Bitget Daily Morning Report: Meta acquires Manus for billions of dollars, RWA protocol TVL becomes fifth largest DeFi category

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Meta acquires Manus for billions of dollars, RWA protocol TVL becomes fifth largest DeFi category

Strategy repurchases 1,229 bitcoins.

Author: Bitget

Today's Outlook

1. Delphi Digital: GameFi fundraising this year has declined over 55% year-on-year, while Web2.5 gaming is quietly rising.

2. The TVL of RWA protocols has surpassed DEXs to become the fifth-largest DeFi category.

3. Billionaire Grant Cardone announced plans to launch the world's largest real estate Bitcoin company in 2026.

Macro &热点

1. Strategy purchases another 1,229 bitcoins, bringing total holdings above 672,000.

2. Spot gold accelerates its decline, falling below $4,350 per ounce, plunging more than $180 intraday with a 4% drop.

3. Cointelegraph: In the past 19 hours, the total cryptocurrency market cap shrank nearly $100 billion, retreating from a peak of $3.02 trillion to $2.93 trillion.

Market Trends

1. Over the past 24 hours, the crypto market saw $243 million in total liquidations across all positions, with longs accounting for $160 million. BTC liquidation amounted to approximately $82 million, and ETH liquidation reached about $56 million.

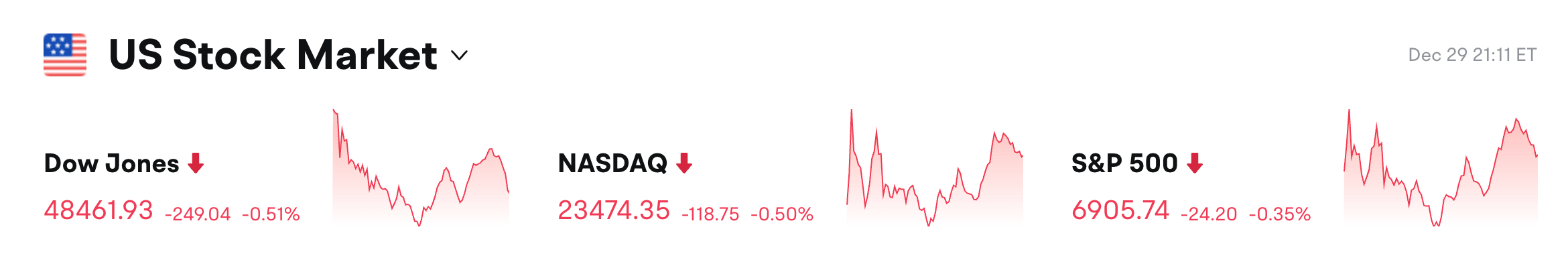

2. U.S. stocks: Dow -0.51%, Nasdaq -0.5%, S&P 500 -0.35%. Nvidia (NVDA.O) -1.21%, Circle (CRCL.N) down nearly -0.94%, MSTR (Strategy) -2.15%.

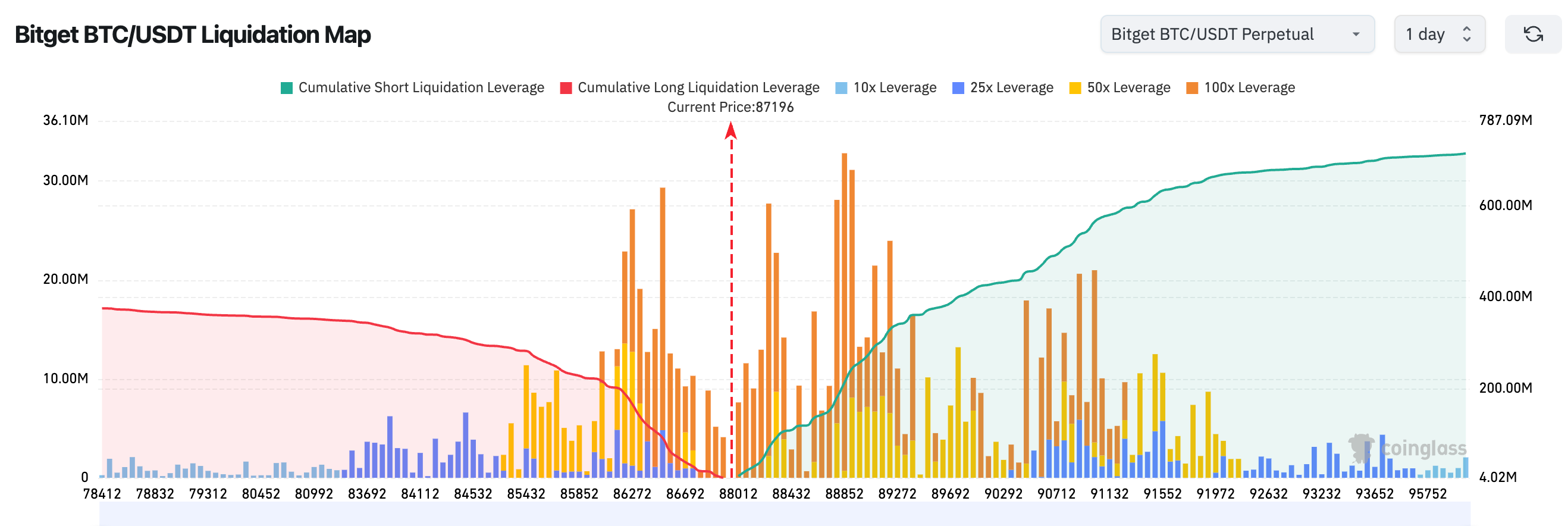

3. Bitget BTC/USDT liquidation map shows: current price hovering around 87,200, located within a dense zone where long and short liquidations converge. Above, the 88,000–89,000 range holds a large volume of high-leverage short positions, which could trigger cascading short covering if broken. Below, the 86,000–87,000 range is densely packed with long positions; a breakdown may trigger concentrated stop-losses. Short-term price action exhibits a high-volatility structure with "high risk on both sides."

