Dissecting Ethena: USDe, Converge, and the New Frontier of Business

TechFlow Selected TechFlow Selected

Dissecting Ethena: USDe, Converge, and the New Frontier of Business

In the field of settlement and asset tokenization, Ethena is aggressively expanding its product portfolio.

Author: ASXN Daily

Translation: TechFlow

Ethena

Ethena's strategy revolves around two major application scenarios in cryptocurrency, explicitly mentioned by the team in multiple interviews:

-

"Settlement for speculation": including meme coins, derivatives, yield farming, and casino-like activities. The team has established a foothold in this market through its USDe and sUSDe products.

-

"Settlement for stablecoins, digital dollars, and tokenization": bringing traditional financial assets on-chain. The team is gradually shifting focus to this area, launching products such as iUSDe, USDtb, and Converge.

In the speculative domain, the Ethena protocol focuses on deeply integrating USDe into both decentralized and centralized trading venues to ensure tight linkage with trading activity.

Within the DeFi ecosystem, this integration takes various forms: users can use USDe holdings as collateral for borrowing (for speculation or yield generation); trade sUSDe yield on platforms like Pendle; or use USDe as margin for perpetual contracts and other trades on decentralized and centralized exchanges. In this way, Ethena attempts to build competitive moats, positioning itself as an asset tightly coupled with speculation and trading. In some cases, USDe itself becomes a tradable asset—for example, on Pendle.

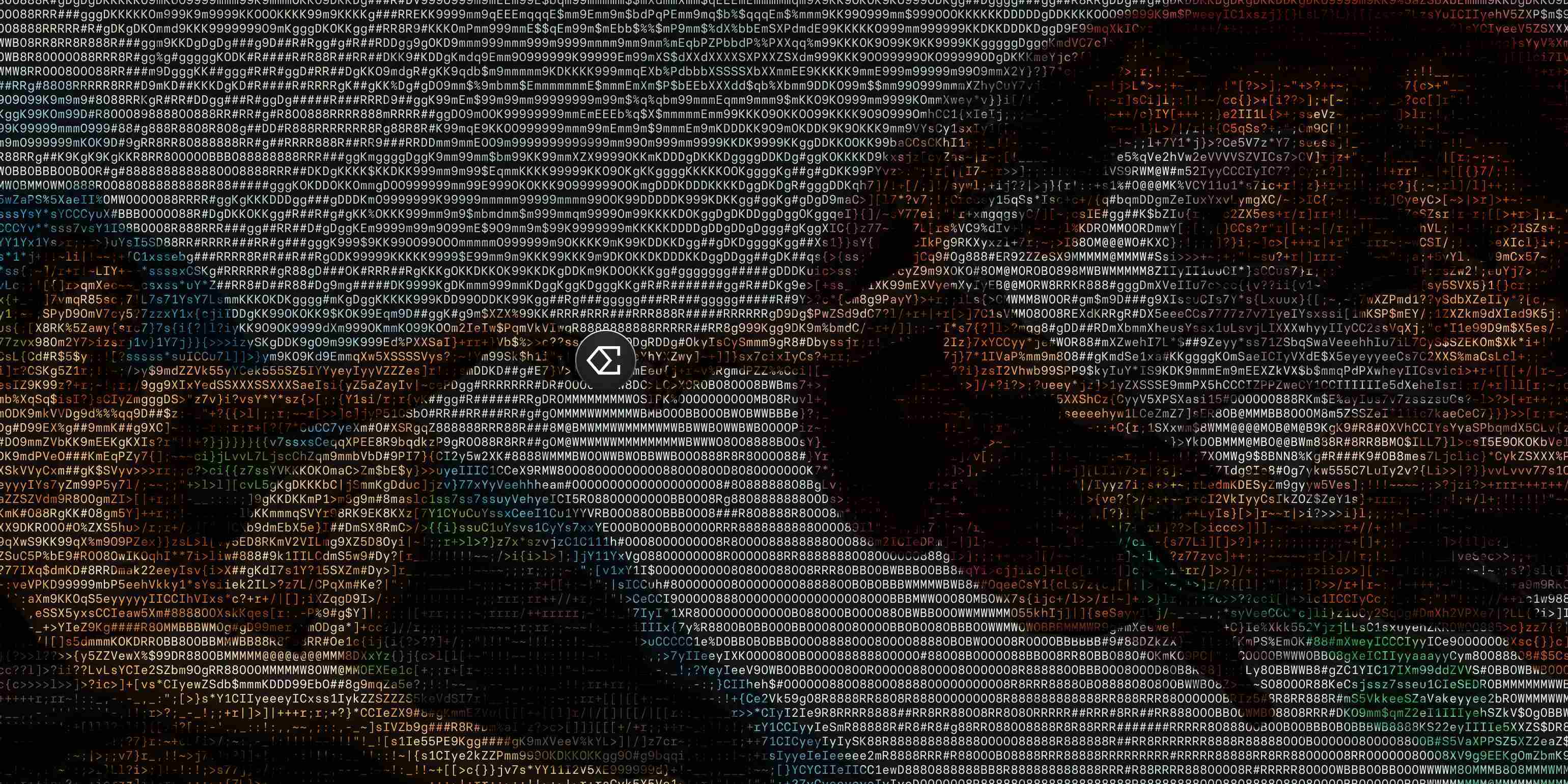

In the settlement and asset tokenization space, Ethena is aggressively expanding its product suite. During its first few years, Ethena clearly focused on growing its core product, USDe, achieving exceptional execution. The protocol grew rapidly: within its first year, USDe reached $6 billion in circulation, making it one of the fastest-growing dollar-denominated products and DeFi protocols in crypto. Since then, USDe has become the third-largest dollar product in crypto and DeFi, behind only Tether (USDT) and Circle (USDC).

Over the past year, Ethena’s focus has gradually shifted toward bringing traditional financial assets on-chain, concentrating on settlement for stablecoins, digital dollars, and asset tokenization. Guy, Ethena's founder, stated, “Institutional capital inflows into crypto are the most important theme of this cycle and will be key to future development.” To successfully capture this institutional opportunity, the team has developed several products—including iUSDe, USDtb, and most importantly, Converge—that not only aim to attract institutional capital and bring in tokenized assets but also complement each other synergistically.

Recently, the application landscape for cryptocurrency has evolved significantly. While decentralization, trustlessness, permissionless access, and transparent markets remain important, increasing attention is being paid to how crypto improves settlement efficiency and infrastructure for traditional finance. Ethena’s product expansion directly targets this trend, aiming at institutional-level efficiency improvements through stablecoins and asset tokenization.

Ethena

USDe

USDe is Ethena’s flagship product—a synthetic dollar built upon tokenized basis trades. Its rapid growth stems from high embedded yields, accessible by staking USDe to receive sUSDe, as well as broad integration across DeFi protocols and centralized exchanges. The team has adopted an aggressive strategy to ensure USDe is widely used across trading venues and frequently ranks among the highest-yielding dollar products.

Guy, Ethena co-founder, has repeatedly emphasized over recent years that the key difference between USDe and USDT/USDC lies in yield distribution. USDT and USDC typically internalize their earnings (e.g., Treasury yields) or return them only in select venues (such as USDC on Coinbase). Ethena, however, chose a different competitive path—not competing with USDT and USDC on velocity or liquidity, but focusing instead on yield, passing all basis trade profits directly to stakers and USDe holders.

