Why is Web3 not far from mass adoption?

TechFlow Selected TechFlow Selected

Why is Web3 not far from mass adoption?

The popularization of Web3 finance, or rather, the advancement of compliance in traditional financial sectors and the PayFi sector.

By JamesX

Why do I believe Web3 is close to Mass Adoption⁉️

Or rather, the endgame of Web3 Mass Adoption is actually Web2.5.

And here’s an introduction to several projects and product concepts that can truly drive Web3 toward Mass Adoption👇

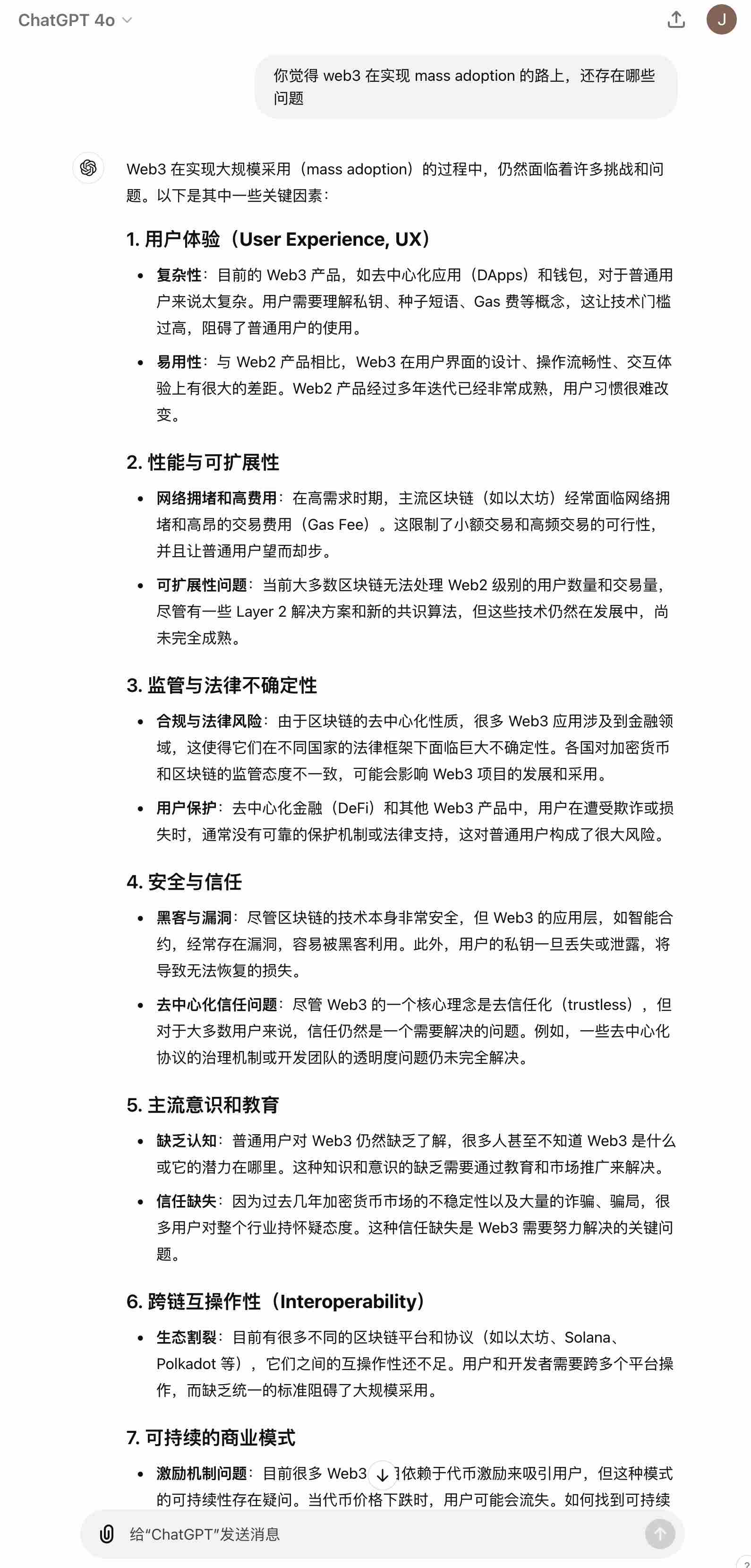

The image below shows the response I got when I asked GPT: "What are the remaining challenges on Web3's path to Mass Adoption?"

