From High Returns to Potential Collapse: Deconstructing the Logic Chain Behind USDe Incentives

TechFlow Selected TechFlow Selected

From High Returns to Potential Collapse: Deconstructing the Logic Chain Behind USDe Incentives

An analysis of the systemic challenges behind USDe/sUSDe and related platforms from the perspectives of revenue structure, user behavior, and capital flows.

Author: Trendverse Lab

Since 2024, the stablecoin market has been undergoing a new transformation driven by structural innovation. After years of dominance by fiat-backed stablecoins like USDT and USDC, USDe, launched by Ethena Labs, has rapidly risen with its "fiat-free" synthetic stablecoin design. Its market capitalization once exceeded $8 billion, becoming the "high-yield dollar" in the DeFi world.

Recently, the Liquid Leverage staking campaign launched jointly by Ethena and Aave has sparked heated market discussion: with an annualized return approaching 50%, it appears on the surface to be a routine incentive strategy, but perhaps also reveals another noteworthy signal—the structural liquidity pressure the USDe model bears during an ETH bull market.

This article will focus on this incentive campaign. After briefly explaining USDe/sUSDe and related platforms, it will analyze the hidden systemic challenges from perspectives such as yield structure, user behavior, and capital flow. By comparing historical cases like GHO, it will explore whether future mechanisms possess sufficient resilience to cope with extreme market scenarios.

I. Introduction to USDe and sUSDe: Synthetic Stablecoins Based on Crypto-Native Mechanisms

USDe is a synthetic stablecoin launched by Ethena Labs in 2024, designed to circumvent reliance on the traditional banking system and fiat currency. As of now, its circulating supply exceeds $8 billion. Unlike stablecoins like USDT or USDC, which are backed by fiat reserves, USDe's peg mechanism relies on on-chain crypto assets, particularly ETH and its derivative staked assets (such as stETH, WBETH, etc.).

Image Source: Coingecko

Its core mechanism is a "delta-neutral" structure: the protocol holds positions in assets like ETH on one hand, while opening equivalent ETH perpetual short positions on centralized derivative trading platforms on the other. Through the hedging combination of spot and derivatives, USDe achieves a net asset exposure close to zero, thereby stabilizing its price around $1.

sUSDe is a representative token obtained by users staking USDe into the protocol, featuring automatic yield accumulation. Its yield sources mainly include: funding rate returns from ETH perpetual contracts, and derivative yields brought by the underlying staked assets. This model aims to introduce a continuous yield model for the stablecoin while maintaining its price peg mechanism.

II. Introduction to Aave and Merkl: The Collaborative System of Lending Protocol and Incentive Distribution Mechanism

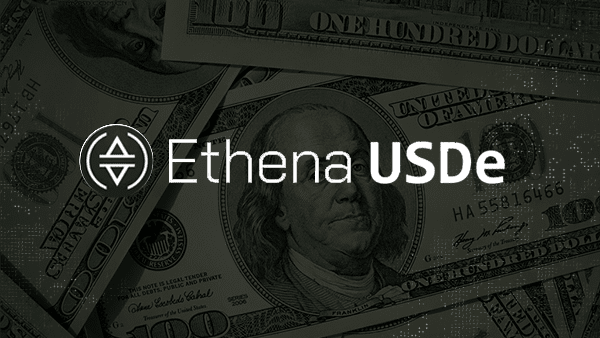

Aave is one of the oldest and most widely used decentralized lending protocols in the Ethereum ecosystem, dating back to 2017. Through mechanisms like "flash loans" and flexible interest rate models, it promoted the early adoption of DeFi lending systems. Users can deposit crypto assets into the Aave protocol to earn interest or borrow other tokens by collateralizing assets, all without intermediaries. Currently, Aave's Total Value Locked (TVL) is approximately $34 billion, with nearly 90% deployed on the Ethereum mainnet. The platform's native token AAVE has a total market cap of about $4.2 billion, ranking 31st on CoinMarketCap.

Data Source: DeFiLlama

Merkl is an on-chain incentive distribution platform launched by the Angle Protocol team, specifically designed to provide programmable, conditional incentive tools for DeFi protocols. By presetting parameters such as asset type, holding duration, liquidity contribution, etc., protocol parties can precisely set reward strategies and efficiently complete the distribution process. To date, Merkl has served over 150 projects and on-chain protocols, distributing a cumulative total of over $200 million in incentives, supporting multiple public chains including Ethereum, Arbitrum, and Optimism.

