Ethena: Behind the $10 billion crypto market liquidations, USDe stablecoin remains stable

TechFlow Selected TechFlow Selected

Ethena: Behind the $10 billion crypto market liquidations, USDe stablecoin remains stable

Ethena successfully captured the discount opportunity by shorting perpetual futures contracts, generating over $500,000 in protocol revenue last week.

Author: Ethena Labs Research

Compiled by: TechFlow

Summary

-

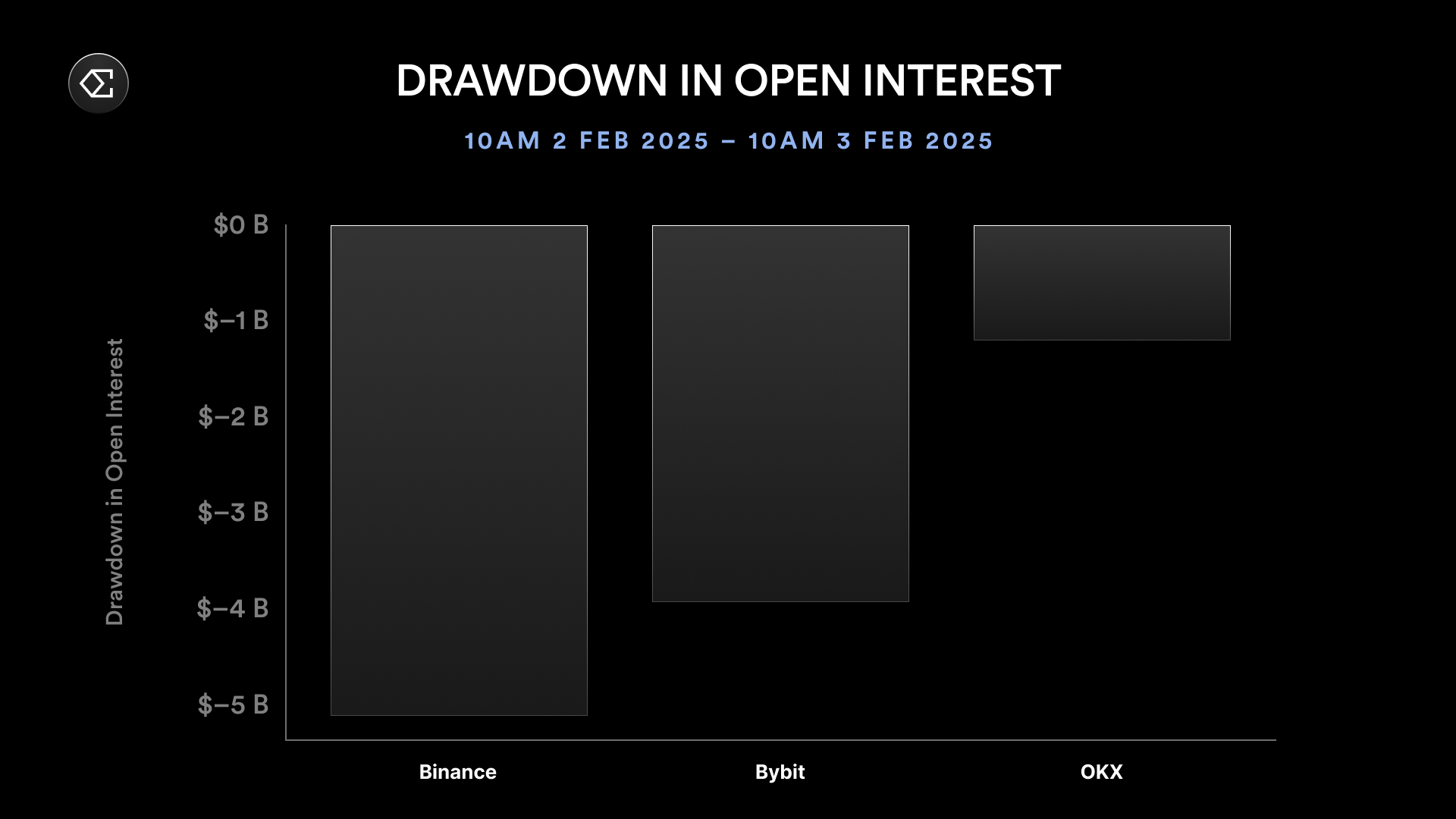

The perpetual futures market experienced the largest liquidation event in history, along with a record decline in open interest.