To be honest, it's spot-on—essentially hitting all the industry's pain points. Among them, issues 3 and 5 are hard to solve purely through product innovation within the industry, but the rest are being continuously optimized by various teams.

Recently, through my own usage and research into other reports and data, I’ve discovered several standout projects that are bringing Web3 significantly closer to Mass Adoption. So I’ll briefly share this with everyone in the industry.

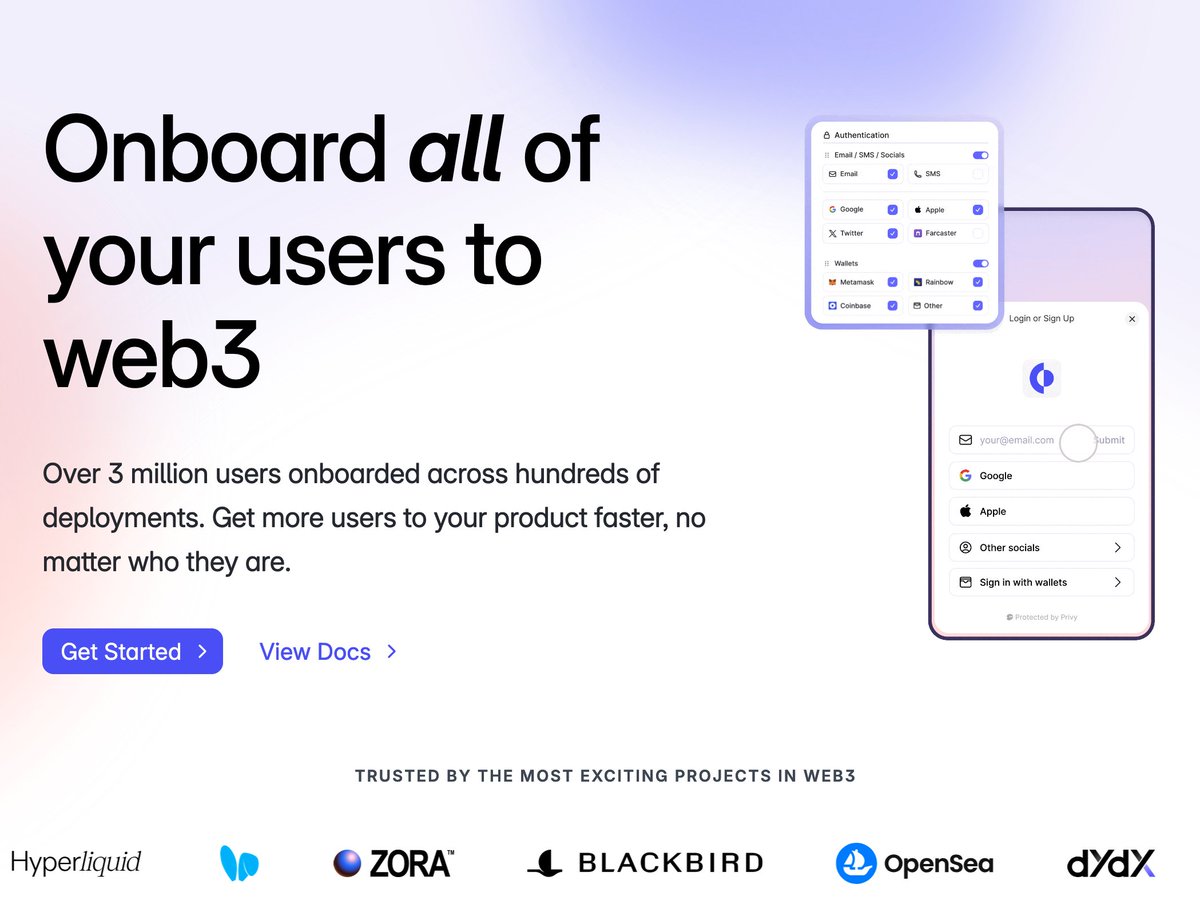

1. Why Should Web3 Platform Login Require a Wallet?

"Connect wallet" and the one-wallet-one-account experience have long been considered by Web3 practitioners as a core advantage over Web2.

Yet this remains the biggest barrier preventing most users from trying Web3 platforms, due to the high learning curve and risks involved in acquiring initial on-chain assets and using Web3 wallets.

So why not adopt a Web2.5 mindset? Let users access and register on Web3 platforms without needing a Web3 wallet at all. Combined with increasingly refined Account Abstraction (AA) wallet products, users could enter the Web3 world seamlessly within non-custodial or non-exchange Web3 applications.

In this direction, the leading product today is privy_io, which supports nearly all Web2 and Web3 account login systems and already has over 3 million users.

If you're someone who actively tries new Web3 products, you've likely noticed how widely Privy’s login/account/wallet components have been adopted across recent Web3 apps—and how smooth the user experience is.

I’ve even seen apps with zero need for Web3 asset interactions using Privy’s login component just to attract high-net-worth Web3 users. Clearly, Web2 and Web3 aren’t isolated worlds. Once UX becomes seamless enough, why should accessing Web3 platforms require a wallet?

I’ll go further with a bold prediction: we might soon see DeFi platforms (or on-chain financial platforms) where users don’t need a Web3 wallet at all—enabling one-click operations from traditional payment accounts (PayPal, Apple Pay, credit cards) to receiving on-chain assets and depositing them directly into protocols. (Of course, this depends on the evolution of the PayFi narrative, which we’ll discuss later.)

