Is USDe really safe enough?

TechFlow Selected TechFlow Selected

Is USDe really safe enough?

Unless multiple "black swan events" occur simultaneously, USDe remains secure.

Author: The Smart Ape

Translation: AididiaoJP, Foresight News

More and more people are beginning to worry about whether USDe is truly safe, especially after the recent depegging incident.

The depeg triggered a flood of FUD, making it difficult to remain objective. The goal of this article is to clearly and factually examine @ethena_labs. With all the information in hand, you can form your own opinion instead of following those who may have biases or hidden interests.

USDe Depegging

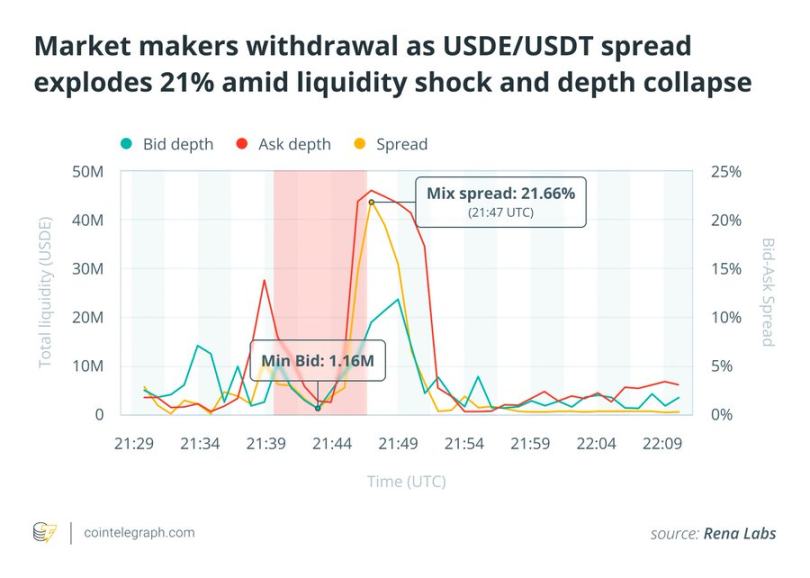

On the evening of October 10, USDe severely depegged. When I saw it drop to $0.65, I panicked too.

However, the depeg only occurred on @binance. On deeper liquidity venues like Curve and Bybit, USDe barely fluctuated for long, bottoming around $0.93, and quickly recovered.

Why Binance?

Because Binance allows users to use USDe as collateral and uses its internal order book—rather than external oracles—to assess the value of that collateral.

Some traders exploited this flaw, dumping $60 million to $90 million worth of USDe, driving the local price down to $0.65 and triggering $500 million to $1 billion in forced liquidations, as these assets were used as margin.

In short, the issue is not related to Ethena's fundamentals but rather to Binance's design. This could have been avoided with oracle-based price feeds.

Will USDe collapse like UST?

Many compare Luna or UST to Ethena, but fundamentally, they are entirely different systems.

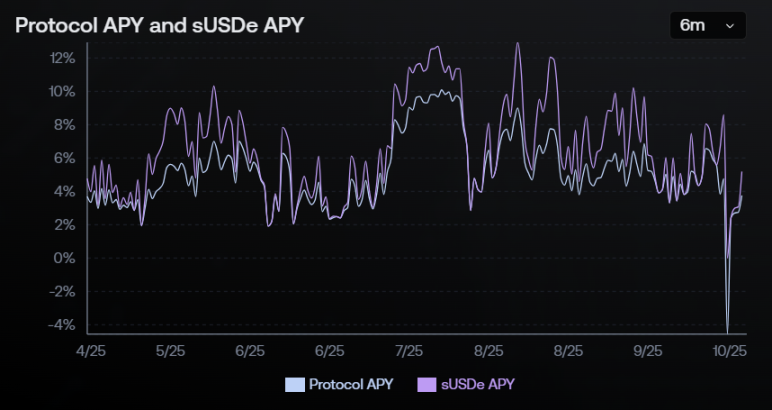

First, Luna had no real revenue, but Ethena does. It earns yield through liquid staking and perpetual funding rates.

Luna’s UST was backed by its own token $LUNA, meaning it effectively had no backing. When LUNA collapsed, so did UST.

Ethena is backed by delta-neutral positions, not by ENA or any Ethena-related token.

Unlike Anchor’s fixed 20% APY, Ethena guarantees no yield; it fluctuates with market conditions.

Finally, Luna’s growth was infinite, with no mechanism to slow expansion. Ethena’s growth is capped by the total open interest across exchanges. The larger it becomes, the lower the yield, keeping its scale balanced.

Therefore, Ethena and Luna are completely different. Ethena might fail, like any protocol, but it won’t fail for the same reasons Luna did.

What are Ethena’s risks?

Every stablecoin carries risk—even USDT and USDC have their own vulnerabilities. What matters is understanding what those risks are and how severe you believe they might be.

