Bitget UEX Daily Report | US, Japan, EU, and Mexico Collaborate on Critical Minerals Development; Nasdaq Introduces New Fast-Track Inclusion Rules; Software Stocks Continue to Face Pressure

TechFlow Selected TechFlow Selected

Bitget UEX Daily Report | US, Japan, EU, and Mexico Collaborate on Critical Minerals Development; Nasdaq Introduces New Fast-Track Inclusion Rules; Software Stocks Continue to Face Pressure

Overall market volatility has intensified; it is recommended to monitor uncertainty surrounding the Federal Reserve’s policy path. Gold is not suitable for short-term chasing of higher prices, and U.S. equities—particularly overvalued tech stocks—should be avoided.

Author: Bitget

I. Top News Highlights

Federal Reserve Updates

Bureau of Labor Statistics Delays Employment Data Release

- The U.S. Bureau of Labor Statistics has postponed the release of the January nonfarm payrolls report to February 11 and the Consumer Price Index (CPI) data to February 13; the Job Openings and Labor Turnover Survey (JOLTS) report has been rescheduled to February 5.

- Key points: The delay stems from the federal government shutdown; market expectations point toward a weak hiring environment in the upcoming nonfarm payrolls data; analysts view the delay as heightening uncertainty regarding the Federal Reserve’s interest rate path.

- Market impact: The data vacuum may amplify market volatility; investor expectations for Fed policy decisions are becoming more cautious, potentially supporting short-term U.S. dollar strength.

International Commodities

EIA Reports Sharp Decline in U.S. Crude Oil Inventories

- According to the U.S. Energy Information Administration (EIA), crude oil inventories fell by 3.455 million barrels last week—the largest weekly decline since 2016—primarily due to severe weather conditions.

- Key points: API reported an even steeper drawdown of 11.079 million barrels; the EIA decline exceeded expectations by 6.7 million barrels; changes in gasoline and distillate inventories were not specified.

- Market impact: The sharp inventory drawdown boosted short-term oil price rebound; however, easing geopolitical tensions may cap gains, while developments in the Middle East remain critical for potential supply disruptions.

Macroeconomic Policy

U.S. Announces Collaboration with Japan, Mexico, and the EU on Critical Minerals Development

- The U.S. will sign a memorandum of understanding with Japan and the EU within 30 days and develop an action plan with Mexico within 60 days, aiming to jointly develop critical minerals essential for defense and other strategic industries—and establish a preferential trade zone.

- Key points: Cooperation focuses on establishing minimum pricing mechanisms and imposing tariffs on non-members; it seeks to reduce overreliance on specific countries; meanwhile, Middle Eastern nations urge the U.S. to resume Iran nuclear talks, scheduled for February 6 in Oman.

- Market impact: This initiative enhances supply chain resilience and may lower geopolitical risk premiums; however, formation of such a trade zone could intensify global competition for resources, affecting commodity prices.

II. Market Recap

Commodities & FX Performance

- Spot gold: +1.02% to $5,016.11/oz, continuing its rebound.

- Spot silver: +2.09% to $90.007/oz, posting notable gains.

- WTI crude oil: +1.99% to $64.47/barrel, driven by the sharp inventory drawdown.

- U.S. Dollar Index: +0.21% to 97.64, supported by delayed economic data releases and developments surrounding Fed nominee appointments.

Cryptocurrency Performance

- BTC: -4.28% to $73,122, extending its decline.

- ETH: -4.54% to $2,261, characterized by intensified market selling pressure.

- Total cryptocurrency market capitalization: Fell to $2.54 trillion, driven by broad-based Bitcoin-led selling pressure.

- Liquidations: $437 million in long positions liquidated / $132 million in short positions liquidated, totaling $606 million.

U.S. Equity Index Performance

- Dow Jones Industrial Average: +0.53%, continuing its upward trend.

- S&P 500: -0.51%, weighed down primarily by technology stocks.

- Nasdaq Composite: -1.51%, driven by concerns over AI-related valuations.

Tech Giants’ Updates

- Apple: +2.6%, benefiting from a market rotation into defensive stocks.

- Microsoft: +0.72%, supported by stable earnings performance.

- Amazon: -2.36%, pressured by broader SaaS sector weakness.

- Google: -1.96%, despite Q4 revenue beating expectations, concerns persist over rising AI investment costs.

- Nvidia: -3.41%, sell-off triggered by intensifying AI competition.

- Tesla: -3.78%, impacted by ripple effects across the semiconductor supply chain.

- Meta: -3.28%, weighed down by soft memory demand and heightened social platform competition. Summary of core drivers: Selling pressure emerged amid uncertainties around AI infrastructure investment and elevated valuations; some tech giants benefited from diversified business models.

Sector Movement Observations

Semiconductor Sector: -3.78%

- Representative stocks: AMD, -17.31%; Micron, -9%.

- Drivers: AMD’s weaker-than-expected revenue outlook raised concerns about its competitiveness in the AI chip market, prompting sector-wide valuation re-rating.