2. Cross-Chain Interoperability & Multi-Chain Account Management—A Sector Bound for Unification at the UX Level

The liquidity fragmentation between Ethereum’s ecosystem (especially its L2s) and other architectures like Solana, Move-based chains, and even Bitcoin remains a major pain point for on-chain user experience.

Recently, a much-discussed project in the Chinese-speaking community, dAppos, launched "intendasset"—an additional multi-chain operable asset type created via asset staking, helping users bypass high cross-chain fees and complex procedures.

But I’d argue this is still a semi-centralized model. In fact, another player in the ecosystem is better positioned to offer similar services: CEXs (centralized exchanges).

Here’s why:

1. The user experience of depositing assets to dAppos for custody isn’t significantly different from depositing to a CEX.

2. CEXs, especially top-tier ones, are already the largest players in cross-chain liquidity management and services.

3. CEXs inherently prefer keeping user funds off-chain. By staking assets with a CEX, users could receive an “intendasset” usable across chains—keeping more value locked within the exchange’s ecosystem.

4. Leading CEXs currently offer stronger compliance and financial security assurances. (This excludes those prone to collapse or issuing dubious synthetic assets.)

However, given the psychological scars left by FTX’s collapse, whether this CEX-driven narrative will gain traction remains debatable. Feel free to comment below—I already expect some will call this idea nonsense.

Clarification: I’m not dismissing cross-chain interoperability protocols and bridges. But current solutions still fall short in UX, fees, and security. I remain hopeful for more native, decentralized, trustless on-chain solutions in the future.

Another key pain point for multi-chain users is managing wallets across multiple ecosystems and chains. While major wallets like OKX Wallet and Phantom now support multi-chain management (EVM, BTC, Solana, etc.), users still need to manually open their wallet, click the address bar, and copy specific addresses when sending or receiving funds.

Though EVM has ENS-style address abstraction (.BNB, .ARB), and Solana offers .SOL, users ultimately want a single service for cross-ecosystem address management.

