The battle for USDH has begun, with everyone eyeing the stablecoin + Hyperliquid concept

TechFlow Selected TechFlow Selected

The battle for USDH has begun, with everyone eyeing the stablecoin + Hyperliquid concept

A battleground that institutions must seize even if it's unprofitable.

Author: BUBBLE, BlockBeats

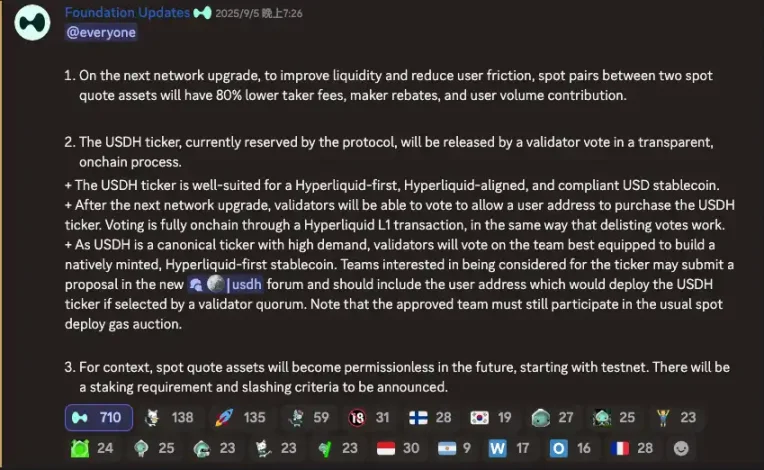

Recently, a notable stablecoin battle has unfolded on Hyperliquid, a decentralized derivatives trading platform. On September 5, Hyperliquid officially announced it would soon auction the ticker "USDH," a native stablecoin designed for the Hyperliquid ecosystem. The proposal deadline was set for September 10 at 10:00 UTC, and by now, multiple institutions including Paxos, Ethena, Frax, Agora, and Native Markets have already submitted proposals, competing fiercely to become the issuer of USDH, Hyperliquid’s chain-native stablecoin.

The participants in this race include not only established compliant institutions and emerging DeFi projects but also teams backed by well-known investment firms. The high-stakes competition stems from Hyperliquid's rapid rise as a leading decentralized trading platform, with monthly perpetual contract trading volume nearing $400 billion and August fee revenue reaching $106 million—capturing approximately 70% of the decentralized perpetual market share.

Currently, the dollar liquidity on Hyperliquid relies primarily on external stablecoins like USDC, with circulation peaking at around $5.7 billion—accounting for about 7.8% of USDC’s total supply. Hyperliquid’s decision effectively hands over rights to potentially hundreds of millions in annual interest income directly to the community.

Therefore, securing the right to issue USDH means not only capturing significant market share but also gaining control over this massive potential revenue stream. With heavyweight players competing head-to-head, the bidding war has been intense from the start, and the on-chain vote to determine ownership of the stablecoin issuance will take place within a one-hour window from 10:00 to 11:00 UTC on September 14.

Hyperliquid-first, Hyperliquid-aligned

Behind Hyperliquid’s current stablecoin bidding war lies a major shift in its stablecoin strategy. Earlier this year, the Hyperliquid team considered issuing its own native dollar-pegged stablecoin, reserving the "USDH" ticker and temporarily blocking others from registering it through the on-chain domain auction mechanism.

Hyperliquid’s unique ticker auction system allows anyone to bid for new asset symbols, but USDH—as a potential platform-exclusive stablecoin—was initially reserved and withheld by the official team. This led the community to believe that Hyperliquid would launch USDH directly.

However, after careful consideration, the team chose to decentralize the USDH issuance, inviting multiple bidders and letting the community vote on the final recipient. Past incidents had raised concerns about Hyperliquid being overly centralized, and this move is seen as an important signal toward more open, community-driven governance. By giving up exclusive rights to stablecoin issuance profits, the platform instead offers this opportunity to whichever bidder can best return value to the community. This multi-stablecoin operational model could also provide Hyperliquid with broader expansion channels.

This strategic shift is driven by clear motivations. On one hand, changing interest rate environments have made stablecoin reserve yields a significant revenue source. At current risk-free rates of around 4%-5%, the nearly $6 billion in stablecoin deposits on Hyperliquid could generate over $200 million in annual interest income. Previously, most of these gains flowed to centralized issuers like USDC, leaving the Hyperliquid ecosystem largely uncompensated. As the platform grows, this situation—essentially “making clothes for others”—has become increasingly unacceptable.

