From mining to mining artificial intelligence

TechFlow Selected TechFlow Selected

From mining to mining artificial intelligence

A deep analysis of Galaxy Digital's Q2 2025 financial report reveals that the digital asset and data center solutions provider is preparing for a transformation.

Author: Prathik Desai

Translation: Block unicorn

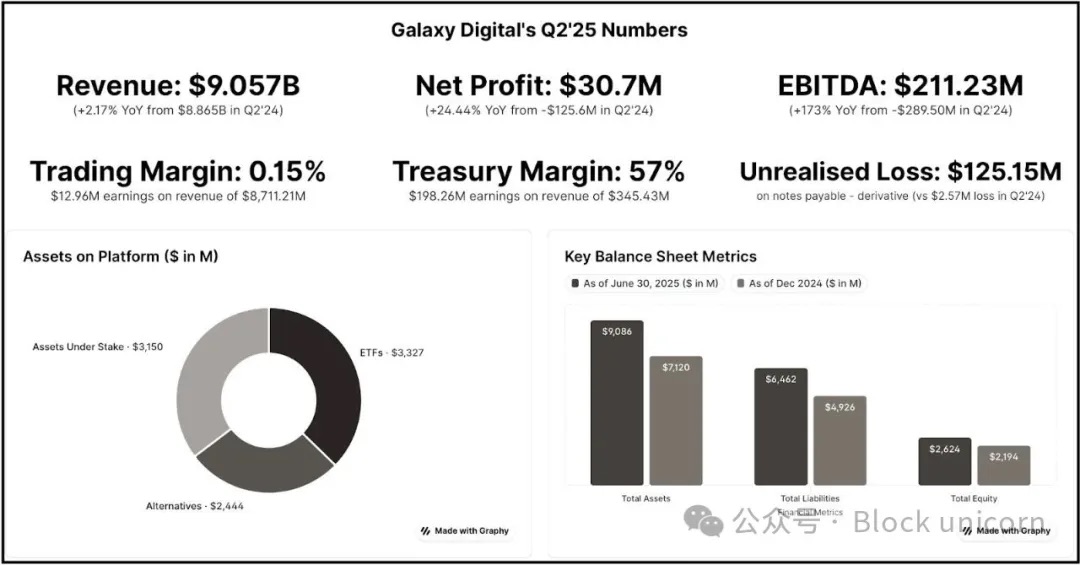

Today, we dive into Galaxy Digital's Q2 2025 earnings report, as this digital asset and data center solutions provider prepares for a transformation. From its core business—accounting for 95% of revenue but with margins under 1%—to a business model promising an almost too-good-to-be-true revenue-to-cost ratio.

Summary

-

Galaxy’s crypto trading business generated just $13 million in profit on $8.7 billion in revenue (a 0.15% margin), while paying $18.8 million per quarter in compensation—its core operations are cash flow negative.

