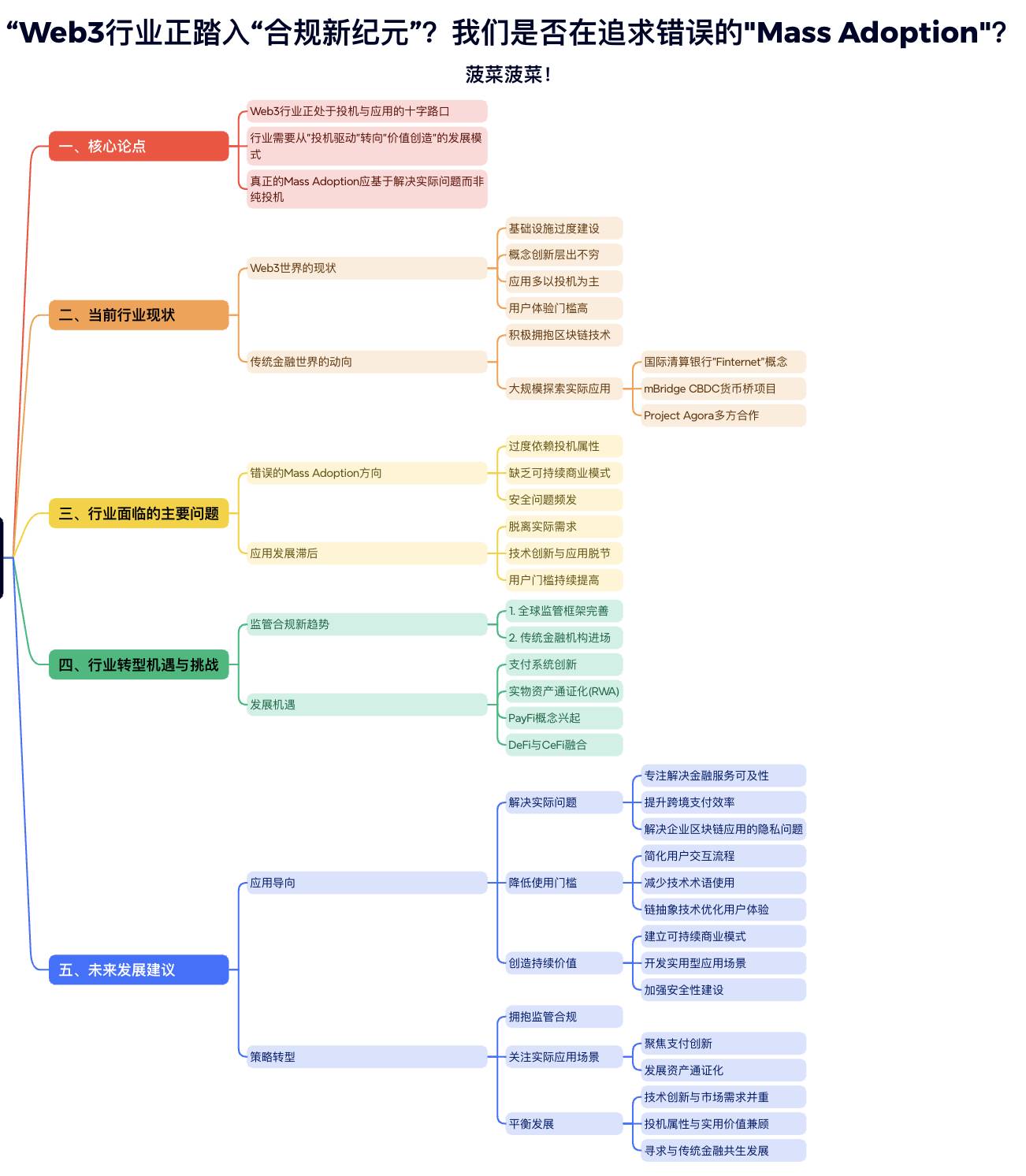

Is the Web3 industry entering a "new era of compliance"? Are we pursuing the wrong kind of "mass adoption"?

TechFlow Selected TechFlow Selected

Is the Web3 industry entering a "new era of compliance"? Are we pursuing the wrong kind of "mass adoption"?

The tipping point for Mass Adoption of Web3 applications has arrived.

By Bo Cai

Recently, discussions around Ethereum FUD have been heating up across the industry. Not long ago, a three-hour Twitter Space debate titled "What's Wrong With Ethereum?" took place, in which I participated fully and heard many insightful perspectives. From the strategic dynamics between Ethereum and Layer2s to ideological, organizational, and historical reflections, I gained a comprehensive understanding of the current challenges facing Ethereum and the broader ecosystem. It was clear that people’s criticism comes from a place of deep care — love so deep, it hurts.

