When the market is bad, consider Plasma mining—how to mine it appropriately?

TechFlow Selected TechFlow Selected

When the market is bad, consider Plasma mining—how to mine it appropriately?

Plasma's multi-million dollar subsidy.

Author: BUBBLE, BlockBeats

On September 25, the highly anticipated native token of Plasma, XPL, launched and surged to $1.60 shortly after going live. In addition to presale participants, early depositors also received generous airdrop rewards. With various exchange airdrops—including on Binance Alpha, where users could claim approximately $220 worth of $XPL—it was truly a broad-based windfall.

Shortly after launch, Plasma kicked off a massive seven-day liquidity incentive program running through October 2, covering major protocols such as Aave, Euler, Fluid, Curve, and Veda. Users can deposit stablecoins into these protocols or hold relevant tokens to earn XPL rewards.

If you missed deposits, missed the presale, and missed arbitrage opportunities on-chain, you absolutely cannot miss this chance to farm rewards. BlockBeats has compiled five major yield farms, some offering APRs exceeding 35%.

Preparation Before Farming

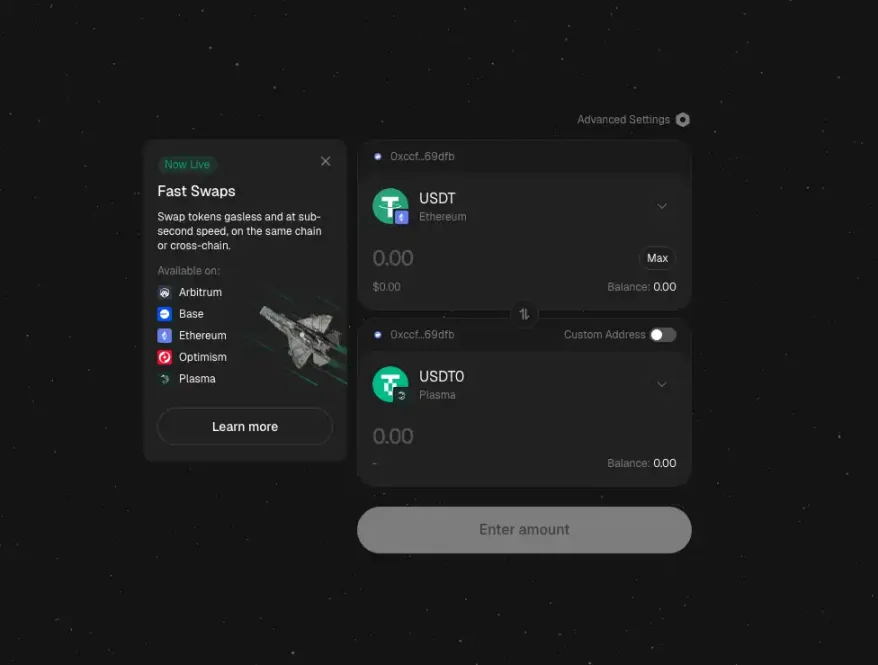

Prior to farming, users need to prepare assets. Some protocols require bridging mainnet USDT to Plasma via Stargate to obtain an equivalent amount of USDT0. Additionally, a small amount of XPL is needed for transaction gas fees (compatible with most EVM chains).