-

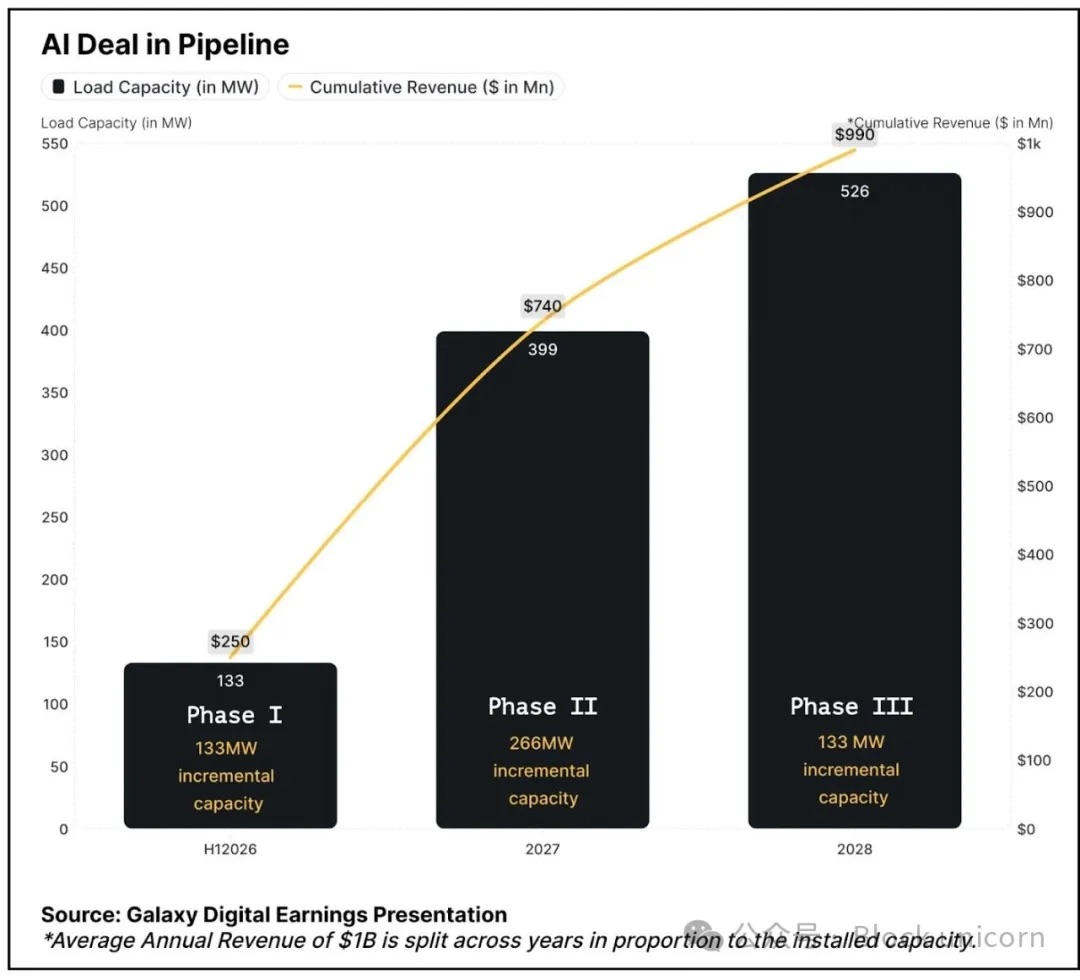

AI transformation: A 15-year, 526-megawatt contract with CoreWeave is expected to begin in the first half of 2026, delivering over $1 billion in annualized revenue across three phases with 90% margins.

-

Holding 3.5 gigawatts of capacity in Texas within a supply-constrained market, where data center demand must quadruple by 2030.

-

$1.4 billion in project financing secured, validating commercial viability and eliminating execution risk.

-

The current model relies on crypto asset gains (up $198 million in Q2) to fund operations, as capital-intensive trading yields thin returns.

-

Stock rose 17% then retreated, as investors see no incremental revenue before the first half of 2026.

When reviewing Galaxy Digital’s Q2 figures, it’s easy to miss what comes next. Look closer, and you’ll find the company, led by Michael Novogratz, stands at an inflection point—shifting from cyclical crypto trading to more stable AI infrastructure revenue.

The AI Infrastructure Goldmine

Galaxy Digital is undergoing one of the largest business transformations in the crypto industry—from low-margin trading to high-margin AI data centers.

