Liquidity challenges in the RWA era: the role and positioning of AMMs

TechFlow Selected TechFlow Selected

Liquidity challenges in the RWA era: the role and positioning of AMMs

AMM, positioning it at the "last mile," focusing on providing small-amount, seamless, and transparent exchange experiences.

Author: @sanqing_rx

Introduction

Real-world assets (RWA) are becoming a key narrative for Web3's move into the mainstream. However, bringing trillions of dollars worth of real-world assets on-chain involves more than just tokenization—the real challenge lies in building efficient and robust secondary market liquidity, which will ultimately determine success or failure. As the cornerstone of DeFi, automated market makers (AMM) are naturally expected to play a major role—but can they be directly transplanted into the world of RWA?

Summary (Three-Sentence Overview)

Conclusion: Current mainstream AMMs (concentrated liquidity, stablecoin curves, etc.) are unsuitable as the "primary market" for RWA. The biggest obstacle is not the curve model itself, but rather that the LP (liquidity provider) economic model cannot sustainably function in an environment characterized by low turnover, strict compliance, and slow pricing.

Positioning: Issuance/redemption, KYC order books/RFQs, and periodic auctions should serve as the "main arteries" of RWA liquidity; AMMs should instead take a back seat as a "convenience layer," handling only small-scale, everyday, and easy secondary transactions.

Approach: A combination of "narrowband market making + Oracle slip-band/Hook + yield bridging" can effectively channel native RWA yields (such as coupons or rental income) to LPs, supported by comprehensive risk controls and disclosure mechanisms.

I. AMM Should Not Be the "Primary Market" for RWA

RWA aims to establish predictable, measurable, and settleable financial infrastructure. While the continuous quoting mechanism of AMMs is highly innovative, it faces three inherent challenges in most RWA scenarios: naturally low trading volume, slow information updates ("heartbeat"), and extended compliance processes. This makes the returns from trading fees alone insufficient for LPs, who still remain exposed to impermanent loss.

Therefore, our core view is: AMM should not serve as the "primary market" for RWA, but rather as the "last mile" of liquidity. Its role should be to allow users to conveniently exchange small amounts of assets anytime, anywhere—enhancing user experience—while core functions like large trades and price discovery must be handled by more suitable mechanisms.

II. Why Does AMM Thrive in Native Crypto Environments?

To understand AMM’s limitations in RWA, we must first recognize why it succeeds in native crypto ecosystems:

-

No trading downtime: With 7x24 global markets and permissionless cross-market arbitrageurs, any price discrepancy is immediately corrected, creating sustained trading activity.

-

High composability: Almost anyone or any protocol can seamlessly become an LP or participate in arbitrage, generating strong network effects and self-reinforcing traffic.

-

Volatility equals business: High volatility drives substantial trading demand and arbitrage opportunities, generating enough fee revenue for LPs to potentially "outpace" impermanent loss.

When attempting to replicate these three factors in RWA contexts, we find the foundation has completely shifted: significantly lower trading frequency, extremely slow pricing updates, and much higher compliance barriers.

【In-place Explanation | Pricing Heartbeat】

"Pricing heartbeat" refers to the "frequency of credible price updates," a key concept in understanding the difference between RWA and native crypto assets.

Native crypto assets: Heartbeat is typically at the second level (exchange quotes, oracle feeds).

Most RWAs: Heartbeat is often daily or even weekly (fund net asset value updates, property valuations, auction results).

The slower the heartbeat, the less suitable an asset is for long-term deep, continuously quoted pools.

III. LP Economics Don't Add Up in RWA Scenarios

An LP’s annualized return perception primarily depends on three factors: trading fees, the intensity of capital turnover within effective price ranges, and the number of annual trading cycles.

For RWA, this math rarely balances because:

-

Low turnover: Capital sitting in the pool is rarely "activated" by high-frequency trading, leading to minimal fee income.

-

High opportunity cost: Attractive coupon payments or risk-free interest rates exist in external markets. LPs could often earn more by simply holding the underlying RWA asset directly (if allowed) rather than providing liquidity.

-

Misaligned risk-reward: Against a backdrop of low fee income, LPs still bear impermanent loss (relative to holding the asset outright) and the risk of being exploited by arbitrageurs due to delayed oracle pricing.

Overall, the LP economic model is inherently disadvantaged in RWA AMMs.

IV. Two Structural Frictions: Pricing and Compliance

Beyond economics, two structural issues hinder AMM adoption.