On the other hand, excessive reliance on USDC brings concentration and regulatory risks. Hyperliquid aims to introduce a native platform stablecoin to enhance autonomy, bringing both interest income and seigniorage benefits into its own ecosystem, thereby strengthening HYPE token value and internal value generation.

Thus, when deciding to open USDH bidding, the team established a clear value orientation: “Hyperliquid-first, Hyperliquid-aligned,” prioritizing proposals that return the majority of profits to the community and reinforce HYPE’s value. Notably, the Hyperliquid Foundation holds substantial HYPE voting power but has pledged not to use it, deferring entirely to community votes.

Nevertheless, team founder Jeff Yan remains an influential figure whose views are widely watched. The community generally believes the official team favors proposals where the majority of profits go back to users. This unique decision-making mechanism ensures the outcome aligns with Hyperliquid’s long-term interests and sets an implicit benchmark: the bidder offering the greatest benefit to the Hyperliquid ecosystem stands the best chance of winning.

What strategies are the institutions using to bid?

Bidders vying for USDH issuance rights are pulling out all the stops, each presenting compelling incentives for the Hyperliquid community. Paxos, Frax, Agora, and Native Markets have successively submitted detailed proposals, while projects like Ethena are also preparing to enter. Despite their diverse backgrounds, all proposals converge on one central theme: aligning interests and yielding benefits to the ecosystem.