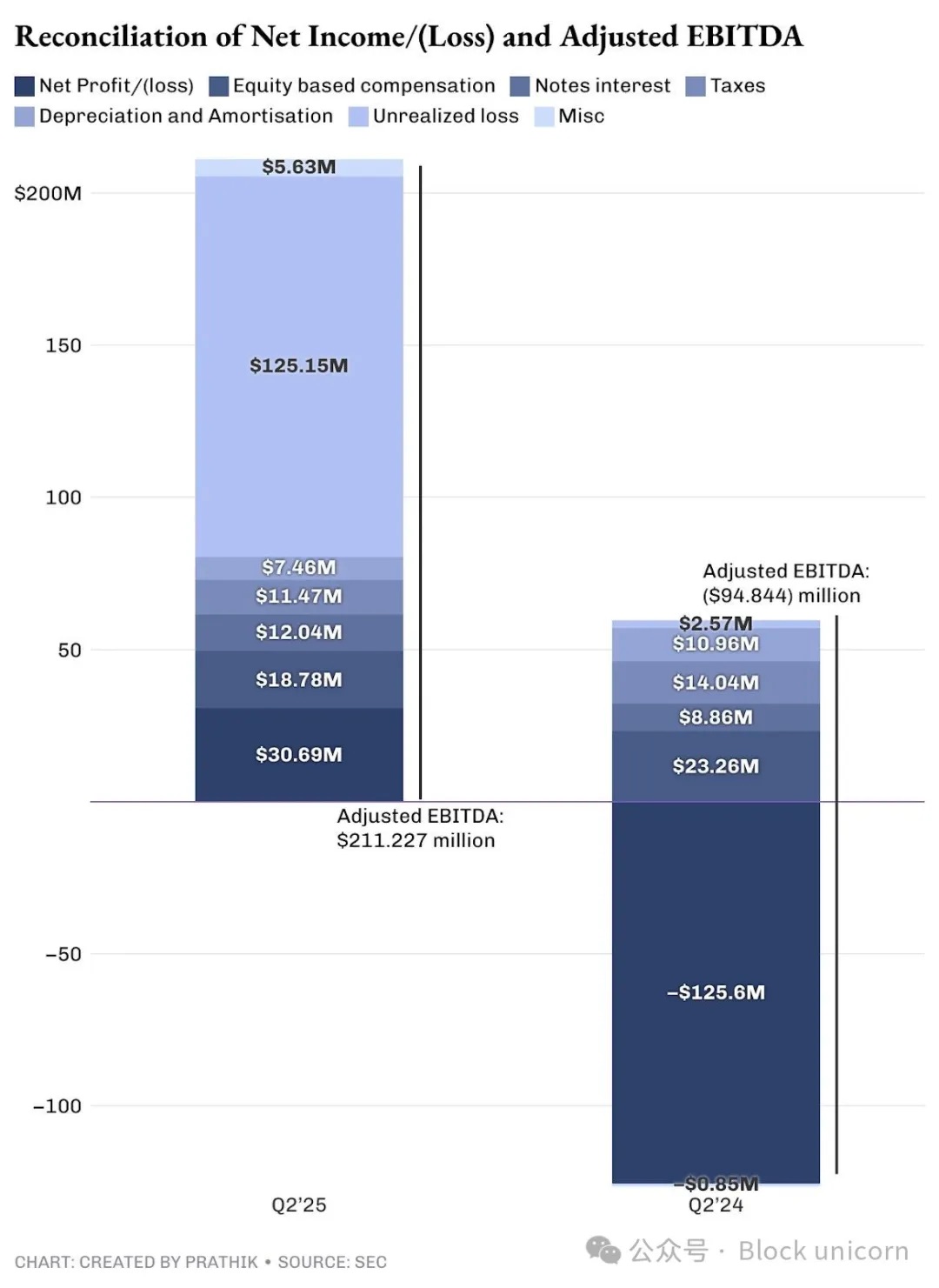

The company posted $31 million in net income this quarter, and after adjusting for non-cash and unrealized items, achieved $211 million in adjusted EBITDA.

Of its total revenue, the trading business earned only $13 million in profit on $8.7 billion in sales—a mere 0.15% margin. Thus, 95% of its revenue is nearly unprofitable.

In contrast, its new AI data center contract promises 90% margins on over $1 billion in annualized revenue.

While I’m bullish on building AI and high-performance computing capacity, I believe the promised margins are overstated. But don’t just take my word—compare with top-tier AI data operators like Equinix and Digital Realty, who reported margins of 46–47% this quarter.

Still, the direction is correct from a pure revenue-generation standpoint. Currently, most of Galaxy’s revenue comes from high-cost, low-margin trading. Most of its profits (revenue minus expenses) come from its assets and corporate divisions.

