Buying seafood in Vietnam with USDT: Has Web3 really achieved mass adoption?

TechFlow Selected TechFlow Selected

Buying seafood in Vietnam with USDT: Has Web3 really achieved mass adoption?

Five small things I experienced firsthand in Vietnam's crypto ecosystem.

By: Joe Zhou, Foresight News

Vietnam—a magical country repeatedly mentioned in countless Web3 research reports.

It boasts one of the youngest population structures in the world, extremely high mobile internet penetration, and a financial vitality that resembles wild, unchecked growth. In Chainalysis’ Global Crypto Adoption Index, Vietnam has ranked at or near the top for several consecutive years.

As a long-time observer of the crypto industry, I’ve always wanted to answer one question: What kind of chemical reaction occurs when grand concepts like “crypto payments,” “stablecoins,” and “mass adoption”—often confined to slides and research papers—are actually deployed on the streets of Vietnam?

In late 2025, I arrived on this land. During my two weeks in Vietnam, I didn’t visit high-profile exchanges or attend lavish industry cocktail events. Instead, I lived as an ordinary tourist—hailing rides, getting massages, eating street food.

I recorded five small incidents from my journey. They may not represent the full picture, but they offer the most authentic glimpses into Vietnam’s current Web3 reality.

1: "No international credit cards—only cash or USDT"

At a spa in Nha Trang, our group of 12 was charged $320. At checkout, the merchant stated clearly: 10% discount for cash, full price for Visa or Mastercard.

I was initially annoyed—carrying large amounts of Vietnamese dong cash isn't convenient—and even suspected the owner was overcharging foreigners. But the owner patiently explained, clearing up my misunderstanding.

In Vietnam, international credit card processing fees are high, often 3% or more. More importantly, card payments go through the banking system and trigger additional taxes, while cash payments can bypass these. From the pragmatic perspective of a small business owner, she laid out her difficulties.

In the end, we paid $300 in cash. She saved on taxes; we saved dozens of dollars. A win-win. Of course, the losers were the credit card networks and banks—the middlemen.

Above: The author paying with USD cash

This deeply resonated with me: the global credit card payment system has long been monopolized by a few giants, charging a 3% “toll” on every transaction, with ATM withdrawal fees exceeding 4%. For merchants, this isn’t just a financial cost—it’s also a compliance burden.

Since businesses naturally favor the US dollar, theoretically, their acceptance of “digital dollars” (stablecoins) should also be promising—as long as the payment tool can solve the “last mile” problem: instantly converting USDT into Vietnamese dong.

With this hypothesis in mind, I began my hands-on crypto payment experience across Vietnam.

2: Stablecoin Payments in Vietnam—The Dawn of Mass Adoption

When Vietnamese merchants accept physical US dollars, are they ready to accept dollar-pegged stablecoins?

