Taking Doodles as an example, how does the attention economy influence NFT value?

TechFlow Selected TechFlow Selected

Taking Doodles as an example, how does the attention economy influence NFT value?

What is the attention economy in NFTs?

Author: danii

Translation: TechFlow

In this era, we have access to an endless stream of digital media and products. However, we can't possibly absorb it all—we're constrained by one extremely valuable resource: attention.

As ordinary individuals, we can only focus on so many things at once; dedicating attention to one topic consumes our mental energy for others. Given a choice, we naturally prefer to spend our attention on what interests us most and brings us the greatest satisfaction.

On the other side, projects need our attention to generate revenue and maintain influence. By capturing users’ attention, they can convert it into advertising, merchandise, subscriptions, or any other income stream. Our attention is invaluable to project teams, which is why they constantly compete against each other—this is the attention economy.

So, what does the attention economy look like in the world of NFTs?

First, running an NFT project is very much like running a company—a company that sells NFTs.

How do such companies sell NFTs?

Simply by winning—and retaining—our attention.

Projects that capture our attention gain sales, long-term holders, influence, network effects, and sustained relevance. Those that lose our attention fade into obscurity.

For many projects, announcements and roadmaps are the primary tools for attracting attention. Some try to sustain engagement through games, while others boost user stickiness via unique or novel experiences—storytelling, burn mechanics, etc.

Sometimes, attention comes from outside the project itself—such as a well-known wallet making large purchases, influencers promoting the NFT, or rumors circulating about the team.

These tactics and activities draw public attention, sparking interest and conversation (network effects), thereby increasing the value of their NFTs. And when NFTs hold value, people are willing to buy.

If a project runs too long without updates, progress, or clear direction, it risks losing attention. As attention wanes, so does the value of its NFTs.

Another important consideration is the nature of the NFT audience itself. Most participants in the NFT space are there to make money, not to HODL indefinitely.

NFT traders chase the next big idea—the next profitable opportunity—so their attention span is short. When better profit opportunities arise elsewhere, NFT traders won’t hold and wait for the next announcement (opportunity cost).

Now, let’s examine some real-world examples to see how this concept plays out. I’ll start with Doodles as a case study (I promise this isn’t an ad for Doodles), and later touch on other projects as well.

Doodles launched back in October 2021, drawing early attention from NFT OGs like Burnt Toast, Poopie, and Evankeast.

Before minting, Doodles closed off access to their Discord server, granting whitelist spots only to those inside—creating massive FOMO among outsiders.

This led to an unprecedentedly successful mint, setting the stage for absurd gas prices, an immediate spike in floor price, and massive Twitter engagement.

Doodles captured attention at mint—but what happened afterward?

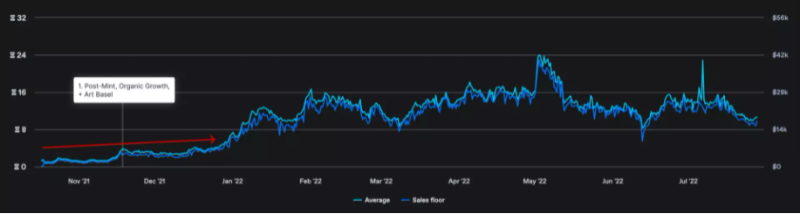

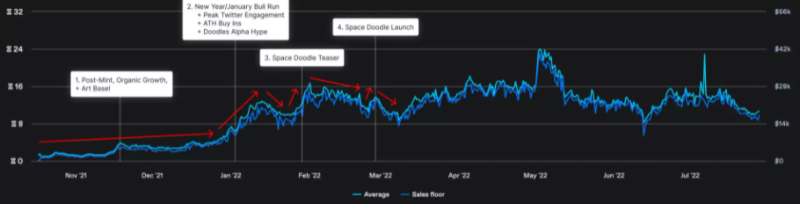

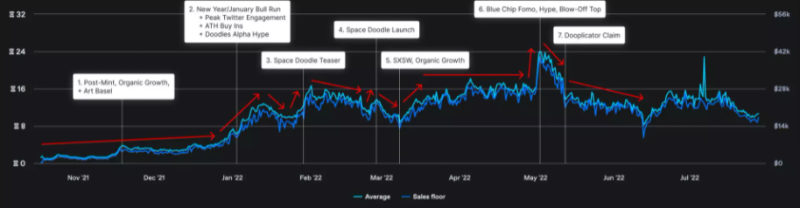

For reference, here's a chart showing Doodles' price trajectory alongside key events and time periods:

Event 1—Post-Mint

Aside from Art Basel, Doodles remained quiet during this period. For most projects, such inactivity would lead to a slow erosion of attention down to zero. But for Doodles, this became a phase of organic attention growth and accumulation.

Over these two months, founder interviews, community Twitter Spaces, and the bear market—which offered little else to talk about—helped maintain and even grow interest in Doodles.

