From CEX to Reverse-Engineer PERP DEX Opportunities: Then and Now, the Moment Repeats Itself

TechFlow Selected TechFlow Selected

From CEX to Reverse-Engineer PERP DEX Opportunities: Then and Now, the Moment Repeats Itself

The Perp sector has existed for a long time; it's just the timing that has now brought it into the spotlight.

Author: Crypto Weituo

Recently I've seen many influencers getting FOMOed into the Perp DEX sector because of Aster.

But to be honest, there's no need to rush in anxiously because of this.

I led a technical team back in March to reverse-engineer most of the existing Perps on the market, which helped me catch some obscure small wins like AVNT. In May, I was fortunate enough to receive guidance from CZ in person, and immediately took a position on Aster in the secondary market.

The more I research, the more I realize we shouldn't over-dramatize things or brainwash ourselves.

I'll try to explain my understanding of this sector as neutrally as possible, mainly for those who aren't very familiar with it.

TL;DR

1. Perp isn't only one type like Hyperliquid;

2. The Perp sector has existed for a long time—the timing is what brought it into the spotlight;

3. Exchanges of the same type as Hyperliquid may have fundamental conflicts of interest with major centralized exchanges;

4. Avantisfi’s path represents the greatest common denominator between on-chain Perp and exchange interests.

5. Reverse-engineer listing potential to decide whether to participate in points programs.

What exactly is the Perp sector?

On-chain Perp has existed since 2018, with projects like Synthetix, MUX, and PERP—it's not a new sector at all. Due to historical reasons, there were many ways to implement on-chain derivatives, but eventually two main types remained: AMM Perp and CLOB (orderbook-based Perp).

AMM Perp (Jupiter, Avantisfi, GMX):

Uses oracles to quote prices and liquidity pools as counterparty to all traders. It's like running a table in Macau earning annualized returns—because according to the law of large numbers, the house always wins over enough bets.

CLOB Perp (Hyperliquid, edgeX, Lighter, Orderly, Aster, etc.):

Perp exchanges based on order books and matching engines, following the same logic as CEXs. The specific difference is that platforms like Hyperliquid claim their entire order book is publicly stored on-chain, while others like Lighter use ZK circuits for verifiability.

But ultimately, they're essentially decentralized versions of CEXs—once nodes increase, transaction performance and speed will inevitably suffer.

There are clear differences in cost and trading experience between the two, but in my view, there's no "one replaces the other" logic. Perp DEXs face an impossible trinity: new asset coverage - liquidity depth - price fairness.

You can only pick two. Hyperliquid chose new asset coverage and liquidity depth, sacrificing risk control because it's inherently a market-maker-oriented product—MMs thrive in chaotic environments, so events like XPL and JellyJelly are not bugs but features for them.

Jupiter chose liquidity depth and price fairness, but still only supports three trading pairs.

Most CLOBs choose new assets and price fairness, resulting in strict position limits and poor liquidity for long-tail assets.

All choices are viable within their respective contexts.

Why wasn't Perp popular before but now it is?

Perp DEXs weren't non-functional before—it was just a matter of timing. They should have always been core DeFi infrastructure in any ecosystem (due to leveraged trading demand), but simply hadn’t received attention.

Orderbook models existed in the last cycle: $snx became a blue-chip in 2020, DYDX’s airdrop amazed the entire internet, GMX/GNS saved the brutal bear market in 2023—yet you only remember Hyperliquid. The reason is simple:

