Another veteran exchange enters the Launchpad race: Can Kraken Launch break through with Yield?

TechFlow Selected TechFlow Selected

Another veteran exchange enters the Launchpad race: Can Kraken Launch break through with Yield?

Yield Basis carries the market's dual expectations for technological innovation and wealth effects.

Author: Umbrella, TechFlow

In mid-September, Kraken Launch—a token launchpad jointly developed by veteran exchange Kraken and ICO platform Legion—is set to debut its first project, Yield Basis. This marks Kraken as another major exchange entering the Launchpad arena following Binance and OKX.

As the inaugural project, Yield Basis is developed by Michael Egorov, founder of the prominent DeFi protocol Curve. The BTCFI protocol, designed to provide impermanent loss protection for BTC holders, has already sparked widespread attention and discussion in the crypto market.

To understand the market's expectations for Kraken Launch and Yield Basis, it’s essential to review the performance of other exchange Launchpads and the underlying investment logic.

The History of Exchange Token Launches

Over the past year, major exchanges have generated remarkable returns through their Launchpad platforms. Binance Alpha once delivered average monthly returns exceeding 1,500 USDT. Although OKX's recent X Launch has been controversial, guides and tutorials on how to participate flooded various crypto communities, clearly indicating strong market anticipation for such products.

Many projects launched via exchange Launchpads have also seen strong market performance. $MYX, which debuted on Binance Alpha in May, surged nearly 20x at the beginning of this month. For users who held onto the 644 $MYX airdropped by Binance Alpha, peak gains approached 13,000 USDT—an extreme figure that reignited FOMO across the market for exchange Launchpads.

These figures reflect the core FOMO logic around established exchanges: flagship projects from reputable platforms often enjoy significant liquidity premiums and visibility, translating directly into investment returns.

This explains the current optimism surrounding Kraken Launch, a collaboration between Kraken—a compliance-focused veteran exchange with 14 years of operation—and Legion, which brands itself as the "world’s first ICO underwriter." From inception, their joint platform carries inherent advantages such as scarcity positioning and high liquidity potential.

Moreover, unlike traditional Launchpads, projects launched via Kraken Launch will be immediately listed on Kraken after the sale concludes. This clear expectation significantly boosts anticipated returns from this initial launch.

Timing-wise, data from existing exchange Launchpads already show the market is in a state of heightened FOMO toward this product category. This sentiment naturally spills over to new entrants, making it highly likely that Kraken Launch will capture and extend this momentum with its first project.

However, it should be noted that as a latecomer, Kraken Launch faces considerable challenges. Binance and OKX have already captured the majority of the Launchpad market share, making it difficult for a new platform to attract high-quality projects. More importantly, the Yield Basis project itself has stirred controversy within the Curve community, where some members view its 60 million crvUSD credit line as posing systemic risks. These uncertainties could impact the actual performance of Kraken Launch’s debut.

Yield Basis: The Curve Founder’s New BTCFI Experiment

As the first project on Kraken Launch, Yield Basis aims to solve a long-standing problem in DeFi—impermanent loss. In traditional AMM models, sharp price fluctuations lead liquidity providers to earn significantly less than simply holding assets outright; this gap is known as impermanent loss.

In simple terms, when you provide liquidity to a pool, asset rebalancing occurs automatically as prices change, resulting in lower returns compared to direct holding. Data shows that with a 5x price swing, impermanent loss can reach up to 25%. This issue has hindered DeFi development for years and discouraged many BTC holders from participating in liquidity mining.

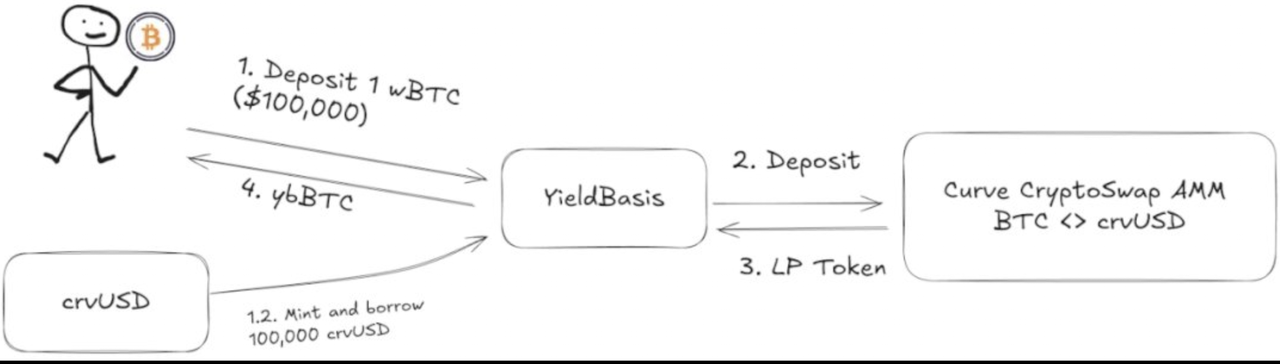

Yield Basis employs a 2x leverage mechanism: users deposit BTC, and the protocol automatically borrows an equivalent amount of crvUSD to pair with BTC into a Curve pool, using the generated LP tokens as collateral. When BTC price rises, the protocol borrows more crvUSD to maintain 2x leverage; when prices fall, it repays part of the debt.