-

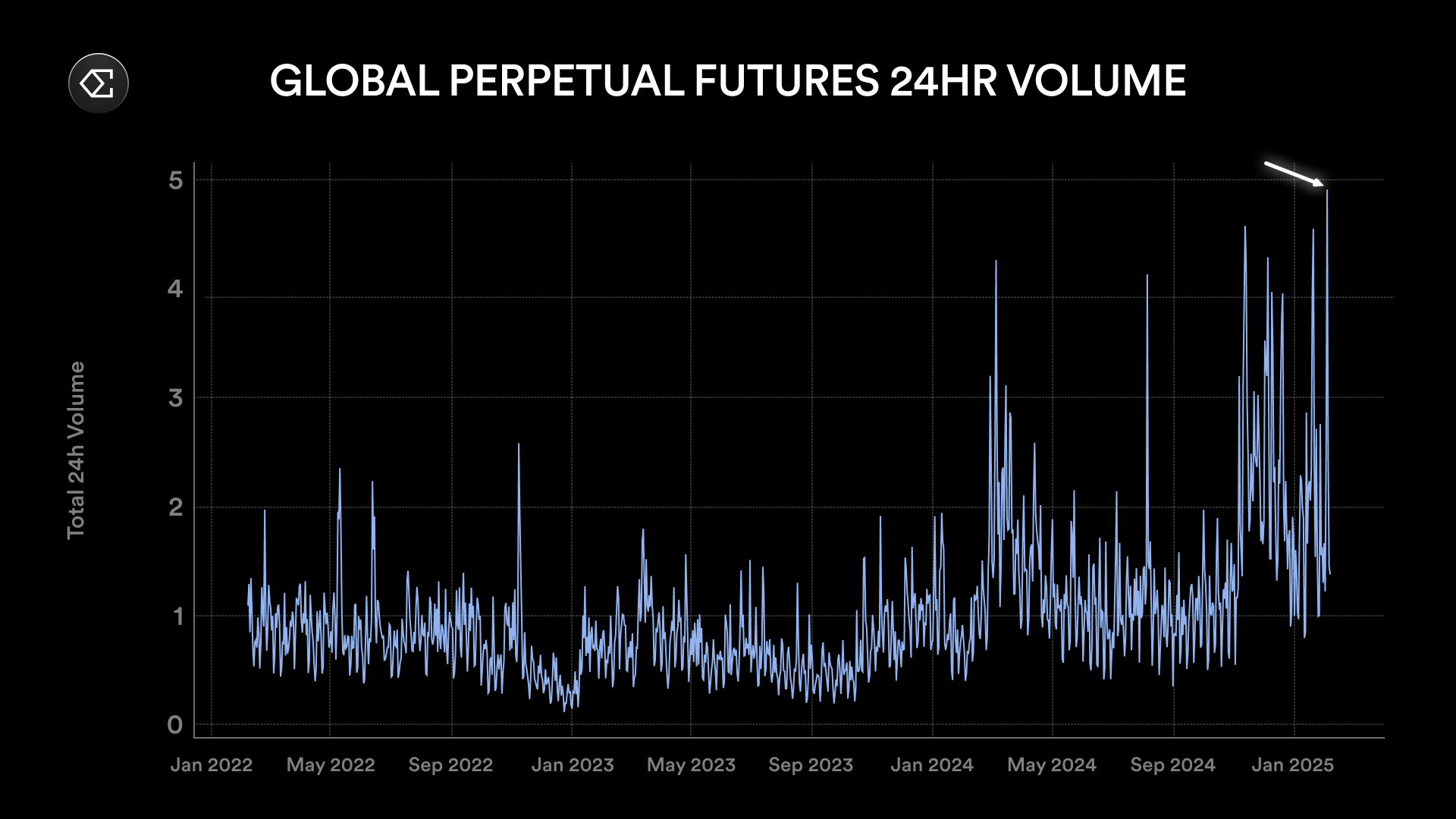

Perpetual futures trading volume reached an all-time high within 24 hours.

-

Open interest dropped by approximately $14 billion, consistent with estimated liquidations of around $10 billion.

-

Despite extreme market volatility, the USDe stablecoin remained stable and aligned with other fiat-backed stablecoins.

-

During the sell-off, perpetual futures contracts traded at a discount of up to 5.8% compared to spot markets.

-

Ethena successfully captured this discount opportunity by shorting perpetual futures, generating over $500,000 in protocol revenue last week.

-

Ethena automatically unwound underperforming contracts, helping restore funding rates to positive levels while shifting over $1 billion in perpetual futures exposure into yield-generating stablecoins.

Historic Liquidation Event

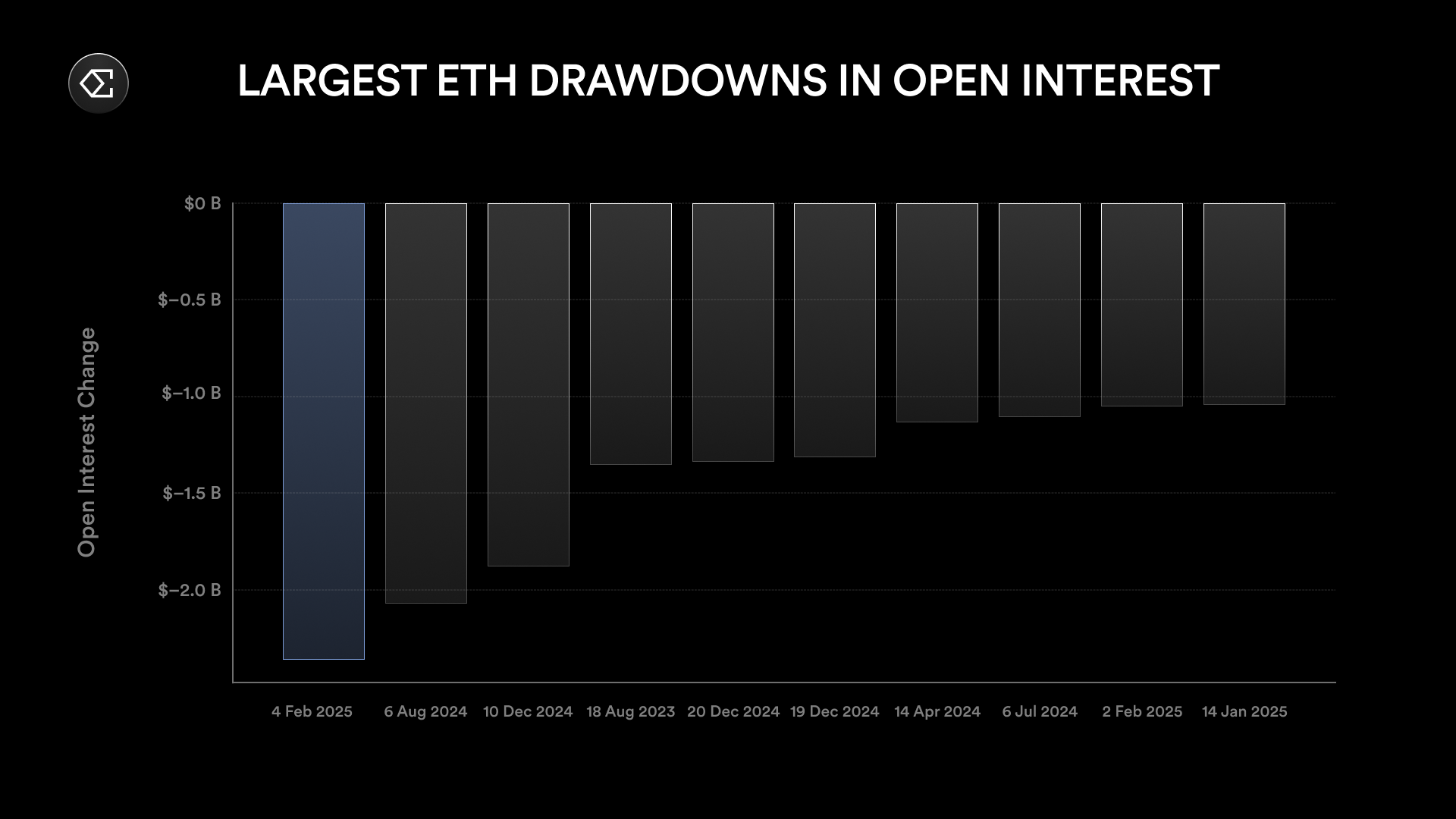

The perpetual futures market underwent its largest liquidation event on record, with ETH markets showing the most significant movement. This marks the ninth time since Ethena’s launch that ETH open interest has declined by more than $1 billion, and only the second time exceeding $2 billion. Within just 24 hours, ETH open interest dropped by $2.3 billion—the largest single-day decline in history.