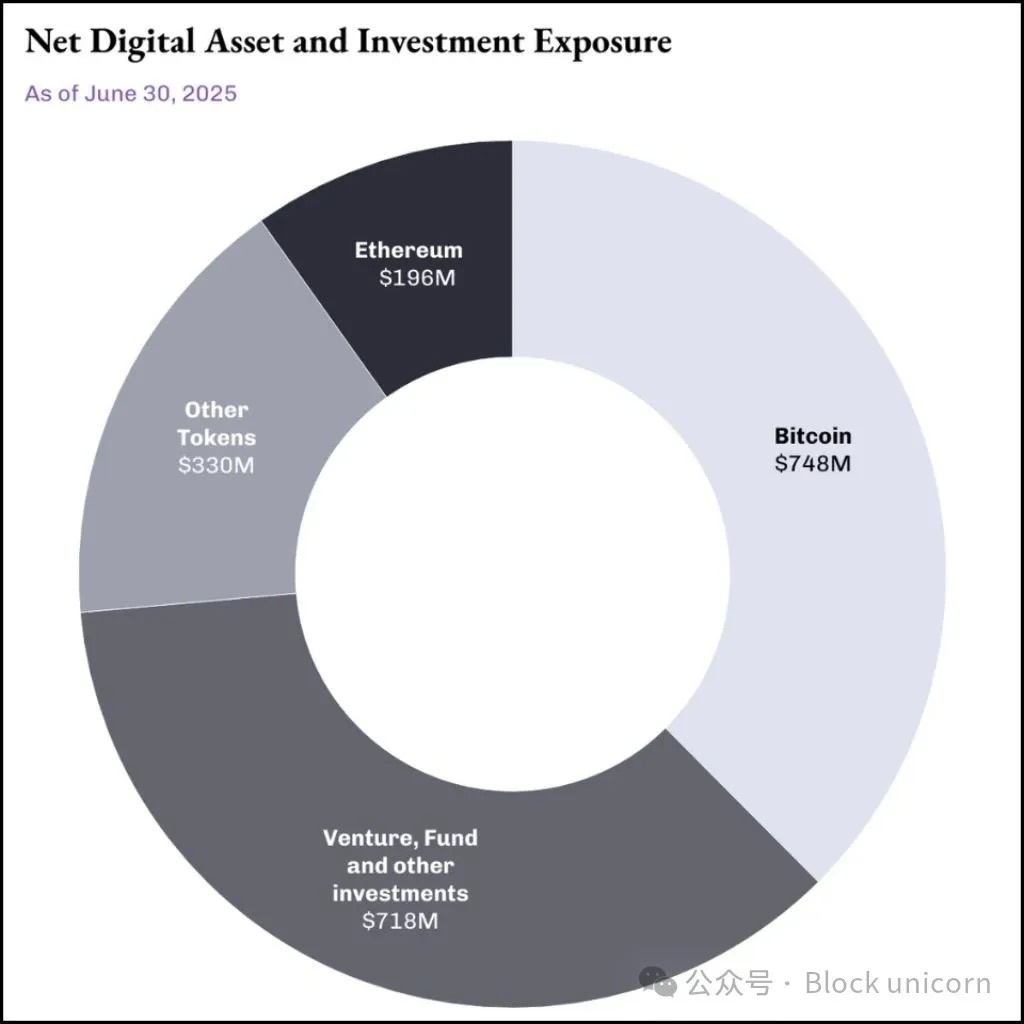

The assets division includes investments in digital assets and mining activities, equity stakes, and realized/unrealized gains or losses on digital assets and equities.

Its $2 billion asset pool serves as both an investment vehicle and a strategic funding source during favorable market conditions.

This segment generated $198 million in gains, excluding non-cash unrealized gains. Unlike pure-play crypto firms, Galaxy funds operations through strategic asset sales.

This is where I believe Galaxy’s crypto asset strategy differs from Michael Saylor’s Bitcoin strategy. Saylor’s “buy, hold, never sell” approach yielded $14 billion in unrealized gains this quarter—but these are paper profits; shareholders get nothing tangible.

Galaxy is different. It not only buys and holds crypto in its portfolio but also strategically sells, generating real, realized profits—actual cash that can be shared with shareholders.

However, I view Galaxy’s assets division as an unreliable income source. As long as crypto markets remain strong, this segment will keep generating gains. But markets—whether traditional or crypto—don’t work that way. At best, they’re cyclical, making these returns heavily dependent on market conditions.

This is why Galaxy needs its AI transition to succeed—the current model is unsustainable.

Market Opportunity

Galaxy has positioned itself at the intersection of two massive trends: explosive AI compute demand and long-term U.S. power infrastructure shortages. McKinsey reports global data center demand is projected to grow fourfold—from 55 GW in 2023 to 219 GW by 2030.

