Hermes V2: A New AMM Model Solving the Pain Points of Traditional Solidly DEXs

TechFlow Selected TechFlow Selected

Hermes V2: A New AMM Model Solving the Pain Points of Traditional Solidly DEXs

Hermes is a DEX built on Metis and is currently developing its V2 version.

Written by: hangry

Compiled by: TechFlow

Hermes is a DEX built on Metis and is currently developing its V2 version. This update will include major upgrades such as full-chain expansion, unified liquidity, decentralized liquidity management, and a new Gauge system. This article provides a detailed introduction to Hermes v2 and its related protocols.

Hermes is a Solidly fork on Metis, but with the V2 upgrade, it will become significantly more powerful. Due to lack of activity and innovation, I usually avoid the Metis chain. But it seems Hermes might change that habit.

MaiaDAO

MaiaDAO is the team behind Hermes, aiming to bootstrap its ecosystem using the $MAIA token. Think of Maia as similar to Redacted Cartel. They also hold a significant portion of the $Hermes supply.

Maia CLAMM

Maia recently launched a Uniswap V3 fork, creating the first CLAMM (Concentrated Liquidity Automated Market Maker) on Metis. Fees will be distributed to token holders and are expected to synergize well with the upcoming Hermes V2.

So what is Hermes V2?

Hermes V2 will be a massive upgrade to the DEX, including:

-

Full-chain expansion;

-

Unified liquidity;

-

Decentralized liquidity management;

-

New Gauge system;

-

Tokenomics redesign.

Let’s dive into each one in detail.

New Gauge System

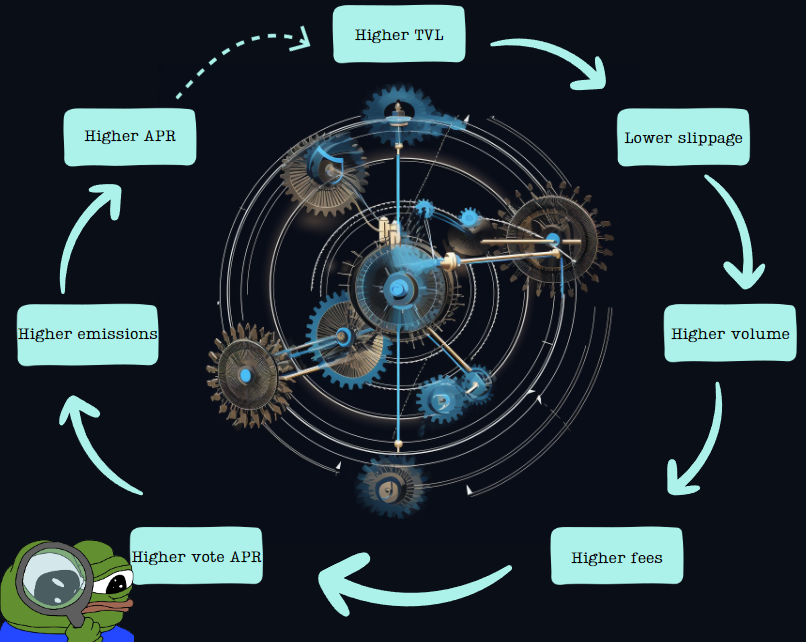

Gauges are a core component of any Solidly-based DEX because they play a crucial role in the flywheel mechanism.

The basic flywheel goes: higher liquidity → more trading volume → more fees → higher APR → more emissions → more liquidity → and so on...

Hermes is expanding the traditional Gauge model by introducing customizable Gauges applicable to any yield-bearing asset. This means Hermes is no longer limited to its own pools, unlocking massive opportunities. First, Hermes will implement this new Gauge model for Uniswap V3.

Talos

An open, automated liquidity optimization strategy—known as Talos—is a cross-chain concentrated liquidity management protocol built on top of Hermes. Talos is permissionless and customizable, allowing anyone to create their own strategies.

Since Talos wraps concentrated liquidity positions, it supports different types of positions:

-

Vanilla: Represents shares of one or more UNI V3 NFT positions.

-

Staked: Same as Vanilla, but the position is staked in a Hermes Gauge.

These strategies are fully customizable and support features such as:

-

Support for multiple NFTs;

-

Multiple rebalancing ratios;

-

Fixed maturity dates;

-

Hedging options;

-

Capital solutions.

