How much growth potential remains for AMM-based perpetual contracts, options, and volatility trading products in the future?

TechFlow Selected TechFlow Selected

How much growth potential remains for AMM-based perpetual contracts, options, and volatility trading products in the future?

Perpetual futures and options have already found their place in the cryptocurrency space, and it's only a matter of time before they evolve into mature products sought after by traders and liquidity providers.

Author: GABE TRAMBLE

Translation: TechFlow

Introduction

For some, automated market makers (AMMs) are the only compelling aspect of decentralized exchanges (DEXs). Centralized exchanges often exclude these assets due to factors like low liquidity and reliance on traditional market makers. Whether it's Uniswap, Curve, Balancer, or aggregators like MetaMask and 1inch, AMMs have facilitated hundreds of billions of dollars in trading volume since their emergence a few years ago. The permissionless design of DEXs makes them ideal platforms for trading low-liquidity or long-tail assets, as anyone can create a market for new tokens. Unlike centralized exchanges (CEXs), which require manual integration of assets, AMMs allow any ERC-20 token to be seamlessly deployed and traded as long as someone provides liquidity. This is because AMMs allow anyone to deposit assets and become a market maker without needing to be an institutional entity, as required in traditional finance (TradFi). Market makers increase liquidity by providing buy and sell orders on exchanges, ensuring users can execute trades even without other counterparties. They profit from the spread between buying and selling prices.

However, most spot AMMs are quite basic and typically support only simple buy and sell orders. While some spot AMMs and aggregators offer advanced features such as limit orders and deep liquidity (sufficient for large entities to trade), they still cannot convert their liquidity into other trading primitives.

In product development, it’s often said that a product needs a 10x improvement to displace existing solutions and achieve significant adoption. The introduction of DEXs like Uniswap solved the liquidity problem by enabling users to instantly create markets for any ERC-20 token at unprecedented speed.

DEXs like Uniswap and Curve have been battle-tested over sufficient time to now serve as primitives for other applications.

Similar to DEX spot markets, other trading products such as perpetual futures (Perps) and options remain highly competitive and are still dominated by CEXs in terms of trading volume. Despite this dominance, perpetuals, options, and other derivatives still have massive growth opportunities by leveraging DeFi composability—stacking DeFi “building blocks” or applications that can build on one another.

Most on-chain perpetual futures and derivatives offer only a limited number of assets, rely on oracles, and are vulnerable to liquidity issues. Without sufficient liquidity, derivative exchanges cannot function or attract more users—a classic chicken-and-egg problem. To overcome this, new protocols are leveraging concentrated and constant-function AMM liquidity to power new trading products (leveraged trading, perpetuals, and options). In short, protocols use AMMs like Uniswap as liquidity primitives to create novel trading instruments.

-

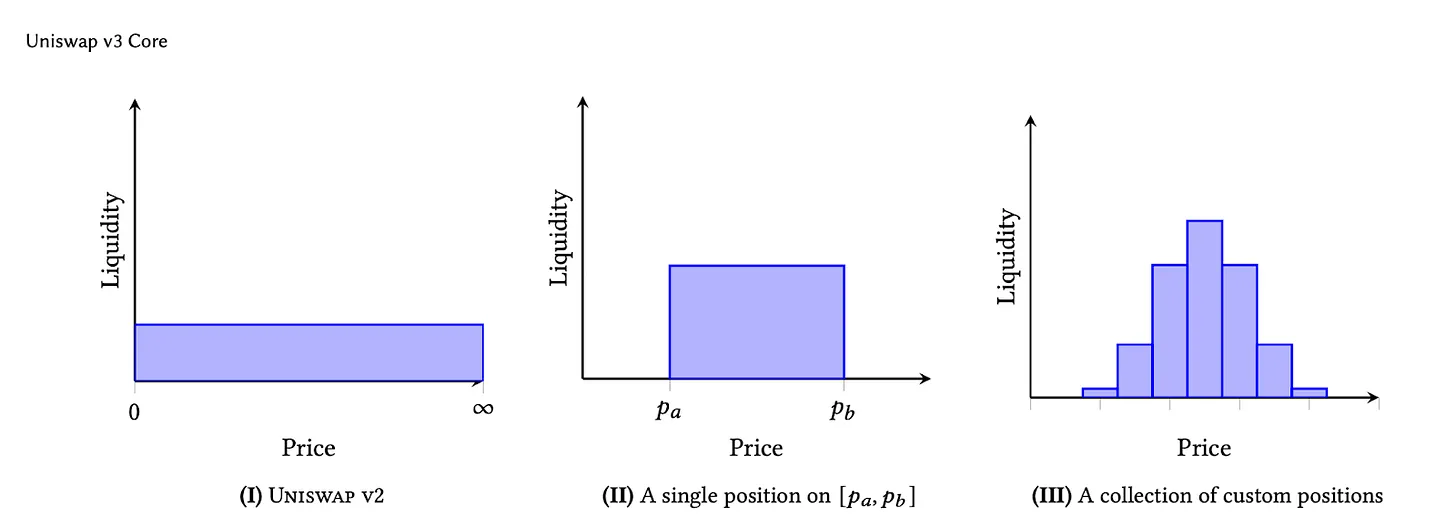

Constant Function AMM: Liquidity is typically distributed infinitely across the full price range (e.g., Uniswap v2, Balancer).