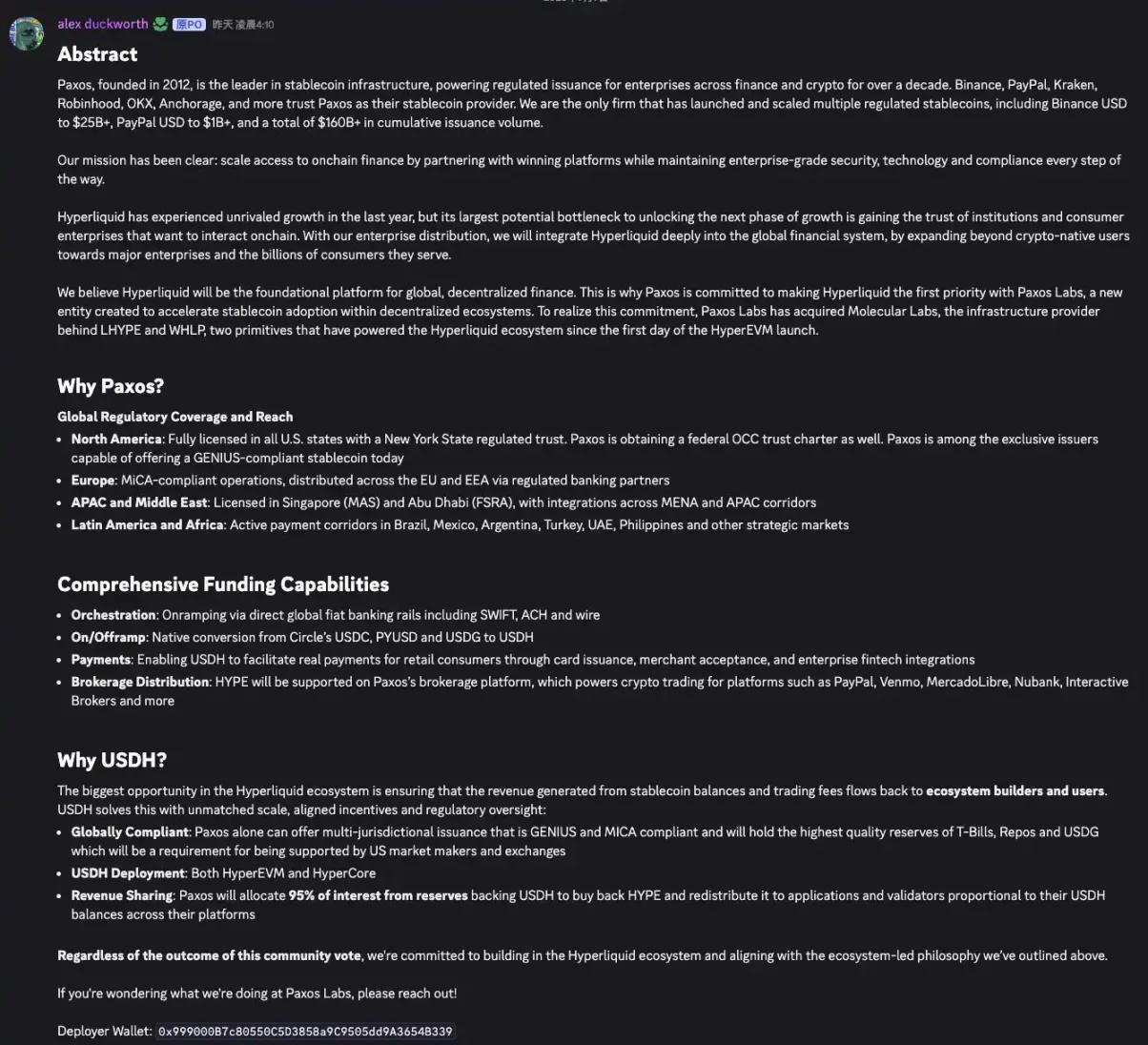

Paxos (Compliance advantage and buyback model)

Established compliant stablecoin issuer Paxos (known for USDP and PayPal USD) was among the first to submit a proposal. Paxos promises to make USDH a compliance-compliant dollar-pegged stablecoin “native to Hyperliquid,” fully adhering to U.S. GENIUS Act standards and EU MiCA regulations. Technically, USDH would be operated by Paxos Labs and natively issued across Hyperliquid’s two chains (HyperEVM and HyperCore).

In terms of profit distribution, Paxos made a standout commitment: 95% of interest generated from USDH reserves will be used to repurchase HYPE tokens on the secondary market, with proceeds returned to ecosystem projects, validators, and users.

Estimates suggest that if USDH fully replaces the existing ~$5.7 billion USDC holdings on Hyperliquid, this mechanism could bring nearly $190 million in annual buybacks for HYPE.

Additionally, Paxos will leverage its deep traditional finance network, promoting integration of HYPE assets across dozens of financial institutions it serves—including PayPal, Venmo, MercadoLibre, Nubank, and Interactive Brokers—to expand Hyperliquid’s mainstream reach. Paxos also pledges a free one-click conversion channel between USDC and USDH to ensure smooth user migration.

Overall, Paxos’s proposal is built on regulatory credibility, enhanced by massive buybacks and extensive channel resources. It has been praised as “highly sincere,” addressing legal compliance and initial liquidity access while directly empowering HYPE—and even bridging connections to fiat and traditional finance partnerships.