In the current USDe incentive campaign jointly initiated by Ethena and Aave, Aave is responsible for organizing the lending market, configuring parameters, and matching staked assets, while Merkl handles the reward logic setting and on-chain distribution operations.

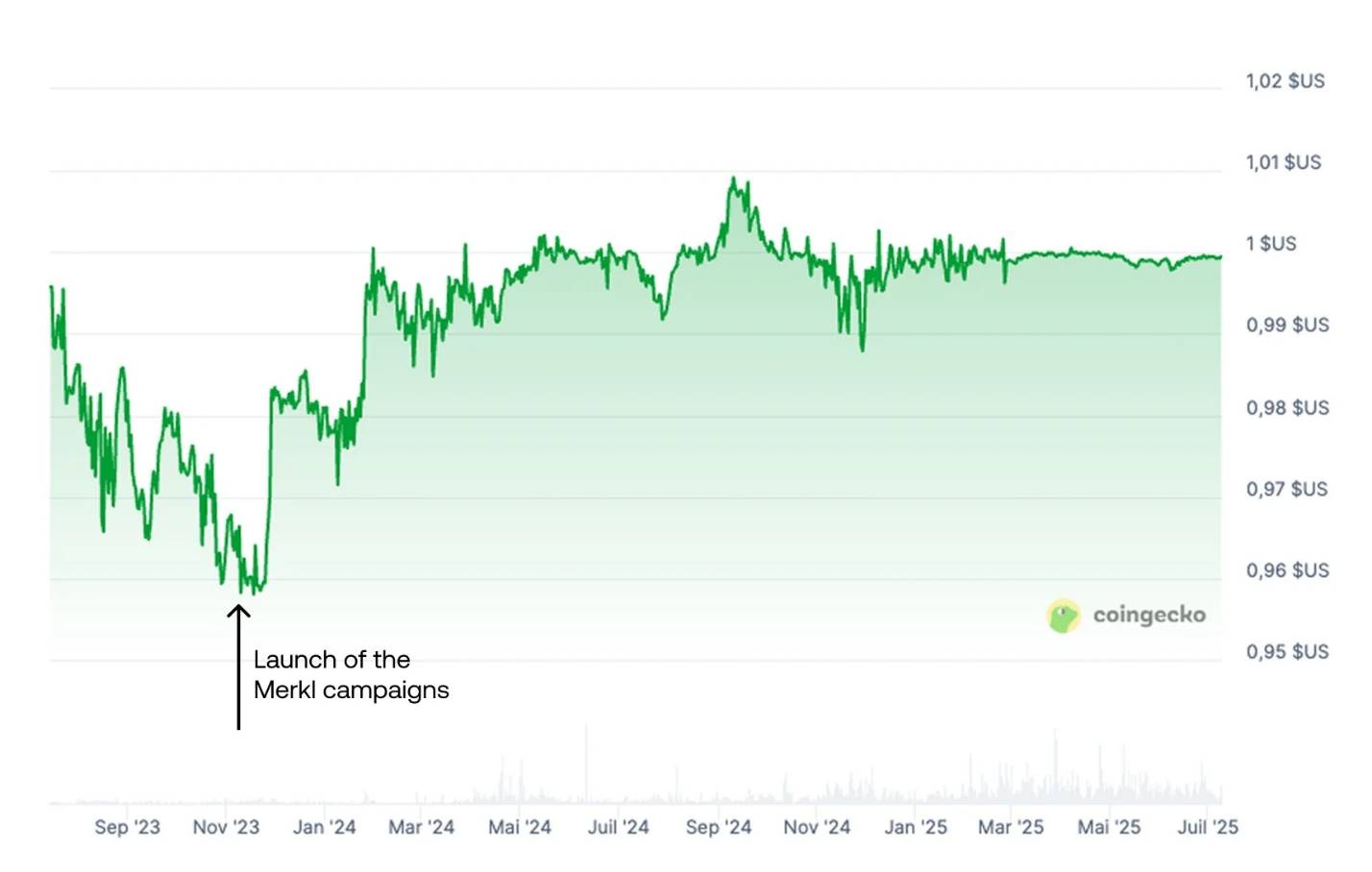

Beyond the current USDe incentive collaboration, Aave and Merkl have previously established stable collaborative relationships in multiple projects, with one of the most representative cases being their joint intervention in the GHO stablecoin de-pegging issue.