-

Concentrated Liquidity AMM: Liquidity is concentrated within specific price ranges (e.g., Uniswap v3).

The Uniswap Moment for Perpetuals and Options

The killer use case for AMM-driven trading products is the ability to create perpetuals (Perps), hybrid options, and other volatility markets for illiquid and newly deployed assets. $PEPE surged to a multi-billion dollar market cap within weeks during its FOMO phase. During this period of extreme volatility, traders repeatedly asked: "Where can I go long on $PEPE?"

Despite PEPE’s rapid rise and billions in trading volume, initially only spot markets supported the asset. Weeks later, some exchanges began offering perpetual futures (Perps), remaining the sole source of such trading—and still do today. Even among exchanges supporting $PEPE Perps, many traders report issues with liquidations and settlement, core problems in perpetual exchange design. With AMM-powered volatility products and derivatives, LPs could immediately market options and perpetuals upon token launch, similar to how Uniswap works.

There is substantial speculative demand for crypto assets, particularly around leverage. Beyond speculation, these products also provide excellent tools for LPs to hedge their positions in assets.

Perpetual Trading Products

Many on-chain perpetual contracts rely on oracles, which can be easily manipulated for long-tail assets. Oracles translate off-chain data into on-chain data usable by protocols, commonly used for price feeds. Have you ever wondered why only a few assets are supported on perpetual DEXs? Most on-chain Perps and options platforms offer only a small selection of assets designed to achieve deep liquidity and use external oracles as pricing mechanisms. Liquidation risk is another major concern, as managing liquidations depends on accurate oracles and timely execution to meet collateral requirements. In other words, liquidations must occur seamlessly to ensure sufficient collateral covers positions. Trading products powered by Concentrated Liquidity AMMs (CLAMMs) typically eliminate oracle and liquidation risks because liquidity is borrowed from predefined LP ranges.

With this approach, trader risk is also pre-defined and capped within parameters set by the exchange protocol for closing positions. Many AMM-LP-enabled protocols adopt perpetual-like mechanisms to determine trade duration—positions remain open as long as fees are paid to maintain them.

AMMs and LP Fees

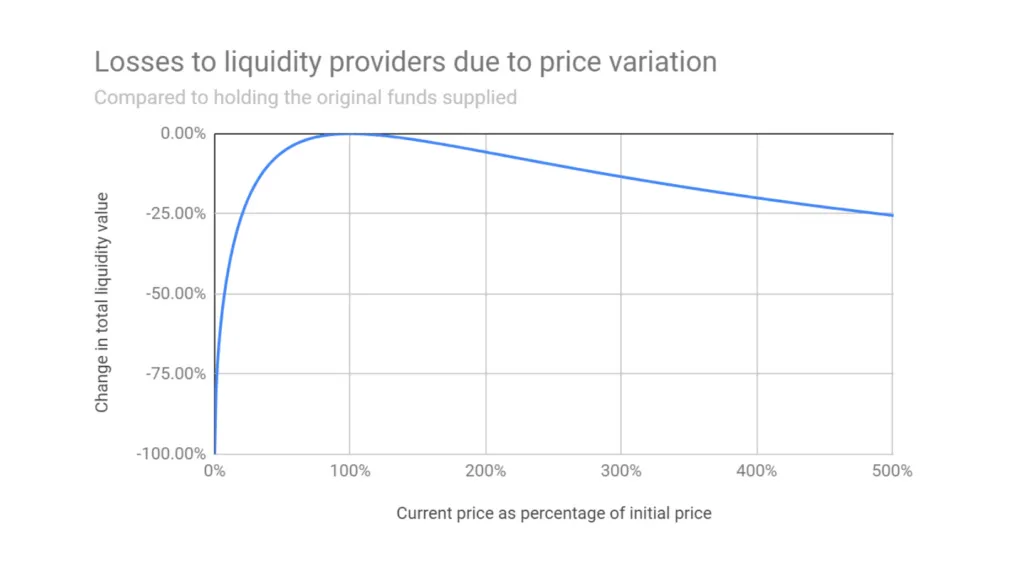

Concentrated Liquidity Automated Market Makers (CLAMMs) and Constant Function Automated Market Makers (CFAMMs) form two-sided markets involving liquidity providers (LPs) and traders. For traders, the AMM product experience is largely similar across platforms. Conversely, many exchanges struggle to optimize the liquidity provision experience, which often leads to losses. In many cases, LPs require additional incentives to be profitable.

