Smilee Finance: A Novel Options Solution for DeFi AMM Impermanent Loss

TechFlow Selected TechFlow Selected

Smilee Finance: A Novel Options Solution for DeFi AMM Impermanent Loss

The Smilee team is being very bold in their approach. They are leveraging existing knowledge of traditional instruments (such as options) to create entirely new DeFi primitives.

Author: Leftside Emiri

Translation: TechFlow

Automated Market Makers (AMMs) are considered one of the key innovations in decentralized finance (DeFi). A Google search for AMMs will show that nearly every article refers to them as DeFi's "zero-to-one innovation"—and rightly so. Permissionless trading of assets is one of DeFi’s most important use cases, and it is AMMs that make this possible. Interestingly, as a byproduct of the systems they created, they also introduced something else: the opportunity to earn passive yield.

AMMs require liquidity to function, which comes from liquidity providers (LPs). These individuals willingly lock their assets into liquidity pools so others can trade against them. In return for taking on this risk, LPs earn a share of the trading fees collected by the pool.

While experienced providers may profit from their LP positions, the vast majority of inexperienced LPs end up losing money—often without understanding why. This is due to a phenomenon known as "impermanent loss."

Impermanent Loss

When providing liquidity via an AMM, LPs lose value in their holdings due to fluctuations in asset ratios—this is known as impermanent loss. The greater the volatility of the trading pair, the higher the impermanent loss suffered by the LP.

Impermanent loss occurs in standard ratio liquidity pools (e.g., 50/50 ETH/USDC). Since trades involve users depositing one token and withdrawing another, after volatile trading sessions, the asset ratio within the pool naturally deviates from 50/50. Because LPs own a proportional share of the entire pool rather than fixed amounts of each asset, their total holdings decrease as arbitrageurs correct these imbalances by extracting small amounts of liquidity.

As a result, LPs often find that depositing assets into a pool leaves them with fewer assets than if they had simply held the tokens outright. Clearly, DEXs and AMMs have become mainstream—but how do we solve the persistent problem of impermanent loss that plagues LPs and undermines liquidity incentives?

Until now, the only solution has been for LPs to hope that the trading fees they collect are sufficient to offset impermanent loss. Unfortunately, this hasn't worked as expected. Some reports indicate that the majority of LPs remain at a loss over extended periods.

So, you might ask: what’s the solution?

Smilee Finance might be the answer.

Smilee Finance: Overview

Smilee Finance transforms impermanent loss from a problem into a feature by leveraging various volatility-based products. To create these products, they first had to reframe how impermanent loss is understood.

It views LPs as sellers of options. Based on the nature of impermanent loss described above, LPs profit when volatility decreases. Therefore, in options terminology, creating an LP position is effectively taking a short volatility (i.e., short gamma) position. They take on this risk hoping that over time, trading fees will compensate for it—essentially forming a long theta position.

Then, who is the counterparty—the buyer—in this scenario?

Previously, there was no buyer because no mechanism existed to create an “option buyer” role. Now, Smilee Finance is creating exactly that option. Before diving into details, let’s first understand the general product flow.

Smilee is essentially building a primitive version of volatility infrastructure for DeFi, and their products are commonly referred to as Decentralized Volatility Products (DVPs). These DVPs fall broadly into two strategies: long volatility and short volatility. If you deposit into a long-volatility vault, you profit from market movements regardless of direction; if you join a short-volatility vault, you earn returns in stable market conditions.

But how does the option buyer make money in this setup? What about those taking long volatility positions?

It works like this:

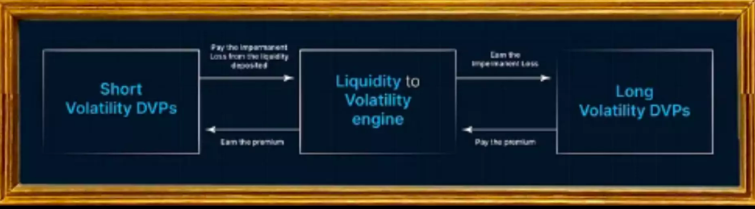

DVPs involve two counterparties: those with long volatility exposure and those with short volatility exposure. Essentially, long-volatility DVPs pay a premium to purchase impermanent loss options—these premiums are paid to short-volatility DVPs. In turn, short-volatility DVPs incur impermanent loss based on their LP positions, which is then routed through the engine and transferred to long-volatility DVPs. This effectively converts impermanent loss into impermanent gain.

Although DVP vaults can take many forms, they all share similar defining parameters.

