From AMM to CLOB: The $7 Trillion Race to Bring Nasdaq On-Chain

TechFlow Selected TechFlow Selected

From AMM to CLOB: The $7 Trillion Race to Bring Nasdaq On-Chain

CLOB is not meant to replace AMM, but to build complex financial infrastructure on-chain suitable for traditional markets.

Author: A1 Research

Translation: AididiaoJP, Foreight News

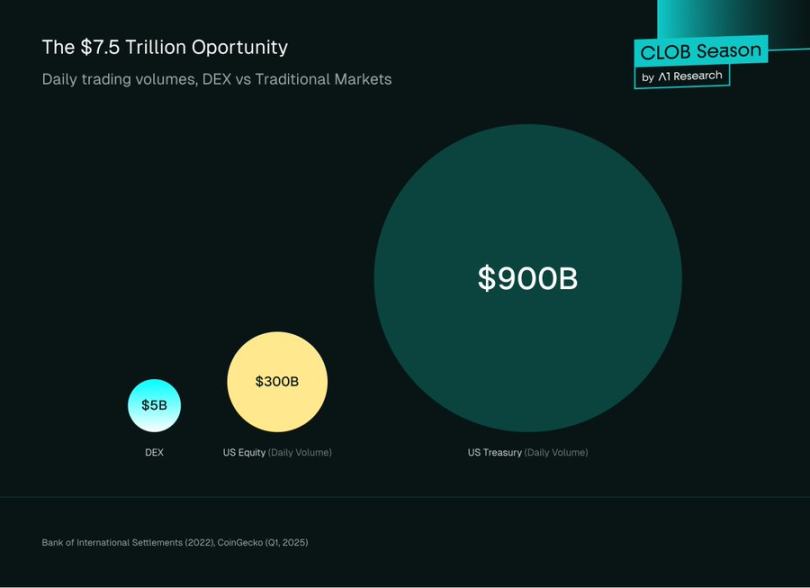

From AMM to CLOB: The $7 Trillion Race to Bring Nasdaq On-Chain. According to a 2022 report by the Bank for International Settlements, global exchange markets process over $7.5 trillion in daily trading volume. Cryptocurrency accounts for less than 2% of this; in Q1 2025, average daily crypto trading volume plummeted to $14.6 billion, with spot DEXs handling only about $5 billion per day—a negligible rounding error in global finance.

If financial markets are destined to move on-chain, the primary question is not when, but whether the infrastructure is ready. Consider the scale: U.S. equities trade around $300 billion daily, while U.S. Treasuries exceed $900 billion. For decades, professional traders, market makers, and institutions have built their algorithms, risk models, and entire operational stacks around one standard: the Central Limit Order Book (CLOB).

Now contrast this with DeFi. DeFi asks them to abandon this framework and embrace Automated Market Makers (AMMs): trading against mathematical curves instead of order books. From the perspective of institutions managing billions, this is inefficient and alien.

The result? Capital entering crypto largely stays on centralized exchanges like Binance and Coinbase—platforms with the familiar infrastructure of traditional finance. While DeFi’s promise of transparent, self-custodied markets is compelling, its current form stands in stark opposition to Wall Street.

The good news is this is changing. The emergence of on-chain CLOBs marks DeFi’s coming-of-age moment—the point where blockchain infrastructure finally matches the sophistication of traditional markets.

When Citadel Securities processes about 35% of U.S.-listed retail trading volume, when Jane Street generated $20.5 billion in net trading revenue in 2024, they aren’t using AMMs—they’re using CLOBs. And now, with platforms like @HyperliquidX handling 200,000 orders per second, and Ethereum L2s and Solana achieving millisecond latency through scaling, the infrastructure is maturing to support $7.5 trillion in daily volume.

This isn’t about replacing AMMs. AMMs will continue to play a vital role in on-chain price discovery, especially for long-tail digital assets. It’s about building a bridge to bring Wall Street on-chain—enabling BlackRock to directly trade mainstream stocks and bonds on DeFi rails, making "decentralized finance" more than just a vision for retail traders, and ultimately unlocking the full potential of programmable, composable on-chain DeFi primitives.

The journey from AMM to on-chain CLOB is not merely a technical evolution—it’s the story of DeFi growing up. When blockchains first enabled trading, limited block space and slow settlement made traditional order books computationally and economically unfeasible. AMMs provided an elegant solution: trade against a curve, not a counterparty. They made DeFi possible. But now, as infrastructure matures and institutional demand becomes paramount, the market is reverting to how things have always operated at scale: order books.

