Bitget Daily Morning Report: SIGN and JUP Face Large Token Unlocks This Week; $612 Million Long Positions Liquidated in Crypto Market

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: SIGN and JUP Face Large Token Unlocks This Week; $612 Million Long Positions Liquidated in Crypto Market

Spark lending whale sells 11,190 ETH.

Author: Bitget

Today’s Outlook

1. Japan may lift its ban on crypto ETFs by 2028; SBI and Nomura are actively developing related products.

2. This week, Microsoft, Apple, Tesla, and Meta will release their quarterly earnings reports—offering insights into the health of industries ranging from cloud computing and consumer electronics to software and digital advertising.

3. Michael Saylor has again posted his Bitcoin Tracker update; new BTC accumulation data may be disclosed this week.

4. Data: Large token unlocks are scheduled this week for SIGN, JUP, and others.

Macroeconomic & Hot Topics

1. Analysis: Markets expect the Federal Reserve to pause rate cuts this week; Powell’s dovish or hawkish signals could significantly impact Bitcoin’s price action.

2. Spot silver surged past $107 for the first time ever, gaining over $35 this month; spot gold broke above the historic $5,000 milestone.

3. Placeholder Partner: If the crypto market declines further, they plan to increase their BTC holdings; a sub-$50,000 BTC price could revive the “Bitcoin is dead” narrative.

Market Trends

1. Over the past 24 hours, the global crypto market saw $676 million in liquidations, including $612 million in long positions. BTC liquidations totaled ~$194 million, while ETH liquidations reached ~$217 million.

2. U.S. equities: Dow Jones -0.58%, Nasdaq +0.28%, S&P 500 +0.03%. CRCL (Circle) -0.03%; MSTR (MicroStrategy) +1.32%; NVDA (NVIDIA) +1.53%.

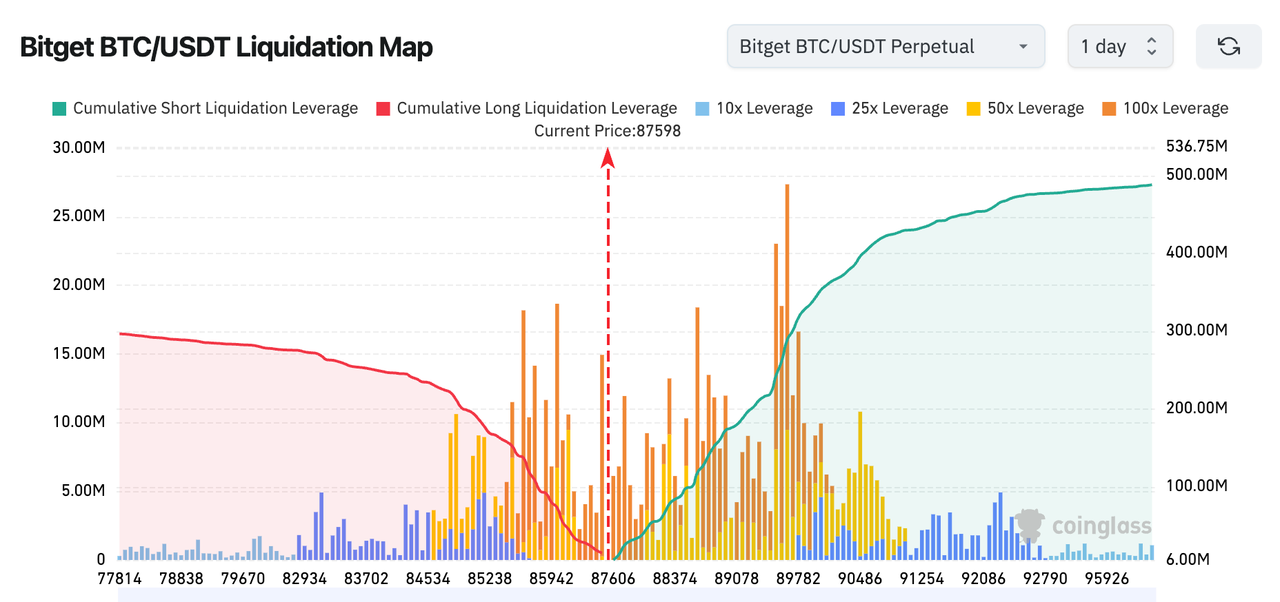

3. Bitget’s BTC/USDT liquidation heatmap shows a pronounced gap between long and short liquidations near the current price (~$87,600). Short liquidation volume accumulates rapidly above this level, creating conditions conducive to a short squeeze. Long liquidations below this level are relatively dispersed and weaker—suggesting downside movement is likely gradual, whereas an upside breakout could trigger accelerated momentum.

4. Over the past 24 hours, BTC spot inflows totaled ~$232 million, outflows ~$190 million, resulting in net inflows of $42 million.

News Updates

1. According to CoinDesk, U.S. regulation of crypto assets is accelerating. If the proposed Crypto Market Structure Bill passes, it would clearly assign regulatory authority over digital assets to federal agencies—making cryptocurrencies easier to manage, track, and trade, potentially attracting more investors and boosting token valuations.

2. Data: Stablecoin issuers generated $5 billion in revenue on Ethereum in 2025.

3. The White House’s official X account declared, “America is now the global capital of crypto”; the CFTC will follow with modernized rules and regulations.

4. Colombia’s second-largest pension fund manager, AFP Protección, plans to launch a Bitcoin exposure fund.

Project Updates

1. A whale known for “buying high and selling low” panicked and dumped 5,500 ETH over the past three days—worth $16.02 million.

2. WLFI transferred rewards from its treasury related to USD1 staking activities to Binance, totaling $40 million worth of WLFI tokens.

3. Two whale/institutional addresses appear to have accumulated 61,000 ETH and 20,000 ETH respectively.

4. a16z Crypto: Quantum threats are overstated; protocol governance and upgrade coordination remain the biggest challenges for public blockchains.

5. Pendle Finance team-associated addresses deposited 1.8 million PENDLE tokens to centralized exchanges.

6. Report: Ethereum is achieving both high throughput and low fees simultaneously—and may be transitioning toward a modular settlement layer. According to the “1011 Insider Whale” representative, Ethereum will become the global capital markets’ settlement layer, and 2026 will be the “Year of RWAs.”

7. Yesterday, a whale transferred $11 million worth of PUMP tokens to Binance; if sold, the profit would reach $3.15 million.

8. A Spark Lending whale sold 11,190 ETH, lowering its liquidation price to $2,268.

9. Coinbase’s Bitcoin premium index has remained negative for ten consecutive days—the only two positive readings this year occurred earlier this year.

10. Seven wallets linked to the same entity collectively purchased $21.71 million worth of $XAUT.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News