DeBank offers a Web3ID minting service, but the ~$100 registration fee turned me off—and requiring users to first deposit assets to DeBank’s L2 makes the UX poor.

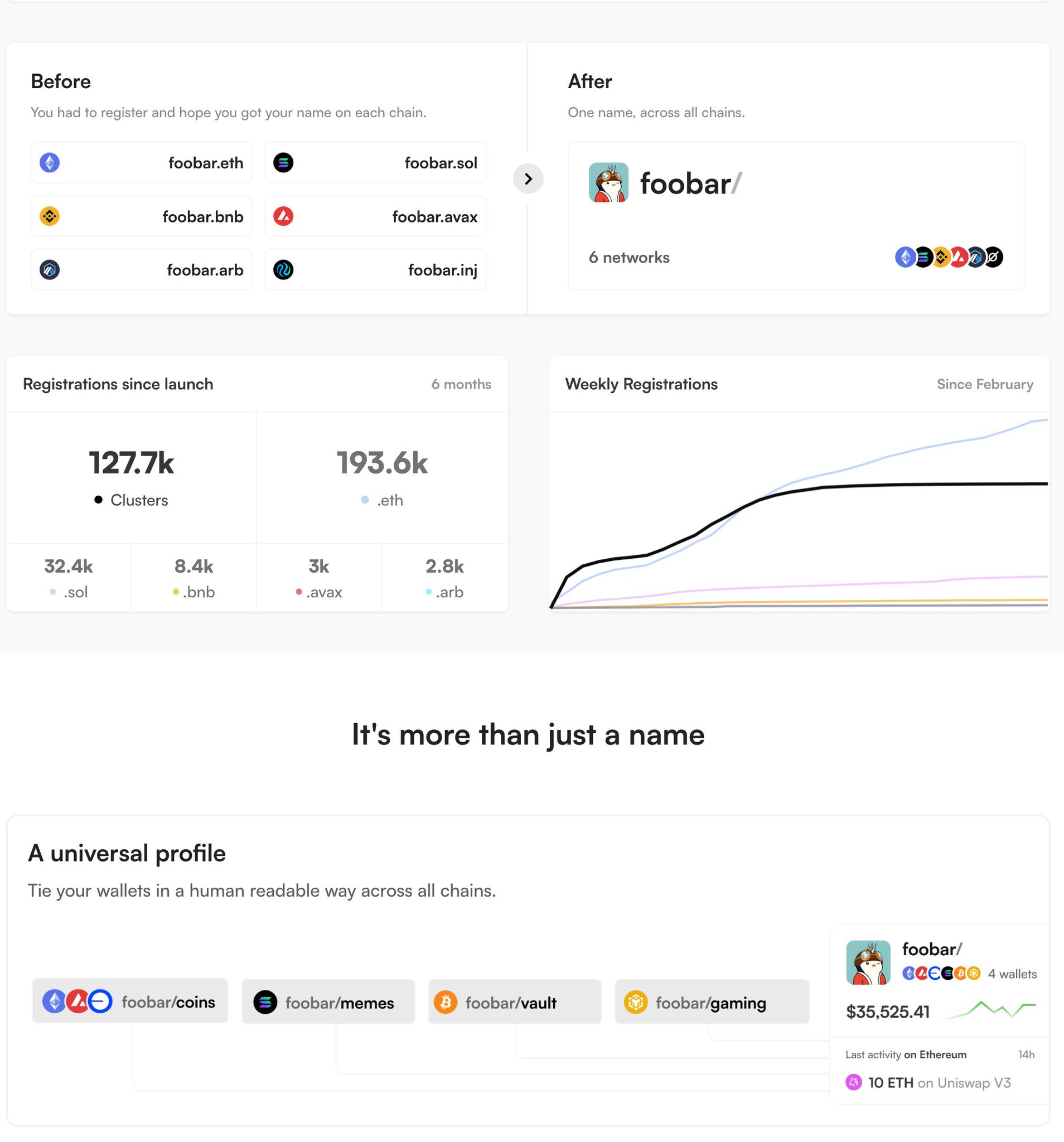

That changed when I recently discovered clustersxyz.

