin. All existing Bitcoin-related products require users to give up control of their assets, such as WBTC or cross-chain bridges. Even many current Bitcoin Layer 2 solutions rely on centralized bridging mechanisms.

Side Protocol aims to safely unlock Bitcoin's liquidity and capital efficiency using native Bitcoin technologies, making pool-based Bitcoin lending protocols possible.

More importantly, Side Protocol is not just positioned as a lending protocol—it also provides developers with Bitcoin expansion infrastructure via Side Chain and a rich set of ecosystem development tools to support various applications. If the project progresses successfully, a large number of ecosystem projects are expected to emerge in the future.

Main Protocols and Applications of Side

Side Finance, the core product of Side Protocol, is a native Bitcoin liquidity lending protocol (not P2P). Discreet Log Contracts (DLCs) form the foundational architecture of Side Finance. DLCs are an oracle-based smart contract framework for Bitcoin. They allow conditional payments based on off-chain events without requiring third-party custody of funds. Using cryptographic techniques such as multi-signature transactions, Hash Time-Lock Contracts (HTLCs), Schnorr signatures, and Adaptor signatures, DLCs ensure security, non-custodial nature, and user rights protection.

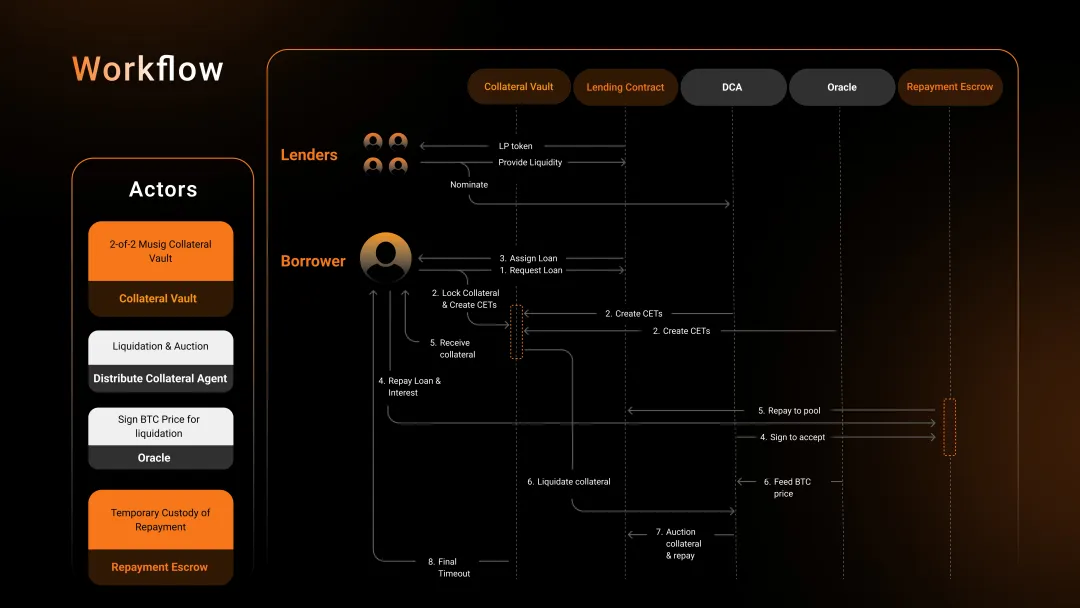

During the lending process, DLCs lock collateral via an initial 2-of-2 multisig setup and generate pre-signed transactions (CETs) based on event outcomes. When the oracle reveals the liquidation price, the DCA (Distributed Collateral Agent—a component co-holding the 2-of-2 multisig with the user)—can spend the UTXO to conduct a discounted auction of the collateral, allowing external bidders to repay the liquidity pool. Thus, Side achieves non-custodial BTC lending: except during liquidations, no party can use the collateral without the user's explicit consent.

It's worth noting that prior to Side Finance, most DLC-based Bitcoin lending was peer-to-peer, requiring matching between borrowers and lenders—an approach inconsistent with the automated operation model common in DeFi. Pool-based lending protocols unlock greater DeFi composability.

Additionally, Side Chain is a key component of the Side Protocol ecosystem and the core of liquidity aggregation in Side Finance.

Built on the Cosmos stack and powered by the high-performance CometBFT consensus engine, Side Chain supports fast transaction finality and high throughput, making it ideal for applications requiring rapid confirmation. Smart contracts run in a Wasm virtual machine and are written in Rust, delivering excellent performance and security. Rust’s memory safety and Wasm compatibility significantly reduce risks like reentrancy attacks commonly seen in Ethereum smart contracts.

From a user experience perspective, Side Chain is fully compatible with Bitcoin addresses: Users can continue using native formats like Taproot and Native SegWit without changing address formats, and directly sign transactions using Bitcoin wallets such as Unisat and OKX, resulting in a smoother experience. Compared to EVM-based Bitcoin scaling solutions (which use 0x addresses and EVM wallets), Side Chain offers clear usability advantages.

Furthermore, Side Chain includes a built-in cross-chain bridge module called Side Bridge, providing cross-chain services for BTC and runes to users with higher trust requirements. Combined with native DeFi offerings such as a DEX on Side Chain, this lays the foundation for a vibrant on-chain DeFi market following a potential explosion in rune-based meme coins.

Finally, according to the project roadmap, Side Chain will eventually serve as a modular settlement layer for Bitcoin, supporting one-click deployment of various Rollups and connecting to other blockchain ecosystems via interoperable protocols like IBC, enabling access to diverse asset liquidity including native USDC and USDT.

On the application side, the team has already developed ecosystem tools such as Side Station (browser) and Side Wallet (a dual-chain wallet for Bitcoin and Side Chain), delivering seamless product interactions for users.

Built by the Chainspace Mafia

The team has a strong background, with core members coming from renowned Web2 and Web3 companies such as Meta, Binance, and Google. Co-founders Dave Hrycyszyn and Shane Qiu possess deep expertise in distributed systems, blockchain scalability, token economics, and DeFi product design.

They have successfully founded, scaled, and exited multiple startups, including Chainspace and Nym. Chainspace was acquired by Facebook and became the Libra project, while Nym raised over $50 million in funding from investors such as a16z, Polychain, and Binance. In publicly disclosed funding rounds, Side Protocol has already secured support from institutions including Hashkey and Symbolic Capital.

Genesis Airdrop

Within the Bitcoin ecosystem, teams focusing on native application development are few and far between. Side Protocol is the first project to propose a liquidity lending protocol, aiming to achieve a status in the Bitcoin ecosystem similar to Aave in Ethereum—or even surpass it.

The team are also OG developers from the Cosmos ecosystem, highly skilled in blockchain fundamentals and cryptographic engineering. They are poised not only for significant revenue from the lending protocol but also for flourishing growth across broader ecosystem applications.

Side Protocol has completed multiple testnet phases, and the mainnet is expected to launch soon. Finally, we strongly recommend following the official X account—the genesis airdrop is about to begin, bringing generous rewards to users across the Bitcoin ecosystem.

Official X Account

https://x.com/SideProtocol

Disclaimer: This article is for informational purposes only and should not be construed as legal, tax, investment, financial, or any other advice. It does not represent the views of RunesCC.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News