Burn half of $HYPE? A radical proposal sparks a major debate on Hyperliquid's valuation

TechFlow Selected TechFlow Selected

Burn half of $HYPE? A radical proposal sparks a major debate on Hyperliquid's valuation

Is a project on the chain serving large capital or grassroots crypto natives?

Author: David, TechFlow

Recently, amid the surge in Perp DEXs, a wave of new projects has emerged, continuously challenging Hyperliquid's dominant position.

Everyone is focused on innovations from these new entrants, seemingly overlooking how the price of $HYPE—the leading token—might evolve. And what’s most directly tied to price changes is the supply of $HYPE.

Two factors affect supply: ongoing buybacks, which continuously reduce circulation by purchasing tokens on the open market—akin to draining water from a pool; and adjustments to the overall supply mechanism, equivalent to turning off the tap.

A closer look at $HYPE’s current supply design reveals fundamental issues:

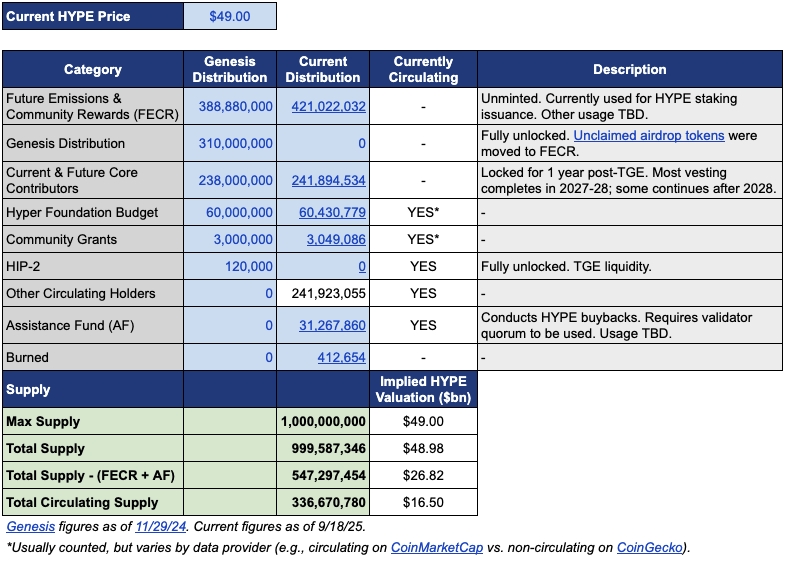

The circulating supply is about 339 million tokens, with a market cap around $15.4 billion; yet the total supply approaches 1 billion, resulting in a fully diluted valuation (FDV) as high as $46 billion.

The nearly threefold gap between market cap (MC) and FDV comes mainly from two sources: 421 million tokens allocated to "Future Emissions and Community Rewards" (FECR), and 31.26 million held in the Aid Fund (AF).

The Aid Fund is Hyperliquid’s account that uses protocol revenue to repurchase HYPE daily but does not burn them—instead, it holds them. The problem is, investors often still perceive the $46 billion FDV as overvalued, even though only one-third is actually circulating.

In this context, investment manager Jon Charbonneau (DBA Asset Management, holding a large HYPE position) and independent researcher Hasu published an unofficial proposal on September 22 regarding $HYPE, which was highly radical; the TL;DR version is:

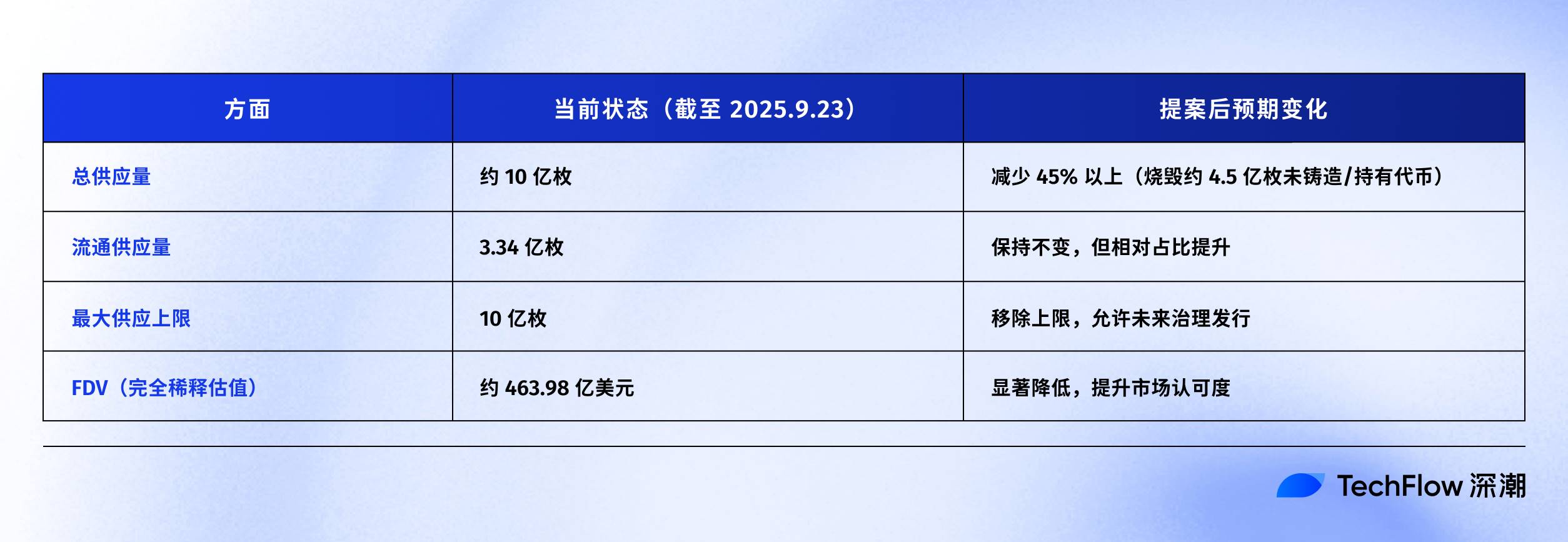

Burn 45% of the current total $HYPE supply to bring FDV closer to actual circulating value.

The proposal quickly ignited community discussion, amassing 410,000 views at the time of writing.

Why such a strong reaction? If adopted, burning 45% of HYPE’s supply would nearly double the value represented by each token. A lower FDV could also attract investors who previously hesitated.

We’ve summarized the original post content for quick reference below.

Reduce FDV to Make HYPE Look Less Expensive

Jon and Hasu’s proposal appears simple—burn 45% of the supply—but the implementation is complex.

To understand it, one must first grasp HYPE’s current supply structure. According to data provided by Jon, at $49 (the price of HYPE when they made the proposal), only 337 million out of the total 1 billion tokens are actually circulating, corresponding to a $16.5 billion market cap.

So where did the remaining 660 million go?

The two largest portions are: 421 million allocated to "Future Emissions and Community Rewards" (FECR)—essentially a massive reserve pool with no clear usage plan—and 31.26 million held by the Aid Fund (AF), which buys HYPE daily but never sells, simply accumulating them.

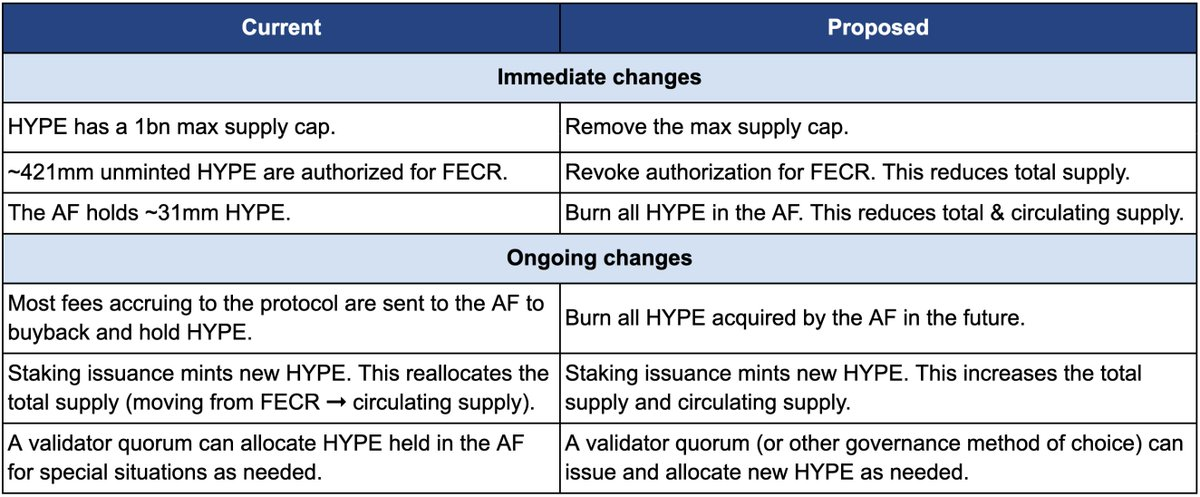

Now, how would the burn work? The proposal includes three core actions:

First, revoke the authorization of the 421 million FECR tokens. These were originally intended for future staking rewards and community incentives but lack a defined issuance schedule. Jon argues that rather than leaving these tokens hanging over the market like a sword of Damocles, their allocation should be canceled outright. If needed later, issuance can be re-approved through governance voting.