This article explores the technical mechanics of both systems, their fundamental trade-offs, and why the most sophisticated trading applications are leading the return to CLOB—not a rejection of DeFi innovation, but its natural evolution toward institutional readiness.

Automated Market Makers: DeFi’s Zero-to-One Innovation

Ethereum has significant limitations: low throughput (~15 transactions per second) and high, volatile gas fees. Replicating a traditional high-frequency CLOB—which requires constant order submission, cancellation, and modification—is computationally and economically infeasible. AMMs were the ingenious solution to this problem.

Rather than matching individual buyers and sellers, AMMs allow users to trade against pooled reserves of assets, known as liquidity pools. Prices are not determined by an order book, but by a deterministic algorithm.

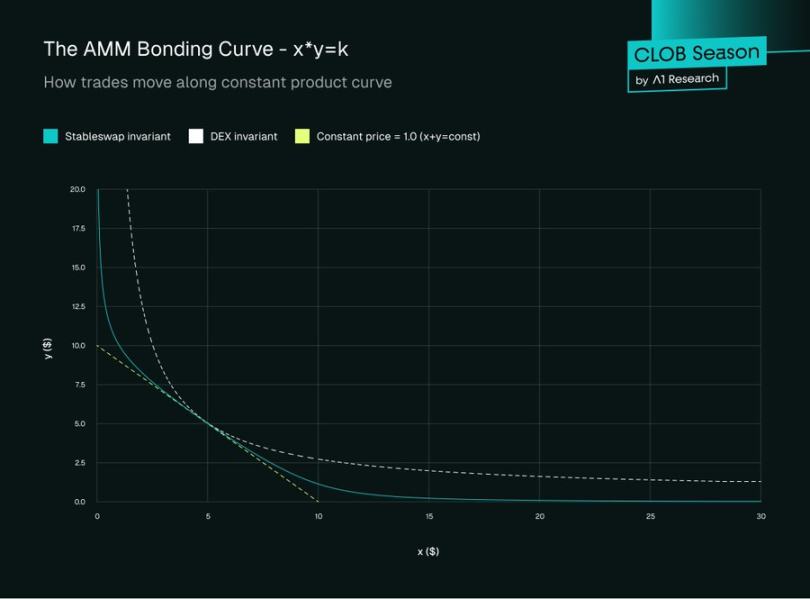

Constant Product Market Maker (CPMM)

The most basic and popular type of AMM is the Constant Product Market Maker, pioneered by Uniswap. Its mechanism is governed by a simple yet powerful formula:

x × y = k

Where:

-

x is the quantity of asset A in the liquidity pool.

-

y is the quantity of asset B in the liquidity pool.

-

k is the constant product. This value must remain unchanged during a trade (excluding fees).

In a CPMM, the price of an asset is simply the ratio of reserves: price of asset A = y / x.

Trade Example

Let’s walk through a concrete example to understand how trades execute in a CPMM and why slippage becomes a critical consideration.

Initial Pool State

Consider an ETH/USDC pool with the following reserves:

-

x = 1,000 ETH

-

y = 4,500,000 USDC

-

k = 1,000 × 4,500,000 = 4,500,000,000

Prior to any trade, the spot price is simply the reserve ratio:

Price = y / x = 4,500,000 / 1,000 = 4,500 USDC per ETH

Executing a Trade

Scenario: A trader wants to swap 10 ETH for USDC.

When the trader removes 10 ETH from the pool, the constant product formula dictates:

New ETH balance: x『 = 1,000 - 10 = 990 ETH

The USDC balance must adjust so that: 990 × y』 = 4,500,000,000

Thus: y『 = 4,500,000,000 ÷ 990 = 4,545,454.55 USDC

The trader must deposit:

Required USDC = 4,545,454.55 - 4,500,000 = 45,454.55 USDC

Effective price paid = 45,454.55 ÷ 10 = 4,545.45 USDC per ETH

Note the trader paid 4,545.45 USDC per ETH, not the initial spot price of 4,500. This difference is known as price impact.

