Will Hermes Wars have a positive impact on $HERMES?

TechFlow Selected TechFlow Selected

Will Hermes Wars have a positive impact on $HERMES?

Do you know about the upcoming Hermes Wars?

Author: Okoye Modestus

Compiled by: TechFlow

Are you aware of the upcoming Hermes Wars? It's similar to what happened during the Curve Wars. In this article, I will use Curve Wars as a case study to analyze the Hermes Wars and highlight the differences between the two protocols—if you're interested, keep reading.

Like Curve Finance, the Hermes protocol is a zero-slippage, low-fee AMM. Within this protocol, both correlated and uncorrelated assets can be traded with minimal fees and slippage.

In simple terms, we can think of these protocols as currency markets where token pairs of similar or dissimilar value/price are exchanged at low cost and slippage.

When we refer to "wars" in cryptocurrency, we mean shifting usage dynamics among various protocols. Examples include L2 wars, stablecoin wars, blockchain wars, and now—this current war is about using incentives to compete for liquidity.

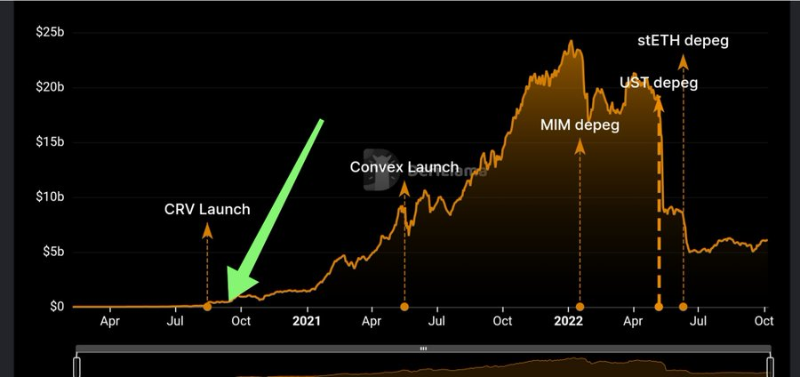

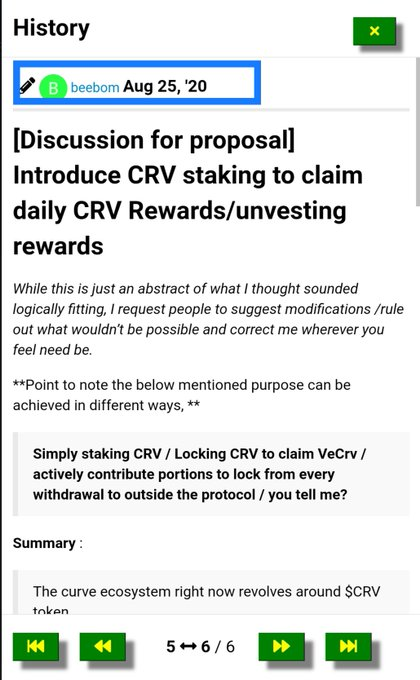

After Curve Finance proposed paying fees to CRV stakers and granting them voting rights over CRV emissions, its TVL surged massively, as shown in August 2020 below.

This proved that investors respond well to yield rewards for providing liquidity.

But how did this war emerge?

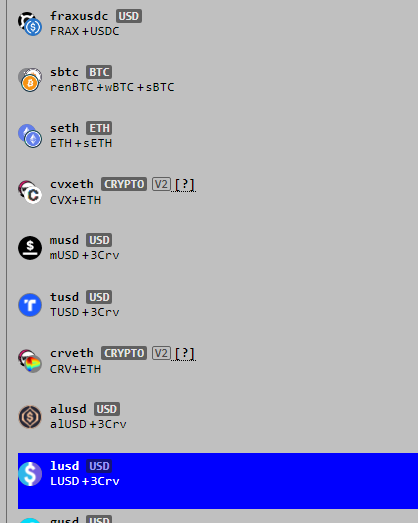

For investors to deploy capital into a protocol, they ultimately must add it to liquidity pools within protocols using automated market makers (AMMs). These pools vary depending on the DeFi protocol they’re deployed in. For example, different Curve Finance pools owned by other protocols—such as Frax owning the FRAX/USDC pool.

These protocols began competing to gain influence over Curve Finance’s liquidity pools—and thus, the Curve War began.

In other words, the Curve War is a competition aimed at capturing the liquidity already deployed by other DeFi protocols within Curve Finance’s pools.

Why does this matter?

The reason is simple: the more liquidity flows into a specific pool, the more traders use it to avoid high slippage, which generates higher fees—and therefore greater incentives. Typically, these incentives are distributed back in the form of Curve Finance’s native token (CRV). However, to prevent sell pressure, they implemented a model where users lock tokens to accumulate more value.

This locked CRV is known as veCRV (vote-escrowed CRV), which captures the following value:

- Trading fees;

- CRV emissions;

- The right to determine the weight of CRV emissions across each pool.

Due to the value captured by veCRV, different DeFi protocols attempt to acquire as much of this value as possible and redirect it toward themselves.

This led to the rise of "bribes," where different protocols try to capture a majority of veCRV to gain access to trading fees and CRV allocations. More importantly, the voting power determines which pool receives more CRV emissions.

Essentially, they bribe other users to surrender their CRV for permanent locking.

Meanwhile, a yield aggregator protocol called Convex Finance has locked over 50% of CRV, channeling this value into its own token.

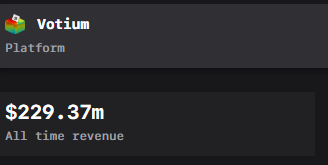

Through Votium (an incentive marketplace), even more protocols compete for veCRV voting power via vlCVX. Over time, it has paid out over $250 million in bribes.

The Hermes protocol is replicating this model within the METIS ecosystem, but there are four key differences between the two protocols:

- Trading fee is 0.01%, compared to Curve Finance’s 0.04%. This is a strong incentive to attract more traders and trading volume.

- In the upcoming Hermes v2, $HERMES locked for 4 years will effectively be permanently burned, removing those tokens from circulation. However, there may be a bHermes/Hermes pool to facilitate trading.

- In v2, a cross-chain DEX will be built leveraging centralized and unified liquidity, enabling deeper liquidity and greater efficiency.

- Additionally, concerns exist about potential CRV sell pressure when veCRV unlocks after 4 years—although this might not fully materialize—permanently locking $HERMES eliminates this risk entirely.

Many DeFi protocols are already preparing to join this war, starting with MAIA DAO Ares, followed by HummusFinance, all eager to drive liquidity into their respective pools.

More liquidity = more traders = more fees and higher HERMES emissions.

MAIA DAO Ares has already acquired over 50% of $HERMES. Can you imagine the impact this permanent locking of Hermes could have on the $HERMES supply?

On September 14, HummusFinance added 100,000 $HUM as rewards to bribe veHermes lockers to vote for their pool.

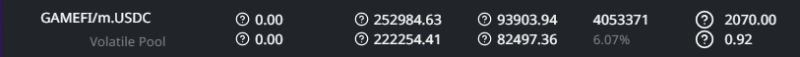

RevenentGamefi has also been actively bribing users who vote for their pool.

With the launch of Hermes V2 and ongoing Metis ecosystem activities, we are now set for a power struggle among these protocols.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News