Yield Basis is built entirely on Curve’s infrastructure, leveraging Curve’s CryptoSwap AMM and crvUSD stablecoin, ensuring technical stability.

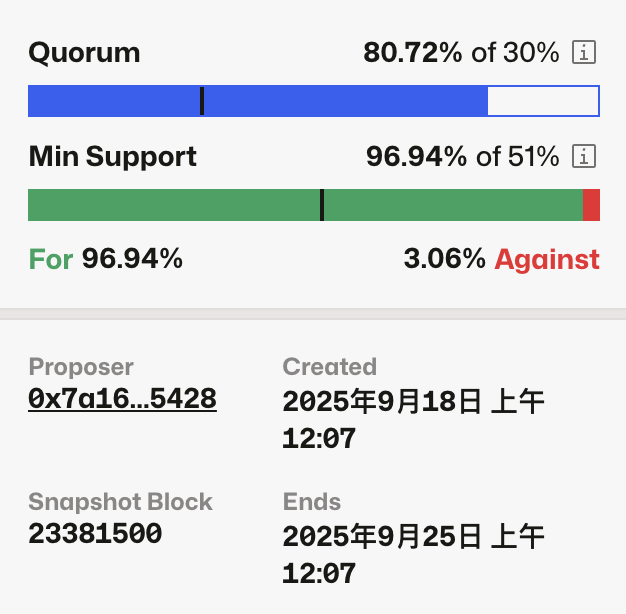

Yet innovation often brings controversy. Just yesterday, Curve DAO passed Proposal 1206, approving a 60 million crvUSD credit line for Yield Basis—sparking significant debate within the community. Supporters see it as a sign of Curve’s commitment to innovation, but opponents raise valid concerns: this allocation accounts for nearly 60% of total crvUSD supply, and any failure could jeopardize the entire system’s stability.

More notably, members on the Curve forum have pointed out a subtle conflict of interest: several key figures in the Curve ecosystem who voted in favor are also investors in Yield Basis. While Egorov responded that inviting well-known ecosystem participants was “only natural,” such dual roles inevitably raise questions about the fairness of the decision-making process.

On tokenomics, $YB has a total supply of 1 billion tokens: 30% allocated for community incentives, 25% for the team, 15% for development reserves, and the remaining 30% split equally among investor sales, Curve ecosystem licensing, and partners.

Additionally, Yield Basis requires liquidity providers to choose between earning trading fees denominated in BTC or receiving $YB token rewards. This design may work well during bull markets, when investors prefer tokens for potential appreciation. However, in bear markets, if most users opt for stable BTC returns over $YB tokens, downward pressure on the token’s value could increase.

Participation Guide

The Yield Basis launch consists of two phases, requiring advance registration on both Kraken and Legion platforms along with KYC verification.