Chart: 24-hour decline in ETH open interest

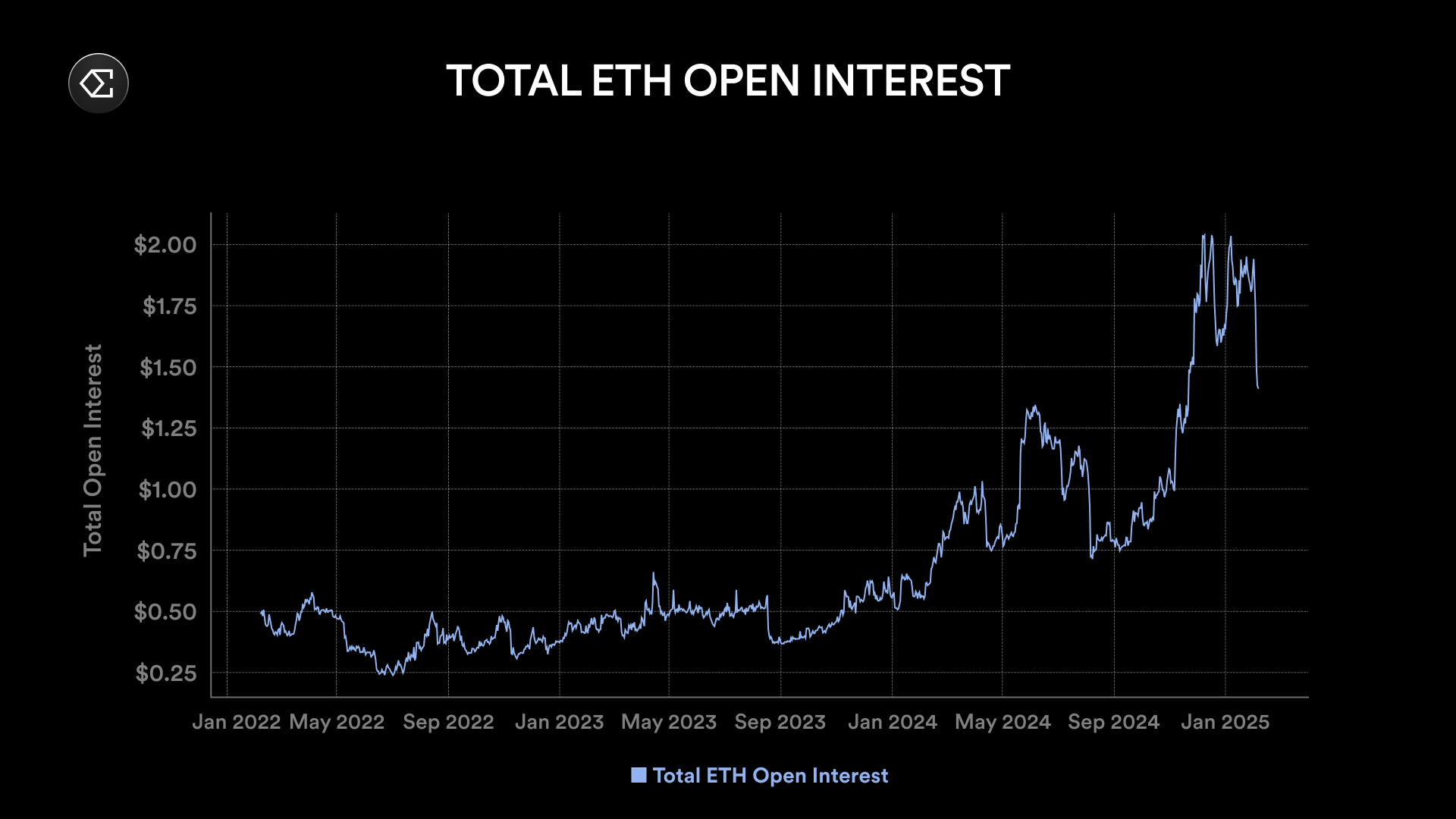

Over the past week, ETH open interest decreased by more than $5 billion—over 25% in total.

