Stablecoin Showdown: Can USDe Challenge Tether's USDT Dominance?

TechFlow Selected TechFlow Selected

Stablecoin Showdown: Can USDe Challenge Tether's USDT Dominance?

This article analyzes Ethena's business model, the yield mechanism of USDe, and compares the advantages and disadvantages of Ethena and Tether, thereby exploring future trends in the stablecoin market.

Author: 0xResearcher

The rapid growth of Ethena and its flagship product, the USDe stablecoin, is one of the most notable developments in DeFi recently. Fueled by its collaboration with BlackRock and other factors, USDe’s TVL surpassed $3 billion within just a few months—a growth rate rarely seen in stablecoin history. Initially focused on building a secure and high-quality DeFi-native stablecoin, Ethena has maintained stable operations even through periods of market turbulence. Now, Ethena appears to be setting its sights directly on Tether, the dominant player in the crypto market, challenging its massive market share exceeding $160 billion.

This article will analyze Ethena’s business model, the yield mechanism behind USDe, and compare the strengths and weaknesses of Ethena and Tether. It will then explore future trends in the stablecoin market and examine the competitive positioning of Ethena, Tether, and other major players going forward.

A Potential Challenger to Tether's Dominance

Let’s start with Ethena’s strategy. Originally a purely DeFi-native stablecoin project, Ethena aims to evolve into a comprehensive competitor with stronger value propositions and improved distribution channels. Recent moves—such as the announcement of USTb, partnerships with traditional finance giants like BlackRock, and the global trend of declining interest rates—have created favorable external conditions. It now seems possible that Ethena could position USDe as the leading stablecoin in the cryptocurrency space. However, significant challenges remain, and whether Ethena succeeds depends on multiple factors.

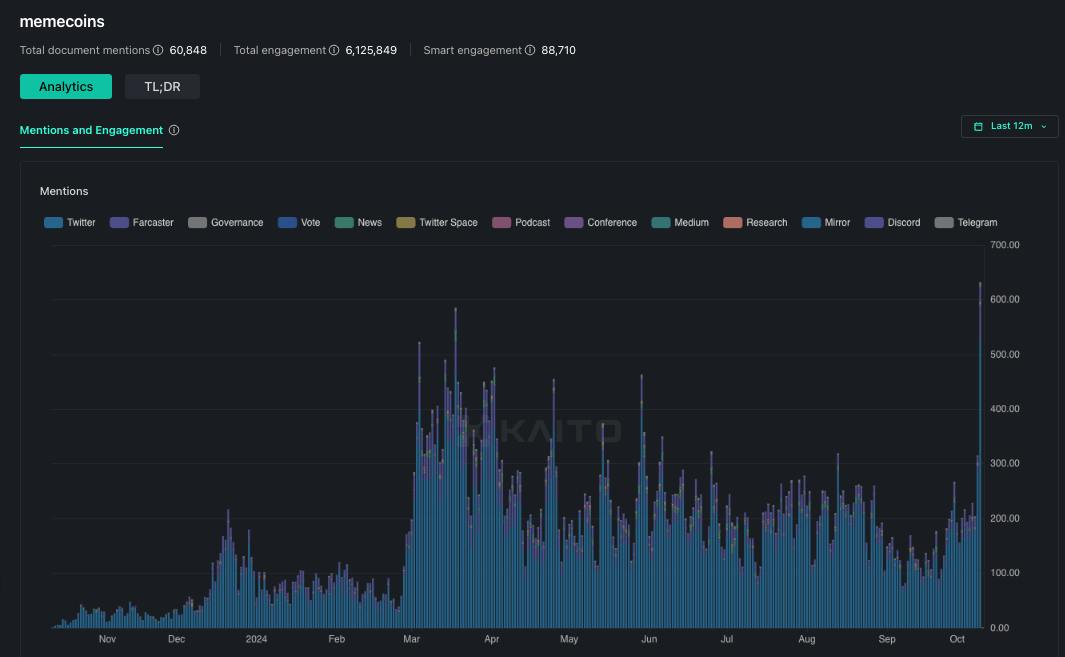

In today’s market environment, meme coins dominate and speculation reigns supreme. Investors are primarily chasing short-term gains, often disregarding long-term project fundamentals. This phenomenon, sometimes referred to as "financial nihilism," emphasizes narrative over substance—even outright disdain for fundamentals. While this approach delivered substantial, even outsized returns for some investors during the recent bear market, its long-term sustainability is questionable.

