I Used Claude to Scrape 260,000 Records and Uncovered Epstein’s Crypto Connections

TechFlow Selected TechFlow Selected

I Used Claude to Scrape 260,000 Records and Uncovered Epstein’s Crypto Connections

After scraping, it was discovered that Epstein was not merely an observer in the crypto community but more akin to an information broker.

Author: David, TechFlow

Recently, documents related to the Jeffrey Epstein case have been rapidly declassified. Social media is abuzz with users digging through the released lists.

People in the crypto industry are also asking: Are any of us implicated?

I was curious too, so I decided to investigate. But the problem is that the volume of released documents is enormous—thousands of PDFs—and manually sifting through them isn’t feasible. Plus, I have little coding experience.

While aimlessly browsing online, I eventually stumbled upon a project on GitHub.

This project is called Epstein Doc Explorer. Its creator used AI to structurally process legal documents related to Epstein that were publicly released by the U.S. House Committee on Oversight and Reform, extracting relationships among people, events, times, and locations—all stored in a database.

The project also includes an online, interactive visualization website for searching. However, due to the sheer volume of data and my underpowered laptop, the site runs extremely slowly, making it nearly impossible to retrieve useful information.

What I needed was bulk querying—to extract all crypto-related people and events in one go.

Methodology

I fed this GitHub project to Claude and asked how to query the database.

After reviewing the project structure, Claude informed me that the core data resides in an SQLite database file named document_analysis.db, containing a table called rdf_triples. Each record follows a “who-did-what-to-whom-when-where” structure. For example:

However, the database contains over 260,000 such records, covering the entire publicly disclosed network of interpersonal relationships from the Epstein files—and I only wanted crypto-related ones.

My approach was to filter relevant records using keywords—but I ran into two pitfalls in practice.

First pitfall: The file was “fake.”

I downloaded the project’s ZIP archive from GitHub, extracted it, and tried opening the database—but my computer couldn’t read it. Claude helped me troubleshoot and discovered that what I’d downloaded was merely an index file, not the actual database. Returning to the GitHub page, I manually downloaded the full 266 MB file.

Second pitfall: Keyword selection.

In my first query, I used 25 keywords—including direct terms like Bitcoin, Crypto, and Blockchain, as well as names and institutions only loosely connected, such as Peter Thiel, Bill Gates, and Goldman Sachs. My logic was “better false positives than missed hits.”

The result? 1,628 records—most of which were noise. For instance, 90% of the results for “Goldman Sachs” were economic forecasting reports, while searches for “Virgin Islands” returned local tourism data.

So I asked Claude to help refine the search across three rounds:

- Round 1: Broad keywords → 1,628 records, high noise but provided a panoramic view and identified a cohort of individuals.

- Round 2: After reviewing Round 1 results, Claude noted I’d missed crypto-specific terms like Libra, Stablecoin, and Digital Asset. Adding these confirmed no omissions.

- Round 3: Reverse search—excluding names entirely, instead querying only for records where the “action” field contained Bitcoin, Crypto, or Blockchain.

Round 3 proved most critical: filtering directly by action yielded only strongly associated records.

By cross-referencing all three rounds and eliminating weak associations, I compiled the list below.