GHO is a native over-collateralized stablecoin launched by Aave, which can be minted by collateralizing assets like ETH and AAVE. In its early stages, due to limited market acceptance and insufficient liquidity, its price quickly fell below the peg, lingering for a long time in the $0.94–$0.99 range, losing its price peg to the dollar.

To address this deviation, Aave collaborated with Merkl to establish liquidity incentive mechanisms for the GHO/USDC and GHO/USDT trading pairs on Uniswap V3. The incentive rules were "targeted near $1," offering higher rewards to market makers providing concentrated liquidity around $1, thereby guiding buying and selling depth to concentrate in the target range and forming a price stability wall on-chain. This mechanism proved highly effective in practice, successfully pushing the GHO price back to near $1.

This case reveals the essential role of Merkl in stabilization mechanisms: through programmable incentive strategies, it maintains liquidity density in key on-chain trading ranges, akin to arranging "subsidized vendors" at market price anchor points. Only by continuously providing yields can a stable market structure be maintained. However, this also raises related questions: once incentives cease or vendors withdraw, the support for the price mechanism may also fail.

III. Analysis of the Source Mechanism for the 50% Annualized Yield

On July 29, 2025, Ethena Labs officially announced the launch of a feature module named "Liquid Leverage" on the Aave platform. This mechanism requires users to deposit sUSDe and USDe into the Aave protocol simultaneously in a 1:1 ratio, forming a composite staking structure, and thereby obtain additional incentive returns.

Specifically, eligible users can obtain three sources of yield:

1. Incentive USDe rewards automatically distributed by Merkl (currently approximately 12% annualized);

2. The protocol yield represented by sUSDe, i.e., the funding fees and staking yields from the delta-neutral strategy behind USDe;

3. Aave's base deposit interest, depending on current market fund utilization and pool demand.

The specific participation process for this campaign is as follows:

1. Users can acquire USDe via the Ethena official website (ethena.fi) or decentralized exchanges (like Uniswap);

2. Stake the held USDe on the Ethena platform, exchanging it for sUSDe;

p>3. Transfer equal amounts of USDe and sUSDe into Aave in a 1:1 ratio;4. Enable the "Use as Collateral" option on the Aave page;

5. After the system detects compliant operations, the Merkl platform automatically identifies the address and periodically distributes rewards;

Image Source: Official Twitter

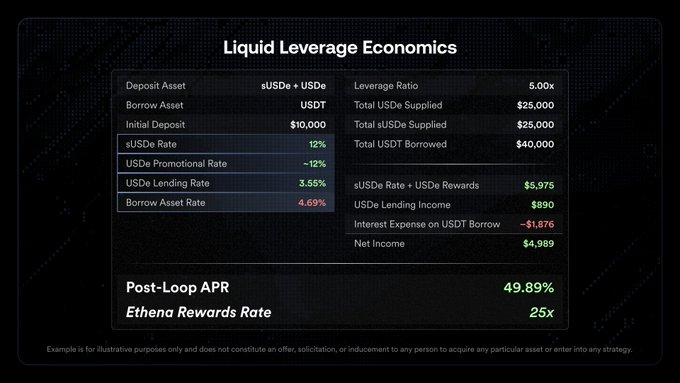

Official data, breakdown of underlying calculation logic:

Assumption: $10,000 principal, 5x leverage, total borrowed $40,000, with $25,000 each collateralized for USDe and sUSDe.

Leverage Structure Explanation:

This yield premise relies on a composite structure established through a "borrow -> deposit -> continue borrowing" cycle. That is, after the initial principal is used for the first round of staking, borrowed funds are used for the next round of bidirectional deposits of USDe and sUSDe. By amplifying the staking position with 5x leverage, the total input reaches $50,000, thereby amplifying rewards and base yields.

IV. Does the Incentive Plan Reveal That USDe and GHO Face the Same Structural Dilemma?

Although both are stablecoins issued based on crypto asset staking, USDe and GHO have significant differences in their mechanisms. USDe maintains its peg through a delta-neutral (hedging) structure. Its historical price has generally fluctuated stably around $1, without experiencing severe deviations like GHO's de-pegging to $0.94, nor liquidity crises reliant on liquidity incentives for price recovery. However, this does not mean USDe is completely immune to risks. Its hedging model itself has inherent vulnerabilities, especially during periods of severe market volatility or the withdrawal of external incentives, potentially facing stability shocks similar to GHO.

