Will Ethena become a new financial hub with USDe's planned 25 billion circulation?

TechFlow Selected TechFlow Selected

Will Ethena become a new financial hub with USDe's planned 25 billion circulation?

In-depth analysis of Ethena's unique secrets, revealing the reasons behind its irreproducibility.

Author: Ponyo :: FP, Researcher at FourPillarsFP

Translation: Deep from TechFlow

Editor's Note: Ethena maintains a $5 billion market cap stablecoin USDe with a team of just 26 people, using a delta-neutral strategy to hedge volatility in assets like ETH and BTC, maintaining its peg to $1 while delivering double-digit annualized yields. Its automated risk management and multi-platform hedging have created a moat, successfully weathering extreme market swings and the Bybit hack. Ethena plans to scale USDe circulation to $25 billion through iUSDe, the Converge chain, and a Telegram application, aiming to become a financial hub connecting DeFi, CeFi, and TradFi.

The following is the original content (slightly edited for clarity):

Have you ever tried eating hot noodles while riding a roller coaster? Sounds absurd, but it’s the perfect metaphor for what @ethena_labs does every day: maintaining a $5 billion stablecoin (USDe) firmly pegged to $1 despite constant crypto market turbulence—all managed by a lean 26-person team led by founder @gdog97_. This article dives into Ethena’s secret sauce, explains why it’s hard to replicate, and outlines how Ethena plans to scale USDe circulation to $25 billion.

Hedging Billions in Volatility

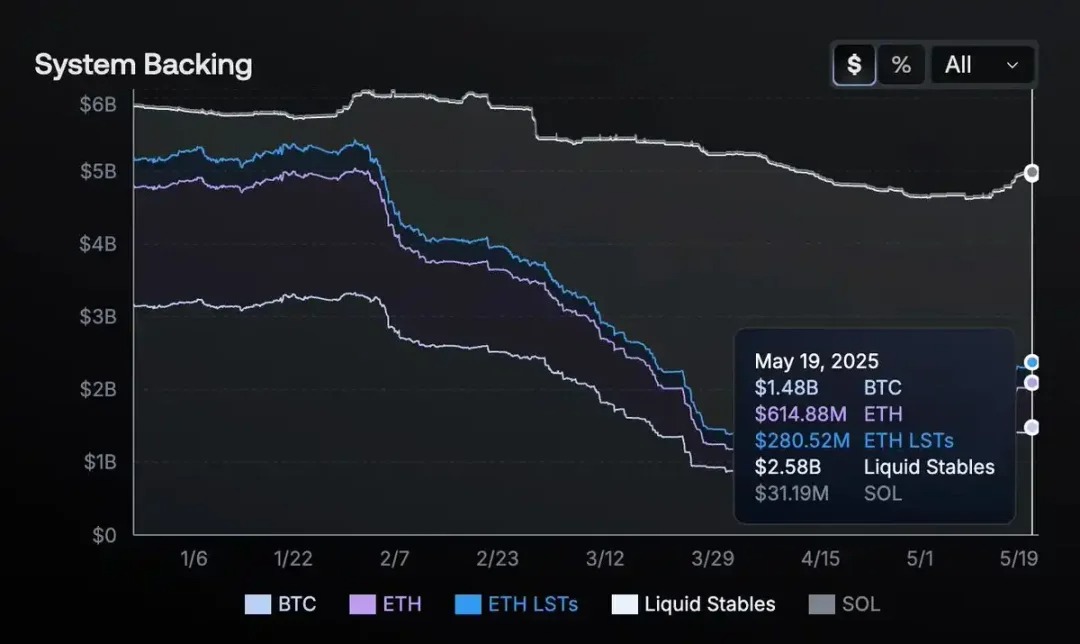

Stablecoins seem boring on the surface: $1 is $1, right? But look under Ethena’s hood, and you’ll find anything but simplicity. Instead of backing its stablecoin with dollars in a bank, Ethena uses a powerful portfolio including ETH, BTC, SOL, ETH LSTs (liquid staking tokens), and $1.44 billion worth of USDtb—a stable asset backed by U.S. Treasuries. These assets are continuously shorted on major derivatives exchanges to ensure that any price movement in the collateral is offset by gains or losses in the short positions.