Second, burn the 31.26 million HYPE tokens currently held by the Aid Fund (AF), and all future HYPE purchases by AF will also be immediately burned. Currently, AF uses protocol revenue (primarily 99% of trading fees) to buy back HYPE daily, averaging around $1 million per day. Under Jon’s plan, these purchased tokens would no longer be held but instantly destroyed.

Third, remove the 1 billion token supply cap. This may seem counterintuitive—if reducing supply is the goal, why eliminate the cap?

Jon explains that fixed caps are a legacy of Bitcoin’s 21 million model and hold little practical meaning for most projects. Removing the cap allows future token emissions (e.g., for staking rewards) to be decided via governance rather than drawn from pre-allocated reserves.

The table below clearly shows the before-and-after comparison: left side is the current state, right side is the proposed outcome.

Why so drastic? Jon and Hasu’s core argument is that HYPE’s token supply design is an accounting issue, not an economic one.

The root lies in how major data platforms like CoinMarketCap calculate metrics.

Burned tokens, FECR reserves, and AF holdings are treated inconsistently across platforms when calculating FDV, total supply, and circulating supply. For example, CoinMarketCap always uses the maximum 1 billion supply to compute FDV, even after tokens have been burned.

As a result, no matter how much HYPE is bought back or burned, the displayed FDV remains unchanged.

As shown, the biggest change under the proposal is the elimination of both the 421 million FECR tokens and the 31 million AF holdings, while the hard cap of 1 billion is replaced with governance-based issuance as needed.

Jon wrote in the proposal: “Many investors, including some of the largest and most sophisticated funds, only look at the headline FDV number.” A $46 billion FDV makes HYPE appear more expensive than Ethereum—who would dare buy?

However, most proposals come with inherent bias. Jon explicitly stated that his DBA fund holds a "material position" in HYPE, and he personally owns it too; if there’s a vote, they will vote in favor.

The proposal emphasizes that these changes won’t affect existing holders’ relative ownership, Hyperliquid’s ability to fund projects, or its decision-making mechanisms. In Jon’s words,

"It’s just about making the books honest."

When 'Allocated to Community' Becomes an Unquestioned Norm

But will the community accept this proposal? The comment section of the original post has already exploded.

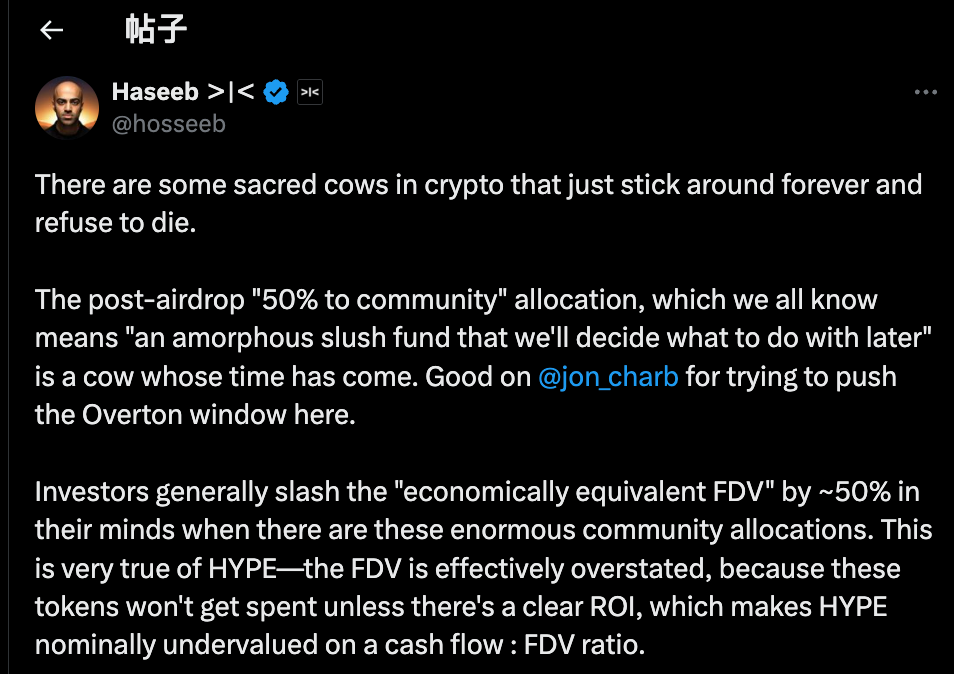

Among them, Dragonfly Capital partner Haseeb Qureshi placed the proposal within a broader industry-wide pattern:

“Some ‘sacred cows’ in crypto just won’t die—it’s time to slaughter them.”