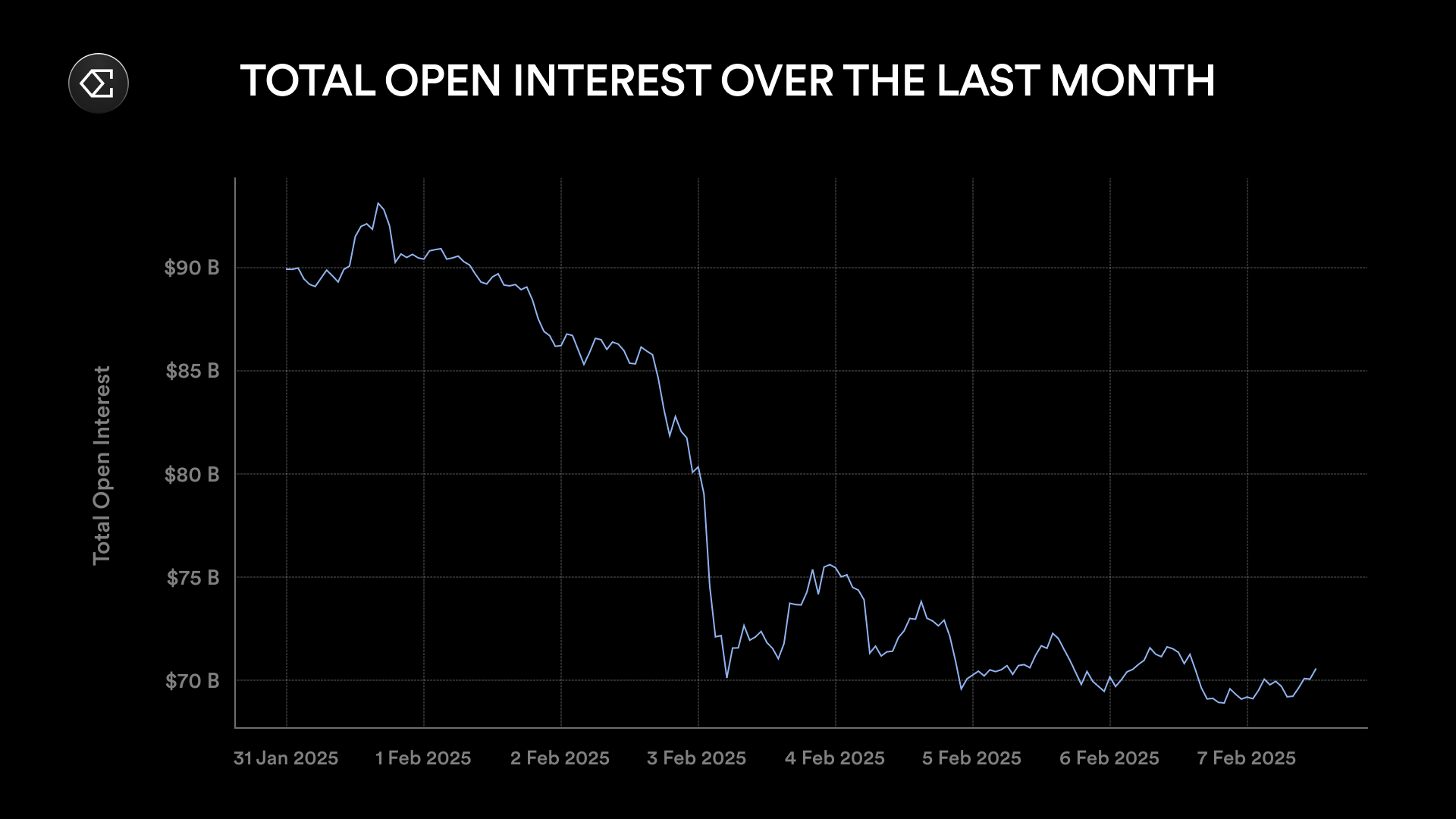

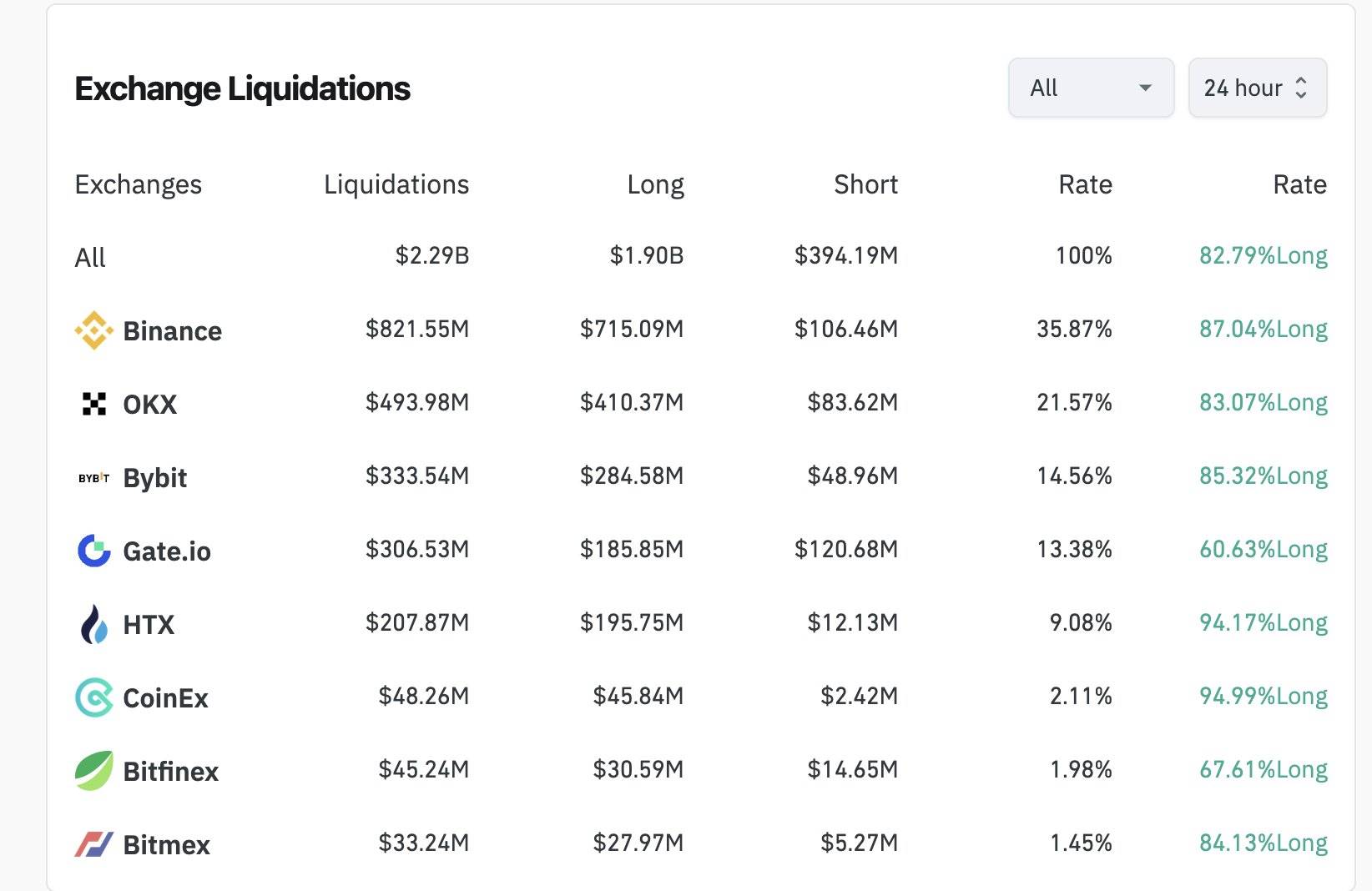

Total open interest across all assets declined by over $20 billion during the week. BTC contracts saw smaller nominal declines than ETH despite having nearly twice the market size. From February 2 to February 3, total open interest fell by $14 billion within 24 hours.

This intense sell-off also pushed 24-hour trading volume in perpetual futures to an all-time high.

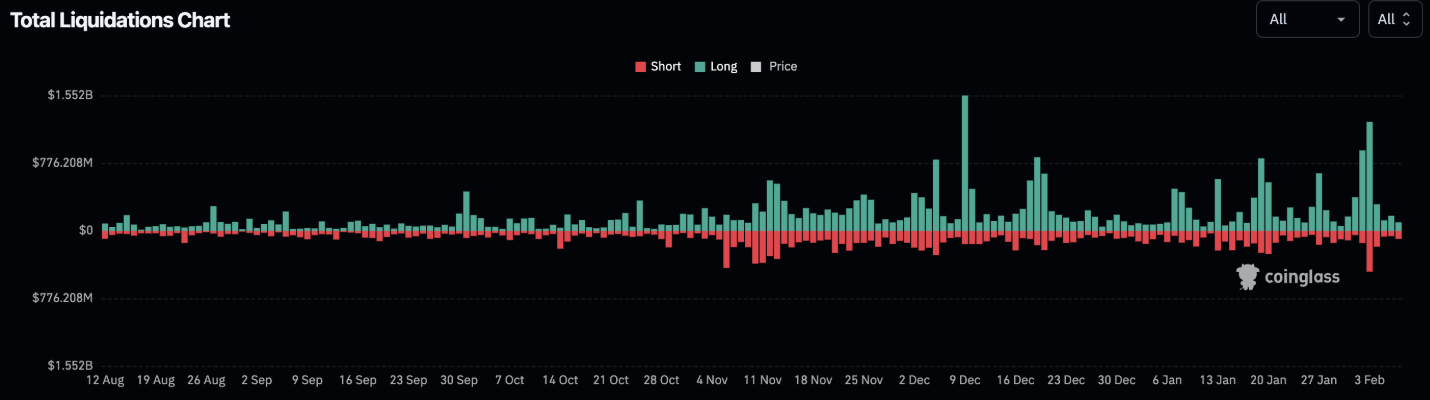

It is difficult to precisely determine how much of the trading volume and open interest drop was due to liquidations. Due to API data rate limits, exchanges often underreport liquidation figures, leading third-party data providers to also understate actual numbers.

Of the roughly $14 billion in open interest cleared on February 3, only $2.3 billion was directly attributed to liquidations according to public reports.

Chart: Coinglass data

However, Ben Zhou, founder and CEO of Bybit, tweeted after the event that Bybit alone saw $2.1 billion in liquidations, whereas Coinglass reported only $333 million.

Chart: Coinglass data

He estimated total liquidations could have been between $8 billion and $10 billion—a figure much closer to the actual decline in open interest across major exchanges. For example, from February 2 to February 3, Bybit's open interest dropped by $4 billion and Binance by $5 billion.

If this reasoning holds, it may have been one of the largest liquidation events in cryptocurrency history. This market stress test also provided Ethena with an opportunity to further validate the stability of USDe during extreme volatility.