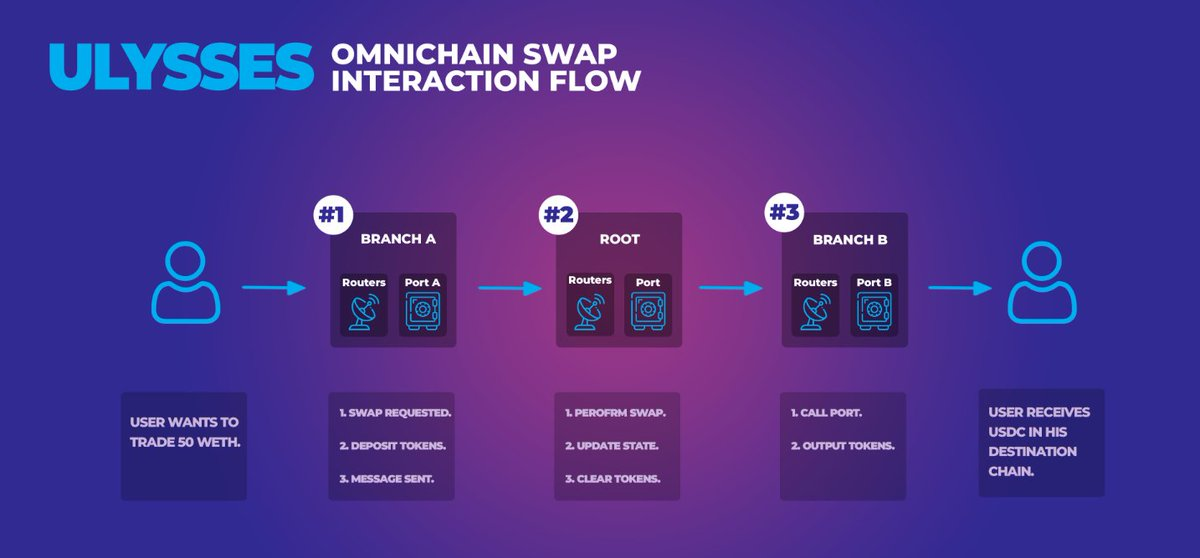

Ulysses

Ulysses is a cross-chain liquidity protocol built on Hermes that enables LPs to deploy assets on one chain and earn revenue from activities on other chains. Ulysses’ virtual and unified liquidity makes this possible.

Virtual Liquidity

Virtual liquidity enables cross-chain asset mirroring, making them usable across various pools/protocols. Liquidity providers can earn income across multiple chains while reducing the negative impact of IL and improving capital efficiency.

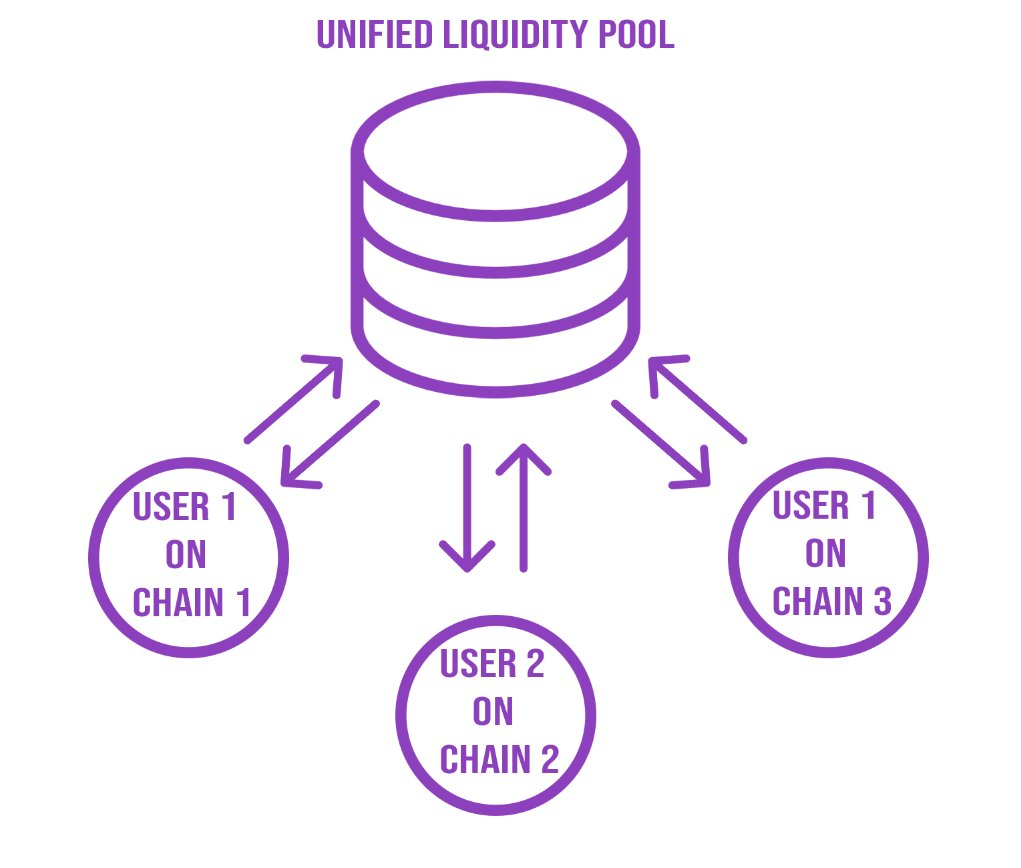

Unified Liquidity Pools

Ulysses’ Unified Liquidity Pools are single-sided staking pools that allow asset trading among other Ulysses liquidity pools. Each Unified Liquidity LP only handles a single token from a specific chain.

