Bitget UEX Daily Report | Trump Puts Brakes on Trade War, US Stocks Rebound; Memory Stocks Keep Rallying to New Highs; Musk Aims for SpaceX IPO in July (Jan 22, 26)

TechFlow Selected TechFlow Selected

Bitget UEX Daily Report | Trump Puts Brakes on Trade War, US Stocks Rebound; Memory Stocks Keep Rallying to New Highs; Musk Aims for SpaceX IPO in July (Jan 22, 26)

Trump's trade easing boosts Dow and other indices, but beware of tariff reinstatement risks.

Author: Bitget

I. Key Highlights

Federal Reserve Developments

Trump narrows Fed chair shortlist to one candidate; Supreme Court cautious on removing理事

- Trump indicated the candidate pool has narrowed, suggesting someone potentially as capable as Greenspan, with Hasset likely remaining in current role.

- Supreme Court justices questioned the legality of removing Fed governor Lisa Cook, raising concerns over undermining central bank independence.

- Wash and Riddell mentioned as potential candidates. This eased market worries over Fed independence, boosting U.S. tech stocks, though confirmation of a dovish nominee could further depress Treasury yields.

Global Commodities

Geopolitical easing and shifting demand expectations drive heightened volatility in energy and metals

- Crude oil prices edged higher after Trump lifted European tariffs, but oversupply concerns remain dominant.

- Gold and silver extended gains on safe-haven demand and expectations of looser monetary policy, hitting new highs.

- Institutions raised 2026 global oil demand growth forecasts, yet inventory buildup risks persist. Markets are optimistic about reduced trade tensions, but rising supply may cap energy rebounds, while metals benefit from AI-driven demand and reserve diversification.

Macroeconomic Policy

Trump criticizes allies at Davos; EU insists summit will proceed amid tariff threats

- Trump reiterated interest in acquiring Greenland, advocated nuclear power for AI, and criticized Europe’s development model.

- Reached framework agreement with NATO, eliminating tariffs on eight countries.

- EU spokesperson confirmed summit will proceed as planned, with ongoing talks to safeguard interests. These developments ease near-term trade war risks, lifting global equities, though strained alliance relations may increase economic uncertainty and disrupt transatlantic investment flows.

II. Market Recap

- Spot Gold: $4796/oz, up for five consecutive days driven by safe-haven demand and a weaker dollar.

- Spot Silver: $92.28/oz, weighed by weak industrial demand but still up over 30% from last month.

- WTI Crude Oil: Up 0.38% to $60.68/barrel; geopolitical easing supports rebound, but supply glut limits upside.

- DXY (U.S. Dollar Index): Flat, as trade optimism reduces safe-haven appeal.

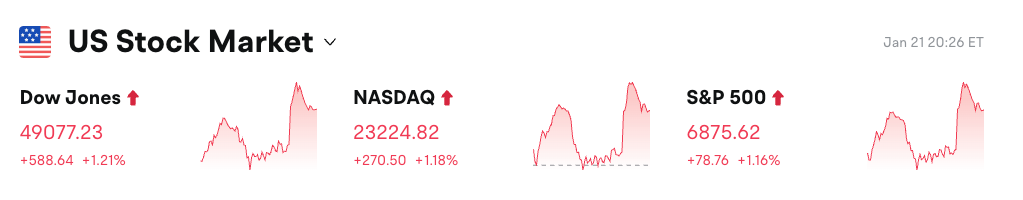

U.S. Equity Index Performance

- Dow Jones: +1.21% to 49,077.23, continuing rebound amid fading trade tensions.

- S&P 500: +1.16% to 6,875.62, led by technology and energy sectors.

- Nasdaq: +1.18% to 23,224.82, driven by memory and AI-related stocks.

Tech Giants Update

- NVIDIA: +2.95%, boosted by AI and nuclear energy policy expectations.

- Apple: +0.39%, sentiment lifted by Siri upgrade news.

- Microsoft: -2.29%, under pressure with broader software sector weakness.

- Google: +1.98%, strong search and cloud performance.

- Amazon: +0.13%, stable e-commerce demand.

- Meta: +1.46%, advertising recovery on social platforms.

- Tesla: +2.91%, Cybercab progress slow but acknowledged positively.

Overall, gains outnumbered losses, mainly due to improved risk appetite from Trump's trade de-escalation, with tech stocks benefiting from AI and data center themes.

Sectoral Movement Watch

Memory-related stocks broadly rose 6–14%

- Key movers: Micron Technology +6.61%, SanDisk +10.63%.