Specific risks are reflected in the following two aspects:

1. Negative Funding Rate, Protocol Yield Decline or Even Inversion:

The primary yield of sUSDe comes from the LST yield obtained from staking assets like ETH and the positive funding rate from the ETH short perpetual contracts established on centralized derivative platforms. Current market sentiment is positive, with longs paying shorts interest, maintaining positive yields. However, once the market turns bearish, shorts increase, funding rates turn negative, and the protocol needs to pay additional fees to maintain hedging positions, leading to reduced yields or even negative values. Although Ethena has an insurance fund buffer, whether it can cover negative yields long-term remains uncertain.

p>2. Incentive Termination → Promotional Rate 12% Yield Directly DisappearsThe current Liquid Leverage campaign executed on the Aave platform only provides additional USDe rewards (approximately 12% annualized) for a limited time. Once the incentives end, the actual yield held by users will fall back to the sUSDe native yield (funding fee + LST yield) plus the Aave platform deposit interest, potentially dropping to the 15–20% range. Furthermore, under high leverage (e.g., 5x), after adding the USDT borrowing rate (currently 4.69%), the yield space is significantly compressed. More severely, in extreme environments with negative funding and rising interest rates, users' net yield could be completely eroded or even turn negative.

If incentive termination, ETH price decline, and negative funding rates occur simultaneously, the delta-neutral yield mechanism relied upon by the USDe model will face substantial impact. sUSDe yield could drop to zero or even invert. If accompanied by large-scale redemptions and selling pressure, USDe's price peg mechanism will also face challenges. This "multiple negative overlay" constitutes the core systemic risk in Ethena's current architecture and may be the underlying motivation behind its recent high-intensity incentive campaigns.

V. Will the Structure Stabilize if Ethereum Price Rises?

Since USDe's stability mechanism relies on Ethereum asset spot staking and derivative hedging, its fund pool structure faces systemic withdrawal pressure during periods of rapid ETH price increases. Specifically, when the ETH price approaches market-expected highs, users often tend to redeem staked assets early to realize gains or shift to other assets with higher returns. This behavior triggers a typical chain reaction: "ETH bull market → LST outflow → USDe contraction."