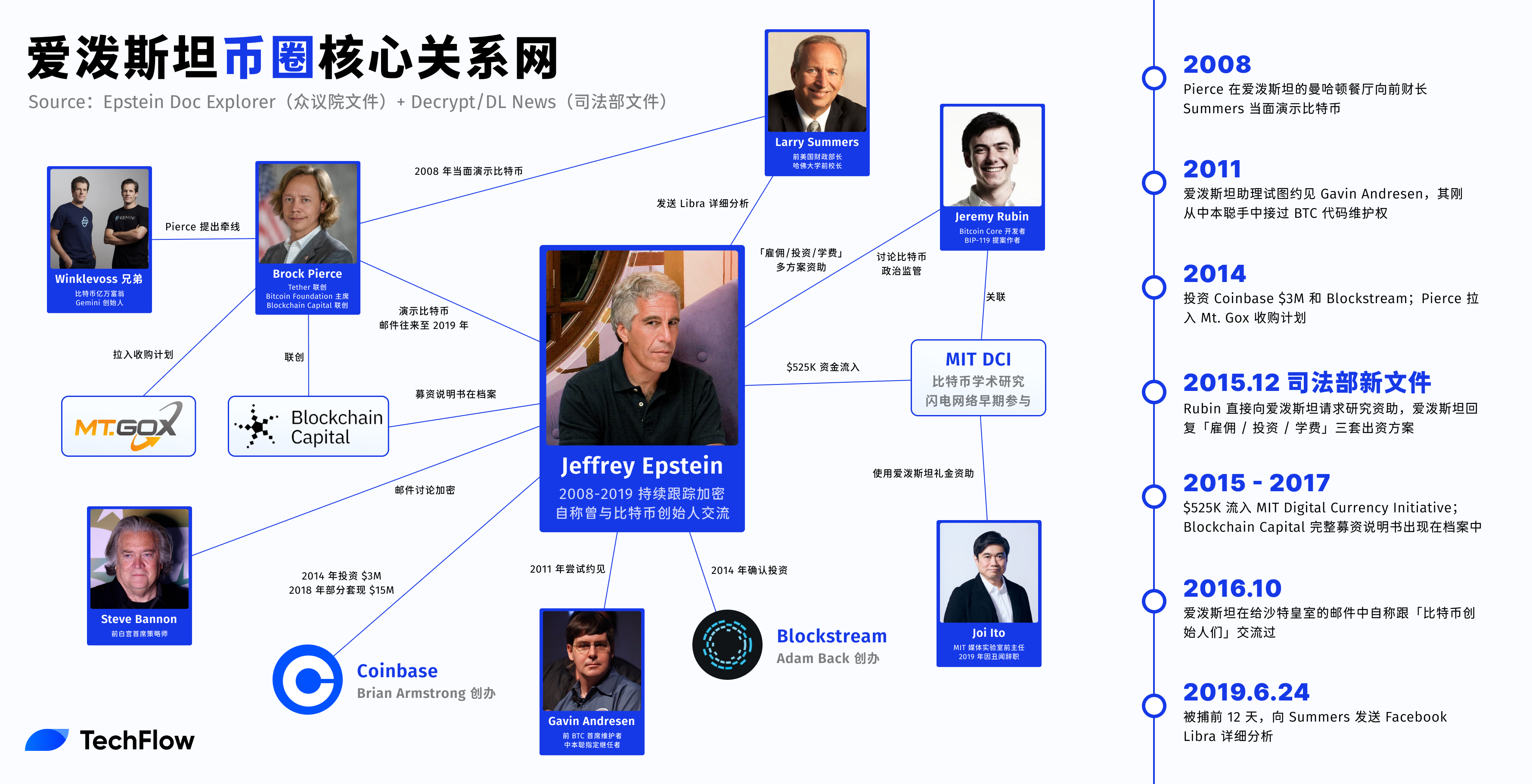

1. Brock Pierce: Demonstrated Bitcoin to Epstein at his restaurant

Background: Co-founder of Tether; former Chairman of the Bitcoin Foundation; co-founder of Blockchain Capital.

Interaction with Epstein: Multiple in-person meetings, primarily at Epstein’s Upper East Side Manhattan mansion.

Crypto topics discussed: Bitcoin demonstration, blockchain discussions, cryptocurrency volatility.

Timeline: Earliest record dated 2008; many entries lack specific dates but share the same location. An email from March 2015 shows someone arranging follow-up meetings.

I lead with Pierce because his records possess the strongest narrative vividness in the entire database.

The records indicate he gave a Bitcoin demonstration in the dining room of Epstein’s Manhattan mansion—in front of former U.S. Treasury Secretary Larry Summers. Afterward, Summers expressed concern about investment risks but also offered Pierce “an opportunity.”

Epstein wasn’t just a passive listener: he called Pierce into the foyer for a private conversation, then invited him back to the dining room to continue. They also discussed cryptocurrency volatility privately.

This wasn’t a casual dinner chat.

An email dated March 31, 2015, reveals Alex Yablon specifically wrote to Epstein asking whether he could arrange a discussion between Pierce and Summers on Bitcoin.

Someone acted as a matchmaker—indicating these meetings were deliberately orchestrated.

Epstein’s Manhattan mansion, during this period, functioned as an informal pitch venue. Pierce brought his project; the guest of honor was a former Treasury Secretary.

For a crypto entrepreneur, such access would be nearly impossible via conventional business channels. Conversely, by organizing such meetings, Epstein positioned himself as a bridge between the crypto industry and policymakers.

Our database processes only documents released by the House Oversight Committee—so the Pierce线索 ends here. Yet, while this article was being written, the U.S. Department of Justice released another batch of over 3 million pages of Epstein files. Decrypt analyzed these new documents in a report, revealing Pierce’s ties to Epstein run far deeper than what appears in the database.

Key additions:

Their email correspondence spanned from 2011 through spring 2019—far exceeding a few dining-room encounters.

Pierce once enthusiastically messaged Epstein: “Bitcoin broke $500!” He pulled Epstein into plans to acquire Mt. Gox (before its collapse) and volunteered to introduce Epstein to Bitcoin billionaires the Winklevoss twins.

Epstein replied he didn’t know the Winklevosses but wanted to send someone to learn about their crypto activities.

The origin of their relationship is now clearer too.

In early 2011, Pierce attended a small, invitation-only conference in the Virgin Islands called “Mindshift,” organized to help Epstein rehabilitate his image following his 2008 sex crime conviction.

