The golden age driven by computing power has arrived—what is the moat for crypto mining companies?

TechFlow Selected TechFlow Selected

The golden age driven by computing power has arrived—what is the moat for crypto mining companies?

Building a compliance moat through optimized internal financial and accounting management.

Author: FinTax

Industry Volatility on the Rise: How Crypto Miners Can Navigate Challenges

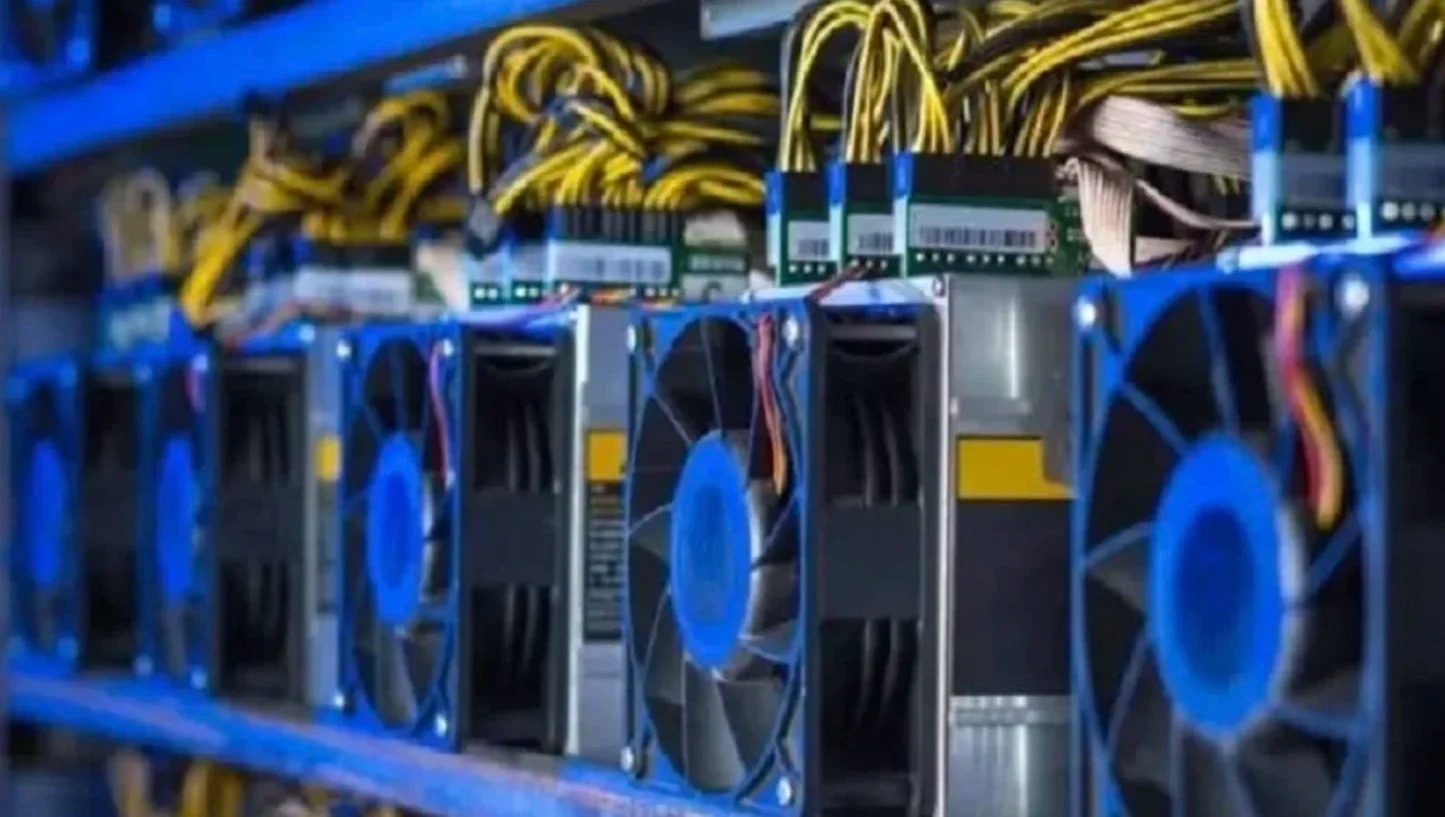

The crypto mining industry in 2025 appears to be fundamentally different from what it once was.

In 2021, mainland China imposed a comprehensive ban on crypto mining, forcing large-scale relocations of mining rigs and abruptly reshaping the global hash rate landscape;

In 2022, Ethereum completed its transition from PoW to PoS, marking the end of traditional mining for one of the largest public blockchains;

In 2024, Bitcoin underwent its halving event, tightening mining profitability and compressing profit margins year-on-year.