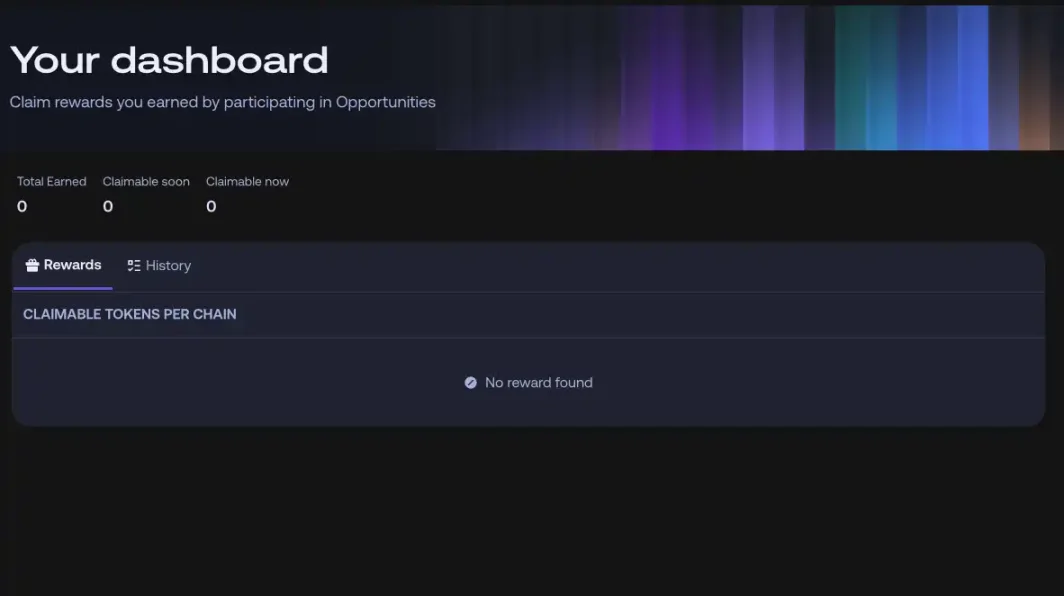

Plasma’s campaigns are mostly conducted in collaboration with Merkl. Users can log in to Merkl’s Dashboard at any time to track their rewards. The Merkl platform automatically calculates rewards based on deposit size and duration, and users simply need to manually claim them periodically.

Which Pools Are Worth Farming?

PlasmaUSD Vault

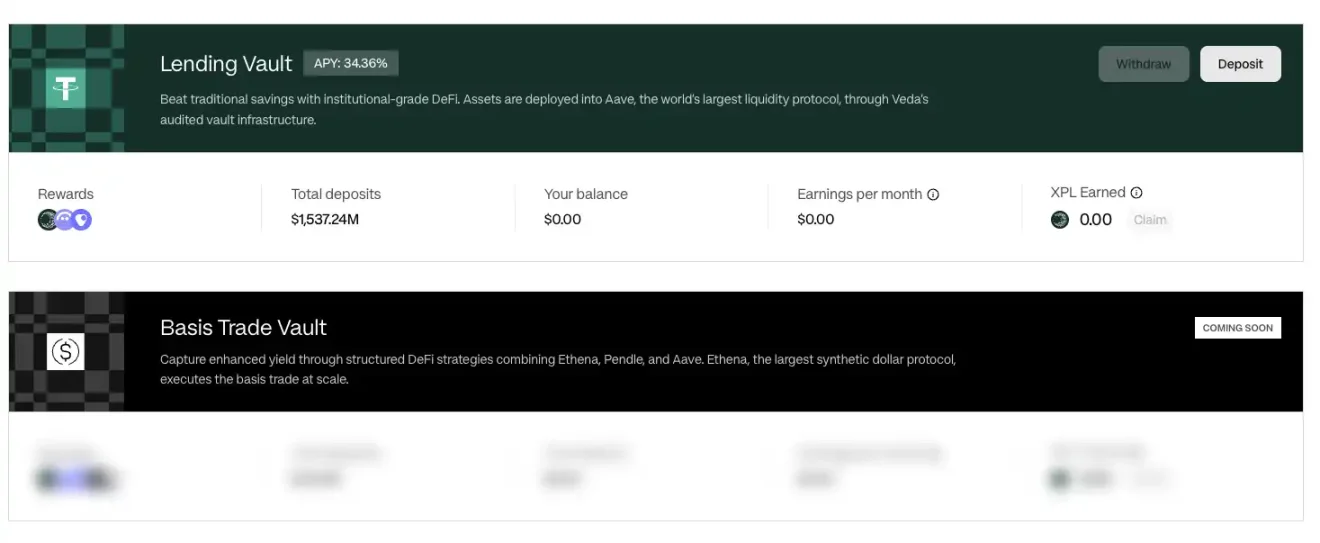

This campaign is initiated by the official Plasma team. Under the Veda protocol, the PlasmaUSD Vault distributes WXPL through a "hold-to-mine" mechanism. Currently, only the Lending Vault is open; the Basis Trade Vault will be launched later.

The process is simple: click Deposit to add USDT0/USDT and hold shares in the vault. Users can earn WXPL rewards whether on the mainnet or Plasma chain, claimable every 8 hours. However, there is a 48-hour withdrawal cooldown period after borrowing USDT0.