Many liquidity providers add liquidity to AMMs under the assumption that fees earned will offset impermanent loss (IL). It's also important to note that not all LPs follow a HODL strategy. A core improvement in the concentrated AMM liquidity derivatives model is that LPs are now compensated not just through trading fees, but also through volatility exposure. This innovation introduces a new dimension to returns from providing liquidity.

For some AMM-driven derivatives like Infinity Pools and Panoptic (Panoptic Option Sellers), LPs generate fees when in-range and earn commission fees when out-of-range. When an LP token moves out of range, it can be used within the protocol’s volatility product—whether leveraged trading, margin trading, or options.

AMM LP-Driven Trading Products—How Do They Work?

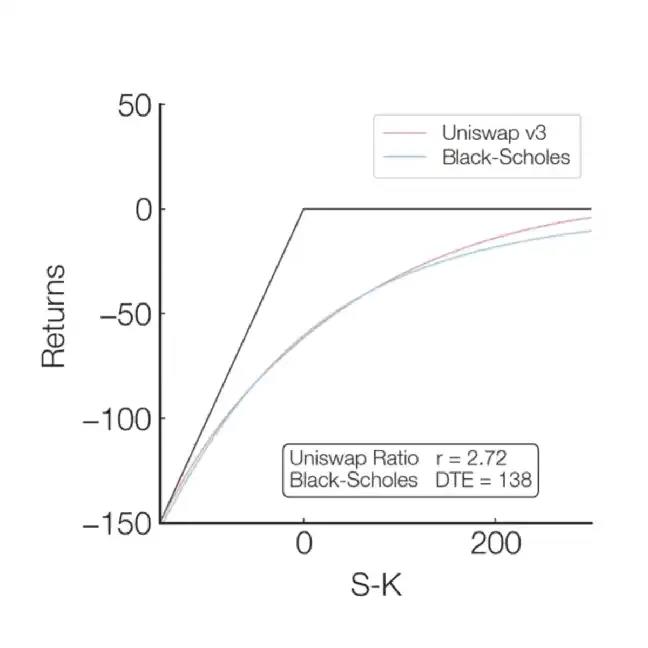

Currently, protocols offering AMM-driven trading derivatives operate on a simple premise: providing LP in a CLAMM is mathematically equivalent to selling a put option. In other words, the return structure of liquidity provision resembles that of selling a put contract. Perpetual and volatility trading protocols build derivative strategies around this concept, creating leveraged positions, perpetual futures, perpetual options, and other structured products.