Understanding Slippage

Slippage represents the percentage difference between the expected price (spot price) and the actual execution price. In our example:

Slippage = (4,545.45 - 4,500) ÷ 4,500 × 100% = 1.01%

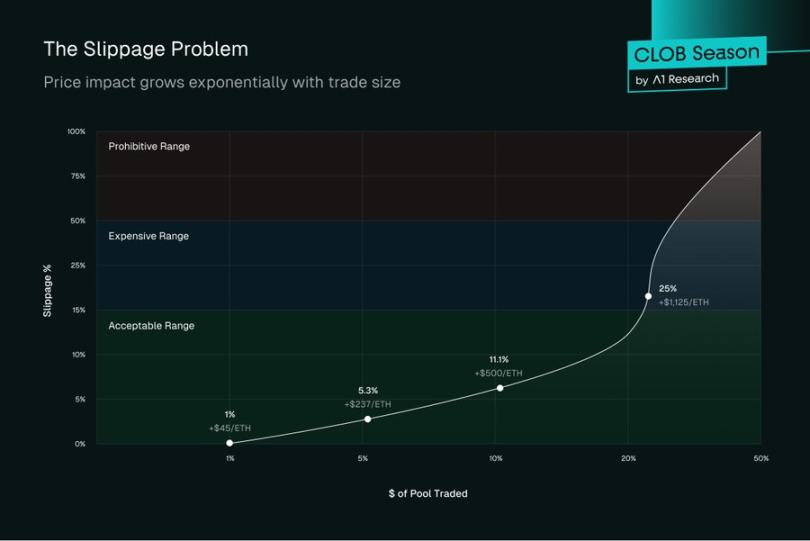

This 1.01% slippage may seem acceptable, but as trade size increases, the constant product formula leads to exponentially worse pricing:

For a 50 ETH trade:

-

New ETH balance: 950

-

New USDC balance: 4,500,000,000 ÷ 950 = 4,736,842.11

-

Required USDC: 236,842.11

-

Price per ETH: 4,736.84

-

Slippage: 5.26%

For a 100 ETH trade:

-

New ETH balance: 900

-

New USDC balance: 4,500,000,000 ÷ 900 = 5,000,000

-

Required USDC: 500,000

-

Price per ETH: 5,000

-

Slippage: 11.11%

Price Impact Curve

The relationship between trade size and price impact follows a hyperbolic curve. As you trade a larger percentage of the pool's liquidity:

-

1% of pool liquidity → ~1% slippage

-

5% of pool liquidity → ~5.3% slippage

-

10% of pool liquidity → ~11.1% slippage

Key AMM Concepts and Challenges

Liquidity Providers: Anyone can contribute assets to a pool (e.g., depositing 1 ETH and 2,000 USDC) to become a liquidity provider (LP). In return, they earn a share of the trading fees generated by that pool.

Impermanent Loss: The most misunderstood risk for LPs is that AMM pools are isolated markets. Their prices are not set by external sources, but by the constant product formula. Whenever the market price moves—say, ETH doubles on Coinbase—arbitrageurs step in to trade with the pool until its price aligns with the global market. This rebalancing process extracts value from LPs: they end up holding more of the depreciating asset and less of the appreciating one. This loss is called "impermanent" because it disappears if prices revert, but in volatile markets, it often materializes as very real opportunity cost compared to simply holding.

Poor Capital Efficiency: In the standard CPMM model, liquidity is spread across the entire price curve from zero to infinity. This means the vast majority of capital in a pool sits idle at any given time, since trading only occurs near the current market price. For stablecoin pairs like USDC/DAI, which trade narrowly around $1.00, providing liquidity at $0.10 or $10.00 is extremely inefficient.

Evolution: Concentrated Liquidity (Uniswap v3)

To address poor capital efficiency, Uniswap v3 introduced concentrated liquidity. Instead of providing liquidity across the entire price range, LPs can choose to provide liquidity within a specific price interval.

For example, an LP might provide liquidity for the ETH/USDC pair only between $4,400 and $4,800. This concentrates their capital where most trading actually occurs, allowing them to earn significantly more fees with the same amount of capital. Functionally, this creates deeper liquidity positions that begin to resemble order book "limit orders," marking the first major conceptual bridge between AMMs and CLOBs.

Remaining challenges with concentrated liquidity:

Amplified Impermanent Loss

Concentrated positions experience amplified impermanent loss when prices move outside their range. LPs face a harsh dilemma: narrower ranges earn more fees, but suffer greater losses when prices drift. A position concentrated within a 1% range could lose 100% of one asset if the price moves just 1% in either direction.

Active Management Burden

Unlike the "set and forget" approach of v2, v3 requires continuous monitoring and rebalancing. When ETH moves from $4,500 to $4,600, a position centered at $4,500 becomes inactive and earns zero fees until manually adjusted. This incurs operational overhead comparable to traditional market making.