Pacing mismatch in pricing: RWA net values/valuations/auctions operate on a "slow heartbeat," while AMMs offer instantly tradable quotes. This time lag creates a significant arbitrage window for those with the latest information, allowing them to easily exploit uninformed LPs.

Compliance breaks composability: KYC, whitelisting, and transfer restrictions extend the path for capital entry and exit, breaking DeFi’s Lego-like "open participation" model. This directly leads to fragmented liquidity and insufficient depth.

Cash flow "plumbing": Cash flows such as coupons or rent either manifest through NAV appreciation or require direct distribution. If the AMM/LP mechanism lacks proper design for capturing and distributing these yields, LPs may miss out entirely or have their share diluted during arbitrage events.

V. Applicability Boundaries and Real-World Cases

Not all RWAs are incompatible with AMMs—we need to categorize and analyze accordingly.

More compatible: Short-duration, daily-updating, transparently priced assets (e.g., money market fund shares, short-term treasury tokens, interest-bearing certificates). These have clear central prices and are well-suited for narrowband AMMs to provide convenient exchange services.

Less compatible: Assets relying on offline valuations or infrequent auctions (e.g., commercial real estate, private equity). These have slow heartbeats and severe information asymmetry, making them better suited for order books/RFQs and periodic auctions.

Case Study: Arbitrage Window in Plume Chain's Nest

Background: Nest project’s nALPHA and nBASIS tokens have AMM pools on Curve and the native Rooster DEX. Initially, redemption was fast (~10 minutes), but token price updates occurred roughly once per day, sometimes slower.

Observation: Due to daily NAV updates versus second-level AMM pricing, after a new NAV release, the AMM price often failed to adjust promptly—creating an arbitrage window where traders could "buy low on DEX → immediately redeem with project → settle at updated, higher NAV."

Impact: Arbitrageurs profited while AMM LPs bore full impermanent loss, especially those providing liquidity far from the current price, suffering heavier losses.

Post-mortem and Remediation Suggestions:

Post-mortem: The root cause was mismatched pricing heartbeat, compounded by lack of protocol-level risk controls and order routing mechanisms.

Remediation Suggestions:

-

Order routing: AMM handles only small trades (see below); large orders are forcibly routed to RFQ or issuance/redemption channels.

-

Active price tracking: Implement an "Oracle slip-band + Hook" mechanism, offering liquidity only within a narrow ± range around the latest NAV, automatically migrating the band or temporarily increasing fees upon NAV update.

-

Risk control safeguards: Set oracle freshness thresholds, price premium/discount circuit breakers, and switch to auction-only or redemption-only modes on days of major valuation adjustments.

-

Disclosure: Establish a public dashboard showing premium/discount distribution, oracle status, redemption queues, etc., enabling LPs to make informed decisions.