Protocol Overview

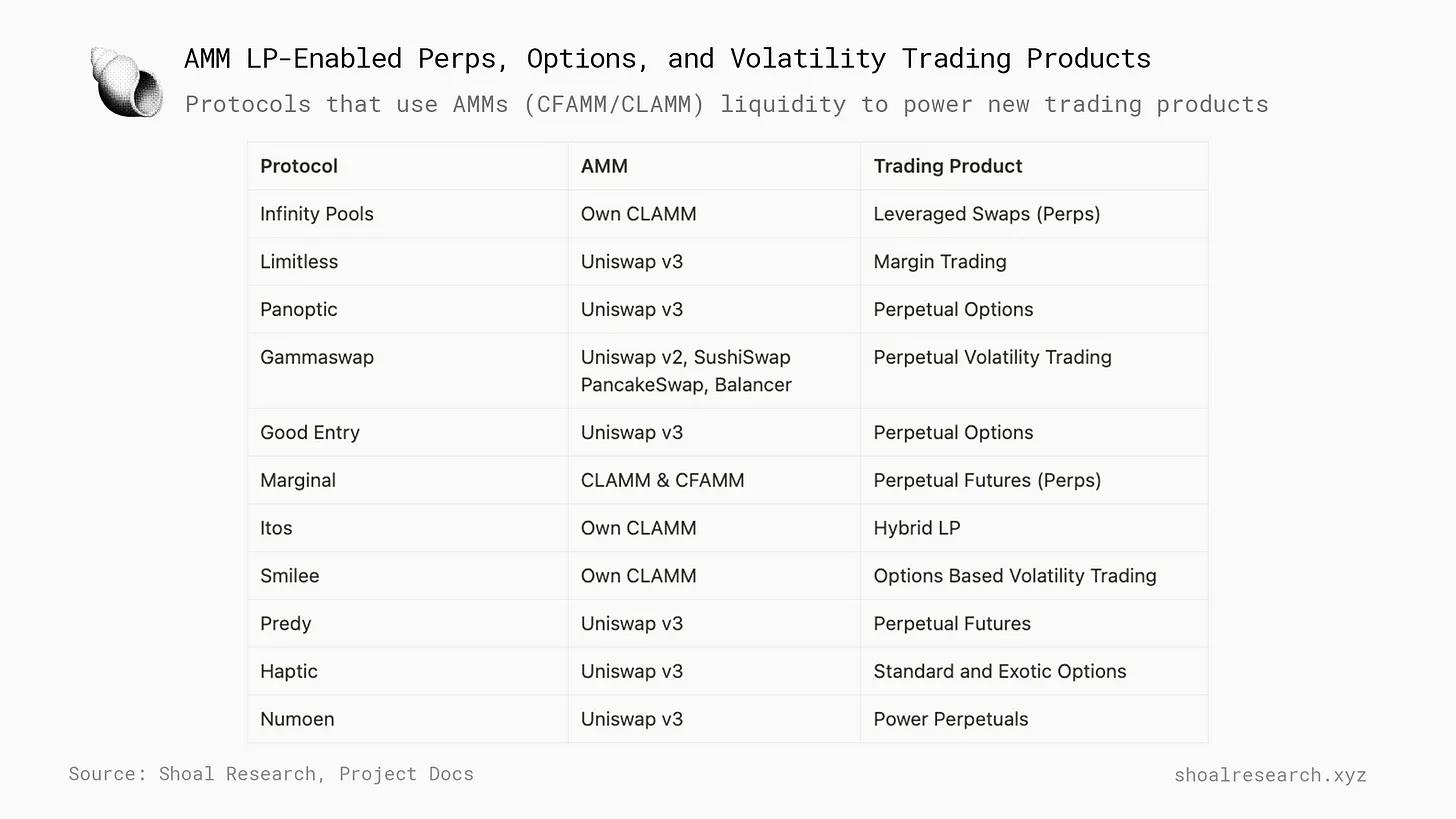

Currently, several protocols aim to utilize CFAMM and CLAMM liquidity for trading. These include leveraged and margin trading, options products, perpetual futures, and more. Although the concept is still novel, many developers see opportunities to bridge liquidity and asset gaps between major and long-tail assets in trading products. The table below outlines the protocols, their liquidity AMMs, and the trading products created:

Let’s dive deeper into the mechanisms and designs.

Perpetual Options Mechanism Design

Protocols like Panoptic and Smilee leverage concentrated liquidity LPs to power their trading products—specifically perpetual options and volatility trading. Among the few protocols utilizing existing AMM concentrated liquidity, each has a slightly different architecture and implementation for building trading products.

At a high level, protocols pull concentrated liquidity from AMMs like Uniswap v3 or their own AMMs, allowing traders to borrow these assets. Traders then redeem underlying LP tokens for a single asset, simulating a directional long or short position constrained by the concentrated liquidity range. Due to the nature of concentrated liquidity positions, when out of range, they consist entirely (100%) of one of the pair’s assets (e.g., USDC/ETH). Since LPs expect to hold 100% of one asset in the pool when out of range, traders pay fees to borrow and redeem LP pairs to obtain one of the assets. Depending on their strategy, they may sell the redeemed token, turning it into a directional bet.