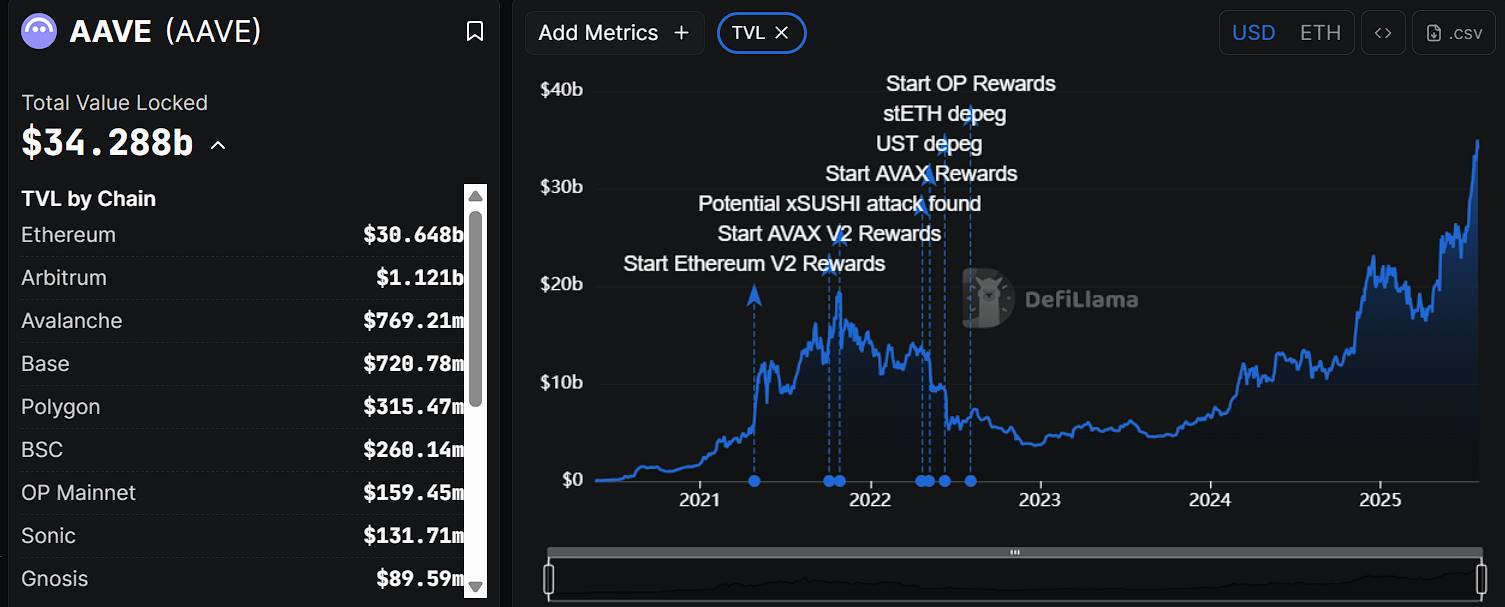

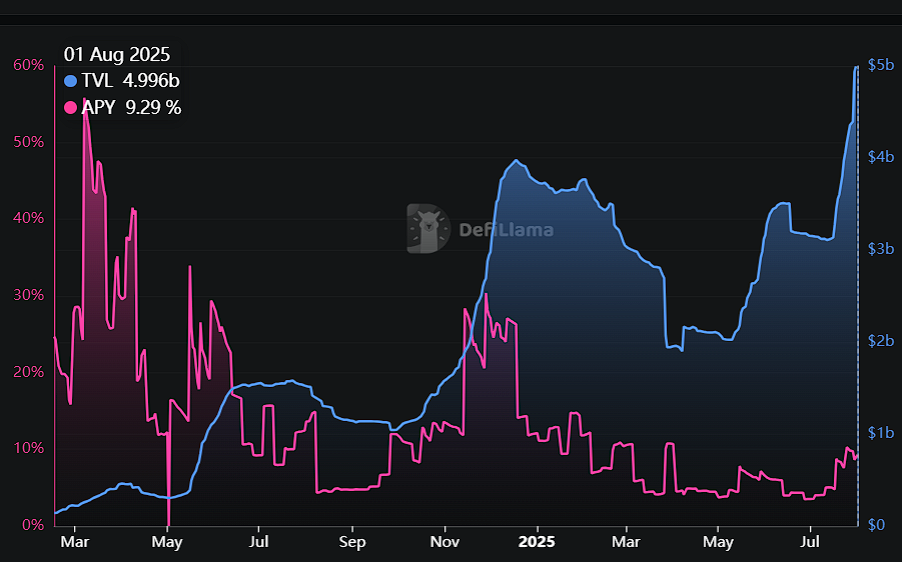

Data from DeFiLlama shows that the TVL of USDe and sUSDe declined synchronously during the ETH price surge in June 2025, and there was no accompanying increase in Annual Percentage Yield (APY) with the price rise. This phenomenon contrasts with the previous bull cycle (late 2024): back then, although TVL gradually declined after ETH reached its peak, the process was relatively slow, and users did not collectively redeem staked assets early.

In the current cycle, the simultaneous decline in TVL and APY reflects rising market participant concerns about the sustainability of sUSDe yields. When price volatility and changes in funding costs bring potential negative yield risks to the delta-neutral model, user behavior shows higher sensitivity and reaction speed, with early exit becoming the mainstream choice. This capital withdrawal phenomenon not only weakens USDe's expansion capability but also further amplifies its passive contraction characteristic during ETH bull cycles.

Summary:

In summary, the current high annualized yield of 50% is not the protocol's norm but rather the result of a phased push from multiple external incentives (Merkl airdrop + Aave collaboration). Once risk factors such as ETH price volatility at highs, incentive termination, and negative funding rates converge, the delta-neutral yield structure relied upon by the USDe model will face pressure. sUSDe yields could rapidly converge to 0 or turn negative, subsequently impacting the stable peg mechanism.

From recent data, the TVL of USDe and sUSDe declined synchronously during the ETH price rise phase, and APY did not increase concurrently. This phenomenon of "withdrawal during a rise" indicates that market confidence is beginning to price in risks early. Similar to the "peg crisis" once faced by GHO, USDe's current liquidity stability largely relies on a strategy of continuous subsidy for stabilization.

When this incentive game ends, and whether it can secure a sufficient adjustment window for the protocol's structural resilience, may become the key test for whether USDe truly possesses the potential to be the "third pole of stablecoins."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News