Ethena relies on a delta-neutral strategy:

-

Long positions via liquid staking or lending protocols (BTC, ETH),

-

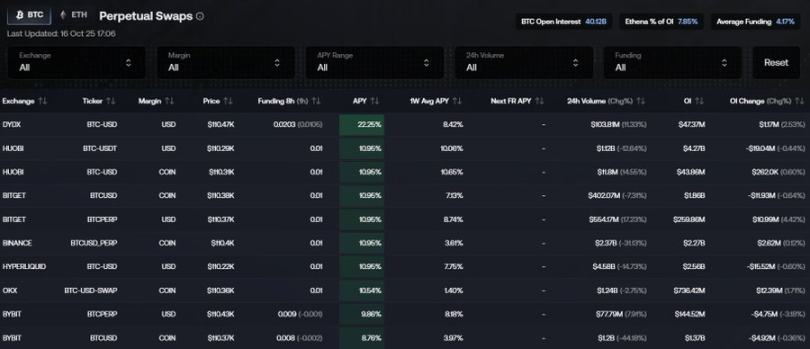

And short positions via perpetual contracts on centralized exchanges.

To me, the biggest risk is if major exchanges (Binance, Bybit, OKX, Bitget) collapse or freeze withdrawals, causing Ethena to lose its hedge and instantly depeg.

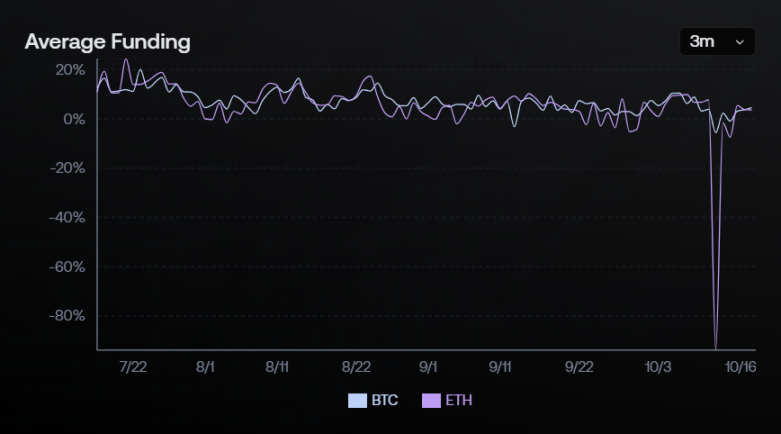

There’s also funding rate risk. If funding rates remain negative for an extended period, Ethena will burn capital instead of earning yield. Historically, funding rates have been positive over 90% of the time, which offsets brief negative periods.

USDe also undergoes rebasing—minting new tokens when the protocol earns yield—which could cause slight dilution if the market turns and collateral value declines. Over time, this might lead to mild undercollateralization.

Ethena also operates within a high-leverage ecosystem. A large-scale deleveraging event (like the cascade of liquidations on October 10) could disrupt hedging or force liquidations.

Finally, all of Ethena’s perpetual short positions are denominated in USDT, not USDe. If USDT depegs, USDe will follow. Ideally, perpetuals should be denominated in USDe, but convincing Binance to change BTC/USDT to BTC/USDe seems impossible to me.

These are the main risks currently debated around Ethena.

Risk Assessment

The above list might sound scary, but the probability of all these events happening simultaneously is extremely low. You’d need a prolonged period of negative funding rates, multiple exchanges collapsing at once, and complete liquidity freezes—all statistically unlikely.

Think of it like rolling dice: the chance of rolling a “1” is one in six, but rolling a “1” followed by a “2” is one in thirty-six. That’s how compound probability works here.

Ethena was built after the Terra and FTX collapses, learning from those failures. It has a reserve fund, off-chain custody, floating yields, and is integrating oracle-based pricing.

In reality, the most likely outcome isn’t collapse, but occasional peg volatility during periods of market stress—like what we saw on Binance—without broader contagion. Even in a severe event, it would affect the entire perpetual and synthetic stablecoin market, not just USDe.

Remember, Ethena has already survived some of the largest liquidation events in crypto history without losing its peg—passing a real stress test.

Its collateral is on-chain and transparent, unlike many “mystery basket” stablecoins backed by obscure altcoins held in opaque off-chain reserves.

Frankly, many stablecoins currently in circulation are far riskier than Ethena—we just hold Ethena to higher standards due to its size and visibility.

My Personal View

Personally, I don’t believe USDe faces significant depeg risk, which would require multiple disasters to occur simultaneously. And if such an event did happen, it wouldn’t fall alone.

There are already far riskier stablecoins in the market with massive market caps.

If USDe emerged unscathed from record-breaking liquidation days in October, that speaks volumes about its resilience.

So, I don’t consider Ethena particularly dangerous—certainly no more so than other stablecoins.

It’s also one of the few projects innovating in the stablecoin space, and based on current results, that innovation is working.

As always, don’t put all your eggs in one basket. Diversify your stablecoin exposure, stay informed, and stay calm.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News