Resilience of USDe

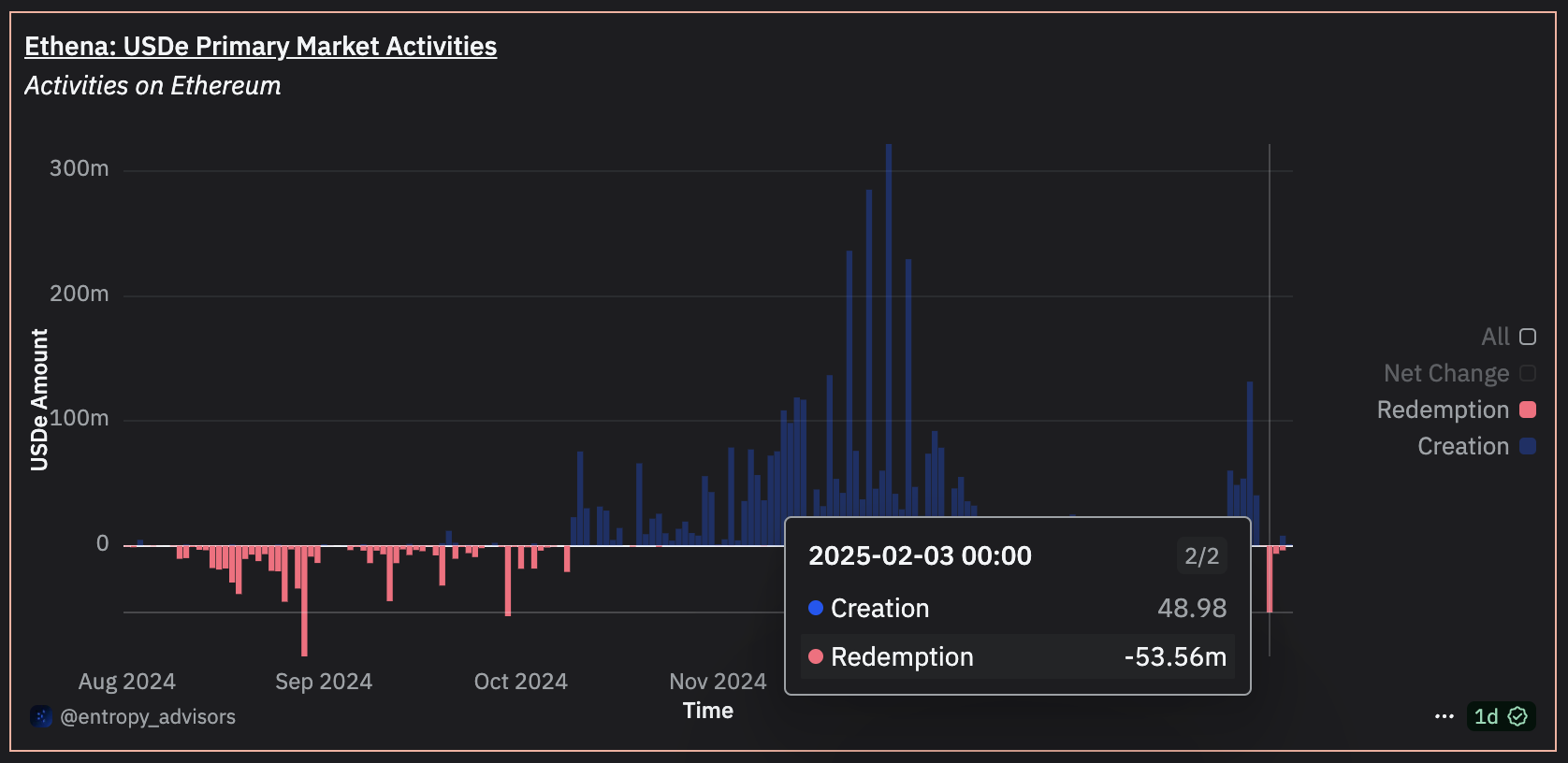

Despite being the largest nominal liquidation event in crypto derivatives history, overall market operations remained smooth. The USDe redemption process faced no disruptions, and unwinding perpetual futures positions incurred minimal losses. These contracts traded below spot prices during the sell-off, creating profitable opportunities for Ethena.

Within 24 hours, $50 million worth of USDe redemptions were processed smoothly through primary markets. Secondary market trading volume for USDe exceeded $350 million, with price differences between USDe and USDT consistently within 10 basis points.

During the volatility, USDe’s price tracked closely with USDC and DAI, thanks to active market makers who quickly arbitrated imbalances between primary and secondary markets.

Chart: USDe price vs USDC (red) and DAI (purple)

In the DeFi ecosystem, sUSDe and USDe collateral (on platforms like Aave, Morpho, Fluid, Curve, and Pendle) operated normally without any liquidations, de-pegging, or liquidity issues.

As prices fell, many perpetual futures contracts traded below their spot equivalents, enabling Ethena to profit by closing short perpetual positions.

Profit Opportunities During the Sell-Off

Ethena has an often-overlooked structural advantage: during market downturns, Ethena is typically on the “right” side of trades—shorting perpetual futures while holding spot collateral. During sell-offs, due to liquidation pressure and panic in futures markets, perpetual contracts often trade below their corresponding spot prices. Such discounts have previously exceeded 5%, and similar patterns emerged again this time.

Shorting deeply discounted perpetual futures increases unrealized PnL and provides additional margin buffer for Ethena’s unleveraged positions. When Ethena’s system automatically unwinds these perpetual contracts, the protocol benefits from market mispricing, placing it in a stronger position.

By closing perpetual contracts priced significantly below spot, the protocol captures discount gains and converts them into realized PnL. This profit directly benefits sUSDe holders.