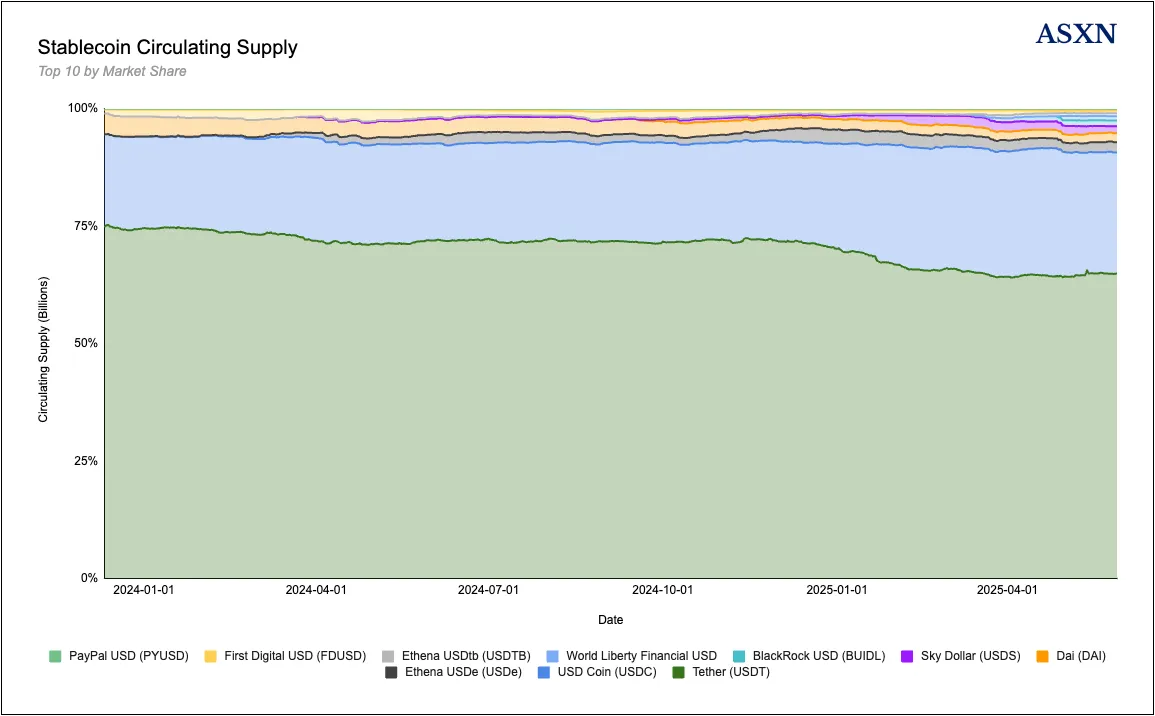

As of May 2025, USDe’s circulating supply reached $5.3 billion, accounting for approximately 2% of the total stablecoin market cap. Its influence is particularly strong in money markets, yield products, and CDP-based stablecoin ecosystems. USDe frequently serves as a source of yield, a trading instrument, or collateral.

In this report, we refer to USDe as a dollar product or synthetic dollar product, but must emphasize that its risk profile differs from traditional stablecoins—those backed by Treasuries or short-term government bonds.

Ethena specifically aims to provide users with a store-of-value or savings product via its synthetic dollar, USDe. The team does not attempt to directly compete with USDT (and to a lesser extent, USDC) to dominate payments and settlements. USDT enjoys powerful network effects and widespread distribution advantages in MENA, Africa, and Asia. Instead, Ethena offers a semi-complementary product—USDe—which shares yield with users and appeals to those seeking yield-bearing dollarized products, effectively functioning as a savings account (albeit with higher risk due to high returns). Meanwhile, the team recently launched USDtb, a Treasury-backed stablecoin, to complement USDe rather than directly compete with USDT and USDC.

Unlike fiat-backed stablecoins, USDe is backed by volatile crypto assets and hedged via short positions in derivatives markets. For every USDe minted, the protocol holds an equivalent value of crypto assets (such as ETH, BTC, or liquid staked tokens) and simultaneously establishes a corresponding short position in perpetual contracts or futures. This self-hedging "long + short" structure (i.e., the basis trade) neutralizes price volatility: if the underlying asset rises, the short loses value, and vice versa, keeping the net portfolio value roughly stable at $1. With price risk neutralized, USDe achieves 100% full backing (1:1 support) without requiring the large buffers typical of overcollateralized stablecoins.

To earn the yield generated by Ethena’s mechanism, users must stake USDe into sUSDe, a yield-bearing token. sUSDe functions as a savings token—it accumulates protocol income (such as funding rates) over time, while idle USDe itself earns no interest. By staking USDe, users receive sUSDe and enjoy system-generated yield. In 2024, sUSDe delivered an average annual percentage yield (APY) of about 19%, capturing yield from crypto markets.

USDe Minting Mechanism

Minting USDe involves converting assets into a hedged structure. For example, a whitelisted market maker can deposit $100 worth of USDC or USDT into Ethena and receive 100 USDe. Behind the scenes, Ethena uses these funds to purchase spot assets while opening an equivalent short perpetual position. This process is atomic and automated, enabling immediate hedging upon creation. Aside from execution costs, Ethena charges no additional spread or profit margin on minting or redemption.

All collateral assets are held off-chain in secure accounts (serviced by providers like Copper and Ceffu), not directly on exchanges, minimizing counterparty risk. This allowed Ethena to successfully withdraw positions during the Bybit hack, protecting user collateral. Exchanges are granted temporary control only when required for margin purposes, while off-chain settlement custody solutions ensure asset security.

USDe Operation Mechanism and Yield Sources

Ethena's design centers on the basis trade as the primary yield source, augmented by other revenue streams.

Basis Trade

The foundation of USDe is the basis trade. Historically, perpetual contract prices often exceed spot prices, meaning longs pay funding rates to shorts to maintain equilibrium. Ethena essentially tokenizes what Arthur Hayes described as the “Nakadollar”—by going long on the underlying crypto asset and shorting perpetuals, forming a synthetic dollar position. Since price movements in the long and short legs offset each other, the position maintains near-constant value, while the short side collects periodic funding rate income from perps.

Additionally, if the underlying asset itself generates yield (e.g., staked ETH earning protocol rewards), those rewards also accrue. Overall, USDe’s collateral generates yield in two ways:

-

Funding rate payments from perpetuals: Shorts benefit from funding rate payments made by longs.

-

Protocol rewards from underlying assets: e.g., additional yield from staked ETH.

Perpetual Funding Rates

When demand for long positions dominates in the market, shorts receive funding rates. Crypto markets generally exhibit persistent long bias—for instance, due to ETH’s deflationary nature and staking yield, ETH perpetuals often trade at annualized premiums (positive funding rates). By maintaining a constant short position, Ethena captures this yield.