During the discussion, I had already begun forming my own thoughts, yet hesitated to speak out. I knew my views diverged significantly from those of most Web3 natives, and feared backlash — fully aware of how toxic the community atmosphere can be. So I remained silent throughout. But afterward, I decided to step forward and share my perspective, offering what might be an unconventional lens through which to examine Ethereum and the industry’s current struggles — particularly from the often-overlooked angle of real-world applications. While this viewpoint may not be mainstream, I believe only honest and rational dialogue can push the industry toward healthier growth.

This is a long read, so I’ve included an AI summary below for those who prefer a quick overview:

Background

Before diving into my argument, let me briefly explain my current professional context. Many followers may have noticed that my output has slowed considerably over the past year, and I’ve become less vocal about industry trends.

The reason is that for the last 12 months, I’ve served as a founding member at Ample FinTech, a Singapore-based startup, deeply involved in tokenization and cross-border payment projects with central banks from three countries. This experience has shifted my mindset beyond pure Web3 circles, directing my attention toward the strategic moves of global central banks and traditional financial institutions.

During this time, I spent significant effort studying research papers and reports on blockchain and tokenization published by traditional financial players, learning about their active projects. At the same time, I stayed engaged with Web3 developments via Twitter and conversations with peers. By observing both worlds simultaneously — Web3 innovation and traditional finance transformation — I’ve built a more holistic cognitive framework, giving me a different vantage point on the industry’s future.

Two Divided Worlds

This dual perspective has made one thing increasingly clear: there’s a growing disconnect between these two ecosystems in terms of culture and development trajectory.

In the Web3 world, the prevailing sentiment is frustration. We see ever-more technical infrastructure emerging, accompanied by a flood of new concepts and jargon that deliberately increase complexity and raise entry barriers. Most of these efforts seem geared toward impressing Vitalik or launching exchange-traded tokens (TGEs), after which the projects often turn into ghost towns. As for actual utility? Who really cares?

Recently, criticism has intensified around Vitalik and the Ethereum Foundation. More voices are arguing that they’ve become overly obsessed with “technical purity” and ideological ideals — pouring energy into protocol minutiae while showing little interest in user needs or commercial viability. This trend has sparked widespread concern within the industry.

During the Space discussion, Meng Yan @myanTokenGeek insightfully referenced the history of the internet, pointing out that a tech-centric, market-averse path is ultimately unsustainable. If Ethereum continues down this route, such concerns are well-founded.

Yet when we look outside the crypto bubble, the picture looks strikingly different. Traditional financial institutions and governments are undergoing a major shift in attitude toward Web3 technologies. They’re no longer dismissing blockchain but actively embracing it as a transformative upgrade to existing financial systems. This isn’t just about recognizing technological potential — deeper still, it reflects a sense of urgency driven by the disruptive threat Web3 poses to the status quo.

In 2024, a landmark turning point emerged: the Bank for International Settlements (BIS), often called “the central bank of central banks,” formally introduced the concept of “Finternet” — the Financial Internet.

This move carries profound implications. By positioning tokenization and blockchain as the next paradigm for global monetary systems, BIS ignited a firestorm of attention across traditional finance, making it one of the sector’s hottest topics.

It wasn’t just a slogan. It was a powerful endorsement of blockchain and tokenization from the heart of the global financial establishment. The ripple effects were immediate: central banks and financial institutions worldwide accelerated efforts in building tokenized infrastructure, digitizing assets, and deploying real-world payment solutions.

But this wasn’t a rash decision. Behind it lay years of rigorous research. I traced BIS’s intellectual journey and found a clear progression: as early as 2018, the institution began systematically studying Web3, publishing dozens of highly technical research papers.

In 2019, BIS took a decisive step — launching the BIS Innovation Hub to run experimental blockchain and tokenization projects. These deep dives led them to a crucial realization: blockchain and tokenization hold transformative power capable of reshaping the entire global financial architecture.

One of BIS’s most notable initiatives is mBridge — a cross-border CBDC payment bridge co-launched in 2019 by the BIS Innovation Hub Hong Kong Centre, the People’s Bank of China, Hong Kong Monetary Authority, Bank of Thailand, and Central Bank of the UAE. Technically, mBridge is a public permissioned chain based on EVM, where participating central banks serve as nodes, enabling direct cross-border settlement of central bank digital currencies (CBDCs) on-chain.

However, history took an unexpected turn. Amid rising geopolitical tensions — especially following the Russia-Ukraine conflict — this originally efficiency-driven project became a critical tool for BRICS nations to circumvent SWIFT sanctions.