Cluster is an All-Chain Name Service built on LayerZero. Its logic is simple: users register a handle like “jamesx/” and bind a primary wallet. They then instantly generate managed wallet addresses across multiple chains. To send funds to my Solana address, you simply input “jamesx/sol,” and integrated apps resolve it to my actual Solana address.

A single “xxxx/” handle currently auto-generates addresses for 8 major Web3 ecosystems: /evm, /sol, /btc, /ripple, /aptos, /doge, /tron, /cosmos.

As long as enough protocols integrate Cluster’s address resolution, the UX becomes extremely convenient. At a minimum registration cost of ~0.01 ETH (~$30), it’s far more competitive than individually registering .xxx domains and lacking unified management tools.

Notably, Clusters’ founder is the same person behind delegatedotxyz—bringing strong industry credibility and connections to accelerate adoption, backed by LayerZero.

My hope for the future: I can use any “jamesx/xxx” as a universal receive address (and with deeper integration like Privy, even email addresses could become crypto receive endpoints). And when managing multi-chain assets, cross-chain transfers should feel as easy as moving funds between accounts on a CEX.

3. What Truly Sets Web3 Social Apart from Traditional Social Apps?

Web3 Social is an unavoidable topic on the road to Web3 Mass Adoption. Hyped ecosystems like TON/Telegram and Farcaster (which recently raised at a $1B valuation) carry high expectations.

Many believe Web3 Social’s core lies in “decentralization,” “censorship resistance,” or “immutable on-chain storage.” But I disagree.

Let me highlight two fundamental differences between Web3 and Web2 social that many users and even practitioners overlook.

Difference One (already recognized by many): Web3 Social enables the creation of entirely new asset types at the foundational level.

This is intuitive—most Web3 social projects are built on public blockchains, making asset issuance effortless. Early examples include NFT-gated social apps (requiring NFT ownership to join) and token-gated communities (requiring specific tokens/NFTs to access groups)—all based on pre-existing assets.

Then came the realization: issuing new assets creates additional value. This gave us Friend.tech’s fan keys, Farcaster’s DegenTips token drops, and countless “tap-to-earn” or “connect-to-earn” projects on Telegram launching new tokens for users.

These models created real wealth effects and breakout moments, raising user expectations—not just for social interaction, but for financial upside.

This is something Web2 platforms simply can’t replicate. Imagine if I could airdrop a tradable asset to Snowball App users—the regulatory and platform implications would be explosive.

Difference Two (largely overlooked): Accessibility of social data and a fundamental shift in app development logic.

In traditional social media, each app is a data silo. Each requires its own account and data infrastructure, and most don’t offer open data APIs. Those that do—like Twitter—charge high fees, forcing third-party tools (e.g., Twitter analytics platforms) to charge premium subscriptions just to cover data costs.

Telegram follows a similar model. It provides limited data APIs for mini-app developers, but since it’s a messaging app, sensitive data like contact lists or chat logs remain private. As a result, TON-based apps built on Telegram can only access basic user info for things like token airdrops.

Compare this to Farcaster—a Web3 social protocol explicitly designed as an open alternative to Twitter. For developers, it’s like having full access to every user’s public data. Any developer in the Farcaster ecosystem can retrieve a user’s public posts, likes, comments, and reposts to build their own social app.

Beyond the official Warpcast client, we already see alternatives like TakoProtocol’s Takocast, independent developer 0xHaole’s recaster, and over a dozen other specialized clients—all offering unique UIs, recommendation algorithms, and integrated on-chain features.

Each provides a distinct experience, yet every user can access the entire Farcaster network through any client (though some may filter content algorithmically).

This development model is revolutionary. Outside of companies owning multiple platforms (e.g., Facebook, Instagram, Threads), such open, composable social app ecosystems are impossible in Web2.