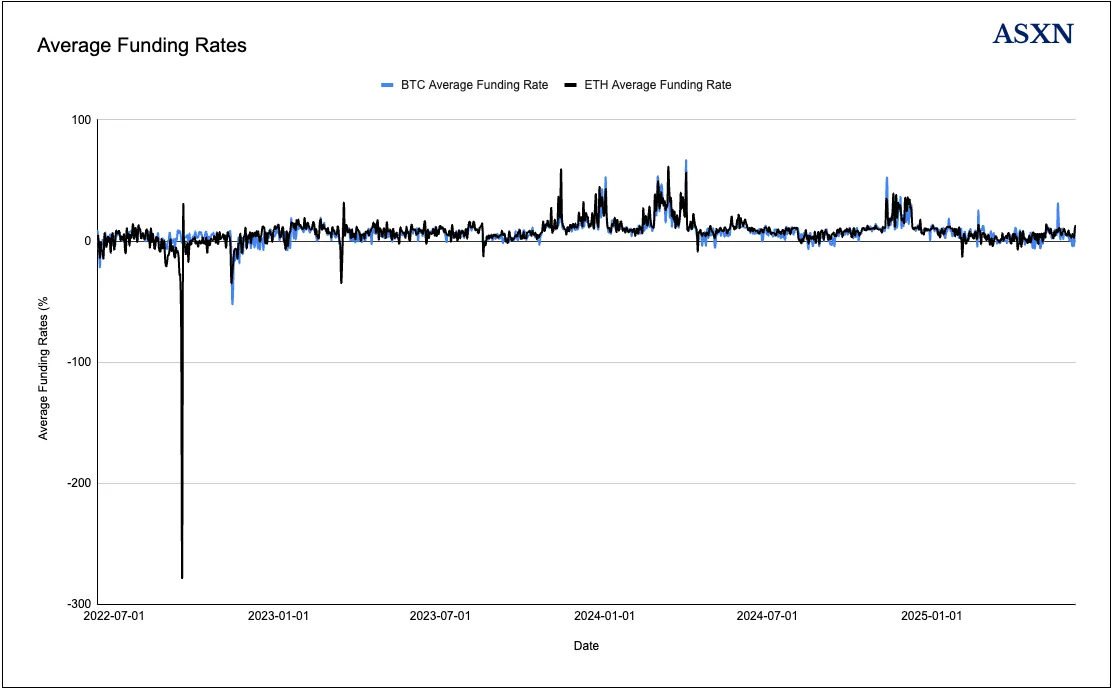

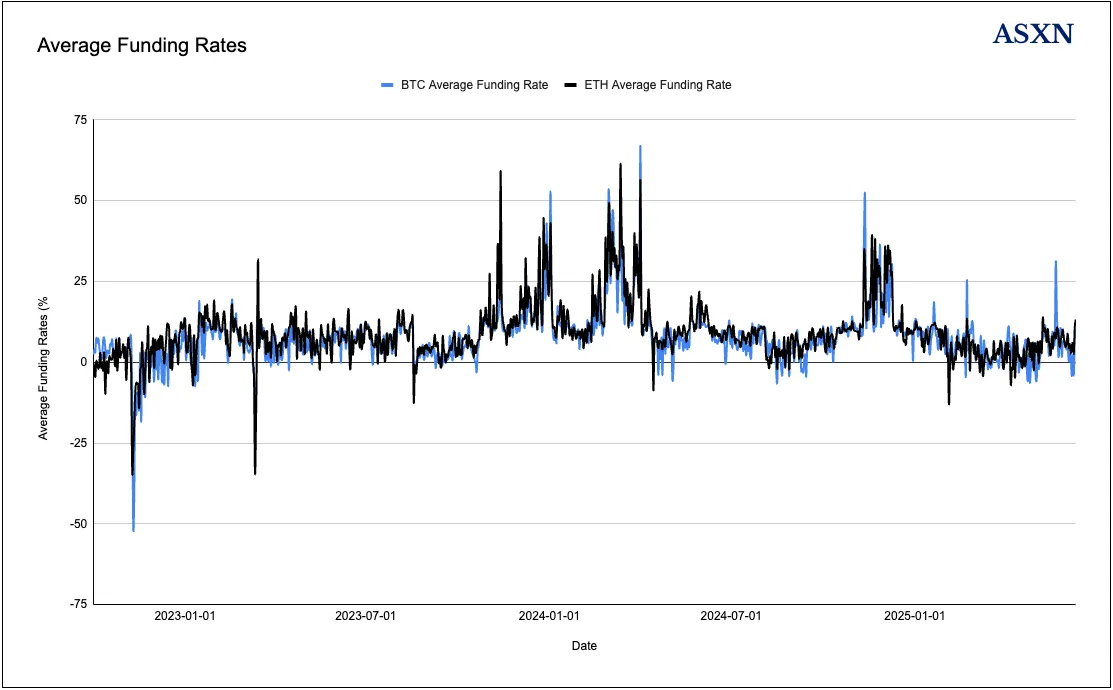

A common discussion point regarding Ethena’s yield strategy—particularly the basis trade—is its sustainability. Looking at ETH and BTC funding rate data, sustained negative funding rates are rare: they seldom last long. For example, BTC’s longest consecutive period of negative funding lasted just 8 days, while ETH saw 13 days. On average, negative funding periods last only 1.6 days for BTC and 2.2 days for ETH, indicating structural long bias quickly rebounds.

It should be noted that the above data includes an outlier driven by arbitrage in the perpetual market following Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The chart below shows the data after removing this anomaly.

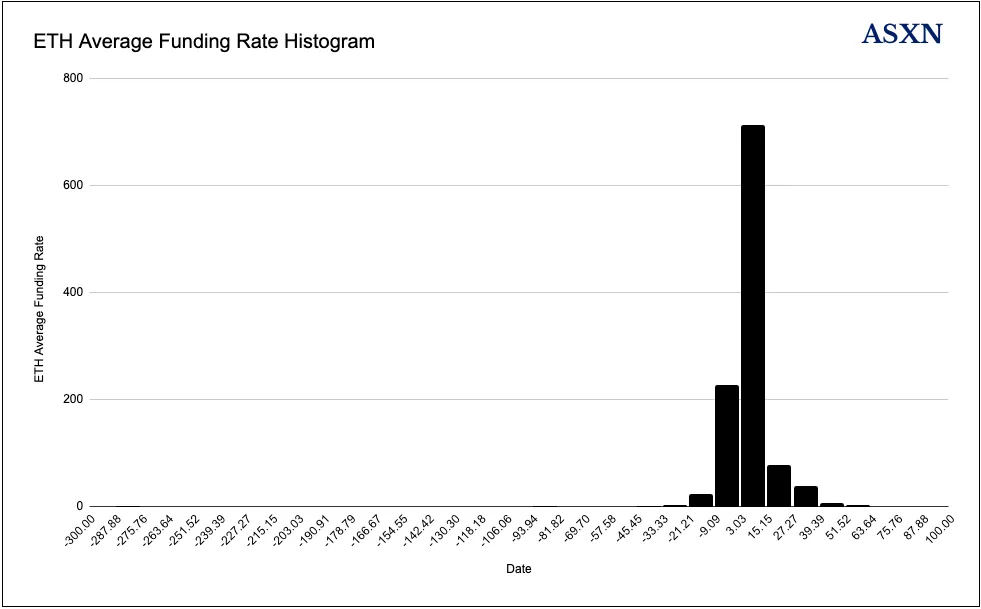

Histogram analysis further confirms a positively skewed distribution: BTC funding rates were negative only 10.5% of the time, ETH 12.5%. The distributions are strongly right-skewed, with average funding rates (BTC: 7.27%, ETH: 7.62%) significantly higher than medians, indicating occasional extreme positive funding spikes elevate overall averages. Notably, the most frequent funding rate ranges are solidly positive, with BTC and ETH mostly ranging between 5%-10% annualized.

Over the past few years, BTC and ETH funding rates have changed dramatically. Average funding rates were relatively low in 2022 (BTC: 1.69%, ETH: -1.92%, with ETH negative due to anomalies around the Merge event—funding briefly dropped to -276%). However, funding surged in 2023 (BTC: 7.59%, ETH: 9.09%) and peaked in 2024 (BTC: 11.12%, ETH: 12.68%).

Currently, Ethena’s total value locked (TVL) approaches $6 billion, representing a substantial portion of perpetual short positions. This raises a theoretical concern: could the protocol’s own hedging compress funding rates over time? Yet data shows funding remains comfortably positive, far exceeding the threshold needed to generate attractive yields even after combining with other rewards. Despite Ethena’s scale, funding rates remain stable, suggesting the market can absorb its hedging demand without fully exhausting basis trade opportunities.

Base Yield Breakdown: Staking and Lending

Ethena holds various forms of collateral. Some of it—gradually decreasing—is staked ETH (and liquid staked tokens like stETH), which earn ETH staking rewards, providing base yield to the pool. Additionally, Ethena may hold stablecoins as collateral (e.g., idle USDC/USDT reserves), deploying them into safe yield-generating channels (like lending markets). Adding liquid stablecoins not only buffers volatility but also generates extra yield via investment. Through dynamic allocation between crypto and stablecoins, Ethena optimizes yield while managing risk (e.g., increasing stablecoin holdings when funding rates are low or negative to reduce exposure).

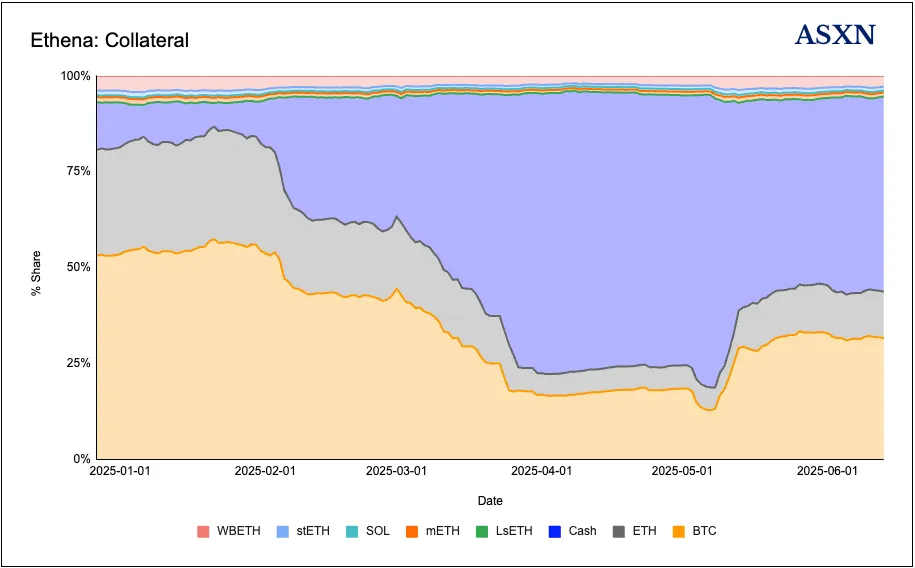

Since launch, Ethena’s reliance on ETH staking yield has decreased, closely tied to declining staking yields. Guy recently noted that when Ethena first launched, ETH staking yields were around 5%-6%, but have since fallen below 3%. He believes current returns no longer justify the inherent term and liquidity risks of staking. This view prompted a major shift in collateral composition—Ethena reduced its LST backing from 80% initially to less than 6% today.