Hyperscale cloud providers are expected to spend $800 billion in capital expenditures (CapEx) on data centers by 2028, a 70% increase from 2025 levels, but are constrained by power availability.

Galaxy’s edge lies in its Helios campus in Texas, with 3.5 GW of potential capacity—enough to power over 700,000 homes. Of this, 800 MW are already approved, and another 2.7 GW are under study with the Electric Reliability Council of Texas (ERCOT). Galaxy controls some of the largest available power capacity in the supply-constrained AI infrastructure market.

Digital rendering of Galaxy’s Helios AI and HPC data center campus in Texas.

The foundation of Galaxy’s transformation is a 15-year commitment with CoreWeave—one of the largest AI infrastructure deals in the industry. CoreWeave has committed to 526 MW of critical IT load across three phases.

The 90% projected profit margin is attributed to the light-asset nature of data center operations once infrastructure is built.

I see a major risk in the CoreWeave deal: execution. Just as I was questioning how much capital Galaxy would need to raise, along with planning and execution capability, the company cleared its first hurdle.

On August 16, Galaxy successfully closed $1.4 billion in project financing for the Helios data center, securing funding for Phase 1 construction. This gives me greater confidence in how key funding risks have been mitigated and the commercial viability of the Helios project validated.

The Cash Flow Equation

Galaxy’s current cash flow highlights the instability of its trading business, while underscoring why AI infrastructure offers real financial stability.

The company ended the quarter with $1.18 billion in cash and stablecoins—this sounds substantial, but the reality is more complex. Galaxy’s trading business operates a capital-intensive model requiring large cash reserves for margin lending. Most of that $1.18 billion is not freely usable.

Galaxy generates negligible free cash flow. After $14.2 million in interest expenses and ongoing operating costs, its core business barely breaks even on a cash basis.

This forces Galaxy to rely on appreciation in crypto markets—its treasury and mining operations—to generate funds for operations, amid inherent cyclicality and unpredictability. In contrast, CoreWeave’s phased contract structure and high-margin business model could generate positive cash flow immediately.

Even if margins fall short of 90%, a more conservative 40–50% would still offer far more reliable and stable returns than the cyclical treasury business.

Unlike trading, which requires continuous investment in working capital and tech infrastructure, cash from data center operations can be reinvested in expansion or returned to shareholders.

Galaxy’s recent Helios project financing helps resolve the cash flow issue. By securing dedicated construction funding, Galaxy decouples infrastructure development from its operational cash flow needs—a separation impossible in trading, where balance sheet capital competes directly with other corporate demands.