Gas Cost Complexity

Managing concentrated positions requires frequent transactions for rebalancing, position adjustments, and fee collection. During periods of high volatility, gas costs can exceed fee revenue, especially for smaller positions. This creates a barrier to entry for retail LPs.

Persistent MEV Vulnerability

Flash liquidity attacks become more sophisticated. MEV bots can sandwich concentrated positions with surgical precision, extracting value moments before large trades and removing liquidity immediately after, leaving losses to regular LPs.

Price Discovery Still Fails

The x*y=k formula, even when concentrated, does not reflect real market dynamics. There is no concept of market sentiment, order flow, or price-time priority. Every trade moves the price regardless of size or intent, creating artificial volatility.

Liquidity Fragmentation

LPs choosing different ranges create a fragmented liquidity landscape. A trader might face good liquidity at $4,500 but terrible slippage at $4,550, resulting in unpredictable execution quality across price levels.

No Native Limit Orders

While concentrated positions resemble limit orders, they are not true limit orders. They continue to provide two-way liquidity, can be partially filled multiple times, and offer no guarantee of execution at a specific price.

Success in Spot vs. Perpetuals Problem

Thus, while AMMs revolutionized spot trading (Uniswap alone has facilitated over $2 trillion in cumulative volume), their success does not translate to perpetual futures markets. This divergence reveals a fundamental truth about market structure: different instruments require different infrastructure.

What does this mean? Spot markets are forgiving. Traders swapping ETH for USDC accept slippage as the cost of instant execution. Trades settle instantly with no ongoing obligations. AMMs excel here because their simplicity aligns with the direct nature of spot trading.

In contrast, perpetual futures require precise entry and exit prices, continuous funding rate calculations, real-time liquidation engines, and leverage management. @GMX_IO and other AMM-based perpetual platforms struggle with these demands. Their reliance on oracle pricing creates toxic order flow opportunities, where traders exploit discrepancies between oracle feeds and actual market conditions. The lack of true price discovery means positions are frequently mispriced, exposing liquidity providers to asymmetric risk. AMM-based perpetual platforms implement stop-loss and limit orders via auxiliary vault systems, but these lack the precision, reliability, and price discovery advantages of true order book markets.

The outcome is predictable: professional traders stay on centralized exchanges. While Uniswap captured significant spot market share from Coinbase, GMX and its peers have barely dented Binance’s dominance in perpetuals. Perpetual futures volume is 3–5x that of spot and remains firmly in CeFi’s hands.

This is not a failure of execution, but a mismatch of architecture. Perpetual futures evolved from traditional futures markets, which have always relied on order books for price discovery and risk management. Trying to force them into an AMM model is like asking a Formula 1 car to run on square wheels—technically possible, but fundamentally inefficient.

The market is ready for a solution, and Hyperliquid and a new generation of on-chain CLOBs are now delivering it. They recognize a simple truth: to capture institutional perpetuals flow, you need institutional-grade infrastructure. Not approximation, not workaround—real infrastructure: an on-chain order book with performance rivaling centralized venues.

Central Limit Order Book (CLOB): Precision and Efficiency

CLOB is the backbone of traditional finance, powering everything from the New York Stock Exchange to Coinbase. It is a transparent and efficient system for matching buyers and sellers.

Core Mechanism

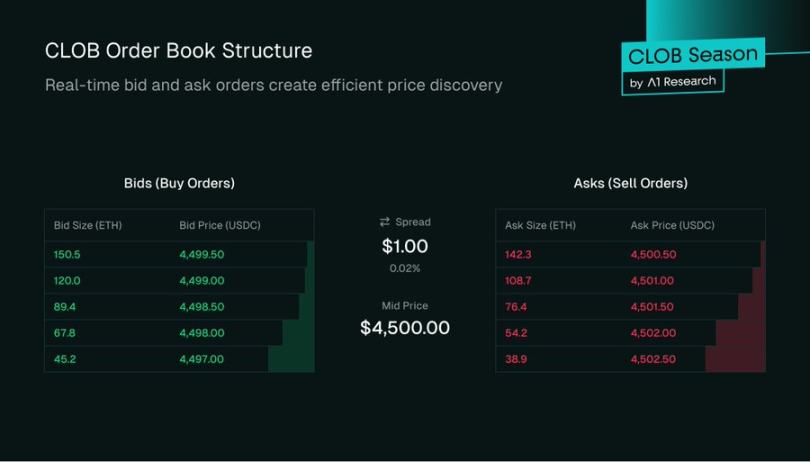

A CLOB is essentially two lists of orders for a specific asset pair:

-

Bids: A list of buy orders, sorted from highest to lowest price.