Each vault has:

-

Volatility exposure (long or short volatility);

-

Token pair (e.g., ETH/USDC);

-

Return formula—the strategy behind the DVP and the mathematical model used to achieve the vault’s objectives;

-

Maturity date;

-

Auction cycle.

All of this is powered by the Liquidity & Volatility Engine—a proprietary system designed by the Smilee Finance team that ensures perfect balance between long- and short-volatility DVPs. What one DVP earns, the other pays, maintaining equilibrium under all market conditions.

Since the sum of all long- and short-volatility DVP returns equals the sum of LP returns and impermanent losses, the issue of impermanent loss is effectively resolved.

The engine also ensures that the notional values of long- and short-volatility DVPs always match, minimizing the possibility of imbalance between vaults.

Moreover, Smilee leverages liquidity from DEXs to maximize composability. It creates an entirely new DeFi primitive, using DEXs as the base layer and positioning Smilee as the topmost financial building block. This architecture allows a wide range of protocols to build customized DVPs and other tools on top, adding more pieces to the Lego-like structure.

We can build various types of vaults on Smilee. There could be direct options vaults executing calls, puts, straddles, or any other options strategy. We could also implement variance swaps, popular in traditional finance but potentially even more valuable in DeFi. Asset protection vaults could also be built, where users are shielded from depegs or impermanent loss.

While the possibilities on Smilee are virtually endless, let’s examine two existing vault types to better understand how Smilee works in practice.

Real Yield Vault

The core idea behind Real Yield Vaults is to fairly compensate liquidity providers. We know most LPs lose money because the fees they earn don’t cover impermanent loss. Thus, these Real Yield Vaults aim to provide LPs with fair returns.

A Real Yield Vault operates on an auction cycle during which LPs deposit liquidity—either as a pair or single-sided—into the vault. On the opposite side is the Impermanent Gain Vault. Users depositing into that vault pay a USDC premium. Upon maturity, LPs in the Real Yield Vault receive both the premium and their deposited liquidity, minus any impermanent loss incurred.

Now, LPs no longer need to rely on unpredictable and inconsistent yields directly offered by DEXs, nor worry about constantly adjusting their positions and ranges. They receive predefined, transparent returns, giving existing and potential LPs greater confidence. This benefits not only users—it also provides a degree of assurance for those hesitant about LPing, ultimately driving increased liquidity across DeFi.

Impermanent Gain Vault

These vaults act as the counterparty to Real Yield Vaults, with users serving as option buyers. By depositing USDC into this vault as a premium, users earn from impermanent loss. They deposit during the auction period, and once the vault reaches maturity, all impermanent losses from positions in the Real Yield Vault are transferred. By “earning” impermanent loss, it effectively becomes impermanent gain.

There are many motivations for potential buyers to use these vaults. First, they serve as excellent hedging tools for funds or individuals with significant naked LP exposure. They could be particularly profitable when positioned ahead of specific events such as FOMC meetings or CPI data releases. Another opportune time is during bear markets, when stablecoin depegs become common—purchasing options then becomes highly lucrative.

However, the entities most likely to utilize this feature extensively are DAOs. DAOs typically engage in large-scale LP activities using their own tokens or project-supporting tokens (as part of protocol-owned liquidity initiatives), exposing them to substantial drawdowns from impermanent loss. Hedging impermanent loss via Impermanent Gain Vaults could thus become a sought-after strategy for most DAO treasuries.

But that’s not all. As previously mentioned, Smilee offers Lego-like composability, allowing Impermanent Gain Vaults to be further enhanced to increase potential returns (alongside increased risk). Additional strategies—such as long-only or short-only bets—can be added, enabling users to speculate on market direction rather than just general volatility. This introduces leveraged exposure with appropriately higher returns, but also carries commensurate risk if the market moves against the position.

It’s important to note that if you’re a potential user of this vault, positions can be closed at any time—there’s no need to wait until maturity. When closing early, the position earns the amount of impermanent loss realized up to that point. However, the paid premium is forfeited in full.

Conclusion

The Smilee team is taking a bold approach. They are applying established knowledge from traditional finance—such as options—to create entirely new DeFi primitives. While there are several options markets in DeFi, few have attempted to transform native DeFi concepts like impermanent loss into structured products. In doing so, they’ve created a truly unique, DeFi-native options tool.

While the concept and execution may be top-tier, it’s important to remember that risks exist. Trading volatility products inherently involves risk due to unpredictable market swings, and like all DeFi protocols, there’s always the potential for exploits or hacks.

As of now, Smilee remains in its early stages—an emerging protocol worth watching closely. Follow their social media channels and try to gain early access to their Discord for alpha insights.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News