1. A massive number of new users entered post-2023, most unaware of the DeFi Summer story.

2. Before the Luna collapse, many CEXs quietly served Western users with perp products.

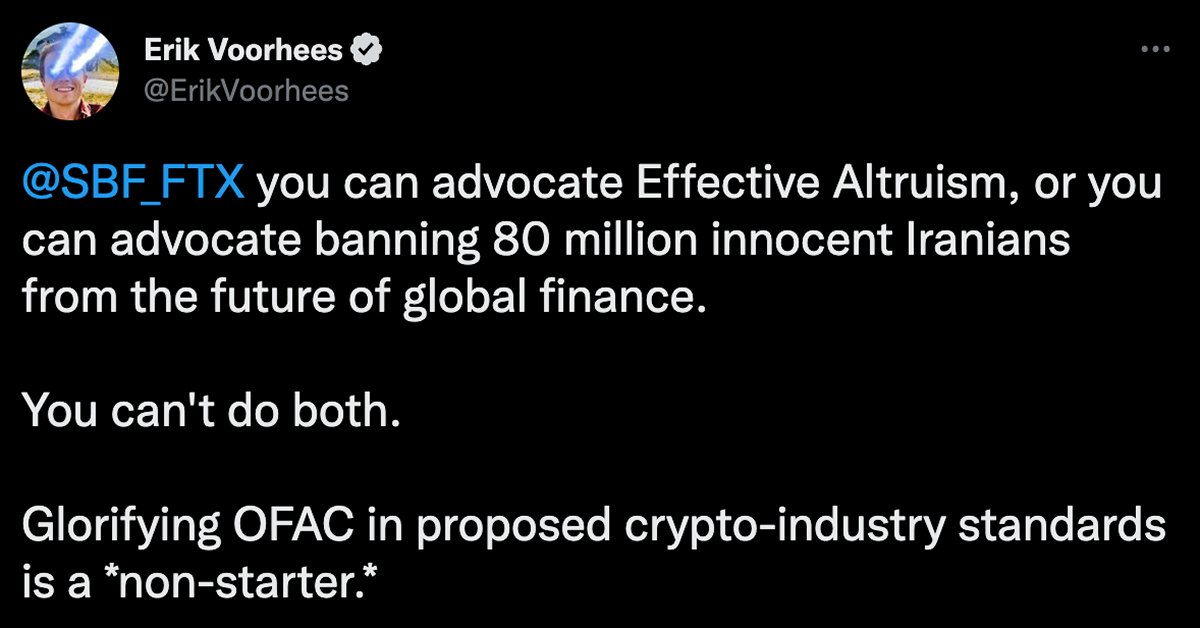

3. After Luna collapsed, especially after Kucoin got hit hard, Western users lost access to perp services. Meanwhile, the SEC is extremely hostile toward DeFi—even buybacks and dividends get targeted, and they’ve even tried forcing KYC on DeFi. As a result, VCs avoid investing in DeFi (once again, thank you @cz_binance for saving DeFi).

The revival of Perp, or DeFi in general, has only happened in the past year since Trump’s return. For Perp DEXs, KYC-free DeFi perp has now become a must-have for Western users who can't access Binance. Moreover, DeFi tokens don’t carry the same compliance baggage as exchange platform tokens, allowing more aggressive maneuvers. This creates an asymmetric advantage over CEXs.

Think outside the box: viewing Perp DEX through CEX history

Think about why certain CEXs succeeded from 2018–2019 to today—that’ll help you identify which Perp DEXs can truly succeed.

Regardless of decentralization, every exchange’s core mission is serving its LPs, whales, and capital providers well. With them come volume, liquidity, and user attraction.

When people say “Tier 1, 2, 3 exchanges” or that listing on a certain exchange supports a project’s valuation, they’re really valuing that exchange’s liquidity—not the project itself.

This is known as “listing pricing power.”

Conversely, listing power is also the first step to acquiring whales, because crypto is a money-printing industry with little legacy wealth. By listing, you turn air into real money, creating a group of wealthy holders around a specific asset. Then, continuously offering new coins for market-making or structured products provides APY opportunities (see each exchange’s VIP, Earn, and institutional sales teams).

Today’s project team, tomorrow’s speculative whale. Exchanges, projects, and speculators are deeply intertwined.

Thus, the core competitiveness of a CEX lies in listing pricing power, tightly coupled with its key KPI: capital depth. This is why pure futures exchanges like Bybit, Bitget, and BingX eventually had to add spot trading.

The challenge of “Hyperliquids”—going head-to-head against major exchanges

First, CLOBs lack capital depth. Due to structural limitations, they can at best offer strategy vaults, making true capital depth difficult, let alone leveraged capital depth. This forces CLOBs to rely entirely on market makers. To retain them, projects must offer token incentives and maker rebates—even negative fees.

After TGE, once token value is realized, market makers often withdraw liquidity. Unless CLOBs engage in gambling-like mechanisms like JLP, vault yields will be low, TVL won’t grow, and TVL cannot translate into trading depth. In short, a pure CLOB struggles to attract big players—it resembles 2019’s 58Coin or Bingbong. And as everyone knows, a perp trader’s lifecycle is only 1–3 months. Thus, CLOBs inevitably fall into a “volume war,” competing against all other Perp DEXs and CEXs.

Second, as previously mentioned, CLOBs are direct competitors to CEX futures businesses and enjoy the asymmetric advantage of being KYC-free. So how do Binance or OKX perceive CLOBs? Do they see them merely as a DeFi niche, or as equal CEX rivals? If the latter, does that mean nearly all current CLOBs might never get listed on major exchanges (since big exchanges rarely list rival platform tokens)?

There are only two ways to break this deadlock:

1. Without listing on major exchanges, pump the native token aggressively to enter top 100 or even top 50 by market cap, artificially creating capital depth. Turn early MM and large holders into retained asset management clients (dividend model – restrict liquidity + increase sunk cost).

2. Build an entire ecosystem with the ability to launch new assets, giving the native chain and exchange new asset pricing power. Continuously attract market makers and project teams, forming your own whale ecosystem (spin-off model).