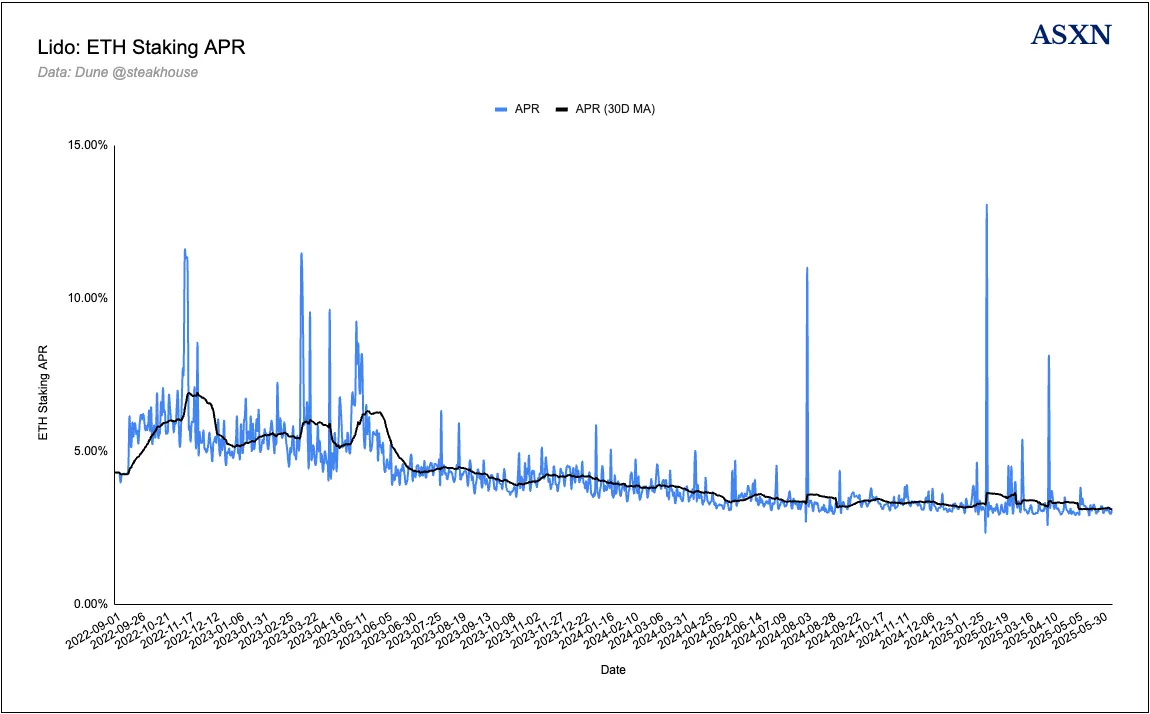

ETH staking yield briefly exceeded 13% in early 2023 before falling sharply. Starting from ~4.3% at Ethereum’s PoS transition in September 2022, yields averaged 3.9% in early 2024 and have since declined to ~3.1%.

Ethena’s collateral composition reflects its strategic pivot. From December 2024 to June 2025, staked ETH allocation dropped from 6.4% to 5.4%, while liquid cash expanded to nearly 50% of total collateral. This shift clearly indicates Ethena’s greater emphasis on conservative collateral strategy and capital preservation.

The rationale behind this adjustment lies in risk-return trade-offs. At current ~3% staking yields, stakers face multiple risks: lock-up period illiquidity, smart contract risk in liquid staking protocols, and slashing penalties from validator misbehavior. Combined, these risks make returns inferior to traditional risk-free rates. Moreover, Ethena’s core perpetual strategy already generates significant yield—adding more staking exposure adds operational complexity and monitoring burden without meaningful return improvement.

Beyond perpetual funding and staking rewards, Ethena enhances USDe returns or resilience through supplementary yield strategies:

-

Protocol Revenue Sharing

Ethena charges a 10 basis point (0.1%) fee on USDe minting, with zero fees on redemption. The protocol’s main income comes from unallocated yield. Only staked USDe (sUSDe) earns yield. This reserve fund can strengthen collateral or fund protocol initiatives. Effectively, this provides Ethena with sustainable revenue to support operations or ensure USDe peg stability. For users, it also creates incentive to stake. As of May 2024, Ethena’s reserve fund had grown substantially, generating millions in monthly revenue after distributing sUSDe yields.

-

Liquidation and Trading Fees

The protocol may occasionally realize gains when rebalancing collateral. If supporting asset prices change and positions are rehedged, small arbitrage gains or losses may occur (Ethena may minimize this, but any structural gains belong to the system).

-

External Yield Integration

Ethena is exploring integrations with DeFi platforms to generate additional yield on USDe. For example, depositing USDe into lending markets (when not needed for hedging) or liquidity pools can earn fees. Ethena noted that even the “liquid stablecoin” portion of collateral might earn rewards depending on where it’s held. This suggests active management of idle collateral—for instance, parking USDT in yield accounts during low funding periods or earning reserve yield via protocols like Aave without compromising peg stability. Each external protocol requires approval by the governance body—the Risk Committee.

-

Market Volatility

Though not consistent, Ethena can benefit from market volatility. For example, earlier this year, a cascade of ETH liquidations drove prices below $2,200. Because Ethena’s short perpetual positions temporarily decoupled from spot during the drop, the protocol gained ~5%-7% PnL despite theoretically delta-neutral positioning. This gain arose because cascading liquidations caused short perp positions to deviate from spot, creating extra profit space.

Ethena's Growth Trajectory

Ethena’s growth is characterized by rapid integration into DeFi and CeFi platforms, driving USDe demand and expanding use cases. Below is an overview of its key growth vectors:

Centralized Exchange & Trading Feature Integration

One of Ethena’s core strategies is integrating USDe into perpetual exchanges. This leverages stablecoins’ widespread demand as margin assets. In 2024, Ethena announced a partnership with Bybit to support USDe. Bybit not only listed USDe trading pairs but also enabled traders to use USDe as perpetual margin and earn yield on it. Traditionally, traders use USDT or USDC as margin, which themselves can generate yield. By allowing USDe usage, Bybit users can partially offset funding costs with yield earned on USDe. Before the hack incident, Bybit held over $700 million in USDe, demonstrating strong market acceptance.

In early 2025, Ethena announced plans to integrate USDe into Deribit (a leading crypto options exchange) and recently revealed a collaboration with Hyperliquid. Additionally, USDe has been integrated into Ethereal, a native perpetual DEX developed by Converge.

Ethena aims to establish USDe as a standardized margin asset alongside USDT and USDC. If traders migrate margin assets to USDe for its yield advantage, each exchange integration could trigger massive capital inflows. Given the industry-wide margin asset base runs into hundreds of billions, Ethena is targeting a highly promising market.

For exchanges, supporting USDe attracts more liquidity, as traders can earn yield on their collateral. Moreover, exchanges often already partner with Ethena, as the short leg of Ethena’s basis trade executes on their platforms.

For Ethena, this creates a virtuous cycle: more USDe on exchanges → higher captured funding → higher sUSDe APY → more users minting USDe.

Lending Platform Integration

Lending markets are natural fits for yield-bearing dollar products. Protocols like Aave, Morpho, and Euler allow borrowing of stablecoins and other dollar assets. Once USDe integrates, users can earn lending interest by supplying USDe while also gaining sUSDe rewards. Users can also borrow USDe against collateral—an attractive option since borrowed USDe can be staked to partially offset interest and potentially capture spread gains.

In early 2024, Spark Protocol—the lending sub-DAO under Sky (formerly MakerDAO)—began collaborating with Ethena. On March 29, 2024, Spark used Maker’s Direct Deposit Module (DDM) to route $100 million newly minted DAI into two Morpho Blue markets (DAI/USDe and DAI/sUSDe). These DAI loans were backed by overcollateralized USDe positions, offering traders credit lines while generating stable fee income for Maker.

According to a February 2025 governance disclosure, Spark may expand direct USDe/sUSDe holdings or related credit exposure up to $1.1 billion if market conditions allow. sUSDS (formerly sDAI) now represents a significant portion of Ethena’s TVL—$1.4 billion.

Additionally, Ethena has deep integration with Pendle (discussed further later). Principal tokens from Pendle, especially PT-SUSDE and PT-EUSDE, are widely integrated into protocols like Morpho, Euler, and Aave, further expanding USDe’s utility.

Pendle & Yield Derivatives

Pendle Finance is a protocol specializing in yield tokenization, and its integration with Ethena is considered one of the most significant collaborations. Pendle allows splitting yield assets into Principal Tokens ("PT") and Yield Tokens ("YT"), which can then be traded. USDe/sUSDe is naturally suited for yield tokenization—sUSDe itself is a yield asset (earning basis trade yield). Their integration created the SY (Standardized Yield) USDe market, where users can deposit USDe to receive SY tokens that accumulate yield, or trade future yield via YT and PT.

