Bitget UEX Daily Report | Trump's tariff threats escalate, US stocks plummet, gold and silver prices hit record highs, Fed chair nomination nearing decision

TechFlow Selected TechFlow Selected

Bitget UEX Daily Report | Trump's tariff threats escalate, US stocks plummet, gold and silver prices hit record highs, Fed chair nomination nearing decision

Trump’s tariff pressure on the EU; US economic growth outlook is optimistic but harbors underlying risks.

Author: Bitget

I. Key Highlights

Federal Reserve Developments

Trump Accelerates Selection of Fed Successor as Powell Attends Supreme Court Hearing

Federal Reserve Chair Powell will attend a Supreme Court hearing today on the case involving理事Lisa Cook, a ruling that could determine the future of the Fed’s independence.- Treasury Secretary Bessent revealed Trump has narrowed down Powell's successor to four candidates, with an announcement expected as early as next week, including Kevin Hassett and Kevin Warsh;- UBS report warns that an unfavorable court decision might open the door for the White House to bypass legal procedures in removing Fed officials.

Market Impact: This increases uncertainty around monetary policy and may further weaken confidence in the dollar, boosting demand for safe-haven assets.

International Commodities

Geopolitical Trade Tensions Escalate, Gold and Silver Hit Record Highs

Trump's tariff threats have heightened risk aversion, sending spot gold and silver prices soaring to new records.- Gold surged over 2%, reaching $4,766 per ounce;- Silver rose more than 1%, peaking at $95.9 per ounce;- Bridgewater’s Ray Dalio warned of “capital war” risks, highlighting gold as a key hedge.

Market Impact: Fears of trade wars combined with a weaker dollar enhance the appeal of precious metals as safe-haven assets, potentially supporting short-term price gains, though global economic slowdown could dampen demand.

Macroeconomic Policy

Trump Pressures EU with Tariffs; U.S. Growth Outlook Remains Strong but Risks Lurk

Trump reiterated that if tariffs are blocked, he would use licensing systems or other measures against the EU, and even suggested possible military action to seize Greenland.- The European Parliament has frozen approval of the U.S.-EU trade deal in response to Trump’s 10% tariff threat;- Commerce Secretary Lutnick forecasts Q1 GDP growth exceeding 5%, potentially rising to 6% if rates are cut, while warning the EU against retaliation;- ADP data shows weekly average job creation slowed to 8,000, signaling a cooling hiring pace.

Market Impact: Escalating tariffs could reignite a global trade war, dragging down equities and increasing economic uncertainty, though rate cut expectations may cushion some negative impacts.

II. Market Recap

- Spot Gold: +1.31%, hitting a record high, driven by risk-off sentiment;

- Spot Silver: -0.55%, volatile at elevated levels, supported by both safe-haven and industrial demand;

- WIT Crude Oil: -0.91%; Chinese economic growth supports demand, but trade tensions cap gains;

- DXY (Dollar Index): -0.04%; tariff threats trigger capital outflows from the dollar;

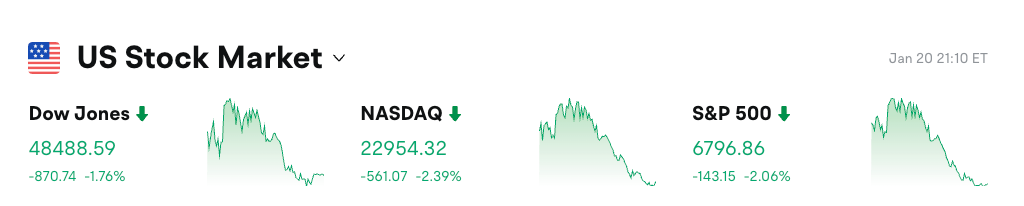

U.S. Equity Index Performance

- Dow Jones: -1.76%, largest single-day drop in nearly three months, driven by trade concerns

- S&P 500: -2.06%, worst performance since October last year, dragged down by tech stocks

- Nasdaq: -2.39%, broad tech selloff amid escalating geopolitical risks

Tech Giants Update

- NVIDIA: -4.38%, hit by worsening trade tensions impacting chip demand outlook

- Tesla: -4.17%, growing concerns over supply chain disruptions

- Apple: -3.46%, rising exposure risks in European markets

- Amazon: -3.40%, global trade friction affecting e-commerce logistics

- Google: -2.42%, advertising revenue impacted by economic uncertainty

- Meta: -2.60%, stronger expectations of slowing user growth

- Microsoft: -1.16%, fluctuating cloud service demand. Overall, the seven major tech firms fell broadly due to fears of a global trade war triggered by Trump’s tariff threats, with tech sector particularly vulnerable and under clear short-term pressure.