The current annualized yield is approximately 34.36%, with daily rewards reaching up to $1.4 million. Notably, $1 million of this comes from a main reward pool that will only last three days, ending on September 29. It remains unclear whether the team will continue incentives afterward.

Aave USDT0

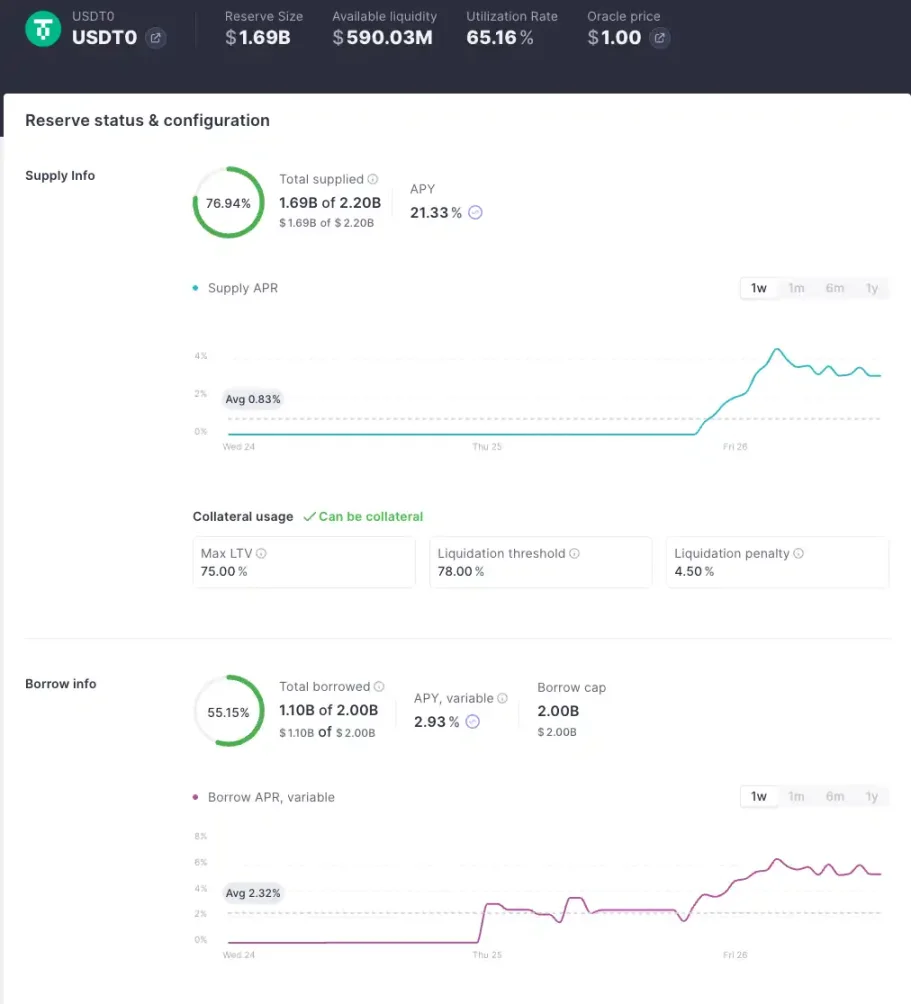

Similar to Plasma’s lending vault, depositing USDT0 into Aave and opening a borrowing position earns WXPL rewards. Currently, $1.7 billion has already been deposited into the protocol, offering an annualized yield of approximately 21.33% (with ~3.19% APY from the protocol itself and ~18.15% APY from WXPL), and daily rewards amount to about $700,000 worth of XPL.

Compared to Plasma, its advantage lies in allowing withdrawals at any time. However, users must supply USDT0 without holding any USDT0 or USDe debt, meaning leveraged looping strategies to increase capital efficiency are not possible.