Event 2—The Bull Run Begins

Doodles had been quietly building momentum organically, and once signs of a bull market emerged, they sprang into action. This drove media and Twitter engagement to new highs, triggered massive buying pressure on rare Doodles reaching all-time highs (ATH), and turned the Doodles Alpha chat into a hot spot.

Doodles dominated the attention economy—as previously noted, when attention and interest peak, NFT values rise as people buy in, expecting further gains. Until, of course, attention fades...

Hype and excitement don’t last forever. Eventually, people lose interest and start looking for the next thing. Sometimes, something new appears and captures everyone’s attention. As attention declines, prices follow.

And that’s exactly what happened. The hype around Doodles quickly ended, prices dropped, and attention shifted to the next target (Azuki and anime aesthetics!)

Lesson 1:

When a project dominates attention and hype, its price has likely peaked (potential top), making it a good time to sell.

Event 3—Announcement of Space Doodle

When the teaser dropped, excitement surged and attention spiked. But then the floor price began to slowly decline until...

Event 4—Launch of Space Doodle

Although community excitement was high before launch, interest quickly faded after release (attention peak). (“There’s nothing we can do with Space Doodle...”)

Event 5—SXSW

After the disappointing Space Doodle launch, confidence in Doodles was low, attention was minimal, and the floor price continued to fall. Then Doodles launched their SXSW campaign.

Doodles received widespread acclaim at SXSW, signaling that the project was here to stay and doing cool things. Attention and confidence returned, and the floor price began to recover.

Lesson 2:

When a project is experiencing low attention (potential price bottom) but you believe it has the ability to regain momentum, this may be an ideal time to buy.

Event 6—Blue-Chip Hype

Profits from BAYC/MAYC hitting ATHs, profits from Otherside/Koda airdrops, and dissatisfaction with Otherside’s airdrop mechanism led to intense speculation over which projects would outperform Yuga or be “the next big thing.”

This created a surge of attention, driving FOMO buying across potential next-gen blue chips—Doodles, Azuki, Clone-X.

Unfortunately, this peak coincided with a broader market downturn, causing floor prices to sharply decline.

Event 7—Dooplicator Airdrop

Airdrops often create selling pressure, and Dooplicator was no exception. For many, once they received the airdrop, they lost interest in Doodles, leading to dumping and a drop in floor price.

However, for those interested in engaging with the Doodles ecosystem, attention actually shifted toward Dooplicators.

Event 8—NYC Event and Related News

As NYC kicked off, expectations for Doodles were high. Indeed, the event reignited significant attention and interest in the project, pushing the floor price upward (attention peak). But as usual, the hype eventually died down. After a period of sideways movement, prices began to gradually decline again.

What about other projects?

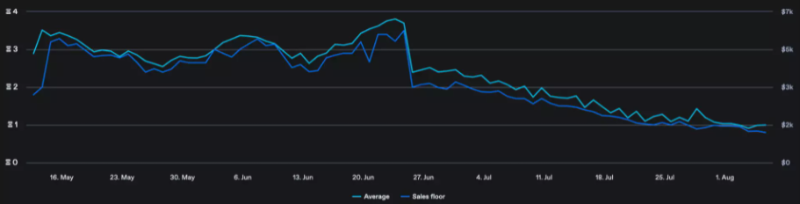

Goblintown caused a sensation in May. There’s no denying it stole the spotlight from much of the NFT space. Their free mint arrived during a weak market. Despite polarizing opinions on the artwork, it performed exceptionally well.

Who was behind the hype? Rumors swirled that it might be Yuga, Larva Labs, or even Beeple—speculation that fueled price increases.

But it wasn’t sustainable. Goblintown eventually revealed its founders, unsurprisingly not who people hoped for. Interest quickly faded, and as updates slowed, prices declined.

Earlier this year, Cool Cats announced they’d pivot into game development. While people were uncertain if this was the right move, there was still interest—it was Cool Cats, after all.

But at launch, Cool Cats fumbled. Both the Cool Pet mint and the game rollout faced serious issues. Confidence in the team eroded—this wasn’t how a top-tier project should behave.

When OthersideMeta launched, it predictably captured widespread attention—after all, it was Yuga Labs—leading to sell-offs in other NFTs as people rotated funds into it.

Despite the initial hype and Yuga’s influence, public attention on Otherside eventually faded.

As you can see, sustaining attention at the top is extremely difficult. No matter how big a project is or how groundbreaking its launch, once the hype ends—or something new emerges—people move on, and floor prices begin to slide.

We can also observe that attention can come from outside the project itself. The community plays a major role in shaping and sustaining narratives, meaning you too have the power to draw attention to a project and influence its value.

Like traditional ventures, NFTs operate within the attention economy. Understanding this concept can help you identify peaks and troughs in attention, guiding better decisions on when to buy or sell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News