Afterward, Epstein’s executive assistant Lesley Groff marked Pierce as one of Epstein’s “liked people” and forwarded his contact details.

2. Blockchain Capital: A crypto VC fundraising deck surfaced—Epstein may have been an investor

Background: A San Francisco–based crypto venture fund founded in 2013. Co-founders include Bart Stephens, Brad Stephens, and Brock Pierce (mentioned above). One of the earliest dedicated crypto VCs.

Link to Epstein: The complete investment memorandum for CCP II LP fund appeared in Epstein’s document archive.

Crypto topics covered: Full investment portfolio, service provider network, investment strategy.

Timeline: Memo dated October 2015; investment records cover 2013–2015.

Across the entire publicly released Epstein database, there are 82 Blockchain Capital–related records.

This doesn’t resemble scattered name mentions—it looks more like a complete fundraising deck broken down into structured data.

Digging deeper, Blockchain Capital’s list of investment targets is highly detailed: Coinbase Series C, Kraken Series A, Ripple Series A, Blockstream Series A, plus BitGo, LedgerX, itBit, ABRA, and over a dozen others.

Even the fund’s service provider network is documented: legal counsel Sidley Austin; banking partner Silicon Valley Bank; crypto custodians Xapo and BitGo.

When a fundraising memorandum appears in someone’s personal files, finance circles have one standard interpretation:

That person was approached as a potential limited partner (LP).

Given that Pierce is both a Blockchain Capital co-founder and demonstrated Bitcoin in Epstein’s dining room, are these two threads likely connected?

I imagine the sequence went like this: Pierce first sparked Epstein’s interest with a Bitcoin demo, then followed up with his fund’s pitch materials—a full-fledged roadshow...

(This remains speculative—not verified.)

While writing this article, I found no evidence of Epstein actually investing.

But Decrypt’s reporting—based on the DOJ’s newly released files—answered that question: Epstein did invest in Coinbase, with the initial introduction coming from Pierce.

Blockchain Capital told Decrypt that Epstein ultimately invested independently of Pierce’s firm. The same batch of files also revealed Epstein invested in Blockstream—Adam Back’s Bitcoin infrastructure company.

3. Jeremy Rubin: Bitcoin Core developer sought funding from Epstein

Background: Bitcoin Core contributor; author of BIP-119 (OP_CTV); affiliated with MIT’s Digital Currency Initiative (DCI). Within the Bitcoin technical community, he’s among those who write low-level code.

Interaction with Epstein: Direct communication, explicitly discussing Bitcoin.

Crypto topics discussed: Bitcoin regulatory outlook, Bitcoin political speculation, teaching Bitcoin courses in Japan, requesting research funding.

Timeline: February 2017, concentrated over four days.

On February 1, 2017, Rubin discussed “Bitcoin regulatory outlook” and “Bitcoin regulatory and political speculation” with Epstein.

Three days later, he reported to Epstein on his progress teaching Bitcoin to engineers in Japan.

This set of records has the highest information density in the entire database.

Their discussions weren’t about “how Bitcoin works”—they centered on regulatory trajectories and political maneuvering, indicating Epstein had long passed the stage of needing Bitcoin basics explained.

Doesn’t Rubin’s behavior seem suspicious?

He proactively reported work progress to Epstein—suggesting an ongoing exchange of information, not a one-off social interaction.

What Rubin gained from Epstein remains unknown.

But according to DL News’ reporting based on DOJ files, in December 2015, Rubin emailed Epstein directly requesting funding for his crypto research.

Epstein’s reply was specific: he proposed three funding options—(1) paying Rubin directly as an employee; (2) investing in a company Rubin would form (requiring additional paperwork); or (3) funding Rubin’s research (with tax advantages).

A Bitcoin Core developer proactively seeking funds from Epstein, and Epstein responding with a systematic, multi-option proposal.

Here’s some context on MIT’s Digital Currency Initiative. DCI was launched in April 2015 under Joi Ito, Director of MIT Media Lab. It focused exclusively on academic research into Bitcoin and digital currencies, later contributing to foundational infrastructure like the Lightning Network.

Within the Bitcoin technical community, DCI is no fringe academic outfit—its research directly influences protocol-level development directions. Rubin is one of the developers affiliated with this initiative.

4. Joi Ito: Launched MIT’s Digital Currency Initiative with Epstein’s money

Background: Former Director of MIT Media Lab. Resigned in 2019 after revelations he accepted funds from Epstein.

Link to Epstein: Accepted funding; direct communication.

Crypto topics covered: Funding source for MIT’s Digital Currency Initiative.

Timeline: Digital currency program launched April 2015; communications continued into 2017.

