The Future of BTCFi: Beyond Ethereum, Building a DeFi Ecosystem for Next-Gen Mass Adoption

TechFlow Selected TechFlow Selected

The Future of BTCFi: Beyond Ethereum, Building a DeFi Ecosystem for Next-Gen Mass Adoption

This cycle, as external institutions gradually enter and infrastructure continues to improve, we will witness the arrival of the next DeFi wave driven by BTCFi.

Bitcoin's Rapid Advancement

As the world's first cryptocurrency, Bitcoin enjoys the highest social consensus and security, having become digital gold. In this cycle, Bitcoin has made rapid progress in infrastructure, applications, and consensus.

Infrastructure Enhancement

OP_CAT opcodes and the BitVM computational paradigm, which expand mainnet programmability, are gradually maturing, while numerous BTC Layer 2 solutions and interoperability protocols have launched consecutively.

Application Innovation

The Ordinals and Runes protocols have introduced native assets to the Bitcoin ecosystem, and Babylon’s native staking solution has injected vitality into Bitcoin, enabling the BTCFi ecosystem to achieve a breakthrough from zero to one.

Strengthened Consensus

Bitcoin’s mainnet experienced its fourth block reward halving, reducing miner rewards by half and causing mining costs to continuously rise.

Breakthroughs in Traditional Markets

BTC ETFs have been approved by regulators in both the United States and Hong Kong, allowing retail and institutional investors to include Bitcoin in their investment portfolios.

Looking ahead, as Bitcoin network programmability continues to improve and token consensus strengthens, Bitcoin’s total market capitalization and DeFi ecosystem value will grow far beyond current levels. The rapid development of Bitcoin in the BTCFi domain will bring revolutionary changes to the crypto world and even the global financial system.

The Vast Prospects of BTCFi

Bitcoin’s market potential is immeasurable, and its influence in global financial markets continues to expand.