Unified Liquidity Tokens

Ulysses’ Unified Liquidity Token is a new type of token that allows users to access liquidity pools across multiple chains using a single token. These tokens support any number of ERC-20 tokens and do not necessarily need to be Ulysses LP tokens.

bHERMES

Hermes has also decided to redesign its ve(3,3) tokenomics model. Many users want to maximize rewards, but the pain point lies in managing their veHERMES positions, especially when holding multiple stakes simultaneously.

Instead of manually claiming rewards weekly, accepting bribes, re-locking tokens, and voting on Gauges, bHERMES automates this entire process. Rather than locking for four years, you permanently lock/burn your tokens.

Why burn $HERMES tokens?

-

Governance rights;

-

Propose new Gauges;

-

Direct control over $HERMES emissions;

-

Earn bribes;

-

Boost your Gauge deposits.

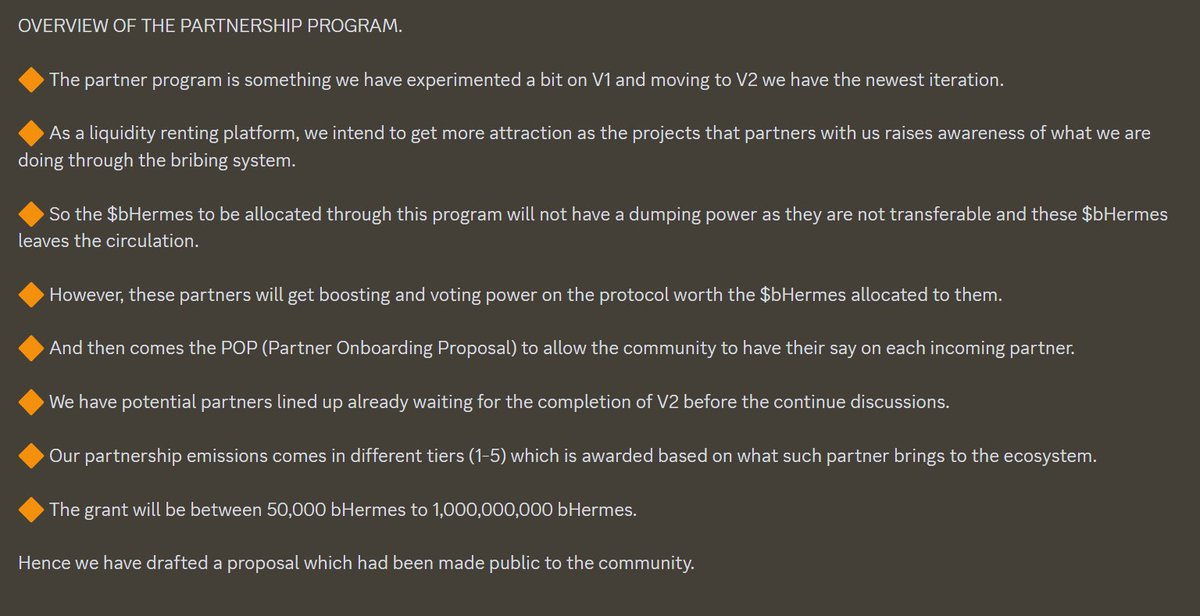

Partnership Program

Maia recently announced a partnership program—its way of bringing protocols and bribes to Hermes. Partners selected via DAO vote will receive non-transferable bHERMES tokens to incentivize liquidity migration to Hermes.