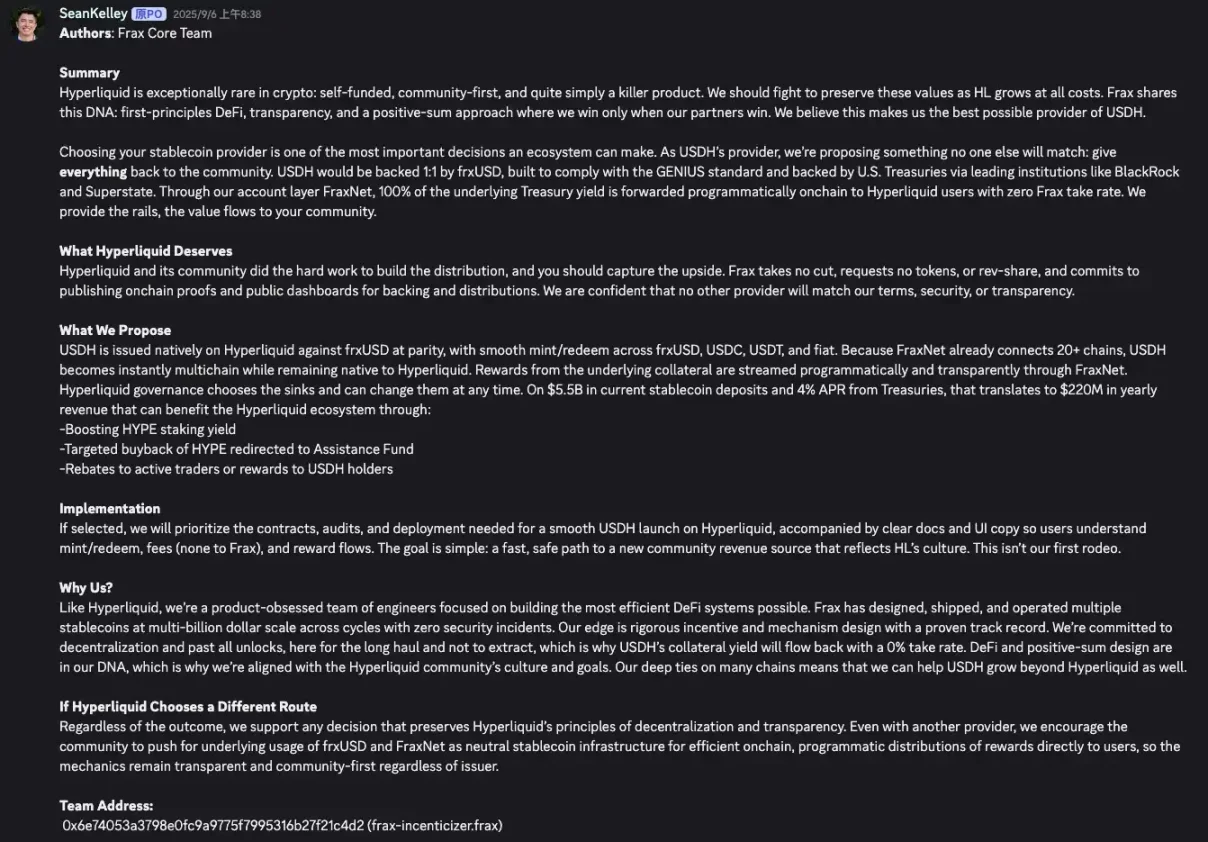

Frax (Full yield payout and DeFi-centric approach)

Decentralized dollar stablecoin protocol Frax Finance quickly followed with its own proposal. Frax emphasizes “maximum concession” and on-chain governance, pledging to return 100% of USDH’s underlying yield directly to the Hyperliquid community.

Technically, USDH will be 1:1 pegged to frxUSD—the existing Frax stablecoin—whose reserves are backed by high-quality bond assets such as BlackRock’s BUIDL fund, generating yield. Frax proposes directing all interest from these bonds toward rewarding HYPE holders. Additionally, users will enjoy seamless conversion between USDH and USDT, USDC, frxUSD, or fiat, matching the convenience offered by centralized entities.

Notably, Frax stresses that HYPE—not Frax—will govern USDH liquidity and distribution, avoiding conflicts of interest. Compared to Paxos, Frax offers even more attractive terms: no fees, no cuts, no requests for token allocations or revenue sharing. Instead, via the FraxNet account layer, 100% of underlying Treasury yields will be programmatically distributed to Hyperliquid users. Under current conditions—with $5.5 billion in stablecoin deposits and a 4% annual Treasury yield—this translates to $220 million in annual income flowing back into Hyperliquid.

However, Frax lags behind in traditional reserve management reputation, regulatory licenses, and institutional networks. In short, Frax embodies a radical DeFi-native stance—maximizing returns to the community—but lacks the strong regulatory backing and traditional industry support that Paxos provides.

Agora (Neutral alliance and full profit-sharing)

New stablecoin infrastructure firm Agora (founded by Nick van Eck, with Wall Street asset management experience) has also entered the fray. Agora recently closed a $50 million funding round led by Paradigm, and its first stablecoin AUSD currently has a market cap of about $130 million.

Its proposal introduces the concept of a “stablecoin issuance alliance”: Agora provides the on-chain issuance technology, Rain handles compliant fiat on/off-ramps, and cross-chain communication protocol LayerZero ensures USDH interoperability across chains.

Moonpay’s president joined the alliance just hours ago—possibly in response to community leader mlm criticizing Dragonfly partner Rob’s somewhat “FOMO-leaning” tweet supporting Agora—and specifically announced that Matt Huang, co-founder of Paradigm, should recuse himself from voting (as Paradigm is an investor in Stripe, Tempo, MoonPay, and Agora Finance).

In terms of revenue sharing, Agora commits to returning 100% of USDH reserve yield to the Hyperliquid ecosystem, either through HYPE buybacks or contributions to a community relief fund.

Agora also emphasizes its “neutral” positioning—dedicated solely to serving Hyperliquid without leveraging USDH for other payment networks, brokerage services, or cross-chain deployments. It pledges not to engage in any activity that competes with or conflicts with Hyperliquid’s ecosystem. This appears to be a direct counter to Paxos, implying that large-scale issuers with multi-chain, multi-institutional footprints may have impure incentive alignment.

