Dig into the top-tier VC behind Plasma, what major airdrops does Founders Fund still hold?

TechFlow Selected TechFlow Selected

Dig into the top-tier VC behind Plasma, what major airdrops does Founders Fund still hold?

A clear investment philosophy and decision-making system drives Founders Fund.

Author: Luke, Mars Finance

Plasma's airdrop ultimately distributed 9,300 $XPL tokens to each participant. Based on the recent high of $1.45, this translates into an airdrop reward worth over $13,400—regardless of initial investment.

This astonishing wealth effect has once again drawn market attention to its key backer—Founders Fund. The top-tier VC firm founded by Peter Thiel has practically earned the title of the definitive treasure map for crypto airdrops, thanks to its precise early investments in projects like Starknet, Avail, and Plasma.

Their success is clearly no accident. It’s driven by a clear investment philosophy and decision-making framework. What lies at the core of this system? How does Founders Fund’s leadership think? And after catalyzing Plasma, what other projects aligned with their "doctrine" and possessing high airdrop potential deserve our close attention?

"The Brain" and "OG": Founders Fund's Dual Decision Core

Founders Fund’s strong momentum in the crypto space stems from the perfect synergy between two key figures: one serving as the visionary "brain" providing overarching philosophy and grand narratives, and the other as the hands-on "crypto OG" ensuring tactical execution.

Peter Thiel: The "Brain" and Soul of Investment

As founder and spiritual leader of Founders Fund, Peter Thiel's personal philosophy deeply influences every investment decision. His principles of "contrarian thinking" and pursuit of "monopolistic technology," as articulated in *Zero to One*, form the foundation of the fund’s investment strategy. As the godfather of the "PayPal Mafia," Thiel holds a long-standing conviction in building new financial networks independent of traditional systems. This ideological stance ensures Founders Fund consistently focuses on foundational protocols and infrastructure capable of reshaping entire industries, rather than chasing short-term application trends. He sets the direction: seek teams solving the hardest problems and capable of creating an entirely new future.

Joey Krug: The Frontline "Crypto OG"

If Thiel provides the philosophical answer to "why invest," partner Joey Krug addresses the tactical questions of "who to invest in" and "how." A true OG in the crypto world, Krug co-founded Augur, the decentralized prediction market, giving him firsthand experience in building and operating a successful DeFi protocol from scratch. Prior to joining Founders Fund, he served as Co-CIO at Pantera Capital, accumulating extensive crypto investment expertise. Krug has emphasized that he highly values a team’s "shipping velocity"—their ability to continuously turn ideas into products. His deep industry roots and sharp judgment on technical execution ensure Founders Fund’s grand vision aligns precisely with the most capable teams.

The combination of Thiel’s top-down vision and Krug’s ground-level insights forms Founders Fund’s powerful dual-core decision engine, enabling them to both ride the largest technological waves and identify the best "surfers" capable of mastering them.