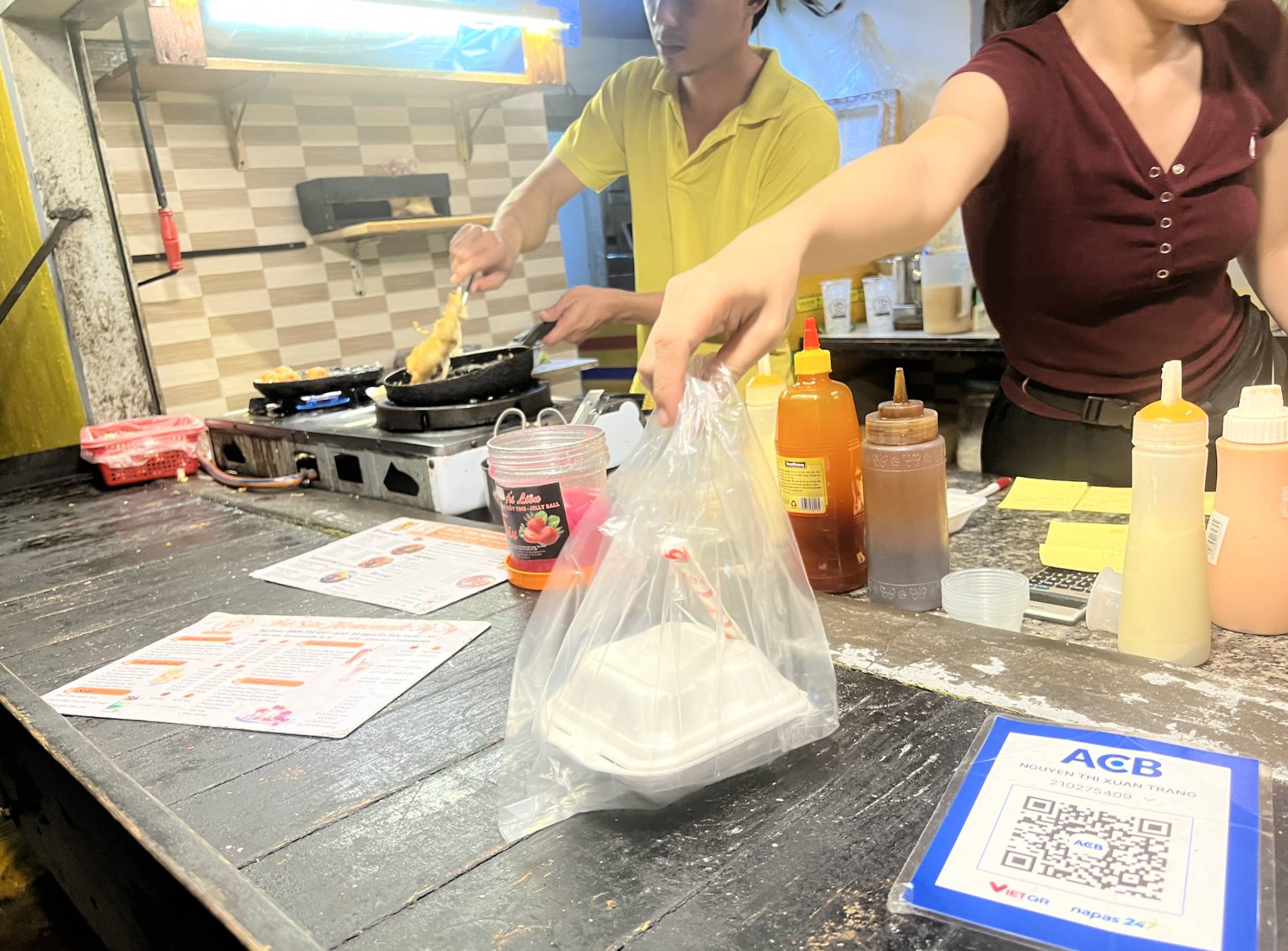

On my journey, I deliberately tried living solely with Bitget Wallet. Grab rides, street food, spa treatments, seafood feasts—I was surprised to find that as long as the merchant had VietQR (Vietnam’s universal payment QR code), I could usually scan and pay directly through my wallet, with funds instantly converted and settled. And VietQR is visible almost everywhere in Vietnam.

I say “usually” because I discovered a notable bug in crypto payments—one I’ll discuss in Chapter 3.

Above: VietQR (bottom right), ubiquitous across Vietnam, can be scanned directly via Bitget Wallet

Without exaggeration, crypto payments in Vietnam now feel indistinguishable from Alipay.

I’d heard about it before, but experiencing it firsthand was still astonishing. Cryptocurrency wallets like Bitget Wallet are integrated at the backend with aggregated payment networks such as Aeon Pay, transforming crypto from a speculative asset into real purchasing power, directly reaching tens of millions of merchants across Vietnam and neighboring countries.

Of course, this seamless experience rests on Vietnam’s highly unified and widespread QR code payment system (VietQR). It’s the infrastructure; crypto payments are the new blood running on top.

Yet frequent usage eventually revealed that Bitget Wallet’s QR scanning isn’t foolproof. Once, I truly encountered a bug.

3: A Failed Crypto Payment Reveals a “Real-World Bug”