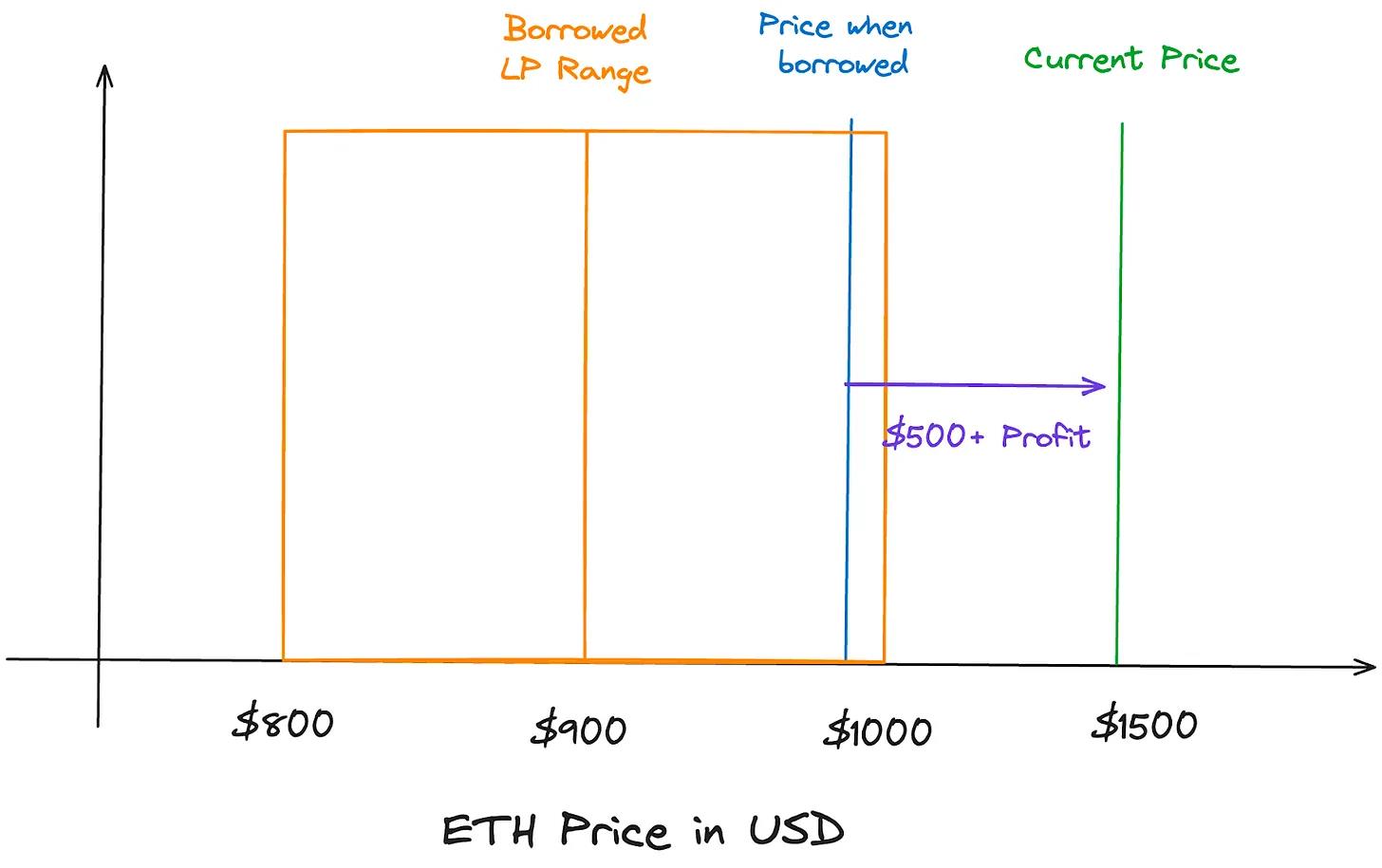

Example: Long ETH Position

Taking perpetual options as an example, suppose a trader wants to borrow a USDC/ETH LP token where ETH is priced at $1,000. The trader is bullish on ETH and thus borrows an out-of-range USDC/ETH LP token below the current price, worth $1,000 in USDC. The LP token is worth $1,000 in USDC because the current price has moved to the right of the range, leaving the liquidity-providing LP (the option seller) holding 100% USDC. The option buyer’s strike price can be seen as the midpoint of the LP range—in this case, we’ll use $900. As a long position, the trader redeems the LP token worth $1,000 in USDC and exchanges it for 1 ETH, also worth $1,000. If ETH’s price rises to $1,500, the trader profits by selling 1 ETH for $1,500—enough to repay the loan and pocket an extra $500. The option buyer only needs to repay $1,000 to the LP, as that marks the end point of the liquidity range.

Protocols typically abstract away most of the complexity. Users may need to deposit collateral to fund their position, choose position duration (if applicable), strike price, and direction.