Ito’s acceptance of Epstein’s funds was widely reported in 2019 by outlets including The New Yorker—not new information. But the database adds a previously unclear detail from earlier reporting:

The precise flow of those funds.

The database explicitly states “Joichi Ito used gift funds to finance MIT Media Lab Digital Currency Initiative,” as shown above.

Thus, Epstein’s money didn’t go into the Media Lab’s general operating pool—it was earmarked specifically for cryptocurrency research.

This connects directly to Rubin’s thread above.

Rubin is affiliated with MIT’s Digital Currency Initiative—and that initiative was funded by Epstein.

We cannot definitively conclude Rubin met Epstein through Ito, but both threads point in the same direction: Epstein’s penetration of the crypto industry extended beyond social networking—he engaged core technical developers by funding academic research.

Now let’s connect these dots:

Epstein’s funds flowed into DCI; DCI is a major hub for Bitcoin core technical research; Rubin, affiliated with DCI, directly discussed regulatory politics with Epstein and reported his work to him.

This funding chain raises an uncomfortable question:

Did Epstein gain access to Bitcoin core developers—and even indirectly influence infrastructure-level research directions—by funding academic work?

Current data cannot prove this. But the chain—“money → institution → developer → direct communication”—does exist in the database. Readers can assess the strength of causality themselves.

5. Epstein himself: Tracked crypto—from Bitcoin to Libra—for at least a decade

Chronologically ordering Epstein’s own crypto-related records reveals a clear evolution:

Viewing this table holistically yields two conclusions.

First, Epstein’s crypto interest wasn’t a passing fad in any single year.

The earliest record dates to around 2008—shortly after Bitcoin’s whitepaper was published, when perhaps only a few thousand people worldwide followed crypto.

His exposure to Bitcoin at that stage implies his information network reached the field’s earliest adopters. And his crypto-related records continue uninterrupted for a full decade—this is a continuous line.

Second, his level of engagement deepened over time.

In 2008, he was “watching a demo”; in 2017, he debated regulatory politics with developers; in 2018, he placed crypto alongside John Kerry and Qatar in geopolitical agendas; by 2019, he produced a detailed analysis of Facebook’s Libra whitepaper just six days after its release...

This is no trajectory of a casual observer—it reflects someone actively trying to build influence within the crypto industry.

The timing of the final Libra-related record is also noteworthy.

He completed his Libra analysis on June 24, 2019—and was arrested on July 6. In his last two weeks of freedom, he was still analyzing Facebook’s stablecoin proposal.

Given this role—and this level of attention to crypto—the irony is almost absurd.

People absent from the database

One reverse finding.

CZ, Sam Bankman-Fried, Brian Armstrong, Vitalik Buterin, the Winklevoss twins...

None of these most prominent figures in crypto appear in the currently processed files with any direct interaction record involving Epstein.

Vitalik Buterin does have one entry—“authored What is Ethereum”—but that references publicly available material, not interpersonal connections.

Not appearing in the database doesn’t mean no connection exists—only that no evidence has surfaced yet. The House Committee continues releasing files, and this database is actively updated.

What do these clues collectively imply?

Epstein wasn’t a crypto investor—at least, current evidence shows no actual capital deployed into any crypto project.

He wasn’t a technical participant either—no code written, no tokens issued, no on-chain activity.

Yet clearly, he wasn’t a passive bystander either.

After reviewing all these records, I believe his role resembled that of an information broker.

He hosted Pierce’s Bitcoin demo for a former Treasury Secretary in his dining room; he held Blockchain Capital’s full fundraising deck; he debated regulatory politics with Bitcoin Core developers; he funded MIT’s digital currency research; he analyzed Facebook’s Libra just before his arrest...

These actions share a common feature: positioning himself at the intersection of information flows—connecting crypto entrepreneurs, policymakers, and academic researchers.

This aligns precisely with his behavior in other domains.

Epstein didn’t conduct scientific research himself—but he funded scientists. He didn’t draft policy—but he arranged meetings between politicians and businesspeople. Crypto was simply another domain he penetrated using the same methodology.

The possible difference lies in timing: Between 2008 and 2019, crypto was undergoing a critical transition—from underground to mainstream—making the industry unusually reliant on informal networks to access policy intelligence and capital channels.

And isn’t that exactly what Epstein excelled at providing?

Still, the author has done their best—there remains a logical gap between “contact records” and “substantive influence.” This article presents only the former.

Again, full transparency: All findings derive from an open-source database and assisted analysis by Claude. This article offers no definitive conclusions—it’s best viewed as a snapshot of current data.

If you discover crypto-related clues in this database that I missed, please let me know.

-

References:

1. Epstein Document Explorer open-source project:

https://github.com/maxandrews/Epstein-doc-explorer

2. Location of the 260,000-record database:

https://github.com/maxandrews/Epstein-doc-explorer/blob/main/document_analysis.db

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News