Source: Ethena Transparency Dashboard

A 5% rise in ETH with a misaligned hedge ratio could expose tens of millions in risk. If markets crash at 3 a.m., the risk engine must instantly rebalance collateral or close positions. There’s almost zero room for error. Yet through the roller-coaster markets of 2023–2024, Ethena managed billions in daily hedging without a single blowup (no de-peg, no margin liquidations, no shortfall).

During the Bybit hack, Ethena remained solvent with no loss of collateral. Traditional hedge funds might need an entire floor of analysts and traders to handle such volatility—Ethena pulled it off with a lean team and zero mistakes.

Within months of launch, Ethena became a top counterparty for multiple centralized exchanges. Its hedging trades even influenced liquidity and order book depth, yet few noticed—because the stablecoin simply worked.

About those high yields: Ethena delivered double-digit APY during bullish markets. At first glance, this recalls Terra/LUNA and its tragic 20% Anchor yield. But unlike Terra, Ethena’s returns come from real market inefficiencies (staking rewards plus positive perpetual funding rates), not token minting or unsustainable subsidies.

How Ethena’s Delta-Neutral Magic Works

When users deposit $1,000 worth of ETH, they can mint about $1,000 of USDe. The protocol automatically opens a short futures position. If ETH falls, the short profits offset collateral losses; if ETH rises, the short loses value but the collateral appreciates. The net dollar value stays stable. Meanwhile, when perpetual markets are overly leveraged to the long side, Ethena—as the short holder—earns funding fees, enabling double-digit APY for USDe during bull runs, all without treasury subsidies.

Ethena spreads these hedges across Binance, Bybit, OKX, and even some decentralized perpetual protocols to avoid concentration risk and margin limits on any single exchange. A recent governance proposal shows Ethena planning to add Hyperliquid to its hedging mix, placing shorts in the deepest liquidity pools. By distributing short exposure, Ethena reduces reliance on any one platform, further enhancing stability.

Source: Ethena Transparency Dashboard

To manage constant adjustments, Ethena deploys automated bots working alongside its trading team—akin to high-frequency trading systems—continuously rebalancing its multi-platform ledger. This is why USDe holds its peg regardless of market turbulence.

Finally, the protocol uses over-collateralization to withstand extreme downturns and can pause minting under unsafe conditions. Custody integrations (Copper, Fireblocks) allow Ethena to control assets in real time instead of leaving them in exchange hot wallets. If an exchange fails, Ethena can quickly withdraw collateral, shielding users from single points of failure.

A Strong Moat

Ethena’s approach may seem replicable on paper (hedge crypto assets, collect funding fees, profit), but in practice, the protocol has built formidable moats that deter copycats.

A key barrier is trust and credit lines: Ethena hedges billions via institutional desks with custodians and major platforms (Binance Ceffu, OKX). Most small projects can’t easily access these institutions or negotiate million-dollar short positions with minimal on-exchange collateral requirements—this demands institutional-grade legal, compliance, and operational rigor.

Equally important is multi-platform risk management. Splitting large hedges across exchanges requires real-time analytical capabilities rivaling Wall Street quant teams. Yes, anyone can replicate delta hedging at small scale, but scaling to $5 billion—and rebalancing massive collateral around the clock across platforms—is another level entirely. The complexity of analytics, automation, and credit relationships grows exponentially with scale, making it nearly impossible for newcomers to catch up overnight.

Meanwhile, Ethena doesn’t rely on perpetual free yield. If perpetual funding rates turn negative, it reduces short exposure and leans on staking or stablecoin yields. A reserve fund buffers prolonged periods of negative funding, while many high-yield DeFi protocols collapse the moment the music stops.

By not holding all collateral directly on a single exchange, Ethena further reduces counterparty risk; instead, assets are held with custodians. If a platform becomes unstable, Ethena can swiftly close positions and move collateral off-exchange, minimizing the risk of catastrophic failure.

Finally, Ethena’s track record during extreme volatility strengthens its moat. USDe has never de-pegged or collapsed during months of market chaos. This reliability drives new user adoption, listings, and top-tier brokerage interest (from Securitize to BlackRock and Franklin Templeton), creating an unreplicable snowball effect of trust. The gap between talking about delta hedging and delivering it 24/7 at a billion-dollar scale is exactly what sets Ethena apart.

The Path to $25 Billion

Ethena’s growth strategy relies on a self-reinforcing ecosystem where currency (USDe), network (“Converge” chain), and exchange/liquidity aggregation evolve together. USDe launched first, driven by crypto-native demand from DeFi (Aave, Pendle, Morpho) and CeFi (Bybit, OKX). The next phase involves iUSDe—a compliant version tailored for banks, funds, and corporate treasuries. Even a small fraction of traditional finance’s (TradFi) massive bond market flowing into USDe could push stablecoin circulation to $25 billion or beyond.