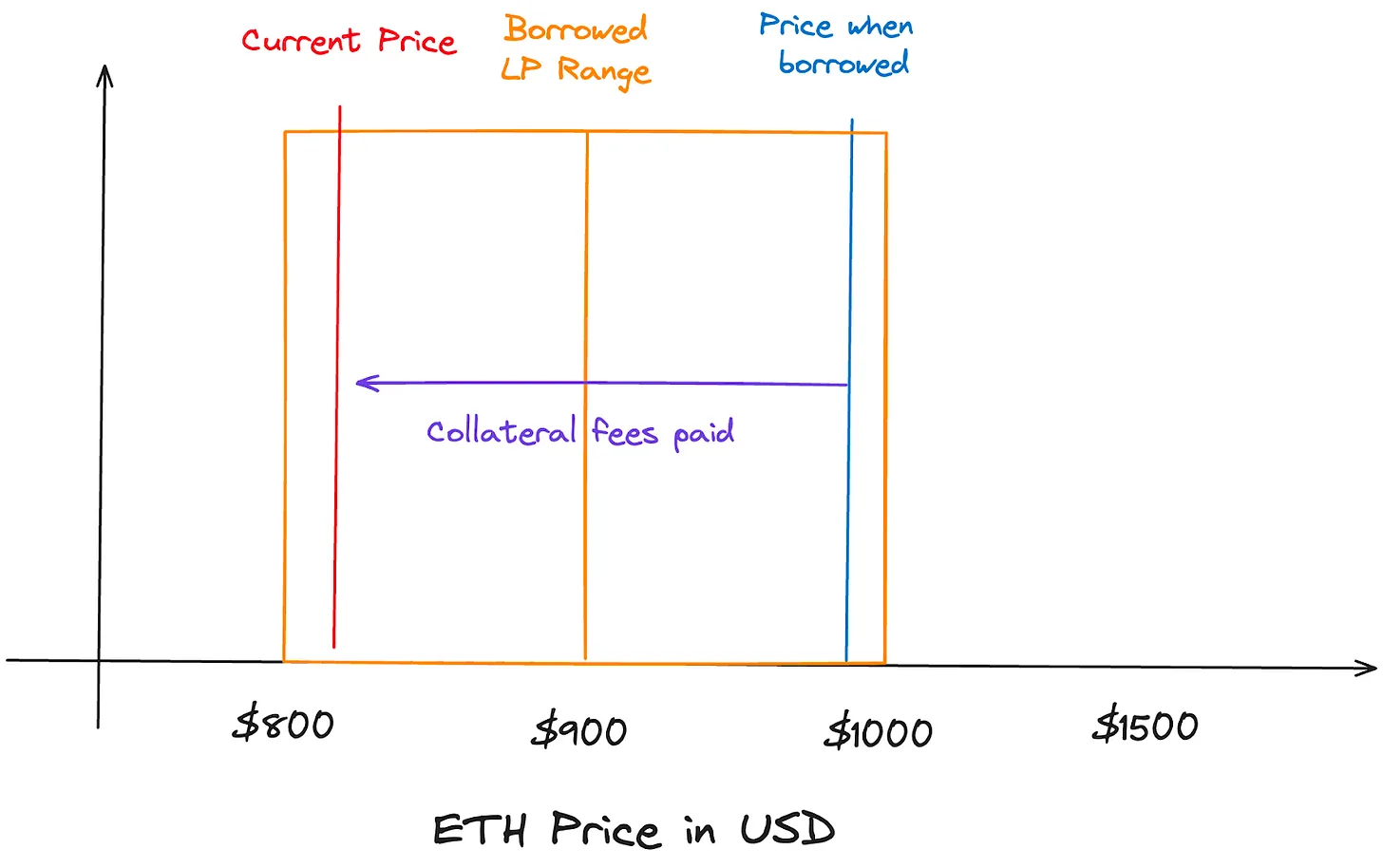

If the trade goes against them and ETH drops to $800, moving beyond the opposite end of the LP range, the borrower now owes 1 ETH instead of USDC. Since the borrower still owes 1 ETH, they must acquire it to repay the loan. If 1 ETH is worth $800, the borrower must spend $800 worth of USDC to buy 1 ETH and settle the debt.

Decentralized exchanges (DEXs) manage the underlying assets for protocols like Panoptic to ensure LPs are compensated. Instead of paying a premium upfront, Panoptic requires users to hold initial collateral in their wallet to cover ongoing funding fees similar to perpetual funding rates. Collateral ensures fee payments. Fees are based on realized volatility and liquidity utilization in the underlying Uniswap pool, determining how much the option buyer pays the seller (LP). Positions are liquidated when traders stop paying funding fees or when fees exceed their collateral.

In both examples, the option seller continuously earns funding fees while the position remains open. This is a general overview of Panoptic, as each protocol differs in managing liquidity, offering leverage, calculating collateral, premiums, and funding fees.

From a bird’s-eye view, the trade is bilateral: LPs deposit their LP tokens into the protocol and earn volatility fees, while traders open positions. LPs are incentivized to provide liquidity due to enhanced rewards compared to other methods. A core issue with AMM LPs is that fees often don’t sufficiently compensate for risk. Finally, profitable traders can exercise their winning positions or continue paying funding fees to LPs to keep trades open.

Perpetual Futures Mechanism Design

For perpetual platforms like Limitless or InfinityPools, the mechanism is similar to perpetual options. However, users deposit collateral that gets combined with the borrowed LP. Required collateral and leverage are determined by distance from the spot price. Like perpetual options, if a trader borrows an out-of-range LP token, they can sell one of the base tokens to create a leveraged directional bet. The mechanism design is very similar to the previous example, with the main difference being user-deposited collateral covering maximum losses if the trade moves against them. Both Limitless and InfinityPools claim to offer hundreds to thousands of times leverage depending on the distance between the range and current price. If a trader loses on the trade, the protocol closes their position and pays the collateral to the LP, restoring the perpetual futures seller’s LP position.

Market Opportunity—Crypto Trading Derivatives

Traditional Financial Market Size

According to Sifma Asset Management, the U.S. equity market dominates globally, accounting for over 42.5% of the $108.6 trillion global equities market value in 2023, amounting to $44 trillion.

Traditional Financial Derivatives Market

The notional value of the derivatives market is estimated to exceed $1 quadrillion, although some argue this figure may be inflated, according to Investopedia. This astronomical upper bound includes the notional value of all derivative contracts.

There is a significant gap between the notional value and actual net value of derivatives—$600 trillion and $12.4 trillion respectively as of 2021.