Still, community feedback suggests that while Agora’s philosophy closely aligns with Hyperliquid’s interests, its proposal lacks the transparency of Paxos and Frax regarding yield redistribution and ecosystem synergy. Its ability to bring external incremental resources is also relatively limited. In short, Agora offers a “Hyperliquid-controlled custom stablecoin” model but currently lacks the scale and influence of Paxos.

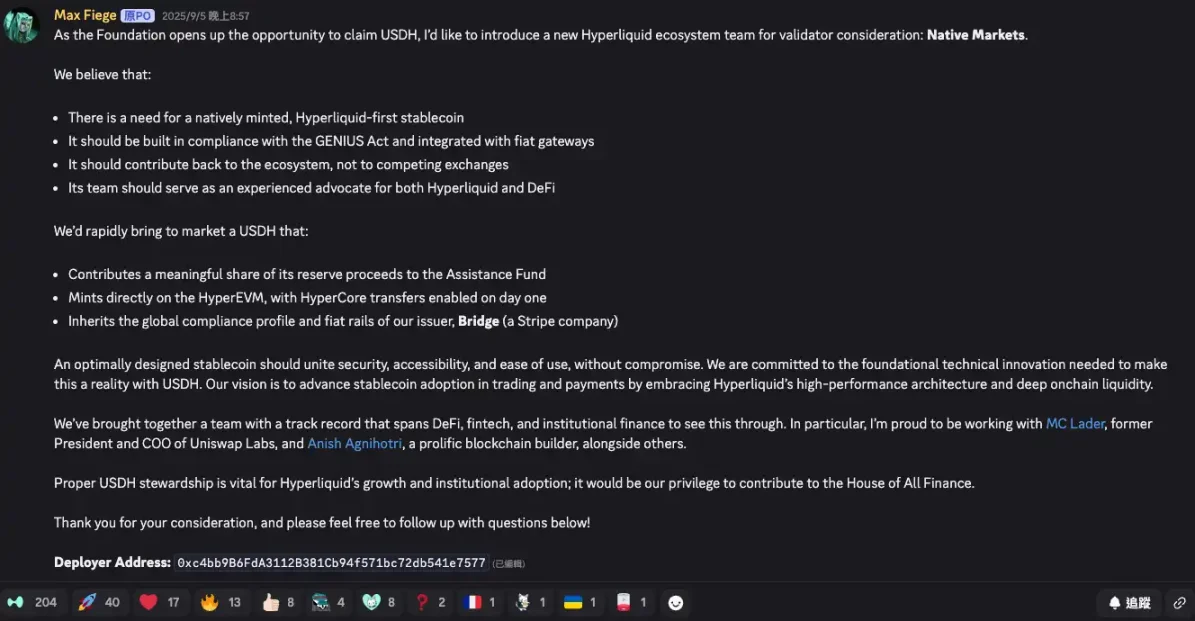

Native Markets (Differentiated approach from a local team)

Native Markets’ proposal was spearheaded by Max, a community leader who previously led the listing of Hyperion—a company tied to Hyperliuquid DAT—and has sparked the most discussion among community members.

The team includes former Uniswap Labs President and COO Mary-Catherine Lader and builder Anish Agnihotri. Native Markets similarly commits to ensuring USDH complies with U.S. GENIUS regulatory standards and leverages the global compliance credentials and fiat rail capabilities of Bridge, the issuing entity behind the team.

Bridge was acquired last year by payments giant Stripe. Native plans to use Bridge to connect stablecoin fiat channels. However, this raises potential conflicts: Stripe recently partnered with Paradigm to develop its own stablecoin-focused chain, Tempo, and Bridge’s involvement may create entangled interests—an angle exploited by the Agora alliance.

Native’s plan involves channeling reserve interest profits into Hyperliquid’s community assistance fund, similar to Agora, focusing on ecosystem reinvestment. Overall, as the least prominent bidder, Native Markets’ strength lies in its deep roots within the Hyperliquid chain and profound understanding of the local ecosystem. However, its brand recognition and ability to deliver external collaboration opportunities remain limited compared to larger players.