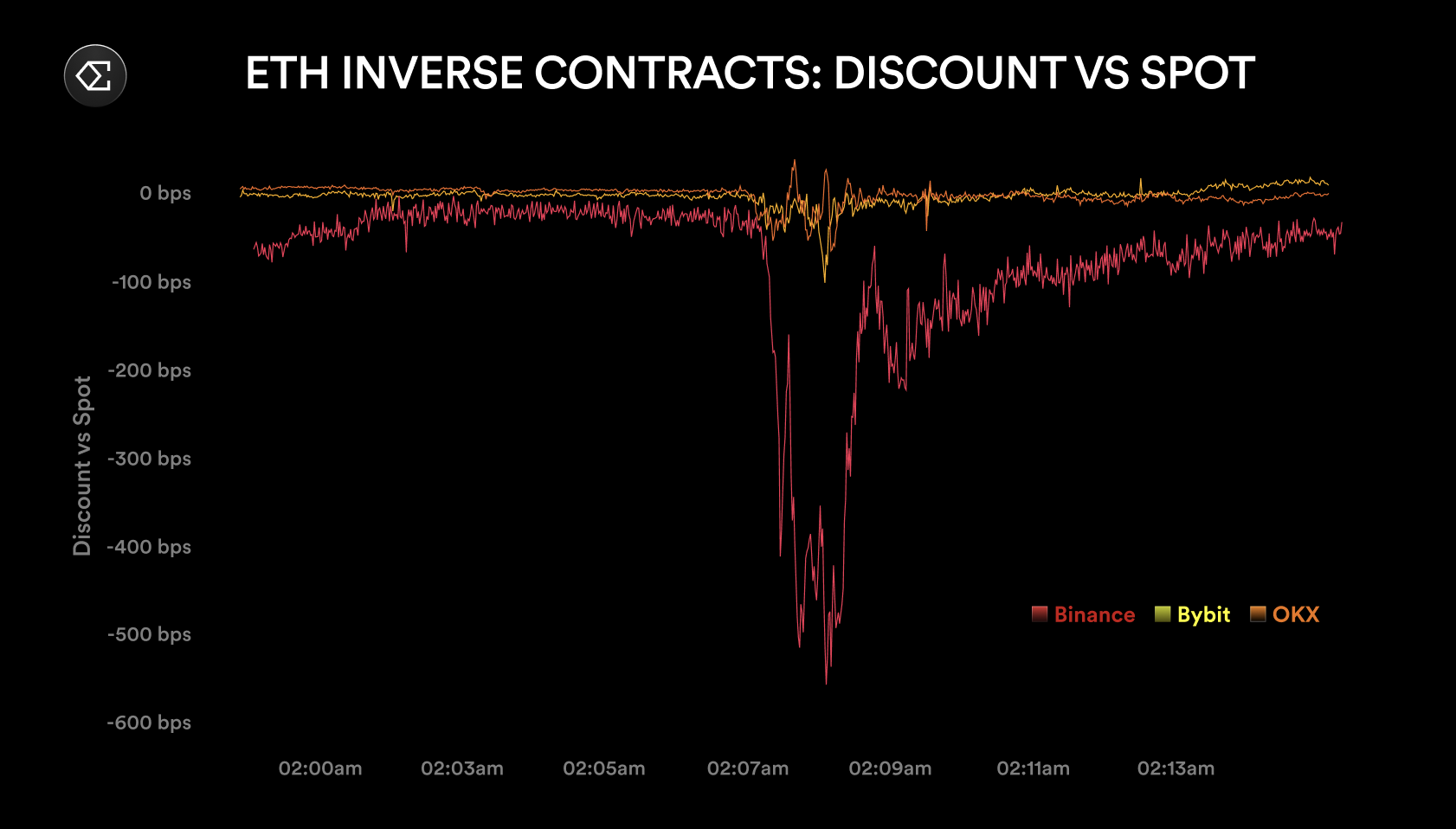

For instance, during this sell-off, Binance’s ETH contract (ETH coin-m) traded at a -5.8% discount to spot (shown below in basis points). Ethena held approximately $200 million in short exposure on this contract. At peak discount, the theoretical unrealized PnL exceeded $11 million—if fully closed, this gain would have been converted into protocol income.

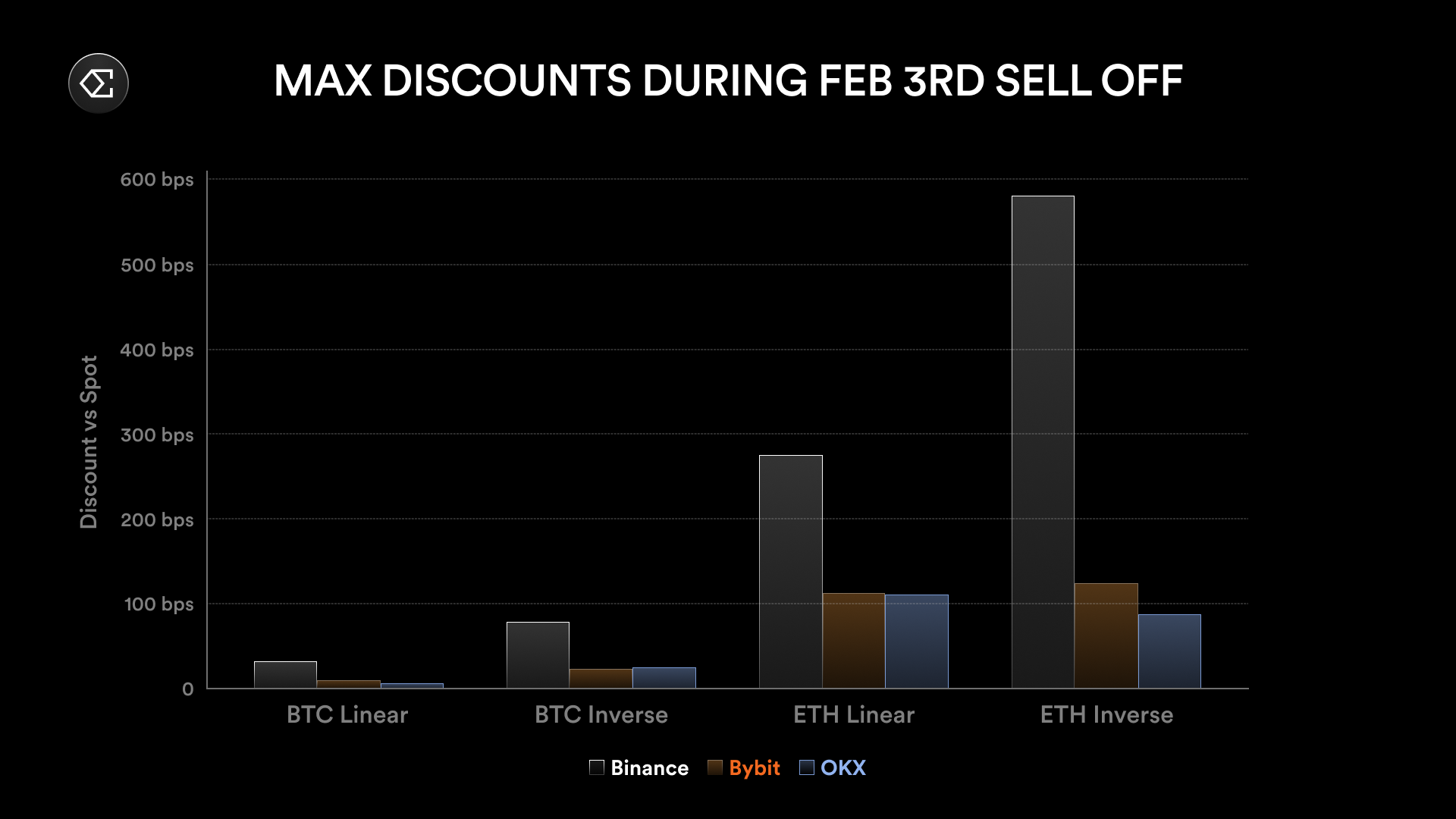

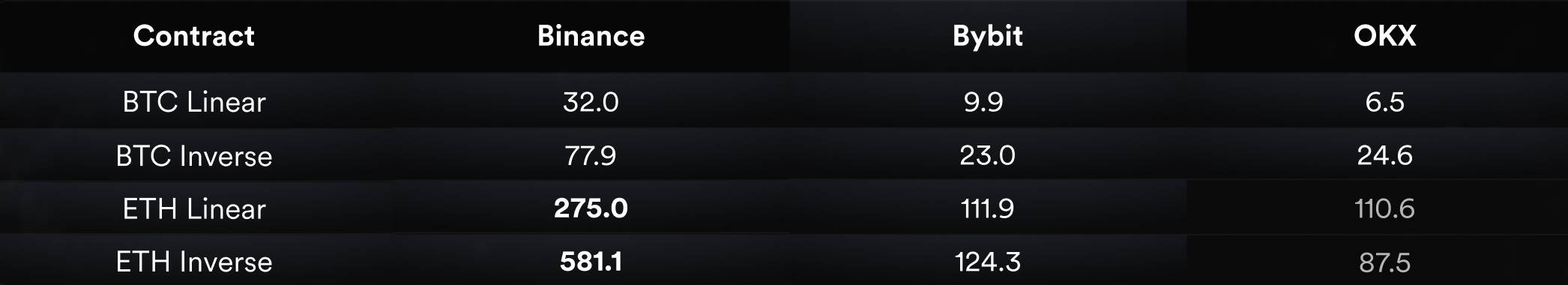

Compared to Binance, ETH contracts on Bybit and OKX showed smaller discounts, close to only 1%. BTC contracts across all three exchanges generally outperformed ETH contracts, as the sell-off was concentrated in ETH perpetuals, particularly inverse (coin-margined) contracts.

