Is the probability of winning in Solo mining higher than that of a lottery?

TechFlow Selected TechFlow Selected

Is the probability of winning in Solo mining higher than that of a lottery?

The probability of successfully mining a block is over 100 times higher than winning the lottery.

Author: Liu Jiaolian

Solo mining, as the name suggests, refers to individual miners. Although most of today's BTC mining power is concentrated in mining pools—where several large pools distribute rewards based on estimated hash rate contribution—there are still many individuals who choose to mine solo using their own computational power.

Compared to steadily collecting "work points" from a mining pool, solo mining is akin to a high-stakes gamble: “either you strike a block, or your effort is wasted.” For today’s BTC block reward, striking a block means the solo miner gets to keep 3.125 BTC entirely for themselves—worth over 300,000 USD. However, the probability of actually striking a block is vanishingly small.

Just how low is the chance of solo mining success?

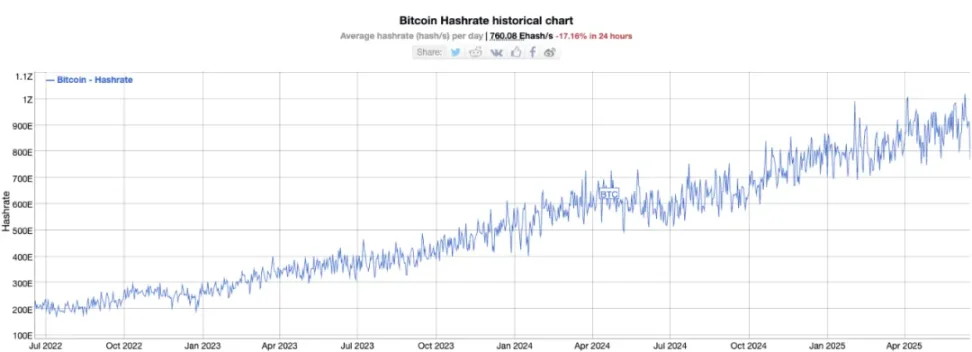

According to estimates of Bitcoin’s total network hash rate, the current global hashrate is around 900E (900 EH/s). For simplicity, we’ll use 900E. This figure means that globally, the Bitcoin network computes approximately 900 quintillion hashes per second—an astronomical number.

As estimated by internet user Matt Cutler, if you use a desktop mining rig with 1T (1 TH/s) of hashing power, under the assumption of independent and identically distributed trials, your chance of finding a block would be 1T / 900E = 1 / 900M, or one in 900 million.

How low is this? Given that Bitcoin finds a new block roughly every 10 minutes on average, it would take an average of 9 billion minutes—or about 17,000 years—to successfully mine one block.

For comparison, he listed the jackpot odds of two well-known lottery games:

-

Powerball Jackpot: 1 in 292 million (1/292M)

-

Mega Millions: 1 in 303 million (1/303M)

At first glance, the odds of mining a block appear much worse than winning either of these lotteries.

But wait. We’ve ignored time. These lotteries draw winners only two or three times per week—far less frequently than Bitcoin’s ten-minute interval.

If we assume all jackpot odds are roughly 1 in 300 million, then for Powerball (drawn three times weekly), you’d expect to wait about 100 million weeks—or 1.92 million years—to win once.

Clearly, then, solo mining appears to offer better odds than winning the lottery.

Let’s bring time into alignment and compare them directly:

Weekly:

-

Powerball (3 draws): Jackpot chance = 1 in 97 million (1/97M)

-

Mega Millions (2 draws): Jackpot chance = 1 in 151 million (1/151M)

-

Solo mining (1T rig) (1008 draws): Success chance = 1 in 892 thousand (1/892K)

Monthly:

-

Powerball (12 draws): Jackpot chance = 1 in 22 million (1/22M)

-

Mega Millions (8 draws): Jackpot chance = 1 in 35 million (1/35M)

-

Solo mining (1T rig) (4320 draws): Success chance = 1 in 208 thousand (1/208K)

Annually:

-

Powerball (156 draws): Jackpot chance = 1 in 1.87 million (1/1.87M)

-

Mega Millions (104 draws): Jackpot chance = 1 in 2.9 million (1/2.9M)

-

Solo mining (1T rig) (~52,000+ draws): Success chance = 1 in 17 thousand (1/17K)

In other words, the annual odds of successfully mining a block are over 100 times higher than winning a major lottery jackpot.

Of course, probability theory reminds us that even being 100 times more likely still means, for most people, costs will exceed rewards—effort outweighs return. In short: mining at a loss.

After all, most human lifespans are less than 100 years—barely 1/200th of 17,000 years.

This is precisely where Bitcoin’s underlying design brilliance shines through.

Name another financial instrument (or speculative asset) in the world where millions participate, most lose money, yet everyone remains passionately engaged?

Some might jokingly answer: lottery tickets.

But they’re right.

The correct answer *is* the lottery.

Bitcoin’s Proof-of-Work mining operates on an incentive model very similar to a lottery.

Miners may not profit, but their relentless computation voluntarily and automatically makes an extraordinary contribution to the world’s largest “public good”: securing the Bitcoin public ledger.

There’s almost a spirit of charitable lottery embedded within it.

For 16 years since Bitcoin’s inception, skeptics have repeatedly asked: when block rewards dwindle due to halvings, and mining becomes unprofitable, what will sustain the Bitcoin network?

This reflects a dogmatic error—viewing things statically rather than dynamically.

Today, because Bitcoin’s hash power is mostly supplied by mining pools and corporations, people assume these entities require profits and will quit once mining stops being profitable.

But perhaps this is exactly what the system intends.

When profit-driven miners and mining companies gradually exit due to shrinking margins, solo miners and household miners—who don’t mine for profit, who mine for fun even at a loss—will naturally take over.

By that stage, Bitcoin will have entered relative maturity.

Today’s state of affairs is merely a phase in Bitcoin’s rapid growth—manifested by its fast-rising price.

From a financial perspective, Bitcoin is a non-yielding, non-exploitative currency. On the Bitcoin blockchain, fractional reserve banking and credit expansion—hallmarks of traditional finance—are disallowed. As established decades ago in financial theory, any institution offering deposits without lending must not pay interest; instead, it should charge depositors a management fee, otherwise it cannot be economically sustainable.

The Bitcoin network functions like such an institution—one that holds Bitcoin deposits but cannot lend them out. A decentralized, virtual bank jointly operated by hundreds of thousands of miners distributed worldwide.

Thus, the electricity and operational costs individual miners bear are effectively the “management fees” economists say depositors should pay to maintain such a system.

In the future, unlike today’s miners who are motivated by block rewards (which dilute all holders’ value) and transaction fees (what users willingly pay), individual miners will be personal or corporate Bitcoin holders who mine simply to secure their own savings.

Today, the total network hash rate held by a few large mining pools is about 900E. Suppose this were evenly distributed among 9 million users—each would need to contribute just 100T of hash power.

With future improvements in efficiency, lower energy consumption, quieter hardware, cheaper electricity (e.g., via nuclear fusion), and secondary uses for waste heat (like heating homes via chip thermal output), providing 100T or more per user may become entirely feasible.

We should already be thinking ahead: keeping the Bitcoin ledger lean, strictly controlling spam data and misuse, so we don’t lock ourselves into irreversible centralization and can eventually return to greater decentralization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News