Cobie: The Importance of Attention in the Cryptoeconomy

TechFlow Selected TechFlow Selected

Cobie: The Importance of Attention in the Cryptoeconomy

Attention is the only factor affecting supply and demand variables, and it changes in the same rhythm as players because it is directed and controlled by players.

Written by: Cobie, host of Uponly

Translated by: TechFlow

People often talk about scarcity in crypto. Whether it's enhancing digital scarcity through NFTs, or the idea that there are 55 million millionaires but only 21 million bitcoins.

In reality, the only scarce resource in cryptocurrency is attention.

Risk-seeking capital is not scarce. The people who joined crypto in the summer of 2021 are raising billions of dollars to explore the "metaverse" and decentralized Uber. A billion dollars isn't a lot of money anymore.

Crypto assets aren’t truly scarce either. Sure, this is a bit intellectually dishonest. Bitcoin and Ethereum themselves are scarce due to their hard-capped supply or deflationary token designs; CryptoPunks are scarce because supply is limited and fixed; yes, there may only ever be 5,200 Crypto Dickbutts. But the number of things you can speculate on within crypto is increasing—and theoretically infinite. More specifically, billions in risk-seeking capital aren't fully allocated toward buying OG crypto assets.

The destinations for new dollars entering crypto are highly diluted. This is more pronounced during bull markets—especially during the euphoric phase, when long-term value arguments seem to retreat from the minds of fund managers who recently discovered they were geniuses.

Yes, there are only 10,000 CryptoPunks. But there are also 10,000 BAYC, 10,000 MAYC, the kennel one, a bunch of cool ArtBlocks, CoolCats, Meebits, Hashmasks—yes, you get the point. Sure, Ethereum launched EIP-1559 and is burning billions in ETH, making it increasingly scarce over time. But if people feel they’ve missed ETH, there’s AVAX, SOL, LUNA, ONE, NEAR, even ADA.

Truly valuable crypto assets have proven extremely rare over time. The number of crypto assets that have outperformed Bitcoin across multiple bull/bear cycles is small, and most have completely died off. It’s not unrealistic to imagine something similar happening again over a mid-term horizon. When the ecstasy leaves us, we’ll wake up stark naked. Recovering from manic episodes. Reflecting on the decisions we made during this out-of-body experience, tasting reality and shame. Capital will return to value. And for investors now suffering the hangover of excitement, the pool of “value” may be much smaller than previously imagined.

But for now, this brand-new $1 billion fund, run by former Citi “innovation division managers” turned wagmi-punk-2383s, is spoiled by a bloated and expanding universe of investment opportunities. They have LPs knocking on their doors asking to invest more money, and 100 founders reaching out daily to build cross-chain DeFi metaverse gaming scholarship platforms.

The only truly scarce thing is attention.

Attention

Attention is a form of "currency" on the modern web. Web2 companies figured this out long ago. Users pay for services with their attention. Companies capture that attention and eventually sell something to users at some point. Often, the company doesn’t sell anything directly—they simply act as brokers between user attention and businesses that want to sell products.

Attention as currency in token economies is even more explicit and direct. Over 50 IDOs happen every day, all competing for your dollars and trying to add you to their communities. Over the past 12 months, airdrops have flowed nonstop, offering economic rewards to users who use and support their products.

Traditional companies might pay you $5–10 to use their product. You get $10 off your first Uber ride after signing up. In web3, the battle for attention is so fierce that nine-figure reward programs have become the norm, and five-figure user airdrops are common. Video ad placements with crypto YouTube influencers cost five to six figures per spot. Attention is scarce and in high demand.

Valuation Based on Attention

In my last article, I wrote that the bull market crypto ecosystem resembles a video game more than an investment landscape. If crypto is a multiplayer game scored in dollars, then attention determines much of the short-term meta-game.

Most participants in the multi-player crypto game cannot adequately assess a project’s technical or fundamental merits on their own. Instead, retail investors heavily rely on signals and social proof when making decisions.

If you oversimplify crypto prices into some equation of supply/sellers and demand/buyers changing over time, you can begin to explore the impact of attention scarcity.

Clearly, price goes up if demand increases or sellers decrease. But the underlying factors affecting supply and demand don’t change as quickly as the rhythm at which players engage in the crypto bull market video game.

More specifically, protocol development and value creation by builders happens on multi-year timelines, while crypto bull market trader-players operate on multi-week timelines at best—and often much shorter.

Attention is the only factor influencing supply and demand variables that changes at the same rhythm as players do—because it is commanded and controlled by the players themselves.