This integration enables mutually reinforcing growth. Pendle attracted USDe holders by offering fixed or leveraged yield opportunities. For example, in mid-2024, users could deposit USDe into a Pendle pool maturing in July 2025, locking in ~32% APY—effectively fixing high funding rates at the time. Others speculated or amplified yield by buying YT (e.g., YT-sUSDe offered higher effective APY but with greater risk). This flexibility led over 17% of USDe supply to flow into Pendle by July 2024. Pendle’s trading volume and TVL also surged due to sUSDe’s popularity, fueling its broader growth.

Ethena further accelerated this integration through incentive campaigns like the “Sats Campaign,” rewarding users who hold or use USDe with Bitcoin Sats points. Depositing USDe into Pendle’s YT/LP pools offered the highest bonus multipliers (e.g., 20x). This strategy drew more USDe into Pendle, creating a positive feedback loop: high yield → increased USDe demand → higher Pendle usage → competitive yields maintained.

By incentivizing usage in external protocols, Ethena successfully drove liquidity and utility growth without building these services itself.

Risk Comparison: USDe vs USDC vs USDT

Ethena’s USDe fundamentally differs from traditional fiat-backed stablecoins (USDC and USDT) in construction and risk modeling.

Collateral & Transparency

USDe is crypto-collateralized and hedged, while USDC and USDT are fiat-collateralized. USDe’s collateral (e.g., BTC, ETH) is stored on-chain or in crypto custodians, with corresponding liabilities (short positions) held on centralized derivative exchanges. In contrast, USDC and USDT are backed by cash or bonds (e.g., Treasuries or short-term debt instruments) held in off-chain bank or trust accounts.

Thus, USDe offers on-chain transparency (partially involving off-chain exchanges) and includes crypto assets; USDC and USDT rely on off-chain audits (e.g., USDT audit reports).

USDe is relatively more transparent—users can monitor collateral value on-chain (e.g., via public custody addresses for Ethena’s holdings, and exchange APIs for short position sizes). Additionally, Ethena publishes monthly proof-of-reserves for USDe collateral, showing assets in off-chain custody. USDC publishes monthly attestations, while USDT does so quarterly.

In decentralization, USDe’s architecture is more distributed—spanning multiple exchanges, custodians, and smart contracts—making trust more decentralized. USDC and USDT are fully centralized (controlled by single entities), meaning USDe cannot be unilaterally censored or frozen—a major advantage in censorship resistance.

Counterparty & Exchange Risk

USDC and USDT face traditional financial system risks: bank failures (e.g., SVB collapse in 2023 caused USDC to depeg to $0.88), regulatory freezes (e.g., OFAC blacklisting addresses, Circle or Tether freezing tokens), and lack of transparency (especially USDT, though Tether has improved disclosures). In contrast, USDe’s risks are more crypto-native: it depends on exchange counterparties. If a major exchange holding Ethena’s short positions goes bankrupt, Ethena could suffer losses or struggle to rehedge.

This risk was partially tested during the Bybit hack: Bybit suffered asset loss, but because Ethena’s assets were off-chain custodied, only unrealized PnL on derivatives was affected, and Ethena’s reserves were sufficient to cover it. At the time, Ethena’s exposure on Bybit was ~$30 million, fully offset by its reserve fund, and exposure was quickly reduced to zero post-event. This demonstrates that while USDe’s model carries exchange risk, it is mitigated through distributed custody and reserve buffers. However, if a larger exchange (or multiple exchanges) suddenly fails, USDe could become undercollateralized until collateral is recovered or reserves fill the gap.

Stability Mechanism

USDC and USDT maintain stability via simple redeemability: when price drops, arbitrageurs buy cheap tokens and redeem 1:1 for dollars (if issuers honor redemptions). USDe’s stability relies on market mechanisms and its hedging model’s arbitrage. When USDe trades below $1, arbitrageurs can buy USDe and redeem via Ethena’s process: burning USDe returns its corresponding collateral (worth $1 if hedged properly). Note: only authorized parties can redeem directly; however, in practice, authorized entities (e.g., market makers) will arbitrage profitably, maintaining price stability.

Additionally, Ethena may deploy its reserve fund to stabilize price if needed (though no explicit backstop mechanism is publicly confirmed; reserves primarily cover shortfalls). So far, USDe has maintained tight pegging, supported by deep liquidity pools.

Scale & Support Limits

USDC and USDT can theoretically expand indefinitely with fiat inflows (reaching tens of billions, limited by banking capacity and market trust). USDe’s growth, however, ties to derivatives market capacity and availability of crypto collateral. Practical limits exist: to mint large-scale USDe, Ethena needs matching perpetual short positions. Exchange open interest (OI) caps may become bottlenecks. As of July 2025, Ethena occupies significant OI share on certain platforms (e.g., ~4.3% of BTC perpetual OI, ~4.9% of ETH perpetual OI). Doubling USDe size could strain these markets or widen spreads.

To address this, Ethena diversifies across multiple exchanges (e.g., Binance, Bybit, OKX, Bitget) and may help expand USDT-denominated perpetual markets. In contrast, USDT’s growth limit depends on how many Treasuries Tether can buy or the stability of its banking relationships—constraints that are relatively high (Tether has scaled beyond $80 billion without major issues).

Volatility, Funding Rates & Market Risk

USDe is exposed to derivatives market conditions. If prolonged negative funding rates occur (shorts pay longs), Ethena’s position value declines continuously. Ethena must cover these funding costs from its own funds or collateral, creating a “drain.” The protocol can handle short-term negative funding (via reserve fund), but if market conditions fundamentally shift (e.g., months of strong demand for shorting crypto), USDe could face yield deficits, endangering collateral if poorly managed.

Ethena’s launch of USDtb partly addresses this, shifting to positively yielding assets. Traditional stablecoins aren’t affected by market rate fluctuations—their value depends solely on issuer solvency.

Durinɡ extreme crypto volatility, USDe’s peg mechanism may be theoretically more fragile. If crypto prices double overnight, Ethena’s short positions lose value, possibly lagging behind collateral gains, or vice versa, causing slight imbalance (though designed 1:1, slippage in execution may play a role). If exchange liquidity is insufficient, rebalancing large positions may incur costs, causing temporary depegs until arbitrage restores balance. However, Ethena’s daily PnL settlement and collateral adjustments minimize this risk under normal conditions.

USDT and USDC can also depeg due to panic selling (e.g., USDC fell to $0.88 during bank failure fears), but usually restore peg via arbitrage if reserves are sound. Key difference: trust vs algorithm. USDC and USDT rely entirely on issuer trust; USDe relies on algorithmic hedging and trust in Ethena’s operations. If Tether’s reserves are questioned (e.g., major audit failure), USDT could severely depeg. USDe depegs more likely from technical failures (e.g., smart contract bugs, exchange chain defaults) or extreme funding reversals.

Regulatory & Institutional Adoption

From an institutional risk perspective, USDC and USDT are well-understood with clear legal frameworks (e.g., USDC regulated as stored value). In contrast, USDe may be seen as riskier or more complex, possibly operating in regulatory gray areas.

Institutions may worry about operational risks of USDe—e.g., explaining a short position backing a stablecoin to a risk committee. To ease concerns, Ethena may position USDtb as the institutional product, while USDe suits crypto-native funds, prop trading teams, and DeFi users.

Over time, if USDe proves stable and yield-capable, even institutions (like hedge funds) might adopt it for yield (early investors in low-rate environments earned ~20% APY—highly attractive by any standard).

USDC and USDT face regulatory scrutiny (e.g., NYAG investigation into Tether, potential stablecoin legislation).

USDe introduces derivatives, so regulators may view it as a “synthetic prime money market fund,” attracting attention. If deemed systemic or unregistered, Ethena could face pressure, especially as it scales.

However, Ethena’s global, decentralized nature may offer some buffer (its foundation may reside offshore). Conversely, regulators worried about stablecoin bank exposure might find USDe’s full transparency and non-reliance on banks appealing—USDe faces crypto market risk, not bank risk. This remains an underexplored angle.

For institutions and protocols, these differences mean USDe currently complements USDC/USDT rather than replacing them. For example, Maker has found a role for USDe (earning yield on DAI reserves) but hasn’t abandoned USDC as stable backing. Yet, if USDe and USDtb continue growing in track record and liquidity, it’s conceivable protocols like Maker or Frax might use USDtb as reserve (replacing USDC), or exchanges prefer USDe as collateral. Institutions might treat USDtb as cash equivalents on balance sheets while using USDe for yield strategies.