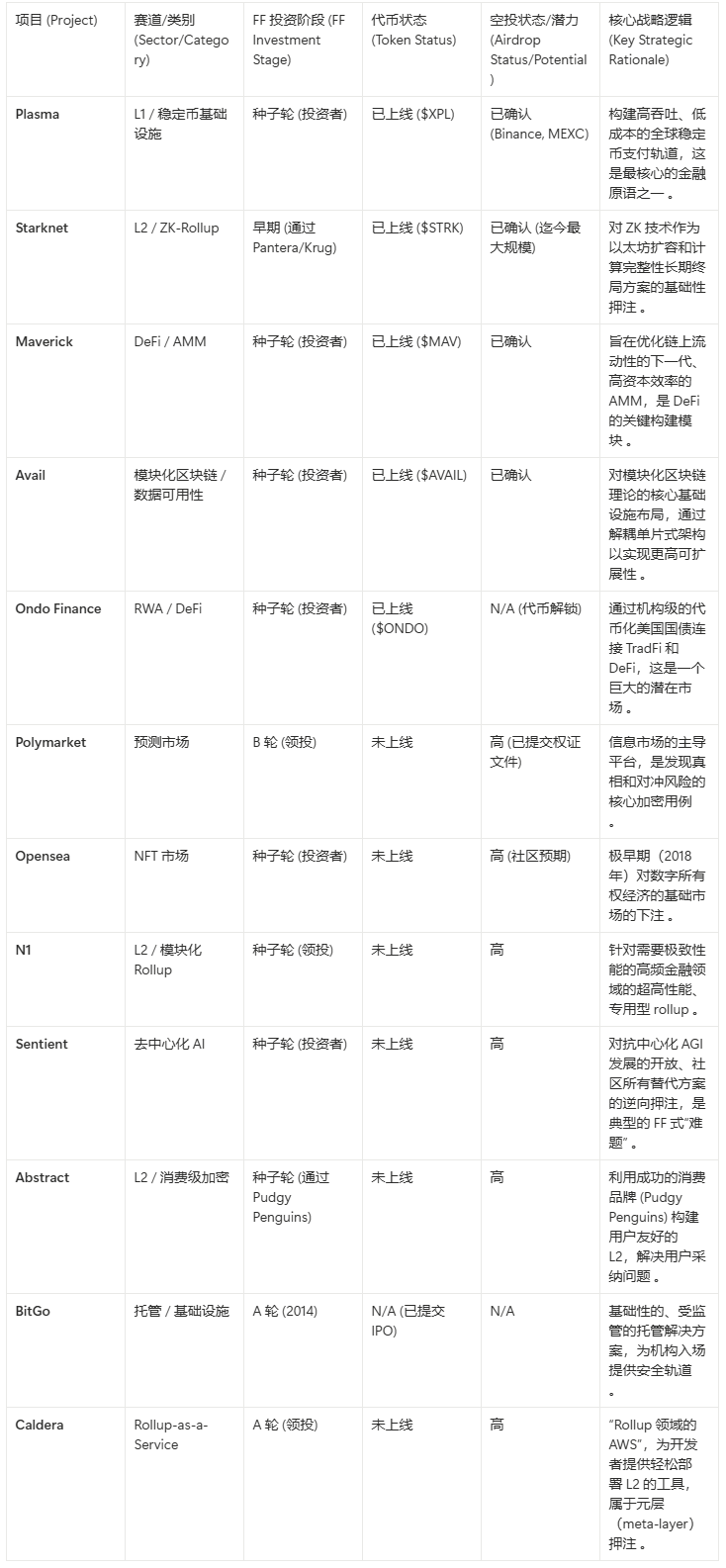

Founders Fund Crypto Investment Doctrine: Portfolio Overview

This table aims to consolidate users’ scattered observations and findings from this report into a structured analytical tool, clearly illustrating Founders Fund’s investment model prioritizing infrastructure, early entry, and high-potential outcomes.

Alpha List: High-Potential Projects to Watch Closely

Based on the above investment doctrine, we can clearly identify the next batch of projects within Founders Fund’s portfolio with significant airdrop potential.

1. Polymarket: The King of Prediction Markets

Project Overview: As the undisputed leader in decentralized prediction markets, Polymarket allows users to trade on the outcomes of global events such as elections, economic data, and regulatory approvals. It has become a critical hub for information gathering and trend forecasting across the crypto world and beyond, consistently maintaining high daily trading volume and monthly active users.

Airdrop Expectation: The issuance of a token by Polymarket is almost an open secret. First, as a decentralized protocol requiring community governance and value capture, a token is essential for its ecosystem closure. Second, and most critically, documents filed with the U.S. SEC explicitly mention "warrants," which in investment agreements typically signify rights for early investors to receive tokens in the future. Recent positive regulatory signals from the U.S. Commodity Futures Trading Commission (CFTC) have further cleared major hurdles for compliant token issuance.

Why to Watch: The community widely expects Polymarket may follow the airdrop models of Starknet and Avail, conducting large-scale retroactive airdrops for early and deeply engaged platform users. This is a project with a mature product, massive user base, and clear business model—its token launch will be a highly anticipated value realization event.

2. Sentient: At the Frontier of AI+Crypto, a Vehicle for Grand Narratives

Project Overview: Sentient’s ambition is immense—it aims to build a decentralized, open artificial general intelligence (AGI) network. In an era where AI computing power and models are increasingly monopolized by tech giants, Sentient seeks to create a permissionless, community-owned AI economy using blockchain technology.