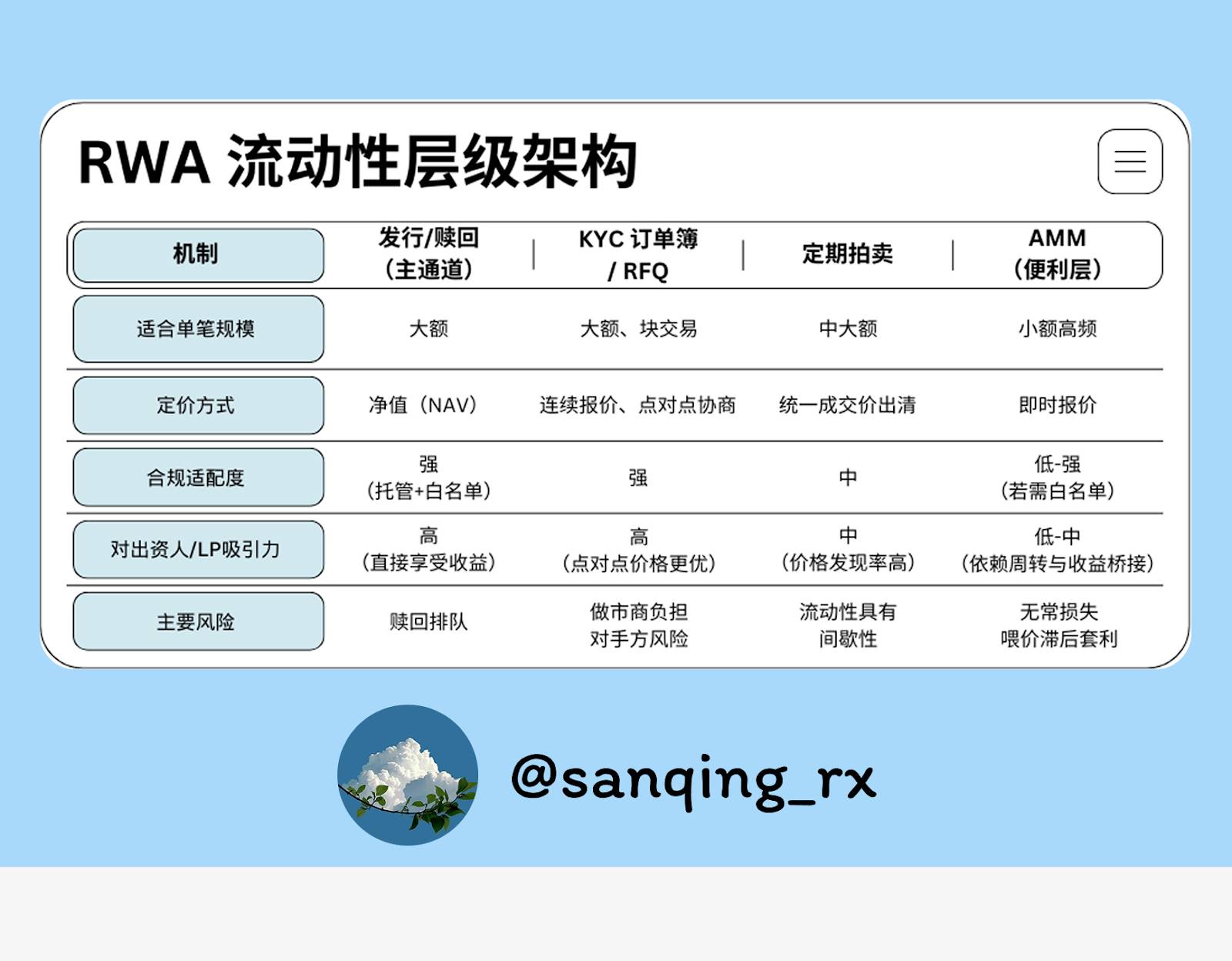

VI. Four-Pronged "Liquidity Backbone"

A mature RWA market requires a multi-layered liquidity architecture.

VII. Precision Operations: Three Key Levers for Effective RWA AMMs

To make AMMs effective in their "convenience layer" role, three things must be done well:

1. Narrowband Market Making (Concentrated Liquidity)

Provide liquidity only within a very narrow band around the asset’s net value. This greatly improves capital efficiency and reduces the time window during which liquidity is exposed to arbitrage at outdated prices.

2. Price Tracking and Self-Protection (Oracle Slip-Band / Hooks)

An advanced dynamic version of narrowband market making. Through oracle and smart contract orchestration, prices are automatically tracked, and protective mechanisms activated during market anomalies.

【In-place Explanation | Oracle Slip-Band and Hook】

Slip-Band: A narrow "quoting corridor" tightly following oracle feeds (e.g., NAV). Liquidity is concentrated here.

Hook: Programmable actions embedded in the AMM contract. When the oracle price updates, the Hook is triggered to shift the "slip-band" near the new price, or even temporarily raise fees to hedge risk.

Core goal: Avoid being stuck at outdated prices and exploited, while preserving convenience for small trades.

3. Yield Bridging

A clear mechanism must be established to accurately distribute cash flows (e.g., coupons, rent) generated by the underlying RWA asset to LPs in the AMM pool. It is crucial to clearly define in code the entire path—from "yield entering the pool → entitlement by share → withdrawal timing"—so that LP returns expand beyond fees to include both "fees + native asset yield."

VIII. Conclusion: From "Continuous Quoting" to "Predictable Liquidity"

RWA may not need blockchain’s 7×24 price noise. What it truly needs is predictable, measurable, and settleable liquidity infrastructure.

Let’s assign tasks to the right mechanisms:

Issuance/redemption, KYC order books/RFQs, periodic auctions — build these primary lanes so that price anchoring and large trade execution occur here.

AMM — reposition as the "last mile," focused on delivering small-scale, smooth, and transparent exchange experiences.

When capital efficiency aligns with compliance realities, and when we stop expecting AMMs to carry the fantasy of being the "primary market," the on-chain secondary liquidity ecosystem for RWA will become healthier and more sustainable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News