Nonetheless, fundamental market principles still hold: successful speculation usually rests on at least some real-world foundation. The rise of meme coins largely stems from retail-driven market behavior. Yet these users often overlook a key truth: over the long term, the best-performing, highly liquid assets tend to follow parabolic growth trajectories built on solid fundamentals. Only when fundamentals are strong can broad consensus form across all participants—including retail traders, hedge funds, proprietary trading desks, and long-only funds.

The rapid rise of $SOL in early 2023 serves as a good example. Its growth was underpinned by increasing developer activity and ecosystem expansion. Similar cases include Axie Infinity and Terra Luna, both of which experienced brief surges before ultimately revealing inherent structural flaws.

Although “financial nihilism” dominates current market sentiment, projects with strong product-market fit still have the potential to shift market consensus.

Ethena may well be one such contender.

High-Yield Stablecoin USDe and Investment Outlook for $ENA Token

Having analyzed broader market trends, let’s now examine where Ethena’s potential lies. Currently, two key advantages stand out: value proposition and distribution channels.

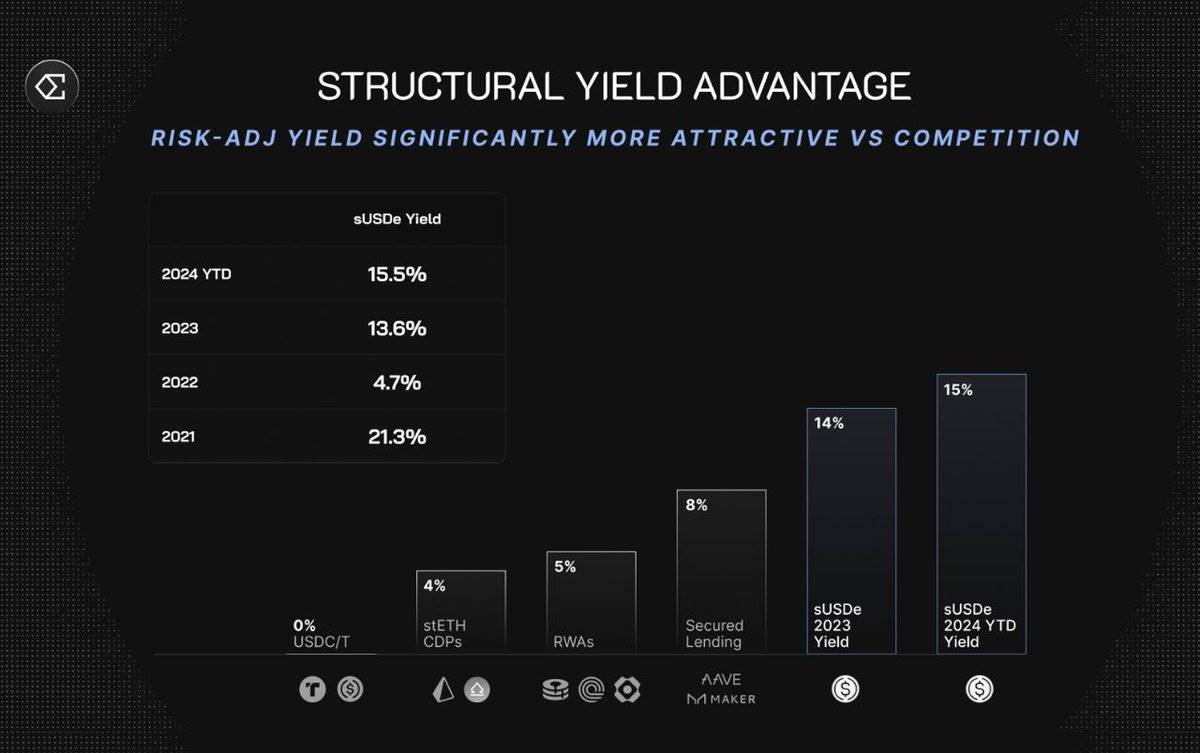

Ethena’s value proposition is clear. Users deposit $1 to gain exposure to a delta-neutral position split between staked ETH and short ETH futures, while earning yield. Under normal funding rate conditions, sUSDe offers a sustainable annualized return of 10–13%, among the highest yields available across all stablecoins. This compelling value proposition propelled Ethena to become one of the fastest-growing stablecoins in history, reaching a peak TVL of $3.7 billion within seven months and stabilizing around $2.5 billion after funding rates declined. USDe significantly outperforms other DeFi products in terms of yield. Nevertheless, Tether remains dominant due to its superior liquidity and widespread availability.