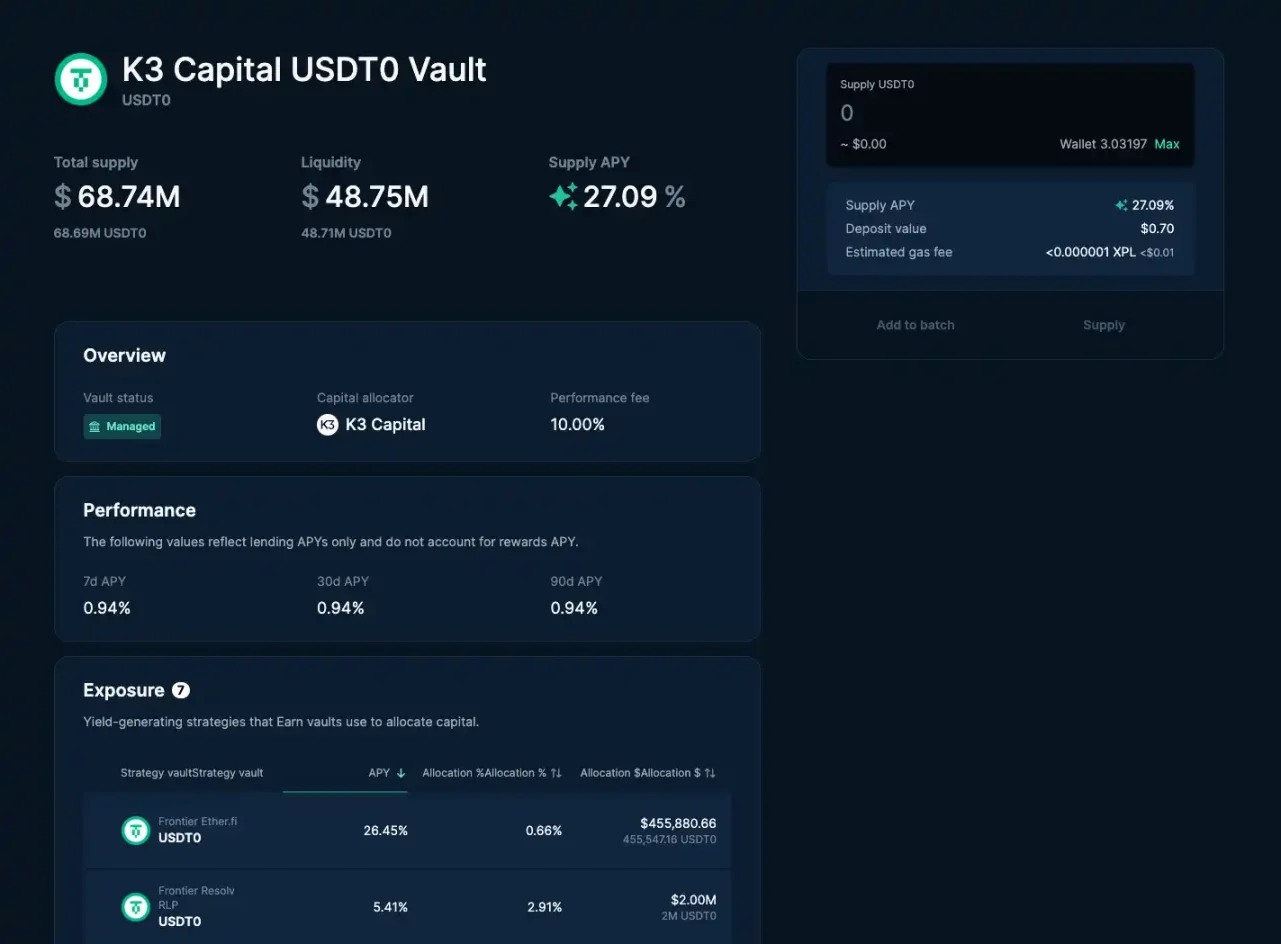

Euler K3 Capital USDT0 Vault

On Plasma’s Euler protocol, the USDT0 Vault managed by K3 Capital currently offers an annualized yield of around 27%, with daily incentive distributions of approximately $55,000 worth of WXPL.

Users simply need to deposit USDT0 on the Plasma mainnet and supply it to the vault to begin farming.