Sector Movement Watch

Precious Metals Sector up ~6%

- Representative stock: Kinross Gold, +8.62%

- Drivers: Geopolitical tensions and a weak dollar boost safe-haven demand, record highs in gold and silver energize mining equities

Crypto-Related Sector down ~7%

- Representative stock: Coinbase, -5.57%

- Drivers: Bitcoin跌破$90K, Ethereum失守$3,000, risk asset sell-off spills over

III. In-Depth Stock Analysis

1. Netflix – Q4 Earnings Beat but Outlook Disappoints

Event Summary: Netflix reported Q4 revenue of $12.05 billion, above estimates of $11.97 billion; EPS came in at $0.56 versus $0.43 a year earlier; free cash flow reached $1.87 billion, surpassing expectations of $1.46 billion. However, the company projected 2026 revenue between $50.7–51.7 billion, slightly below the $50.96 billion estimate; Q1 operating profit of $3.91 billion and EPS of $0.76 missed market forecasts. Shares dropped over 5% in after-hours trading. Additionally, Netflix revised its proposed $72 billion acquisition of Warner Bros. Discovery from a mix of cash and stock to all-cash to expedite shareholder voting.

Market Interpretation: Goldman Sachs analysts noted strong subscriber growth but slow progress in ad business expansion; Morgan Stanley highlighted weak guidance reflecting intensifying competition and rising content costs.

Investment Insight: Near-term share price pressure likely due to lowered guidance; long-term focus should be on streaming industry consolidation opportunities.

2. NVIDIA – Trade Friction Fuels Chip Demand Concerns

Event Summary: NVIDIA shares fell 4.38%, dragged down by broader semiconductor sector weakness amid Trump’s tariff threats. No major company announcements were made recently, but as the AI chip leader, its supply chain relies heavily on stable global trade. Markets worry retaliatory EU measures could disrupt its European expansion and indirectly affect Asian supply chains.

Market Interpretation: Bernstein analysts warn that escalating trade wars could increase chip production costs; UBS believes short-term volatility is high, but long-term AI demand remains robust.

Investment Insight: Caution advised during risk-off periods; consider accumulating positions once geopolitical risks ease.

3. Tesla – Rising Supply Chain Disruption Risks

Event Summary: Tesla shares declined 4.17%, continuing the tech selloff. No new company-specific events occurred, but its high exposure to European markets makes it vulnerable to Trump’s EU tariff threats, directly impacting exports and component procurement. While Model Y sales remain strong, overall global trade uncertainty has increased.

Market Interpretation: Citi analysts pointed out that tariffs could raise prices in Europe, hurting demand; Barclays believes faster Cybertruck production may partially offset these risks.

Investment Insight: Increased near-term volatility; watch for government support policies in clean energy as potential buffers.

4. Alibaba – Broad China ADR Selloff Amid U.S. Market Weakness

Event Summary: Alibaba fell 1.82%, with the Nasdaq Golden Dragon China Index down 1.45%. Despite no company-specific news, falling U.S. markets and trade war fears spilled over into Chinese ADRs. Alibaba’s core e-commerce business remains solid, but it is highly sensitive to cross-border trade dynamics.

Market Interpretation: JPMorgan analysts believe geopolitical tensions are suppressing valuations in the short term; Goldman Sachs remains positive on cloud business growth potential.

Investment Insight: Consider adding positions when U.S.-China relations stabilize; currently advisable to maintain conservative exposure.

IV. Today’s Market Calendar

Economic Data Schedule

| 10:00 ET | U.S. | Construction Spending (Sep) | ⭐⭐⭐⭐ |

| 10:00 ET | U.S. | Pending Home Sales (Dec) | ⭐⭐⭐⭐ |

| 10:30 ET | U.S. | EIA Crude Oil Inventories (Jan 16) | ⭐⭐⭐⭐⭐ |

Key Event Preview

- Trump’s Davos Speech: Wednesday – Watch for comments on Greenland negotiations and tariff policy

- Powell Attends Supreme Court Hearing: Wednesday – Focus on debate over Fed independence

- High-Level Meetings at Davos Forum: All Day – Updates on U.S.-EU trade agreement progress

Bitget Research View:

U.S. equities were hammered by Trump’s tariff threats, with the S&P 500 posting its worst drop in three months, led by tech; precious metals surged as gold and silver hit records, driven by safe-haven flows and dollar weakness—Bridgewater’s Dalio sees gold as the top hedge against “capital wars”; oil gained on Chinese demand hopes but trade war risks capped gains; balanced portfolio allocation is advised.

Disclaimer: The above content is compiled via AI search, with human verification only for publication purposes. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News