USDe: A Solution to the Stablecoin Trilemma? Or a Profitable Hedge Fund Model?

TechFlow Selected TechFlow Selected

USDe: A Solution to the Stablecoin Trilemma? Or a Profitable Hedge Fund Model?

USDe aims to provide a scalable decentralized stablecoin, with improved stability mechanisms and long-term operational model compared to previous versions, though its performance still requires market observation.

Author: Tiena Sekharan

Translation: Baishuo Blockchain

1. What problem is USDe trying to solve?

In a world where most cryptocurrencies struggle to prove their utility, stablecoins are an asset class that has already found product-market fit:

(i) They act as a bridge between crypto and traditional finance (TradFi).

(ii) The most liquid trading pairs on centralized exchanges (CEXes) and decentralized exchanges (DEXes) are priced in stablecoins.

(iii) They enable instant peer-to-peer payments, especially cross-border ones.

(iv) For people forced to hold weak currencies, they can serve as a store of value.

However, current stablecoin designs face several challenges:

Fiat-backed stablecoins are not decentralized.

Currently, the most widely used stablecoins are fiat-backed and controlled by centralized entities. They also have the following drawbacks:

(i) They are issued by centralized entities susceptible to censorship.

(ii) The fiat backing them is held in banks that may go bankrupt, with opaque deposit accounts that can be frozen.

(iii) The securities backing them are custodied by government-regulated entities, with non-transparent processes.

(iv) Their value is subject to rules and laws that may change based on political environments.

Ironically, the most widely used token within an asset class designed to enable decentralized, transparent, and censorship-resistant transactions is issued by centralized institutions and backed by assets held within traditional financial infrastructure—assets vulnerable to government control and revocation.

USDe aims to address these issues by offering a decentralized stablecoin solution focused on transparency, censorship resistance, and independence from traditional financial systems.

2. The Problems USDe Aims to Solve

Crypto-collateralized stablecoins lack scalability.

Before being backed by real-world assets (RWAs), MakerDAO's DAI was a relatively decentralized stablecoin whose collateral could be verified on-chain.

DAI’s collateral consists of volatile assets like ETH. To ensure a safety margin, minting DAI requires locking up 110–200% of collateral. This makes DAI capital-inefficient and less scalable.

1) Algorithmic stablecoins are unstable

Algorithmic stablecoins like Terra Luna’s UST offered advantages in scalability, capital efficiency, and decentralization—but their spectacular collapse clearly demonstrated their instability, triggering a prolonged bear market across the entire cryptocurrency sector.

Ethena Labs’ USDe attempts to solve these identified challenges. I will assess below whether it succeeds.

2) What is USDe?

USDe is a scalable synthetic dollar, backed by a delta-neutral portfolio combining long spot positions and short derivative positions, usable in DeFi protocols without relying on traditional banking infrastructure.

How does USDe maintain its peg to the dollar?

The assets backing USDe include:

-

Long spot collateral: Liquid staked tokens (LSTs) such as stETH, rETH, BTC, and USDT.

-

Short-term derivative positions: Using the same collateral.

Here’s how it works:

Institutions that have completed KYC (Know Your Customer) in permitted jurisdictions can mint USDe by depositing LSTs, BTC, or USDT with Ethena Labs.

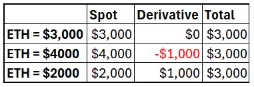

For example: Assume 1 ETH = $3,000. A whitelisted user mints 3,000 USDe by depositing 1 ETH. Ethena Labs uses the deposited ETH as collateral to open a hedging position—such as a perpetual contract or futures short—on a derivatives exchange.

Initially, the backing assets for 3,000 USDe are:

-

$3,000 worth of 1 ETH

-

One ETH short futures contract valued at $0 (execution price $3,000)—temporarily ignoring funding rates or basis spreads received by the short seller

If ETH price rises by $1,000, the backing assets for 3,000 USDe become:

-

1 ETH now worth $4,000

-

One ETH short futures contract now worth -$1,000

If ETH price drops by $1,000, the backing assets for 3,000 USDe become:

-

1 ETH now worth $2,000

-

One ETH short futures contract now worth $1,000

-

The total value of the portfolio backing USDe remains $3,000.