Favored

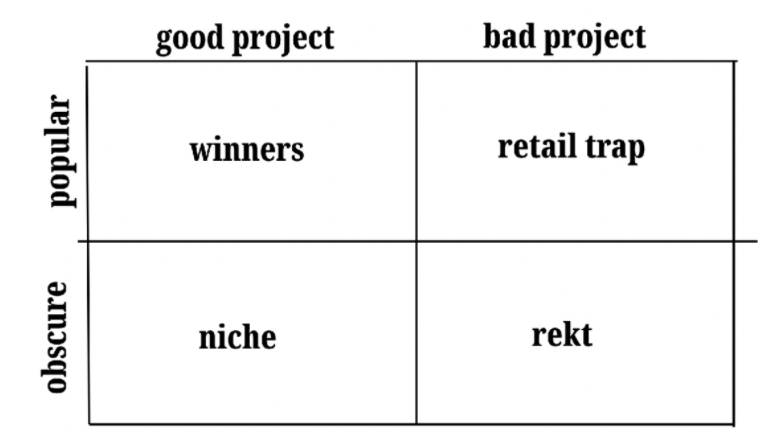

During the hype phase of a bull market, skilled players don’t try to buy the “best” assets. Instead, they try to buy assets that are about to cross the attention threshold or realize their valuation potential.

Skilled traders know they really want to buy “winners” for maximum returns. They want to buy projects that will transition from “niche” to “winner.” They’re even willing to buy projects with a chance to move from “rekt” to “retail trap,” though they know it’s obviously riskier, since a bad project becoming popular is less likely. Projects can also shift from rekt to niche via product pivots, tech upgrades, or leadership changes. Traders know that any project moving upward or leftward in the chart above presents an opportunity.

“Winners” are the best assets for long-term investors and retail users because they’re easy to identify. But for daily crypto gamers, they likely lack relative opportunity since they may converge toward market average performance—while skilled traders aim to significantly outperform the market. A clear example of a “winner” is Ethereum. Of course, winners carry downside risks too, as they can slowly drift into “niche” or even “rekt” territory over time as the crypto landscape evolves.

Compared to market average, “retail traps” may also lack relative opportunity, but carry even higher risk than “winners” because the project has weak technology or team, and worse long-term prospects. They could become good projects, but it’s unlikely and would take a long time. At best, they continue hovering near market average. Worse, they slide from retail trap to rekt as the market realizes they’re flawed and lose popularity.

Projects become favored by traders as their visibility and recognition grow. This “favored” period is when asset valuations change the most.

Once a project becomes favored, the number of market participants owning the asset grows until saturation. After saturation, the asset needs either (a) the overall crypto market to grow further for continued price appreciation, or (b) fundamentals behind the asset to keep improving relative to the market. This is why holding “winners” (or “retail traps”) during the hype phase isn’t ideal for most hardcore crypto gamers—because (a) and (b) move too slowly for these video game addicts. With massive opportunities across the crypto market, opportunity costs are equally huge.

Skilled crypto gamers try to find projects far below their potential valuation, then sell those strong projects as they approach those valuations. They sit in “winners” while searching for better deals.

Long-term investors care less about the game. They’re happy to buy “winners” and bet on solid projects growing with the overall market or gaining importance over time.

$SOS, Loot, BAYC

There are many examples of sudden attention injections into the market.

Take the recent $SOS airdrop, for instance. $SOS was airdropped by a third party to Opensea users based on their prior NFT purchase history. This is interesting because giving a certain amount of free funds to nearly every serious crypto “gamer” is a fast way to sharply increase attention across all crypto gamers.

Remember, at this point $SOS had no product, no fundamentals—it was purely a speculative market catalyzed by community desire for an OpenSea token or competitor.

When players’ attention shifted to $SOS, they had three main choices:

1. Sell their airdropped tokens for ETH or USD

2. Hold onto their airdropped tokens and see what happens

3. Buy more $SOS from sellers dumping their airdrops

When attention shifts to a new market, crypto gamers ask themselves, “How do I make money from this new thing?” That, of course, is the ultimate goal of the video game. If enough people choose actions (2) and (3), such that the capital in (3) exceeds that in (1), the price of $SOS rises and its price chart starts to look good.

If the chart looks good, more people talk about $SOS, exposing more people—and a new cohort—to the same set of choices. Now, market participants who never used OpenSea, or didn’t use it enough to qualify for a good airdrop, must decide:

1. Buy $SOS and participate

2. Wait or ignore the market entirely

Some will choose (1), which in turn drives price even higher. As price rises, people enjoy making money and keep talking about this trendy new thing.