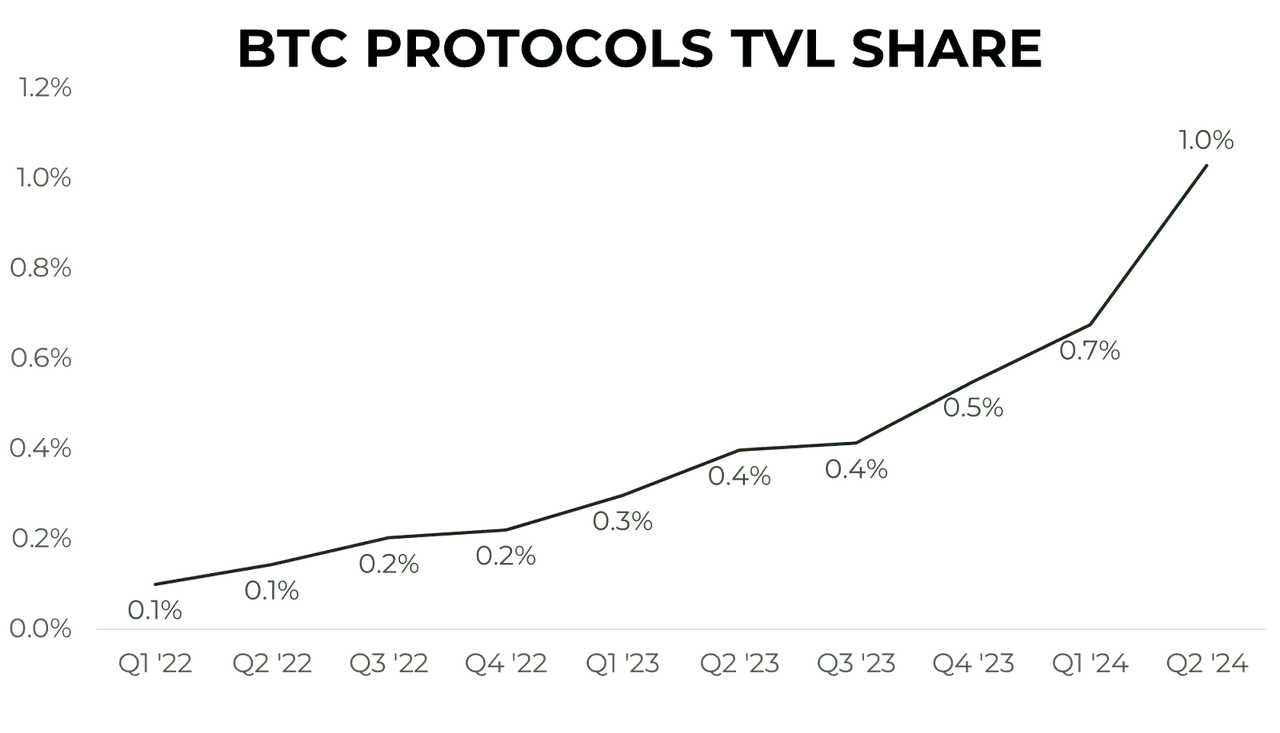

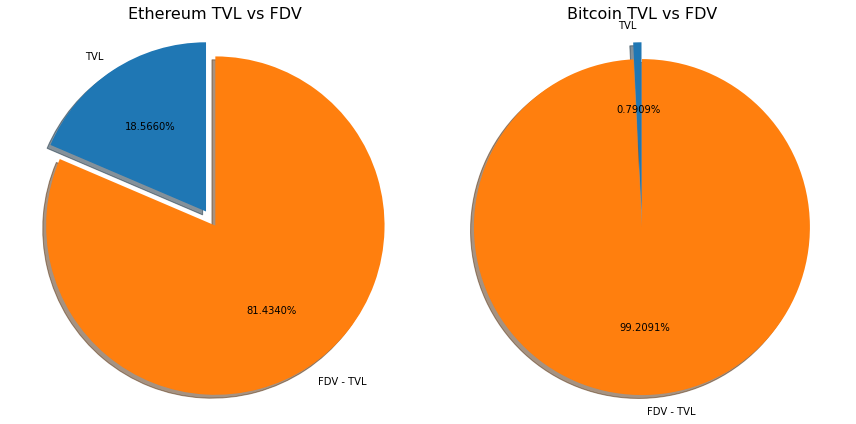

Although the TVL (total value locked) of Bitcoin protocols has grown year by year, as of Q2 2024, the total TVL of BTCFi (Bitcoin decentralized finance) accounts for only 1% of Bitcoin’s total market cap. In contrast, Ethereum mainnet protocols and Layer 2 solutions combined account for 18.6% of ETH FDV (fully diluted valuation). Conservatively estimating that BTCFi could reach the relative scale of Ethereum’s DeFi ecosystem, there remains at least a 20-fold growth potential—creating a blue-ocean market worth tens of billions of dollars.

To fully unlock the potential of this blue-ocean market, the BTCFi ecosystem must meet three critical demands:

Robust Foundational Layer Role

The BTCFi ecosystem must fully realize Bitcoin’s mainnet and sidechains as foundational issuance layers for other tokenized assets, providing the most secure and stable technical support to lay a solid foundation for DeFi applications.

Enhanced Bitcoin Productivity

The BTCFi ecosystem must address the growing market demand for increasing Bitcoin asset productivity. Users expect Bitcoin not only as a store of value but also as an active participant in various financial activities—utilizing their BTC through mechanisms like collateralized lending, liquid staking, and restaking to achieve asset appreciation.

A Truly Decentralized Financial System

The BTCFi ecosystem must build a financial system that genuinely embodies Bitcoin’s decentralization principles, minimizing reliance on centralized institutions and delivering fairer, more transparent financial services to users worldwide.

With continuous advancements in mainnet programming codes, scaling solutions, zero-knowledge proofs, AVS cross-chain communication, and other technologies, these needs will be progressively met, unlocking Bitcoin DeFi’s immense potential.

Potential to Surpass Ethereum DeFi

In the field of decentralized finance (DeFi), Ethereum has long held the lead, primarily due to its powerful smart contract capabilities and rich application ecosystem.

However, in the current market cycle, with the decentralization and institutionalization of Ethereum’s consensus mechanism underway, BTCFi is poised to surpass Ethereum DeFi and dominate the future institutional-grade DeFi market.

ETH/BTC ratio continues to decline

The current market cycle places unprecedented emphasis on compliance, user growth, and sustainable revenue models. Binance invested as much as $213 million in compliance within a single year; simultaneously, it has continued listing TON ecosystem tokens such as $NOT and $CATI. Delta-neutral on-chain financial products like Ethena have also gained widespread support. DeFi is gradually transforming from a speculative tool into the next-generation financial instrument advancing inclusive finance.

Compared to Ethereum’s DeFi, BTCFi better aligns with future market demands and is positioned to fill market gaps through long-term strategies and solutions, driving sustained industry development.

