Dragonfly Partner Haseeb: Has USDe really depegged?

TechFlow Selected TechFlow Selected

Dragonfly Partner Haseeb: Has USDe really depegged?

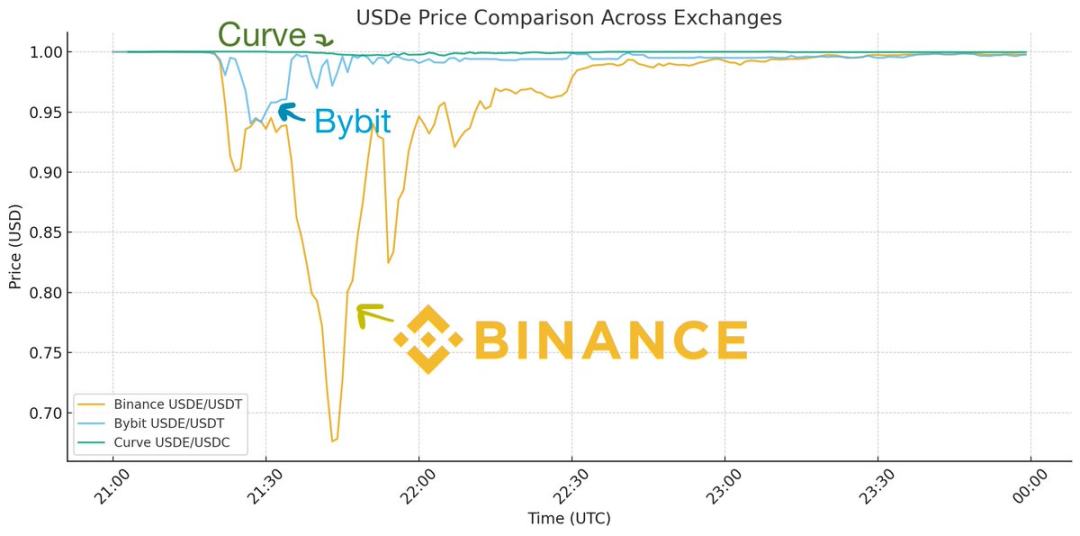

Although USDe experienced price declines on every centralized exchange, the drops were not uniform.

Author: Haseeb Qureshi, Partner at Dragonfly

Translation: Luffy, Foresight News

I've seen a lot of discussion about USDe (the stablecoin issued by Ethena) de-pegging during this weekend's market turmoil. The narrative is that USDe briefly dropped to around $0.68 before recovering somewhat. This is the Binance chart everyone has been citing:

But after diving deep into the data and speaking with many people over the past few days, it’s now clear this narrative is incorrect—USDe did not de-peg.

The first thing to understand is that the most liquid venue for USDe isn’t actually on exchanges—it’s on Curve. There are hundreds of millions of dollars in standing liquidity on Curve, while any single exchange, including Binance, only has tens of millions.

So if you only look at the USDe chart on Binance, it appears de-pegged. But when you overlay other liquid venues for USDe, you get a different picture:

We can see that while USDe prices dipped on every centralized exchange, the extent was uneven. Bybit briefly fell to $0.95 and quickly recovered, while Binance experienced a massive de-peg that took a long time to correct. Meanwhile, the price on Curve only dropped by 0.3%. How do we explain this discrepancy?

Remember, every exchange was under tremendous stress that day—the largest liquidation event in crypto history. Binance was especially unstable, with APIs failing, deposits and withdrawals disrupted, market makers unable to move positions, and no one able to step in for arbitrage.

It was as if there was a fire at Binance, but all roads were blocked and firefighters couldn’t get through. This caused conditions on Binance to spiral out of control, while elsewhere the fire was quickly extinguished by liquidity bridges. As Guy showed in his post, due to similar systemic instability, USDC also briefly de-pegged by a few cents on Binance—only because liquidity couldn’t enter—but this wasn’t considered a true de-peg event for USDC.

So large price discrepancies across exchanges during API outages aren’t surprising, since no one could access their positions. But why did Binance’s price drop so much deeper than Bybit’s?

There are two reasons. First, Binance has no primary dealer relationship with Ethena, meaning there’s no direct minting or redemption available on the platform (unlike Bybit and other exchanges that have integrated this). This integration allows market makers to perform on-platform arbitrage. Without it, market makers would have to withdraw funds from Binance, conduct peg arbitrage via Ethena, then redeposit their positions back. During a crisis with failed APIs, no one could do this.

Second, Binance’s oracle performed poorly, beginning to liquidate positions that shouldn’t have been liquidated. A well-designed liquidation mechanism should not trigger during price flashes. If you’re not the primary trading venue for an asset (and Binance is not for USDe), you should reference prices from the main venue. If you rely solely on your own order book, you risk over-liquidating. This led Binance to start liquidating USDe at around $0.80, triggering a cascade. It’s also a key reason why Binance is now refunding users whose USDe positions were liquidated (as far as I know, no other exchange is doing this). They made a mistake by relying solely on their internal price rather than true external market prices.

So this was a Binance-specific flash crash that better market structure could have prevented. USDe remained relatively stably pegged throughout the day on the primary venue, Curve. This is fundamentally different from what people describe as a de-peg.

If you recall the USDC situation during the 2023 Silicon Valley Bank crisis, that was a real de-peg scenario:

During the SVB crisis, USDC dropped in price across every venue—there was nowhere you could sell USDC for $1. Redemptions were actually paused, so $0.87 was its true market price. That’s what a de-peg means.

This time, it was merely a Binance-specific price dislocation. It’s an important lesson for market infrastructure, but if you're trying to infer anything about USDe’s mechanism from this weekend’s events, understanding these nuances is critical.

Throughout the incident, USDe was fully collateralized at $1 on major trading venues, and due to volatility, its collateral actually increased over the weekend. In fact, this market stress turned out to be beneficial by delivering valuable lessons for the entire industry. Guy’s thread explains how any exchange, including Binance, can avoid such issues in the future.

In short: USDe did not de-peg. Binance had a price problem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News