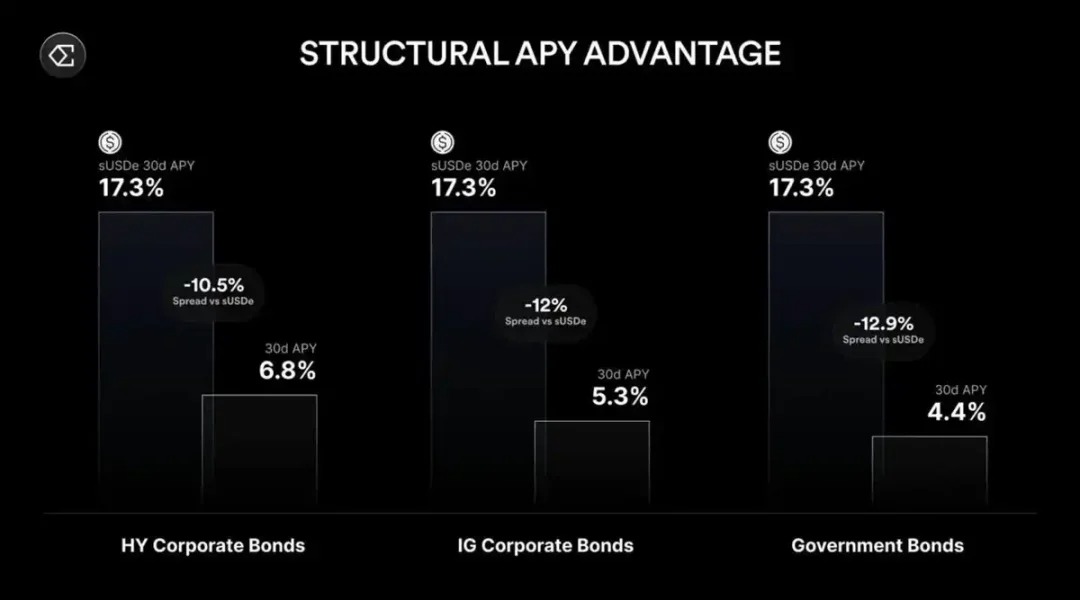

Driving this growth is arbitrage between on-chain funding rates and traditional interest rates. As long as significant yield gaps exist, capital flows from low-yield to high-yield markets until equilibrium is reached. Thus, USDe becomes a hub linking crypto yields with macro benchmarks.

Source: Ethena 2025: Convergence

In parallel, Ethena is building a Telegram-based app to bring high-yield dollar savings to everyday users via a simple interface, potentially onboarding hundreds of millions into sUSDe. On the infrastructure side, the Converge chain weaves together DeFi and CeFi rails—each new integration fuels a compounding increase in USDe’s liquidity and utility.

Notably, sUSDe returns are inversely correlated with real interest rates. When the Fed cut rates by 75 basis points in Q4 2024, yield surged from around 8% to over 20%, highlighting how falling macro rates boost Ethena’s earning potential.

This isn’t slow, linear progress—it’s circular expansion: broader adoption enhances USDe’s liquidity and yield potential, attracting larger institutions, driving supply growth, and reinforcing the peg.

Looking Ahead

Ethena isn’t the first stablecoin to promise high yields or claim innovation. What sets it apart is that it delivers—through the most intense market shocks, USDe has stayed firmly anchored at $1. Behind the scenes, it operates like a top-tier institution, shorting perpetuals and managing staked collateral. Yet for ordinary holders, the experience is simply a stable, yielding dollar—reliable and easy to use.

Scaling from $5 billion to $25 billion won’t be easy. Stricter regulatory scrutiny, larger counterparty exposures, and potential liquidity crunches could bring new risks. Yet Ethena’s multi-asset collateral (including $1.44 billion in USDtb), robust automation, and disciplined risk management suggest it’s better equipped than most to handle them.

In the end, Ethena demonstrates how to navigate crypto volatility at an astonishing scale using delta-neutral strategies. It paints a vision for the future: USDe as a core financial asset across every domain—from DeFi’s permissionless frontier and CeFi trading desks to TradFi’s vast bond markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News