-

Asks: A list of sell orders, sorted from lowest to highest price.

The difference between the highest bid (the highest price someone is willing to pay) and the lowest ask (the lowest price someone is willing to accept) is called the bid-ask spread. Beyond the spread, the depth at each price level also affects execution quality. For example, a CLOB with 100 ETH available at $4,500 offers better execution for large trades than one with only 10 ETH at that level, as deeper liquidity reduces slippage.

Order Types and Matching Engine

Users interact with a CLOB using various order types:

Limit Order: An order to buy or sell at a specified price or better. A limit buy order for ETH at $4,495 will only execute if the ask reaches $4,495 or lower. If it cannot be filled immediately, it remains on the order book, adding market depth. This is how market makers provide liquidity.

Market Order: An order to buy or sell immediately at the best available market price. A market buy order will "walk the book," consuming the lowest asks one by one until the entire order is filled. This provides execution certainty but no price guarantee.

Stop Order: Activates only when a specified trigger price is reached. For example, a stop-sell order at $4,400 executes once ETH drops to that level, helping traders manage downside risk.

The matching engine is the core algorithm that enforces these rules, typically following price-time priority. Orders at better prices are matched first. If multiple orders exist at the same price, the earliest placed order is matched first. This FIFO method at each price level ensures fairness and prevents front-running, unlike AMMs where larger trades extract more value.

The Engine Behind the Book: Professional Market Makers

An order book is just a list of intentions until liquidity exists. Unlike AMMs, where liquidity is passively provided by a diverse pool of LPs, CLOBs rely on a specialized class of participants to function effectively: market makers. These are sophisticated entities, often professional trading firms or dedicated liquidity funds, whose core business is providing liquidity.

What Do Market Makers Actually Do?

The core function of a market maker is to be ready to buy and sell an asset at any given time. They achieve this by simultaneously placing a bid and an ask on the order book. This action serves two key purposes:

-

Ensure Liquidity: Market makers guarantee there are always orders for retail traders to trade against. A trader wanting to sell can immediately hit the market maker’s bid; one wanting to buy can immediately take their ask.

-

Narrow the Spread: Competition among multiple market makers forces the gap between the highest bid and lowest ask to be as small as possible. A tight spread is a hallmark of a healthy, liquid market and delivers better prices to traders.

Market makers primarily profit from capturing the bid-ask spread. For instance, if they have a bid for ETH at $1,999.50 and an ask at $2,000.00, they aim to buy from sellers at the lower price and sell to buyers at the higher price, earning a $0.50 spread on each round-trip trade. Their total profit is essentially (spread) × (volume).

This is not risk-free. Market makers face significant inventory risk.

If the overall market price of ETH suddenly drops, their bids get filled, accumulating ETH inventory now worth less than they paid. If a market maker accumulates 100 ETH at $4,500 and the price falls to $4,400, they face a $10,000 unrealized inventory loss.

Conversely, if ETH price surges, their asks get filled, selling inventory below the new, higher market price.

To manage this, market makers use complex algorithms that continuously adjust their quotes based on market volatility, volume, and their current inventory. Professional market makers often hedge inventory risk using perpetual futures or options on centralized exchanges to maintain delta-neutral positions. This is a highly active, data-driven process, sharply contrasting with the passive "deposit and forget" nature of standard AMM LPs.

The On-Chain Liquidity Fund Landscape

The shift to on-chain CLOBs has attracted professional liquidity funds and trading firms honed in traditional finance and centralized crypto markets. Companies like @wintermute_t, @jump_ and @GSR_io are now major players in DeFi, providing deep liquidity to on-chain order books.

These firms don’t trade manually. They connect to DEX protocols via APIs and run high-frequency, automated strategies. To attract these key participants, on-chain CLOBs have developed robust incentive structures:

Maker Rebates: Many order books employ a "maker-taker" fee model. "Takers" pay fees, while "makers" receive small rebates. For high-volume market makers, these rebates can become a significant revenue stream.

Liquidity Mining Programs: Protocols often directly reward market makers with native governance tokens. These programs typically require market makers to meet specific KPIs, such as maintaining certain order depth, maximum spreads, and over 90% uptime on designated trading pairs. This is an efficient strategy for protocols to bootstrap liquidity in new markets.