- Catalysts: Surging AI data center demand and supply chain optimization driving valuations.

III. In-Depth Stock Analysis

1. Intel – Wins Major U.S. Military Contract

Event Overview: Intel secured a $151 billion chip contract under the U.S. Missile Defense Agency’s SHIELD program, becoming an indefinite-delivery supplier. Announced by newly appointed VP James Chew, shares surged nearly 12%, marking a three-year high. Ahead of earnings, shareholder optimism peaked, betting on CEO transformation plans and strong data center demand. Market Interpretation: Analysts believe the deal strengthens Intel’s defense segment, offsetting softness in consumer chips; however, intensifying competition warrants attention to execution risks. Investment Insight: Defense orders provide stable cash flow, offering short-term stock support; long-term investors should monitor AI chip market share trends.

2. Apple – Plans to Transform Siri into Chatbot

Event Overview: Apple plans to upgrade Siri into its first chatbot “CAMPOS” in late 2026, leveraging Google’s Gemini model, running on Google Cloud with TPU chips. Aimed at enhancing voice assistant competitiveness amid the AI wave. Market Interpretation: Analysts note ecosystem integration advantages, though reliance on external models may raise costs; institutions remain positive on long-term iOS ecosystem benefits. Investment Insight: AI enhancements may boost hardware sales; investors should watch June launch timing for competitive assessment.

3. Tesla – Slow Initial Production of Cybercab and Optimus

Event Overview: Musk stated initial production of Cybercab autonomous taxis and Optimus robots will be extremely slow, gradually ramping up. Cybercab features no steering wheel, targeting mass production in 2026; Optimus expected to begin deployment by year-end. Market Interpretation: Wall Street views differ—some worry delays may impact valuation, while others see robotics’ long-term potential; regulatory and technical hurdles remain key risks. Investment Insight: Short-term production bottlenecks may pressure stock; long-term AI applications offer compelling potential for patient investors.

4. Kraft Heinz – Berkshire May Sell 27.5% Stake

Event Overview: Kraft Heinz filed with the SEC to register possible resale of 325 million shares by Berkshire Hathaway, representing 27.5% of total shares. Triggered sell-off concerns, shares down nearly 6%. Stock has fallen 70% from 2017 restructuring highs due to health trends and private label competition. Market Interpretation: Analysts see stake reduction reflecting food sector weakness, with limited fundamental improvement; institutions suggest monitoring consumer behavior shifts. Investment Insight: Major shareholder exits increase volatility; defensive investors should avoid until valuation recovery.

5. Micron Technology – Memory Stocks Extend Strong Rally

Event Overview: Micron rose 6.61%, joining peers like Rambus (+14.38%) and Western Digital (+8.49%) at new highs. Gains fueled by AI data center expansion and supply chain recovery, maintaining multi-day strength. Market Interpretation: Institutions remain bullish—AI demand drives supply tightness; cyclical risks persist if macro slowdown occurs. Investment Insight: High allocation value during tech upcycle; monitor semiconductor inventory levels to avoid overheated entries.

IV. Today’s Market Calendar

Data Release Schedule

| 08:30 ET | U.S. | GDP Growth Rate (QoQ) Final Q3 | ⭐⭐⭐⭐⭐ |

| 08:30 ET | U.S. | GDP Price Index (QoQ) Final Q3 | ⭐⭐⭐⭐ |

| 08:30 ET | U.S. | Initial Jobless Claims (Jan 17) | ⭐⭐⭐⭐ |

| 08:30 ET | U.S. | Continuing Jobless Claims (Jan 10) | ⭐⭐⭐ |

| 10:00 ET | U.S. | Core PCE Price Index (YoY) Nov | ⭐⭐⭐⭐ |

Key Event Outlook

- Earnings Releases: PG, GE, ABT to report Q4 results; focus on guidance for consumer and industrial sectors.

- Fed Speeches: 14:00 – Fed officials comment on rate path, providing clues on easing expectations.

Bitget Research View:

Trump’s trade de-escalation lifted indices like the Dow, though tariff reinstatement risks linger; precious metals extend gains on loose policy and safe-haven demand, with gold projected to reach $4,900/oz; crude remains pressured by oversupply, averaging around $65/barrel, as slowing demand emerges as concern; USD slightly stronger, but analysts project 3% depreciation by 2026 amid accelerating reserve diversification. Overall risk appetite improves, though geopolitical and policy uncertainties remain.

Disclaimer: The above content is compiled via AI search, manually verified and published, not intended as investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News