Faced with this shift, BIS chose to step back from mBridge. Recently, Russia leveraged this foundation to officially launch BRICS Pay, a blockchain-based international payment and settlement system, placing blockchain technology squarely at the forefront of geopolitical competition.

BIS’s other major initiative is Project Agora — the largest public-private collaboration in blockchain history. It brings together an unprecedented coalition: seven major central banks (the U.S. Federal Reserve, Banque de France representing the EU, Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, and Bank of England), along with over 40 global financial giants including SWIFT, VISA, MasterCard, and HSBC.

Such massive multinational coordination has a surprisingly focused goal: using blockchain and smart contracts to build a unified global ledger system that enhances — rather than disrupts — the current financial order. This is a strong signal: blockchain momentum is unstoppable, and traditional finance has moved from observation to full-scale adoption and implementation.

Meanwhile, the Web3 industry continues shouting slogans about Mass Adoption while obsessing over meme coins and short-term attention games. This stark contrast raises a fundamental question: as traditional institutions take concrete steps toward large-scale blockchain deployment, should Web3 reevaluate its own direction?

Mass Adoption: Casino or Application?

In light of this divergence, we must ask: what does true Mass Adoption actually mean? The term is thrown around constantly in Web3, yet everyone seems to define it differently.

Looking back at recent so-called “breakout” projects in Web3, a troubling pattern emerges: nearly all of them are speculative games disguised as innovation. Whether endless meme coins, GameFi-labeled P2E schemes (like the once-popular running shoe app), or SocialFi experiments like Friend.tech, upon closer inspection, they’re all just repackaged versions of digital casinos. Despite attracting waves of users, none truly solve real user problems.

If Mass Adoption simply means getting more people to speculate, pump token prices, and enrich insiders, then it’s merely a zero-sum game — wealth concentrated among a few. Its unsustainability is obvious.

I’ve personally seen countless friends outside crypto lose everything entering this space. Very few succeed. Recent data confirms this: a chain analyst recently found that on pump.fun, only 3% of users earned over $1,000 in profit. That cold number reveals speculation is a game for the extremely lucky few.

Even worse, the industry has become a breeding ground for hackers, phishing attacks, and scams. It’s common to see tweets about whales losing millions due to permit exploits. For average retail investors, it’s even riskier. According to the latest FBI report, Americans lost over $5.6 billion to crypto scams in 2023 alone — and shockingly, 50% of victims were aged 60 or older. In this “dark forest,” ordinary investors’ interests remain unprotected.

As speculation and hacking grow rampant, the environment deteriorates further. Are we chasing the wrong version of Mass Adoption? In our obsession with hype, have we ignored sustainable value creation?

To be clear, I’m not dismissing speculation entirely. Most people enter crypto seeking returns — that motivation is natural and will persist. Speculation won’t disappear. But Web3 shouldn’t and cannot remain just a global casino. It must evolve to deliver real, sustainable applications.

Among all possible use cases, payments and finance stand out as the most promising areas for Web3. This consensus now spans traditional finance, governments, and markets alike. We’re seeing serious exploration in payment innovation, real-world asset tokenization (RWA), DeFi-CeFi integration, and emerging concepts like PayFi. These efforts clearly reflect where market demand is strongest.

In my humble opinion, the core issue for Ethereum or the industry isn’t whether the technical direction is correct — it’s whether we truly understand what constitutes valuable application. When we obsess over technical upgrades but ignore user needs; when we chase buzzwords instead of real-world relevance — is that really progress?

This leads to a deeper concern: if we continue on this path, could it be that the very legacy systems we aimed to disrupt — traditional finance, SWIFT — end up becoming the main drivers of blockchain adoption? Could it happen that permissioned public blockchains led by governments and financial institutions dominate real-world use cases, while public chains are relegated to niche “speculation playgrounds”?

While Web3 remains focused on Solana and other Ethereum challengers, few seem to notice that traditional finance has already sounded the charge. Facing this seismic shift, should Ethereum and the wider industry rethink not only current strategies, but also how to position themselves amid the coming wave of regulation and institutionalization? That may be the real test ahead.

Observing these trends, I’ve come to the following conclusions about a healthy, sustainable path to Mass Adoption:

First, solve real problems: Whether infrastructure or applications, we must start from real needs — addressing genuine pain points. Billions of people and small businesses still lack access to financial services. Privacy issues plague enterprise blockchain adoption. The value of tech innovation must be proven by solving tangible problems.

Second, lower the barrier to entry: Technology should serve users, not create obstacles. The endless jargon and complexity in Web3 today hinder true mass adoption. We need to make tech accessible — for example, leveraging Chain Abstraction to improve user experience.