Sounds familiar?

Exactly—this is the Bitget-BGB and Hyperliquid-Hype playbook.

This explains why BGB needed pumping, why Hype and Aster both require aggressive pumps (higher depth = larger user base), why they need solo mining, and why Hype chose Native Markets for USDH.

Just like Launchpad competition isn’t about the Launchpad itself, the battle among CLOB-type Perp DEXs isn’t about the product. How clunky Aster is doesn’t matter—the key is whether it has resources comparable to getting an entire L1 onto CMC’s front page.

Among so many CLOB perps, how many actually possess such capabilities?

AVNT’s “alternative path”—coexisting peacefully with major exchanges

Many describe AVNT as “Base’s Hyperliquid”—this is completely wrong. It’s actually “Base’s Jupiter.” Only orderbook platforms like Hibachi or Synfutures resemble Hyperliquid.

The common criticism of AMM Perp is high “slippage,” high costs, slow speeds, and unsuitability for institutions like market makers compared to CLOB Perp.

This is inaccurate. In fact, AMM Perp uses oracle pricing, meaning trades are technically zero-slippage. However, due to global counterparty risk, manual “price impact” is added on large trades to prevent tail risks. This can be operationally adjusted—for example, waiving fees for positions above 75x leverage. The stereotype that “institutions can’t use it” stems from traditional market makers not knowing how to handle liquidity-based pricing models, much like early Uniswap days when many MM didn’t know how to set strategies. In reality, on-chain market makers are growing rapidly, and performance issues outside Ethereum have largely been resolved.

AMM Perp’s real strengths lie in two areas:

1. AMM spot holds pricing power. Why have memes and fair launches become sustainable user growth engines? Because they enable low-cost, permissionless issuance without relying on market makers for pricing. AMM Perp contracts are the only model capable of achieving low-cost, permissionless issuance and non-MM pricing.

2. It doesn’t conflict with CEXs—it doesn’t steal CEX order book depth or whales. On the contrary, assets like “JLP” and “GLP” are among the highest-yielding revenue-generating assets on-chain, with massive depth capacity. They can even complement CEX asset management divisions (similar to Binance’s BTC and SOLV).

If you don’t believe it, check Binance listings: only three orderbook-based tokens: $inj $dydx $aevo

Aevo is somewhat considered a Binance-affiliated pre-market listing, INJ is listed as a blockchain.

But AMM Perp has five (excluding JUP): $GMX $GNS $AVNT $SNX $PERP

Considering CLOB Perp projects vastly outnumber AMM ones, this disparity clearly matters.

For those interested, look into Avantisfi and the latest GMX designs—the old notion that AMM Perp only supports three tokens is long outdated, just like how people think "lending equals AAVE, Compound = boring" without noticing KMNO and Morpho are entirely different architectures and species.

How to choose points programs from a Shandong academic perspective

First, if you’ve already incurred sunk costs, stick with your choice. Aster proved that “consistent investment brings returns” still happens today.

If you haven’t invested yet, consider these two questions:

1. Does your chosen project directly conflict with major exchanges’ interests? Could it be denied listing because it’s seen as a “platform token”?

2. Can it solve capital depth and pricing power without relying on major exchange liquidity?

If choosing Orderbook, prioritize:

- Projects backed by major ecosystem-level chains (e.g., Sui, Monad)

- Projects continuously promoted in public by highly influential or third-party-verified financially strong exchange systems, institutions, or individuals (e.g., CZ supporting Aster, CL and other top trader KOLs backing Hype)

If choosing AMM, prioritize:

- Chains with proven asset pricing capabilities: those with foundations that actively support projects and have multiple precedents of high-valuation listings on major exchanges, such as Sui, Solana, Base, etc.—and where the current sector leader hasn’t yet achieved Binance Futures-tier results

- Highest TVL in “JLP/GLP-type” assets: for AMM Perp, capital depth comes first, then taker-side traffic.

A few less popular but potentially rewarding picks from my perspective:

- Ethena’s Ethereal: Clear strategic partnership with major exchanges involving real financial commitment, holding dual importance in Binance/Ethena ecosystems; downside is being slow-moving

- BasedApp: A frontend for Hyperliquid, similar to Axiom’s trench on Solana, plus its own HypeEVM launchpad. Unlikely to list on Binance or OKX, but could serve as a frontline in Hype’s pricing power struggle

- Phantom: MetaMask launching a token makes major wallet tokenization feasible this cycle—the best timing for token launches. Phantom earns revenue mainly from swap and Hyperliquid frontend fees. If Phantom airdrops, these two sources are most likely. Fundamentally, there's no reason it wouldn’t sweep (see WCT), even with Hyperliquid elements.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News