SaaS Sector: ~-1.45%

- Representative stocks: Oracle, -5.17%; Shopify, -4.42%.

- Drivers: Rising concerns over AI tool risks—particularly legal issues tied to Anthropic’s Claude Cowork plugin—have sparked investor skepticism about monetization models.

Weight-Loss Drug Sector: Mixed performance

- Representative stocks: Eli Lilly, +10%; Novo Nordisk, -6%.

- Drivers: Strong Q4 revenue growth at Eli Lilly versus Novo Nordisk’s acknowledgment of pricing pressure; market focus remains on GLP-1 drug sales volumes and competitive dynamics.

III. In-Depth Stock Analysis

1. Google – Q4 Revenue Beats Expectations

Event Summary: Alphabet (Google’s parent company) reported Q4 revenue of $113.828 billion, exceeding consensus estimates of $111.375 billion; its 2026 capital expenditure forecast stands at $175–185 billion—well above the expected $119.5 billion. The company is integrating Gemini AI, supplying Anthropic with one million AI chips, and assisting Apple in upgrading Siri—all part of a major investment push to counter competition from Amazon, Microsoft, and OpenAI. This comes amid surging demand for AI infrastructure but also growing valuation concerns that have contributed to stock volatility. Market Interpretation: Analysts view robust revenue as evidence of advertising business resilience, though heavy capex may compress margins; Morgan Stanley maintains a neutral rating, highlighting the long-term return potential of AI investments. Investment Implications: Increased short-term volatility warrants caution; monitor real-world AI application adoption; long-term outlook remains positive given diversified growth avenues.

2. Qualcomm – Q1 Revenue Meets Expectations, But Q2 Outlook Disappointing

Event Summary: Qualcomm reported adjusted Q1 revenue of $12.25 billion—meeting expectations—but issued a Q2 revenue guidance range of $10.2–11.0 billion, below the consensus estimate of $11.2 billion; EPS guidance of $2.55 falls short of the expected $2.89. Weak smartphone chip demand stems from memory shortages, prompting the company’s strategic pivot toward automotive, PC, and data center markets. This shift reflects ongoing supply-chain bottlenecks—including prior global chip shortages—with recovery dependent on future demand trends. Market Interpretation: Analysts acknowledge smartphone segment drag but commend Qualcomm’s diversification strategy; Goldman Sachs lowered its price target, citing near-term profit pressure. Investment Implications: Monitor slow smartphone market recovery closely; diversification efforts may serve as a buffer against sector-specific headwinds.

3. AMD – Earnings Miss High Expectations, Triggering Sharp Sell-Off

Event Summary: AMD’s stock plunged over 17%—not due to poor fundamentals, but because results failed to meet sky-high market expectations. The company faces fierce AI-domain competition from Nvidia, and its revenue outlook fell short of optimistic forecasts. While AI chip demand had previously propelled its share price higher, actual delivery lagged behind expectations, triggering widespread selling. Market Interpretation: Analyst opinions are divided: Citigroup views fundamentals as sound but valuations excessive; Barclays downgraded the stock, underscoring competitive risks. Investment Implications: Adopt a short-term defensive stance; await clearer signals on AI market share distribution.

4. Eli Lilly – Q4 Revenue Surges 43%

Event Summary: Eli Lilly reported 43% Q4 revenue growth and 50% net income growth, powered by strong sales of GLP-1 weight-loss drugs; its 2026 revenue guidance of $80–83 billion implies 27% growth. Lilly has overtaken Novo Nordisk in pricing power amid intense competition; this follows explosive demand for obesity therapeutics, with future attention focused on capacity expansion. Market Interpretation: Analysts applaud Lilly’s sales leadership; UBS raised its price target, forecasting further market share gains. Investment Implications: Pharma giants aligned with health-trend tailwinds offer compelling long-term holding potential.

5. Novo Nordisk – Acknowledges Pricing Pressure

Event Summary: Novo Nordisk’s stock declined over 6% after its CEO acknowledged unprecedented pricing pressure in 2026; Wegovy was discounted to boost volume, and the company launched a $3.8 billion share buyback and dividend program. An oral formulation of Wegovy represents a key future growth driver, though recent price competition triggered a prior correction. Market Interpretation: Analysts express concern over margin compression, yet Goldman Sachs maintains a Buy rating, emphasizing pipeline strength. Investment Implications: Near-term pressure remains significant; watch closely for progress on new drug development.

IV. Cryptocurrency Project Updates

1. U.S. Treasury Secretary Bessent stated the government will not “bail out” Bitcoin; the $500 million in Bitcoin seized by U.S. authorities has appreciated to $15 billion.