3) How can USDe offer yields above 25%?

USDe has two sources of yield:

-

Staking yield – LSTs used as collateral generate staking rewards through: (i) consensus-layer inflation, (ii) execution-layer transaction fees, and (iii) MEV. Note that while BTC can now be used as eligible collateral to mint USDe, BTC itself does not generate staking yield.

-

Basis spread and funding rate – Basis trading is one of the best-known arbitrage strategies. Futures often trade at a premium. Therefore, buying spot and selling futures at a premium captures the difference—the basis spread—as profit. In perpetual contracts, when the perpetual price exceeds the underlying asset price, long position holders typically pay funding rates to short position holders.

Not all USDe earns yield

Note that not all USDe automatically earns yield. Only stUSDe earns yield. Users in eligible regions must stake USDe to qualify for yield distributions. This amplifies yields because returns are generated across all minted USDe but distributed only to those who stake.

Assume only 20% of USDe is staked:

-

Total USDe minted: 100

-

Staking yield: 4%

-

Funding rate: 3%

-

Protocol total yield: 7%

-

stUSDe yield: 7 / 20 * 100 = 35%

USDe ≠ UST

High yields have raised suspicions about similarities between USDe and Terra Luna’s UST.

I hope the explanation above clarifies that this comparison is flawed. UST was a Ponzi scheme, distributing funds from new investors to earlier ones. The yields generated by USDe are real and mathematically understandable. There are risks involved, which we’ll discuss below, but for those capable of managing them, the returns are genuine.

3. Has USDe solved the stablecoin trilemma by delivering scale, decentralization, and stability?

1) Scale

Since USDe’s backing includes both spot and derivatives, we need to consider the scalability of both.

Spot: Compared to DAI, USDe’s advantage in scalability lies in not requiring over-collateralization. However, USDe only accepts ETH, BTC, and USDT as collateral, whereas DAI accepts several other crypto tokens and even real-world assets (RWAs). Fiat-backed stablecoins like USDT have greater scalability potential, given that the market caps of BTC and ETH are relatively small compared to the $30 trillion Treasury market.

Derivatives: If Ethena Labs were limited to decentralized exchanges (DEXes), scalability would be constrained. Instead, it strategically uses centralized exchanges (CEXes), which offer 25x more liquidity.

USDe will have scaling limits, but from its current market cap, there remains ample room for growth.

2) Decentralization

Unlike fiat-backed stablecoins like USDC and USDT, USDe does not rely on closed traditional banking infrastructure to custody its backing collateral. The LSTs, USDT, or BTC backing USDe can be transparently observed on-chain.

Regarding derivative positions, transparency would be higher if only DEXes were used. However, as noted, Ethena Labs made a deliberate decision to use CEXes for scalability. By using “off-exchange settlement” providers, counterparty and centralization risks associated with CEXes can be mitigated. When establishing derivative positions with centralized derivatives exchanges, collateral ownership does not transfer to the exchange; instead, it is held by the off-exchange settlement provider. This enables more frequent settlement of pending PnL and reduces exposure to exchange insolvency.

While collateral positions can be transparently viewed on-chain, the actual value of derivatives cannot. Users must rely on Ethena Labs’ disclosure process to track hedging positions across multiple platforms. Derivative values can be highly volatile and often deviate from theoretical prices. For instance: when ETH’s price halves, the short position’s value may rise—but not enough to fully offset the drop in ETH’s price.

3) Stability

Cash-and-carry arbitrage is a long-standing strategy in traditional finance, involving going long on spot and short on futures to capture price differences. Derivatives markets for top crypto assets have matured sufficiently to support this proven strategy.