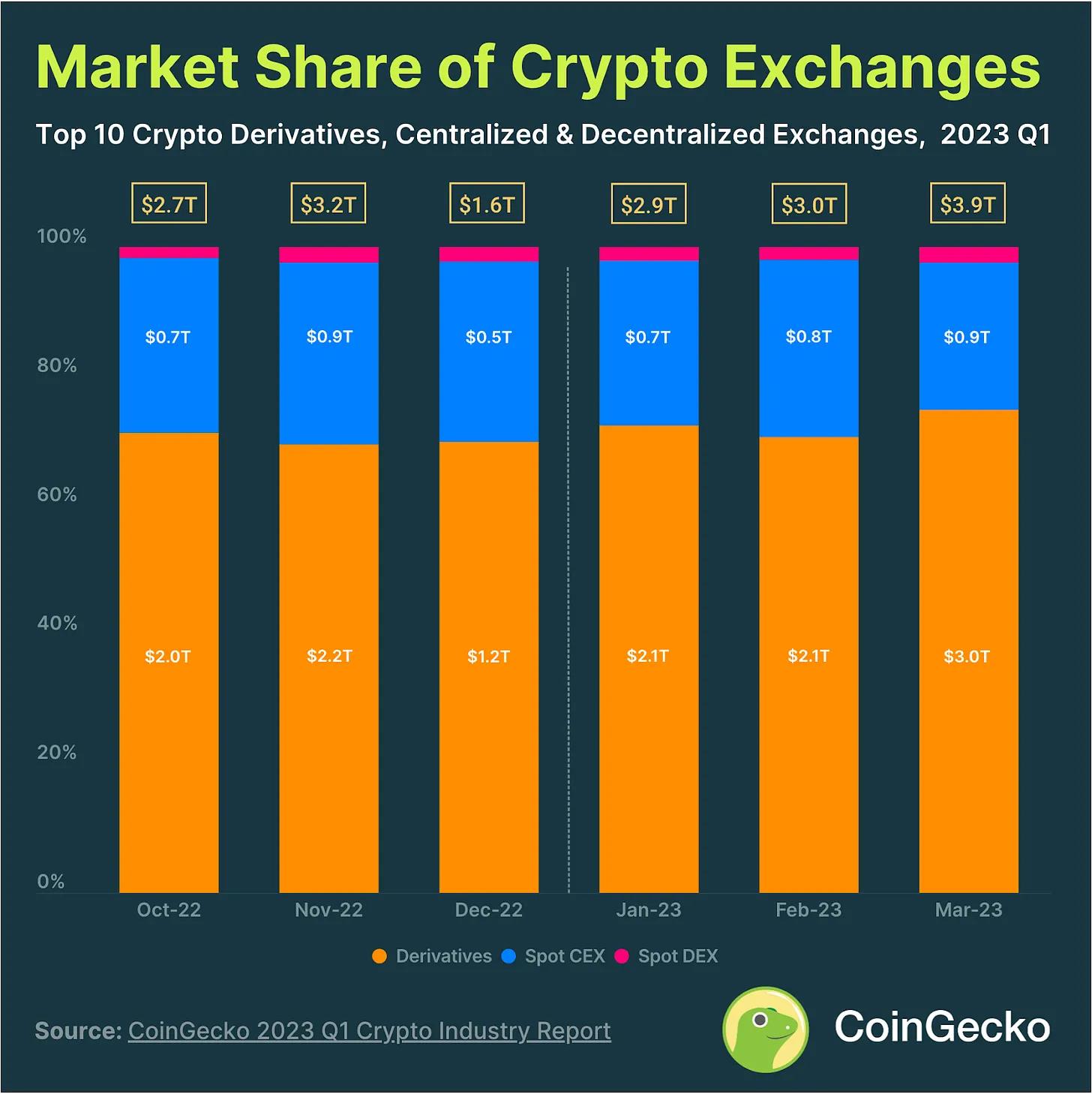

In traditional finance, derivatives trading volume vastly exceeds spot trading. The same holds true in crypto, though most volume occurs on centralized exchanges (CEXs).