Chart: Discount vs spot

Overall, perpetual contracts on Binance exhibited larger discounts than those on other exchanges.

Chart: Maximum discount between perpetual futures and spot (in basis points)

The price divergence between contracts and underlying assets highlights the importance of execution quality. Ethena’s automated execution mechanism efficiently captures such market inefficiencies.

Over the past week, the Ethena protocol generated $5.5 million in revenue, with over $500,000 coming from two sources: capturing discounts between perpetual futures and spot markets, and unwinding contracts with the lowest funding rates. These actions added approximately 50 basis points to sUSDe’s annual percentage yield (APY). Additionally, these realized gains provided extra cushion against potential negative funding periods over the weekend.

Adapting to Lower Funding Rates

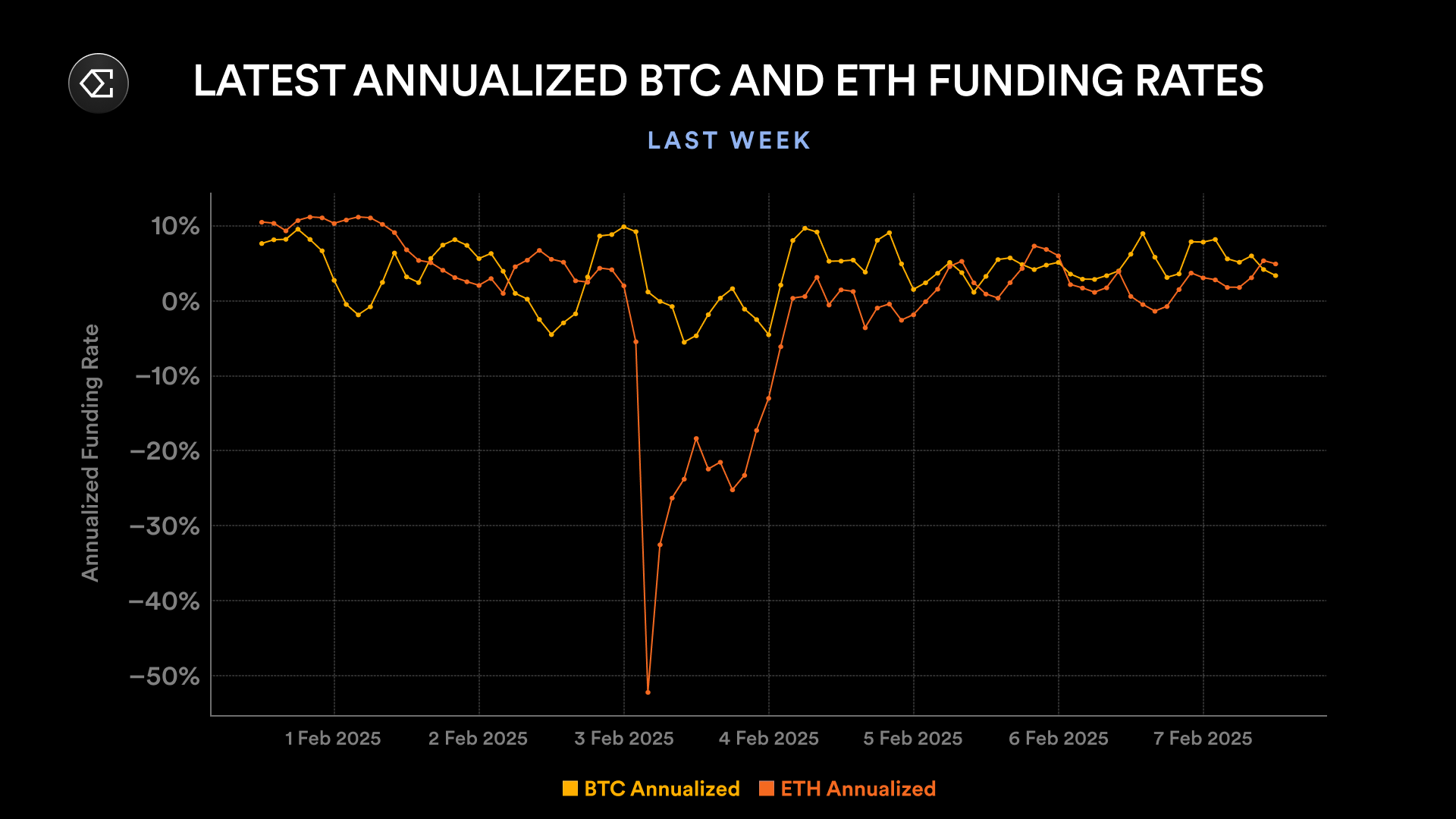

With heightened market volatility and significant performance divergence across exchanges and assets, Ethena had to rapidly respond to structural changes in the perpetual futures market. Over the past week, ETH contract funding rates were notably lower than BTC’s, and both were below年初 levels.