Trends in Bitcoin Ecosystem Development

Growing Developer Numbers

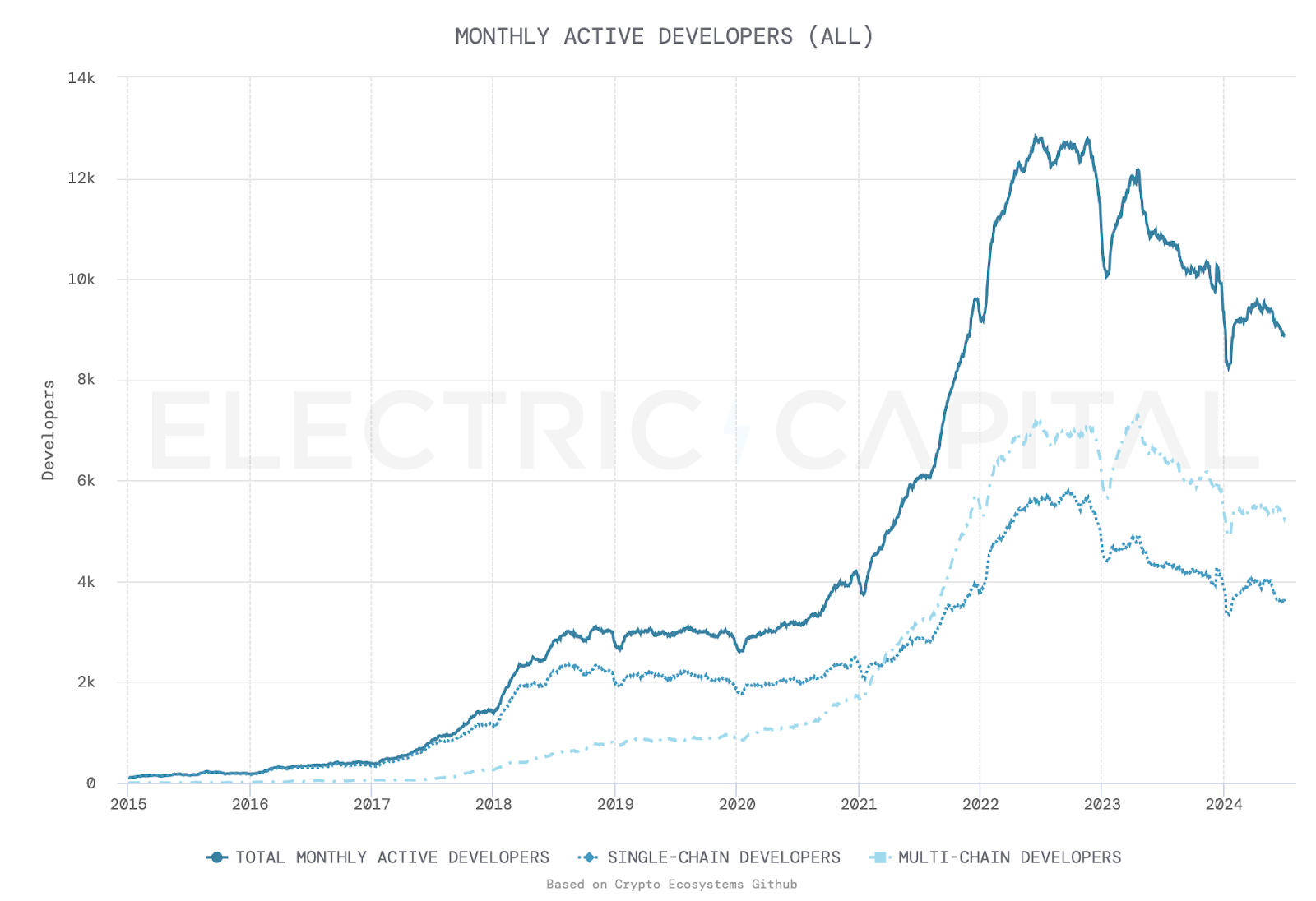

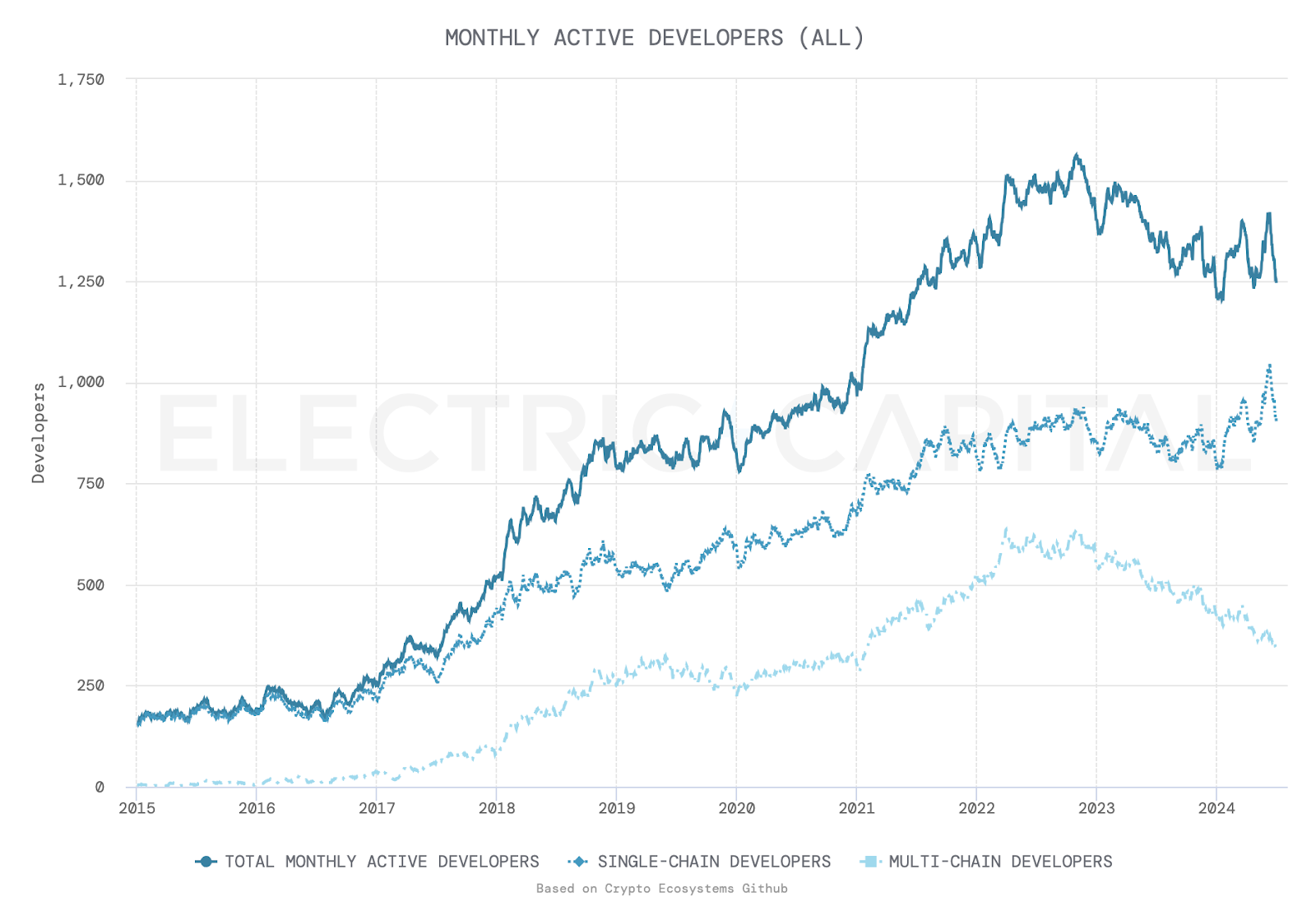

As of January 2024, Ethereum had 7,864 monthly active developers—a 25% decrease from the previous year. In contrast, Bitcoin’s developer count continues steady growth, now surpassing 1,000. This trend indicates rising appeal within the developer community, signaling the emergence of more innovative applications.

