Bitget Daily Morning Report: Spot Bitcoin ETFs see $3.5 billion outflow in November, Massimo adds BTC to treasury strategic reserves

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Spot Bitcoin ETFs see $3.5 billion outflow in November, Massimo adds BTC to treasury strategic reserves

Benchmark: No need to worry about Strategy's solvency.

Author: Bitget

Today's Outlook

1. An address疑似linked to Bitmine or Sharplink Gaming received over 7,080 ETH.

2. The FDIC plans to release its first draft regulatory framework for stablecoin issuance under the GENIUS Act this month.

3. SEC Chair Paul Atkins will deliver a speech tonight at the NYSE, focusing on a reform vision for the 250th anniversary of U.S. capital markets.

4. Spot Bitcoin ETFs saw $3.5 billion in outflows in November, the largest monthly outflow since February.

Macro & Highlights

1. The probability of a 25-basis-point Fed rate cut in December is 87.6%.

2. Polygon co-founder: Hopes Strategy won't become the LUNA of this cycle; Benchmark, a Wall Street broker, stated there's no need to worry about Strategy’s solvency.

3. Kalshi and Polymarket recorded November trading volumes of $5.8 billion and $3.74 billion respectively, both all-time highs.

4. Bitfinex Alpha: The crypto market is approaching a local bottom, with potential to build a sustainable recovery foundation in Q4.

5. Data: Last week, global listed companies had a net BTC purchase of $21.86 million.

Market Trends

1. Over the past 24 hours, total liquidations in the crypto market reached $583 million, with long positions accounting for $457 million. BTC liquidations amounted to $281 million, and ETH liquidations to $124 million.

2. U.S. stocks: Dow down 0.9%, S&P 500 down 0.53%, Nasdaq Composite down 0.38%.

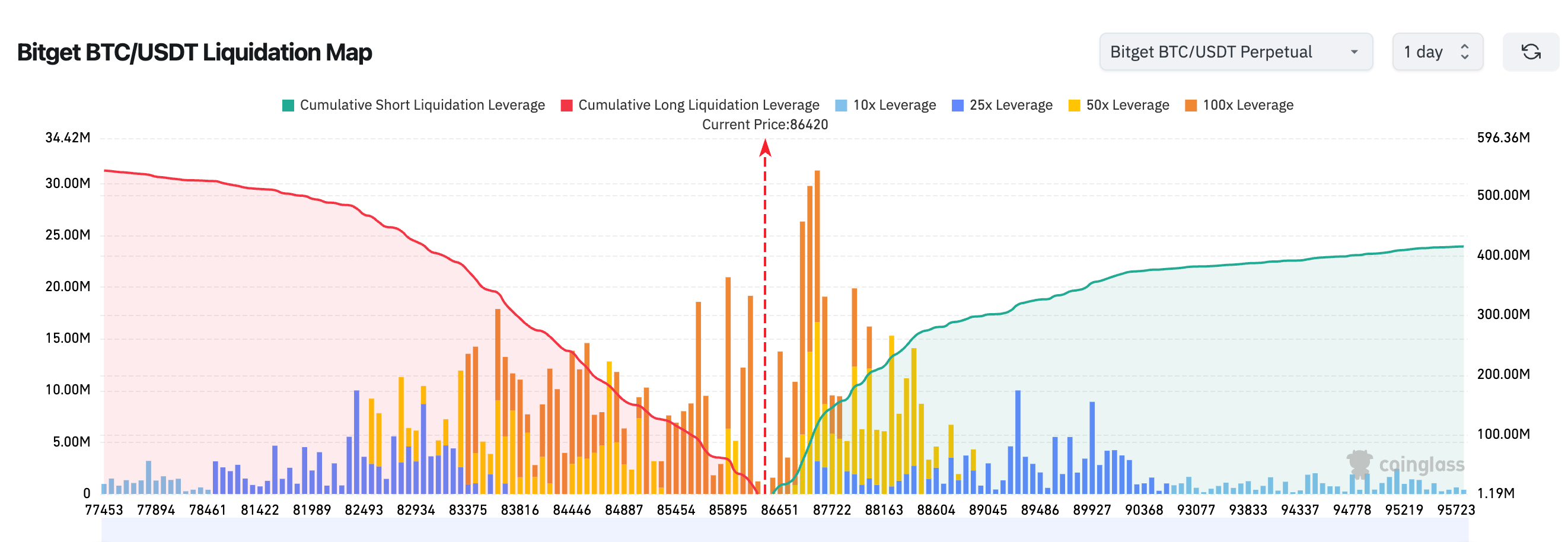

3. BTC’s current price of $86,420 sits at the center of a densely concentrated long-leveraged liquidation zone (approximately $85,400–$88,000). A downward move could trigger cascading long liquidations. Short liquidations are primarily clustered above $88,500; a breakout above this range may prompt accelerated short covering, pushing prices higher.