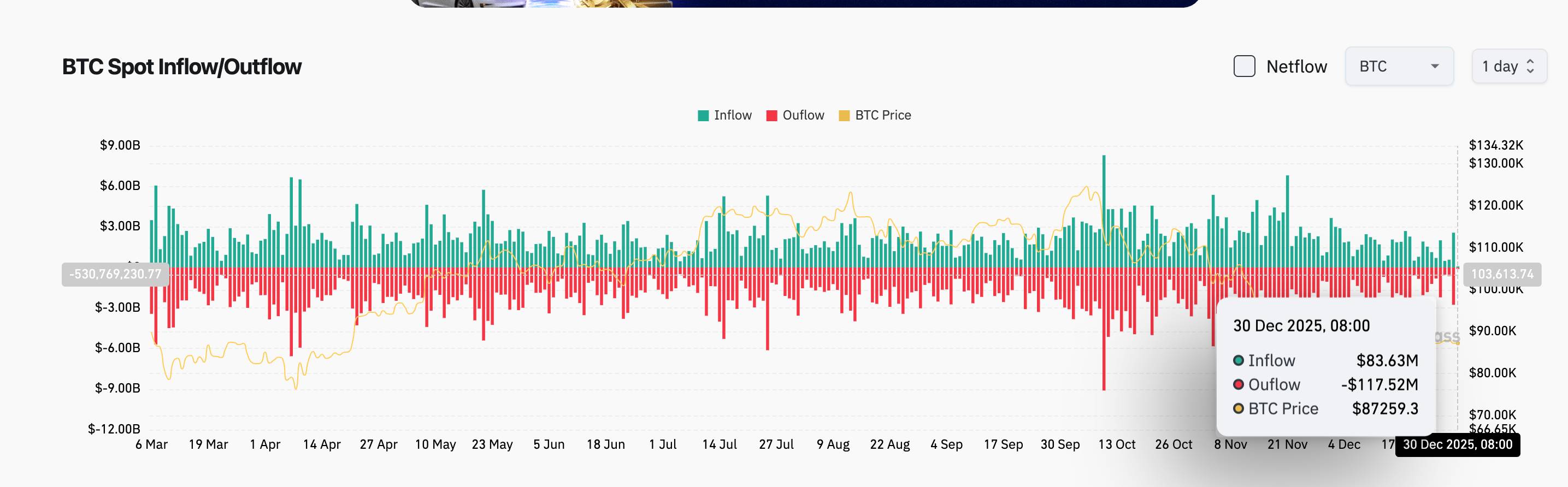

4. Over the past 24 hours, BTC spot inflows were approximately $84 million, outflows $118 million, resulting in a net outflow of $34 million.

News Updates

1. Cantor Fitzgerald: 2026 may see an "institutional winter," but on-chain assets and DeFi will remain growth highlights.

2. Co-founder of Framework Ventures: The 2026 market will focus on mainstream tokens, with institutions continuing to pour into high-quality DeFi projects.

3. Dragonfly partner: BTC will surpass $150,000 by the end of 2026, though its market share will slightly decrease.

4. South Korea's Supreme Court upheld a four-year prison sentence for a cryptocurrency exchange employee who assisted North Korean hackers in recruiting a South Korean Army captain to obtain military secrets in exchange for bitcoin.

Project Developments

1. Neel Somani, founder of Ethereum Layer2 protocol Eclipse, has stepped down as Executive Chairman, effective October 2025.

2. Meta acquires Butterfly Effect, the company behind AI application Manus, for several billion dollars.

3. The total market cap of tokenized stocks has risen to $1.2 billion, reaching a new all-time high.

4. BlackRock’s first tokenized money market fund BUIDL has distributed over $100 million in cumulative dividends.

5. U.S. XRP spot ETF records $8.44 million in total net inflows for a single day.

6. Sky Protocol repurchased 29.3 million SKY tokens last week, with cumulative buybacks exceeding 96 million USDS.

7. Lookonchain data shows Bitcoin and Ethereum ETFs had net outflows of 3,495 BTC (~$306 million) and 17,969 ETH (~$52.74 million) on that day, with 7-day cumulative net outflows reaching 8,778 BTC (~$768 million) and 29,287 ETH (~$859.6 million) respectively.

8. USDC Treasury minted 76 million new USDC tokens on Ethereum and burned nearly 168 million USDC.

9. Trend Research increased its ETH holdings by over 46,000 in a single day, lowering average cost to approximately $3,105.5 (total unrealized loss around $110 million), continuously reducing holding costs.

10. WLD treasury company Eightco announces a stock buyback program of up to $125 million.

Disclaimer: This report is generated by AI, with human verification only for information accuracy. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News