Operating on blockchains introduces unique challenges absent in traditional finance:

-

Gas Costs: Every order placement, cancellation, and update is an on-chain transaction requiring gas. This creates a persistent operational cost that market makers must factor into their profitability. Low-fee L2s and high-throughput L1s are essential for viability.

-

Latency and MEV: Blockchain block times introduce latency. With Ethereum’s ~12-second block time, a market maker’s order may be "in flight" and unmodifiable for up to 12 seconds, compared to microsecond updates in traditional finance.

During this window, the market may move against them. Compounding this, orders are visible in the public mempool before confirmation, exposing them to Maximum Extractable Value (MEV) strategies like front-running. To mitigate this, market makers adopt techniques such as order splitting, routing through private mempools, or leveraging off-chain execution.

Why the Return to CLOB: Technical Enablers

On-chain CLOBs initially faced computational barriers

High-Throughput L1s: Chains like @solana, @SeiNetwork, @monad, @Aptos and @SuiNetwork are built for high throughput and low latency, making on-chain order books feasible. These are general-purpose L1s designed to host many applications. In contrast, dedicated L1s like Hyperliquid’s HyperCore are tailored for trading, with matching engines optimized for speed and performance.

Rollups: High-performance rollups like @megaeth_labs, @fuel_network and @rise_chain aim to deliver real-time, low-latency trading on Ethereum by leveraging parallel transaction processing. Beyond general rollups, we see specialized L2 app-chains. For example, @hibachi_xyz built on @celestia or networks like @bulletxyz_ extending Solana, are specifically designed to host on-chain matching engines.

Critically, these designs rely on scalable data availability layers like @eigen_da and Celestia, enabling the throughput required for order-book-style trading. Meanwhile, advances in ZK infrastructure make verifiable off-chain CLOBs possible, combining performance with Ethereum-level security.

Projects like Hyperliquid, Bullet, @dYdX exemplify successful CLOB-based DEXs.

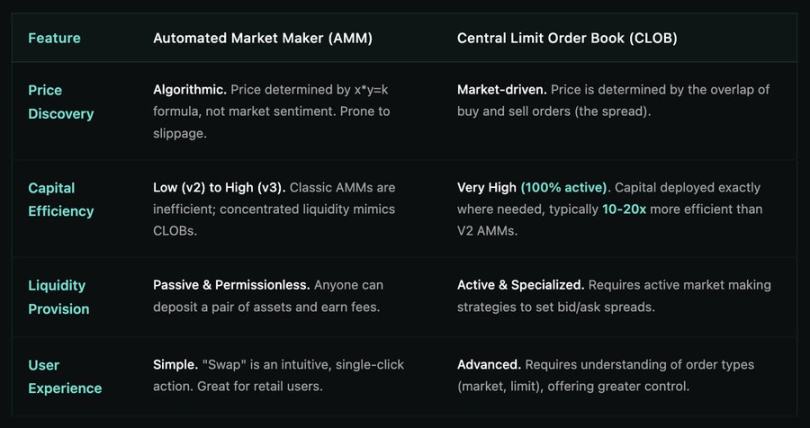

Part Three: Head-to-Head Comparison: AMM vs. CLOB

What This Means for Users

The shift from AMM to CLOB is not just a technical upgrade—it directly reshapes user experience:

Retail Traders: Get better prices and lower slippage, with an interface familiar to anyone used to centralized exchanges.

Institutions: Now have access to professional-grade tools, advanced order types, risk management, and deep liquidity on transparent, decentralized rails.

DeFi Protocols: Unlock more composable liquidity, with capital efficiently allocated and seamlessly integrated across the ecosystem.

As blockchains approach traditional finance-grade performance, the gap between centralized and decentralized trading experiences will narrow, making on-chain markets not just an alternative, but a competitive venue for global finance.

Conclusion: The Maturation of DeFi Trading

AMMs were DeFi’s zero-to-one innovation, solving the cold-start problem of enabling on-chain trading when blockchains were slow and expensive. They democratized market making and offered a simple, unstoppable way to trade on-chain.

But as DeFi matures from a niche for early adopters into a parallel financial system seeking institutional capital and professional traders, its infrastructure must mature too. Central Limit Order Books offer unmatched capital efficiency, precise price control, and fine-grained control needed for sophisticated trading strategies.

While AMMs will always have a place for long-tail assets and simple swaps, the future of high-volume, professional-grade decentralized trading belongs to CLOBs. The movement toward CLOBs isn't about replacing AMMs—it's about building the next layer of sophisticated financial infrastructure on-chain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News