Expense Breakdown

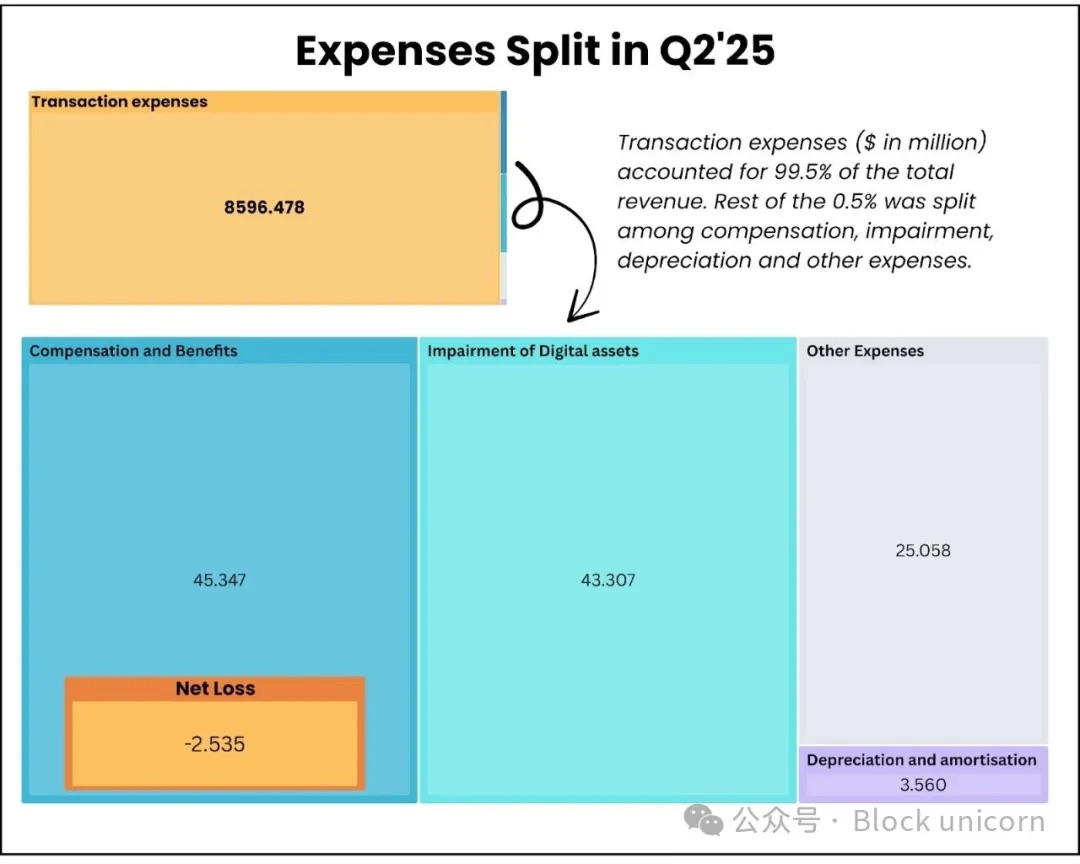

Total expenses in the digital asset segment were $8.714 billion, with trading expenses accounting for the largest share ($8.596 billion). These are purely pass-through costs with little room for growth. Galaxy has minimal ability to optimize them, as spreads continue to narrow in commoditized trading, making these costs unavoidable.

More concerning, quarterly compensation includes $18.8 million in stock-based compensation that must be paid in cash. This means Galaxy pays more to retain talent than its core business generates in profit ($13 million).

The AI infrastructure shift will change this dynamic. Once facilities are operational, data center operations require minimal variable costs.

To illustrate, Galaxy’s entire digital asset business generated $71.4 million in adjusted gross profit in Q2. At full capacity, just Helios Phases 1 and 2 (~400 MW) could generate $180 million in quarterly revenue, with a fraction of the operational complexity and cost of the trading business.

Market Reaction

Following its Q2 earnings release, Galaxy’s stock rose modestly by 5% within 24 hours and jumped about 17% within a week, before investors began exiting positions.

This may be because investors realized that $180 million of the $211 million in adjusted EBITDA came from non-cash adjustments and treasury gains—not operational improvements.

Investors may not yet fully appreciate the complexity of Galaxy’s transition to AI infrastructure, given that meaningful data center revenue isn’t expected before the first half of 2026.

I remain optimistic about long-term market sentiment, given future potential.

Galaxy’s addition of 2.7 GW under ERCOT study suggests the company intends to solidify its position as a long-term infrastructure provider rather than a single-tenant facility operator.

At full build-out, Galaxy’s Texas operations could rival the largest hyperscale campuses run by Amazon, Microsoft, and Google. This scale could give it negotiating leverage with other AI firms while improving operational efficiency and boosting margins.

The company’s expertise in crypto uniquely positions it at the emerging intersection of AI and blockchain technology.

The Path Forward

Galaxy is making a massive, polarizing bet. If the AI infrastructure transition succeeds, it transforms from a low-margin trading firm into a cash-generating machine. If it fails, it will have spent billions building expensive real estate in Texas while its core business withers.

The $1.4 billion in project financing confirms external confidence, but I’m watching two key metrics: Can they actually deliver 133 MW of AI-ready capacity before the first half of 2026? And once actual operating costs kick in, can they sustain that 90% margin?

Current operations provide enough cash flow to sustain the business, but sustained strength in crypto markets is required for meaningful growth investments. The AI infrastructure opportunity promises steady, reliable revenue potential—its success hinges entirely on execution over the next 18–24 months.

The recent close of project financing eliminates major execution risk, but Galaxy must now prove it can successfully transform crypto mining infrastructure into enterprise-grade AI computing facilities to win long-term investor confidence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News