Ownership draws attention, and the project quickly moves from niche/rekt levels of popularity/recognition to winner/retail trap levels.

As price rises, more people decide they’re happy to sell their airdropped tokens. As the chart stalls and attention fades, fewer new people decide to hold $SOS. Since $SOS is no longer shiny and new, it suddenly becomes just another token without a product, with few people talking about it—the asset’s k-factor declines. With initial attention levels unsustainable, most remaining attention comes from existing holders.

Once an asset enters the consciousness of many players, it’s easy to get all players to reconsider it—but sustaining attention without a product or users is much harder.

I think you could argue Loot followed a similar blueprint to some extent. This might also explain why BAYC, the top-performing NFT PFP series this year, managed to surge past Punks’ baseline while competitors launched around the same time achieved zero. BAYC focused on building community by creating value for it—and engaged community members became perpetual promoters, generating sustained or growing attention.

Doge

Doge was another fascinating attention case in 2021.

Historically, Doge’s siphoning of attention from Bitcoin has been common. Yet, from inception to end of 2020, these pumps mostly stayed within the same range. As shown in the chart below, from 2014 to late 2020, its price chart basically moved sideways for seven years.

When people learn about Dogecoin, they have two choices

1) Buy doge

2) Ignore doge

You can imagine that over seven years, the decision ratio remained largely unchanged. Suppose for every 100 people, 90 ignored it and 10 bought doge.

Then in 2021, a new attention catalyst emerged. Elon became Doge’s cheerleader, changing two things:

1) More crypto natives were convinced to buy doge

2) Entirely new market participants were persuaded to buy crypto for the first time—starting with doge

So when Elon began broadcasting his love for Doge, it became a very interesting moment in the market. You could ask yourself: If Elon keeps driving attention, what’s the maximum audience it could reach? How would the above buy/ignore ratio shift?

Thinking this way makes betting on Doge in some capacity very easy. If he continues, the increased attention will dramatically shift supply and demand in favor of Doge holders for some time—maybe you estimate 5x or 10x upside. If he stops, you might only lose -33% on your investment. Risk/reward is unbalanced.

Ultimately, though, it feels like nearly everyone worldwide who might decide to buy doge already knows about it. It was a damn sketch on SNL. At this point, attention is flat at best—awareness of doge is saturated, and those convinced to buy it already have. Now attention centers on confused observers and those who’ve already bought as much as they’re willing to. The rate of change in attention declines, leading to far fewer new participants willing to buy, and it becomes an object of attention only for the remaining holders.

As ownership and valuation draw attention, smart traders begin selling.

ADA

Cardano is another interesting example. Despite having similar core arguments as others, its performance throughout 2021 diverged sharply from Avalanche, Solana, and Luna.

At the start of the bull market, Cardano received widespread attention. It became the favorite token on Crypto YouTube, with all major names and faces listing it among their top 3 assets. Of course, the founder himself is a crypto YouTuber—Charles’s videos regularly drew 50,000 viewers.

Yet since early 2021, Cardano has fallen 93% against SOL.

Perhaps this can be explained using the same framework we applied to SOS or BAYC.

When projects receive attention beyond ownership, they typically get repriced. By late 2020 and early 2021, Cardano was the front-runner in retail “eth killer” attention. Moreover, the bull market was just beginning, so many new participants entered, further amplified by attention.

But throughout the year, other L1s like Avalanche and Solana built vibrant, engaged ecosystems—similar to BAYC’s approach. They continuously captured greater mindshare and attention from users, developers, and speculators. New projects and profit-making opportunities rapidly launched on these L1s.

These communities became perpetual promoters, and because crypto gamers hate being idle, these DeFi/gaming/whatever projects created positive feedback loops of sustained attention. Because attention is scarce, all these L1s competed simultaneously for mindshare. Solana and Avalanche won users’ attention—which meant losses for other L1s.

Highly popular, yet because users currently can’t do much there, and there’s no ecosystem of daily-living Cardano-based crypto gamers earning points in the crypto game, it feels like it shifted more into “retail trap” than “winner.”

Summary

Attention is the only scarce resource in cryptocurrency.

When evaluating crypto assets or playing the multiplayer crypto trading video game, the rate of change in attention and the saturation of ownership are useful indicators to observe or estimate.

The best hype-phase traders are looking for assets with relatively low popularity—if they can cross the chasm from obscurity to popularity, their valuations have significant room to grow. They sell them once ownership attracts attention.

Holding “winners” through the thrill phase only works for mentally stable, functional, well-balanced individuals. Maybe one day I’ll join their ranks.

Don’t listen to most crypto YouTubers. They’re turning your attention into a product for their ad business.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News