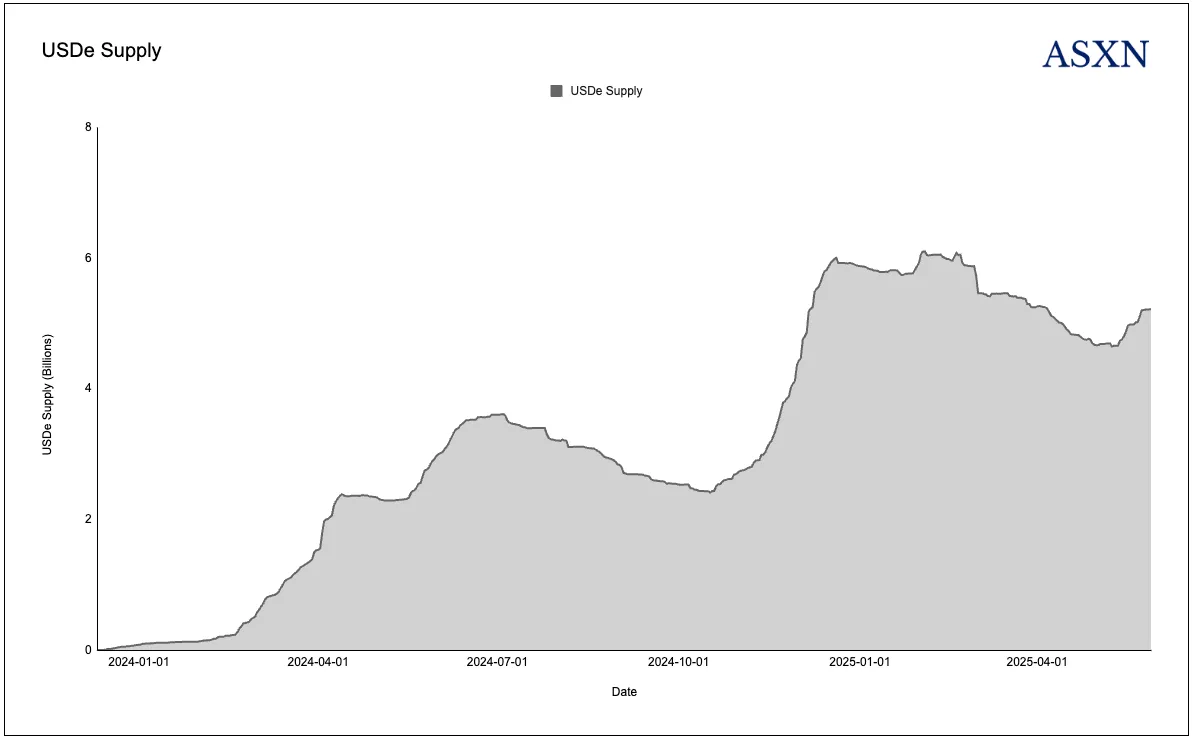

To attract institutional inflows and gain more share in the settlement market for stablecoins, digital dollars, and asset tokenization, Ethena decided to develop a suite of new products—iUSDe and USDtb—specifically targeting institutional capital and flows.

USDtb and iUSDe

iUSDe

iUSDe is a compliant version of the core sUSDe product, featuring basic permissions and KYC restrictions. This design allows traditional financial institutions and entities to interact with the product, meeting AML and KYC compliance requirements. While unlikely to reach USDe’s scale, iUSDe serves as a uniquely valuable tool tailored for institutional participants.

USDtb

USDtb is Ethena’s second stablecoin—a fully collateralized “digital dollar” backed by tokenized U.S. Treasury assets. Unlike USDe’s basis trade structure, USDtb follows the fiat-backed stablecoin model. Each USDtb token represents a claim on dollars invested in an institutional-grade U.S. Treasury fund, operating similarly to USDC and USDT.

In launching USDtb, Ethena partnered with BlackRock’s USD Institutional Liquidity Fund (“BUIDL”) as the primary backing asset. Through BUIDL, USDtb holders gain indirect exposure to U.S. Treasuries and other short-term instruments—similar to how USDC holders rely on Circle’s Treasury and cash reserves.

From a user experience standpoint, USDtb functions identically to traditional stablecoins:

-

Maintains a 1:1 peg to the U.S. dollar

-

Transferable across blockchain networks (initially Ethereum, potentially Ethena’s Converge chain in the future)

-

Usable for payments, trading, or lending—just like USDC/USDT

USDtb’s design leverages the growing institutional recognition of stablecoin infrastructure.

Visa expressed its views on stablecoins in a report dated April 30, 2025:

Modernized Settlement Infrastructure: From Visa’s perspective, stablecoins enhance efficiency and practicality in back-end financial and fund movement infrastructure. While front-end payment systems have digitized significantly over the past decade, the back-end of global settlement and fund transfer systems still lags.

In traditional cross-border payment and settlement systems, processes are complex and multi-step, requiring coordination among multiple intermediaries:

-

Banks debit customer accounts and send SWIFT messages containing payment details and compliance checks.

-

Messages pass through one or more intermediary banks, as most banks don’t maintain accounts in all currencies. Each intermediary moves funds between nostro/vostro accounts, updates ledgers, and charges fees. Reduced correspondent banking relationships have decreased reliance on intermediaries.

-

Within each currency zone, banks settle daily accumulated balances via central bank RTGS or delayed net settlement systems. These systems operate only during specific hours, meaning payments arriving outside business hours must wait, extending end-to-end settlement from minutes to potentially two days.

-

In fund processing, participating intermediaries must maintain idle funds or intraday liquidity, increasing cost and risk.

-

Finally, the receiving bank credits the recipient, completing the transfer.

Stablecoins can drastically reduce the number of intermediaries needed in payments and settlements. Traditional cross-border transactions involve lengthy chains, where each added step increases cost, complexity, and settlement risk. Stablecoin-based systems simplify cross-border flows by reducing the need for extensive correspondent banking relationships.

By reducing intermediaries, stablecoin systems lower settlement risk, reduce pre-funding and intraday credit needs, limit rent-seeking, and thus significantly cut fees. With broader adoption, network effects and economies of scale could further reduce costs, while standardized data formats make integration with other systems more efficient and economical.

Another advantage of blockchain technology is its 24/7 operation, enabling near-instant end-to-end settlement. Traditional correspondent bank paths can take anywhere from under five minutes to over two days (depending on national banking systems), whereas stablecoins eliminate these delays entirely, enabling instant settlement throughout.

Beyond settlement and efficiency, stablecoins play crucial roles in countries with poor monetary management—e.g., Argentina, Lebanon, Nigeria—where preserving purchasing power is paramount. Converting local currency into dollar-pegged stablecoins enables instant “dollarization.” Stablecoins inherit the dollar’s relative stability and credibility, offering an attractive alternative for populations losing trust in local currencies.

In these regions, physically obtaining USD is often difficult and costly, and withdrawing USD from domestic banks poses additional challenges. Many USD bank customers face arbitrary withdrawal limits. Stablecoins allow users to self-manage USD assets securely via hardware wallets, ensuring continuous access and safety.

Moreover, traditional USD-based services (banks or remittance providers) are often restricted by regulation, censorship, and political interference. Stablecoins, especially when traded peer-to-peer or on decentralized platforms, offer greater privacy and censorship resistance.

Stablecoins also offer yield opportunities. While security remains users’ top concern, individuals can choose varying risk levels based on appetite. Yield can be achieved through integration with broader crypto ecosystems, underlying support mechanisms, or both. For example, in inflationary environments, users can deposit USDe into decentralized lending protocols to earn 10%-15% APY, turning stablecoin holdings into interest-bearing assets—critical where local banks offer near-zero or negative real rates.

It should be noted that stablecoin use cases extend far beyond those mentioned—this discussion focuses on two primary applications we see today. We will explore others in depth in our upcoming stablecoin report.

Notably, Ethena focuses on providing users with a store-of-value or savings product, exemplified by its synthetic dollar USDe. The team does not attempt to directly compete with USDT (Tether) or significantly challenge USDC in payments and settlement dominance. USDT enjoys strong network effects and wide distribution, especially dominant in MENA, Africa, and Asia. Instead, Ethena offers a semi-complementary product—sUSDe—that shares yield with users, acting as a savings account (albeit with higher risk due to high returns), attracting users seeking yield on dollarized products and gradually expanding market share.

Recently, Ethena began offering a Treasury-backed stablecoin product, USDtb, intended to complement USDe rather than directly compete with USDT and USDC.

USDtb is a stablecoin backed 100% by liquid, low-risk assets, primarily shares in BlackRock’s money market fund, which holds short-term U.S. government debt. This design effectively reduces bank credit risk, shifting focus to sovereign credit risk, widely regarded as nearly risk-free. It also means USDtb reserves naturally generate yield (money market returns), currently around 4.5% APR due to Treasury rates. Proof of USDtb reserves is updated monthly, with assets custodied by Zodia, Komainu, and Copper.