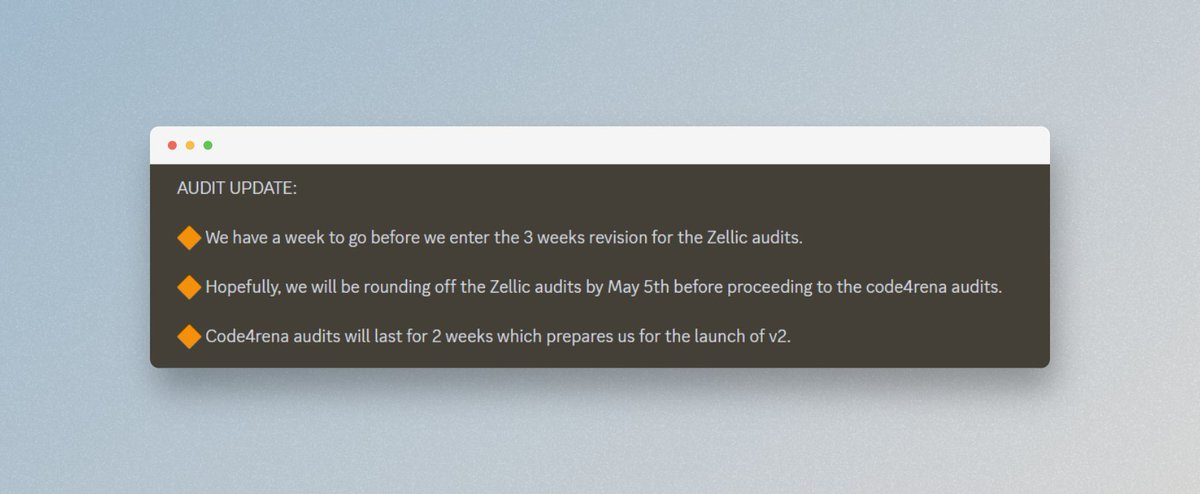

Roadmap

Now that we understand V2, the question becomes “when will it launch?” While there's no exact date yet, the code is complete and undergoing audit. It looks like we can expect Hermes V2 sometime in May.

Potential Catalysts to Watch

-

Hermes V2 launch;

-

Metis Marathon (large $METIS incentives for protocols following V2 launch);

-

Aave deployment (will bring new activity/liquidity; proposal already passed);

-

Bedrock upgrade;

-

Hybrid Roll-up technology (combining Optimistic and ZK).

Conclusion

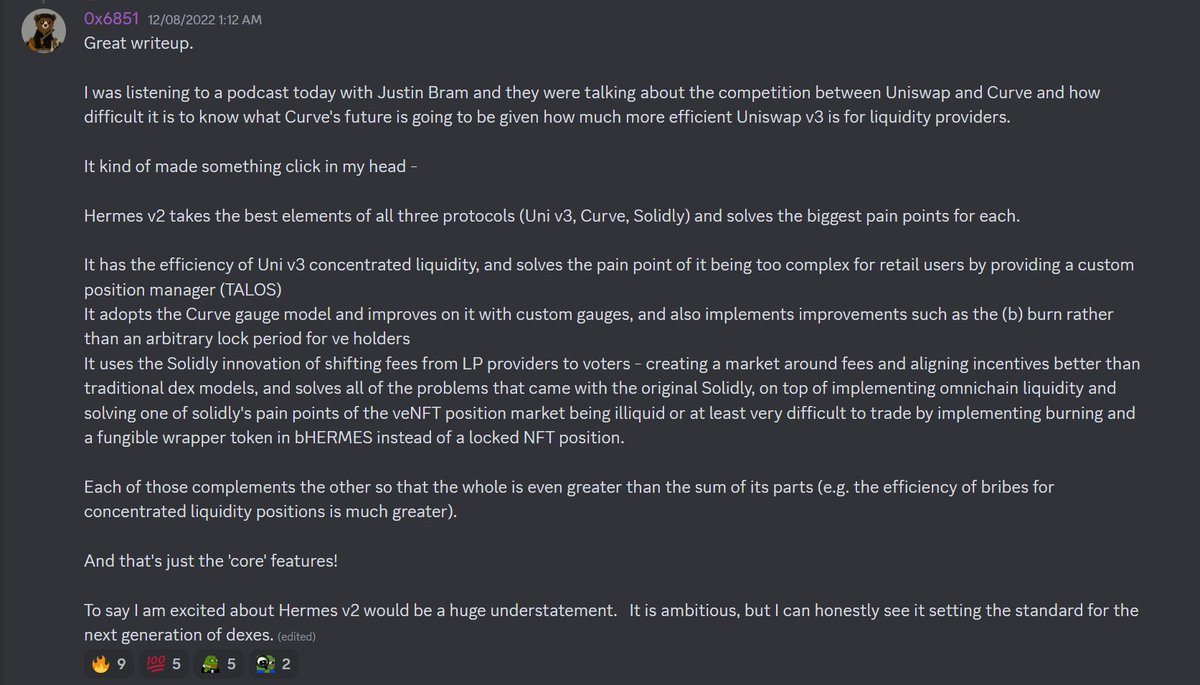

Hermes V2 addresses the pain points of every AMM model (Curve/Uniswap/Solidly) and merges them into a single DEX—I believe this is an incredibly exciting innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News