Here’s a stark example: if Twitter were built on a Farcaster-like Web3 protocol, I could develop a “Twitter Horny Edition” app whose algorithm only recommends NSFW content. No need to grow creators—it simply curates existing public data.

This is Web3 Social’s true disruption: open data access and frictionless app development. Just as BTC/ETH created an open, decentralized financial infrastructure, protocols like Farcaster are building an open foundation for social interaction, content, and identity—one whose ecosystem could eventually rival or surpass DeFi and the broader crypto space.

And crucially, these benefits don’t require tokens. Users can engage directly. Tokens or new assets are merely early-stage incentives.

For instance, I could build not a social app, but an e-commerce platform that uses your social data, social graph, or even on-chain assets to recommend products and services tailored to you.

(Of course, user privacy concerns will evolve alongside regulations and technical standards to meet broader needs.)

4. Web3 Finance’s Path to Mass Adoption Lies in Traditional Finance’s Compliance Push and the PayFi Narrative

Two core narratives underpin Web3 finance:

a. Cryptocurrencies gaining recognition as legitimate stores of value and investment assets—this is the foundational crypto thesis, so I won’t dwell on it.

b. On-chain assets disrupting traditional off-chain payment systems by serving as settlement or payment tools.

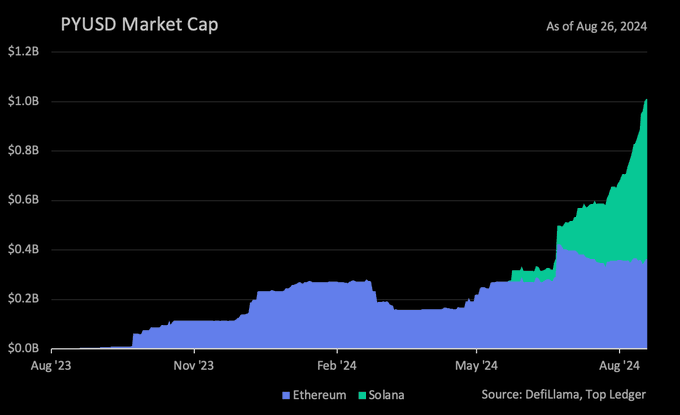

On this front, pay attention to PYUSD—the USD-pegged stablecoin issued by PayPal, a leader in North America’s payment infrastructure. Few in China use it, but its growth metrics are worth watching. Last I checked, its supply had already surpassed $1 billion.

Anyone familiar with North American markets knows that once PayPal commits, it can rapidly deploy PYUSD across its vast payment network.

Moreover, PayFi involving offline payments demands strict local compliance (think China’s digital yuan). Only institutions with deep traditional finance ties or local resources can succeed here—making it unsuitable for small dev teams (unless operating in gray areas).

Will DeFi yield opportunities continue to grow? Personally, I think the narrative has plateaued. Look at semi-centralized projects like Ethena or MakerDAO’s SKY upgrade—they still rely on centralized financial teams. As the sector matures, stricter regulatory oversight is inevitable. True DeFi is best suited for simple, transparent yield mechanisms like over-collateralized lending.

However, once companies like PayPal streamline the fiat-to-on-chain USDC onboarding process, DeFi usage and data will likely surge—helping solve Web3’s high entry barrier.

Thus, the widespread adoption of Web3 finance is inevitable—but it won’t be driven by DeFi. Instead, it will come from traditional financial institutions enabling “on-chain finance.”

In summary, here’s my outlook on Web3’s path to Mass Adoption:

1. Web2-like login and account experiences for users.

2. Seamless cross-chain/cross-ecosystem asset transfers and improved address management.

3. An open Web3 social infrastructure enabling a new wave of social app development.

4. Everyday on-chain financial transactions powered by traditional finance players (PayFi).

Looking back, though—should we still call this Web3? Or is Web2.5 a more fitting name?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News