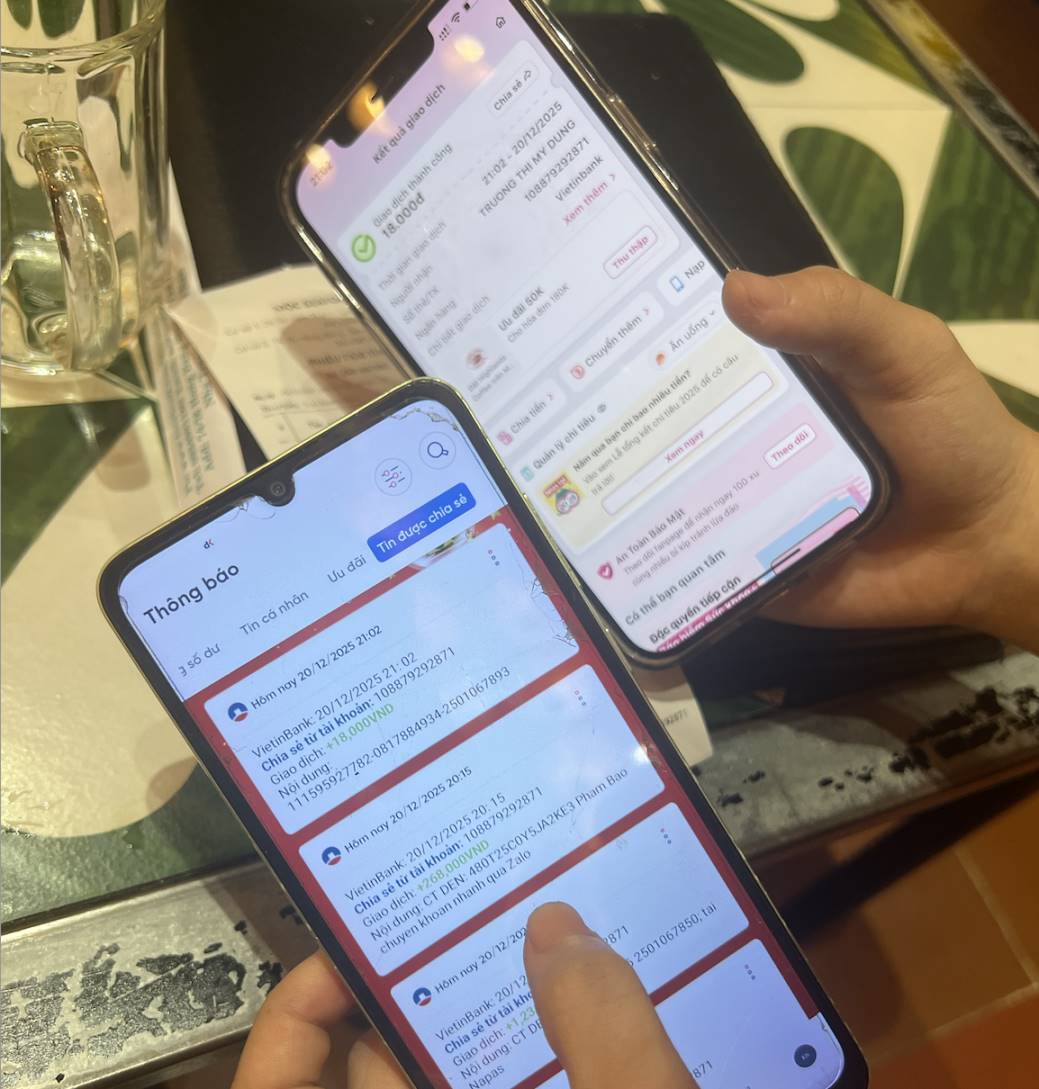

On December 20, 2025, I dined again at Moc Seafood, a well-known restaurant in Nha Trang. The first two times I paid in cash and by credit card. This time, I decided to try paying with Bitget Wallet.

But this “challenge” failed.

The reason? The merchant displayed not the standard VietQR aggregated code, but a printed QR code from an internal or outdated banking system. My wallet showed successful deduction, but after the on-chain transfer completed, the merchant received no voice alert or confirmation of receipt.

She demonstrated on her own phone: when she scanned with her local banking app, the payment arrived instantly.

Above: Author’s failed crypto payment attempt, while staff member successfully completes payment via local bank scan

Helplessly, she showed me their verification method: scanning with a local financial app results in instant settlement.

The loss of a few dollars became tuition for this experience. This minor incident reminded me that crypto payments remain fragile in the real-world “last mile.” Missing compatibility protocols, delayed merchant-side confirmations, and the cognitive gap between user-side “deduction = success” and merchant-side “receipt = success” are all potholes that must be filled on the road to mass adoption.

4: To Ordinary People, Cryptocurrency Remains “Gray”

Technology commercialization depends not only on code maturity but also on cultural acceptance.