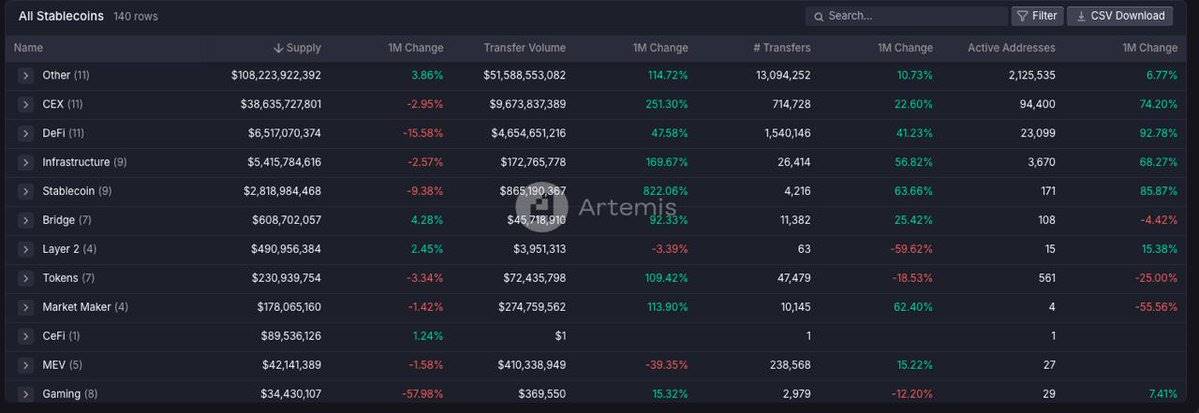

Now, let’s discuss distribution. Distribution channels are critical to any new stablecoin’s success. USDT dominates because it functions as a base currency on nearly every centralized exchange—an enormous competitive moat that takes years for newcomers to replicate. However, Ethena has successfully leveraged partnerships with large centralized exchanges like Bybit to bring USDe to market, integrating auto-yield features that lower user barriers. This level of integration remains difficult for other decentralized stablecoins to match.

Currently, centralized exchanges hold about $38.6 billion worth of stablecoins—15 times the current supply of USDe. Consider this: if just 20% of that amount shifted to USDe, its addressable market would grow nearly fourfold. If all major CEXs adopt USDe as a margin asset, the implications would be profound.

Ethena faces two major catalysts: structural interest rate declines and the launch of USTb.

Since its inception, sUSDe’s yield premium has consistently exceeded the Federal Funds Rate by 5–8%. This structural advantage has attracted billions in capital inflows. However, the Fed’s rate-cutting cycle may indirectly affect USDe’s yields by influencing funding rates in the crypto markets.

USDe’s supply is highly sensitive to the yield spread relative to U.S. Treasuries. Historical data shows that higher yield premiums correlate with increased demand for USDe, and vice versa. Therefore, a rebound in yield spreads could reignite growth in USDe adoption.

The launch of USTb is seen as a game-changing development. USTb is a stablecoin fully backed by BlackRock and Securitize’s tokenized fund BUIDL. When integrated with USDe, it can provide sUSDe holders with exposure to Treasury yields, alleviating market concerns about the stability and sustainability of Ethena’s yield generation.

Finally, let’s examine the $ENA tokenomics. $ENA suffers from a common issue affecting many VC-backed tokens: large unlock schedules for early investors and team members create persistent sell-side pressure. Since its peak, $ENA’s price has dropped approximately 80%. However, inflation is set to decline sharply over the next six months, potentially easing selling pressure. Currently, $ENA appears to have bottomed out and begun recovering.

The Future Competitive Landscape of Stablecoins

Ethena’s long-term goal is to scale USDe to tens or even hundreds of billions of dollars in size. Given the growing demand for stablecoins in cross-border payments, a trillion-dollar valuation is not entirely out of reach. If Ethena achieves this, the value of the $ENA token could increase substantially.

However, I believe this journey remains fraught with challenges and uncertainty. Whether Ethena can truly compete with Tether for dominance in the stablecoin arena remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News