To enable fast redemptions and on-chain swaps, Ethena keeps part of USDtb’s reserves in stablecoin form (e.g., USDC). This allows USDtb to handle large withdrawals or transfers without immediately redeeming BUIDL shares.

Complementary Stablecoins

USDtb and USDe are fundamentally different products. Unlike sUSDe, which builds moats through yield and returns, USDtb primarily aims to attract institutional capital. Many institutions, treasuries, and investors may be unfamiliar with or uncomfortable relying entirely on crypto ecosystems for products like USDe. USDtb offers these users a more familiar crypto dollar, backed by U.S. government debt, with strong compliance foundations (Securitize is a regulated digital securities platform). By offering institution-grade products (including KYC, full collateralization, and yield from liquid, low-risk Treasuries), Ethena can onboard vast new capital into its ecosystem.

Through USDtb and USDe, Ethena achieves stablecoin complementarity. USDe offers higher risk and higher return, while USDtb prioritizes minimal risk and baseline yield (~4.5%). This combination allows Ethena to serve users with diverse preferences and market conditions. For example, investors can hold USDtb as stable reserves (earning ~4.5%), while using USDe for aggressive yield farming. This strategy makes Ethena a one-stop stablecoin issuer, reducing reliance on third-party stablecoins. Moreover, this dual-product model adapts to various market environments: when funding costs are low but rates high, USDtb demand may rise; otherwise, USDe shines.

iUSDe represents the other end of the stablecoin spectrum. While some institutions may be interested in tokenized base-yield products, KYC and AML compliance risks may prevent direct access.

Institutions cannot use permissionless DeFi tools for several reasons, including:

-

Regulatory & Compliance Risk: Institutions cannot transact with unknown counterparties.

-

Counterparty Transparency: Institutions need to know borrower identities, especially concerning sanctioned entities.

-

Legal Requirements: Institutions have legal obligations to comply with AML and KYC regulations.

-

Internal Policy Restrictions: Large financial institutions require counterparty identification—risk departments need full transparency on identity.

To address these compliance challenges, iUSDe offers a solution. While USDtb provides a completely different risk-return profile as a stablecoin, iUSDe ensures institutional capital and investors can access the same yield and risk characteristics as USDe under regulatory compliance. Through iUSDe, Ethena successfully bridges the gap between institutional needs for compliance and yield.

Converge

Ethena Labs, in partnership with Securitize, is developing a new chain called Converge, aimed at introducing tokenized real-world assets (RWAs), traditional financial markets, and their associated tools.

Similar to stablecoin adoption, over the past year, tokenization has gained traction among traditional financial institutions due to its numerous benefits for real-world financial instruments and markets. These include enhanced transparency, reduced transaction and information costs, faster processing, and improved risk management.

Programmability & Composability

Traditional financial transactions typically involve multiple intermediaries, each maintaining separate records at various stages—issuance, trading, matching, settlement, custody, and corporate actions. Tokenization, through smart contracts, fundamentally transforms this structure, automating all steps without reliance on fragmented intermediaries.

Shared ledger use enables integration of traditionally siloed financial functions. For example, foreign exchange payment systems, securities custody platforms, and collateral management systems can merge into a unified framework. This integration reduces value transfer costs and simplifies clearance of previously expensive or hard-to-settle transactions.

Additionally, tokenization enhances financial composability through conditional transactions—enabling complex financial instruments and workflows to be combined and executed automatically under defined conditions.

Tokenization’s automation capabilities can also significantly optimize asset servicing. For instance, it streamlines corporate actions (e.g., dividend and interest payments) and improves efficiency in shareholder voting processes.

Transparency & Auditability

Current cross-border payment systems rely on a series of correspondent banks, each maintaining independent ledgers and communicating only through periodic confirmation messages. This model requires tedious reconciliation, as institutions must align their records.

In contrast, tokenization platforms use shared ledgers, maintaining a single, continuously synchronized record visible to all relevant parties. This shared “source of truth” provides real-time visibility, eliminating the need for interbank coordination or end-of-day reconciliation. Redundant manual processes (e.g., repeated AML/KYC screening across transaction stages) can be completed once via smart contract logic or eliminated entirely. These improvements reduce operational costs and significantly boost straight-through processing (STP) efficiency.

Standardization & Process Optimization

Asset issuance is often expensive and time-consuming due to numerous participants and manual operations. Tokenization solves these inefficiencies by standardizing issuance processes and reducing intermediaries, lowering costs and barriers to capital market entry.

These improvements not only facilitate new asset issuance but also enable shared or fractional ownership of existing assets—including those with low liquidity in traditional markets. This expanded accessibility may attract new investor demand. Where legally permitted, tokenization may even allow participants to directly issue assets or negotiate contract terms for specific tokens without relying on traditional intermediaries.

Tokenization also supports atomic settlement of multi-step transactions. For example, when purchasing a tokenized Treasury bond with a stablecoin on-chain, both parties achieve simultaneous delivery via smart contract: the buyer submits stablecoin tokens, the seller submits bond tokens, and the contract releases both only when both assets are available. If either party lacks sufficient assets, the transaction fails, completely eliminating principal risk. In contrast, traditional off-chain trades process steps independently, often at different times, involving clearing brokers, CCPs, custodians, and banks, with settlement typically taking T+2.

Asset Class Differentiation

Tokenization’s benefits vary significantly across asset classes. For illiquid, non-standardized assets, tokenization offers the highest efficiency gains. These include syndicated loans and mid-market private credit—typically involving manual onboarding, customized covenants, and lacking centralized market infrastructure. Equity shares in commercial real estate fall into this category, usually illiquid and traded bilaterally.

In contrast, highly liquid, standardized assets like U.S. Treasuries, large-cap stocks, and ETFs have mature infrastructure, leaving limited room for efficiency gains. Still, even these assets benefit from enhancements like trading and settlement outside local market hours, atomic settlement, increased composability, programmable lifecycle events, unified recordkeeping, and fractional ownership opportunities.

Ethena is building a new chain named Converge, focused on bringing tokenized real-world assets (RWAs) onto the blockchain and connecting them with DeFi and crypto (hence the name “Converge”). While tokenization remains in early development, its expansion potential could be exponential. Currently, many public and private chains compete to attract tokenized assets. Some offer KYC, AML, and full stack control (e.g., Avalanche Subnets, L2s, and other institutional chains); others prioritize composability, vibrant DeFi ecosystems, and tight links to crypto issuance and activity (e.g., Solana, Ethereum). As discussed later, Converge aims to give institutions both control and composability.

Technical Design & Performance Specs

Converge is envisioned as a high-throughput, low-latency, Ethereum Virtual Machine (EVM)-compatible blockchain. It will launch with 100ms block times and plans to reduce this to 50ms by Q4 2025. Its goal is at least 1 gigagas per second throughput—processing around 1 billion gas units per second. In comparison, Ethereum currently processes about 15 million gas per block (roughly 100 million gas per minute).

Architecture Design

Converge is built on Arbitrum Orbit tech stack and uses Celestia for data availability. Transaction execution and ordering are handled by an optimized Arbitrum-based sequencer (Conduit G2). Converge runs the Arbitrum Nitro stack (offering fraud-proof security and EVM compatibility) but with custom sequencers and configurations optimized for high throughput.

For data availability, Converge initially publishes data to Celestia, enabling high-volume data publishing at low cost. Celestia’s architecture supports ultra-large blocks (its recent testnet demonstrated 128MB blocks and ~21MB/s throughput, with a roadmap for 1GB blocks). Through Celestia, Converge can publish large volumes of transaction data in parallel, unconstrained by Ethereum’s current data throughput limits.

Transaction sequencing is managed by the Conduit G2 sequencer—a high-performance sequencer from Arbitrum that rapidly collects, executes, and proposes blocks. Target block intervals are ~100ms, averaging 10 new blocks per second (sometimes called mini-blocks or lightning blocks). Converge plans to further reduce block times below 50ms through optimizations like continuous mini-block streams and improved RPC handling, targeting achievement by Q4 2025.

Converge Validator Network (CVN) & Security Model

A key component of Converge is the Converge Validator Network (“CVN”), a dedicated validator layer. CVN is a permissioned set of validators serving a “security council” function with certain autonomous powers. In emergencies, the validator set can intervene (e.g., pausing the chain, rolling back state during major exploits or errors). Unlike traditional validators focused only on block production or sequencing, CVN’s role is to safeguard economic integrity and user funds.