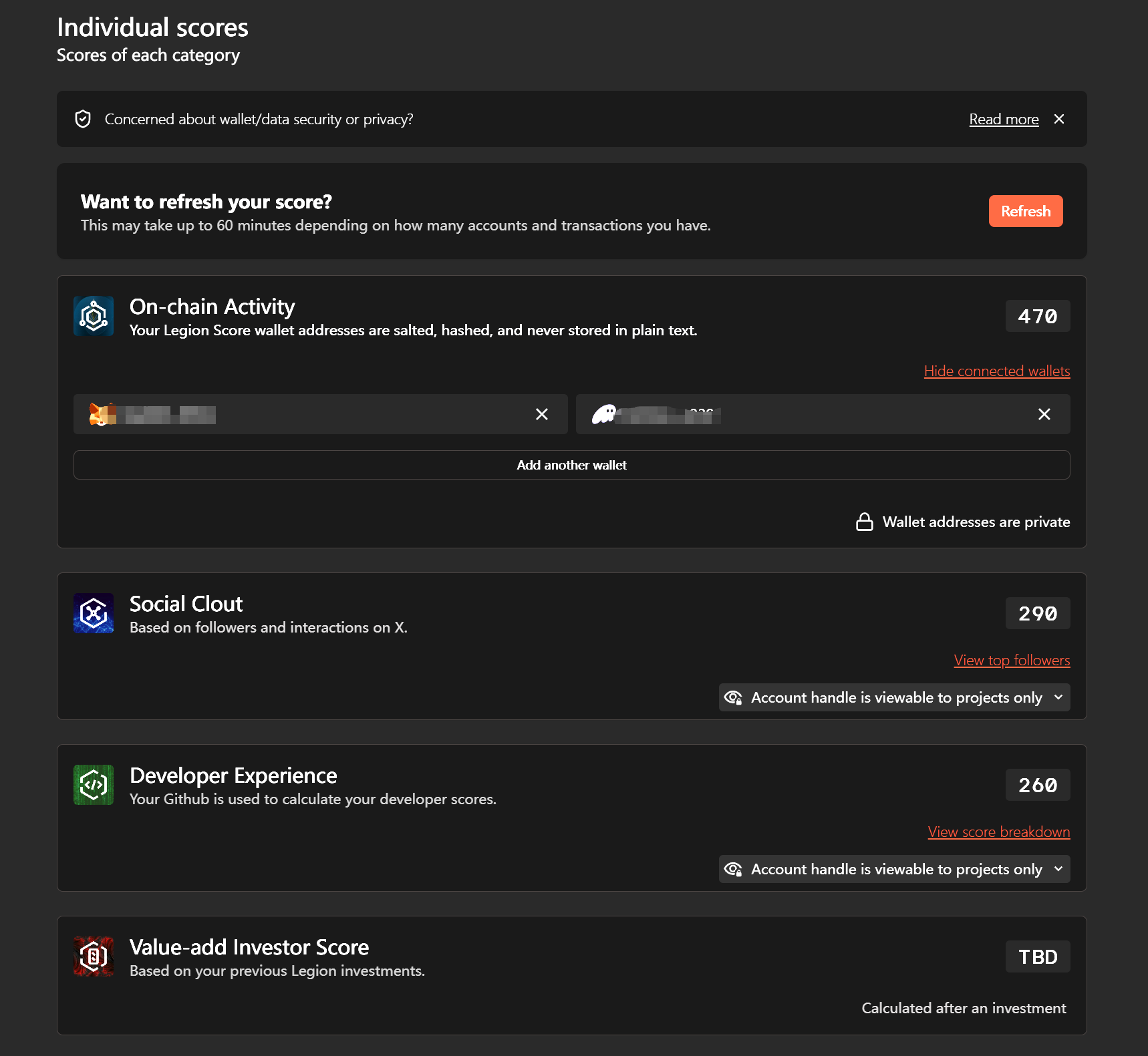

The first phase allocates up to 20% of tokens via a merit-based distribution on Legion. Users must connect their wallet, Twitter, and GitHub accounts. Legion calculates scores based on on-chain activity, social contributions, and code contributions, granting higher allocations to users with better scores.

The second phase will distribute at least 80% of the remaining $YB tokens simultaneously on both Legion and Kraken Launch, operating on a first-come, first-served basis for all KYC-verified users.

Note that KYC processes on Kraken and Legion are relatively strict, requiring identity documents and proof of address. Users from certain regions—including the United States, Canada, and Australia—may be ineligible to participate.

The exact launch date for Yield Basis and Kraken Launch has not yet been announced. However, since Kraken and Legion require 1–3 days to process KYC applications, investors interested in participating are advised to complete registration and verification early.

Market Observations and Discussions

According to community observations, the announcement for Kraken Launch’s first project was briefly delayed by 18 hours without an official explanation. As of the evening of September 24, no information or interface related to the Yield Basis launch was visible within Kraken.

Additionally, recent discussions about Yield Basis and Kraken Launch have shown unusually similar content, suggesting potential risks.

Currently, market sentiment toward Kraken Launch’s $YB launch is largely optimistic. Support comes notably from José Maria Macedo, founder of Delphi Ventures, who likened $YB to a "BTC version of Ethena," highlighting Yield Basis’ innovative approach to solving impermanent loss. In a podcast, he emphasized founder Egorov’s pioneering contributions to DeFi and the protocol’s market potential.

Podcast link: "Michael Egorov: Yield Basis - Bringing Real Yield to Bitcoin"

Nonetheless, skepticism exists, primarily focused on concerns over systemic risk within Curve DAO, particularly regarding the large 60 million crvUSD credit line.

Conclusion

As the debut project on Kraken Launch, Yield Basis carries dual market expectations: technological innovation and wealth generation.

However, as a new protocol still in testing phase, investors must fully recognize the associated technical risks and market uncertainties. Amid rising FOMO, maintaining rational analysis and risk management remains crucial.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News