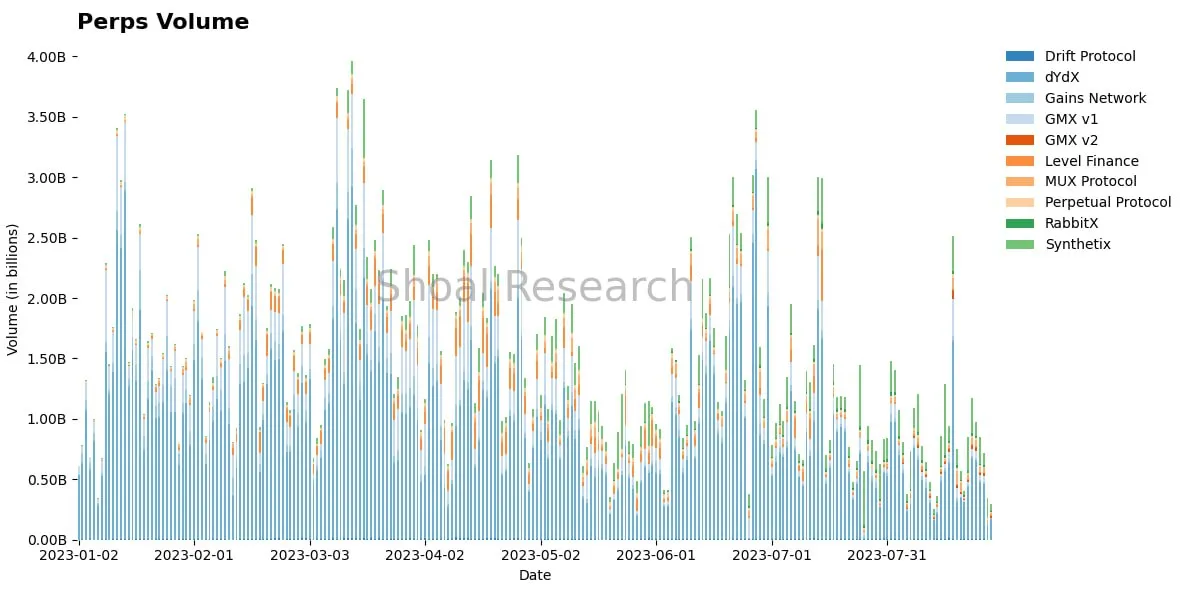

Bitmex, another centralized exchange, launched its perpetual (Perp) trading instrument—the perpetual XBTUSD leveraged swap—in 2016. Their new product allowed users to trade Bitcoin (XBTUSD) with up to 100x leverage. The contract had no expiry date; longs paid shorts and vice versa. As the most traded instrument in crypto, this product expanded from centralized exchanges to various decentralized versions: dYdX, GMX, Synthetix, etc. Perpetual protocols facilitate hundreds of millions in daily trading volume and are the dominant derivative product in today’s crypto market due to their high leverage. This represents a stark contrast to traditional finance, where options dominate the derivatives landscape.

Crypto Spot vs. Perpetuals

In Q1 2023, derivatives accounted for 74.8% of total crypto market volume ($2.95 trillion). Spot trading held market shares of 22.8% for centralized crypto exchanges (CEXs) and 2.4% for decentralized exchanges (DEXs). Notably, centralized crypto derivatives exchanges like Binance, Upbit, and OKX lead the market. According to CoinGecko’s 2023 Crypto Derivatives Report, while derivatives volume grew 34.1% year-over-year, spot trading on CEXs and DEXs grew 16.9% and 33.4% respectively.

As of July 2023, 74% of crypto trading volume involved leverage.

Innovative volatility trading platforms like Panoptic, Infinity Pools, Smilee, and others are pushing the industry forward by offering oracle-free, non-liquidatable, and in some cases highly leveraged trading. Backed by concentrated liquidity, AMM LP trading products eliminate key weaknesses such as oracle management and liquidation handling.

Risks

While these products may be exciting, risks remain. Most notably, smart contract risk. Since all AMM-LP trading products control LP tokens or require deposits, vulnerabilities or bugs could expose them to smart contract exploits.

Credit Liquidity Risk

Additionally, there are concerns about economic design. The Gammaswap team investigated the feasibility of building on Uniswap v3 and CLAMMs due to what they call "credit liquidity risk." This risk involves liquidity providers (LPs) being unable to pay long positions or vice versa, usually due to excessive leverage leading to liquidation issues. Due to concentration, AMMs like Uniswap may have regions or "ticks" with low liquidity, where prices moving out of range can cause excessive slippage—even for stable pairs. Gammaswap opted to build on a constant-function model, viewing it as a more robust liquidity primitive.

In Uniswap v3, there may not be enough liquidity to fulfill LP payouts. Unlike traditional finance, where the Federal Reserve can inject liquidity, there is no equivalent entity in DeFi. Moreover, the absence of traditional liquidation oracles adds further complexity.

Panoptic mitigates credit liquidity risk by requiring pool creators to deposit small amounts of both tokens across the entire range—deposits that Panoptic traders cannot remove. Initial deposits ensure every price tick has some baseline liquidity.

Complexity and User Adoption

Perpetual futures (Perps) have proven easier for crypto investors to understand. They operate via two simple mechanisms—long and short positions—with traders opening positions via a single button click. In contrast, options and potentially perpetual options introduce added complexity—Greeks, strike prices, and other traditional options knowledge—that may hinder user adoption. This is especially likely among retail investors, who are often the earliest adopters of new trading tools. Furthermore, introducing volatility trading increases UX complexity. Given that the crypto space already struggles with user adoption, some powerful but complex products may fail to gain widespread traction due to financial sophistication.

Conclusion

Perpetuals and options have already found their place in crypto, and it's only a matter of time before they evolve into mature products sought after by traders and LPs alike.

In the coming months, many of the mentioned protocols will launch test versions and live products. The next evolution in on-chain derivatives—including perpetuals and options—will be the ability to leveraged-long (or short) any asset. The question, "Where can I go long on PEPE?" will finally be answered through leveraged liquidity channels for mid-to-long tail assets.

AMM-driven trading products are paving the way for a new trading paradigm and could enable a new DeFi paradigm where protocols support one another. This includes options, perpetuals, volatility trading, and other leveraged products. Enhanced trading experiences will deliver superior utility, potentially rivaling existing market leaders.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News