For example, CVN can restrict or block malicious cross-chain messages from bridges to prevent bridge attacks. It can trigger protocol-level circuit breakers (pausing or halting specific contracts or the entire chain) in response to impending oracle manipulation, critical smart contract bugs, or other economic anomalies risking fund loss. In extreme cases, CVN may even question finality or coordinate chain pauses/forks to protect users.

These powers are designed as last-resort measures, providing institutional users with safeguards (institutions typically demand robust risk mitigation) without fundamentally undermining decentralization or liveliness. This mechanism offers a safety net, preserving blockchain’s core values while ensuring fund security.

Execution Mechanism

Converge employs a multithreaded execution pipeline, leveraging multicore CPUs to process transactions in parallel where possible, while strictly guaranteeing deterministic outcomes.

Instead of generating large blocks at long intervals, Converge’s sequencer generates a continuous stream of small “lightning blocks” (microblocks) in real-time based on transaction flow. Validators can progressively execute and verify these microblocks without waiting for full block completion. This significantly reduces propagation latency, keeping the system highly responsive even under heavy load. Block production becomes more continuous, smoothing out transaction peaks and reducing the time for new transactions to reach validators.

To manage rapid state growth from high TPS, Converge uses a flattened, path-based state storage model, supported by high-performance databases. This boosts contract state read/write efficiency. The storage engine supports concurrent reads and writes, allowing parallel access or updates to different parts of the state tree without conflict. It also features online state pruning, discarding old state as needed. These traits are essential for chains targeting 10x throughput of existing networks, preventing state databases from becoming performance bottlenecks or bloating uncontrollably.

At its base, Converge is a permissionless chain: anyone can bridge assets onto it, and any developer can freely deploy smart contracts. However, it supports a diverse ecosystem where some apps may implement their own permissioning at the application level (especially those involving regulated assets). Converge expects to host two parallel types of applications:

-

Fully permissionless protocols;

-

Regulated or permissioned applications for traditional finance use cases.

The key is that these applications can interact. For example, a permissioned RWA platform can benefit from on-chain liquidity and DeFi composability (e.g., a bond token serving as collateral in a DeFi lending pool), provided interactions comply with necessary rules. Converge’s design imposes no global permissioning—the decision on access control rests entirely with app developers or asset issuers at the smart contract level.

Initial Ecosystem

Horizon - Aave

Horizon is a new institutional-grade lending market launched by Aave Labs, a permissioned version of the Aave protocol designed for real-world assets (RWA). Horizon extends Aave’s money market architecture, enabling institutions to borrow stablecoins against tokenized traditional assets. Its first product focuses on tokenized money market funds (e.g., tokenized U.S. Treasury fund shares) as collateral, offering qualified investors a way to unlock liquidity from low-risk yield assets.

Horizon initially uses Aave V3 smart contracts (future upgrade to V4) deployed in a standalone environment customized for institutional needs. The protocol retains core designs of overcollateralized loans and automated risk parameters, adding a compliance layer for restricted assets. Drawing from Aave Arc (Aave’s earlier permissioned pool framework), Horizon doesn’t restrict the entire market but applies permissions at the token level. Effectively, only whitelisted institutional participants can hold RWA collateral tokens, while the protocol’s stablecoin liquidity pools remain open and decentralized.

Horizon officially launched in March 2025 via an Aave governance proposal and Temp Check vote. Its revenue will be shared with Aave DAO (50% of first-year profits) and supervised by Aave’s governance. Remaining revenue goes to the Labs team—a distribution that sparked some controversy (beyond this report’s scope).

Unlike Aave’s focus on crypto-native collateral, Horizon brings traditional financial instruments—starting with tokenized money market funds—into Aave’s lending model. The protocol allows users and institutions holding Treasuries and high-quality debt portfolios to tokenize these assets and borrow stablecoins against them on-chain. This resembles traditional repo agreements or secured credit lines, unlocking capital efficiency without selling assets or entering complex repos.

For example, a money market fund manager could use Horizon to borrow iUSDe against their fund tokens. For lenders, Horizon targets investors and cash managers holding stablecoins who accept low risk for yield, earning interest by lending to high-quality collateral. These users might be institutions seeking iUSDe or USDtb yield, looking to earn extra interest via stablecoin lending markets.

This relationship is symbiotic: Ethena provides Horizon with compliant stablecoins (iUSDe and USDtb) and a settlement layer (Converge), while Horizon gives Ethena’s USDe/iUSDe a key use case in on-chain lending markets.

Morpho

Morpho is a money market protocol offering permissionless on-chain lending infrastructure. Its core functionality allows anyone to create lending markets with custom parameters. Each market is defined by a collateral asset, a loan asset, and a set of risk parameters, with no restrictions on permissible combinations.

This design enables Morpho to aggregate liquidity across multiple markets, serving as foundational lending infrastructure on-chain. Morpho’s architecture consists of two main components:

-

Morpho Protocol: handles market creation and ongoing interest calculations;

-

Morpho Vaults: sit atop the base protocol, managing lenders’ risk and returns.

The protocol tracks lenders’ earnings and borrowers’ debts in real time across all markets, while Vault smart contracts automatically allocate lenders’ liquidity to a curated set of markets, offering a passive, managed yield experience. These Vaults are typically operated by professional risk managers who adjust allocations based on market conditions to optimize risk-return balance.

Like Horizon, Morpho will provide key use cases for Ethena’s USDe/iUSDe, enabling funds, institutions, and users to tokenize real-world financial instruments and borrow against them, enhancing capital efficiency. Due to Morpho’s flexible design, it also supports permissioned markets where KYC-verified tokens serve as collateral. This allows Morpho to accommodate diverse credit arrangements—from crypto-backed loans to real-asset financing.

Maple

Maple Finance is a decentralized institutional credit market focused on undercollateralized and cash-flow-based lending. The platform connects borrowers and lenders via on-chain lending pools managed by credit assessors (“Pool Delegates”).

Each Maple lending pool has a defined investment mandate—e.g., lending to crypto trading firms or financing real-world assets like invoices—with specific terms including interest rates, durations, and collateral requirements. Lenders deposit stablecoins into pools, while Pool Delegates screen and approve loans. All loans are represented on-chain, with interest accruing transparently.

Maple’s hybrid model combines on-chain fund management with off-chain legal contracts, enabling unsecured or lightly collateralized lending not feasible with pure code-based protocols. Loan servicing, interest distribution, and default handling are automated, while Pool Delegates conduct due diligence including KYC and credit analysis.

Maple offers two distinct products for different audiences:

-

Maple Institutional: offers permissioned lending pools for large capital allocators and qualified investors, featuring curated borrowers, strict risk management, and typically required collateral (e.g., custodied Bitcoin). These pools operate under legal agreements, usually requiring lender KYC.

-

Syrup.fi: offers permissionless lending pools, tokenizing or tranching portions of Maple Institutional loans, further expanding lending market flexibility and accessibility.

Pendle Finance

Pendle Finance is a decentralized protocol focused on tokenizing yield-bearing assets, enabling yield trading and interest rate markets. Simply put, Pendle allows users to split a yield-generating asset (e.g., interest-bearing stablecoins or staked tokens) into two parts:

-

Principal Token (PT): represents the principal portion, redeemable for the original asset at maturity.

-

Yield Token (YT): represents the right to collect interest generated by the asset before maturity.

Through this split, Pendle creates a market where participants can lock in fixed yields or speculate on future rates. For example, users can sell YT for upfront principal, locking in yield; conversely, users can buy YT to gain leveraged yield exposure, betting that the underlying asset’s yield exceeds market expectations.

Pendle supports a wide range of assets, including stablecoin yield tokens (e.g., sUSDe, cDAI), staking derivatives (e.g., stETH), and other DeFi yield tokens.

Pendle provides infrastructure for interest rate discovery in DeFi, similar to how bond markets set rate expectations in traditional finance. Its architecture locks the original asset in Pendle’s smart contracts, generating PT and YT. These tokens are tied to specific maturity dates (e.g., PT maturing December 2025).

Pendle’s automated market maker (AMM) supports the following trades:

-

PT vs underlying asset: implies discount rate, deriving fixed interest rate.

-

YT vs underlying asset: implies yield pricing.

Over time, PT price converges toward the underlying asset value (1 PT = 1 unit of asset at maturity), while YT accumulates actual yield.

Pendle is a non-custodial, automated protocol introducing novel mechanisms to boost capital efficiency:

-

Synergy Mechanism: automatically reinvests yield, further amplifying capital utilization.

-

Yield Staking: offers users additional yield optimization options.

Ethereal

Ethereal is a non-custodial decentralized exchange (DEX) supporting spot and perpetual trading, natively built on the

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News