Third, create lasting value: Sustainable growth requires business models rooted in real value, not speculation. Only projects that generate real utility — like Web3 payments, PayFi, RWA — will survive long-term market scrutiny.

Technical innovation matters, no doubt. But we must remember: application is the primary productive force. Without real-world usage, even the most advanced infrastructure is just castles in the air.

The Tipping Point for Web3 Application Mass Adoption Has Arrived

Throughout history, attempts to connect blockchain with the real world have repeatedly failed — blocked by immature tech, regulatory hurdles, or poor timing. But now, conditions are aligning like never before: infrastructure is maturing, traditional finance is actively exploring applications, and global regulatory frameworks are taking shape. All signs suggest the next few years could mark a pivotal breakthrough for Web3 application adoption.

At this juncture, regulation is both the biggest challenge and greatest opportunity. Clear signals indicate Web3 is transitioning from its “wild west” phase into a new era of compliance. This shift doesn’t just promise a more orderly market — it heralds the beginning of sustainable, long-term growth.

This transformation is visible across multiple dimensions:

1. Maturing Regulatory Frameworks

-

Hong Kong launched a comprehensive Virtual Asset Service Provider (VASP) regulatory regime

-

The EU’s MiCA regulation officially came into effect

-

The U.S. FIT21 Act passed the House of Representatives in 2024

-

Japan revised its Payment Services Act to provide clear definitions for crypto assets

2. Institutional Participation Under Regulation

-

Major asset managers like BlackRock launched Bitcoin and Ethereum ETFs

-

Traditional banks began offering custody services for crypto firms and issuing tokenized deposits

-

Mainstream payment companies introduced compliant stablecoins

-

Investment banks established dedicated digital asset trading desks

3. Compliance Upgrades in Infrastructure

-

More exchanges proactively applying for regulatory licenses

-

Widespread adoption of KYC/AML solutions

-

Rise of regulated stablecoins

-

Privacy computing applied in compliant scenarios

-

Launch of central bank-grade blockchains (e.g., CBDC bridge mBridge, Singapore’s Global Layer 1, BIS Project Agora)

4. Regulatory Pressure and Project Compliance Shifts

-

MakersDAO pivoting to Sky and embracing compliance

-

FBI conducting sting operations against meme coin market makers

-

DeFi protocols increasingly adopting KYC/AML measures

Under these trends, we are witnessing:

-

More traditional financial institutions entering Web3 through acquisitions or partnerships

-

Traditional players gaining pricing control over Bitcoin via BTC ETFs

-

A new wave of compliant Web3 applications rapidly emerging

-

The industry gradually establishing order under regulatory pressure, reducing get-rich-quick opportunities

-

Stablecoins shifting from speculative tools to practical uses like international trade

There’s no doubt: the future battlefield of blockchain will center on key domains — payment innovation, real-world asset tokenization (RWA), PayFi, and the convergence of DeFi with CeFi. And this reality presents an unavoidable truth: to achieve breakthroughs in real applications, the industry must directly engage with regulators and traditional financial institutions. This isn’t optional — it’s the inevitable path forward.

The fact is, regulation sits atop the ecosystem. This isn’t opinion — it’s a law repeatedly proven over more than a decade of crypto evolution. Nearly every major industry inflection point has been tied to regulatory policy.

So we must confront some fundamental questions: Do we embrace regulation and seek coexistence with the existing financial system? Or do we cling to decentralization dogma and linger in regulatory gray zones? Do we pursue a casino-style Mass Adoption — repeating the speculation-driven cycle of the past decade — or commit to creating real, lasting value that fulfills blockchain’s transformative promise?

Currently, Ethereum faces a clear structural imbalance: relentless accumulation of infrastructure and technical innovation on one side, and a relatively stagnant application layer on the other. Against this backdrop, Ethereum confronts dual threats: first, aggressive new public chains like Solana challenging it in performance and UX; second, compliance-focused permissioned chains backed by traditional finance encroaching on real-world use cases.

The situation is even more complex: Ethereum is squeezed from both sides. On one flank, Solana and others leverage superior speed to capture mindshare and user attention in the meme economy. On the other, regulated, permissioned chains — armed with inherent compliance advantages and massive user bases — are steadily expanding into payments and asset tokenization, potentially securing first-mover advantage in these critical sectors.

How can Ethereum break through this pincer movement — maintaining technical leadership without sacrificing market relevance? These are the essential challenges it must confront to secure its future.

The above views are strictly personal opinions intended to spark constructive dialogue. As participants in this space, we all have a responsibility to help guide Web3 toward a healthier, more valuable future.

Given the limits of individual perspective, I welcome respectful discussion and collective exploration of the industry’s path forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News