Facing multi-layered shocks from policy, technology, and market forces, crypto mining companies have had to accelerate transformation efforts to find new paths for survival and growth. In response, these companies have pursued various external strategies: upgrading ASIC hardware to chase higher computational efficiency; rebranding and expanding their business scope, shifting identity from "miners" to "digital infrastructure providers," and entering AI and high-performance computing markets; accessing capital markets and issuing hash rate derivatives to enhance financing capabilities and stabilize revenues; signing long-term power purchase agreements (PPAs) and adopting advanced cooling and operational optimization technologies to mitigate energy pressures, among others. Meanwhile, mining pools continue innovating in hash rate allocation mechanisms, settlement transparency, and derivative services to retain users amid intensifying competition.

While these transformations have effectively buffered external risks, they cannot change one reality: the external environment remains inherently uncertain—policies may shift overnight, and energy prices and cryptocurrency valuations are subject to constant fluctuation. At such times, perhaps part of the focus should shift inward, exploring internal sources of growth. Specifically, by strengthening internal financial and accounting management, enhancing compliance and transparency, mining enterprises and pools can build their own moats, stabilizing current operations and laying a solid foundation for earning long-term trust from capital markets.

Overview of Financial and Accounting Pain Points for Miners and Mining Pools

In practice, most crypto mining companies and mining pools face several persistent challenges in internal financial and accounting management, including:

Inaccurate profit calculation: Hash rate output is distributed across multiple mining pools and accounts, while costs such as electricity, depreciation, and site operations are scattered across different entities, making precise cost-revenue matching difficult. As a result, although reported profits may appear to grow, actual gross and net profit margins remain unclear, leaving business decisions unsupported by reliable data.

Fragmented cross-border finances: As hash rate relocates to regions like North America, Central Asia, and the Middle East, differing accounting standards across jurisdictions lead to financial records being dispersed across subsidiaries. Consolidated reporting becomes time-consuming and error-prone due to inconsistent methodologies. When facing external fundraising or regulatory audits, management often struggles to deliver a unified, credible financial statement.

Siloed operations and finance: In mining pool operations, operational systems track hash rate distribution and user settlements, but financial systems often rely on manual imports or Excel spreadsheets. Data delays and information asymmetry cause frequent misalignment between on-chain earnings and financial records—undermining both internal management and external credibility.

Compliance and audit pressure: With tightening tax regulations, businesses must provide complete, traceable transaction trails. Yet in reality, many crypto miners lack audit-ready accounting systems, unable to quickly verify asset ownership or cost basis. This exposes corporate reputation and financing capacity to risk when facing regulators or capital markets.

Strategic disconnect: Crypto mining firms often focus intensely on hash rate expansion and energy cost negotiation, treating internal value management as a "back-office task." This leaves finance teams perpetually overwhelmed with reconciliation and reporting, preventing them from evolving into strategic enablers or helping the company establish long-term transparency and credibility in capital markets.

Building a Compliance Moat Through Optimized Financial and Accounting Management

Facing volatile external conditions, crypto mining companies and pools cannot achieve true control by relying solely on hash rate expansion or business pivots. To navigate cycles with resilience, they should consider establishing a more compliant and sustainable financial and accounting management system—one that ensures the authenticity, timeliness, and comprehensiveness of financial data, enabling accurate reflection of operational performance, reducing compliance risks, and providing management with reliable decision-making insights.

First, profitability must become visible. Through automated data collection and reconciliation, companies can track hash rate output and revenue down to individual transactions, precisely matching them with costs such as electricity, depreciation, and operations. The resulting gross and net margins are no longer rough estimates but verifiable outcomes—providing a solid basis for strategic decisions. Without comprehensive consolidation of ledgers across jurisdictions, entities, and currencies, a complete financial picture cannot emerge, leaving management ill-equipped to meet financing, audit, or regulatory demands promptly and accurately.

Simultaneously, integration between operations and finance is key to improving management efficiency. Operational tasks within mining pools—such as hash rate distribution, user settlements, or fund flows—when handled manually, are often delayed and prone to errors. Real-time synchronization of these events with financial data would significantly reduce reconciliation burdens, enhance transparency, and strengthen trust with partners and capital markets.

Furthermore, rising compliance and audit requirements demand fully traceable evidence chains. Any gap—from raw transactions to final reports—introduces potential risk. An audit-friendly accounting system enables companies to confidently meet financial disclosure obligations, tax inspections, and due diligence requests from capital markets. Ultimately, through automation and systematization, finance teams can be freed from tedious reconciliation and reporting tasks, allowing them to focus on higher-value initiatives—transforming the finance function from a "record-keeper" to a "growth accelerator."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News