Airdrop Expectation: For a protocol aiming to build a global decentralized network, a token is indispensable. It serves not only as the core mechanism to incentivize contributors of AI models, computing power, and data validators but also as the sole medium for network governance and value distribution. Its $85 million seed round provides ample resources to build a vast ecosystem and execute large-scale community incentive programs, including airdrops.

Why to Watch: Sentient perfectly embodies Founders Fund’s philosophy of investing in "revolutionary technologies." Its airdrop would go beyond mere wealth creation—it would represent the initial distribution of ownership in a future decentralized AI network. For those bullish on the AI+Crypto space, early participation and contribution to its ecosystem could yield substantial returns.

3. N1 (formerly Layer N): Next-Gen Financial L2, Reimagining Infrastructure Value

Project Overview: N1 is a high-performance Rollup network (L2) specifically designed for financial applications. Rather than being a generic "one-size-fits-all" chain, it uses a customized architecture to deliver extreme performance and efficiency for high-frequency trading, derivatives settlement, and other financial use cases.

Airdrop Expectation: Backed by Founders Fund from inception, N1 has attracted significant attention. Token issuance and airdrops to reward early users, developers, and ecosystem projects have become standard practice for L2 blockchains. The token will serve not only for decentralized governance but also as a crucial weapon to capture network value and compete with rivals like Starknet and Arbitrum for liquidity and users.

Why to Watch: N1 represents the专业化 and精细化 evolution of the L2 sector. Following Starknet’s successful path, N1’s airdrop is likely tied closely to depth of interaction on its testnet and early adoption on mainnet. For users familiar with L2 interactions, this is an opportunity not to be missed.

4. OpenSea: The Lingering Giant Airdrop

Project Overview: As the OG and pioneer of the NFT marketplace, OpenSea has virtually defined the entire category. Founders Fund participated in its seed round back in 2018, demonstrating extraordinary foresight regarding the "digital ownership economy."

Airdrop Expectation: Community demand for OpenSea to issue a governance token has persisted for years. The primary driver is competition from platforms like LooksRare and Blur, which rapidly gained traction through "vampire attacks" and generous token airdrops. OpenSea needs a powerful tool to reward its vast historical user base and incentivize future loyalty. Issuing a token for community governance and value sharing is widely seen as inevitable.

Why to Watch: OpenSea’s airdrop differs from new projects. It won’t depend on testnet activity but could instead become an unprecedented retroactive distribution, potentially rewarding years of transaction history, total trading volume, held NFT collections, and created galleries. Despite prolonged anticipation, its potential scale makes it a "sleeping giant" no NFT participant can afford to ignore.

5. Infrastructure Matrix: Caldera, Citrea, Helius

Beyond the three marquee projects, Founders Fund’s portfolio includes a group of "water sellers"—key infrastructure providers delivering essential tools and services to the broader crypto ecosystem, all of which have intrinsic reasons to issue tokens.

Caldera: A "Rollup-as-a-Service" (RaaS) platform enabling developers to deploy custom Rollup chains with one click. As "app-specific chains" become a trend, Caldera has the potential to become the "AWS" of the future blockchain world, giving its platform token enormous upside potential.

Citrea: A Layer 2 solution focused on the Bitcoin ecosystem. With the revival of Bitcoin’s ecosystem, L2 projects bringing programmability and scalability to Bitcoin are gaining market attention. Issuing a token to incentivize ecosystem growth and secure the network is a necessary step in its development.

Helius: A leading infrastructure provider in the Solana ecosystem, offering critical developer services such as APIs and nodes. While more B2B-oriented, many core infrastructure providers eventually issue governance tokens to share protocol value and governance rights with the broader ecosystem.

Conclusion

In a market fatigued by fleeting MEME narratives and increasingly seeking sustainable value, Founders Fund’s investment playbook offers a clear, proven roadmap. It reminds us that beyond the noise of hype cycles, the projects truly committed to building foundational technologies and solving core problems are the ones that endure bull and bear markets and accumulate lasting value.

Following smart money is essentially about adopting a proven strategy for identifying long-term value. This list provides clear guidance for research and participation. Yet in the high-risk, high-reward world of crypto, DYOR (Do Your Own Research) remains the first principle before engaging with any project.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News