Left: Ethereum developer count shows a clear downward trend since late 2022; Right: Bitcoin developer count steadily rises

Increasing Institutional Holdings

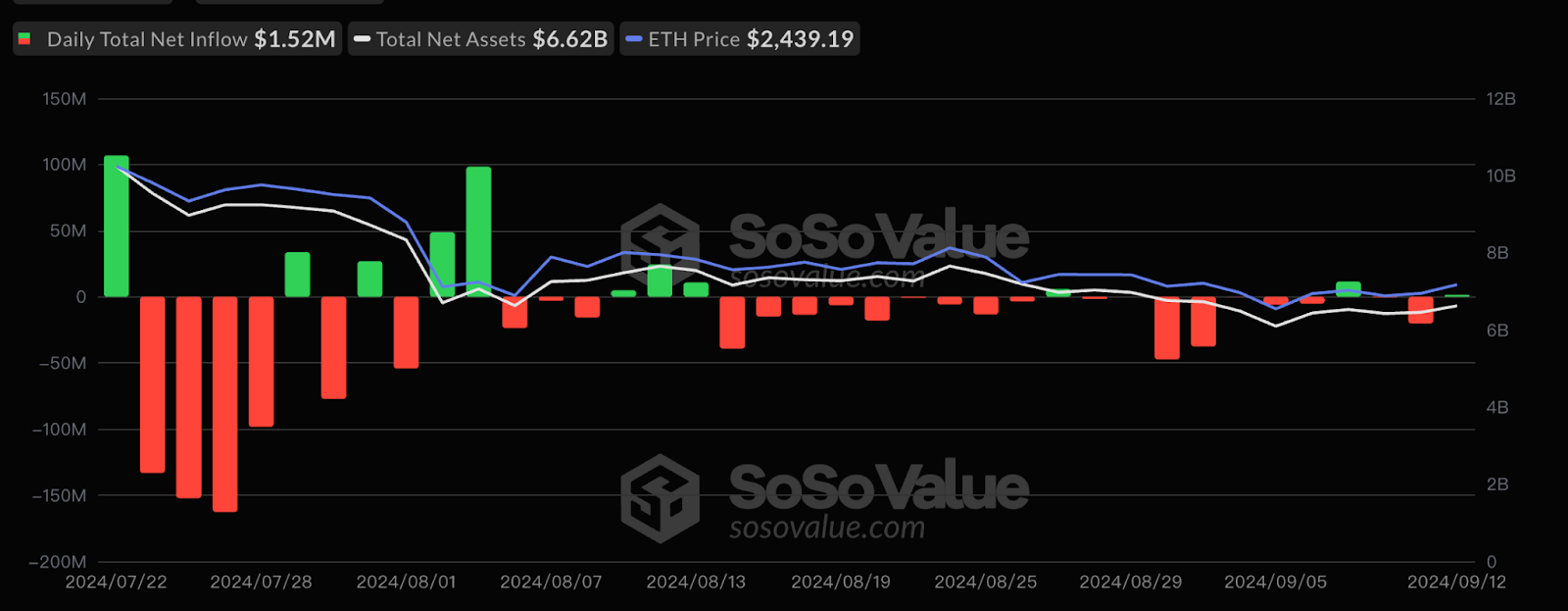

As Bitcoin becomes increasingly recognized as digital gold and the top alternative asset, more institutional investors are allocating Bitcoin into their portfolios. These investors typically hold long-term positions and have strong demand for risk-free BTC appreciation. Since the approval of BTC and ETH ETFs, institutional net inflows into Bitcoin have continued to rise, while those into Ethereum have relatively declined.

Left: ETH ETF net inflows continue declining post-approval; Right: BTC ETF net inflows steadily increase post-approval

Unparalleled Network Security and Token Deflation Mechanism

Bitcoin’s network is renowned for its high level of security, proven over time. Its massive hash power and decentralized nature ensure network stability and resistance to attacks, making Bitcoin ideal for high-security financial applications. Bitcoin’s built-in deflationary and halving mechanisms effectively guarantee steady growth in token market value.

Innovative Technical Scaling

Through scaling solutions like the Lightning Network, RGB, and sidechain technologies, Bitcoin is overcoming limitations in smart contract functionality. These technological innovations enable Bitcoin to support more complex DeFi applications while preserving the main chain’s security and stability.

Conclusion

Since DeFi Summer in 2020, DeFi has completed a full four-year cycle, with significant differences in service users and product quality compared to earlier years. In this cycle, with gradual entry by external institutions and continuous improvements in infrastructure, we will witness the arrival of the next DeFi wave driven by BTCFi—extending broad global consensus around BTC into DeFi use cases and enabling broader Web3 adoption.

About Uniquid Layer

Uniquid Layer is a liquidity platform designed for a broader community, aiming to serve as an onboarding gateway for newcomers in the Bitcoin space, maximizing Bitcoin yields with the highest security.

Website:https://uniquid.io

Telegram:https://t.me/uniquid_layer

Puni Telegram Mini App:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News