He refers to a widespread unspoken rule in the crypto industry: after token generation, teams routinely reserve 40–50% of tokens for the so-called “community.” This sounds decentralized and Web3-native, but in reality, it’s performance art.

In 2021, during the bull market peak, every project competed over who was more “decentralized.” Thus, tokenomics whitepapers boasted community allocations of 50%, 60%, even 70%—bigger numbers being more politically correct.

But how are these tokens actually used? No one knows.

At worst, certain teams treat the “community” allocation as discretionary funds—using them whenever and however they please, under the noble banner of “for the community.”

The market isn’t fooled.

Haseeb also revealed an open secret: professional investors automatically apply a 50% discount to these so-called “community reserves” when evaluating projects.

A project with a $50 billion FDV and 50% “community allocation” is seen as having a real valuation of only $25 billion. Unless there’s a clear ROI, those tokens are just pie in the sky.

This is exactly HYPE’s dilemma. Over 40% of its $49 billion FDV consists of the “Future Emissions and Community Rewards” reserve. Investors see that number and walk away.

Not because HYPE is bad, but because the on-paper figures are too inflated. Haseeb believes Jon’s proposal plays a constructive role—turning once-taboo radical ideas into mainstream discourse. We need to question the crypto industry’s convention of allocating tokens to vague “community reserves.”

In summary, supporters’ view is straightforward:

If you need to use tokens, go through governance—clearly state why, how many, and what expected returns are. Be transparent and accountable, not opaque.

That said, due to its radical nature, the post also drew criticism. We summarize the main objections into three categories:

First, some HYPE must be kept as risk reserves.

From a risk management perspective, some argue that the 31 million HYPE in the Aid Fund aren’t just inventory—they’re emergency funds. What if regulatory fines or a hack require compensation? Burning all reserves removes crisis buffers.

Second, HYPE already has robust technical mechanisms for destruction.

Hyperliquid already has three natural burn mechanisms: spot trading fee burns, HyperEVM gas fee burns, and token auction fee burns.

These mechanisms automatically adjust supply based on platform usage—why intervene manually? Usage-based burns are healthier than one-time destruction.

Third, large-scale burns harm incentives.

Future emissions are Hyperliquid’s key growth tool, used to incentivize users and reward contributors. Burning them equals self-mutilation. Also, large stakers could be locked out. Without new token rewards, who would still stake?

Who Is the Token Serving?

On the surface, this is a technical debate about whether to burn tokens. But analyzing the positions reveals it’s ultimately about whose interests are prioritized.

Jon and Haseeb make their stance clear: institutional investors are the primary source of incremental capital.

These funds manage billions of dollars—when they buy, prices truly move. But they hesitate at a $49 billion FDV. So the number must be corrected to make HYPE more attractive to institutions.

The community sees it differently. To them, retail traders constantly opening and closing positions on the platform are the foundation. Hyperliquid’s success wasn’t built on VC money, but on support from 94,000 airdrop recipients. Changing the economic model to cater to institutions is putting the cart before the horse.

This divide isn’t new.

Looking back at DeFi history, nearly every successful project has faced a similar crossroads. When Uniswap launched its token, the community and investors clashed fiercely over treasury control.

The core question is always the same: should an on-chain project serve big capital or grassroots crypto natives?

This proposal clearly serves the former: “Many of the largest, most sophisticated funds only look at FDV.” The implication is clear—if we want these big players in, we must play by their rules.

The proposer Jon himself is an institutional investor, and his DBA fund holds a large amount of HYPE. If the proposal passes, the biggest beneficiaries would be whales like him. Reduced supply could drive up prices, increasing the value of their holdings.

Combined with Arthur Hayes recently selling $800,000 worth of HYPE to “buy a Ferrari,” there’s a subtle sense of timing. Early supporters are cashing out, while someone proposes burning tokens to push prices higher—whose interests are really being served?

At the time of writing, Hyperliquid has not officially responded. Regardless of the final decision, this debate has exposed an uncomfortable truth we’ve long avoided:

When profits are at stake, we may never have truly cared about decentralization—we’ve just been pretending.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News