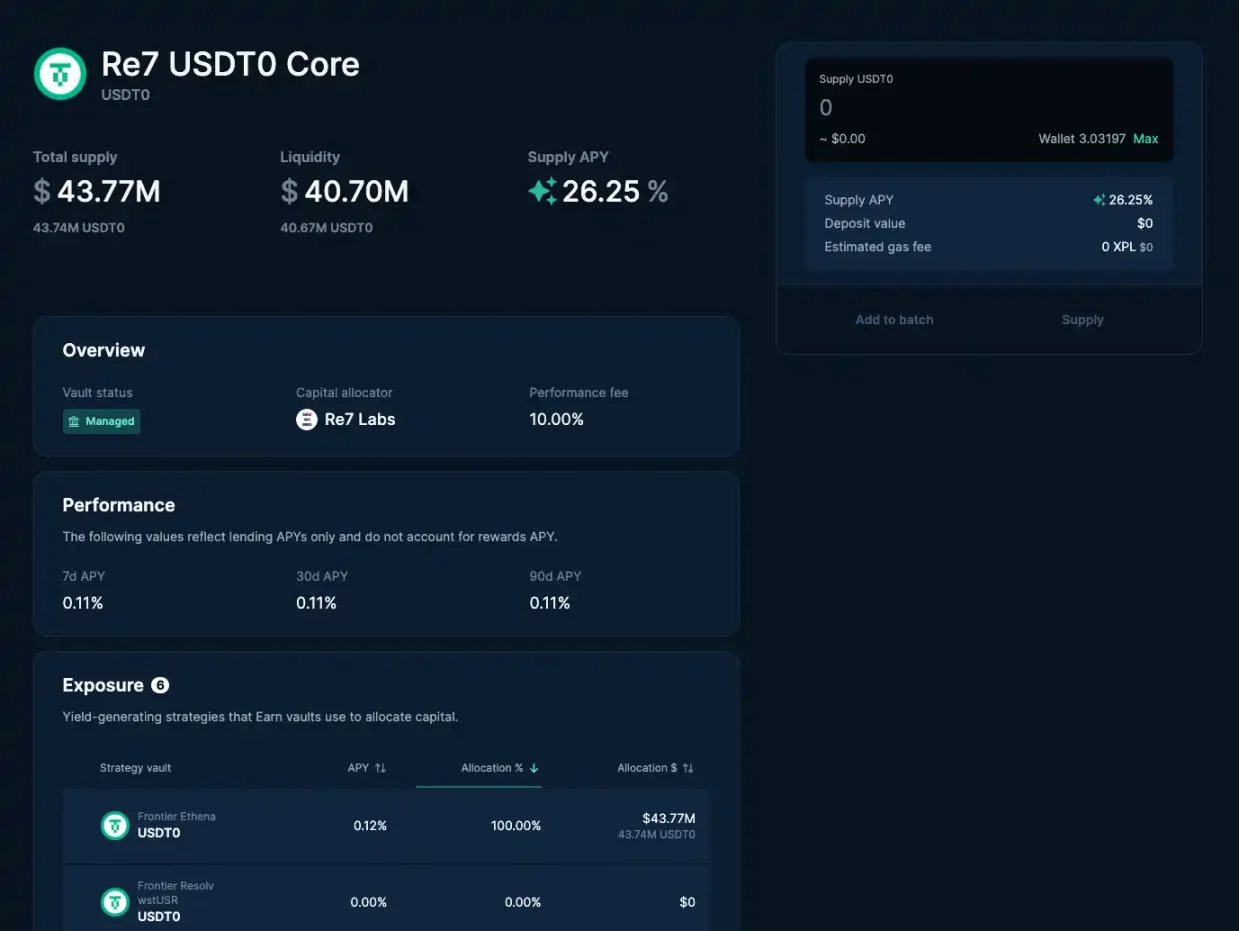

Euler Re7 Core USDT0 Vault

Also under the Euler protocol, the Re7 Core USDT0 Vault uses a no-loss, demand-style lending model. Users participate by depositing USDT0 into the vault. The current annualized yield is approximately 30.43%, with daily rewards totaling about $35,000 worth of XPL. Although the TVL of Euler pools is relatively low, their yields and reward levels remain attractive—ideal for retail investors looking to diversify.

Fluid fUSDT0 Vault

The fUSDT0 Vault on Fluid offers rewards for depositing USDT0, USDe, or ETH into the lending vault, as well as for borrowing USDT0 using USDai and USDT0 as collateral—meaning users can first pledge USDai and USDT0 to borrow USDT0 and earn an approximate annualized yield of 24%.

Then use the borrowed USDT0 to provide liquidity in the lending pool, which currently offers an annualized yield of approximately 25%.

Note that most USDT0 borrowing activities are subsidized by Plasma’s incentive programs. The actual borrowing rate is currently around 3%. If borrowing demand increases, rates may rise quickly, compressing your net yield.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News