Despite its youthful demographics, among the general public, crypto doesn’t have a positive image—especially in northern Vietnamese cities. In Hanoi, I spoke with locals including currency exchangers, motorbike taxi drivers, and university students. Their immediate association with cryptocurrency was strikingly consistent: money laundering, gray-market activities, gambling.

To them, it’s not the “future of the internet” or “the future of finance,” but rather a tool to evade regulation.

On the bustling streets of Hanoi and Nha Trang, I could hardly find a Bitcoin ATM or physical OTC exchange shop. This stands in stark visual contrast to places like Hong Kong, Japan, or Georgia—where neon signs of crypto exchanges proudly occupy prime spots on commercial streets.

On one hand, top-ranked in global on-chain data; on the other, nearly invisible in the physical world. This complete online-offline split vividly illustrates a “Vietnamese-style crypto fold.”

5: In a Driver’s Car, I Found a Binance Hat

A chance discovery peeled back a corner of Vietnam’s crypto world.

During a Grab ride, my colleague noticed a hat with the Binance logo casually placed on the dashboard of our young driver. When he saw us looking, the driver grinned, pulled out his phone, and confidently showed us the Binance app running on his screen.

This moment made me realize that cryptocurrency in this country isn’t just an underground current—it’s penetrating everyday life with remarkable vitality. Multiple public datasets indicate that over 20 million people in Vietnam have held or used digital assets. With a large youth demographic (e.g., ages 10–24 making up a significant portion of the population), this significantly drives digital asset adoption and the formation of Web3 usage habits.

This penetration shows a fascinating “north-south divide” geographically.

A university student in Hanoi told me that northern and southern Vietnam have fundamentally different attitudes toward money: Northerners, represented by the capital Hanoi, are conservative, prefer saving, and plan ahead. Southerners, led by economic hub Ho Chi Minh City, are heavily influenced by Western business culture, accustomed to spending in advance, and highly receptive to new things.

This explains why the vast majority of Chinese Web3 professionals—whether media, VCs, or blockchain game developers—choose to settle in Ho Chi Minh City when in Vietnam.

Here, low labor costs collide with high-return crypto economies, turning Vietnam into a paradise for geographic arbitrage in “play-to-earn” gaming. Many young people by day are regular office workers; by night, they transform into “gold-farming worker ants” on the blockchain.

If point four of this travelogue revealed the public’s “bias” against crypto in northern cities, then on the streets of Ho Chi Minh City, my friends described the nation’s “frenzy” for cryptocurrency.

Vietnam has a strong coffee culture. In crowded cafes like Highlands Coffee or The Coffee House, my friend witnessed a hardcore scene: among rows of young people typing on laptops, not all screens displayed games or social apps—Binance candlestick charts and even black windows of Solidity code editors appeared frequently.

Data doesn’t lie. According to Chainalysis’ Global Crypto Adoption Index, Vietnam has ranked at or near the top for several consecutive years. It possesses the perfect “golden demographic structure”—tens of millions of young people eager to climb the social ladder, digitally savvy, and unburdened by faith in traditional banking systems.

This gives Vietnam a curious “folded” character:

On the street, a motorbike taxi driver might tell you crypto is a “money laundering tool”; yet in a back-alley café, a young developer might be building the next Axie Infinity (the viral Web3 game born in Vietnam).

This bottom-up vitality may be the truest color of Vietnam’s Web3 landscape. There are no grand financial centers, but every crowded café could be a Web3 node; behind the wheel of every Grab speeding through the rain, there might sit a young man waiting for the next Bitcoin bull run.

Conclusion: Seeking the Next Decade’s “Alpha”

These five small stories are merely the tip of the iceberg in my observation of Vietnam.

The journey is far from over. Next, I will dive deep into Ho Chi Minh City—the “southern economic heart”—climb the highlands of Da Lat (“Vietnam’s Dali”), cross the coastal hub of Da Nang, and finally reach Phu Quoc Island at the southern tip.

After visiting dozens of countries and having repeated conversations with long-term local experts and Vietnamese nationals, I am increasingly convinced of one judgment: Over the next decade, Vietnam will be one of—if not the most—promising economies globally. Its youthful population, relentless upward ambition, and relatively open societal attitude toward foreign ideas form a rare soil—the ideal ground for nurturing new technologies.

I will continue walking across this vibrant land and neighboring countries—not just as a tourist, but as an observer—exploring the real state of Web3’s growth in Southeast Asia.

Stay tuned. Our exploration continues.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News