But how stable is “stable enough”? If USDe aims to be used as a “means of payment,” maintaining a 1:1 peg to the dollar 98% of the time is insufficient. It must maintain its peg even during the most volatile market conditions.

Banking systems are trusted so highly because we know that one dollar at Wells Fargo is the same as one dollar at Bank of America—and the same as physical dollar bills in your wallet—“consistently.”

I believe the cash-and-carry model cannot support this level of stability.

To mitigate the impact of market volatility and negative funding rates, USDe has two protective measures:

Staking yield acts as the first layer of defense, supporting the dollar peg.

If staking yield is insufficient to cover negative funding rates, the reserve fund serves as a second layer, providing additional protection for the dollar peg.

If even after exhausting the reserve fund, persistently high negative funding rates continue, the peg may break.

Historically, funding rates have mostly been positive, averaging 6–8% over the past three years—including during the 2022 bear market. As stated on Ethena’s website: “The longest streak of consecutive negative funding rates was only 13 days. The longest streak of positive funding rates was 108 days.” Yet this does not guarantee funding rates will remain positive.

4) Ethena Labs is like a hedge fund

Ethena Labs operates much like a hedge fund managing a complex investment portfolio. The yields are real, but users face not only market volatility risk but also the risk of whether Ethena Labs can effectively manage the technical aspects of maintaining a delta-neutral portfolio.

Maintaining a delta-neutral position in a portfolio holding spot and short derivatives is an ongoing activity. When USDe is minted, derivative positions are opened and then continuously adjusted to realize PnL:

(i) Optimizing across different contract specifications and capital efficiency offered by various exchanges;

(ii) Switching between coin-margined inverse contracts and USD-margined linear contracts;

(iii) Derivative prices often deviate from theoretical values. Each trade incurs transaction fees and potential slippage losses.

Users must trust that Ethena Labs’ experienced team can responsibly manage the portfolio.

5) The real scalability limit may be the lack of incentive to mint USDe

Any hedge fund’s goal is to attract assets under management (AUM). For Ethena Labs, attracting AUM means encouraging more people to mint USDe.

I understand why someone might want to “stake” USDe. Even accounting for risks, the returns are compelling. But I don’t see why anyone would want to “mint” USDe.

In traditional finance (TradFi), when someone needs cash, they pledge property or stocks instead of selling them—because they want to retain upside potential if those assets appreciate.

Similarly, when you mint (borrow) DAI, you know that upon burning (repaying) DAI, you’ll get back your original collateral.

But when someone mints USDe, they do not have the right to reclaim their original collateral. Instead, they receive collateral equal in value to the USDe minted.

Suppose 1 ETH = $3,000, and you mint 3,000 USDe. If you decide to redeem six months later and ETH has risen to $6,000, you’ll receive only 0.5 ETH. If ETH drops to $1,500, you’ll receive 2 ETH.

This is equivalent to selling your ETH today. If ETH rises, you’ll be able to buy less ETH later with the same amount. If ETH falls, you’ll need to buy more ETH to repay.

The generated returns go to those who stake USDe. The only benefit for minters is the potential ENA token airdrop.

Without clear incentives to mint USDe, I don’t understand how they’ve attracted a market cap exceeding $2 billion.

I should note that regulatory uncertainty may be the reason behind their design choice not to distribute yield on all minted USDe. Yield could classify USDe as a security, leading to complications with the U.S. Securities and Exchange Commission (SEC).

4. Conclusion

USDe is a viable attempt to solve the stablecoin trilemma. However, any temptation to promote it to retail markets as a stable token with risk-free returns must be resisted.

Before Bitcoin emerged, there were several attempts at digital currency, including eCash, DigiCash, and HashCash. Although they ultimately failed, they made significant contributions to cryptography and digital money research, and many of their features were eventually incorporated into Bitcoin.

Likewise, USDe may not be perfect, but I believe its characteristics will be integrated into the stronger synthetic dollar that eventually emerges.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News