Ethena Labs

Other projects, such as Ethena Labs, are rumored to be preparing bids. Ethena is an emerging player in decentralized derivative-based stablecoins, and its founding team claims to have submitted a USDH proposal to Hyperliquid as early as autumn—only to receive no response.

After the bidding news broke, Ethena’s Twitter “intern” posted a meme-style tweet referencing Eminem’s song “Stan,” calling out Hyperliquid founder Jeff, complaining that their proposal seemed to have vanished into silence (the song tells the story of a fan who, after receiving no reply from his idol, tragically takes his own life along with his family).

This anecdote indirectly reveals that Hyperliquid was initially selective about bidders and raises curiosity about what alternative path Ethena—a platform using LSD and perpetual hedging to build non-dollar-reserve stablecoins—might offer if it enters the race.

When institutions serve the community, the era of Stablecoin 2.0 is approaching

Faced with several highly attractive proposals, the Hyperliquid community has engaged in vigorous debate. Public sentiment generally favors high-yield-return models that strengthen HYPE’s value. Many token holders have responded positively to both Paxos and Frax, seeing them as aligned with the principle of “returning most benefits to the community.”

Paxos, in particular, has gained support from another faction due to its compliance reputation and vast resources. Although it only commits to returning 95% of interest, its method of indirectly empowering HYPE via buybacks could create more sustained demand for the token. Moreover, Paxos’s channels could bring new traditional finance users into Hyperliquid. Still, some point out uncertainties in how the buyback proceeds are “redistributed” to ecosystem partners, worrying that actual community benefits might be diluted.

In contrast, Frax’s direct return of all earnings to users is seen as the ultimate example of “trustless, zero-take” design—transparent and efficient, with yields governed and distributed on-chain via HYPE. Under the Frax model, rewards go straight to HYPE stakers via smart contracts, minimizing manipulation and earning greater trust from crypto-native users. Many prefer this on-chain, user-direct distribution model.

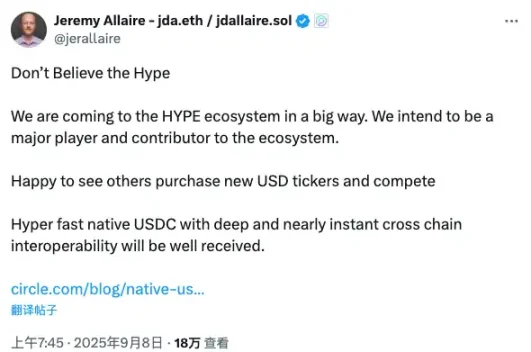

The bidding war has also drawn reactions from broader industry participants. Jeremy Allaire, CEO of Circle (issuer of USDC), was among the first to respond, stating on X that he welcomes competition and adding, “Don’t fall for the hype—Circle will aggressively enter the HYPE ecosystem.”

Circle may stand to lose the most from this USDH auction, pushing it to propose favorable measures for Hyperliquid—starting with launching native USDC on the Hyperliquid chain (previously mostly cross-chain versions).

Analysts suggest that if a new USDH issuer successfully emerges, USDC’s dominance on Hyperliquid will be broken—a further blow to USDC, which is already losing market share. For the Hyperliquid community, however, the key concern is whether the winning proposal can fulfill its promises to HYPE holders and whether the platform can finally reduce its dependence on centralized stablecoins, achieving true internal value circulation.

As the vote approaches, the fate of USDH issuance is about to be decided. This contest is no longer just a battle among a few institutions—it’s a litmus test for the evolution of stablecoin models in today’s crypto market. Regardless of the winner, one thing is certain: stablecoin issuance is moving away from a landscape dominated by a few giants toward a new phase where major trading platforms and ecosystems compete fiercely for control.

Recent developments—including Circle’s new Arc chain, Stripe and Paradigm’s Tempo chain, decentralized stablecoin initiatives like Ethena’s Converge, and MetaMask’s mUSD—highlight unprecedented热度 in the stablecoin space, with innovative models emerging constantly.

In the case of Hyperliquid, we see stablecoin issuers willing to surrender almost all profits in exchange for ecosystem distribution—an unimaginable scenario in the past. It’s foreseeable that once USDH launches successfully and proves the viability of a “yield-to-community, value-back-to-ecosystem” virtuous cycle, other exchanges or public chains may follow suit, triggering a major transformation in industry-wide stablecoin strategies. Perhaps the “Stablecoin 2.0 era” is about to begin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News