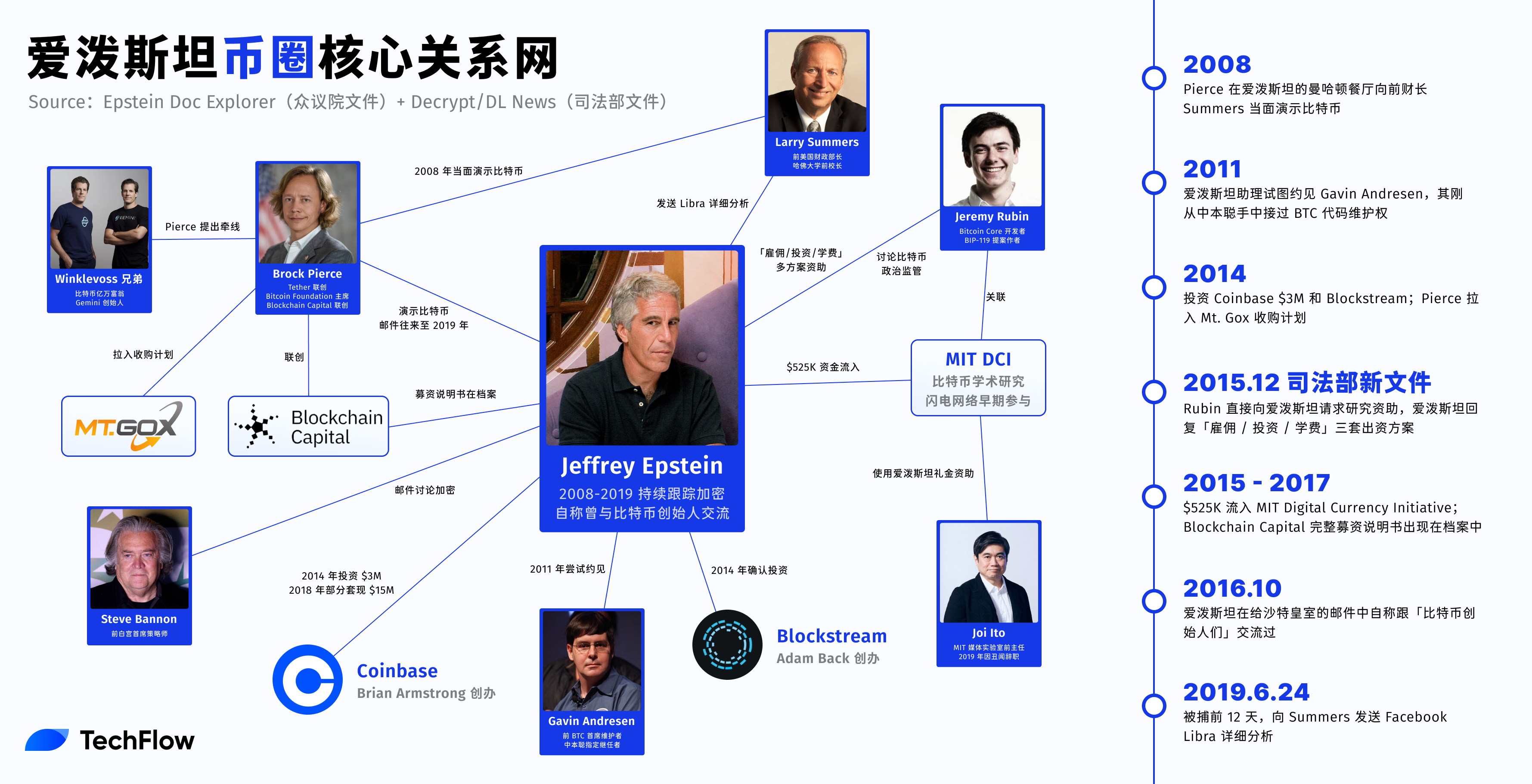

2. Bitcoin developers called on Blockstream CEO Adam Back to resign following revelations in the Epstein documents.

3. CoinDCX CEO noted Indian investors are buying Bitcoin on dips, reflecting increasingly rational investment behavior.

4. BLOCK unveiled its tokenomics, allocating 50% to the community.

5. VIRTUAL introduced a 60-day framework enabling reversible token issuance.

V. Today’s Market Calendar

Data Release Schedule

| 21:30 | U.S. | Initial Jobless Claims | ⭐⭐⭐⭐ |

| TBD | Eurozone | ECB Interest Rate Decision | ⭐⭐⭐⭐⭐ |

Key Event Previews

- MicroStrategy, IREN, and Amazon earnings: After-market hours — watch for insights into tech and crypto-related performance.

Bitget Research Institute View:

U.S. tech stocks face pressure as the AI valuation bubble deflates, strengthening the Nasdaq’s short-term bearish bias; gold’s rebound above $5,000 is viewed as a countertrend move—not the start of a new bull market—constrained by U.S. dollar strength; the sharp crude inventory draw supports oil’s rebound, though easing geopolitical tensions may limit upside; among FX, the U.S. Dollar Index edged higher, aided by delayed data releases and Fed personnel developments. Overall market volatility is intensifying; investors should closely monitor uncertainty surrounding the Fed’s policy path, avoid chasing gold in the near term, and steer clear of overvalued tech stocks in the U.S. equity market.

Disclaimer: The above content was compiled via AI search and verified manually before publication. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News