The Evolution of China's Cryptocurrency Market: From "Thriving Growth" to "No Room for Flexibility"

TechFlow Selected TechFlow Selected

The Evolution of China's Cryptocurrency Market: From "Thriving Growth" to "No Room for Flexibility"

What does the government's latest crackdown mean for cryptocurrencies in China, and how is it different from previous measures?

Author | Sally Wang (Sino Global Capital) and Jonathan Cheesman

Translation | Anima

2021 may be remembered as the year crypto grew too large for regulators to ignore. We are now in uncharted territory, where the disruptive nature of the technology makes its path neither predictable nor smooth. Global regulators are adopting approaches ranging from authoritarian to inclusive, while entrepreneurs are engaging proactively in diverse ways.

Despite the challenges, China has played a fascinating and indispensable role in the development of crypto assets. In 2007, Tencent’s Q币 (QQ Coin) predated Satoshi Nakamoto’s whitepaper; in 2013, BTCChina became the first major exchange; later, Huobi, Okex, F2Pool, and Poolin dominated global trading volume and mining capacity.

Recent crackdowns on mining and cryptocurrency trading have further damaged crypto activities within China's economy. Within less than two months, policy actions by Chinese authorities sent shockwaves through the crypto market, forcing many Bitcoin miners to relocate overseas. What do the government’s latest measures mean for cryptocurrency in China, and how do they differ from previous actions?

Historical Context

As early as 2013, five departments including the People’s Bank of China (PBOC, China’s central bank) issued a clear document prohibiting all financial and payment institutions from conducting any business related to Bitcoin and shutting down RMB on-ramps.

On September 4, 2017 (known as the 9.4 incident), the PBOC and seven national ministries released a regulation banning ICOs and cryptocurrency exchanges due to allegations of illegal fundraising activities.

On May 21, 2021, Chinese regulators tightened restrictions, unequivocally cracking down on Bitcoin mining and trading activities.

Purpose

China has taken a firmer stance on cryptocurrency for two main reasons: financial conservatism and stability objectives.

The "2021 Q1 China Monetary Policy Implementation Report," published by the PBOC in May 2021, set the tone for the next phase of monetary policy, clearly stating that “prudent monetary policy should be flexible, targeted, and moderate, placing greater emphasis on serving the real economy, cherishing the space available under normal monetary policy, and balancing economic recovery with risk prevention.”

During periods of speculative frenzy, retail investors in China poured funds into “hot assets,” some of which were low-quality altcoins (such as LoserCoin, QiongB, etc.). Despite government warnings, this speculation spiraled upward, causing concern among officials. After all, the PBOC aims to promote stable and measured growth that better serves the real economy and creates a “virtuous cycle of economic and financial health.”

Relevant departments at the PBOC also pointed out that cryptocurrency trading activities disrupted “normal economic and financial order, giving rise to risks of illegal cross-border asset transfers, money laundering, and other criminal activities, severely infringing upon the public’s property safety.”

Compared to the 2017 ban, the new rules are harsher and significantly expand the scope of prohibited services. While the 2017 policy focused on ICOs, this year’s regulations go deeper, targeting excessive energy consumption (specifically mining) and over-the-counter trading. Recently, advertisements related to cryptocurrencies have increasingly been banned.

Cryptocurrencies, especially Bitcoin, pose a challenge to Beijing because the PBOC cannot track the flow of funds. The central bank remains extremely concerned about the destabilizing risks of capital flight. China is “going all out” to develop its own cryptocurrency—but of course, its digital currency/e-CNY (DCEP) version will be centrally controlled by the central bank. It is expected to provide the Chinese government with powerful new tools to monitor its economy and citizens. This aligns with China’s growing role in the global economy and initiatives such as the Belt and Road Initiative. By design, DCEP will eliminate one of Bitcoin’s key “flaws”: user anonymity.

China’s 14th Five-Year Plan (2021–2025), spanning 2021—the centennial anniversary of the Communist Party of China—declares a great era of development and prosperity for the digital economy. It will also be a five-year period of accelerated blockchain innovation, ecosystem building, widespread application deployment, and implementation of regulatory practices. Under President Xi Jinping’s “Vision 2035” strategy, blockchain plays a critical role in national digital economic development across three key directions: technological innovation, industry applications, and regulatory systems.

Based on current trends, China is separating the concept of cryptocurrency from blockchain, advocating for tokenless blockchains. It aims to turn DCEP/digital yuan into a truly global currency. Under tighter government controls, trading volumes at major Chinese exchanges like Huobi and Okex are declining. Undoubtedly, China’s crypto environment has undergone profound changes in a short time.

Market Impact

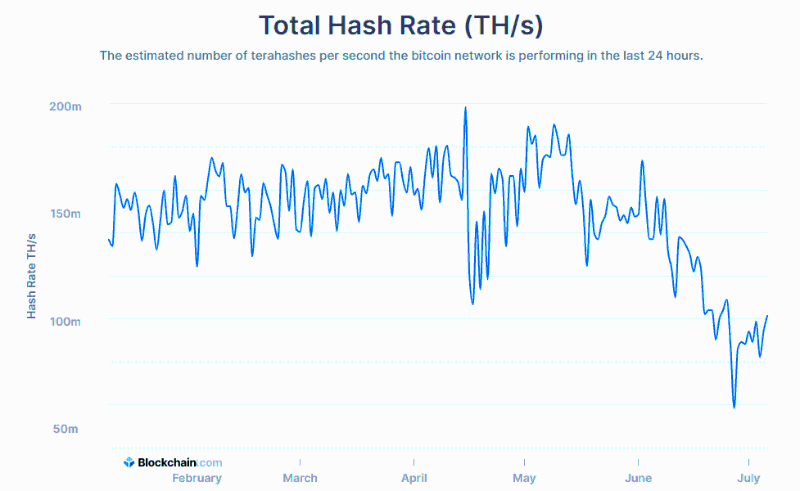

Given China’s dominant market share in mining and trading, the strategic decision to exit caught many by surprise. Arguably, it was a financial-policy decision rather than a short-term business move. These actions have reshaped both global and local cryptocurrency landscapes. Most importantly, they triggered a significant hash rate adjustment—an unexpected windfall for ongoing mining operations. Estimates vary widely on how quickly hash rate will recover, but it should take at least months, not weeks, during which theoretically forced selling (to cover costs) would decrease.

Total Hash Rate Chart

Total Hash Rate Chart

On the negative side, China was a massive consumer of crypto assets, leaving a void. On the positive side, it was also a source of speculative volatility and leverage, and raised concerns about mining centralization. As recently as 2015, four Chinese mining pools controlled more than 50% of global computing power. More geographically dispersed mining and reduced volatility globally should benefit institutional adoption.

For those still bullish, Bitcoin is antifragile. Taleb defines this as going beyond resilience or robustness—some things benefit from shocks; they thrive when exposed to volatility, randomness, disorder, and stress, and enjoy adventure, risk, and uncertainty... Resilient people resist shocks and remain unchanged; antifragile people get stronger.

One could describe China’s recent policy shifts as a “national attack” on Bitcoin. Its survival proves its durability, and we will see whether it demonstrates antifragility by emerging stronger on the other side. The current short-term bear market narrative may give way to more bullish medium- and long-term fundamentals.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News