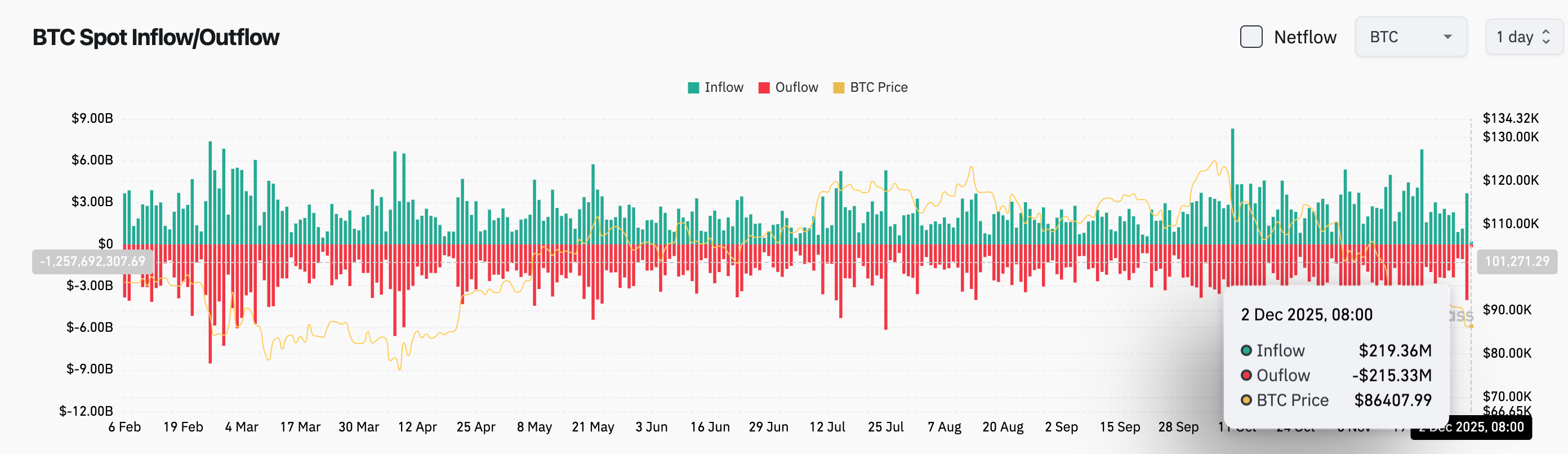

4. In the past 24 hours, BTC spot inflows were $219 million and outflows $215 million, resulting in a net inflow of $4 million.

News Updates

1. Bloomberg: Stablecoin firm First Digital plans to go public via SPAC merger.

2. Bitcoin mining profits have compressed to historic lows, entering a survival-of-the-fittest phase for the industry.

3. Google expands Gemini 3 and Nano Banana Pro AI search capabilities to nearly 120 countries.

Project Developments

1. A whale transferred 6.2 million LDO tokens to Binance after two years of inactivity, facing a loss exceeding $6 million.

2. A whale moved over 10,000 ETH to Kraken, potentially ending a five-year holding period.

3. Vanguard, the world’s second-largest custodian, opens trading for cryptocurrency ETFs, supporting major assets like BTC and ETH.

4. Kalshi is migrating thousands of prediction markets onto Solana.

5. Synthesis’ long-term strategic investment in Sushi includes acquiring over 10 million SUSHI tokens.

6. USDC Treasury burned 55 million USDC tokens on the Ethereum blockchain.

7. Jared Grey announced stepping down from leadership at Sushi to become an advisor, as Sushi secures major investment from Synthesis.

8. Massimo, a publicly traded U.S. company, announced incorporating Bitcoin into its long-term treasury reserve strategy.

9. Strategy updates 2025 fiscal year profit forecast: If BTC ends the year between $85,000 and $110,000, revenue could reach $7–9.5 billion.

Disclaimer: This report is generated by AI, with human verification only for information accuracy. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News