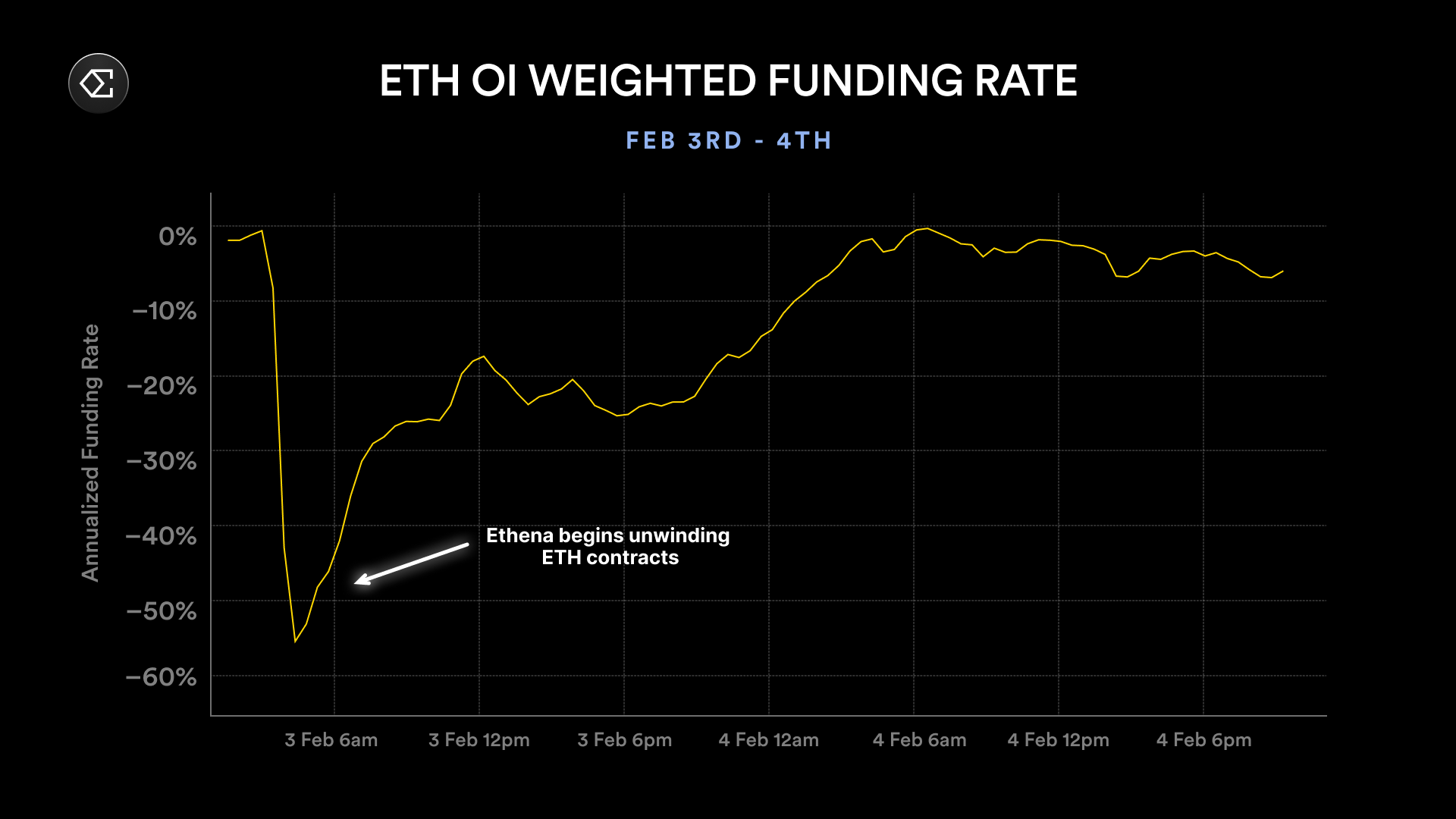

These funding rate shifts indicate that Ethena must adjust its USDe asset allocation strategy. By reallocating funds into yield-generating stablecoins such as USDS, the protocol can earn yields as high as 8.75%, while reducing reliance on underperforming perpetual contracts. As Ethena began unwinding ETH short positions, funding rates gradually improved.

Chart: Funding rates improve after Ethena closes short positions

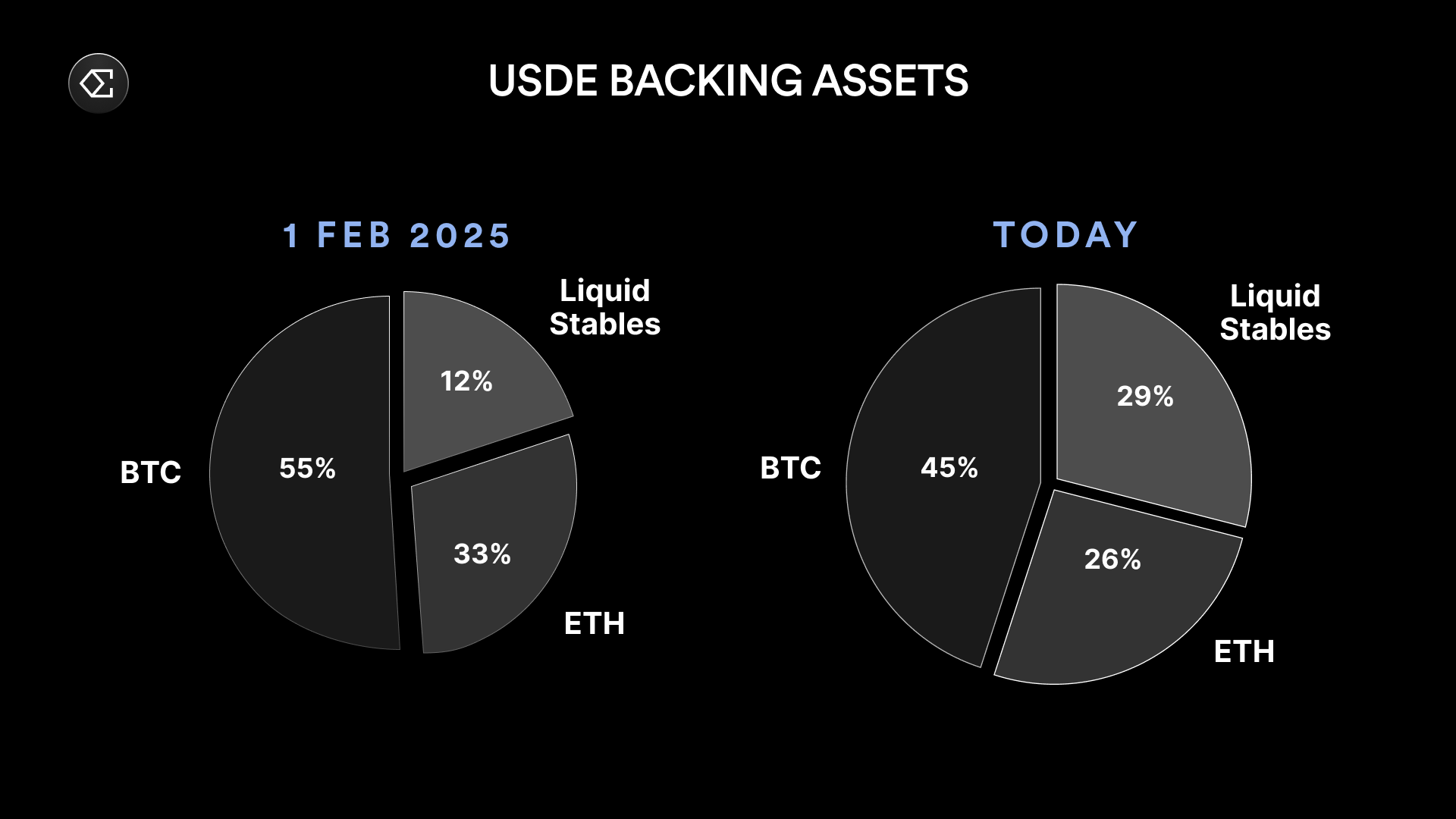

Last week demonstrated Ethena’s ability to swiftly adapt to changing conditions. Amid low funding rates, the protocol shifted $1 billion from BTC and ETH contracts into stablecoin assets, further strengthening sUSDe’s stability.

The comparison chart below shows the evolution of USDe’s backing assets from early February to today. USDe is now backed by nearly $1.8 billion in liquid stablecoins, accounting for 29% of total backing assets. Some of these liquid stablecoins now offer yields higher than perpetual funding rates. As long as perpetual contracts underperform expectations, Ethena will continue increasing allocations to liquid stablecoins to optimize the composition of USDe’s backing assets.

Even in the face of the largest nominal liquidation event in history, USDe demonstrated strong resilience—handling all redemption requests smoothly and maintaining a stable peg to its target value. This performance stems from Ethena’s ability to generate profits during market sell-offs and its structural advantage of shorting perpetual futures. This design effectively protects sUSDe holders during market downturns.

USDe has proven resilient in every stress test, establishing itself as one of the most reliable assets in today’s market. Ethena aims to continue building user trust through sustained strong performance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News